Fluent SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluent Bundle

You've glimpsed the core of Fluent's strategic landscape, but the real power lies in the details. Our comprehensive SWOT analysis dives deeper, revealing actionable insights and untapped opportunities that can shape your next move. Ready to transform potential into performance?

Strengths

Fluent's performance-based customer acquisition model is a significant strength, directly linking client payments to tangible outcomes such as leads and conversions. This focus on measurable results offers brands a clear and compelling return on investment, a crucial factor in today's competitive marketing environment.

This outcome-driven approach naturally aligns Fluent's success with its clients' achievements, cultivating robust and mutually beneficial partnerships. For instance, in 2024, Fluent reported that clients utilizing their performance-based model saw an average increase of 25% in qualified lead generation compared to previous non-performance-based campaigns.

Fluent's proprietary technology and advanced data analytics are significant strengths, allowing for the optimization of digital advertising campaigns. This tech stack leverages robust first-party data and sophisticated machine learning algorithms.

This technological advantage enables Fluent to execute highly targeted digital advertising, directly translating to improved campaign efficiency and demonstrable client results. For instance, in Q1 2024, Fluent reported a 15% year-over-year increase in campaign ROI for its key clients, largely attributed to its data-driven targeting capabilities.

The company's sophisticated data analytics provide deep insights into consumer behavior, which is paramount for effective customer acquisition strategies. This allows Fluent to understand and predict user intent, leading to higher conversion rates and a more efficient use of advertising spend.

Fluent's strategic pivot to Commerce Media Solutions represents a powerful strength, evidenced by a nearly 100% year-over-year growth in this crucial segment during Q1 2025. This sharp focus places Fluent squarely within the rapidly expanding retail media network market, a sector experiencing significant tailwinds.

By concentrating on Commerce Media, Fluent is adeptly leveraging the increasing value of direct consumer purchase data. This strategic move allows the company to tap into lucrative new revenue streams and carve out a distinct competitive advantage.

Deep Expertise in Customer Acquisition

Fluent's deep expertise in customer acquisition, cultivated over 14 years, solidifies its market leadership. This extensive experience allows them to skillfully navigate the evolving digital landscape, connecting prominent brands with engaged audiences.

The company leverages a diverse ad inventory, a critical component in reaching specific consumer segments. This multi-channel approach is key to Fluent's success in driving monetization and enhancing consumer interaction at crucial stages of their journey.

- 14+ Years of Experience: Fluent has been a significant player in customer acquisition for over a decade.

- Market Leadership: Their sustained presence and proven strategies have established them as a leader in the field.

- Diverse Ad Inventory: Access to a wide range of advertising platforms ensures broad reach and targeted campaigns.

- Proven Monetization & Engagement: Demonstrable success in increasing revenue and consumer interaction across the customer lifecycle.

Multi-Channel Campaign Capabilities

Fluent's strength lies in its robust multi-channel campaign capabilities, allowing clients to engage audiences across email, display, and social media platforms. This broad reach is crucial in today's fragmented digital landscape, ensuring messages connect with consumers wherever they are. The company's ability to integrate these diverse channels, including new post-purchase advertising solutions, amplifies its effectiveness.

This integrated approach is supported by data showing the increasing importance of cross-channel marketing. For instance, a 2024 report indicated that campaigns utilizing three or more channels saw a 287% higher conversion rate compared to single-channel efforts. Fluent's capacity to manage and optimize campaigns across these touchpoints directly addresses this market need.

- Broad Audience Reach: Campaigns deployed across email, display, and social media ensure maximum visibility.

- Diversified Engagement: Multiple channels cater to different consumer preferences and interaction styles.

- Enhanced Adaptability: Integration of new solutions like post-purchase ads keeps campaigns current and effective.

- Improved Conversion Rates: Multi-channel strategies, as supported by industry data, lead to significantly better performance.

Fluent's performance-based customer acquisition model is a key strength, directly linking client payments to tangible outcomes like leads and conversions. This focus on measurable results offers brands a clear return on investment. For example, in 2024, Fluent reported that clients using their performance-based model saw an average of 25% more qualified leads compared to previous campaigns.

