First Commonwealth Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Commonwealth Bank Bundle

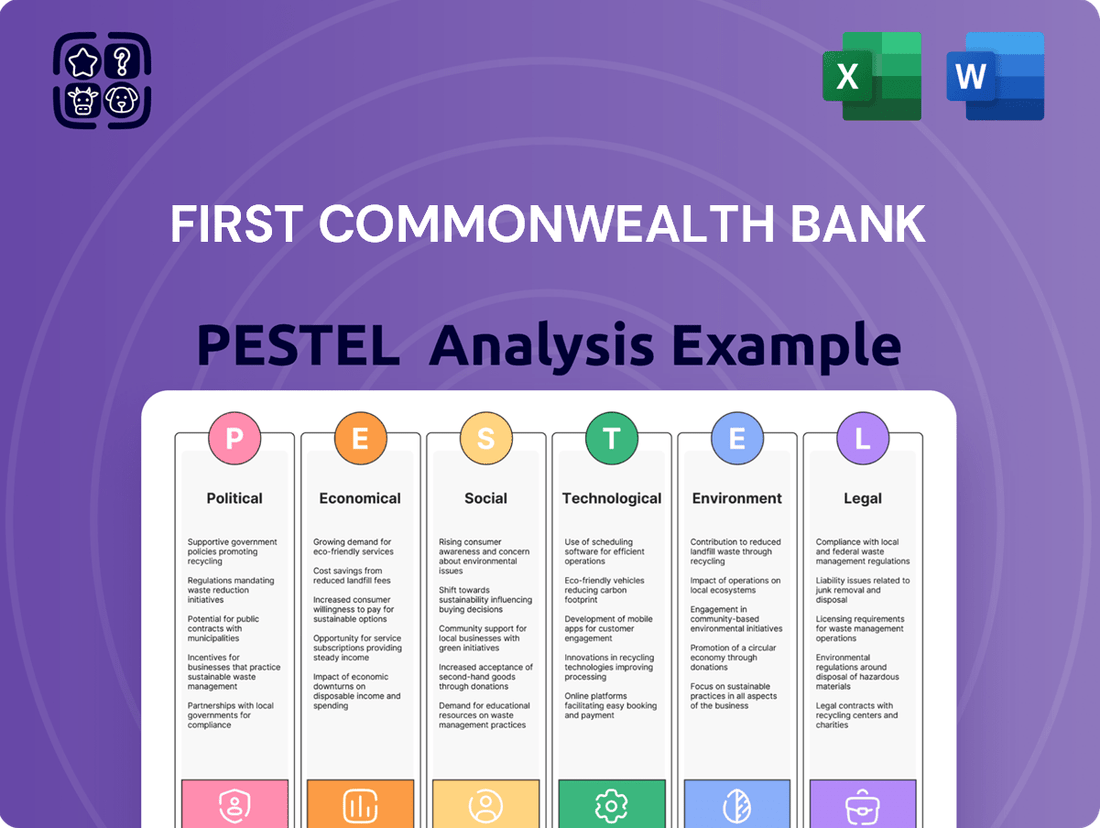

Uncover the critical external forces shaping First Commonwealth Bank's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges. This expertly crafted report provides actionable intelligence for investors, strategists, and anyone looking to gain a competitive edge.

Don't get left behind in the evolving financial landscape. Our PESTLE analysis dives deep into the social, technological, legal, and environmental factors impacting First Commonwealth Bank, offering a clear roadmap for strategic planning. Equip yourself with the insights needed to navigate risks and capitalize on emerging trends.

Gain the strategic advantage you need. Download the full PESTLE analysis of First Commonwealth Bank today and unlock a wealth of data-driven insights designed to inform your investment decisions and business strategies. Get ahead of the curve with intelligence you can trust.

Political factors

First Commonwealth Bank navigates a banking landscape shaped by stringent U.S. regulations, especially within Pennsylvania and Ohio. Federal Reserve directives and state banking oversight directly influence crucial areas like capital adequacy, lending standards, and the expenses associated with compliance, impacting the bank's operational framework.

The evolving political environment may signal a trend towards regulatory moderation at the federal level. Such a shift could potentially bolster First Commonwealth Bank's profitability by easing capital constraints and could also provide flexibility for strategic initiatives and expansion.

Political stability in the United States, particularly within First Commonwealth Bank's core markets of Pennsylvania and Ohio, is a bedrock for sustained economic growth and investor confidence. In 2024, the U.S. maintained a relatively stable political landscape, though upcoming elections in late 2024 and 2025 will be closely watched for potential policy shifts.

While geopolitical tensions and international trade policies might seem distant from a regional bank, they can significantly shape the broader economic climate. For instance, shifts in global trade agreements could indirectly affect manufacturing sectors in Pennsylvania and Ohio, influencing loan demand and the creditworthiness of businesses and individuals that First Commonwealth Bank serves.

