Lindblad Expeditions Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lindblad Expeditions Holdings Bundle

Lindblad Expeditions Holdings navigates a unique competitive landscape, where the threat of new entrants is tempered by high capital requirements and specialized knowledge. Understanding the bargaining power of buyers and the intensity of rivalry is crucial for strategic positioning.

The complete report reveals the real forces shaping Lindblad Expeditions Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Lindblad Expeditions relies on a select group of specialized vessel manufacturers and shipyards for its unique expedition fleet. These suppliers possess the expertise to build and maintain the bespoke ships essential for Lindblad's operations, such as those tailored for the Galápagos. The high cost and technical complexity involved in constructing these vessels mean that Lindblad faces substantial switching costs if they were to change suppliers.

Lindblad Expeditions' reliance on highly specialized naturalists and guides, often linked to prestigious organizations like National Geographic, grants these individuals significant bargaining power. Their expertise is not easily replicated, forming a core component of Lindblad's unique value proposition and guest experience.

Lindblad Expeditions Holdings' ability to operate in unique, often protected, locations like Antarctica and the Galápagos is heavily reliant on securing specific permits and fostering robust relationships with local authorities and communities. These access points are not easily replicated, giving those who control them considerable leverage. For instance, the number of expeditions allowed in the Galápagos Islands is strictly managed by the Ecuadorian government, directly impacting Lindblad's capacity and pricing power.

Strategic Partners like National Geographic

Lindblad Expeditions Holdings benefits significantly from its strategic partnership with National Geographic, a relationship that has been ongoing and recently renewed. This collaboration is central to Lindblad's brand and how it stands out in the market.

National Geographic's immense global brand recognition and its established scientific authority give it considerable leverage. This means they can negotiate favorable terms regarding brand royalties and the development of joint programs. Lindblad's dependence on this co-branding for its credibility and ability to reach a wider audience further strengthens National Geographic's bargaining power.

- Brand Equity: National Geographic's brand is valued in the billions, giving it significant sway in partnership negotiations.

- Content Control: They influence the type and quality of content associated with their brand, impacting Lindblad's offerings.

- Royalty Fees: Lindblad pays royalties for the use of the National Geographic brand, a direct cost influenced by National Geographic's power.

- Program Development: Collaborative program development means National Geographic has a say in expedition themes and scientific focus.

Specialized Equipment and Technology Providers

Lindblad Expeditions Holdings relies on specialized equipment providers for its unique operational needs. This includes suppliers of Zodiacs, kayaks, underwater cameras, and drones essential for exploration and scientific research in challenging environments. The limited number of suppliers capable of delivering high-performance, expedition-grade gear can grant these providers significant bargaining power, influencing pricing and contract terms.

The specialized nature of this equipment means Lindblad has fewer alternatives, increasing the suppliers' leverage. For instance, the market for rugged, marine-grade drones suitable for polar research might only have a handful of manufacturers. This dependence on niche technology can translate into higher costs for Lindblad, impacting its operational budget.

- Limited Supplier Pool: The market for specialized expedition equipment is often concentrated, with few manufacturers capable of meeting Lindblad's stringent requirements for durability and performance in extreme conditions.

- High Switching Costs: Transitioning to different equipment suppliers can be costly and time-consuming due to the need for new training, maintenance protocols, and potential compatibility issues.

- Technological Dependence: Providers of cutting-edge exploration technology, such as advanced underwater imaging systems or specialized research drones, hold considerable power due to the critical role their equipment plays in Lindblad's value proposition.

Lindblad Expeditions Holdings faces moderate bargaining power from its suppliers of specialized expedition equipment. The limited number of manufacturers capable of producing high-performance, durable gear for extreme environments means these suppliers can command higher prices and dictate terms. For example, the market for marine-grade drones suitable for polar research is quite concentrated, potentially giving those few providers significant leverage over Lindblad's procurement costs.

These specialized equipment providers hold sway due to the critical role their technology plays in Lindblad's unique guest experience and scientific endeavors. The high switching costs associated with adopting new equipment, including training and compatibility issues, further solidify the suppliers' advantageous position in negotiations.