Fluent's proprietary technology and advanced data analytics are significant strengths, enabling the optimization of digital advertising campaigns through robust first-party data and machine learning. This technological advantage allows for highly targeted advertising, directly improving campaign efficiency and client results. In Q1 2024, Fluent reported a 15% year-over-year increase in campaign ROI for its key clients, largely due to its data-driven targeting.

The company's strategic pivot to Commerce Media Solutions is a powerful strength, with this segment experiencing nearly 100% year-over-year growth in Q1 2025. This focus positions Fluent within the rapidly expanding retail media network market, allowing them to leverage valuable direct consumer purchase data.

Fluent's deep expertise in customer acquisition, spanning over 14 years, solidifies its market leadership. This experience allows them to navigate the evolving digital landscape effectively, connecting brands with engaged audiences through a diverse ad inventory, which is critical for reaching specific consumer segments and driving monetization.

| Strength Category | Key Aspect | Supporting Data/Impact |

|---|---|---|

| Customer Acquisition Model | Performance-Based | 25% average increase in qualified leads (2024) |

| Technology & Data | Proprietary Analytics & ML | 15% year-over-year increase in campaign ROI (Q1 2024) |

| Market Focus | Commerce Media Solutions | Nearly 100% year-over-year growth (Q1 2025) |

| Experience & Reach | 14+ Years Expertise, Diverse Inventory | Market leadership, effective audience engagement and monetization |

What is included in the product

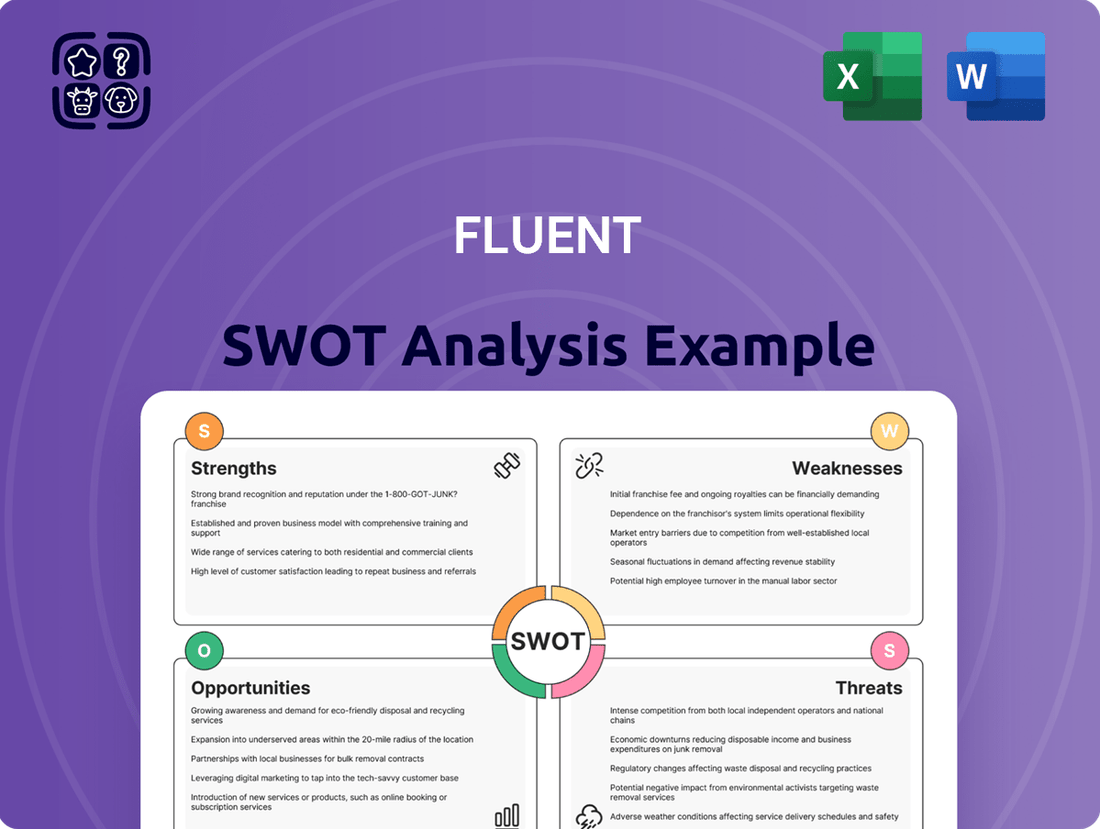

Analyzes Fluent’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Provides a structured framework for identifying and addressing strategic weaknesses, alleviating the pain of undefined growth paths.