Any substantial changes to trade policies, such as tariffs or new international agreements, could ripple through the economy, impacting supply chains and consumer spending. This, in turn, can affect the financial health of the bank's customers, potentially leading to changes in loan repayment behavior and overall credit quality.

Increased government scrutiny continues to shape the banking landscape, with a particular focus on consumer protection, mortgage lending practices, and ensuring equitable branch access across communities. While some federal regulations might see adjustments, states and international bodies are likely to maintain or even increase their mandates, especially concerning data privacy and environmental, social, and governance (ESG) reporting. For example, the CFPB, a key US regulator, has been actively pursuing enforcement actions against financial institutions for various consumer protection violations. This persistent oversight demands that First Commonwealth Bank maintains rigorous internal controls and sophisticated risk management systems to navigate these evolving compliance requirements and mitigate potential penalties.

Monetary Policy and Federal Reserve Actions

Federal Reserve monetary policy, particularly adjustments to the federal funds rate, significantly shapes interest rate environments for banks like First Commonwealth. Changes here directly impact the bank's net interest margin, which is the difference between what it earns on loans and pays on deposits. For instance, if the Fed were to maintain higher rates through much of 2024, it would likely support higher lending income for the bank, but potentially also increase funding costs.

Looking ahead to 2025, projections suggest a potential for gradual rate cuts. This shift could compress net interest margins as loan yields decrease, and it might also spur increased lending activity as borrowing becomes cheaper. The Fed's ongoing assessment of inflation and economic growth remains a critical determinant of the pace and direction of these policy changes.

Key considerations for First Commonwealth Bank regarding monetary policy include:

- Federal Funds Rate Trajectory: Monitoring the Fed's guidance on future rate movements is crucial for forecasting interest income and expense.

- Inflation Outlook: Persistent inflation could lead to prolonged higher rates, while easing inflation might accelerate rate cuts.

- Economic Growth Impact: The Fed's policy is designed to balance growth and price stability, influencing overall loan demand and credit quality.

Legislative Changes Affecting Financial Services

Legislative changes significantly shape the financial services sector. For instance, while a broad federal privacy law in the U.S. isn't imminent, evolving state-level data privacy regulations necessitate continuous adaptation by institutions like First Commonwealth Bank. These state laws, such as California's CCPA/CPRA, impose new data handling and consumer rights mandates.

Amendments to existing financial regulations, potentially including aspects of the Dodd-Frank Act, could introduce fresh compliance burdens or reshape market competition. Furthermore, shifts in political priorities can directly impact the regulatory environment for bank mergers and acquisitions, influencing consolidation trends within the industry.

- Federal Privacy Law Uncertainty: While a U.S. federal privacy law remains elusive, the increasing number of state-level data privacy laws, like those in Virginia and Colorado, require significant compliance resources.

- Dodd-Frank Act Evolution: Potential revisions to the Dodd-Frank Act could alter capital requirements or consumer protection standards, impacting bank operations.

- M&A Regulatory Climate: Political administrations can influence antitrust scrutiny and approval processes for bank mergers, affecting strategic growth opportunities.

Political stability and government policies directly influence First Commonwealth Bank's operating environment, particularly concerning regulations and economic stability in its core markets of Pennsylvania and Ohio. The ongoing focus on consumer protection and data privacy by regulatory bodies like the CFPB necessitates robust compliance measures, as evidenced by their active enforcement actions in 2024.

Anticipated shifts in federal regulations in 2024 and 2025, potentially including adjustments to capital requirements or lending standards, could impact the bank's profitability and strategic flexibility. Furthermore, legislative changes at the state level, especially regarding data privacy, demand continuous adaptation and investment in compliance infrastructure.

Geopolitical events and international trade policies, while indirect, can affect regional economic conditions by influencing sectors vital to Pennsylvania and Ohio, thereby impacting loan demand and credit quality for First Commonwealth Bank. Political decisions on trade, such as tariffs, can create economic ripples that affect the financial health of the bank's customer base.

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting First Commonwealth Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover strategic opportunities and threats.

A clear, actionable PESTLE analysis for First Commonwealth Bank, simplifying complex external factors into easily digestible insights for strategic decision-making.

Provides a concise, visually segmented PESTLE overview of First Commonwealth Bank, enabling rapid identification of opportunities and threats for informed business planning.

Economic factors

The prevailing interest rate environment, shaped by Federal Reserve policy, significantly influences First Commonwealth Bank's profitability. As of mid-2025, the federal funds rate remains stable, with projections indicating a gradual descent in the years ahead.

Lower interest rates can decrease borrowing expenses for both individuals and businesses, potentially boosting loan demand. However, this also compresses the bank's net interest margin, affecting its core revenue stream.

