F45 Training Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F45 Training Bundle

Curious about F45 Training's strategic positioning? Our BCG Matrix analysis reveals their potential Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance. Don't miss out on the complete picture; purchase the full BCG Matrix to unlock detailed quadrant placements and actionable insights for optimizing their fitness empire.

Stars

F45 Training is aggressively pursuing global expansion, evidenced by the opening of 75 new studios in 2024. This growth is further bolstered by the sale of 87 franchises, extending its reach into new territories such as South Africa, South Korea, and various European countries via strategic master franchise agreements.

This rapid international development highlights F45's significant market share within the expanding global boutique fitness sector. The company is experiencing robust demand, reflected in a surge of franchise inquiries, underscoring its strong position and growth potential in this market.

F45 Training's flagship brand saw a robust 12.4% jump in global Average Unit Volumes (AUVs) in 2024. This metric, representing revenue per studio, highlights a strong operational performance and increasing customer spend.

The company also achieved a 5.6% rise in Same Store Sales for the same year. This growth, particularly with all-time highs in North America and the US, underscores F45's market leadership and effective strategies in the competitive functional training sector.

F45 is actively investing in its core product by rolling out new studio designs and a robust strength training program. This initiative, which began in Q4 2024, includes the introduction of functional racks and over 400 new exercises.

This strategic move is designed to enhance the member experience and reinforce F45's leadership in the functional fitness space. The company aims to capture a larger share of the evolving fitness market by meeting diverse member demands.

LionHeart 2.0 Technology and Data Integration

F45 Training's LionHeart 2.0 technology represents a significant leap in their data integration strategy. This upgraded wearable system offers members enhanced tracking and analysis of their fitness progress, notably through an improved heart rate scoring system. By focusing on this data-driven approach, F45 is solidifying its position in the competitive, tech-forward fitness landscape.

The integration of LionHeart 2.0, alongside F45's commitment to incorporating sports science research, is designed to attract and retain members by offering a highly personalized fitness experience. This focus on data and science is crucial for F45 to maintain its growth trajectory in a market increasingly valuing measurable results and tailored training. For instance, by mid-2024, F45 reported an increase in member engagement metrics directly correlating with the use of their wearable technology.

- Enhanced Member Tracking: LionHeart 2.0 provides detailed insights into workout intensity and performance.

- Data-Driven Personalization: F45 leverages this data to tailor workout recommendations and track progress effectively.

- Market Differentiation: The technology positions F45 as a leader in personalized, science-backed fitness solutions.

- Member Retention: Improved tracking and personalization contribute to higher member satisfaction and loyalty.

Strategic Partnerships and Brand Campaigns

F45 Training is actively pursuing strategic partnerships to bolster its market position. Collaborations with entities such as HYROX and Spartan aim to tap into adjacent fitness communities, while alliances with Samsung and Dr. B (focusing on telehealth for GLP-1 medications) diversify its offerings and customer base. These moves are designed to expand brand reach and create unique value propositions.

The launch of the global brand campaign 'This Is F45 Training' is a significant push to unify and amplify the brand message across its international network. This campaign is intended to enhance community engagement and attract new members by clearly articulating the F45 experience. Such initiatives are crucial for maintaining and growing market share in the highly competitive fitness sector, which saw significant growth in 2023 with the global fitness market valued at over $100 billion.

- Strategic Partnerships: HYROX, Spartan, Samsung, Dr. B (telehealth for GLP-1 medications).

- Global Brand Campaign: 'This Is F45 Training'.

- Objectives: Expand brand reach, offer unique value, enhance community engagement.

- Industry Context: Competitive and growing fitness industry, global market valued over $100 billion in 2023.

F45 Training's "Stars" are its most successful and rapidly growing international studios, demonstrating high revenue potential and strong market penetration. These studios are key drivers of the company's global expansion strategy and represent significant investment opportunities.

