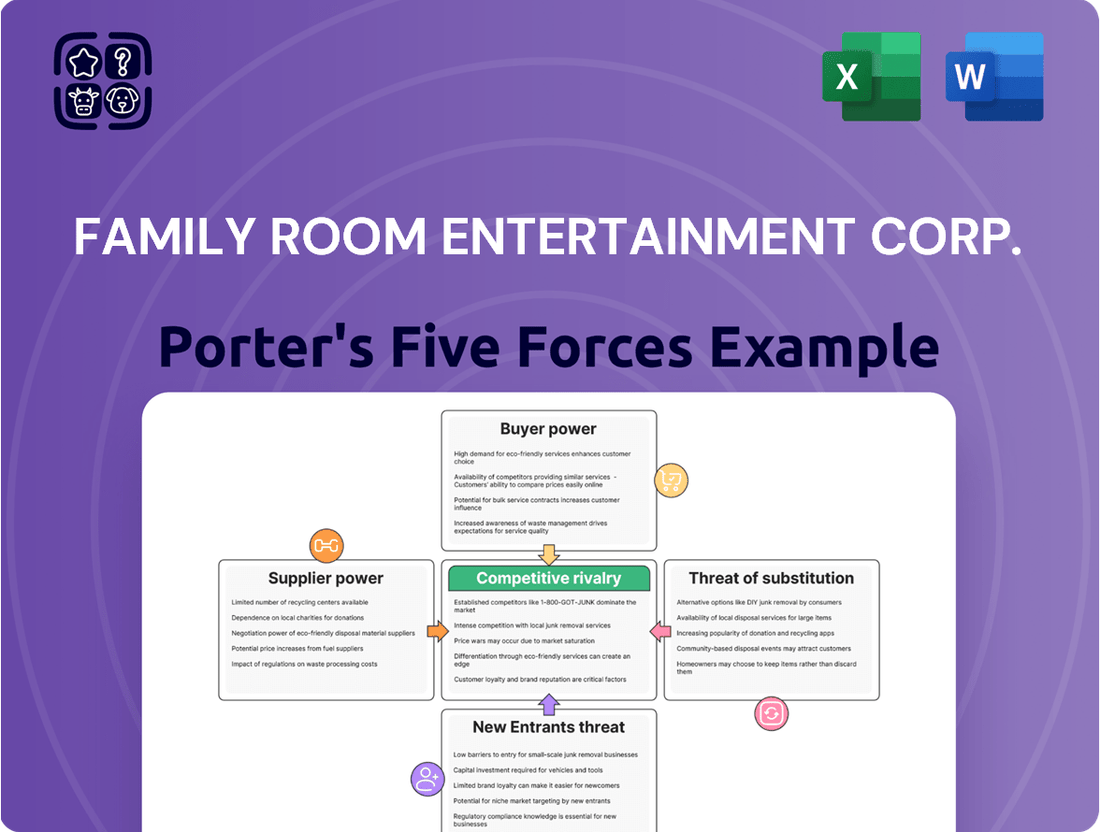

Family Room Entertainment Corp. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Family Room Entertainment Corp. Bundle

Family Room Entertainment Corp. faces a dynamic competitive landscape, with moderate threats from new entrants and a significant bargaining power of buyers influencing pricing. The availability of substitutes also presents a challenge, potentially impacting market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Family Room Entertainment Corp.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The media industry, including Family Room Entertainment Corp., thrives on the appeal of its creative talent. Top writers, directors, and actors possess unique skills and brand recognition that are essential for drawing audiences. This reliance grants them substantial bargaining power, allowing them to negotiate for higher fees and more favorable contract terms, which directly influences production costs and schedules.

The collective strength of creative guilds and unions was notably demonstrated in recent industry-wide labor actions. These strikes highlighted the significant leverage these groups wield when negotiating for improved compensation and working conditions, impacting the entire production landscape.

Suppliers of specialized production services, such as visual effects (VFX) and advanced animation, wield significant bargaining power. These services often demand highly skilled personnel and specialized, costly equipment, making them crucial for delivering premium entertainment content. In 2024, the global VFX market alone was projected to reach over $20 billion, highlighting the substantial investment and expertise involved.

Intellectual property (IP) rights holders wield significant bargaining power, particularly for content derived from established franchises, literature, or real-world events. These original owners dictate the terms for beloved stories, characters, and concepts, which are the bedrock of Family Room Entertainment Corp.'s scripted productions.