First Commonwealth Bank's success is intrinsically linked to the economic vitality of Pennsylvania and Ohio, its core markets. Regional GDP expansion, robust employment figures, and strong consumer spending directly impact the bank's loan origination, deposit gathering, and overall credit risk profile. For instance, as of Q1 2024, Pennsylvania's unemployment rate stood at 3.9%, a slight decrease from the previous year, indicating a stable labor market that supports consumer confidence and borrowing activity.

The trajectory of regional economic growth significantly bolsters both First Commonwealth's retail and commercial banking operations. A thriving economy in Pennsylvania and Ohio translates to higher demand for mortgages, business loans, and other financial services. In 2023, Ohio's GDP grew by an estimated 2.1%, outpacing the national average, which provides a favorable environment for the bank's expansion and profitability.

Inflationary pressures significantly influence consumer purchasing power and First Commonwealth Bank's operating costs. For instance, the U.S. Consumer Price Index (CPI) saw an annual increase of 3.4% in April 2024, impacting how much consumers can afford and raising expenses for the bank, from technology to employee compensation.

Sustained high inflation can erode the real value of assets and increase the bank's cost of funds, potentially affecting loan profitability. This necessitates careful management of interest rate risk and asset-liability matching.

Consumer sentiment, closely tied to inflation and the broader economic outlook, directly shapes demand for banking services. In early 2024, consumer confidence surveys indicated some hesitation due to persistent price increases, which can translate to lower demand for mortgages, auto loans, and discretionary credit lines.

The bank must adapt its product offerings and pricing strategies to align with evolving consumer spending habits and economic conditions. This includes offering products that help customers manage inflationary impacts, such as savings accounts with competitive rates.

Real Estate Market Trends

The real estate market's condition in Pennsylvania and Ohio is a critical factor for First Commonwealth Bank, directly impacting its mortgage and commercial real estate loan books. Fluctuations in housing starts, property valuations, and commercial construction activity directly shape the bank's lending prospects and its exposure to potential loan defaults.

For instance, the Federal Reserve's sustained elevated interest rates through 2024 and into early 2025 have demonstrably cooled residential real estate investment. Data from the Pennsylvania Association of Realtors indicated a slowdown in existing home sales through late 2024, with a projected modest recovery in 2025. Similarly, Ohio's housing market experienced a dip in new construction permits in the latter half of 2024, reflecting buyer sensitivity to higher borrowing costs.

Commercial real estate also faces headwinds. Rising construction costs and tighter lending standards for development projects in both states are likely to temper new commercial property growth, impacting the bank's commercial loan origination volume. However, select sectors like industrial and logistics spaces continue to show resilience, offering some offset.

Key trends impacting First Commonwealth Bank include:

- Slowing Residential Demand: Higher mortgage rates (averaging above 7% nationally through mid-2025) are continuing to limit affordability and dampen buyer activity in key Pennsylvania and Ohio markets.

- Commercial Development Restraint: Increased construction material costs and a more cautious lending environment for commercial projects are expected to slow the pace of new office and retail development.

- Regional Disparities: While some urban centers may see continued demand for housing and commercial spaces, rural and less economically diverse areas within Pennsylvania and Ohio might experience more significant market softening.

- Impact on Loan Portfolios: A sustained downturn in property values or an increase in commercial vacancies could lead to higher delinquency rates and potential losses within the bank's real estate-secured loan portfolios.

Mergers and Acquisitions Activity

The banking sector is witnessing a significant uptick in mergers and acquisitions (M&A), fueled by evolving market conditions and a more accommodating regulatory landscape. This wave of consolidation presents both opportunities and challenges for established players like First Commonwealth Bank.

First Commonwealth Bank's strategic acquisition of CenterGroup Financial, Inc. in Cincinnati, which closed in early 2024, exemplifies this trend. This move is a clear indicator of their intent to broaden their market footprint and utilize M&A as a primary engine for growth, aiming to enhance their competitive standing and service offerings.

The broader implications of this M&A acceleration include increased industry consolidation, which can lead to heightened competition. For instance, in 2023, the U.S. banking sector saw 148 M&A deals, a notable increase from previous years, signaling a dynamic period of strategic realignment within the industry. This environment necessitates agile strategic planning and a keen awareness of competitive pressures.

- Increased Competition: Consolidation through M&A often results in fewer, larger banking institutions, intensifying competition for market share and customer acquisition.

- Market Expansion: Acquisitions allow banks like First Commonwealth to enter new geographic markets or strengthen their presence in existing ones, as seen with the CenterGroup deal.

- Synergies and Efficiency: Merging entities often seek to achieve cost savings and operational efficiencies through economies of scale, potentially leading to improved profitability.

- Regulatory Scrutiny: While the environment may be more favorable, larger M&A deals still face significant regulatory review to ensure fair competition and financial stability.

Economic factors significantly shape First Commonwealth Bank's operating environment. Interest rate policies, regional economic health, inflation, consumer sentiment, and real estate market dynamics all directly influence loan demand, net interest margins, and credit risk. The bank's performance is intrinsically linked to the economic vitality of Pennsylvania and Ohio, its primary markets.