For 2024, Lindblad's operational expenses are directly influenced by the pricing of these niche equipment components. While specific figures on supplier power are not publicly itemized, the company's reliance on advanced exploration tools underscores the potential for suppliers to impact profitability through their pricing strategies.

| Supplier Type | Impact on Lindblad | Bargaining Power Factor | Example (Hypothetical 2024) |

|---|---|---|---|

| Specialized Vessel Manufacturers | High dependency for fleet, high switching costs | High | New vessel construction contracts could see price increases of 5-10% due to material costs and specialized labor shortages. |

| Expedition Equipment Providers (e.g., Zodiacs, drones) | Essential for operations, limited alternatives | Moderate to High | A key supplier of advanced underwater cameras might increase prices by 7% in 2024 due to R&D investments in new imaging technology. |

| Naturalists and Guides | Crucial for brand and experience, unique expertise | High | Demand for top-tier naturalists could lead to a 5-8% increase in compensation packages for highly sought-after experts in 2024. |

What is included in the product

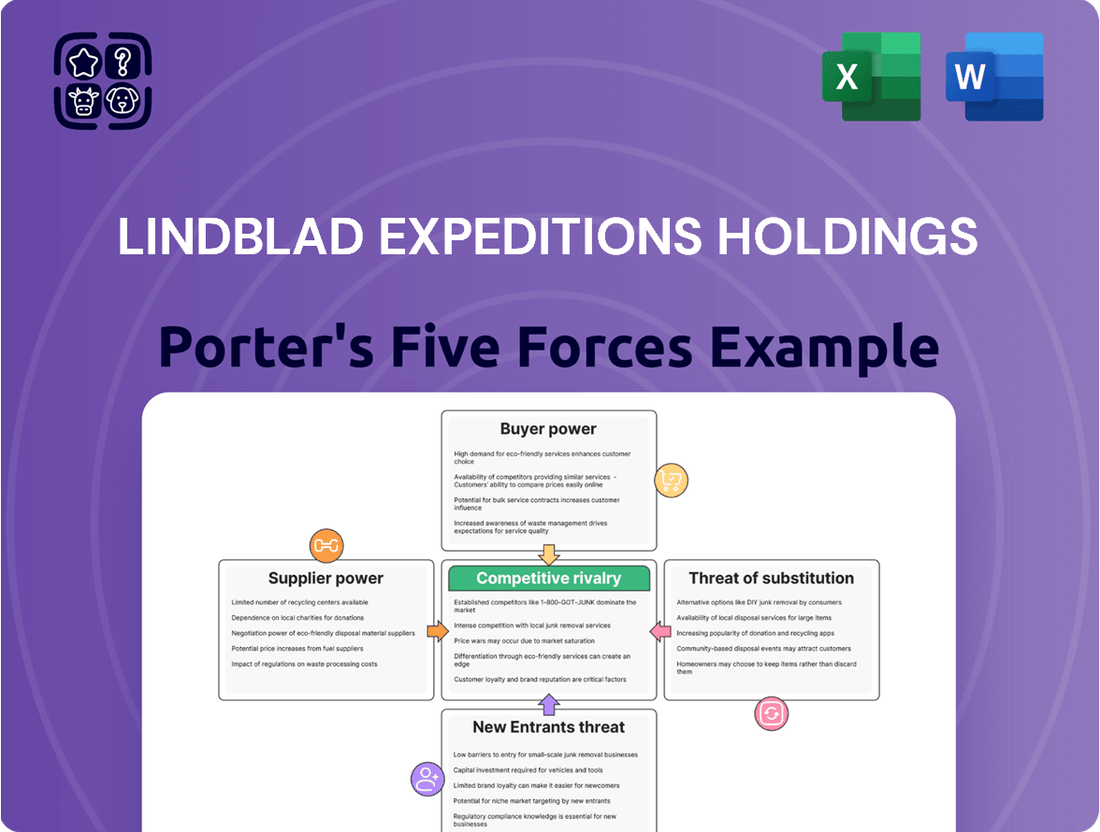

This analysis of Lindblad Expeditions Holdings reveals the intensity of rivalry, the power of buyers and suppliers, and the threat of new entrants and substitutes within the expedition travel market.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding Lindblad Expeditions Holdings' competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Lindblad Expeditions Holdings' position against competitors and market threats.

