Fnac Darty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fnac Darty Bundle

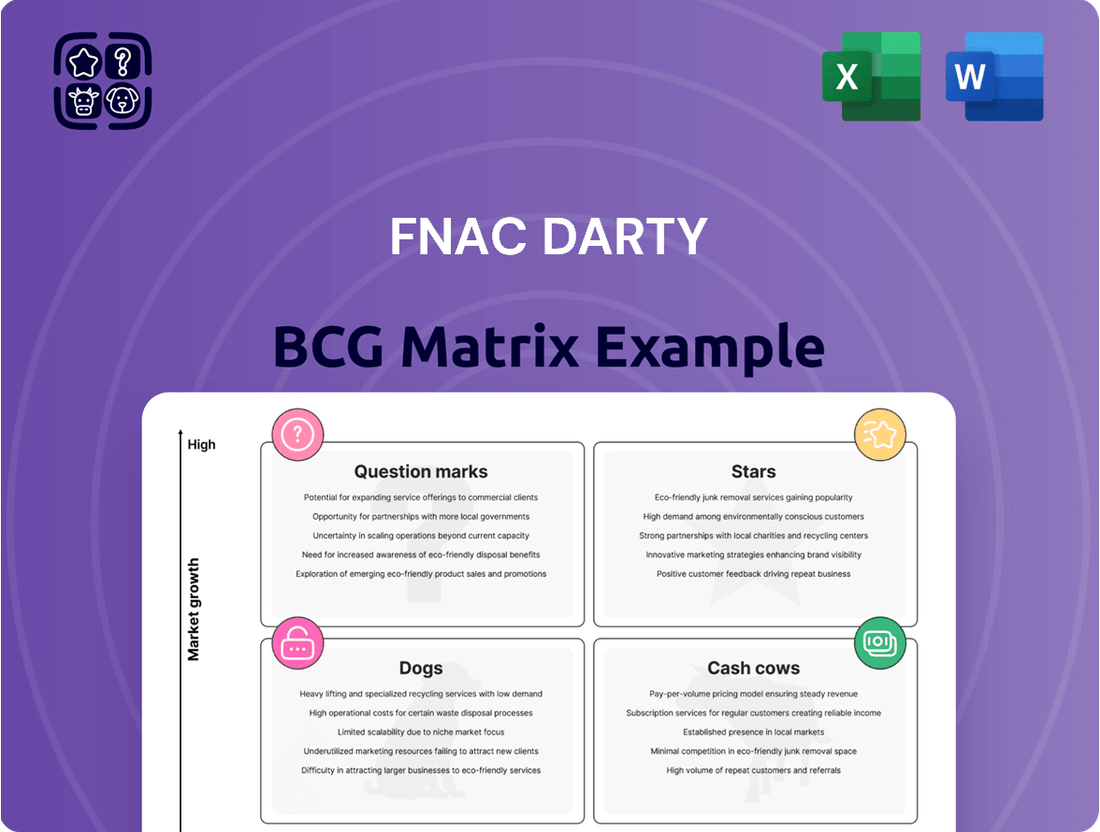

Unlock the strategic secrets of Fnac Darty's product portfolio with this glimpse into their BCG Matrix. Understand which offerings are fueling growth and which might be holding them back.

This preview offers a snapshot of Fnac Darty's position across Stars, Cash Cows, Dogs, and Question Marks, hinting at the opportunities and challenges within their diverse business.

To truly grasp the competitive landscape and Fnac Darty's strategic direction, a deeper dive is essential.

Purchase the full BCG Matrix to gain a comprehensive understanding of their market share and growth potential, enabling you to make informed decisions.

This detailed report provides the actionable insights needed to navigate Fnac Darty's market effectively and capitalize on their strategic positioning.

Don't miss out on the complete breakdown; invest in the full BCG Matrix for a clear roadmap to understanding and leveraging Fnac Darty's product strategy.

Stars

Fnac Darty's e-commerce platform is a clear star performer. In 2024, online sales represented a substantial 22% of the group's total revenue, a significant contributor to overall growth. This digital strength, combined with a robust omnichannel approach, is a major advantage.

The company's integrated online and in-store strategy is paying off. Omnichannel sales grew by 1.7 percentage points in 2024, making up 52% of all online sales. This seamless blend of digital and physical experiences is a key differentiator in the evolving retail environment.

