EQT AB Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

EQT AB's marketing mix is a finely tuned engine of success, but this brief glimpse only reveals the tip of the iceberg. Understanding their product innovation, strategic pricing, efficient distribution, and impactful promotion is key to grasping their market dominance. To truly unlock the secrets of their competitive advantage and gain actionable insights, delve into the complete 4Ps analysis.

Product

EQT AB provides a diverse array of investment strategies, including private equity, infrastructure, real estate, and venture capital. These funds cater to institutional investors by supporting businesses across their entire lifecycle, from early-stage ventures to established companies.

In 2024, EQT notably broadened its product landscape with the introduction of specialized strategies. These new offerings, such as EQT Healthcare Growth and EQT Transition Infrastructure, reflect EQT's commitment to expanding its reach into key growth sectors and sustainable investments.

EQT's Active Ownership Model is a key differentiator in its product offering, focusing on deeply engaging with portfolio companies. This hands-on approach is applied across diverse sectors like healthcare and technology, where EQT leverages its substantial industrial network and deep expertise. For instance, as of the first half of 2024, EQT reported a significant increase in value creation initiatives across its funds, directly attributable to this active management. This strategy aims to drive not just financial returns but also tangible operational improvements and enhanced sustainability within the businesses it backs.

EQT's product is designed to deliver strong returns for its institutional investors by emphasizing long-term value creation and preparing companies for the future. This means they look beyond short-term gains, focusing on building businesses that can thrive for years to come.

A core tenet of EQT's approach is the integration of sustainability. They believe that by focusing on environmental, social, and governance (ESG) factors, they can achieve both financial success and a positive societal impact. This dual objective is central to their investment philosophy.

The EQT Annual and Sustainability Report 2024 underscores this commitment, detailing how ESG considerations are woven into their investment strategies. For instance, the report highlights their efforts in climate resilience, a key aspect of future-proofing portfolio companies and aligning with investor demands for sustainable investments.

By prioritizing sustainability, EQT aims to mitigate risks and unlock new opportunities, ultimately enhancing the value and longevity of the businesses they invest in. This forward-thinking strategy resonates with a growing number of investors seeking both financial performance and responsible corporate citizenship.

Tailored Solutions for Institutional Investors

EQT AB's tailored solutions for institutional investors are meticulously crafted to address their unique requirements, with a strong emphasis on delivering consistent, attractive returns across a 5 to 10-year investment horizon. This focus on long-term value creation is a cornerstone of their strategy.

A key component of this offering includes co-investment opportunities. These allow institutional clients to invest directly alongside EQT's flagship funds, fostering a deeper alignment of interests and providing enhanced, diversified exposure to specific deals and sectors. For instance, as of Q1 2024, EQT reported significant growth in its co-investment programs, demonstrating strong institutional appetite.

Furthermore, EQT has strategically expanded its product suite to cater to the burgeoning private wealth segment. This includes the introduction of new evergreen vehicles, designed to offer more liquid and flexible investment options for a broader range of investors. This diversification of offerings signals EQT's commitment to serving a wider market while maintaining its core institutional strengths.

- Focus on Long-Term Returns: Aiming for consistent, attractive returns over 5-10 years.

- Co-Investment Opportunities: Aligning interests and providing diversified exposure.

- Private Wealth Expansion: Introducing new evergreen vehicles to broaden market reach.

- Strategic Growth: Demonstrating increasing demand for tailored institutional solutions.

Thematic Investment Approach

EQT AB's thematic investment approach centers on identifying and capitalizing on enduring secular trends. This strategy, crucial for their 4P marketing mix, prioritizes long-term growth sectors. For instance, EQT has actively invested in areas like digitalization, health and wellbeing, and the energy transition. This focus aligns their product development and service offerings with markets poised for substantial capital deployment over many years.

By concentrating on these high-growth niches, EQT ensures its portfolio companies, and by extension its products, remain relevant and competitive. This is particularly evident in sectors demanding significant, sustained capital investment, such as digital infrastructure and cybersecurity. EQT's commitment to these themes allows them to foster innovation and build market-leading positions.