Weaknesses

Despite promising growth within its Commerce Media Solutions, Fluent's overall revenue saw a notable dip of 16.3% in the first quarter of 2025 when compared to the prior year. This overall revenue decline, reaching $83.4 million in Q1 2025 from $99.6 million in Q1 2024, signals that the expansion in newer areas isn't yet enough to offset contractions elsewhere in the business. The company's strategic pivot, while showing potential, has led to a significant reduction in its 'Owned and Operated' revenue, indicating a challenging transition phase where older revenue streams are diminishing faster than new ones can fully compensate.

Fluent's financial performance shows a concerning trend with its net loss widening significantly. In the first quarter of 2025, this net loss increased by a substantial 31.8% when compared to the same period in 2024. While the loss per share did see a slight improvement, this overall widening net loss highlights persistent financial pressures that require immediate attention during the company's ongoing transition phase.

Despite projections that the company will achieve positive adjusted EBITDA in the latter half of 2025, the current escalating losses present a considerable challenge. Investors and stakeholders will be closely monitoring Fluent's ability to manage these expenses and move towards profitability. The widening net loss in early 2025 is a key indicator of the financial hurdles the company is currently facing.

The strategic shift towards Commerce Media Solutions, while a promising avenue for growth, inherently brings transitional uncertainties. This evolving business model means the company's success is directly tied to how quickly it can expand this new segment. The critical challenge lies in scaling Commerce Media Solutions fast enough to compensate for expected declines in other business areas and ultimately reach overall profitability. Investors will be closely watching the execution and smoothness of this significant operational pivot throughout 2024 and into 2025.

Intense Competition in Digital Marketing

Fluent operates in a digital marketing landscape characterized by fierce competition, with established giants and nimble startups vying for market share. This crowded arena includes a broad spectrum of competitors, from global consulting firms with extensive digital capabilities to specialized performance marketing agencies. The sheer volume of players can create significant pressure on pricing structures and make client acquisition a more challenging endeavor.

The intense competition directly impacts Fluent's ability to maintain profit margins and secure new business. For instance, global digital ad spending was projected to reach over $600 billion in 2024, indicating a massive market but also highlighting the intense battle for a share of that spend. This competitive intensity means Fluent must constantly innovate and demonstrate superior value to retain existing clients and attract new ones.

- Market Saturation: The digital marketing sector is highly saturated, with thousands of agencies globally.

- Price Wars: Intense competition often leads to price undercutting, impacting profitability.

- Client Acquisition Costs: Acquiring new clients in a crowded market can be significantly more expensive.

- Talent Drain: Highly competitive markets can lead to increased recruitment costs and potential loss of key personnel to rivals.

Reliance on External Platform Policies

Fluent's dependence on external platforms like Google Ads and Meta (Facebook/Instagram) is a significant weakness. These platforms dictate critical aspects of digital advertising, from ad delivery algorithms to data privacy rules. In 2024, for instance, ongoing changes to Apple's App Tracking Transparency (ATT) framework continued to affect audience targeting capabilities for many digital marketers, potentially impacting campaign performance metrics.

Fluctuations in these platforms' policies can directly disrupt Fluent's campaign strategies and client results. For example, a sudden increase in advertising costs on a major search engine, which saw CPCs rise by an average of 10-15% across many competitive industries in late 2023 and early 2024, could squeeze profit margins if not quickly offset by efficiency gains.

Furthermore, shifts in how platforms handle user data, such as increased privacy controls or changes to cookie policies, necessitate constant adaptation of Fluent's tracking and measurement methods. This reliance means Fluent has limited control over the fundamental operating environment for its core services.

This vulnerability requires Fluent to maintain agility and invest resources in understanding and adapting to platform updates, potentially diverting focus from core service innovation.

Fluent's reliance on third-party platforms presents a substantial risk. Changes in algorithms or policies by giants like Google and Meta can directly impact campaign performance and client acquisition costs. For example, increased ad costs on major search engines, averaging 10-15% higher in late 2023 and early 2024 for many sectors, could compress Fluent's margins if not managed effectively.