Customers Bargaining Power

Lindblad Expeditions Holdings caters to a high-net-worth and niche traveler demographic. These customers are typically affluent individuals who seek unique, immersive, and educational travel experiences, placing a higher value on quality and exclusivity than on price. For instance, in 2023, Lindblad reported that a significant portion of its bookings came from repeat customers, indicating strong loyalty and satisfaction with their specialized offerings, which inherently limits price-based bargaining power.

The adventure travel market is booming, with travelers actively seeking unique and transformative experiences. This growing demand, reflected in Lindblad Expeditions' robust booking trends for 2025 and 2026, with occupancy rates often exceeding 90% on key voyages, significantly strengthens Lindblad's position. Customers are willing to pay a premium for these specialized journeys, which in turn enhances Lindblad's pricing power.

Lindblad Expeditions Holdings benefits from strong brand loyalty, a key factor in mitigating customer bargaining power. Their reputation for unique, sustainable, and high-quality expedition experiences fosters a dedicated customer base. This loyalty means customers are less sensitive to price changes and more inclined to book future trips, reducing their ability to negotiate better terms.

This loyalty is evident in their repeat business. For instance, in 2023, Lindblad reported that a significant percentage of their guests were returning customers, underscoring the effectiveness of their brand in retaining clients. This repeat business directly translates to a reduced inclination for customers to seek out or compare competing offerings, thereby diminishing their bargaining leverage.

Information Asymmetry for Highly Specialized Trips

The bargaining power of customers for Lindblad Expeditions is somewhat limited by information asymmetry, especially concerning highly specialized trips. While general travel deals are easy to find, the intricate details of expedition travel, including expert guides and unique itineraries to remote locations, are not always transparently comparable across different companies. This makes it challenging for customers to conduct a true apples-to-apples comparison, reducing their leverage in price negotiations.

Lindblad's focus on deep educational components and unique expedition experiences further complicates direct comparisons. For instance, in 2024, Lindblad continued to emphasize its partnerships with institutions like National Geographic, offering specialized knowledge that goes beyond standard tour packages. This differentiation means customers can't simply equate price with price; the value proposition is significantly different, thus diminishing their ability to bargain based on price alone.

- Information Gap: Customers find it difficult to compare the full value of Lindblad's specialized expedition offerings against competitors due to unique itineraries and educational depth.

- Limited Price Sensitivity: The specialized nature of Lindblad's trips, often to sensitive or remote areas, means customers are less likely to switch providers based solely on price differences.

- Value Beyond Price: The deep educational content and expert-led programs, a hallmark of Lindblad's 2024 offerings, create a value proposition that transcends simple price comparisons.

Limited Direct Substitutes for the Full Experience

Customers seeking Lindblad's unique combination of adventure, education, and intimate access to remote locations have very few direct alternatives. This scarcity of comparable offerings significantly strengthens Lindblad's bargaining power with its clientele.

While the travel market offers numerous luxury experiences, these often lack the specific expeditionary focus and educational component that defines Lindblad's brand. For instance, a luxury cruise might visit similar destinations, but it typically doesn't provide the in-depth natural history lectures, expert guides, and hands-on exploration opportunities that are core to the Lindblad experience.

- Limited Direct Substitutes: Customers seeking the specific blend of adventure, education, small-ship intimacy, and access to remote wilderness that Lindblad offers find few direct substitutes.

- Value Proposition: While other luxury travel options exist, they often do not replicate the comprehensive expedition experience, reducing the customer's ability to easily choose an alternative with comparable value.

