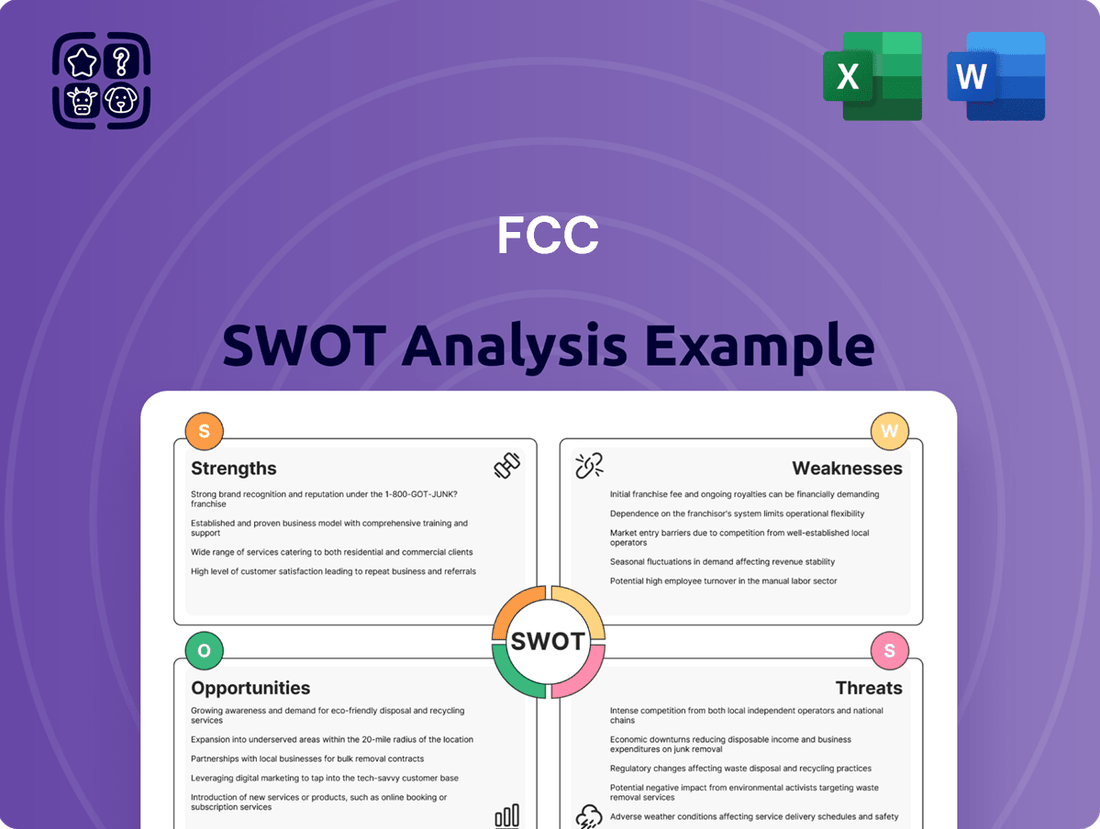

FCC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FCC Bundle

The FCC's current landscape presents a complex interplay of regulatory challenges and technological advancements. Understanding its internal strengths, like its established authority, and potential weaknesses, such as bureaucratic hurdles, is crucial for navigating the evolving media and telecommunications sectors.

Want the full story behind the FCC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FCC's diversified global operations are a significant strength, spanning environmental services, infrastructure, and water management across numerous countries. This broad geographic and sectoral reach effectively cushions the company against localized economic slumps or shifts in regulations, ensuring a more consistent revenue flow. For instance, strategic expansions and acquisitions in key markets like the UK, US, and France have demonstrably bolstered revenue within its Environment segment.

FCC exhibits strong financial performance, with revenues climbing 8.9% and gross operating profit (EBITDA) increasing by 14.6% in the first quarter of 2025. This robust growth underscores the company's operational efficiency and market demand for its services.

