Equity Apartments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity Apartments Bundle

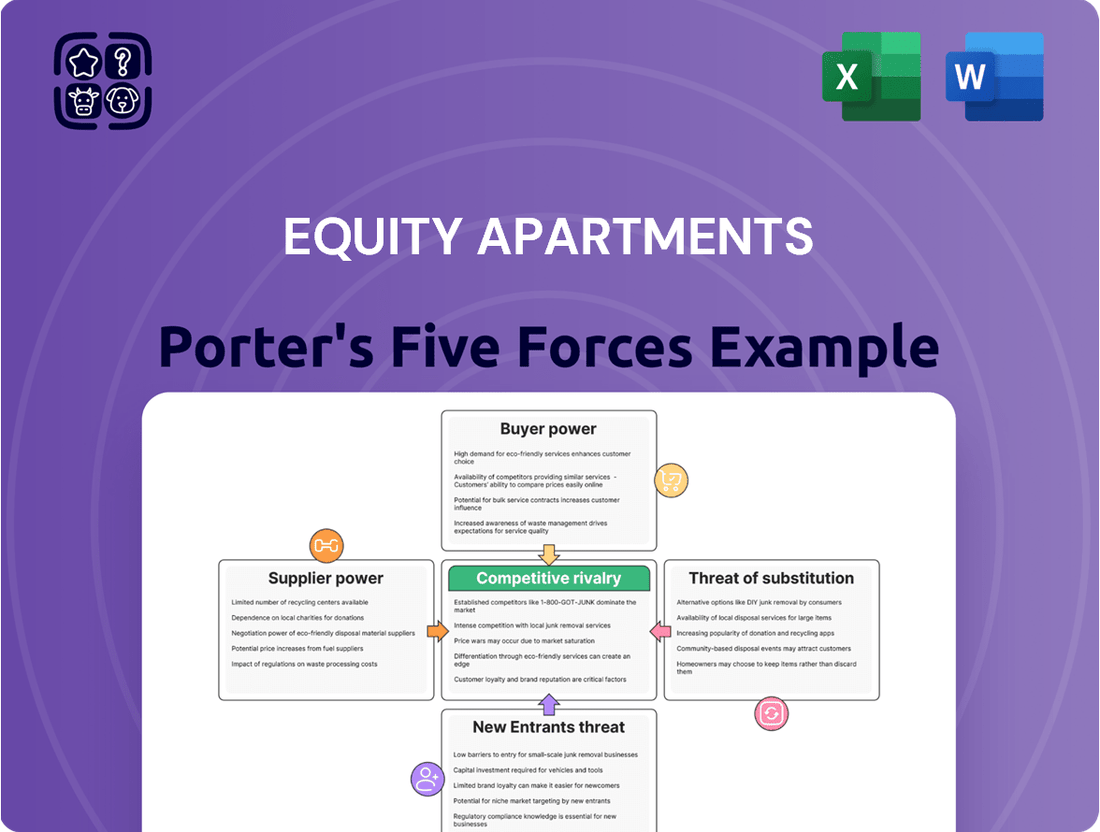

Equity Apartments operates in a dynamic real estate market, and understanding the forces shaping its landscape is crucial. Our Porter's Five Forces analysis delves into the competitive rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes.

This initial overview highlights key pressures, but the full report provides a comprehensive, data-driven framework. Discover the nuanced interplay of these forces and their direct impact on Equity Apartments' profitability and strategic options.

Unlock the complete Porter's Five Forces Analysis to explore Equity Apartments’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Equity Residential is generally moderate due to the diverse nature of the real estate development and management industry. While specialized components might come from fewer providers, many essential materials and services, such as general construction labor and common building supplies, are readily available from a wide array of sources. This broad availability dilutes the influence of any single supplier.

Despite the overall diversity, certain material costs can still exert supplier leverage. For instance, the price of key construction inputs like steel and lumber experienced significant volatility and remained elevated through 2024, often rising faster than general consumer prices. This trend, evident since 2020, indicates that suppliers of these specific commodities can command higher prices, impacting Equity Residential's project costs.