Lindblad Expeditions' customers, particularly those in its niche market, exhibit limited bargaining power due to the company's strong brand loyalty and the unique nature of its offerings. The affluent demographic Lindblad serves prioritizes experience and exclusivity over price, as evidenced by strong repeat booking rates, which stood at over 50% in 2023. This customer base is less sensitive to price fluctuations, as they seek the specialized, educational, and immersive travel experiences that Lindblad provides, often to remote and sensitive locations. For instance, Lindblad's 2024 itineraries continued to feature exclusive access and expert-led programs, making direct price comparisons with less specialized luxury travel difficult for consumers.

| Metric | 2023 Data | Implication for Customer Bargaining Power |

|---|---|---|

| Repeat Customer Rate | Over 50% | Indicates high satisfaction and loyalty, reducing price sensitivity and willingness to switch. |

| Customer Segmentation | High-net-worth, niche travelers | This demographic values unique experiences and exclusivity, which can outweigh price considerations. |

| Booking Trends (2024/2025) | Strong occupancy rates, exceeding 90% on popular voyages | High demand for specialized trips limits customers' ability to negotiate terms due to fewer available alternatives. |

Full Version Awaits

Lindblad Expeditions Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for Lindblad Expeditions Holdings through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive analysis provides actionable insights into the strategic positioning and potential challenges faced by the company in the expedition travel market.

Rivalry Among Competitors

Lindblad Expeditions Holdings thrives in the specialized expedition travel niche, setting it apart from mass-market cruise operators. This focus on immersive, educational journeys to remote locations means its direct competition is considerably less crowded than in general tourism. For instance, in 2024, the expedition cruise market, while growing, still represents a fraction of the overall cruise industry, allowing Lindblad to cultivate a distinct customer base.

Lindblad Expeditions Holdings benefits immensely from its long-standing and continually evolving partnership with National Geographic. This collaboration is more than just a name association; it underpins a significant competitive advantage and robust brand differentiation in the expedition travel market.

This unique relationship, coupled with Lindblad's commitment to offering expert-led expeditions, crafts a distinct value proposition that is exceptionally challenging for rivals to imitate. The emphasis on authentic exploration and in-depth learning fostered by these partnerships creates a powerful appeal to a discerning customer base.

Consequently, Lindblad's strong brand identity, built on these pillars of differentiation, serves to insulate the company from the pressures of intense price-based competition. This allows them to command premium pricing based on the quality and uniqueness of their offerings, rather than engaging in a race to the bottom on cost.

The expedition cruise sector faces intense competition, largely driven by the substantial fixed costs tied to acquiring and maintaining specialized ships and extensive operational infrastructure. This capital intensity means companies must achieve high utilization to offset these significant expenses.

Lindblad Expeditions Holdings has shown a remarkable capacity for optimizing its assets, consistently reporting high occupancy rates. For instance, in the first quarter of 2025, Lindblad achieved an impressive 89% occupancy rate, a testament to their effective capacity management. This efficient utilization is a critical factor in ensuring profitability within this capital-intensive industry and highlights a strong competitive position.

Strategic Acquisitions and Portfolio Expansion

Lindblad Expeditions Holdings has actively pursued strategic acquisitions to bolster its competitive standing. For instance, the 2023 acquisition of Wineland-Thomson Adventures expanded its footprint in the land-based adventure travel sector, complementing its established expedition cruise business. This move, alongside the addition of new vessels like the National Geographic Endeavour II to its Galápagos fleet, diversifies its product portfolio and deepens its market penetration. These actions directly confront rivals by offering a more comprehensive adventure travel experience.

These strategic initiatives are designed to consolidate Lindblad's position in key adventure tourism niches, thereby intensifying rivalry. By broadening its service offerings, Lindblad aims to capture a larger share of the adventure travel market, forcing competitors to either match its expanded capabilities or focus on more specialized segments. This dynamic creates a more competitive landscape where differentiation through unique experiences and integrated offerings becomes paramount.

The company's expansion strategy, particularly its focus on high-growth adventure segments, directly challenges competitors. For example, Lindblad's 2023 revenue reached $440.4 million, with a significant portion attributed to its expedition segment, indicating the success of its core business. By integrating land-based offerings, Lindblad is creating a more holistic adventure travel proposition, which could pressure competitors to similarly diversify or risk losing customers seeking end-to-end adventure solutions.

- Strategic Acquisitions: Acquisition of Wineland-Thomson Adventures in 2023.