Fnac Darty has set an ambitious target of €1 billion in online sales by the end of 2024, projecting a 25% increase from the previous year. This focus on digital expansion, coupled with its strong physical footprint, solidifies its position as a star in the competitive retail sector.

Fnac Darty's subscription services, notably Darty Max, are a key growth driver, boasting over 1.4 million subscribers by the end of 2024. These offerings, which include unlimited repairs and extended warranties, are integral to the company's 'Beyond Everyday' 2030 strategy, targeting close to 4 million subscribers across all its subscription platforms.

These services significantly bolster gross margin, with ambitious plans to increase their contribution to over 80% by 2030. This highlights them as a high-growth, high-profit segment for the group.

The emphasis on extending product lifespans through these subscriptions also resonates with increasing consumer interest in sustainable consumption patterns and product longevity.

The premium smartphone market continues its robust expansion, a key driver for Fnac Darty's electronics division. In 2023, Fnac Darty reported significant revenue growth, with a notable contribution from its electronics sales, underscoring the strength of its smartphone segment. This upward trend is expected to persist into 2024, fueled by consumer appetite for cutting-edge technology such as 5G and advanced camera systems.

Fnac Darty's strategic focus on offering a wide array of the latest premium smartphone models, coupled with essential accessories, positions it favorably within this competitive landscape. This approach not only captures market share but also capitalizes on the increasing demand for integrated tech ecosystems. The company's performance in 2023 and projections for 2024 highlight the enduring appeal and profitability of this category.

Connected Home & Smart Devices

The Connected Home & Smart Devices segment for Fnac Darty likely falls into the Stars category within a BCG Matrix. This is driven by the robust expansion of the European smart home market, which is anticipated to achieve a compound annual growth rate exceeding 17.6% between 2024 and 2032. This growth is fueled by consumer interest in enhanced energy efficiency, improved security, and greater convenience in their homes.

Fnac Darty, with its established presence as a major retailer of consumer electronics, is strategically positioned to leverage this burgeoning market. The company offers a diverse portfolio of connected home devices, encompassing popular items such as smart speakers, advanced lighting controls, and comprehensive home automation systems. This broad selection directly addresses the increasing consumer demand for integrated and intelligent living solutions.

Furthermore, Fnac Darty's demonstrated commitment to innovation and sustainability directly aligns with the core drivers propelling the smart home sector forward. By emphasizing products that contribute to energy savings and offer advanced technological features, the company can effectively capture market share and solidify its position as a leader in this high-growth area.

- Market Growth: European smart home market projected to grow at over 17.6% CAGR from 2024-2032.

- Fnac Darty's Position: Well-positioned due to its extensive consumer electronics retail network.

- Product Offering: Includes smart speakers, lighting controls, and home automation systems.

- Strategic Alignment: Focus on innovation and sustainability matches market demand drivers.

Gaming Consoles & High-Performance PCs

The gaming market, encompassing both consoles and high-performance PCs, remains a vibrant sector fueled by continuous innovation and robust consumer interest. Fnac Darty strategically positions itself within this space, serving a tech-savvy demographic that drives significant sales within its electronics division.

While precise financial data for Fnac Darty's gaming console and PC sub-segment isn't publicly itemized, the broader consumer electronics market is projected to rebound with positive growth starting in 2025. High-demand categories such as gaming are anticipated to be key contributors to this resurgence.

- Market Trend: The global gaming market, valued at over $200 billion in 2023, is expected to grow further, with consoles and PCs being significant segments.

- Fnac Darty's Position: The company leverages strong brand recognition and retail presence to capture demand from enthusiastic gamers.

- Future Outlook: As the consumer electronics market recovers from 2025, gaming hardware is poised to be a leading growth driver, benefiting Fnac Darty's electronics sales.

- Consumer Engagement: Fnac Darty's product assortment caters to a wide range of gamers, from casual players to enthusiasts seeking cutting-edge performance.

Fnac Darty's e-commerce platform is a clear star performer, with online sales representing a substantial 22% of the group's total revenue in 2024. This digital strength, combined with a robust omnichannel approach, positions it as a key growth driver. The company's ambitious target of €1 billion in online sales by the end of 2024, a projected 25% increase, underscores its stellar performance in the digital retail space.