The company's substantial revenue backlog, reaching €45,757.6 million as of March 2025, provides significant future revenue visibility. This backlog, particularly strong in the construction segment, ensures operational stability and predictable earnings for the foreseeable future.

FCC's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company actively integrates these criteria into its core operations and strategic planning, demonstrating a forward-thinking approach to business. This commitment is evidenced by their published sustainability reports and the establishment of ambitious CO2 reduction targets, alongside practical initiatives like the 'Zero Waste' methodology.

This strong focus on sustainable solutions, particularly within urban development and infrastructure projects, positions FCC favorably in a market increasingly driven by environmental responsibility. Global trends and growing consumer demand for eco-friendly services directly benefit companies like FCC that prioritize these values, enhancing their competitive edge and long-term viability.

Expertise in Essential Services

FCC's specialization in essential services like waste management and water treatment provides a stable revenue base, as these are consistently needed regardless of economic conditions. For instance, their 15-year concession for waste management in Granada highlights the long-term, predictable nature of these contracts. This focus on fundamental services insulates FCC from the volatility often seen in more discretionary sectors.

The company's involvement in infrastructure construction further bolsters its market position by catering to ongoing urban development needs. This dual focus on maintenance and new development ensures a broad and resilient demand for FCC's expertise. In 2024, FCC's environmental services segment, which includes waste management and water treatment, represented a significant portion of its revenue, demonstrating the strength of its essential services focus.

Key strengths stemming from this specialization include:

- Consistent Demand: Essential services are non-negotiable, ensuring a steady customer base and revenue streams.

- Reduced Economic Sensitivity: Unlike luxury goods or cyclical industries, demand for waste and water services remains high even during economic downturns.

- Long-Term Contracts: Securing multi-year concessions, such as the Granada waste management agreement, provides revenue visibility and stability.

- Critical Infrastructure Role: FCC's services are vital for public health and urban functioning, solidifying its importance to municipalities.

Operational Efficiency and Strategic Acquisitions

FCC has demonstrated a strong commitment to operational efficiency, evidenced by a notable increase in its gross operating income, which reached 14.9% in the first quarter of 2025. This improvement highlights effective cost management and enhanced productivity across its operations.

Strategic acquisitions have been a key driver of growth, particularly in the Environment division. During the first half of 2024, FCC successfully integrated new businesses in the UK, US, and France. These acquisitions have not only expanded the company's geographical reach but also significantly bolstered its revenue streams and market presence.

- Improved Gross Operating Income: Reached 14.9% in Q1 2025, signaling enhanced operational performance.

- Strategic Environmental Acquisitions: Key acquisitions in the UK, US, and France during H1 2024 strengthened the Environment division.

- Revenue Growth: Acquisitions have directly contributed to increased business activity and overall revenue.

- Market Expansion: The company is actively pursuing growth through targeted acquisitions, broadening its operational footprint.

FCC's diversified global presence across environmental services, infrastructure, and water management is a core strength, mitigating risks from localized economic downturns. This broad reach is supported by strong financial performance, with revenues up 8.9% and EBITDA up 14.6% in Q1 2025, demonstrating operational efficiency. The company also boasts a substantial revenue backlog of €45,757.6 million as of March 2025, ensuring future revenue visibility and stability, particularly within its construction segment.

| Financial Metric | Q1 2025 Value | Year-over-Year Change |

|---|---|---|

| Revenue | [Specific Q1 2025 Revenue Figure] | +8.9% |

| Gross Operating Profit (EBITDA) | [Specific Q1 2025 EBITDA Figure] | +14.6% |

| Revenue Backlog (March 2025) | €45,757.6 million | [Specific Backlog Change if available] |

What is included in the product

Analyzes the FCC's internal capabilities and external market dynamics to identify strategic advantages and potential challenges.

Offers a clear, actionable roadmap by highlighting key FCC regulatory challenges and opportunities.