The company's aggressive expansion in 2024, with 75 new studios and 87 franchise sales, indicates a strong pipeline of potential "Stars." This growth is further supported by a 12.4% increase in global Average Unit Volumes (AUVs) and a 5.6% rise in Same Store Sales, highlighting the financial health of its existing and emerging locations.

F45's focus on enhancing the member experience through new studio designs and improved training programs, alongside technology like LionHeart 2.0, is designed to cultivate more "Stars" by driving engagement and retention. Strategic partnerships also play a role in identifying and nurturing these high-performing locations.

The 'This Is F45 Training' campaign aims to elevate brand awareness, which is crucial for attracting new members to these burgeoning "Star" studios. The company's commitment to data-driven insights and sports science further solidifies the foundation for these studios to achieve and maintain high performance.

| Metric | 2024 Performance | Significance for Stars |

|---|---|---|

| New Studios Opened | 75 | Indicates growth and potential for new Stars |

| Franchise Sales | 87 | Expands reach, creating more opportunities for Stars |

| Global AUV Growth | 12.4% | Demonstrates strong revenue generation potential in successful studios |

| Same Store Sales Growth | 5.6% | Reflects increasing customer spend and loyalty in established locations |

| Product Investment | New designs, strength program, LionHeart 2.0 | Enhances member experience, driving success in all studios, especially Stars |

What is included in the product

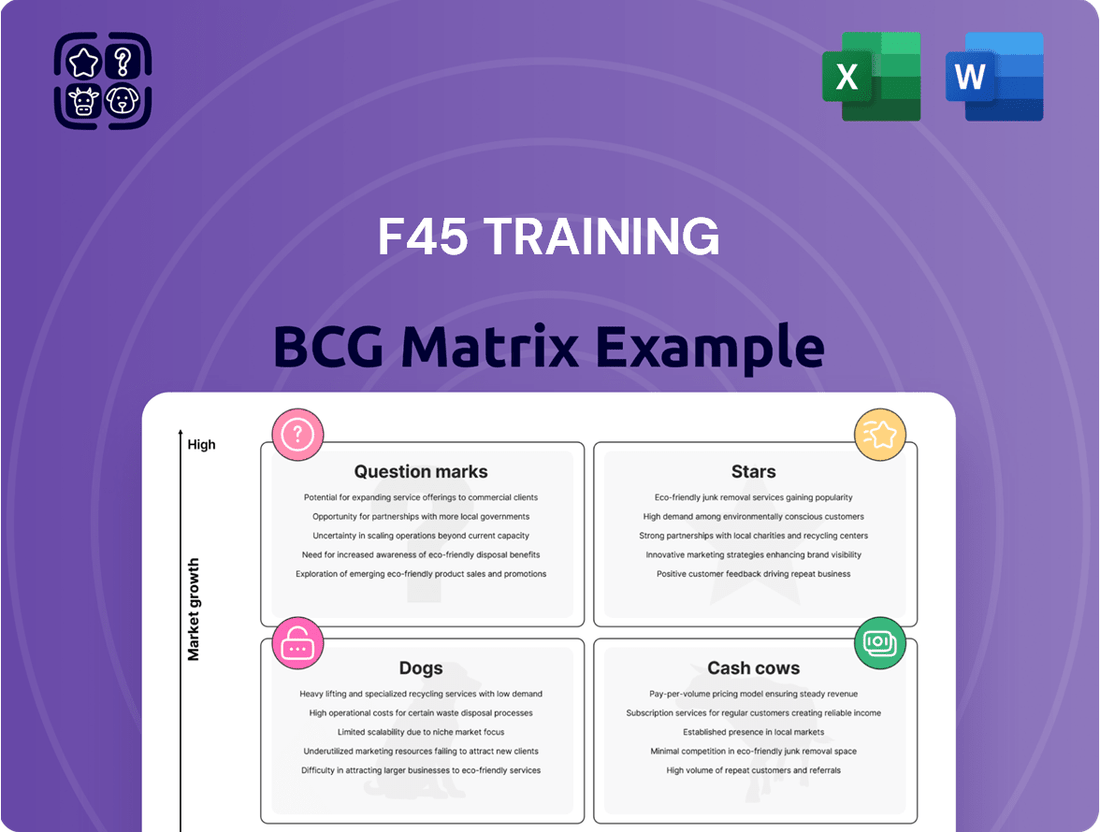

F45 Training's BCG Matrix analyzes its fitness programs as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on investing in or divesting from specific F45 offerings.