The acquisition of these essential rights frequently involves intense bidding wars and necessitates ongoing royalty payments, directly impacting production expenses and the potential for future financial gains. For instance, in 2024, the average cost to license popular book series for film or television adaptation saw an increase of approximately 15% compared to the previous year, reflecting the escalating demand and the inherent value of well-known IP.

Distribution Platform Demands

Major distribution platforms, while often seen as customers, wield significant supplier power by controlling market access for content creators like Family Room Entertainment Corp. These platforms dictate crucial technical specifications and delivery formats, often demanding exclusivity or specific content types that shape production. As of early 2024, the streaming market continues to consolidate, with major players like Netflix and Disney+ holding substantial leverage over content acquisition and licensing terms.

- Platform Exclusivity Demands: Streaming services frequently require exclusive rights to content, limiting a creator's ability to distribute across multiple channels and impacting overall revenue potential.

- Technical and Delivery Specifications: Platforms impose stringent requirements on video resolution, audio quality, and metadata, necessitating specific production workflows and potentially increasing costs for content creators.

- Revenue Sharing Models: The terms of revenue sharing, particularly for ad-supported tiers or premium content, are largely set by the distribution platforms, directly affecting the profitability of Family Room Entertainment Corp.

- Market Consolidation Amplifies Power: With fewer dominant platforms, their ability to dictate terms and influence content creation strategies for companies like Family Room Entertainment Corp. grows significantly.

Technology and Software Providers

Technology and software providers hold considerable sway in the entertainment industry. Companies offering critical production software, editing suites, cloud storage, and even emerging AI tools are becoming indispensable. For instance, Adobe's Creative Cloud, a staple for many production houses, saw its revenue grow by 12% in the fiscal year ending September 2023, reaching $19.4 billion, indicating the essential nature of such software. This reliance means their pricing and update schedules can significantly impact Family Room Entertainment Corp.'s operational costs.

The increasing digitization of media production, coupled with the integration of advanced technologies like generative AI, further amplifies the bargaining power of these suppliers. As of early 2024, the global AI in media market is projected to reach substantial figures, with some estimates placing it in the tens of billions of dollars, highlighting the growing dependency. This dependence translates into leverage for software vendors, particularly concerning licensing fees and the integration complexities that can arise.

- Essential Software Reliance: Production companies depend on specialized software for editing, rendering, and asset management.

- Cloud Infrastructure Costs: Cloud storage and processing power, vital for large media files, are often provided by a few dominant players, increasing their leverage.

- AI Tool Integration: The adoption of AI for content creation and optimization means companies are increasingly tied to the developers of these advanced tools, impacting future development costs.

Suppliers of specialized production services, such as visual effects (VFX) and advanced animation, hold significant bargaining power due to the high skill and equipment costs involved. The global VFX market was projected to exceed $20 billion in 2024, underscoring the substantial investment required. This reliance on niche expertise means these suppliers can command higher prices and dictate terms, directly impacting Family Room Entertainment Corp.'s production budgets and timelines.

The bargaining power of suppliers is further amplified by the increasing reliance on technology and software providers. Essential tools for editing, rendering, and cloud storage, along with emerging AI applications, are often controlled by a limited number of vendors. For example, Adobe's Creative Cloud revenue grew 12% in its fiscal year ending September 2023, reaching $19.4 billion, demonstrating the critical nature of these services. This dependence allows software companies to influence pricing and update schedules, impacting operational costs for content creators.

| Supplier Type | Key Factors Influencing Power | Impact on Family Room Entertainment Corp. | Relevant 2024 Data/Trends |

| Creative Talent (Writers, Directors, Actors) | Unique skills, brand recognition, union strength | Higher fees, favorable contract terms, increased production costs | Industry-wide labor actions highlighted collective leverage. |

| Specialized Production Services (VFX, Animation) | High skill requirements, costly equipment | Premium pricing, control over delivery schedules | Global VFX market projected over $20 billion in 2024. |

| Intellectual Property (IP) Rights Holders | Value of established franchises, bidding wars | Licensing fees, royalty payments, potential profit limitations | Average book-to-screen licensing costs increased ~15% in 2024. |

| Technology & Software Providers | Essential production tools, cloud infrastructure, AI integration | Software licensing costs, update dependencies, integration complexities | Adobe Creative Cloud revenue: $19.4 billion (FY ending Sep 2023). AI in media market projected in tens of billions. |

What is included in the product

This analysis unpacks the competitive forces impacting Family Room Entertainment Corp., detailing the intensity of rivalry, the threat of new entrants, buyer and supplier power, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Porter's Five Forces, empowering Family Room Entertainment Corp. to navigate market pressures effectively.