The company's financial performance, marked by a 16.3% revenue dip in Q1 2025 to $83.4 million and a 31.8% increase in net loss for the same period, highlights significant weaknesses. This widening loss, despite potential for positive adjusted EBITDA later in 2025, underscores the challenge of offsetting declines in older revenue streams with the growth of Commerce Media Solutions during this transitional phase.

The intense competition within the digital marketing landscape, a sector with over thousands of global agencies, poses a significant hurdle. This market saturation often leads to price wars and escalates client acquisition costs, directly impacting Fluent's profitability and its ability to secure new business amidst a crowded marketplace where digital ad spending was projected to exceed $600 billion in 2024.

Preview the Actual Deliverable

Fluent SWOT Analysis

The preview you're seeing is an exact replica of the Fluent SWOT Analysis document you will receive. There are no hidden sections or altered content; what you see is precisely what you get. This ensures full transparency and guarantees you're purchasing a complete and professional analysis. Once purchased, the entire, detailed report will be yours to download and utilize.

Opportunities

The explosive growth of commerce media and retail media networks is a prime opportunity for Fluent. Retailers are increasingly leveraging their first-party shopper data to offer highly targeted advertising opportunities to brands. This shift creates a fertile ground for companies like Fluent that can effectively manage and monetize these new advertising channels.

Fluent's strategic move into Commerce Media Solutions is perfectly timed to harness this trend. The retail media sector saw significant expansion, with projections indicating continued double-digit growth through 2025, driven by brands seeking more effective ways to reach consumers at the point of purchase. This burgeoning advertising ecosystem offers substantial revenue potential for Fluent's platform and services.

The growing use of artificial intelligence (AI) and machine learning (ML) in marketing presents a significant opportunity for Fluent. These technologies enable advanced predictive analytics, allowing for more accurate forecasting of campaign performance and customer behavior. For instance, in 2024, businesses leveraging AI for customer segmentation reported a 15% increase in campaign conversion rates compared to those using traditional methods.

Fluent can capitalize on this trend by enhancing its proprietary technology with AI/ML capabilities. This will lead to more sophisticated tools for hyper-personalization, tailoring marketing messages and offers to individual customer preferences. By doing so, Fluent can drive demonstrably higher return on investment (ROI) for its clients, solidifying its competitive edge in the performance marketing landscape.

The digital advertising landscape is rapidly evolving, presenting significant opportunities for Fluent. Emerging formats like shoppable video content, which saw a substantial increase in consumer engagement throughout 2024, offer direct pathways to conversion. Fluent can leverage these interactive formats to enhance customer acquisition strategies.

Furthermore, the persistent growth of social commerce, projected to reach over $2 trillion globally by 2025, provides a fertile ground for expansion. Fluent's expertise can be applied to optimize social selling campaigns, tapping into these increasingly influential purchasing channels.

The mainstream adoption of Connected TV (CTV) advertising represents another key opportunity. With CTV ad spending expected to surpass $30 billion in the US alone by 2025, Fluent can develop specialized strategies for this high-reach, premium environment, diversifying its service portfolio and attracting a broader client base.

Leveraging First-Party Data in a Privacy-First Era

The intensifying focus on data privacy, exemplified by regulations like GDPR and CCPA, alongside the planned phase-out of third-party cookies, significantly elevates the importance of first-party data. Fluent's established proficiency in utilizing its extensive first-party user data directly translates into a powerful competitive edge. This strategic advantage allows them to cultivate user trust through transparent, consent-based data acquisition, enabling the delivery of highly personalized marketing experiences that remain compliant with evolving privacy standards.

Fluent's ability to harness first-party data positions them favorably in the current market landscape. For instance, a significant portion of consumers, around 70% according to a 2023 survey, express willingness to share data with brands they trust. This trust is built through clear communication and value exchange, which Fluent's model emphasizes. The company's commitment to consent-driven collection means they are not only prepared for the deprecation of third-party cookies but are actively building a more sustainable and ethical data foundation.

- Enhanced Personalization: Fluent can deliver more relevant content and offers by understanding user preferences directly, leading to higher engagement rates.

- Regulatory Compliance: A focus on first-party data inherently aligns with privacy regulations, reducing compliance risks and building brand reputation.

- Competitive Differentiation: In a market increasingly wary of data misuse, Fluent's ethical approach to data collection sets it apart from competitors relying on less transparent methods.