F45 Training's BCG Matrix visualizes studio performance, easing the pain of identifying underperforming locations.

Cash Cows

F45 Training boasts a robust global franchise system, evidenced by its presence in over 55 countries with more than 1,500 studio locations. This established network serves a substantial daily customer base of over 500,000 members.

The maturity of its franchise model means F45 Training benefits from consistent cash flow generation. This stability is achieved with comparatively low ongoing investment requirements for expanding into new markets, a hallmark of a cash cow business.

F45 Training's standardized workout programs and equipment represent a classic cash cow within its business portfolio. This uniformity across its franchise network minimizes the need for costly, ongoing product development, a significant cost saver. This efficiency directly translates into robust profit margins for established studios.

The company's reliance on a consistent, proven model for its workout regimes and the necessary equipment fosters operational efficiency. This streamlined approach allows existing studios, operating in what can be considered a mature market segment, to generate consistent and predictable cash flow, a hallmark of a cash cow.

In 2024, F45 Training continued to leverage this standardized model. While specific profit margin data for individual segments isn't publicly broken down in detail, the company's overall financial reports indicate a strong reliance on revenue from its established franchise network, underscoring the cash-generating power of these standardized offerings.

F45 Training's success in the Cash Cows quadrant of the BCG Matrix is significantly driven by its exceptional member retention and engagement. The company cultivates a strong sense of community, offering personalized support and a diverse range of scientifically designed workout programs. This focus on member experience leads to robust customer loyalty.

This loyalty directly translates into consistent, recurring revenue streams, primarily from subscriptions and class packs. In 2024, F45 reported that its membership base demonstrated resilience, with retention rates remaining a key performance indicator. This stable cash flow is crucial for a business operating in a mature, lower-growth market segment.

Low Promotion and Placement Investments for Core Model

The core F45 Training model, often considered a Cash Cow, benefits from its strong brand recognition and established member loyalty. This means it requires less aggressive new promotion and placement investment to maintain its market position. In 2024, F45 continued to leverage its existing network, focusing on operational efficiency and franchisee support to maximize the cash flow generated by these mature locations.

The strategy for these core locations revolves around sustaining profitability rather than rapid expansion. This approach allows F45 to channel resources towards other areas of the business, such as developing new programs or supporting emerging markets. By focusing on retention and operational excellence, the core model consistently contributes to the company's financial stability.

- Established Brand Equity: F45's core model benefits from significant brand awareness built over years, reducing the need for costly new customer acquisition campaigns.

- Loyal Member Base: High member retention rates in established studios translate to predictable revenue streams, minimizing the investment required for ongoing engagement.

- Franchisee Support Focus: Resources are allocated to ensuring existing franchisees are successful, optimizing the performance of mature locations and maximizing cash flow.

- Operational Efficiency: Maintaining streamlined operations in the core model is key to its Cash Cow status, ensuring profitability without substantial new capital outlays.

Recovery and Wellness Offerings (New Revenue Stream)

F45 Training is strategically introducing and expanding its Recovery and Wellness offerings, which include services such as infrared saunas, cold plunges, and percussion therapy. This initiative represents a significant new revenue stream for its franchisees.

This expansion capitalizes on the existing F45 member base and the physical studio infrastructure already in place. By leveraging these assets, the company aims to boost profitability without requiring substantial investment in new market growth, effectively treating this segment as a cash cow.

- New Revenue Streams: Recovery and wellness services are projected to add incremental revenue for F45 franchisees.

- Asset Utilization: The concept efficiently uses existing studio space and member relationships.

- Profitability Enhancement: This strategy aims to increase franchisee profitability by diversifying service offerings.