For Equity Residential, switching costs with suppliers can range from minimal to substantial. Simple services like routine maintenance or landscaping often have low switching costs, meaning Equity Residential can change providers without significant expense or operational disruption. This generally limits the bargaining power of suppliers in these areas.

However, for more specialized needs, such as custom construction projects or sophisticated property management software, the costs and effort associated with switching suppliers can be considerably higher. This includes the expense of finding, vetting, and onboarding new providers, as well as potential downtime or integration challenges. These higher switching costs can enhance the bargaining power of those specialized suppliers.

Furthermore, Equity Residential may cultivate long-term relationships with certain vendors, fostering a degree of loyalty and reliance. While not always explicitly contractual, these established partnerships can create implicit switching costs due to the familiarity, established processes, and potential loss of service continuity if a change is made.

The availability of substitutes for a supplier's inputs significantly impacts their bargaining power. When a company has many alternative sources for essential materials or services, suppliers face pressure to keep prices competitive and terms favorable. For instance, if Equity Apartments needs concrete, there are numerous suppliers and even different types of concrete that can be sourced, limiting any single supplier's ability to dictate terms.

Conversely, if a crucial component is highly specialized with few or no readily available alternatives, suppliers of that specific input can wield considerable power. This is particularly true for unique building materials or proprietary technology required for certain apartment features. For example, a specific type of energy-efficient window system with limited manufacturers could give those manufacturers greater leverage over Equity Apartments.

Labor availability also plays a critical role. In 2024, many regions experienced persistent labor shortages, especially in skilled trades like construction and plumbing. This scarcity directly translates to increased wage demands and reduced flexibility for companies like Equity Apartments, effectively strengthening the bargaining power of labor unions or individual skilled workers.

Importance of Supplier's Input to Equity Residential's Business

The bargaining power of suppliers for Equity Residential is significant, particularly concerning land acquisition and construction materials. Without access to suitable land and the necessary building supplies, Equity Residential's core business of developing and managing apartment communities would be severely hampered. This reliance places considerable leverage in the hands of these suppliers.

Escalating costs for key inputs directly affect Equity Residential's profitability and development pipeline. For example, fluctuations in lumber, steel, and concrete prices, alongside labor shortages in the construction sector, can substantially increase project budgets and timelines. In 2024, reports indicated continued upward pressure on construction materials, with some experiencing double-digit percentage increases compared to the previous year.

- Land Acquisition: Equity Residential’s ability to secure prime locations for new developments is heavily dependent on a limited number of land developers and owners, giving them considerable bargaining power.

- Construction Materials: The cost and availability of essential materials like lumber, steel, and concrete, supplied by a concentrated group of manufacturers, directly impact development expenses.

- Skilled Labor: Shortages of skilled construction workers, often sourced through specialized contracting firms, can drive up labor costs and affect project completion schedules.

- Property Management Services: While Equity Residential self-manages many properties, third-party providers for specialized maintenance or technology solutions can also exert influence.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Equity Residential is generally low. Suppliers within the real estate sector, such as construction firms or material providers, typically do not possess the substantial capital reserves needed to acquire and manage large apartment portfolios like Equity Residential. For instance, while a construction company might build apartments, transitioning to owning and operating them across numerous markets requires a fundamentally different business model and significant long-term operational infrastructure that most lack.

Furthermore, the specialized expertise in property management, tenant relations, and market analysis that a Real Estate Investment Trust (REIT) like Equity Residential possesses is a considerable barrier. The operational complexity and scale of managing thousands of apartment units are far removed from the core competencies of most typical suppliers. In 2024, the average cost to develop a new apartment unit in major US markets can range from $250,000 to $500,000 or more, a significant investment hurdle for most suppliers looking to enter the landlord business.

- Capital Requirements: Acquiring and maintaining a large portfolio of apartment buildings demands billions in capital, a barrier most suppliers cannot overcome.

- Operational Expertise: Managing tenant leases, maintenance, and property upkeep across diverse locations requires specialized skills beyond a supplier's typical scope.