Subscription services, particularly Darty Max, are a significant star for Fnac Darty, boasting over 1.4 million subscribers by the end of 2024. These services are integral to the company's long-term strategy, aiming for nearly 4 million subscribers across all platforms by 2030. They also significantly bolster gross margins, with plans to increase their contribution to over 80% by 2030.

The premium smartphone market is a star segment for Fnac Darty, driven by consumer appetite for cutting-edge technology. The company's strategic focus on offering the latest models and accessories capitalizes on this demand, contributing significantly to its electronics division's revenue growth in 2023 and expected continued strength into 2024.

The Connected Home & Smart Devices segment shines as a star, fueled by the European smart home market's projected growth exceeding 17.6% CAGR from 2024-2032. Fnac Darty's diverse portfolio of smart devices and alignment with innovation and sustainability trends position it to capture significant market share in this expanding sector.

What is included in the product

The Fnac Darty BCG Matrix analyzes its portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

A clear Fnac Darty BCG Matrix overview simplifies strategic decisions, alleviating the pain of uncertain investment allocation.

Cash Cows

Fnac Darty's major domestic appliances segment is a classic Cash Cow, benefiting from a dominant position in a mature and stable market, further bolstered by the strategic acquisition of Unieuro, Italy's leading appliance retailer. This segment consistently generates substantial revenue, leveraging established consumer loyalty and the brand's reputation for expertise and reliable after-sales service.

The mature nature of the domestic appliance market means growth is relatively slow, but the high market share Fnac Darty commands ensures a steady, predictable cash flow. This stability is further supported by consistent replacement cycles for these essential household items, making it a reliable engine for the company's overall financial health.

In 2024, the home appliance market in Europe continued to see steady demand, with replacement purchases forming a significant portion of sales. Fnac Darty's strong presence in France and Italy, coupled with its recognized service quality, positions it to capitalize on these ongoing consumer needs, solidifying the domestic appliances as a core generator of free cash flow.

Televisions and sound systems are firmly positioned as Cash Cows for Fnac Darty. This mature segment of consumer electronics benefits from Fnac Darty's strong market position and brand recognition.

While growth in this category is modest, the consistent demand and Fnac Darty's broad product offering, from budget-friendly options to premium home entertainment setups, ensure a reliable stream of revenue. For instance, in 2024, the consumer electronics sector, including TVs and audio, saw steady demand, with Fnac Darty leveraging its established retail footprint and online presence to maintain sales volume.

Fnac Darty's mid-range laptops and desktops represent a solid Cash Cow. This segment consistently delivers high-volume sales due to its broad appeal to both consumers and businesses seeking reliable computing solutions. The demand for these machines remains steady, driven by everyday productivity and entertainment needs, making them less susceptible to the rapid obsolescence seen in high-end technology.

In 2024, the personal computer market, particularly the mid-range segment, demonstrated resilience. While growth might not be explosive, the sheer volume of units sold ensures a predictable revenue stream for Fnac Darty. The company's extensive retail presence and strong brand recognition allow it to effectively capture a significant share of this stable market, translating into dependable profits.

Physical Books & Stationery

Fnac's physical books and stationery segment is a classic cash cow. This category leverages Fnac's deep roots as a cultural retailer, a segment where it holds significant brand power and customer loyalty. Even with digital competition, the tangible book market continues to offer reliable, steady income streams. In 2024, Fnac Darty reported that its Cultural & Leisure segment, which heavily features books, remained a significant contributor to overall sales, demonstrating resilience. This stable performance allows Fnac to generate consistent cash flow with minimal need for heavy reinvestment, supporting other growth areas within the company.

- Dominant market share in cultural goods.

- Stable and predictable revenue generation.

- Low investment requirement for promotion.

- Loyal customer base for physical books.

After-Sales Services & Extended Warranties

Fnac Darty's after-sales services, particularly its extended warranties such as Darty Max, are crucial cash cows for the company. These services are highly profitable, significantly boosting the gross margin by leveraging the existing customer base and product sales. They represent a recurring revenue stream in a segment characterized by low growth but high profitability.

The company's strategic push to extend product lifespans through these services resonates with growing consumer interest in sustainability. This approach not only meets market demand but also fosters stronger customer loyalty, reinforcing the cash cow status of these offerings.

- After-sales services, including extended warranties, contribute significantly to Fnac Darty's gross margin.