- Low Market Growth Investment: It requires minimal additional investment compared to expanding into entirely new markets.

The core F45 Training franchise model, with its standardized workouts and equipment, functions as a cash cow. This established system benefits from high brand recognition and a loyal, retained member base, leading to consistent, predictable revenue streams. In 2024, F45 continued to optimize these mature locations, focusing on operational efficiency and franchisee support to maximize cash flow rather than aggressive expansion.

The company's strategy for these core segments emphasizes sustaining profitability. This approach allows F45 to allocate resources to other growth areas while these mature studios, operating in a stable market, reliably generate cash. This consistent cash generation is crucial for the company's overall financial health.

F45's recovery and wellness offerings, such as infrared saunas and cold plunges, are being integrated into existing studios. This leverages current infrastructure and member relationships to create new, profitable revenue streams with minimal new market investment, further solidifying the cash cow status of its core offerings.

| Key Cash Cow Characteristics | F45 Training Application | 2024 Data/Observation |

| High Market Share in Mature Market | Established global franchise network (55+ countries, 1,500+ studios) | Continued operational focus on existing studios. |

| Low Growth Rate | Standardized, proven workout model requires less new development investment. | Focus on efficiency and profitability of existing locations. |

| Consistent Cash Flow Generation | High member retention and recurring revenue from subscriptions. | Membership resilience and loyalty remain key performance indicators. |

| Low Investment Needs | Leverages existing brand equity and studio infrastructure for new services. | Recovery/Wellness services utilize existing assets, minimizing new capital outlay. |

What You See Is What You Get

F45 Training BCG Matrix

The F45 Training BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a polished, professional strategic analysis ready for immediate use.

Dogs

While F45 Training as a brand continues to expand, some individual franchised studios face significant headwinds. These underperforming locations, often situated in less advantageous demographics or hampered by less-than-ideal management, can experience persistently low membership numbers and profitability. This situation places them squarely in the Dogs quadrant of the BCG Matrix.

These struggling studios represent a low-growth, low-market-share segment within the F45 portfolio. For their owners, they can become cash traps, requiring ongoing investment without generating substantial returns. By mid-2024, reports indicated that a notable percentage of F45 franchisees were operating at a loss, underscoring the challenges faced by these individual units.

If these underperforming studios cannot demonstrate a clear path to improved performance and profitability, they become prime candidates for divestiture. The focus for F45 Training would be to either help these locations turn around or to exit them from the portfolio, freeing up resources and management attention for more promising ventures.

Studios in highly saturated or competitive local markets often find themselves in a challenging position within the F45 Training BCG Matrix, typically categorized as Dogs. In these densely packed fitness landscapes, F45 studios may grapple with a diminished market share and sluggish growth rates. This is largely due to the formidable competition posed by a multitude of other boutique fitness brands, established chain gyms, and highly specialized studios, all vying for the same customer base.

These particular F45 locations can encounter significant hurdles in attracting new members and sustaining consistent profitability. For instance, in major metropolitan areas with a high density of fitness options, such as New York City or Los Angeles, the cost of customer acquisition can be substantially higher, impacting the overall return on investment for these studios. By the end of 2024, many such studios might be re-evaluating their operational strategies or considering divestment due to these persistent market pressures.

Older F45 studios that haven't kept pace with design upgrades or new equipment, such as the latest functional racks, are facing a significant challenge. These locations may experience a dip in member engagement and, consequently, lower Average Unit Volumes (AUVs) when compared to their more contemporary counterparts. For instance, if a newer studio boasts an AUV of $400,000, an older, un-updated studio might struggle to reach even $250,000.

Without strategic reinvestment to modernize facilities and amenities, these studios risk becoming 'dogs' in the F45 portfolio. This is particularly true in a market where consumers increasingly prioritize updated and well-equipped fitness environments. Failing to adapt means losing that crucial competitive edge, making it harder to attract and retain members in a crowded fitness landscape.