In 2024, EQT continued to allocate significant capital towards these identified themes. Their focus on digital infrastructure, for example, is supported by the ongoing global demand for data centers and connectivity solutions. Similarly, the energy transition theme benefits from increasing governmental and corporate commitments to sustainability, driving investment in renewable energy and related technologies. EQT's strategic vision positions them to benefit from these macroeconomic shifts.

- Digitalization: EQT's investments in digital infrastructure and cybersecurity are driven by the exponential growth in data and the increasing need for robust online security.

- Health and Wellbeing: This theme encompasses investments in healthcare innovation, preventative medicine, and wellness technologies, reflecting demographic shifts and rising consumer demand.

- Energy Transition: EQT is actively supporting the shift towards sustainable energy sources, investing in renewable energy generation, storage solutions, and related infrastructure.

- Long-term Capital Focus: The thematic approach necessitates a long-term capital commitment, allowing portfolio companies the runway to develop and scale innovative solutions within these growth sectors.

EQT AB's product strategy centers on thematic, long-term growth, focusing on areas like digitalization, health, and the energy transition. This approach, evident in their 2024 and 2025 offerings, emphasizes deep engagement through their Active Ownership Model, driving operational improvements and sustainability. They offer tailored solutions for institutional investors, including co-investment opportunities, and are expanding into the private wealth segment with new evergreen vehicles.

| Product Focus Area | Key Strategy | 2024/2025 Highlights | Investor Benefit |

|---|---|---|---|

| Thematic Investments | Capitalizing on secular trends (digitalization, health, energy transition) | Continued significant capital allocation to digital infrastructure and renewable energy. | Exposure to high-growth markets poised for sustained capital deployment. |

| Active Ownership | Deep engagement with portfolio companies for value creation | Increased value creation initiatives across funds in H1 2024. | Enhanced operational improvements and financial returns through hands-on management. |

| Institutional Solutions | Tailored offerings with long-term focus (5-10 years) | Strong growth in co-investment programs as of Q1 2024. | Alignment of interests and diversified exposure to specific deals and sectors. |

| Market Expansion | Broadening reach to private wealth segment | Introduction of new evergreen vehicles offering greater liquidity. | Access to EQT's strategies for a wider investor base. |