- Darty Max is a prime example of a service generating recurring revenue.

- These services capitalize on the existing customer base and product sales.

- The focus on product lifespan aligns with sustainability trends and enhances customer loyalty.

Fnac Darty's domestic appliances segment, boosted by the Unieuro acquisition, remains a strong Cash Cow. This mature market offers stable demand, with replacement purchases being key. In 2024, Fnac Darty's strong European presence and service reputation allowed it to capitalize on consistent consumer needs, generating reliable free cash flow.

Televisions and sound systems continue to be Cash Cows due to Fnac Darty's market strength and brand recognition in consumer electronics. Despite modest growth, consistent demand and a wide product range ensure steady revenue. In 2024, the consumer electronics sector, including TVs and audio, showed steady demand, with Fnac Darty leveraging its retail and online channels effectively.

Mid-range laptops and desktops are solid Cash Cows, offering high-volume sales to consumers and businesses. The demand for these reliable computing solutions remains steady, driven by everyday use. In 2024, the personal computer market, especially the mid-range, showed resilience, with Fnac Darty capturing significant share through its retail footprint and brand.

Fnac's physical books and stationery segment is a classic Cash Cow, benefiting from strong brand power and customer loyalty in cultural retail. Despite digital competition, the tangible book market provides steady income. In 2024, books remained a significant sales contributor within Fnac Darty's Cultural & Leisure segment, demonstrating resilience and providing consistent cash flow.

After-sales services, such as Darty Max, are highly profitable Cash Cows for Fnac Darty, significantly boosting gross margins. These services offer recurring revenue by leveraging the existing customer base and product sales. The focus on product lifespan aligns with sustainability trends, further enhancing customer loyalty and the Cash Cow status.

| Segment | BCG Category | 2024 Market Trend | Fnac Darty's Position | Cash Flow Contribution |

| Domestic Appliances | Cash Cow | Stable demand, replacement purchases | Dominant, strong service reputation | Substantial and predictable |

| Televisions & Sound Systems | Cash Cow | Steady demand | Strong brand recognition, wide offering | Reliable revenue stream |

| Mid-Range Laptops/Desktops | Cash Cow | Resilient, steady demand | Extensive retail presence, brand recognition | Dependable profits |

| Physical Books & Stationery | Cash Cow | Resilient, steady income | Deep cultural roots, brand power | Consistent cash flow |

| After-Sales Services (e.g., Darty Max) | Cash Cow | Growing interest in product lifespan | High profitability, recurring revenue | Significant gross margin booster |

Full Transparency, Always

Fnac Darty BCG Matrix

The Fnac Darty BCG Matrix you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate application in your business planning.

What you see on this page is the actual Fnac Darty BCG Matrix document that will be yours upon purchase. You can trust that the final file is professionally designed, meticulously analyzed, and instantly downloadable for your strategic decision-making processes.

Dogs

Physical music CDs and DVDs are firmly positioned as Dogs in Fnac Darty's BCG Matrix. The market for these items has been shrinking for years, largely due to the dominance of digital streaming. In 2024, the global music market revenue from physical formats, including CDs and vinyl, continued to be overshadowed by digital streams, which accounted for the vast majority of earnings.

Fnac Darty maintains these offerings, acknowledging their cultural significance, but the reality is a low-growth environment. Sales volumes for CDs and DVDs are notably declining, and Fnac Darty's market share in this segment is likely small compared to the overall digital music and video consumption. These products typically yield minimal cash flow and occupy valuable inventory space that could be allocated to more profitable ventures.

The demand for basic feature phones is quite low in developed European markets, like France where Fnac Darty operates. Smartphones have really taken over the mobile phone scene, making these simpler phones a niche product. Fnac Darty’s sales in this area would be minimal, serving a very specific customer base.

This segment can be viewed as a low-growth, low-market-share part of Fnac Darty's business. It’s likely that these sales either just break even or even result in small losses. This is due to the very low sales volume and the intense competition from more advanced and popular smartphone devices.

Traditional compact digital cameras are in a challenging position within the Fnac Darty portfolio, fitting into the Dogs category of the BCG matrix. The market for these devices has been significantly impacted, with sales declining as smartphone camera technology continues to advance rapidly. In 2023, the global compact camera market experienced a notable downturn, with many segments seeing double-digit percentage drops in unit sales compared to previous years.