As of mid-2025, the federal funds rate remains stable, with projections suggesting a gradual decline. However, inflation, measured by the U.S. CPI at 3.4% annually in April 2024, continues to impact consumer purchasing power and the bank's operational costs. Regional GDP growth, such as Ohio's 2.1% expansion in 2023, provides a favorable backdrop, but higher mortgage rates, averaging above 7% nationally through mid-2025, are cooling residential real estate demand.

| Economic Factor | Key Data Point (Mid-2025/Early 2025) | Impact on First Commonwealth Bank |

|---|---|---|

| Federal Funds Rate | Stable, with gradual descent projected | Affects net interest margins and borrowing costs |

| Pennsylvania Unemployment Rate | ~3.9% (Q1 2024) | Stable labor market supports consumer confidence and borrowing |

| Ohio GDP Growth | ~2.1% (2023) | Outpacing national average, supports bank expansion |

| U.S. CPI (Inflation) | 3.4% annual increase (April 2024) | Impacts consumer spending power and bank operating costs |

| National Mortgage Rates | Above 7% (through mid-2025) | Dampens residential real estate demand and loan origination |

Full Version Awaits

First Commonwealth Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for First Commonwealth Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the external forces shaping the banking landscape and First Commonwealth Bank's position within it. This detailed report provides actionable insights for strategic planning and risk management.

Sociological factors

Consumers increasingly expect digital-first banking, with mobile apps and online platforms becoming primary interaction points. A 2024 report indicated that over 70% of banking customers now prefer digital channels for routine transactions, highlighting a significant shift from traditional branch visits.

First Commonwealth Bank must enhance its digital offerings to cater to this demand, ensuring user-friendly interfaces and comprehensive mobile banking capabilities. This includes providing seamless access to account management, fund transfers, and customer support via digital means.

The rise of peer-to-peer (P2P) payment services and the introduction of real-time payment networks like FedNow are further shaping consumer banking habits. By mid-2025, it's projected that P2P transaction volume will continue its upward trajectory, demonstrating a clear preference for instant money movement.

Demographic shifts are significantly reshaping the markets where First Commonwealth Bank operates. In Pennsylvania and Ohio, aging populations are on the rise, with the U.S. Census Bureau data indicating that by 2030, roughly 22% of the population in both states will be 65 or older. This trend directly impacts demand for services like retirement planning and wealth management, areas where First Commonwealth can focus its expertise.

Migration patterns also play a key role. As younger generations and new residents move into urban and suburban areas within First Commonwealth's footprint, there's an increased need for accessible banking solutions, digital services, and potentially, first-time homebuyer programs. The bank's strategic expansion, including its 2023 merger with FCB Bancorp, Inc., demonstrates an awareness of these evolving regional demographics and a proactive approach to capturing market share in growing communities.

The ongoing push for financial literacy and inclusion directly shapes the financial products and services First Commonwealth Bank offers. As more people gain financial knowledge and access to banking services, the demand for tailored solutions, from basic savings accounts to more complex investment options, is expected to rise. This trend underscores the importance of community engagement initiatives designed to build trust and broaden the bank's customer base, particularly in areas historically lacking robust financial services.

In 2023, the FDIC reported that approximately 4.5% of U.S. households, or 5.9 million households, remained unbanked. First Commonwealth Bank's proactive approach to financial education can effectively address this gap, fostering stronger relationships with potential customers. Furthermore, the increasing involvement of Community Development Finance Institutions (CDFIs) in providing financial resources and education to underserved communities presents a significant opportunity for collaboration and expanded reach.

Workforce Dynamics and Talent Acquisition

The banking sector, including First Commonwealth Bank, is experiencing shifts in workforce demographics. There's a growing demand for specialized skills, particularly in technology and data analytics. For instance, a 2024 report indicated a 15% year-over-year increase in job postings requiring AI and machine learning expertise within the financial services industry. This trend directly impacts the bank's ability to attract and retain top talent, as competition intensifies.

First Commonwealth Bank, like many financial institutions, faces stiff competition for skilled professionals. The rise of fintech and the increasing importance of cybersecurity mean that banks are not only competing with each other but also with tech companies for talent. In 2023, the cybersecurity talent gap was estimated to be 3.4 million professionals globally, highlighting the intense competition for these critical roles.

To effectively navigate these evolving workforce needs, investing in employee training and development is paramount. This includes upskilling existing employees in areas like digital banking, data science, and cybersecurity. For example, many leading banks have increased their training budgets by an average of 10% in 2024 to address these skill shortages and foster internal growth.

- Demand for Tech Skills: Growing need for AI, data analytics, and cybersecurity professionals in banking.

- Talent Competition: Banks compete with fintech firms and tech giants for specialized talent.