Customers Bargaining Power

Family Room Entertainment Corp.'s primary customers are major streaming services and traditional broadcasters. These large entities wield substantial market power due to their extensive reach and subscriber bases, often dictating terms in content acquisition.

The competitive landscape among content providers intensifies the bargaining power of these customers. For instance, in 2024, the global streaming market saw continued consolidation, with major players like Netflix and Disney+ vying for exclusive content, allowing them to negotiate more aggressively on pricing and licensing agreements.

These broadcasters and streamers can leverage their ability to bundle services or their massive subscriber numbers to gain significant leverage during negotiations. This means Family Room Entertainment Corp. must be strategic in its content offerings and pricing to maintain favorable deals.

End-consumers' growing price sensitivity and a phenomenon known as 'subscription fatigue' significantly influence the bargaining power of customers, even if indirectly. As viewers re-evaluate the cost-benefit of numerous streaming services, their willingness to churn based on content availability and pricing puts pressure on the platforms that license Family Room Entertainment Corp.'s content. By mid-2024, reports indicated that a substantial percentage of consumers were considering reducing their streaming subscriptions due to cost, a trend that directly impacts the leverage these platforms hold when negotiating licensing deals.

The growing demand for exclusive and original content by streaming platforms significantly bolsters their bargaining power over content producers like Family Room Entertainment Corp. Platforms are actively seeking unique intellectual property to stand out in a crowded market and reduce customer churn. For instance, in 2024, major streamers continued to invest billions in original productions, with Netflix alone planning to spend around $17 billion on content. This intense competition for original programming means platforms can negotiate more favorable terms, including lower acquisition costs or a larger share of revenue, from content creators.

Global Content Preferences

Family Room Entertainment Corp. faces significant bargaining power from its global customer base due to highly varied regional content preferences. For instance, in 2024, streaming services saw continued demand for localized content, with Netflix reporting that over 50% of its viewing hours in many international markets came from non-English language titles. This fragmentation forces platforms to curate diverse content libraries, giving them leverage to dictate terms to content creators for market-specific programming.

This dynamic directly impacts content creators like Family Room Entertainment Corp. They must invest in producing or acquiring content tailored to distinct cultural tastes and linguistic requirements across different territories. For example, a successful K-drama adaptation in one region might not resonate in another, necessitating a flexible and responsive production strategy to meet these diverse demands and manage associated costs.

- Regional Demand: Customer preferences for local stories and languages create market segmentation.

- Content Diversity: Platforms need varied content portfolios to cater to these distinct regional tastes.

- Creator Adaptation: Content creators must adjust production to meet diverse, localized demands.

- Negotiating Power: Diverse customer needs empower platforms to negotiate specific programming terms.

Advertising-Supported Video on Demand (AVOD) Growth

The increasing prevalence of Advertising-Supported Video on Demand (AVOD) models significantly elevates the bargaining power of advertisers, who are now crucial customers for streaming platforms. This means content strategies are increasingly dictated by what attracts advertisers and their desired audiences. In 2024, the global AVOD market was projected to reach approximately $118 billion, highlighting the substantial influence advertisers wield.

Platforms are actively developing ad-supported tiers to enhance revenue streams. This strategic pivot necessitates that content not only engages viewers but also appeals to advertisers looking to reach specific demographics. For instance, a platform might prioritize acquiring or producing content with a strong appeal to younger, affluent audiences, as these are highly sought after by advertisers in sectors like consumer electronics and fashion.

- Advertiser Influence: Advertisers are becoming key customers, shaping content acquisition strategies for AVOD platforms.

- Revenue Diversification: Platforms are expanding ad-supported tiers to boost revenue, making content attractive to advertisers.

- Content Commissioning: The demand for advertiser-friendly content can influence the types of shows and movies commissioned, impacting producers' monetization potential.

- Market Growth: The AVOD market’s significant growth, projected to exceed $118 billion globally in 2024, underscores the growing power of advertisers within this ecosystem.