Fnac Darty's presence in this segment likely reflects low demand and intense competition, leading to a low market share and very limited growth prospects. Businesses holding onto these products often find them to be cash traps, meaning capital is invested without generating substantial returns. For instance, specific product lines within this category might show minimal inventory turnover, indicating a lack of consumer interest.

Legacy Software & Peripherals

Legacy software and peripherals represent a category with limited growth potential within Fnac Darty's portfolio. Sales in this segment, which includes outdated software versions and accessories for older technology, face a shrinking market as consumers increasingly adopt newer operating systems and cloud-based solutions. This trend is evident across the retail electronics sector, where demand for products tied to legacy systems is naturally declining.

While Fnac Darty might still offer some of these items, their contribution to overall revenue and profit is expected to be minimal. For instance, a 2023 industry report indicated that sales of accessories for devices older than five years typically constitute less than 2% of a major electronics retailer's total accessory revenue. This low volume reflects the broader market shift towards modern, integrated technology ecosystems.

- Declining Market Share: Sales volume for legacy software and peripherals is low due to the migration to newer technologies.

- Minimal Revenue Contribution: This category likely accounts for a small fraction of Fnac Darty's total sales.

- Consumer Preference Shift: Modern operating systems, cloud services, and updated peripherals are preferred by the majority of consumers.

- Reduced Profitability: The niche nature and lower sales volume typically result in limited profit generation for these products.

Outdated Home Entertainment Systems (e.g., older DVD/Blu-ray players)

The market for older home entertainment systems, like DVD and Blu-ray players, is definitely shrinking. As people move towards smart TVs and streaming, these standalone devices are becoming less popular. Fnac Darty, like many retailers, likely sees this category as a 'dog' in its BCG Matrix. This means it’s in a low-growth market and probably holds a small share of that declining market.

Sales figures from 2024 reinforce this trend. For instance, the global market for physical media players, which includes DVD and Blu-ray, saw a continued downward trajectory. While precise figures for Fnac Darty's specific sales of these older systems are proprietary, the broader industry data suggests a challenging environment for this product category.

- Market Decline: The overall market for standalone DVD and Blu-ray players is experiencing a significant contraction.

- Shift in Consumer Preference: Consumers are increasingly favoring integrated smart TV features and streaming services over physical media.

- Low Growth, Low Share: This category represents a low-growth market segment where Fnac Darty likely holds a modest market share.

- Strategic Consideration: Retailers often consider divesting or minimizing focus on such 'dog' categories to reallocate resources to more promising areas.

Dedicated GPS navigation devices are firmly in the Dogs category for Fnac Darty. The widespread integration of GPS into smartphones has drastically reduced the demand for standalone units. In 2024, the market for dedicated GPS devices continued to shrink as consumers relied on their mobile phones for navigation, leading to a low-growth, low-market-share scenario for this product type.

Fnac Darty likely maintains a presence in this segment to cater to a niche market, but the sales volumes are minimal. These devices offer little in terms of innovation or growth, and their profitability is often marginal. The capital tied up in inventory for these products could be better utilized elsewhere.

The market for basic digital cameras, distinct from advanced mirrorless or DSLR models, is also a clear 'Dog'. As smartphone cameras become increasingly sophisticated, the need for separate, less versatile digital cameras has diminished significantly. For example, industry data from late 2023 indicated a sharp decline in shipments for entry-level digital cameras year-over-year.

Fnac Darty's sales of these basic digital cameras represent a low-growth segment with a consequently low market share. These products typically generate minimal profits and may even require promotional efforts to move inventory, making them a drain on resources rather than a contributor to growth.

Question Marks

Virtual and Augmented Reality hardware represents a burgeoning sector with substantial long-term promise, though widespread consumer uptake remains nascent. Fnac Darty, as a significant player in electronics retail, carries these devices, but their footprint in this developing market may be modest when contrasted with dedicated technology firms or direct-to-consumer enterprises.

These VR/AR devices demand investment for inventory and promotional activities. However, they possess the capacity to evolve into high-performing 'stars' within the BCG matrix should market adoption gain momentum.

For context, the global VR/AR market was valued at approximately $25.9 billion in 2023 and is projected to reach $269.5 billion by 2030, growing at a compound annual growth rate of 39.3%.