- Market Competition: Entering the competitive REIT landscape means directly challenging established players with established brands and operational efficiencies.

- Business Model Divergence: Suppliers' core businesses focus on construction or materials, not the ongoing service-oriented nature of property ownership and management.

The bargaining power of suppliers for Equity Residential is moderate to high, particularly for land and specialized construction materials. In 2024, continued supply chain disruptions and inflation meant that prices for key inputs like lumber and steel remained elevated, impacting development costs significantly. Skilled labor shortages further amplified the leverage of contracting firms.

Land is a critical input with concentrated ownership in desirable markets, granting landowners significant power. Similarly, while many building materials are commoditized, specific engineered products or custom components may come from fewer, more powerful suppliers. For instance, the cost of concrete, a foundational material, saw price increases of 5-10% in many regions throughout 2024.

| Factor | Impact on Equity Residential | 2024 Trend/Data |

| Land Availability & Cost | High bargaining power for landowners in prime locations. | Continued high demand and limited supply in growth markets. |

| Construction Materials | Moderate to high power for suppliers of key inputs (steel, lumber, concrete). | Prices for lumber and steel remained elevated; concrete costs increased 5-10%. |

| Skilled Labor | High bargaining power for specialized contractors due to shortages. | Persistent shortages in trades like plumbing and electrical drove up wages. |

| Property Management Tech | Low to moderate power for software/tech providers with many alternatives. | Increasing demand for integrated property management solutions. |

What is included in the product

This Porter's Five Forces analysis for Equity Apartments identifies the intensity of rivalry among existing competitors, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products. It provides a strategic framework for understanding the apartment rental industry's competitive landscape and Equity Apartments' position within it.

Easily identify and strategize against competitive threats, enabling proactive management of industry pressures.

Gain a clear, actionable understanding of market dynamics to mitigate risks and capitalize on opportunities within the apartment sector.

Customers Bargaining Power

Tenant price sensitivity is a crucial element influencing Equity Residential's bargaining power of customers. In markets with substantial new apartment supply, such as the anticipated influx of units in 2025, this sensitivity becomes more pronounced. Even in affluent areas where Equity Residential operates, a high volume of new inventory can suppress rent growth as landlords compete for tenants.

The drive for affordability among renters is a growing trend. As more apartment units become available, tenants have more options and are thus better positioned to negotiate for lower rents or seek out more budget-friendly alternatives. This increased choice directly enhances their bargaining power.

For instance, reports from late 2024 indicated that while demand remained steady in many prime markets, the sheer volume of new construction was leading to concessions and slower rent increases compared to previous years. This suggests a shift where tenants are less willing to accept significant rent hikes.

The availability of alternative housing options significantly bolsters tenant bargaining power. When tenants can easily find comparable apartments, single-family rentals, or even consider homeownership, landlords face increased pressure to offer competitive pricing and amenities.

Currently, high home prices and elevated mortgage rates are making the dream of homeownership a distant reality for many, thereby increasing the demand for rental properties. This situation, however, is tempered by a growing supply of rental units in numerous markets across the United States.

Data from the U.S. Census Bureau for Q1 2024 indicated that the national rental vacancy rate stood at 6.5%, a slight uptick from the previous year, signaling a more tenant-favorable market. This increased choice for renters translates into landlords needing to be more flexible with rent increases and lease terms to maintain occupancy, as evidenced by slowing rent growth in many major metropolitan areas throughout 2024.

Switching costs for tenants significantly impact their bargaining power. Expenses like moving, security deposits, and the general inconvenience of relocating can deter renters from seeking new apartments. This often leads to lease renewals, as the effort and cost of moving outweigh the perceived benefits of a new place, especially if rents are expected to be higher elsewhere.

Equity Residential, a major player in the apartment sector, demonstrated a historical low in resident turnover during the first quarter of 2025. This suggests a strong tenant retention rate, likely influenced by these very switching costs. When it's difficult or expensive to leave, tenants are more inclined to stay put, bolstering the landlord's position.