Major streaming services and broadcasters, Family Room Entertainment Corp.'s primary customers, possess significant bargaining power. Their large subscriber bases and extensive market reach allow them to dictate terms, particularly as the competitive content acquisition landscape intensifies. For example, in 2024, major streamers continued aggressive investment in exclusive content, with Netflix alone planning to spend approximately $17 billion, enabling them to negotiate more favorable licensing deals.

The growth of Advertising-Supported Video on Demand (AVOD) models has also empowered advertisers as crucial customers, influencing content acquisition strategies. With the global AVOD market projected to reach around $118 billion in 2024, platforms are prioritizing content that attracts both viewers and advertisers, potentially impacting the types of shows producers can monetize.

Furthermore, end-consumer price sensitivity and 'subscription fatigue' indirectly amplify customer bargaining power. As viewers re-evaluate their streaming costs, platforms face pressure to secure compelling content at competitive prices, which translates to tighter negotiations with content providers like Family Room Entertainment Corp. Reports in mid-2024 indicated a notable percentage of consumers were considering reducing their streaming subscriptions due to cost.

Customer preferences for localized content further segment the market, giving platforms leverage. In 2024, streaming services saw over 50% of viewing hours in many international markets attributed to non-English titles, compelling platforms to curate diverse libraries and negotiate specific programming terms with creators to meet these distinct regional tastes.

| Customer Segment | Key Leverage Factor | 2024 Market Context | Impact on Family Room Entertainment Corp. |

|---|---|---|---|

| Major Streaming Services & Broadcasters | Large subscriber bases, exclusive content demand | Intense competition for original content, Netflix content spend ~$17 billion | Negotiating power for pricing and licensing terms |

| Advertisers (AVOD) | Crucial revenue source, audience targeting | Global AVOD market projected ~$118 billion | Content must appeal to advertisers, influencing commissioning |

| End-Consumers (Indirect) | Price sensitivity, subscription fatigue | Consumer reports of reducing subscriptions mid-2024 | Pressure on platforms to secure content at lower costs |

| Regional Audiences | Demand for localized content | Over 50% viewing hours from non-English titles in many markets | Need for tailored content, platform leverage for specific programming |

Full Version Awaits

Family Room Entertainment Corp. Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Family Room Entertainment Corp., offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely what you will receive immediately after purchase, fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The unscripted and scripted content market is incredibly crowded. In 2024, hundreds of production companies are actively seeking projects from major broadcasters and streaming services, creating a highly fragmented landscape. This intense competition forces companies like Family Room Entertainment Corp. to continually innovate and distinguish their content to win lucrative deals.

Global content production volume is soaring, with an estimated over 500 original scripted series alone produced in the US in 2023. This sheer volume intensifies the rivalry, making it a significant challenge for any single production to capture audience attention and secure future funding.

Major studio in-house production intensifies competitive rivalry for Family Room Entertainment Corp. Giants like Disney, Warner Bros. Discovery, and Comcast possess vast content creation resources, directly challenging independent producers. These integrated entities often channel their proprietary content to their own streaming services and distribution channels, leaving less opportunity and potentially lower-value deals for external content creators.

The increasing expense of creating high-quality entertainment, fueled by demands for top talent and elaborate production, intensifies competition. For instance, major studios reported average production budgets for flagship series in the tens of millions of dollars in 2024, making it difficult for smaller entities to match these outlays.

This financial burden forces companies to either innovate in production efficiency or concentrate on more budget-friendly content categories to remain competitive. The need for significant capital investment to produce premium content acts as a barrier, directly impacting competitive rivalry within the family entertainment sector.

Global Market Expansion and Localization

Competitive rivalry intensifies as entertainment companies increasingly target global audiences, fueling a dynamic race to produce both local and international successes. Family Room Entertainment Corp. must contend with established Hollywood giants and increasingly formidable, well-capitalized international studios, such as China's Tencent Pictures and South Korea's CJ Entertainment, which are making significant inroads worldwide. For instance, in 2024, global box office revenue saw a notable rebound, with international markets contributing a substantial portion, underscoring the importance of localized content strategies.

Navigating diverse cultural landscapes and consumer preferences presents a significant challenge. Success hinges on the ability to tailor content, marketing, and distribution strategies to resonate with specific local markets. This localization effort adds a complex layer to the competitive environment, as companies must balance global brand consistency with hyper-local relevance.

- Global Box Office Growth: The worldwide box office generated an estimated $80 billion in 2024, demonstrating a strong recovery and the expanding reach of entertainment products.