Specialized eco-friendly and sustainable tech products represent a significant growth area for Fnac Darty. Consumer awareness of environmental issues is increasing, creating a strong demand for these items. Fnac Darty has set an ambitious target to increase sales of sustainable products by 30% by the close of 2024, demonstrating a clear commitment to this market.

Despite this commitment and the overall market growth, Fnac Darty's position in highly specialized or niche sustainable tech products might still be in its early stages. This segment, characterized by high investment needs and substantial future potential, places these products in the question mark category of the BCG matrix. Continued investment is crucial to capture market share in this evolving sector.

Fnac Darty is actively pursuing new digital content and streaming partnerships to adapt to evolving consumer habits. This strategic move targets a high-growth market, crucial for future revenue streams.

The digital content sector is intensely competitive, with established global tech players holding significant market share. Fnac Darty's current penetration in this space is likely modest, positioning it as a potential Question Mark in the BCG matrix.

Significant investment is necessary for Fnac Darty to build brand recognition and secure a competitive edge in digital streaming and content offerings. For instance, in 2024, the global digital content market was valued at over $2.4 trillion, indicating the scale of opportunity and challenge.

Advanced Smart Home Automation Systems

Advanced smart home automation systems, encompassing integrated security, climate control, and entertainment, represent a high-growth, albeit nascent, market segment. While individual smart devices are established stars, these complex ecosystems require significant consumer education and specialized installation services, areas where a general retailer like Fnac Darty might face initial challenges in market penetration. The global smart home market was projected to reach over $150 billion by 2024, with automation systems being a key driver of this growth.

- Market Growth: The market for integrated smart home automation is experiencing rapid expansion, driven by increasing consumer demand for convenience and enhanced living experiences.

- Fnac Darty's Position: For Fnac Darty, this segment likely represents a 'question mark' or a nascent 'star,' with high growth potential but currently low market share due to the specialized nature of the products and services.

- Investment Needs: Capturing significant market share necessitates substantial investment in technical expertise, reliable installation networks, and robust post-sales support, differentiating it from simpler smart device sales.

- Competitive Landscape: Fnac Darty will compete with specialized home automation installers and tech giants, requiring a clear value proposition to attract and retain customers in this advanced market.

Refurbished & Second-hand Electronics Market

Fnac Darty's 'Second Life' initiative is positioned as a question mark within its portfolio, reflecting a burgeoning market with substantial upside potential. The company's investment in this segment is yielding positive results, with double-digit growth reported for 2024, underscoring the increasing consumer demand for refurbished and second-hand electronics. This aligns perfectly with Fnac Darty's commitment to sustainability and the circular economy.

Despite this strong growth, Fnac Darty's market share in the refurbished sector, particularly when contrasted with dedicated resale platforms, might still be considered nascent. This presents an opportunity for significant expansion if the company continues to prioritize and invest in this high-potential area.

- Market Growth: The refurbished and second-hand electronics market is experiencing robust expansion, evidenced by Fnac Darty's 'Second Life' business achieving double-digit growth in 2024.

- Strategic Alignment: This segment directly supports Fnac Darty's broader sustainability goals and its adoption of a circular economy model.

- Market Position: While showing strong growth, Fnac Darty's market share in this specific niche may still be relatively low compared to specialized competitors, indicating a question mark with considerable room for development.

- Investment Potential: The segment represents a significant opportunity for future investment and market penetration, driven by increasing consumer interest in cost-effective and environmentally friendly electronics.

Question Marks within Fnac Darty's portfolio represent emerging markets with high growth potential but currently low market share. These segments, such as specialized sustainable tech and advanced smart home automation, require significant investment to build expertise and consumer awareness. Fnac Darty's 'Second Life' initiative, while showing strong double-digit growth in 2024, also falls into this category, indicating substantial room for expansion.

| Category | Market Growth Potential | Fnac Darty's Current Market Share | Investment Needs | BCG Matrix Position |

|---|---|---|---|---|

| Specialized Sustainable Tech | High | Low/Nascent | High | Question Mark |

| Advanced Smart Home Automation | High | Low/Nascent | High | Question Mark |

| Refurbished Electronics ('Second Life') | High (Double-digit growth in 2024) | Low/Nascent | Moderate to High | Question Mark |

BCG Matrix Data Sources

Our Fnac Darty BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.