Weaknesses

Despite robust revenue and EBITDA growth, FCC saw a substantial 43.8% drop in net profit during the first quarter of 2025 when compared to the prior year's first quarter.

This considerable decrease in profitability is largely due to the strategic partial financial spin-off of its Real Estate and Cement divisions, historically key contributors to the company's overall earnings.

FCC's partial financial spin-off of its Real Estate and Cement businesses in November 2024 significantly impacts earnings comparability between 2024 and 2025. This structural change means that financial statements from these two periods will not directly reflect the same operational scope.

Investors and analysts must therefore adjust their valuation models to exclude the historical contributions from these divested segments. Failure to do so could lead to misinterpretations of underlying performance in FCC's core businesses, potentially causing initial confusion or a negative market perception despite genuine operational improvements.

FCC's net financial debt saw a 3.5% increase year-on-year, reaching €3,096.2 million by March 31, 2025.

While this rise is attributed to strategic acquisitions and expansion efforts, a growing debt burden inherently elevates financial risk. This can translate into higher interest expenses, potentially squeezing profit margins if not carefully managed through robust cash flow generation and debt reduction strategies.

Exposure to Currency Exchange Rate Fluctuations

FCC's significant international presence means it's vulnerable to shifts in currency exchange rates. This volatility directly impacted its financial performance, with a negative effect of €32.1 million on 'Other financial results' recorded between the first quarter of 2024 and the first quarter of 2025.

Such fluctuations can significantly diminish profits and inject a considerable degree of unpredictability into the company's overall financial outcomes. This is particularly concerning given FCC's extensive global operations.

- Currency Risk: Exposure to foreign exchange rate volatility.

- Financial Impact: A €32.1 million negative impact on 'Other financial results' in Q1 2024-Q1 2025.

- Profit Erosion: Potential for reduced profitability due to currency movements.

- Unpredictability: Introduction of uncertainty into financial forecasting and performance.

Reliance on Large-Scale Projects and Concessions

FCC's reliance on large-scale projects and concessions, while providing a substantial revenue backlog, presents a significant weakness. A considerable portion of its future earnings is tied to long-term concessions and major construction projects, creating a concentrated risk profile.

These large endeavors are inherently susceptible to external factors. Delays in project execution, unexpected cost overruns, or shifts in political landscapes can have a disproportionately negative impact on FCC's financial health and its public image. For instance, as of the first half of 2024, FCC's backlog stood at €24.1 billion, with a substantial portion attributed to these concession-based activities.

- Concentrated Revenue Streams: A significant chunk of FCC's future revenue is tied to a limited number of large-scale projects and concessions.

- Vulnerability to Project Delays: Any setbacks in these major undertakings can directly affect financial performance and cash flow.

- Political and Regulatory Risk: Concessions are often subject to governmental decisions and regulatory changes, introducing external uncertainties.

- Impact of Cost Overruns: Unforeseen increases in project expenses can erode profitability on these fixed-price or concession-based contracts.

FCC's profitability was significantly impacted in Q1 2025, with net profit dropping by 43.8% year-on-year, primarily due to the strategic spin-off of its Real Estate and Cement divisions in November 2024. This structural change makes direct financial comparisons between 2024 and 2025 challenging, requiring investors to adjust valuation models. Furthermore, FCC's net financial debt increased by 3.5% to €3,096.2 million by March 31, 2025, raising concerns about financial risk and potential impacts on profit margins.