- International Studio Investment: Major international studios are significantly increasing their production budgets and global distribution networks, directly challenging established players.

- Localization Demand: Consumer data from 2024 indicates a growing preference for locally produced content across many emerging markets, forcing global players to adapt their offerings.

Technological Advancements and AI Integration

The entertainment industry is seeing a significant shift with the rapid integration of technologies like Artificial Intelligence. AI is now being used across the entire content creation pipeline, from analyzing scripts to streamlining post-production processes. Companies that can effectively harness AI to boost efficiency, tailor content for specific audiences, and develop innovative formats are pulling ahead of the competition.

For Family Room Entertainment Corp., staying competitive means a commitment to ongoing investment in cutting-edge technology and the talent needed to operate it. This technological race is a key factor in the intensity of rivalry.

- AI in Content Creation: AI tools are increasingly used for script analysis, character development, and even generating synthetic media, impacting production timelines and costs.

- Personalization and Efficiency: Companies leveraging AI for personalized content recommendations and optimized workflows gain a significant advantage in attracting and retaining viewers.

- Investment Needs: A 2024 report indicated that the global AI in media and entertainment market was projected to reach over $10 billion, highlighting the substantial investment required to stay relevant.

- Talent Gap: The demand for professionals skilled in AI implementation within creative industries is high, creating a challenge for companies to attract and retain top talent.

The competitive rivalry within the family entertainment sector is fierce, driven by a crowded market and a global pursuit of content. Hundreds of production companies are vying for deals in 2024, making differentiation crucial for entities like Family Room Entertainment Corp. This intense competition is further amplified by major studios’ in-house production capabilities and the escalating costs associated with high-quality content creation.

The race to capture global audiences intensifies rivalry, with both established Hollywood players and emerging international studios investing heavily in production and distribution. Companies must navigate diverse cultural preferences, requiring tailored content strategies to resonate locally. Furthermore, the rapid integration of AI in content creation presents both opportunities and challenges, demanding significant investment in technology and specialized talent to maintain a competitive edge.

| Factor | 2023/2024 Data Point | Impact on Rivalry |

|---|---|---|

| Content Production Volume (US Scripted Series) | Over 500 produced in 2023 | Increases fragmentation and difficulty in audience capture. |

| Major Studio Production Budgets (Flagship Series) | Tens of millions of dollars (2024 estimate) | Creates a significant barrier to entry for smaller competitors. |

| Global Box Office Revenue | Estimated $80 billion in 2024 | Highlights the scale of competition and the importance of global reach. |

| AI in Media & Entertainment Market Projection | Projected to exceed $10 billion (2024) | Drives investment and creates a competitive advantage for tech-savvy firms. |

SSubstitutes Threaten

Platforms like TikTok and YouTube present a significant threat of substitutes for Family Room Entertainment Corp. These platforms offer a vast ocean of free, personalized user-generated content that directly vies for consumer attention, often at zero cost. In 2024, YouTube continued its dominance, with over 2.7 billion monthly active users, while TikTok boasted over 1 billion monthly active users globally, demonstrating the sheer scale of this competition.

The highly engaging and viral nature of content on these UGC platforms provides a compelling, low-barrier alternative to professionally produced entertainment. This can erode viewership and engagement for traditional media, as audiences increasingly opt for the immediate, community-driven experiences these platforms foster. The accessibility and constant stream of new content make them a powerful substitute for scripted and unscripted shows.

The video game industry, encompassing mobile and esports, is a massive force in entertainment, especially for younger audiences. In 2024, global video game revenue was projected to reach around $189.3 billion, illustrating its significant draw on leisure time and spending.

These highly engaging and interactive experiences directly compete with traditional media like film and television for consumer attention and disposable income. The social integration within many games further solidifies their position as a powerful substitute for other forms of family room entertainment.

Live events and experiences like concerts, sporting events, and theater are significant substitutes for in-home entertainment. These out-of-home options compete directly for consumer attention and discretionary spending. For instance, in 2024, the global live events market was projected to reach hundreds of billions of dollars, demonstrating a strong consumer preference for these experiences.

Consumers have limited entertainment budgets, and allocating funds to live events means less is available for home-based media consumption. This diversion of resources can impact demand for Family Room Entertainment Corp.'s offerings. Data from 2023 indicated a robust recovery in live event attendance post-pandemic, with many sectors exceeding pre-pandemic revenue levels.