- Upskilling Initiatives: Investment in employee training is crucial for adapting to industry changes.

- 2024 Data: Reports show a 15% rise in AI/ML skill demand; cybersecurity talent gap remains significant.

Community Engagement and Brand Reputation

First Commonwealth Bank's commitment to community engagement directly influences its brand reputation, a critical sociological factor in today's financial landscape. Strong community ties translate into enhanced customer loyalty and attract new business, especially for a bank emphasizing its local roots. For example, in 2023, First Commonwealth Bank invested over $3.4 million in community initiatives and sponsorships across its operating regions, fostering goodwill and a positive public image.

This deep engagement manifests through various avenues, including supporting local educational programs and participating in revitalization efforts. Such actions not only strengthen the bank's brand but also create a sense of shared purpose with the communities it serves. This sociological connection is vital for sustained growth and trust.

- Community Investment: First Commonwealth Bank's significant financial contributions to local causes in 2023 highlight a strategic focus on building positive social capital.

- Brand Perception: Active participation in community events and sponsorships directly bolsters the bank's reputation as a responsible and engaged corporate citizen.

- Customer Loyalty: Sociological research indicates that consumers, particularly in community-focused banking, exhibit higher loyalty to institutions that demonstrably support their local areas.

- Talent Attraction: A strong community reputation can also aid in attracting and retaining talent, as employees often prefer to work for organizations with a clear social mission.

Consumer preferences are rapidly shifting towards digital-first banking, with over 70% of customers favoring online channels for routine transactions as of 2024. This necessitates First Commonwealth Bank enhancing its digital platforms to meet demand for seamless mobile experiences and instant payment solutions, a trend amplified by the projected continued growth in P2P transaction volumes by mid-2025.

Demographic shifts, particularly aging populations in Pennsylvania and Ohio (projected to reach 22% over 65 by 2030) and migration patterns, influence service demand towards retirement planning and accessible banking solutions for new residents. First Commonwealth Bank's strategic moves, like its 2023 merger, show an awareness of these regional changes.

Financial literacy and inclusion are key, with the FDIC reporting 5.9 million unbanked households in 2023, presenting an opportunity for First Commonwealth Bank to expand its reach through education and potential collaboration with CDFIs.

The bank also navigates workforce trends, facing a 15% year-over-year increase in demand for AI/ML skills in finance by 2024, while competing for cybersecurity talent amid a global gap of 3.4 million professionals. Investing in upskilling and training, with many banks increasing budgets by 10% in 2024, is crucial.

First Commonwealth Bank's community engagement, demonstrated by over $3.4 million invested in local initiatives in 2023, directly impacts its brand reputation and customer loyalty, fostering trust and attracting talent by showcasing a commitment to social impact.

Technological factors

The shift towards digital banking is undeniable, with a significant portion of banking interactions now happening online or via mobile apps. In 2024, it's projected that over 70% of all banking transactions will be conducted digitally, a trend that has only accelerated since 2020.

First Commonwealth Bank needs to stay ahead of this curve by enhancing its digital offerings. This means investing in intuitive mobile apps and user-friendly online platforms that allow for easy account opening and management. For instance, a smooth digital onboarding process can significantly boost customer acquisition and retention rates in today's competitive landscape.

The financial technology (fintech) landscape is rapidly evolving, presenting both hurdles and avenues for established institutions like First Commonwealth Bank. Innovations such as embedded finance, which seamlessly integrates financial services into non-financial platforms, and decentralized finance (DeFi) are reshaping customer expectations. AI-powered tools are also streamlining operations and personalizing customer experiences, forcing traditional banks to adapt. The global fintech market is on a significant growth trajectory, with projections indicating continued expansion through 2034, underscoring the urgency for strategic responses.

To remain competitive, First Commonwealth Bank must consider strategic partnerships with agile fintech firms or invest in developing similar in-house capabilities. This integration of advanced technologies is crucial for enhancing service offerings, improving operational efficiency, and ultimately maintaining market relevance in an increasingly digital financial ecosystem. Failure to adapt could lead to a loss of market share to more technologically forward competitors.

The escalating volume of digital transactions for First Commonwealth Bank amplifies the risk posed by sophisticated cybersecurity threats. These range from AI-powered attacks and phishing schemes to widespread ransomware incidents, all of which can compromise sensitive customer data and erode public confidence. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the magnitude of this challenge for all financial institutions.

To counter these evolving threats, First Commonwealth Bank is compelled to make ongoing investments in advanced cybersecurity infrastructure. This includes implementing cutting-edge fraud detection systems and rigorous data protection protocols. The bank's commitment to safeguarding customer information is paramount for maintaining operational integrity and trust.

Furthermore, regulatory frameworks such as the Digital Operational Resilience Act (DORA) in Europe, which came into full effect in January 2025, mandate robust operational resilience for financial entities. This highlights the critical need for banks like First Commonwealth to fortify their defenses against cyber-attacks and ensure continuous service availability.