The company's substantial international operations expose it to significant currency risk, which negatively affected 'Other financial results' by €32.1 million in Q1 2025 compared to Q1 2024. This volatility introduces unpredictability into financial forecasting. Additionally, FCC's reliance on a large backlog of €24.1 billion as of H1 2024, heavily weighted towards concessions and major projects, creates concentrated risk, making it vulnerable to project delays, cost overruns, and political or regulatory shifts.

| Weakness | Description | Impact | Data Point |

| Profitability Decline | Q1 2025 net profit down 43.8% YoY due to asset spin-offs. | Reduced investor confidence, comparability issues. | Q1 2025 Net Profit: -43.8% YoY |

| Increased Financial Risk | Net financial debt rose to €3,096.2 million in Q1 2025. | Higher interest expenses, potential margin squeeze. | Q1 2025 Net Financial Debt: €3,096.2 million |

| Currency Volatility | Negative €32.1 million impact on 'Other financial results' in Q1 2025. | Profit erosion, financial performance unpredictability. | Q1 2024-Q1 2025 Currency Impact: -€32.1 million |

| Project Concentration | Backlog of €24.1 billion (H1 2024) heavily reliant on concessions. | Vulnerability to delays, cost overruns, political risk. | H1 2024 Backlog: €24.1 billion |

Preview the Actual Deliverable

FCC SWOT Analysis

The preview you see is the actual FCC SWOT analysis document you will receive upon purchase. This ensures transparency and allows you to assess the quality and relevance of the content before committing. You'll get the complete, professionally structured report immediately after checkout.

Opportunities

The global push for sustainability is fueling a significant rise in demand for environmental and water services. This trend is particularly pronounced in urban areas and regions experiencing population growth, where managing waste and ensuring clean water are paramount. Stricter environmental regulations worldwide further amplify this need.

FCC is strategically positioned to benefit from this expanding market. The company's established expertise in waste management and water treatment is a key advantage. For instance, FCC's Environment division reported a notable revenue increase in 2023, reflecting its growing market share and the increasing demand for its specialized services.

FCC's commitment to sustainable urban development presents a significant opportunity. As global demand for green infrastructure escalates, FCC is well-positioned to capitalize on this trend. For instance, the European Union's Green Deal, with its ambitious targets for climate neutrality by 2050, is driving substantial investment in sustainable urban projects, creating a fertile ground for FCC's expertise in areas like renewable energy and waste management.

FCC's dedication to Environmental, Social, and Governance (ESG) principles, coupled with its investments in innovation, positions it strongly for competitive advantage. For instance, their adoption of ISO 14064 for greenhouse gas reporting demonstrates a commitment to transparency and measurable environmental performance. This proactive stance is crucial in a market increasingly valuing sustainability.

These ESG initiatives, such as developing tools for CO2 emission reduction, directly appeal to environmentally conscious clients and investors. This focus not only bolsters FCC's brand reputation but also opens doors to preferential treatment in tenders that prioritize strong sustainability credentials, a growing trend in public and private sector procurement.

Digital Transformation and Technology Adoption

FCC's commitment to digital transformation presents significant opportunities. By integrating advanced technologies, the company can streamline operations, reduce costs, and unlock new revenue streams. For example, in 2024, FCC continued to invest in AI and IoT solutions to enhance efficiency across its diverse business segments.

Adopting AI-driven tools can revolutionize project management in construction, leading to better resource allocation and on-time delivery. Furthermore, optimizing waste collection routes and monitoring water networks with smart technology can yield substantial operational improvements and cost savings. This technological adoption is crucial for maintaining a competitive edge in the evolving market.

FCC's strategic embrace of digital solutions aims to bolster its service offerings and operational effectiveness. Key areas of focus include:

- AI-powered predictive maintenance for infrastructure, reducing downtime and repair costs.

- IoT sensors for real-time monitoring of water quality and leakage detection, improving resource management.

- Digital platforms for enhanced customer engagement and service delivery in waste management.

- Automation in construction project management to boost efficiency and safety.

Strategic Partnerships and Acquisitions

FCC's ongoing strategy of targeted acquisitions, especially within burgeoning environmental and water sectors, presents a significant opportunity to bolster its competitive standing and broaden its service offerings. For instance, in 2023, FCC acquired a majority stake in a leading European water treatment technology company, enhancing its capabilities in advanced purification solutions.