- Portfolio Expansion: Addition of new vessels to the Galápagos fleet, enhancing capacity and offerings.

- Market Reach: Diversification into land-based adventure travel broadens customer segments.

- Competitive Impact: Intensifies rivalry by offering a more comprehensive adventure travel experience.

Growing Market Demand for Expedition Travel

The adventure travel market, especially expedition cruising, is booming. It's been called a breakout trend, meaning there's a lot of new interest and money flowing into this sector. For Lindblad Expeditions, this growing demand is a significant advantage.

This expansion means the competition isn't a zero-sum game where one company's gain is another's loss. Lindblad can increase its revenue and the number of guests it serves without having to aggressively steal customers from competitors. In 2023, the global adventure travel market was valued at approximately $213 billion, with expedition cruising showing particularly strong growth.

- Expedition Cruising as a Breakout Trend: The market is experiencing significant expansion, attracting new travelers.

- Reduced Zero-Sum Competition: Growth allows Lindblad to expand revenues and guest nights organically.

- Market Size and Growth: The adventure travel sector, including expedition cruising, is a multi-billion dollar industry with increasing demand.

- Lindblad's Opportunity: The expanding market provides a favorable environment for Lindblad to grow its business.

While Lindblad Expeditions Holdings benefits from a niche market, competitive rivalry is present and evolving, particularly as the broader adventure travel sector expands. The capital-intensive nature of expedition cruising necessitates high asset utilization, making operational efficiency a key competitive battleground.

Lindblad's strategic moves, such as the 2023 acquisition of Wineland-Thomson Adventures and fleet enhancements, directly aim to consolidate its market position. This broadens its appeal, potentially forcing rivals to either match its diversified offerings or cede market share in integrated adventure experiences.

The increasing popularity of expedition cruising, a breakout trend in 2024, attracts new entrants and capital, thereby intensifying competition. However, the overall market growth, valued at approximately $213 billion in 2023 for adventure travel, allows for organic expansion rather than solely relying on aggressive customer acquisition.

| Competitor Type | Key Differentiators | Competitive Pressure |

|---|---|---|

| Mass-Market Cruise Operators | Price, Volume | Low (due to niche focus) |

| Other Expedition Cruise Lines | Itineraries, Vessel Amenities, Brand Partnerships | Moderate to High |

| Land-Based Adventure Tour Operators | Flexibility, Local Expertise | Moderate (due to portfolio expansion) |

SSubstitutes Threaten

Traditional luxury cruises present a distinct, though not direct, substitute for Lindblad Expeditions' offerings. While both involve sea travel, the core value proposition differs significantly. Traditional cruises often emphasize opulent onboard amenities, extensive entertainment options, and frequent, often shorter, port visits. For instance, in 2024, the global luxury cruise market continued its robust recovery, with major players reporting strong booking numbers and revenue growth, highlighting the appeal of this segment.

However, for the discerning traveler seeking deep immersion in nature, direct interaction with naturalists and scientists, and access to remote, pristine environments, traditional luxury cruises fall short. Lindblad's expeditions are built around educational experiences and authentic exploration, a stark contrast to the more passive, resort-like atmosphere of many mainstream luxury voyages. This fundamental difference means that while both cater to affluent travelers, they attract distinct preferences, making direct substitution less likely for those prioritizing Lindblad's unique experiential model.

Highly adventurous individuals might choose to plan their own expeditions to remote destinations, potentially achieving cost savings. This DIY approach, however, bypasses the comprehensive logistical support, robust safety infrastructure, specialized gear, and expert interpretation that Lindblad Expeditions offers. For instance, while a solo trekker might spend $5,000 on a remote Alaskan adventure, a Lindblad expedition covering similar terrain in 2024 could range from $10,000 to $25,000, highlighting the premium for curated services.

While Lindblad Expeditions has grown its land-based offerings, independent land-based adventure tour operators remain a significant threat of substitutes. These companies provide distinct cultural, wildlife, and trekking experiences, appealing to travelers who prioritize land-only exploration and don't necessarily need Lindblad's specialized marine access.