Artificial Intelligence (AI) and Machine Learning (ML) Adoption

Artificial Intelligence and Machine Learning are profoundly reshaping the banking landscape. First Commonwealth Bank can harness these technologies to streamline operations, from AI-powered chatbots handling customer queries to sophisticated ML algorithms for fraud detection and credit risk assessment. For instance, the global AI in banking market was valued at approximately $10 billion in 2023 and is projected to grow significantly, indicating a strong trend toward AI adoption across the industry.

By integrating AI and ML, First Commonwealth Bank can achieve substantial efficiency gains and cost reductions. These tools enable more accurate credit scoring, leading to better loan portfolio performance, and can personalize financial advice, enhancing customer engagement. A recent study by Accenture found that AI could boost bank profitability by up to 30% by 2030, highlighting the immense potential.

However, the bank must also address critical challenges associated with AI implementation. Ensuring robust governance frameworks and actively mitigating bias in AI models are paramount to maintaining ethical standards and regulatory compliance. The financial sector's reliance on data means that biased algorithms could perpetuate or even amplify existing societal inequalities.

- AI for Enhanced Customer Service: Chatbots and virtual assistants are improving response times and availability, with industry reports indicating a 25% reduction in customer service costs for banks that heavily invest in AI.

- Fraud Detection and Security: ML algorithms can identify anomalous transaction patterns much faster than traditional methods, potentially saving billions in fraud losses annually. In 2023, financial institutions reported significant improvements in fraud detection rates through AI implementation.

- Personalized Financial Products: AI enables banks to analyze customer data to offer tailored product recommendations, increasing cross-selling opportunities and customer satisfaction.

- Risk Management Improvements: Machine learning models are enhancing the accuracy of credit risk assessments and operational risk monitoring, leading to more stable financial outcomes.

Cloud Computing and Infrastructure Modernization

First Commonwealth Bank's adoption of cloud computing and modernization of its IT infrastructure offers significant advantages. This strategic move enhances scalability, allowing the bank to adjust resources dynamically to meet fluctuating demands, and boosts flexibility, enabling quicker responses to market changes. Furthermore, infrastructure modernization can lead to substantial cost efficiencies by reducing the need for on-premises hardware and maintenance. For instance, by 2024, many financial institutions were reporting significant savings through cloud migration, with some seeing operational cost reductions of up to 30%.

This technological evolution is crucial for delivering advanced digital services and fostering faster innovation. By leveraging cloud platforms, First Commonwealth Bank can accelerate the development and deployment of new customer-facing applications and internal tools. Enhanced data management capabilities, a direct benefit of modern infrastructure, are also vital for navigating the increasingly complex and data-driven financial landscape. In 2024, advancements in AI and machine learning within cloud environments were enabling banks to process vast datasets for personalized customer experiences and improved risk management.

- Scalability and Flexibility: Cloud adoption allows First Commonwealth Bank to scale its IT resources up or down as needed, providing agility in a dynamic market.

- Cost Efficiency: Modernizing infrastructure, particularly through cloud migration, can reduce operational expenditures by optimizing resource utilization and minimizing hardware investments.

- Digital Service Delivery: The technological shift underpins the bank's ability to offer competitive digital banking solutions and improve customer experience.

- Innovation and Data Management: Cloud-based environments facilitate rapid innovation cycles and provide robust capabilities for managing and analyzing large volumes of financial data.

Technological advancements are fundamentally reshaping banking, with digital channels dominating customer interactions. By 2025, it's estimated that over 75% of all banking transactions will occur digitally, a trend that First Commonwealth Bank must embrace through enhanced mobile and online platforms for customer acquisition and retention.

Legal factors

First Commonwealth Bank navigates a stringent regulatory landscape, governed by federal entities like the Federal Reserve and FDIC, alongside state banking authorities. Staying compliant with directives such as Basel III capital requirements, which in 2024 continued to emphasize robust capital buffers, directly influences operational efficiency and strategic planning, adding to the bank's overhead.

Adherence to consumer protection statutes and fair lending mandates, critical components of banking law, is non-negotiable for First Commonwealth. Failure to comply can result in significant penalties and reputational damage, underscoring the substantial financial and strategic implications of these legal frameworks.

Data privacy and security laws significantly shape First Commonwealth Bank's operations. The growing landscape of federal and state regulations, including the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA), alongside emerging state-level privacy laws expected in 2024-2025, dictates how the bank handles customer information. For instance, the CCPA, which grants consumers rights over their personal data, demands stringent data management practices. Failure to comply with these evolving mandates can result in substantial financial penalties, impacting the bank's profitability and reputation.

First Commonwealth Bank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. These mandates necessitate the implementation of comprehensive internal controls, the diligent reporting of suspicious activities, and continuous employee training to ensure adherence.