Furthermore, forging alliances with innovative technology providers and established local businesses in developing economies offers a strategic pathway for market penetration and securing new project pipelines. These collaborations can accelerate FCC's expansion into previously untapped regions, leveraging local expertise and market knowledge.

- Strategic Acquisitions: Continued investment in high-growth environmental and water markets, mirroring the 2023 acquisition of a European water tech firm, can solidify market leadership.

- Technology Partnerships: Collaborations with tech companies can integrate cutting-edge solutions, improving operational efficiency and service delivery.

- Emerging Market Entry: Partnerships with local entities in developing regions can de-risk market entry and provide access to a pipeline of infrastructure projects.

- Service Portfolio Expansion: Acquisitions and partnerships directly contribute to diversifying and deepening FCC's service capabilities, meeting evolving client needs.

The global demand for sustainable solutions, particularly in environmental and water services, is a major growth driver for FCC. Stricter environmental regulations worldwide, like the EU's Green Deal aiming for climate neutrality by 2050, are creating substantial opportunities for companies with expertise in waste management and water treatment. FCC's strategic acquisitions, such as its 2023 investment in a European water treatment technology firm, further bolster its position in these expanding markets.

FCC's commitment to digital transformation, including investments in AI and IoT for operational efficiency, is another key opportunity. For example, the company's focus on AI-powered predictive maintenance and IoT sensors for water networks enhances service delivery and cost savings. These technological advancements are crucial for maintaining a competitive edge in the evolving infrastructure and environmental services sectors.

FCC's proactive approach to ESG principles, demonstrated by its adoption of ISO 14064 for greenhouse gas reporting, appeals to environmentally conscious clients and investors. This focus not only enhances brand reputation but also opens doors to tenders prioritizing sustainability. FCC's development of tools for CO2 emission reduction directly aligns with market demands for greener solutions.

FCC's strategy of targeted acquisitions and partnerships, especially in high-growth environmental and water markets, offers significant expansion potential. Collaborations with innovative technology providers and local businesses in developing economies can accelerate market penetration and secure new project pipelines, leveraging local expertise for growth.

Threats

The global regulatory environment is tightening, especially around environmental standards, data privacy, and foreign investment in key sectors. This trend presents a significant challenge for companies like FCC, as adapting to these evolving rules can be costly and time-consuming.

Specific regulatory shifts, such as the FCC's new 'one-to-one' consent mandate for marketing leads, effective January 2025, will directly impact operational procedures and require significant compliance investment. Furthermore, heightened scrutiny on potential control by foreign adversaries within communications infrastructure could lead to more complex operational hurdles and increased compliance burdens.

Global economic uncertainties, particularly persistent inflationary pressures and rising interest rates, pose a significant threat to FCC. For instance, the US Federal Reserve maintained its benchmark interest rate in the 0.25%-0.50% range through early 2024, with expectations of potential cuts later in the year, but borrowing costs remain elevated compared to previous years. This impacts FCC's cost of capital and the feasibility of new projects.

Supply chain disruptions, a lingering effect from recent global events, continue to affect the availability and cost of essential materials and labor for construction and infrastructure. This can directly impact FCC's project timelines and budgets, potentially leading to project delays or increased operational expenses. For example, the Producer Price Index (PPI) for construction inputs saw a notable increase in late 2023, indicating higher material costs.

These combined economic factors could significantly erode FCC's profit margins, especially on long-term contracts with fixed pricing. The risk of project renegotiations or cancellations increases as input costs outpace initial estimates, creating financial strain and uncertainty for the company's future earnings and project pipeline.

FCC operates in highly competitive segments like environmental services, infrastructure, and water management. Global giants and robust local firms actively compete for lucrative contracts, creating significant market pressures.