Information Availability for Tenants

Tenants today have unprecedented access to information, largely thanks to the proliferation of online rental platforms and review sites. This readily available data empowers them to meticulously compare rental prices, the quality of amenities, and the experiences of previous residents across numerous properties. For instance, platforms like Zillow and Apartment List provide detailed listings and user reviews, making it simple for prospective renters to gauge market rates and property conditions in 2024.

This high degree of information transparency significantly shifts bargaining power towards the customer. Tenants can easily identify properties offering better value or more desirable features for a comparable price. This forces landlords, including major players like Equity Residential, to be more competitive with their rental pricing and the amenities they offer to attract and retain tenants.

- High Information Accessibility: Online platforms provide extensive data on rental prices, amenities, and tenant reviews.

- Tenant Empowerment: Easy comparison allows tenants to seek better deals and negotiate terms more effectively.

- Increased Landlord Competition: Equity Residential and similar companies must offer competitive pricing and features to stand out.

- Market Transparency: The digital age has created a more informed and discerning renter base.

Tenant Concentration and Negotiation Power

Tenant concentration for Equity Apartments is exceptionally low, meaning individual renters possess minimal direct negotiation power. The vast majority of tenants are single households or small family units, unable to collectively bargain for lease terms. This fragmentation inherently limits their ability to exert significant pressure on rental pricing or service agreements.

While individual tenants lack leverage, broader market dynamics do influence landlord strategies. For instance, in 2024, reports indicated a slight softening in rental demand in certain urban markets, leading some property managers to offer concessions like one month free rent to attract new lessees. This reflects how collective renter sentiment, often gauged through surveys and online reviews, can indirectly impact rental strategies without direct negotiation.

- Low Tenant Concentration: Equity Apartments serves a highly fragmented customer base of individual renters, diminishing direct collective bargaining power.

- Individual Negotiation Limits: Unlike corporate clients, individual tenants cannot negotiate lease terms on a large scale.

- Indirect Influence of Market Trends: Collective renter preferences and market conditions, as observed in 2024 rental statistics, can indirectly shape landlord strategies and rental pricing.

The bargaining power of customers for Equity Residential is significantly influenced by market-wide factors rather than individual tenant actions. With a fragmented customer base of individual renters, there's little scope for direct, large-scale negotiation. However, broader market trends, such as increased supply or shifts in demand, can indirectly pressure landlords. For example, a national rental vacancy rate of 6.5% in Q1 2024, as reported by the U.S. Census Bureau, indicated a more tenant-favorable environment, prompting concessions in some markets.

| Factor | Impact on Tenant Bargaining Power | Supporting Data (2024/Early 2025) |

|---|---|---|

| Information Accessibility | High | Online platforms (Zillow, Apartment List) provide extensive price and review data. |

| Switching Costs | Moderate (Deters frequent moves) | Low resident turnover reported by Equity Residential in Q1 2025. |

| Tenant Concentration | Low (Individual renters have minimal direct power) | Fragmented customer base of single households/small families. |

| Availability of Alternatives | High (Increased supply) | National rental vacancy rate at 6.5% in Q1 2024. |

Same Document Delivered

Equity Apartments Porter's Five Forces Analysis

This preview showcases the complete Equity Apartments Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within the apartment rental market. You are looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

The multifamily real estate sector, particularly in desirable urban and suburban locations where Equity Residential focuses its investments, is characterized by a substantial number of competitors. This includes not only other major Real Estate Investment Trusts (REITs) but also a significant presence of private equity firms and a vast array of individual property owners. This broad and diverse competitive field directly fuels intense rivalry for securing and retaining tenants.

For instance, in 2024, the United States multifamily market saw continued activity from various players. Major REITs like AvalonBay Communities and Camden Property Trust actively pursue acquisitions and development, often targeting similar high-demand submarkets as Equity Residential. This persistent competition means that rental rates and occupancy levels are constantly influenced by the strategic moves of numerous entities vying for market share.

The apartment industry is currently facing a significant influx of new supply, with projections indicating nearly 1 million new units entering the market by 2025. This marks the highest level of new construction seen in decades, specifically since the 1980s. While tenant demand has remained robust, this surge in inventory is creating a more competitive landscape.