The regulatory landscape for AML compliance is dynamic, with a pronounced emphasis by authorities in 2024 and projected into 2025 on enhancing data quality and refining risk detection methodologies. This evolving environment presents an ongoing challenge for the bank, requiring constant adaptation of its compliance strategies and systems.

Consumer Protection Laws

Consumer protection laws are a significant legal factor impacting First Commonwealth Bank. Regulations like the Fair Credit Reporting Act (FCRA), Truth in Lending Act (TILA), and prohibitions against Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) directly shape how the bank offers its products, advertises, and interacts with customers. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces UDAAP, and in 2023 alone, it issued numerous enforcement actions and collected billions in relief for consumers, underscoring the critical need for strict adherence.

This ongoing regulatory scrutiny necessitates continuous investment in compliance infrastructure and training to ensure all operations align with consumer safeguarding mandates. Banks must be proactive in updating their policies and procedures to reflect evolving consumer protection standards. For example, the CFPB's focus on fair lending practices means First Commonwealth Bank must ensure its underwriting and product offerings are free from discriminatory bias, a key area of enforcement.

The legal framework also extends to data privacy and security, with regulations such as those governing the handling of nonpublic personal information requiring robust safeguards. Failure to comply can result in substantial fines and reputational damage.

- Fair Credit Reporting Act (FCRA): Governs the collection, dissemination, and use of consumer credit information.

- Truth in Lending Act (TILA): Requires clear disclosure of loan terms and costs to consumers.

- Unfair, Deceptive, or Abusive Acts or Practices (UDAAP): Prohibits practices that mislead consumers or exploit their lack of understanding.

- Consumer Financial Protection Bureau (CFPB): A key regulator enforcing many of these consumer protection laws, collecting billions in relief for consumers annually.

Merger and Acquisition Regulatory Approvals

First Commonwealth Bank's expansion through mergers and acquisitions, like its acquisition of CenterGroup Financial, Inc. in late 2023, necessitates navigating a stringent regulatory landscape. This process involves securing approvals from various federal and state bodies, including banking regulators, which can significantly impact deal timelines and feasibility.

The legal framework governing financial institution M&A is intricate, requiring careful compliance to ensure successful integration. For instance, the Bank Merger Act and various state banking laws dictate the approval process, often involving public comment periods and antitrust reviews.

- Regulatory Scrutiny: Mergers and acquisitions in the banking sector are subject to rigorous review by agencies like the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and state banking departments.

- Antitrust Considerations: Authorities assess potential impacts on market competition, ensuring that consolidations do not create undue market power.

- Compliance Burden: Meeting the legal and regulatory requirements for M&A can be a time-consuming and resource-intensive undertaking for the bank.

- Impact on Strategy: The complexity of regulatory approvals directly influences First Commonwealth Bank's strategic planning for growth through inorganic expansion.

First Commonwealth Bank is subject to extensive legal and regulatory oversight, impacting its operations and strategic decisions. Compliance with federal and state banking laws, including capital requirements and consumer protection statutes, is paramount, as demonstrated by the Consumer Financial Protection Bureau's (CFPB) active enforcement, which in 2023 alone resulted in billions of dollars in consumer relief.

Data privacy regulations, such as the Gramm-Leach-Bliley Act and state-specific laws like the CCPA, dictate how the bank handles sensitive customer information, with non-compliance leading to significant financial penalties. Furthermore, Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations require robust internal controls and reporting mechanisms, with a continued focus in 2024-2025 on data quality and risk detection.

The bank's growth strategies, including mergers and acquisitions like the CenterGroup Financial, Inc. acquisition finalized in late 2023, are heavily influenced by regulatory approvals from bodies like the Federal Reserve and state banking departments, involving antitrust considerations and compliance burdens.

Environmental factors

First Commonwealth Bank faces increasing pressure from investors, regulators, and the public to showcase robust Environmental, Social, and Governance (ESG) performance. This trend is a significant environmental factor shaping the banking landscape. For instance, a 2024 report by Morningstar found that sustainable funds attracted a net inflow of $168 billion globally, highlighting investor demand for ESG-aligned investments.

To address this, First Commonwealth Bank must develop and clearly articulate its ESG strategy. This includes outlining specific initiatives focused on environmental sustainability, such as reducing its carbon footprint or promoting green financing options. Such transparency is crucial for building trust and attracting the growing segment of socially conscious investors and customers who prioritize these values in their financial decisions.

Regulators, particularly the U.S. Securities and Exchange Commission (SEC), are intensifying their focus on climate-related financial risk disclosure. This means institutions like First Commonwealth Bank need to clearly report their exposure to climate risks and detail how they manage them. For instance, the SEC's proposed climate disclosure rules, though facing some legal hurdles, signal a significant shift towards mandatory reporting.