What is included in the product

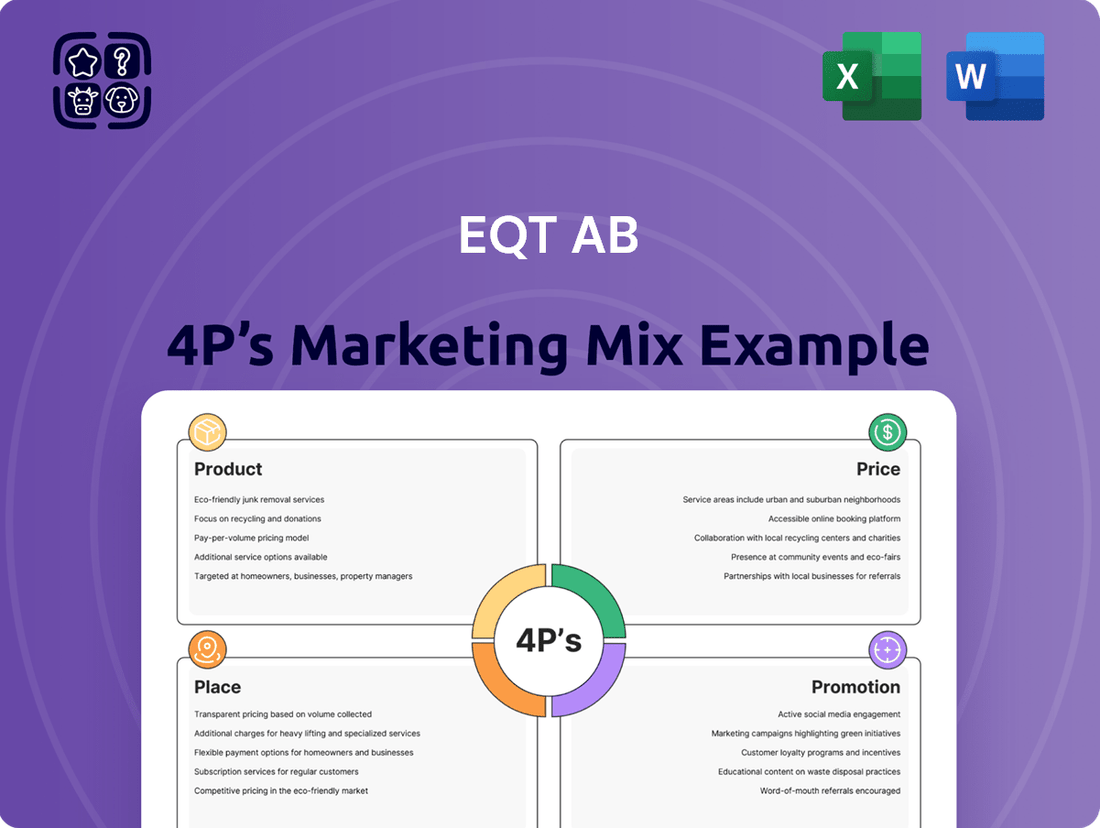

This analysis delves into EQT AB's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market positioning.

It provides a structured, data-driven breakdown of EQT AB's marketing mix, ideal for strategic planning and competitive benchmarking.

This EQT AB 4P's Marketing Mix Analysis acts as a pain point reliever by condensing complex strategies into a clear, actionable framework for leadership and stakeholders.

It simplifies the understanding of EQT AB's marketing efforts, offering a visual solution to the common challenge of aligning diverse teams around a unified strategy.

Place

EQT AB has built a formidable global platform, with local teams operating in regions that collectively account for over 80 percent of global GDP. This expansive network is crucial for understanding nuanced local innovations and geopolitical shifts, allowing EQT to identify and capitalize on opportunities swiftly.

Their strategic 'local with locals' approach, especially evident in their Real Estate division, grants them superior access to investment deals compared to competitors. This deep local integration ensures they are well-positioned to navigate diverse market landscapes and unearth unique value propositions.

EQT AB, a prominent player in private capital, utilizes a multi-faceted approach to connect with its core audience of institutional investors. Direct engagement, a cornerstone of their strategy, is complemented by robust investor relations efforts and active participation in key industry conferences throughout the year. These channels ensure EQT maintains close ties and effectively communicates its value proposition.

The firm's strategic vision includes broadening its reach across diverse investment strategies and geographical markets. A significant push is underway to cultivate its private wealth segment. This expansion is being fueled by forging partnerships with additional distribution banks and introducing innovative new product offerings tailored to this growing investor base.

EQT AB utilizes advanced digital infrastructure to optimize its portfolio companies' efficiency. This includes sophisticated platforms for managing inventory and supply chains, directly contributing to reduced lead times and elevated client service standards. For instance, by streamlining these operational aspects, EQT aims to unlock significant value within its investments.

The firm’s commitment to digital innovation is further evidenced by its strategic integration of artificial intelligence. EQT has been leveraging AI through its proprietary Motherbrain platform since 2016, a move designed to significantly enhance deal sourcing capabilities and identify promising investment opportunities more effectively. This early adoption of AI showcases EQT's forward-thinking approach to operational excellence.

Strategic Expansion into Private Wealth

EQT AB is actively pursuing strategic expansion into the private wealth sector, anticipating that 15-20% of its future fundraising will originate from this client base. This initiative is a key component of their marketing mix, aimed at diversifying capital sources and broadening their investor reach.

To support this growth, EQT has been making significant senior team hires and investing in targeted branding efforts. The launch of new products, such as EQT Nexus Infrastructure and planned US evergreen vehicles, underscores their commitment to catering to the specific needs of private wealth investors.

- Targeted Fundraising: EQT expects 15-20% of future fundraising to come from private wealth clients.

- Talent Acquisition: Senior team hires are being made to bolster expertise in serving this segment.

- Product Development: New offerings like EQT Nexus Infrastructure and upcoming US evergreen vehicles are being introduced.