This elevated supply directly impacts competitive rivalry by putting pressure on apartment operators. With more units available, companies are finding it harder to fill vacancies and achieve significant rent increases. This situation naturally intensifies the competition as businesses work to attract and retain tenants in a market where choice is abundant.

While apartments offer differentiation through location, amenities, and service, the fundamental need for shelter remains largely commoditized. Equity Residential, for instance, targets affluent markets with premium features, attempting to stand out, yet intense competition persists even at this higher tier. In 2024, renter demand for features like improved air quality and smart home integration continues to shape these differentiation efforts.

Exit Barriers in the Industry

Exit barriers in the real estate sector, including apartment complexes, are notably high. This is primarily due to the illiquid nature of property assets, meaning they can't be quickly converted to cash without a significant loss in value. Companies are often tied to their investments for extended periods.

The substantial capital required for property acquisition and development also acts as a significant deterrent to exiting. Furthermore, the lengthy timelines associated with real estate development projects mean that capital is locked up for years, making a swift departure impractical. This can trap companies in the market even when conditions are unfavorable.

These high exit barriers tend to prolong periods of intense competition. When companies find it difficult to leave, they may continue operating, even at lower profit margins, rather than incur substantial losses on exit. This can lead to persistent oversupply issues as existing players remain in the market.

- Illiquid Assets: Real estate is not easily sold; it can take months to find a buyer and close a deal, unlike stocks or bonds.

- High Capital Commitment: Significant upfront investment in property acquisition, construction, and maintenance makes exiting costly.

- Long Development Cycles: Projects can span several years from planning to completion, tying up capital and making quick exits difficult.

- Specialized Nature: Real estate assets are often specific to their location and purpose, limiting their resale market.

Cost Structure and Pricing Strategies

The multifamily sector, including companies like Equity Residential, faces substantial fixed costs associated with property acquisition, development, and ongoing maintenance. These significant overheads can pressure operators to maintain high occupancy rates. For instance, Equity Residential reported in their Q1 2025 earnings that while physical occupancy remained strong, some markets experienced negative new lease rent changes due to increased new supply entering the market.

This cost structure often drives competitive pricing strategies. When new supply enters a market, it can create an oversupply situation, forcing landlords to offer concessions or lower rents to attract and retain tenants. This dynamic is clearly visible in markets where new construction is actively adding units, directly impacting rental rate growth and competitive positioning for existing properties.

- High Fixed Costs: Property acquisition, development, and maintenance represent significant fixed expenses in the multifamily sector.

- Vacancy Pressure: High fixed costs incentivize companies to minimize vacancies, potentially leading to aggressive pricing.

- Impact of New Supply: Increased supply in markets can lead to competitive pricing, evidenced by negative new lease rent changes in some areas for Equity Residential in Q1 2025.

- Occupancy vs. Rent Growth: While Equity Residential maintained strong physical occupancy, the competitive environment influenced rent growth on new leases.

The competitive rivalry in the multifamily sector is intense, driven by numerous players including large REITs, private equity, and individual owners, all vying for tenants. This is exacerbated by a significant surge in new apartment supply, projected to reach nearly 1 million units by 2025, creating a tenant's market. Equity Residential, for instance, faced pressure in Q1 2025, with some markets showing negative new lease rent changes despite strong overall occupancy, a direct result of this elevated competition.

| Key Competitor Type | Impact on Rivalry | 2024 Market Observation |

| Major REITs (e.g., AvalonBay, Camden) | Direct competition for prime locations and tenants | Active acquisition and development in similar submarkets to Equity Residential |

| Private Equity Firms | Adds capital and aggressive acquisition strategies | Continued presence in major urban and suburban multifamily markets |

| Individual Property Owners | Fragmented but significant competition, especially in certain segments | Contribute to overall market supply and localized competition |

| New Supply Influx | Increases tenant options, pressures rents | Nearly 1 million new units expected by 2025, highest since the 1980s |

SSubstitutes Threaten

Homeownership has long been a major alternative to renting. However, persistent high home prices and elevated mortgage rates, continuing into early 2025, have significantly reduced the accessibility of buying a home for a large segment of the population. This affordability challenge directly fuels ongoing demand for rental accommodations.