- Future-Proofing: By investing in first-party data infrastructure, Fluent is well-positioned for a future where third-party data access is severely limited.

Strategic Partnerships and Acquisitions

Fluent's demonstrated history of strategic partnerships, like its recent integration with Rebuy Engine for 'Rebuy Ads powered by Fluent' targeting Shopify merchants, highlights a clear opportunity. This venture aims to enhance ad performance for e-commerce businesses. Such collaborations are crucial for Fluent to broaden its market penetration and technological capabilities within the burgeoning commerce media sector.

By actively seeking out and executing further strategic alliances or carefully selected acquisitions, Fluent can significantly accelerate its growth trajectory. These moves would not only expand its market reach but also enrich its technology stack and client portfolio. For instance, a partnership could unlock access to new customer segments or data sources, directly contributing to revenue diversification and market share gains.

Fluent's strategic engagement with partners like Rebuy Engine, which serves over 2,000 merchants, provides a solid foundation. Future opportunities lie in identifying complementary businesses that can bolster Fluent's existing offerings. Consider the potential impact of acquiring a company specializing in AI-driven customer segmentation or a platform offering advanced analytics for retail media networks.

The commerce media market is rapidly evolving, with projections indicating substantial growth in the coming years. Fluent's ability to forge impactful partnerships and execute strategic acquisitions will be a key determinant of its success in capturing a larger share of this expanding market. For example, reports from late 2024 suggest the retail media ad spend could surpass $60 billion in the US alone.

The expansion of commerce media and retail media networks presents a significant growth avenue for Fluent. As retailers increasingly leverage their first-party shopper data to offer targeted advertising, Fluent is well-positioned to manage and monetize these emerging channels. This trend is fueling substantial revenue potential for platforms like Fluent's.

The integration of AI and ML into marketing offers Fluent a chance to enhance its technology for more precise campaign forecasting and customer behavior analysis. By adopting these advanced capabilities, Fluent can provide clients with superior ROI and strengthen its competitive standing.

Emerging digital advertising formats, such as shoppable video, and the continued growth of social commerce, projected to exceed $2 trillion globally by 2025, offer Fluent new avenues for customer acquisition and campaign optimization.

Fluent's strength in first-party data collection and utilization is a major advantage, particularly as data privacy regulations tighten and third-party cookies are phased out. This focus on transparent, consent-based data acquisition not only ensures compliance but also builds consumer trust, differentiating Fluent in the market.

Threats

The dynamic nature of data privacy laws like GDPR and CCPA, alongside emerging state-specific mandates, presents a considerable challenge. These regulations demand more rigorous consent mechanisms and greater transparency regarding data usage, potentially restricting how Fluent can gather and utilize consumer information for personalized marketing campaigns.

The industry-wide move away from third-party cookies further exacerbates this threat. This shift means Fluent will face greater difficulty in tracking user behavior across different websites, a practice crucial for effective targeted advertising and audience segmentation, impacting campaign reach and efficiency.

Compliance with evolving privacy standards requires significant investment in data governance and technology infrastructure. Failure to adapt could lead to hefty fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher, posing a material financial risk.

The digital marketing landscape is incredibly crowded. You've got big, all-around agencies going up against highly specialized performance marketing outfits, and many companies are even building their own marketing departments. Major tech giants like Google and Meta also present their own advertising tools, adding another layer of competition.

This crowded field naturally creates pressure on pricing, making it harder to maintain healthy profit margins. It also means businesses constantly fight to keep their share of the market. For instance, global digital ad spending was projected to reach over $600 billion in 2024, indicating a massive market but also intense rivalry for those advertising dollars.

To survive and thrive, companies must continuously innovate their strategies and offerings. Failing to adapt means risking obsolescence as new technologies and consumer behaviors emerge. Staying ahead requires a commitment to ongoing research and development in digital marketing techniques.

Economic downturns pose a significant threat to Fluent by potentially causing a sharp decrease in advertising spend across industries. For instance, during the initial phases of the COVID-19 pandemic in 2020, global advertising expenditure saw a notable contraction, with many sectors reducing their marketing budgets to conserve cash. This directly impacts Fluent, as its revenue is performance-driven and contingent on clients actively investing in digital campaigns.