- Client Diversification: The expansion aims to broaden EQT's client base and capital sources.

Robust Investor Relations and Reporting

EQT AB places significant emphasis on robust investor relations, ensuring transparency and open communication with its stakeholders. This commitment is evident in their consistent delivery of timely financial reports, including detailed year-end and sustainability reports, keeping investors well-informed about the company's performance and strategic direction.

To further facilitate engagement, EQT actively hosts conference calls and webcasts. These platforms serve as crucial channels for presenting financial results and engaging directly with financial analysts and media representatives, allowing for immediate clarification and discussion through Q&A sessions.

This multi-faceted approach guarantees that investors receive comprehensive and up-to-date information, fostering trust and enabling informed decision-making. For instance, EQT's Q1 2024 results, reported in April 2024, were accompanied by a webcast that detailed their operational highlights and financial outlook, demonstrating their proactive communication strategy.

- Regular Financial Reporting: EQT consistently publishes quarterly, semi-annual, and annual financial statements.

- Analyst & Media Engagement: Dedicated conference calls and webcasts are held to discuss financial performance and strategic initiatives.

- Sustainability Reporting: Comprehensive reports detail EQT's Environmental, Social, and Governance (ESG) performance, aligning with investor focus on sustainability.

- Accessibility of Information: All reports and webcast materials are readily available on EQT's investor relations website, ensuring broad access.

EQT AB's global presence is a cornerstone of its marketing strategy, enabling deep market penetration and localized insights. This extensive network, spanning regions representing over 80 percent of global GDP, allows EQT to effectively identify and act on investment opportunities worldwide.

Their operational strategy emphasizes a 'local with locals' approach, particularly in Real Estate, which provides superior deal sourcing capabilities. This localized expertise is critical for navigating diverse market dynamics and uncovering unique investment potential.

The firm is actively expanding its reach into the private wealth sector, aiming for 15-20% of future fundraising from this segment. This strategic diversification is supported by new product development, such as EQT Nexus Infrastructure, and targeted senior hires.

Full Version Awaits

EQT AB 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of EQT AB's 4 P's marketing mix provides actionable insights into their product strategies, pricing tactics, promotional activities, and distribution channels. You'll gain a clear understanding of how these elements work together to position EQT AB in the market. This is the same ready-made Marketing Mix document you'll download immediately after checkout, empowering you with the knowledge to inform your own strategic decisions.

Promotion

EQT AB consistently drives thought leadership, publishing in-depth reports on thematic investments, digitalization, and sustainability. These publications, often featuring data from their portfolio companies, showcase EQT's deep understanding of evolving market landscapes. For instance, their 2024 "Future of Private Markets" report highlighted a 15% year-over-year increase in sustainable investment mandates within their funds.

Their active participation in prominent industry conferences and forums further cements their position. EQT's leadership, including their CEO and Managing Partner, frequently shares proprietary insights on market trends and strategic direction, influencing industry dialogue. This presence reinforces EQT's reputation as a forward-thinking leader in private markets, as evidenced by their consistent ranking among the top private equity firms in industry surveys throughout 2024 and early 2025.

EQT AB's promotion strategy is deeply rooted in its formidable brand reputation and a proven history of exceptional performance. The firm consistently emphasizes its ability to generate superior and sustainable returns, a key differentiator that resonates with its investor base.

This commitment to performance is not just marketing; it's backed by tangible achievements. EQT's track record is a powerful promotional tool, attracting both existing and new investors who seek reliable growth. This builds significant trust and credibility in the competitive asset management landscape.

A prime example of this successful promotion is EQT's ability to close major fundraises. In 2024, EQT X was successfully launched, securing its position as the largest private equity fund globally. This achievement significantly bolsters EQT's market reputation and acts as a magnet for further investment capital.

EQT AB actively engages its institutional investor base through a multi-faceted communication approach. This includes direct outreach to key stakeholders, comprehensive investor day presentations showcasing strategic direction, and consistent shareholder relations activities.