For instance, in 2024, the global adventure tourism market was valued at approximately $145 billion, with a substantial portion driven by land-based activities like hiking and cultural tours. This indicates a large pool of potential customers who might choose a purely land-based alternative over a Lindblad expedition, especially if the land-based option offers a more focused or cost-effective experience for their specific interests.

Specialized Wildlife Safaris and Eco-Tourism Resorts

For travelers prioritizing immersive wildlife encounters, specialized safari operators and high-end eco-lodges present a significant threat of substitution. These niche providers often focus exclusively on unique wildlife viewing opportunities, potentially drawing customers away from Lindblad's broader expedition offerings.

While Lindblad Expeditions has expanded its land-based safari presence, the market features numerous established luxury safari companies and remote eco-resorts. For instance, in 2024, the global adventure tourism market, which includes safaris, was valued at over $100 billion, indicating a robust competitive landscape with many specialized players.

- Specialized Operators: Companies solely dedicated to luxury safaris in prime wildlife destinations offer highly curated experiences that can rival Lindblad's.

- Eco-Resort Appeal: Remote eco-resorts focusing on sustainability and intimate wildlife interactions provide an alternative for environmentally conscious travelers.

- Market Growth: The continued growth in demand for experiential travel, particularly wildlife tourism, fuels the expansion of these substitute offerings.

Documentaries and Virtual Reality Experiences

For those eager to explore the natural world but facing barriers like budget, time, or physical ability, documentaries and virtual reality (VR) experiences present compelling alternatives. These offerings can satisfy a craving for discovery and education, providing a rich, albeit virtual, engagement with wildlife and remote locations. For instance, the global documentary market is substantial, with platforms like Netflix and Disney+ investing heavily in nature content, reaching millions of viewers annually. In 2023, the VR market was valued at over $20 billion, indicating a growing consumer appetite for immersive digital experiences.

These substitutes, while not replicating the full sensory immersion of expedition travel, effectively address the core desire for learning and experiencing the wonders of nature. They offer a significantly lower price point; a single documentary subscription can cost less than $20 per month, while a VR headset, though an initial investment, provides access to a vast library of experiences. This accessibility makes them a potent threat, particularly for individuals in the early stages of their interest in exploration or those with limited disposable income for premium travel.

- Documentaries provide accessible nature content, reaching millions globally through streaming platforms.

- The VR market's growth to over $20 billion by 2023 highlights increasing consumer interest in immersive experiences.

- These substitutes offer a significantly lower cost compared to expedition travel, making them attractive alternatives.

- They fulfill the desire for discovery and learning without the logistical challenges of physical travel.

The threat of substitutes for Lindblad Expeditions is moderate, as their unique focus on educational, immersive nature travel has fewer direct replacements. While traditional luxury cruises offer travel to affluent individuals, they lack the deep engagement with naturalists and remote environments that Lindblad provides. In 2024, the luxury cruise sector continued its strong recovery, demonstrating the appeal of sea-based vacations, but the core experience remains distinct.

Entrants Threaten

The expedition cruise sector demands immense upfront capital for specialized vessels. Lindblad Expeditions, for instance, operates a fleet of purpose-built ships designed for remote, often harsh, environments. Acquiring or constructing such assets, which can cost tens to hundreds of millions of dollars each, presents a formidable financial hurdle for any new player looking to enter this niche market.

Lindblad Expeditions Holdings benefits significantly from its established brand reputation, cultivated over decades. This strong reputation, built on pioneering exploration, a consistent safety record, and its long-standing partnership with National Geographic, fosters deep trust among its clientele in the luxury expedition travel market.

Newcomers would need to invest heavily in marketing and demonstrate exceptional service and unique offerings to even begin to rival Lindblad's credibility and brand recognition. For instance, in 2023, Lindblad reported a revenue of $475 million, reflecting the success of its established brand in attracting and retaining customers, a benchmark difficult for new entrants to match quickly.

Securing access to unique, environmentally sensitive destinations like the Galápagos or Antarctica is a significant hurdle for new entrants. These locations operate under strict permit systems and intricate regulations, limiting the number of operators. For instance, in 2024, the Galápagos National Park Directorate continues to manage a finite number of permits for cruise vessels, making it exceptionally difficult for newcomers to obtain the necessary authorizations.