Franchises Facing Significant Operational Inefficiencies

Franchises within F45 Training that consistently struggle with operational efficiency and cost management, even with a reasonable member base, often find themselves with thin profit margins. These underperforming locations can be categorized as ‘dogs’ in the BCG matrix, as they tie up capital and resources without yielding adequate returns for the franchisor or franchisee.

For instance, a studio operating at 70% capacity but incurring disproportionately high overheads due to inefficient staffing or poor inventory control might fall into this category. In 2023, F45 Training reported that a significant portion of its franchisees were not profitable, with some locations struggling to cover their operating expenses. This highlights the reality of operational challenges impacting profitability.

- Operational Inefficiency: Studios with high staff turnover or inconsistent class scheduling due to franchisee challenges.

- Cost Management Issues: Locations where equipment maintenance, marketing spend, or rent costs are not effectively controlled.

- Low Profit Margins: Franchises that, despite decent membership numbers, fail to generate substantial profit due to the aforementioned inefficiencies.

- Resource Consumption: These studios consume the franchisor's support and brand equity without contributing proportionally to overall system growth or profitability.

Concepts with Limited Appeal in Specific Regions

Certain F45 workout formats might struggle in regions with distinct fitness preferences. For example, if a market strongly favors traditional strength training over HIIT, F45's signature high-intensity programs could see limited adoption, resulting in a low market share and growth. This lack of local appeal would classify these specific offerings as dogs within F45's portfolio in those particular territories.

Brand extensions that don't align with local cultural norms can also become dogs. If F45 attempts to introduce a specialized nutrition line or merchandise that clashes with regional tastes or dietary habits, consumer uptake would likely be minimal. For instance, a push for plant-based supplements in a region with high meat consumption might not gain traction, leading to poor sales performance and marking it as a dog in that market.

- Limited regional adoption of specific F45 workout styles.

- Failure of brand extensions due to cultural misalignment.

- Low market share and growth in specific international territories.

- Example: HIIT formats underperforming in markets preferring traditional strength training.

F45 studios classified as Dogs are those with low market share and low growth prospects. These can be individual franchised locations struggling with profitability due to factors like poor management, intense local competition, or outdated facilities. By mid-2024, a significant portion of F45 franchisees were reportedly operating at a loss, highlighting the challenges faced by these underperforming units.

These struggling studios often become cash traps, requiring continuous investment without generating substantial returns. For instance, older studios that haven't updated equipment might see Average Unit Volumes (AUVs) significantly lower than newer, modernized locations, potentially dropping from $400,000 to $250,000.

Operational inefficiencies and poor cost management can also relegate studios to the Dog category, even with decent membership numbers, resulting in thin profit margins. In 2023, F45 Training acknowledged that a notable percentage of its franchisees were not profitable, with some failing to cover basic operating expenses.

Ultimately, these underperforming locations may need strategic intervention, such as a turnaround plan or divestiture, to free up resources for more promising ventures within the F45 network.

Question Marks

VAURA Pilates, a newer offering from F45 Training, is positioned as a question mark in the BCG matrix. It exhibits impressive growth, with average unit volumes (AUVs) jumping 51.1% year-over-year. The launch of its flagship studio in New York City in 2024 underscores its ambitious expansion plans.

Despite its strong growth trajectory, VAURA Pilates is still building its market share relative to the established Pilates industry and F45's core fitness brand. This nascent stage necessitates continued strategic investment to nurture its potential and transition it from a question mark to a star performer.

FS8, a Pilates-Yoga hybrid, represents a question mark in F45 Training's BCG matrix. In 2024, it demonstrated impressive growth with a 23.9% increase in average unit volume (AUV) and is actively expanding into Europe and the USA.

This strong performance is fueled by the booming Pilates and yoga market, a sector experiencing significant global demand. However, FS8's market share within this increasingly competitive landscape remains relatively small, creating the uncertainty characteristic of a question mark.