The enduring appeal of unique, real-world experiences continues to drive consumers towards live events. This desire for tangible, memorable moments presents a constant challenge to in-home entertainment providers. In 2024, ticket sales for major music festivals and professional sports leagues saw continued growth, underscoring the strength of this substitute.

Podcasts and Audio-Only Content

The rise of podcasts and audiobooks presents a significant threat of substitutes for traditional family room entertainment. These audio formats are often free or low-cost, making them highly accessible alternatives. For instance, in 2024, the podcast advertising market was projected to reach $2.7 billion, indicating a massive shift in consumer attention and spending towards audio content.

These substitutes are particularly compelling because they can be consumed passively, allowing individuals to multitask during commutes, exercise, or household chores. This versatility directly competes with the focused attention required for visual media typically enjoyed in a family room setting.

- Podcast Listenership Growth: By 2024, over 160 million Americans were expected to be monthly podcast listeners, a substantial portion of the population seeking audio-first entertainment.

- Audiobook Market Expansion: The audiobook market continued its strong growth trajectory, with revenue in the US alone surpassing $1.6 billion in 2023, demonstrating a clear preference for accessible, portable content.

- Accessibility and Cost: Many podcasts are free to access, and subscription costs for audiobooks are often competitive with or cheaper than streaming services for visual content, lowering the barrier to entry.

- Convenience Factor: The ability to consume audio content while engaged in other activities makes it a highly convenient substitute for passive visual entertainment.

Social Media Engagement (Non-Video)

Beyond video, the social and interactive nature of platforms like Facebook, X (formerly Twitter), and various messaging apps also competes for consumer screen time. The constant stream of updates, personal connections, and news consumption on these platforms can detract from time spent watching traditional or digital media. This broad digital ecosystem constantly vies for limited consumer attention. In 2023, the average daily time spent on social media globally was approximately 2 hours and 24 minutes, according to Statista, highlighting its significant draw on leisure time.

These non-video social platforms offer a different, yet equally compelling, form of engagement. They fulfill needs for connection, information, and entertainment, directly competing with the passive consumption of video content. For instance, users might scroll through X for breaking news or engage with friends on Facebook instead of watching a movie or TV show.

- Social Media Dominance: Platforms like Meta (Facebook, Instagram) and X command significant user engagement, diverting attention from other entertainment forms.

- Time Displacement: The average global user spends over 2 hours daily on social media, directly impacting potential viewing hours for video content.

- Interactive Appeal: The personalized and interactive nature of social feeds offers an alternative to the more passive experience of video entertainment.

- Constant Evolution: New features and content formats on social platforms continuously emerge, keeping users engaged and further fragmenting attention.

The threat of substitutes for Family Room Entertainment Corp. is multifaceted, encompassing digital platforms, gaming, live events, and audio content. User-generated content platforms like TikTok and YouTube, with billions of users in 2024, offer free, personalized entertainment that directly competes for consumer attention. Similarly, the massive video game industry, projected to generate nearly $190 billion in revenue in 2024, captures significant leisure time and spending, especially among younger demographics.

| Substitute Category | Key Platforms/Examples | 2024/2023 Data Point | Impact on Family Room Entertainment Corp. |

|---|---|---|---|

| User-Generated Content Platforms | YouTube, TikTok | YouTube: 2.7B+ monthly users; TikTok: 1B+ monthly users | Diverts attention with free, personalized content. |

| Video Games | Mobile games, Esports | Global revenue projected ~$189.3 billion | Captures leisure time and disposable income through interactive experiences. |

| Live Events | Concerts, Sports, Theater | Global market projected hundreds of billions; strong post-pandemic recovery | Competes for discretionary spending and preference for real-world experiences. |

| Audio Content | Podcasts, Audiobooks | Podcast ad market: $2.7 billion; US Audiobook revenue: $1.6B+ (2023) | Offers convenient, often low-cost, passive entertainment alternatives. |

| Social Media | Facebook, X (Twitter), Instagram | Average daily social media use: ~2.4 hours globally | Displaces viewing time with interactive and information-driven engagement. |

Entrants Threaten

The proliferation of digital platforms and direct-to-consumer streaming has dramatically reduced the historical hurdles for content distribution. Gone are the days when extensive broadcast infrastructure or intricate cinema networks were prerequisites for market entry.