Despite challenges at the federal level in the U.S., a growing number of state-level initiatives and the adoption of international standards, such as those from the Task Force on Climate-related Financial Disclosures (TCFD), necessitate enhanced reporting. This evolving landscape requires First Commonwealth Bank to proactively prepare for more stringent disclosure requirements and embed climate considerations into its core risk assessment frameworks.

The increasing demand for sustainable finance products is a significant environmental factor. In 2024, global sustainable debt issuance reached an estimated $1.5 trillion, demonstrating a clear market preference for environmentally conscious financial solutions. First Commonwealth Bank can capitalize on this by offering green loans and investments that align with environmental goals, meeting customer expectations for eco-friendly banking.

Operational Environmental Footprint

First Commonwealth Bank, like many financial institutions, faces growing pressure to manage its own operational environmental footprint. This includes scrutinizing energy consumption in its branches and offices, the amount of waste generated, and its overall resource utilization. For example, in 2023, financial institutions globally saw a significant increase in investor and customer demand for transparency on environmental, social, and governance (ESG) performance metrics.

Initiatives aimed at reducing this footprint, such as promoting paperless banking options and implementing energy-efficient technologies in its facilities, can significantly bolster the bank's reputation. These efforts not only contribute to broader corporate sustainability goals but also resonate with an increasingly environmentally conscious customer base. For instance, a 2024 report indicated that banks with strong ESG profiles often experience lower capital costs.

Key areas of focus for First Commonwealth Bank's operational footprint reduction include:

- Energy Efficiency: Upgrading lighting, HVAC systems, and encouraging responsible energy use by employees in all 100+ branches and administrative centers.

- Waste Reduction: Implementing robust recycling programs and transitioning to digital document management to minimize paper waste.

- Resource Management: Optimizing water usage and exploring sustainable procurement practices for office supplies and equipment.

Physical and Transition Risks from Climate Change

First Commonwealth Bank, like all financial institutions, must navigate the dual threats of climate change: physical and transition risks. Physical risks stem from the increasing frequency and severity of extreme weather events, which can directly impact the value of collateral securing loans and disrupt the bank's own physical infrastructure. For instance, a severe flood in a region where the bank has significant mortgage exposure could lead to increased defaults and a decline in property values.

Transition risks arise from the societal and economic shifts required to move towards a low-carbon economy. These can include new government regulations, such as carbon pricing or stricter emissions standards, which might affect the profitability of businesses within First Commonwealth Bank's loan portfolio. Technological advancements that render carbon-intensive industries obsolete also pose a transition risk, potentially impacting the loan repayment capacity of companies in those sectors. By the end of 2024, the global financial sector is increasingly focused on integrating climate risk into its stress testing and capital adequacy frameworks, acknowledging that these factors are material to long-term financial stability.

Managing these risks is crucial for First Commonwealth Bank's resilience. This involves robust assessment of climate-related exposures within its lending activities and operational planning. Proactive measures could include diversifying loan portfolios away from highly vulnerable sectors and investing in climate-resilient infrastructure for its own operations. The financial sector's collective response to climate change is evolving rapidly, with an expectation that by 2025, enhanced disclosure requirements related to climate risk will become standard practice globally.

Key considerations for First Commonwealth Bank include:

- Assessing the impact of rising sea levels and increased storm intensity on commercial real estate collateral in coastal or flood-prone areas.

- Evaluating the potential for stranded assets in the energy sector due to policy shifts towards renewable energy sources, affecting companies reliant on fossil fuels.

- Developing strategies to support clients in their transition to more sustainable business models, mitigating potential credit losses.

- Ensuring business continuity plans account for disruptions caused by extreme weather events impacting key operational sites or supply chains.

First Commonwealth Bank must address growing investor and customer demand for Environmental, Social, and Governance (ESG) performance, as evidenced by the $168 billion global net inflow into sustainable funds in 2024. This necessitates a clear ESG strategy, including initiatives like reducing its carbon footprint and offering green financing options to attract socially conscious stakeholders.

The bank also faces increasing regulatory scrutiny, with the SEC proposing climate-related financial risk disclosures, signaling a move toward mandatory reporting. Proactive preparation for these evolving disclosure requirements and the integration of climate considerations into risk assessment frameworks are vital for compliance and long-term stability.

The market shows a clear preference for sustainable finance, with global sustainable debt issuance reaching an estimated $1.5 trillion in 2024. First Commonwealth Bank can leverage this trend by offering green loans and investments, aligning with customer expectations for eco-friendly banking solutions.

First Commonwealth Bank is increasingly focused on managing its operational environmental footprint. This includes improving energy efficiency in its over 100 branches and offices, implementing robust waste reduction programs, and optimizing resource management through sustainable procurement and digital solutions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for First Commonwealth Bank is built on a robust foundation of official government data, reputable financial news outlets, and industry-specific market research reports. We draw insights from economic indicators, regulatory updates, technological advancements, and social trend analyses to provide a comprehensive view.