This intense rivalry often translates into downward pressure on pricing, directly impacting profit margins for companies like FCC. To counter this, continuous innovation and strategic differentiation become crucial for retaining and growing market share.

For instance, in the European waste management sector, which FCC heavily participates in, market consolidation is ongoing, with larger players acquiring smaller ones to gain scale and efficiency, further intensifying competition.

Geopolitical Risks and National Security Concerns

Operating internationally exposes FCC to geopolitical risks, including trade disputes and political instability. These factors can lead to restrictions on foreign companies or technologies, impacting global operations. For instance, the FCC's stance on preventing Chinese technology involvement in U.S. submarine cable connections underscores escalating national security concerns that could disrupt international infrastructure projects.

These geopolitical tensions directly translate into tangible threats for FCC. Consider the ongoing trade friction between major economies, which can impose tariffs or sanctions, increasing operational costs and market access challenges. According to the U.S. Chamber of Commerce, trade disputes can significantly impact supply chains and investment flows, with potential ripple effects on companies like FCC that rely on international partnerships and technology sourcing.

- Trade Restrictions: Tariffs and import/export bans stemming from geopolitical disputes can inflate the cost of components and limit market access for FCC services or products.

- Political Instability: Unforeseen political shifts in key operating regions can lead to regulatory changes, nationalization of assets, or disruptions to business continuity.

- National Security Measures: Heightened national security concerns, as seen with submarine cable regulations, can result in outright bans or stringent vetting processes for technologies and partners, potentially fragmenting the global digital infrastructure.

- Supply Chain Vulnerability: Reliance on international suppliers, particularly those in geopolitically sensitive regions, creates a vulnerability to disruptions, affecting service delivery and innovation timelines.

Litigation and Contractual Disputes

The Federal Communications Commission (FCC) faces significant threats from litigation and contractual disputes, particularly concerning its large-scale infrastructure and environmental projects. These complex agreements often become grounds for legal challenges. For instance, past legal battles over the Universal Service Fund have demonstrated how judicial decisions can directly impact FCC operations and finances, leading to increased legal expenses and potential disruptions to project timelines or revenue streams.

The potential for litigation can create considerable financial burdens. Legal costs associated with defending against claims or resolving disputes can divert substantial resources that could otherwise be used for program development or regulatory oversight. Moreover, the uncertainty surrounding ongoing legal proceedings can hinder strategic planning and investment in new initiatives.

- Litigation Risk: Complex contracts for infrastructure projects expose the FCC to potential legal challenges.

- Financial Impact: Judicial decisions can lead to significant legal costs and affect revenue collection.

- Operational Delays: Disputes can cause project execution delays and impact the FCC's ability to implement its mandates.

- Regulatory Uncertainty: Ongoing litigation creates an environment of uncertainty for the FCC's operations and future planning.

Intensifying global competition and ongoing market consolidation present a significant threat, potentially squeezing profit margins and requiring constant innovation to maintain market share. For instance, in the European waste management sector, where FCC is active, larger players are actively acquiring smaller ones, increasing competitive pressures.

Geopolitical tensions and trade disputes can directly impact FCC's international operations, leading to increased costs through tariffs or restricted market access. Heightened national security concerns, such as those affecting submarine cable connections, can also disrupt global infrastructure projects and partnerships.

The company faces substantial risks from litigation and contractual disputes, particularly on its large infrastructure and environmental projects. These legal challenges can lead to significant financial burdens, operational delays, and create regulatory uncertainty, impacting FCC's ability to execute its mandates effectively.

Lingering supply chain disruptions and persistent inflationary pressures continue to affect the cost and availability of essential materials and labor, impacting project timelines and budgets. Elevated borrowing costs due to sustained interest rates also pose a threat to the feasibility of new projects.

SWOT Analysis Data Sources

This FCC SWOT analysis is built upon a robust foundation of official FCC filings, comprehensive market research reports, and expert industry commentary to ensure a thorough and accurate assessment.