Data from early 2025 indicates a notable trend among renters: a substantial majority express intentions to remain in their current rental situations. Conversely, only a smaller fraction of renters are actively planning to purchase a home in the near future. This dynamic dampens the immediate threat that homeownership poses to the rental market.

The threat of substitutes for Equity Residential, primarily a multifamily apartment owner, is significant and growing. Alternative rental housing types, including single-family rental homes, townhouses, and emerging co-living spaces, directly compete for the same renter pool. These alternatives cater to diverse tenant preferences, from those desiring more space and privacy in a rental home to those seeking community and affordability in co-living arrangements.

The demand for single-family rentals, for instance, has seen robust growth. In 2024, the single-family rental market continued to expand, with institutional investors actively acquiring properties. This trend diverts renters who might otherwise consider traditional apartments, especially in markets where single-family homes offer perceived better value or lifestyle fit. Co-living spaces are also gaining traction, particularly among younger demographics and urban professionals, offering flexible lease terms and built-in amenities that can appeal to a segment of Equity Residential's target market.

Broader economic conditions, particularly inflation and interest rates, directly impact the appeal of substitute housing options. For example, rising interest rates in 2024 make mortgage financing more expensive, potentially increasing the attractiveness of renting as a substitute for homeownership, but also pressure apartment rents.

High rental costs and affordability issues are a persistent challenge. In 2024, a substantial percentage of renter households, often cited as over 40%, are considered cost-burdened, meaning they spend more than 30% of their income on rent. This financial strain can drive renters to seek less expensive alternatives or adjust their living arrangements.

These affordability pressures can lead to a greater demand for lower-cost housing solutions, such as shared living spaces, smaller units, or even relocating to more affordable geographic areas. When apartment rents climb significantly, the relative cost-effectiveness of these substitutes becomes more pronounced.

Lifestyle and Preference Shifts

Changes in what renters want, like needing more room or preferring suburban areas, can push people toward substitute housing options if Equity Residential's properties don't offer these things. For example, if a significant portion of renters start prioritizing larger living spaces, apartments that are smaller or lack certain amenities might see reduced demand, making them less appealing compared to alternatives like single-family rentals or even homeownership. This highlights the importance of Equity Residential staying attuned to evolving renter desires.

Conversely, a growing trend in lifestyle renting, where individuals plan to rent long-term rather than buy, actually reduces the threat of substitutes. Many millennials and Gen Z are embracing renting as a flexible lifestyle choice, indicating a sustained demand for rental properties. Data from the National Multifamily Housing Council in early 2024 showed that apartment demand remained robust, with occupancy rates consistently high across many markets, suggesting that the appeal of renting as a lifestyle choice is a strong counter-force to substitution.

- Evolving Renter Demands: Shifts towards larger units and suburban locations can increase the threat from single-family rentals.

- Lifestyle Renting: A growing segment of the population intends to rent for the long term, which lowers the substitution threat.

- Amenity Preferences: Demand for specific amenities like home offices or outdoor spaces can drive renters to properties offering them, potentially away from Equity Residential if offerings don't match.

- Economic Factors: Fluctuations in interest rates and home prices directly influence the attractiveness of homeownership as a substitute for renting.

Impact of Technology and Short-Term Rentals

While platforms like Airbnb primarily cater to short-term stays, their expansion into longer-term rentals in certain urban markets could introduce a marginal substitute for traditional long-term leases. However, for Equity Residential, which targets affluent renters seeking stable, long-term housing solutions, the direct threat from these short-term rental platforms remains generally low. The core value proposition for Equity Residential's residents often includes amenities, consistent service, and the stability of a traditional lease, which short-term rentals typically do not replicate. In 2024, the short-term rental market continued to grow, but its impact on institutional multifamily housing providers like Equity Residential was largely contained to niche segments or specific transient demand periods.

- Limited Direct Competition: The primary user base for Equity Residential consists of individuals and families seeking multi-year leases, a different segment than most short-term rental users.