The firm prioritizes clear and detailed financial reporting, ensuring transparency and accessibility for investors. This commitment to information sharing is further amplified through dedicated investor calls, where EQT’s management discusses performance metrics and outlines strategic priorities.

For example, EQT's 2024 interim reports, released in August 2024, detailed a strong revenue growth of 15% year-over-year, driven by its private equity and infrastructure segments. These reports, along with subsequent investor calls, provided crucial insights into the company's ongoing capital deployment and fundraising efforts.

This targeted communication strategy ensures that vital information regarding EQT's performance and strategic initiatives reaches the appropriate investor audience effectively, fostering confidence and informed decision-making.

Emphasis on ESG and Impact Investing

EQT AB 4P's marketing mix significantly emphasizes Environmental, Social, and Governance (ESG) and impact investing. This strategic focus resonates with a growing investor base prioritizing sustainable and responsible financial practices. EQT's 2024 ESG Report details concrete progress, illustrating their dedication to these values.

The report highlights tangible achievements, such as a reported 15% reduction in portfolio companies' Scope 1 and 2 greenhouse gas emissions in 2023 compared to their 2020 baseline. Furthermore, EQT's community investment initiatives, totaling €50 million in 2024 across various social impact projects, demonstrate a commitment beyond financial returns. This data-driven approach to ESG reporting directly addresses the increasing demand for transparency and measurable impact from investors.

- Commitment to ESG: EQT actively promotes ESG principles throughout its operations and investment strategies.

- Impactful Investments: The firm directs capital towards ventures that aim to generate positive social and environmental outcomes.

- 2024 ESG Report: This report quantifies achievements, including a 15% reduction in portfolio GHG emissions (Scope 1 & 2) by 2023 against a 2020 baseline.

- Community Investment: EQT allocated €50 million in 2024 to support community development and social impact programs.

Strategic Media Engagement and Public Relations

EQT AB leverages strategic media engagement and public relations to disseminate crucial information, acting as a vital component of its marketing mix. The firm actively uses channels like PR Newswire to broadcast significant announcements. These typically include the release of annual reports, the introduction of new investment funds, and details on major investment activities, both acquisitions and divestitures. This consistent communication strategy aims to bolster brand visibility and cultivate a favorable public perception across the financial community.

By proactively engaging with media outlets, EQT ensures its key developments reach a wide spectrum of stakeholders. This includes individual investors, financial professionals, and business strategists who rely on timely and accurate information for their decision-making processes. For instance, EQT's announcements regarding its latest fundraising efforts, such as reaching €22 billion for its flagship EQT X fund in early 2024, directly inform potential investors and partners about the firm's continued growth and market position.

- EQT X Fundraising: Reached €22 billion in early 2024, demonstrating strong investor confidence.

- Key Announcements: Regular dissemination of annual reports, new fund launches, and significant investment/exit news.

- Media Channels: Utilization of PR Newswire and other established media platforms for broad reach.

- Objective: To increase awareness, maintain a positive public image, and engage financial professionals.

EQT AB's promotional strategy heavily relies on thought leadership, showcasing deep market insights through reports and conference participation. Their 2024 "Future of Private Markets" report, for example, noted a 15% increase in sustainable investment mandates, underscoring their forward-thinking approach and influence in industry dialogue.

The firm's promotion is intrinsically linked to its strong brand and performance track record, emphasizing superior and sustainable returns. This is exemplified by the successful launch of EQT X in 2024, which became the world's largest private equity fund, significantly boosting EQT's market reputation and attracting further capital.

EQT AB effectively communicates with its investor base through direct outreach, investor days, and transparent financial reporting, including interim reports that detailed 15% year-over-year revenue growth in August 2024. This targeted communication fosters investor confidence and supports informed decision-making.

| Promotion Element | Key Activity/Data Point | Impact/Objective |

|---|---|---|

| Thought Leadership | 2024 "Future of Private Markets" Report (15% growth in sustainable mandates) | Establishes expertise, influences industry trends |

| Brand & Performance | EQT X fundraise (largest globally in 2024) | Builds trust, attracts capital, enhances market position |

| Investor Communication | August 2024 interim reports (15% YoY revenue growth) | Ensures transparency, fosters investor confidence |

Price

EQT AB's management fees, a cornerstone of its revenue, are calculated based on committed capital. These fees typically range from 1.4% to 2% annually, providing a predictable and consistent income stream. For instance, EQT's 2023 annual report indicated significant assets under management, translating into substantial fee income. This stable revenue base is crucial for covering operational expenses and supporting the firm's long-term growth.