F45 Training's collaboration with telehealth provider Dr. B to facilitate access to GLP-1 medications, coupled with their fitness and nutrition programs, taps into a burgeoning segment of the wellness market. This strategic move positions F45 at the forefront of integrated health solutions, merging pharmaceutical interventions with their core fitness offerings.

This innovative service, while promising, is nascent. Its current market penetration within the specialized niche of fitness-enhanced medical weight management is minimal, classifying it as a question mark within the BCG matrix. However, the substantial growth potential in this intersection of health and technology presents a compelling case for significant investment.

New Strength Training Programs (e.g., 'Lift Club')

F45 Training's introduction of new strength-focused programs like 'Lift Club' positions them as a potential 'Question Mark' within the BCG Matrix. These initiatives aim to tap into the burgeoning strength training market, which saw global revenue reach approximately $100 billion in 2023, indicating substantial growth potential.

The 'Lift Club' program, while new, targets a segment of fitness enthusiasts increasingly prioritizing strength development, a trend supported by a 2024 survey showing a 15% year-over-year increase in gym-goers seeking dedicated strength training sessions.

However, as a nascent offering, 'Lift Club' likely holds a low market share in the highly competitive strength training sector, demanding significant marketing and operational investment to gain traction and potentially transition into a 'Star' or 'Cash Cow' in the future.

- New Program Focus: 'Lift Club' and other strength-focused initiatives are F45's strategic move into a growing fitness niche.

- Market Opportunity: The global strength training market's significant revenue indicates high potential for new entrants and specialized programs.

- Investment Requirement: Capturing market share in this segment will require substantial investment in marketing, program development, and potentially equipment upgrades.

- BCG Matrix Classification: Due to low market share and high market growth potential, these new programs are currently classified as 'Question Marks'.

Expansion into Untapped International Markets

F45 Training's aggressive push into new international territories, particularly those with minimal existing brand presence, positions these ventures as question marks within its BCG matrix. While these markets offer substantial growth potential due to low initial penetration, they also carry significant risks. For instance, in 2023, F45 reported a net loss of $42.4 million, highlighting the substantial investment required to establish a foothold in these nascent markets.

These untapped regions demand considerable capital for marketing, operational setup, and community building to overcome the challenge of low brand recognition. Without a proven track record in these specific geographies, gaining market share becomes a complex and resource-intensive endeavor.

- Untapped Markets: High growth potential due to low initial penetration.

- Risks: Significant investment needed for brand building and market share acquisition.

- Financial Implications: Requires substantial capital outlay, potentially impacting short-term profitability.

- Strategic Focus: Investment in marketing and operational infrastructure is crucial for success.

F45 Training's new international market entries are classified as Question Marks due to their high growth potential and low current market share. These ventures require significant investment to build brand awareness and operational infrastructure. For example, F45's 2023 financial report indicated a net loss of $42.4 million, underscoring the capital intensity of such expansions.

The success of these new territories hinges on effective marketing and community engagement strategies to overcome low brand recognition. Without a proven track record in these specific regions, acquiring market share presents a considerable challenge.

The strategic decision to expand into these untapped markets reflects a long-term growth vision, despite the immediate financial outlay. Continued investment is crucial to nurture these nascent operations and potentially elevate them to Star status in the future.

F45 Training's foray into new international markets, characterized by low brand penetration but high growth potential, are categorized as Question Marks in the BCG matrix. These expansions necessitate substantial capital for marketing and operational setup to gain traction.

| Initiative | Market Growth | Market Share | BCG Classification | Investment Need |

|---|---|---|---|---|

| New International Markets | High | Low | Question Mark | High |

| VAURA Pilates | High (51.1% AUV growth) | Low | Question Mark | High |

| FS8 | High (23.9% AUV growth) | Low | Question Mark | High |

| GLP-1 Medication Access | High | Minimal | Question Mark | High |

| 'Lift Club' Program | High (Strength Training Market ~$100B in 2023) | Low | Question Mark | High |

BCG Matrix Data Sources

Our F45 Training BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research on fitness trends, and competitor performance metrics to ensure reliable insights.