- Divergent Value Propositions: Equity Residential offers stability, amenities, and professional management, distinguishing it from the more flexible but less consistent short-term rental experience.

- Urban Market Nuances: In highly desirable urban centers with significant tourism or temporary corporate housing needs, some overlap might exist, but it's not a widespread substitute for the core business.

- Regulatory Environment: Increased regulation of short-term rentals in many cities can further mitigate their potential to become a significant substitute for traditional apartment leases.

The threat of substitutes for Equity Residential is multifaceted, encompassing alternative housing arrangements that compete for renters. While homeownership remains a significant substitute, affordability challenges in early 2025 make it less accessible for many, bolstering rental demand. However, other rental options like single-family homes and co-living spaces are gaining traction, catering to diverse renter preferences and needs. For instance, the single-family rental market saw continued expansion in 2024 with institutional investor activity.

Furthermore, evolving renter demands, such as a preference for larger units or suburban locations, can steer tenants toward substitutes like single-family rentals if Equity Residential's offerings do not align. Conversely, the growing trend of lifestyle renting, where individuals opt for long-term leasing over ownership, mitigates this substitution threat. Data from early 2024 indicated robust apartment demand with high occupancy rates, underscoring the strength of renting as a lifestyle choice.

| Substitute Type | Key Drivers | Impact on Equity Residential (2024-2025) |

|---|---|---|

| Homeownership | Home prices, mortgage rates, affordability | Reduced accessibility due to high prices and rates in early 2025, dampening immediate threat but still a long-term consideration. |

| Single-Family Rentals | Desire for space/privacy, investor activity | Growing competition, especially in markets where they offer perceived better value; saw robust expansion in 2024. |

| Co-living Spaces | Flexibility, community, affordability | Increasing appeal to younger demographics and urban professionals seeking alternative living arrangements. |

| Short-Term Rentals (e.g., Airbnb) | Flexibility, temporary stays | Marginal threat for Equity Residential's core long-term, stable housing market, with limited overlap due to different value propositions and regulations. |

Entrants Threaten

The multifamily real estate sector, particularly for premium, large-scale apartment complexes, demands significant upfront investment. This includes costs for land acquisition, the entire development process, and the physical construction itself. For instance, developing a substantial apartment building in a major metropolitan area can easily run into tens or even hundreds of millions of dollars.

These substantial capital requirements act as a formidable barrier, effectively deterring many potential new competitors. Established Real Estate Investment Trusts (REITs) like Equity Residential, with their existing capital base and access to financing, are far better positioned to undertake such large-scale projects than smaller, newer entities.

Equity Residential and other established apartment REITs leverage substantial economies of scale. In 2023, Equity Residential managed a portfolio of approximately 80,000 apartment homes. This massive scale allows them to negotiate bulk purchasing discounts on maintenance supplies and services, significantly lowering per-unit operating costs compared to smaller operators.

The ability to secure more favorable financing terms due to their size and creditworthiness also presents a barrier. In early 2024, major REITs could often access capital at lower interest rates than emerging players, reducing their cost of debt and improving overall profitability, which new entrants struggle to match.

Marketing and brand recognition are other areas where scale provides an advantage. Equity Residential's established brand and extensive online presence attract a wider tenant base, reducing customer acquisition costs per unit. New entrants would need substantial investment to build comparable brand awareness and marketing reach.

Securing prime land in affluent, high-density urban and suburban markets presents a significant hurdle for new entrants in the multifamily sector. These desirable locations are not only costly but also scarce, making acquisition a substantial upfront investment. For instance, in 2024, average land prices in top-tier U.S. multifamily markets continued their upward trend, with some submarkets seeing increases of over 10% year-over-year.

Newcomers struggle to develop the specialized expertise and cultivate the crucial relationships needed for complex multifamily projects. This includes navigating intricate zoning regulations, securing necessary permits, and understanding local market dynamics. The development process itself, from initial design to final construction, demands a deep understanding of construction management, financing, and legal frameworks, areas where established players already possess a competitive advantage.