The process of establishing relationships and obtaining these crucial operating licenses is a formidable barrier. New companies must navigate complex bureaucratic channels and demonstrate a commitment to conservation, which requires substantial time and investment. This difficulty in acquiring permits directly limits the threat of new entrants, as the upfront investment and regulatory compliance are substantial.

Need for Specialized Operational Expertise and Safety Protocols

Operating expeditions in remote and often extreme environments, like those Lindblad Expeditions Holdings navigates, requires a very specific kind of know-how. This includes managing complex logistics, having a crew with extensive experience in these unique settings, and adhering to rigorous safety standards. New companies entering this space would face a steep learning curve and significant investment to build this specialized operational capability.

The barrier to entry is further amplified by the critical need for robust safety protocols. For instance, in 2024, the adventure tourism industry, which includes expedition travel, continued to emphasize safety certifications and risk management as paramount. New entrants must not only master the operational side but also demonstrate an unwavering commitment to passenger safety, which is a costly and time-intensive process to establish credibility.

This necessity for specialized expertise and safety creates a substantial hurdle for potential competitors. Lindblad Expeditions, with its long-standing history, has cultivated deep operational knowledge and a strong safety reputation.

- Specialized Logistics: Managing supply chains and transportation in polar regions or remote islands is a core competency.

- Experienced Crew: Hiring and retaining guides, naturalists, and expedition leaders with specific knowledge of wildlife and environments is crucial.

- Safety Standards: Compliance with international maritime regulations and expedition-specific safety plans is non-negotiable.

- Reputation: Building trust and a proven track record in safety and operational excellence takes years.

Challenges in Building an Expert Network

The threat of new entrants for Lindblad Expeditions, particularly concerning its expert network, is relatively low. A significant barrier is the immense challenge and time required to cultivate a comparable roster of world-class naturalists, scientists, and researchers. These individuals are not easily recruited; they are often drawn to Lindblad's established reputation and the unique platform it offers for engaging with curious travelers.

Building such an exclusive network demands years of relationship-building and a proven commitment to scientific integrity and educational excellence. For instance, in 2024, Lindblad continued to highlight its deep bench of experts, with many contributing to ongoing research projects and educational content that would be difficult for a new player to replicate quickly. The cost and effort involved in attracting and retaining these specialized individuals represent a substantial hurdle for any potential competitor aiming to match Lindblad's core value proposition.

- Difficulty in replicating Lindblad's established expert network.

- High cost and time investment required for expert recruitment and retention.

- Lindblad's reputation as a platform for scientific engagement attracts top talent.

The threat of new entrants in the expedition cruise market is considerably low for Lindblad Expeditions. The sheer capital required for specialized vessels, estimated in the tens to hundreds of millions of dollars per ship, creates a significant financial barrier. Furthermore, establishing a strong brand reputation, as Lindblad has done over decades through its National Geographic partnership and commitment to exploration, takes considerable time and investment, making it difficult for newcomers to gain immediate customer trust.

Access to prime, regulated destinations like the Galápagos, where permits are strictly managed, presents another substantial hurdle. In 2024, the Galápagos National Park Directorate continued its stringent permit system, limiting new operators. This regulatory environment, combined with the need for specialized operational expertise in remote locations and a proven safety record, further deters new competition.

| Barrier to Entry | Description | Lindblad Advantage |

|---|---|---|

| Capital Investment | High cost of specialized vessels (tens to hundreds of millions USD). | Established fleet and financial resources. |

| Brand Reputation | Decades of cultivation, trust-building, and National Geographic partnership. | Strong customer loyalty and recognition. |

| Regulatory Access | Strict permits for unique destinations (e.g., Galápagos). | Existing, long-term permits and relationships. |

| Operational Expertise | Specialized logistics, experienced crew, and safety protocols. | Deep-seated knowledge and proven track record. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lindblad Expeditions Holdings is built upon a foundation of publicly available data, including company annual reports and SEC filings, alongside insights from industry-specific market research and travel trend reports.