This newfound accessibility empowers smaller production entities and independent creators to readily introduce their content, fostering a more dynamic and competitive landscape. For instance, by mid-2024, the global streaming market was projected to exceed $200 billion, a testament to the accessibility digital channels offer.

The threat of new entrants for Family Room Entertainment Corp. is significantly influenced by the increasing accessibility of production technology. Advancements in affordable equipment, editing software, and cloud platforms have dramatically lowered the barrier to entry for content creation. This means that high-quality production is no longer the sole domain of large studios, allowing smaller operations and even individuals to produce competitive content. For instance, the cost of professional-grade cameras has fallen by an estimated 40% in the last decade, making sophisticated filmmaking tools more attainable.

The rise of niche and hyper-personalized content presents a significant threat to established players like Family Room Entertainment Corp. New entrants can effectively target underserved audiences or develop highly specific content that larger studios might overlook. For instance, in 2024, the streaming service Nebula, known for its creator-driven, niche content, saw continued growth, demonstrating the viability of this strategy.

By catering to particular communities or interests, these new players can build loyal fan bases and establish sustainable business models without immediately confronting the market dominance of major entertainment corporations. This approach allows them to gain traction by offering unique value propositions that resonate deeply with specific viewer segments.

Influence of Independent Creators and Talent

The burgeoning creator economy significantly impacts the threat of new entrants for Family Room Entertainment Corp. Individual influencers and independent talents, armed with substantial followings, can now bypass traditional production and distribution channels. This allows them to directly launch their own content ventures, effectively competing without the need for established studio infrastructure.

These talent-led initiatives pose a direct threat as they can monetize their content and audience relationships independently. For instance, platforms like Patreon and Substack enable creators to build subscription models, generating revenue streams that circumvent traditional media gatekeepers. In 2024, the creator economy continued its robust growth, with estimates suggesting it could reach over $250 billion globally.

- Creator Economy Growth: The global creator economy is projected to exceed $250 billion in 2024, indicating a substantial market for independent content creators.

- Direct Monetization: Platforms facilitate direct monetization through subscriptions, merchandise, and brand partnerships, bypassing traditional revenue models.

- Reduced Barriers to Entry: Technology has lowered the cost and complexity of content creation and distribution, empowering individuals to become producers and distributors.

AI-Driven Content Creation and Efficiency

The rapid advancement of generative AI and other artificial intelligence tools presents a significant threat to Family Room Entertainment Corp. by potentially lowering the barriers to entry in content creation. These AI technologies can streamline processes like scriptwriting, animation, and editing, drastically reducing production costs and speeding up turnaround times. For instance, AI-powered tools are already demonstrating capabilities in generating rough animation sequences and assisting with visual effects, which previously required substantial human capital and time.

This democratization of content creation means that agile startups can now produce high-quality content more efficiently and at a lower cost than traditional studios. By leveraging AI, new entrants can bypass some of the capital-intensive stages of production, allowing them to compete more directly with established players like Family Room Entertainment Corp. The ability to generate content at scale with AI support could lead to a more crowded market, intensifying competition for audience attention and revenue.

- AI-driven efficiency: Generative AI can cut content creation costs and speed up production cycles.

- Democratization of content: AI tools empower smaller, agile startups to compete with larger entities.

- Lowered barriers to entry: New companies can enter the market more easily due to reduced production overhead.

- Increased competition: The ease of content creation with AI could flood the market, intensifying rivalry.

The threat of new entrants for Family Room Entertainment Corp. remains moderate to high due to the significantly lowered barriers to entry in content creation and distribution. The rise of digital platforms and accessible technology, including AI, allows smaller players and even individuals to produce and distribute content effectively. This democratization of the industry means established companies must continually innovate to maintain their competitive edge.

| Factor | Impact on New Entrants | Relevance to Family Room Entertainment Corp. |

|---|---|---|

| Digital Distribution Platforms | Lowers distribution costs and reach | Increases accessibility for new content creators |

| Affordable Production Technology | Reduces capital investment for quality content | Enables smaller studios and individuals to compete |

| Creator Economy Growth | Leverages existing audiences and direct monetization | New talent-led ventures can bypass traditional gatekeepers |

| Generative AI | Streamlines production, reduces costs and time | Allows agile startups to produce content more efficiently |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Family Room Entertainment Corp. is built upon a foundation of industry-specific market research reports, financial statements from publicly traded competitors, and consumer behavior surveys. This blend of data allows for a comprehensive understanding of market dynamics.