EQT AB's marketing mix prominently features performance-based carried interest as a key differentiator. This incentive structure, typically 20% of fund profits, aligns EQT's success directly with that of its investors.

Crucially, this carried interest is only realized after investors achieve a preferred return, often set at 6-8% annually. This hurdle rate ensures that EQT's performance fees are generated from genuine profit growth, not simply capital deployment.

For the fiscal year 2023, EQT's carried interest income demonstrated robust growth, reflecting strong fund performance. This financial incentive is a powerful tool in attracting and retaining sophisticated investors seeking alpha generation.

EQT AB's pricing strategy, centered on its carried interest model, directly links the firm's compensation to the success of its investments and the profits delivered to its investors. This means EQT only earns significant performance fees when its funds outperform expectations, creating a powerful alignment of interests. For instance, in 2024, EQT continued to emphasize its commitment to value creation, with its flagship EQT IX fund showing strong performance metrics that directly translate to carried interest for the firm and enhanced returns for its Limited Partners.

Fee-Generating Assets Under Management (FAUM)

EQT's financial performance is closely tied to its Fee-Generating Assets Under Management (FAUM), as growth in this area directly boosts management fee income. The firm's success in fundraising and securing capital commitments is the primary driver for FAUM expansion.

In the first quarter of 2025, EQT reported a significant increase in FAUM, reaching €142 billion. This upward trend demonstrates the market's confidence in EQT's investment strategies and its ability to attract and deploy capital effectively.

- FAUM Growth: EQT's FAUM reached €142 billion in Q1 2025.

- Revenue Impact: Higher FAUM translates directly to increased management fees.

- Fundraising Success: Capital raised and commitments closed are key to FAUM expansion.

- Market Confidence: The increase in FAUM reflects positive market perception of EQT.

Competitive Pricing in Private Markets

EQT AB navigates a competitive private markets environment where pricing, though often confidential, is heavily influenced by a manager's track record and ability to secure significant client commitments. Larger, established firms like EQT typically command a premium due to their demonstrated success.

EQT's capacity to consistently generate strong returns and successfully close substantial funds, such as EQT X which reached €22 billion in commitments by its final close in January 2024, reinforces its competitive pricing power. This success attracts a disproportionate share of investor capital.

- Fundraising Success: EQT X's €22 billion final close in January 2024 highlights investor confidence and EQT's ability to attract capital.

- Track Record: Consistent strong returns are a key driver for EQT's competitive pricing in the private markets.

- Market Position: Larger managers with proven performance, like EQT, are better positioned to attract and retain client commitments.

EQT AB's pricing is intrinsically linked to its performance-driven carried interest model and management fees based on committed capital. The firm's success in fundraising, exemplified by EQT X closing at €22 billion in January 2024, directly influences its ability to command premium pricing due to its strong track record.

The value proposition for investors is EQT's ability to generate alpha, with carried interest being realized only after a preferred return is met. This alignment ensures that EQT's fees are a direct reflection of investor profit, a strategy that has proven successful, as evidenced by their growing Fee-Generating Assets Under Management (FAUM) of €142 billion in Q1 2025.

| Metric | Value | Period | Significance |

|---|---|---|---|

| EQT X Fund Close | €22 billion | January 2024 | Demonstrates strong investor confidence and EQT's fundraising prowess. |

| FAUM | €142 billion | Q1 2025 | Indicates growth in assets managed and potential for increased management fees. |

| Preferred Return (Hurdle Rate) | 6-8% annually | Ongoing | Establishes the performance threshold for earning carried interest. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for EQT AB is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate data from industry publications and market research to provide a holistic view of their Product, Price, Place, and Promotion strategies.