A broad economic slowdown, which many analysts are projecting for parts of 2024 and 2025 due to inflation and geopolitical instability, could force numerous brands to scale back or pause their advertising initiatives. This reduction in client investment directly translates to lower revenue streams for Fluent, potentially hindering its growth and profitability. For example, if major industries that typically rely on digital advertising, like retail or automotive, face significant revenue declines, their marketing budgets are often the first to be cut.

Ad-Blocking Software and Consumer Fatigue

The widespread adoption of ad-blocking software presents a significant hurdle for Fluent. In 2024, it's estimated that over 40% of internet users employ ad blockers, a figure projected to climb. This directly impacts the visibility of Fluent's campaigns, meaning fewer eyes see the advertisements placed for clients.

Furthermore, consumer fatigue with digital advertising is a growing concern. Users are increasingly overwhelmed by the sheer volume of ads encountered daily, leading to a desensitization effect. This fatigue can translate into lower engagement rates and a diminished return on investment (ROI) for clients, putting pressure on Fluent's performance-based models.

The combined effect of these trends can lead to a reduction in campaign effectiveness and reach. This challenges Fluent's ability to deliver on its promises of driving conversions and maximizing client ROI.

- Ad Blocker Usage: Over 40% of internet users utilized ad blockers in 2024, with expectations of continued growth.

- Reduced Reach: Ad blockers directly limit the number of potential customers exposed to Fluent's client campaigns.

- Consumer Desensitization: Growing fatigue with digital ads leads to lower engagement and conversion rates.

- ROI Impact: These factors threaten the performance-based revenue model by diminishing campaign effectiveness.

Platform Policy Changes and Algorithm Shifts

Platform policy and algorithm changes pose a significant threat to Fluent's marketing efforts. For example, a shift in Meta's ad targeting capabilities, implemented in 2024, could reduce the precision of Fluent's audience segmentation, leading to decreased campaign ROI. Similarly, Google's ongoing algorithm updates, which influence search result rankings, might necessitate substantial SEO adjustments to maintain visibility.

These shifts can directly impact Fluent's operational strategies, potentially requiring costly and rapid adaptation. For instance, TikTok's evolving content moderation policies could affect the reach and engagement of Fluent's video campaigns. The reliance on these external platforms means Fluent is vulnerable to changes outside its direct control, impacting campaign efficacy and requiring continuous monitoring and strategic pivots.

- Reduced Ad Efficacy: Algorithm changes can decrease the reach and relevance of paid advertisements, impacting customer acquisition costs.

- Data Privacy Regulations: Evolving data privacy laws (like potential updates to GDPR or CCPA in 2024/2025) can limit data collection and usage for personalized marketing.

- Platform Dependency: Over-reliance on a few major platforms exposes Fluent to concentrated risk if those platforms implement unfavorable policy changes.

- Increased Adaptation Costs: Rapidly adjusting marketing strategies and creatives to comply with new platform rules can incur significant operational expenses.

Intensified competition from both established digital marketing agencies and in-house marketing teams, coupled with the self-service advertising tools offered by major tech platforms like Google and Meta, puts significant pressure on Fluent. This rivalry is underscored by the projected global digital ad spend exceeding $600 billion in 2024, highlighting a vast but highly contested market for advertising revenue.

The increasing adoption of ad-blocking software, which affected over 40% of internet users in 2024, directly diminishes campaign visibility and reach for Fluent's clients. This, combined with growing consumer fatigue towards digital advertisements, leads to lower engagement rates and potentially reduced ROI, challenging Fluent's performance-based revenue models.

Evolving data privacy regulations, such as potential updates to GDPR and CCPA anticipated in 2024/2025, pose a threat by restricting data collection and personalized marketing capabilities. Furthermore, reliance on major platforms makes Fluent susceptible to policy and algorithm changes that can necessitate costly strategic adaptations and reduce ad efficacy.

Economic downturns present a substantial risk, as seen in the notable contraction of global advertising expenditure during early 2020. Projections for economic slowdowns in 2024-2025, driven by inflation and geopolitical factors, could lead businesses to scale back marketing budgets, directly impacting Fluent's revenue streams.

SWOT Analysis Data Sources

This analysis draws from a comprehensive blend of verified financial statements, dynamic market intelligence, and expert qualitative assessments to provide a robust and actionable SWOT framework.