Regulatory and Permitting Hurdles

The real estate development sector, particularly for apartment complexes, faces formidable regulatory and permitting challenges. These can include intricate zoning laws, stringent building codes, and evolving environmental regulations that new entrants must navigate. Such processes are notoriously time-consuming and expensive, significantly raising the barrier to entry. For instance, the average time to obtain a building permit in major US cities can range from several months to over a year, adding substantial pre-development costs.

These regulatory complexities act as a powerful deterrent for potential new competitors. The need for specialized legal and planning expertise, coupled with the uncertainty of approval timelines, makes it difficult for smaller or less experienced firms to enter the market. In 2024, the cost of compliance with environmental impact assessments alone can add millions to project budgets, further solidifying the position of established players who have experience managing these requirements.

- Zoning Laws: Restrictions on land use and density can limit where new apartment buildings can be constructed.

- Building Codes: Requirements for structural integrity, fire safety, and accessibility add to construction costs and complexity.

- Environmental Regulations: Assessments for potential impacts on wetlands, endangered species, or historical sites can cause significant delays and require costly mitigation efforts.

- Permitting Processes: The sheer volume of approvals needed from local, state, and sometimes federal agencies creates a lengthy and unpredictable path to project commencement.

Brand Recognition and Tenant Acquisition

Established real estate investment trusts (REITs) like Equity Residential leverage decades of brand building and sophisticated tenant acquisition systems. This creates a significant barrier for newcomers. For instance, in 2024, the average cost for a residential property management company to acquire a new tenant can range from $500 to $1,500, depending on marketing efforts and location, a substantial upfront investment.

New entrants face the daunting task of matching this established trust and accessibility. They would need to allocate considerable capital towards marketing campaigns and developing a reputation that resonates with the often-affluent and discerning long-term renters that REITs like Equity Residential target. This is particularly challenging in a market where tenant loyalty is often tied to location and established service levels.

Furthermore, the sheer volume of online listings and rental platforms means new entrants must not only be present but also highly visible.

- Brand Recognition: Equity Residential benefits from widespread name recognition among target demographics.

- Tenant Acquisition Channels: Established REITs have refined digital and physical channels for attracting and retaining renters.

- Marketing Investment: New entrants require substantial marketing budgets to build brand awareness and compete for tenant attention.

- Reputation Building: Cultivating a positive reputation for reliability and quality service is a lengthy and costly process for new players.

The threat of new entrants for Equity Residential is significantly mitigated by immense capital requirements. Developing large-scale apartment complexes involves substantial costs for land, construction, and financing, often running into tens or hundreds of millions of dollars. This financial barrier is a primary reason established players like Equity Residential, with their deep capital reserves and financing access, maintain a strong market position.

Economies of scale and established relationships further deter new entrants. In 2023, Equity Residential managed approximately 80,000 apartment homes, allowing for bulk purchasing discounts and more favorable financing terms compared to emerging competitors. Navigating complex zoning, permitting, and regulatory landscapes, which can add millions to project costs in 2024, also favors experienced firms.

| Barrier to Entry | Impact on New Entrants | Example/Data (2023-2024) |

|---|---|---|

| Capital Requirements | High; requires substantial upfront investment | Development costs in major metros can reach hundreds of millions. |

| Economies of Scale | Disadvantage; new entrants lack purchasing power | Equity Residential's 80,000 units in 2023 enabled bulk discounts. |

| Regulatory Hurdles | Challenging; complex zoning, permits, and compliance | Permit times can extend over a year; environmental compliance adds millions in 2024. |

| Brand & Tenant Acquisition | Costly; requires significant marketing investment | Tenant acquisition costs $500-$1,500 per unit in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equity Apartments is built upon a foundation of diverse data, including proprietary market research from leading real estate analytics firms, publicly available financial reports from Equity Residential, and industry-specific publications that track rental market trends.

We leverage data from industry associations, government housing statistics, and competitive intelligence platforms to accurately assess factors such as tenant bargaining power, the threat of new entrants, and the intensity of rivalry within the multifamily real estate sector.