Epsilon Net Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epsilon Net Bundle

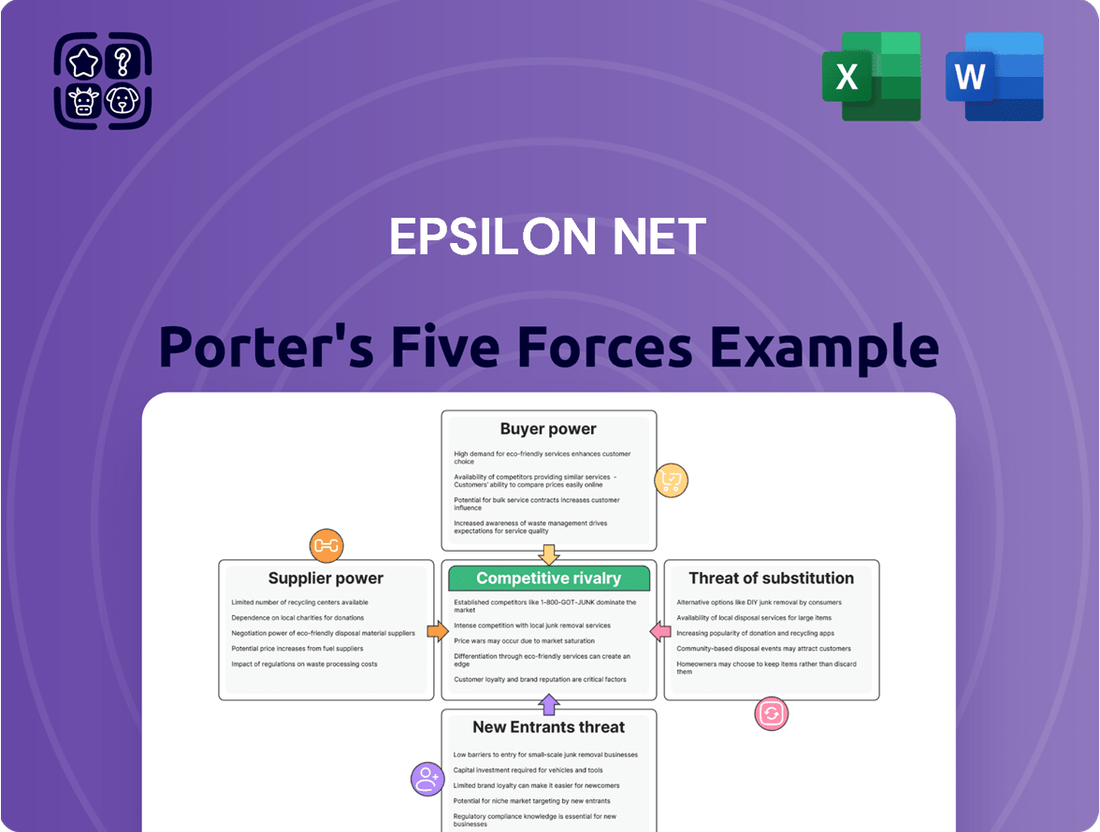

Epsilon Net's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the ever-present danger of substitutes. Understanding these forces is crucial for navigating its market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Epsilon Net’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of highly skilled software developers, AI specialists, and cybersecurity experts in Greece directly impacts their bargaining power. When these specialized roles are in high demand and short supply, suppliers of this talent can command better terms.

Epsilon Net's reliance on specialized human capital, particularly for developing and maintaining its advanced software solutions in areas like AI and Fintech, positions these professionals as influential suppliers. The need for cutting-edge skills means Epsilon Net must compete for this talent.

The accelerating digital transformation across Greek businesses further fuels the demand for these skilled professionals. In 2024, the IT sector in Greece continued to see robust growth, with a particular emphasis on cloud computing and cybersecurity, underscoring the scarcity of top-tier talent.

Epsilon Net's increasing reliance on major cloud infrastructure providers such as Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP) translates to significant bargaining power for these suppliers. Their dominance, with AWS holding an estimated 31% of the cloud infrastructure market share as of Q1 2024 and Azure close behind, allows them to dictate terms through pricing, service level agreements, and the pace of technological innovation.

These providers can leverage their scale and proprietary technologies to influence costs and service offerings, potentially impacting Epsilon Net's operational expenses and competitive positioning. For instance, shifts in pricing models by these giants, which are common given the dynamic nature of cloud services, directly affect Epsilon Net's cost structure.

However, Epsilon Net's strategic development of proprietary cloud applications, such as its Epsilon Smart invoicing solution, serves as a crucial countermeasure. By building its own integrated cloud capabilities, Epsilon Net can reduce its absolute dependence on any single external provider, thereby strengthening its own bargaining position and fostering greater control over its service delivery and cost management.

Hardware and technology component vendors wield significant bargaining power over Epsilon Net, particularly concerning the specialized retail and hospitality hardware like point-of-sale systems and digital cash registers. When Epsilon Net relies on specific suppliers for critical or proprietary components, this dependence can translate into increased costs and potential vulnerabilities in its supply chain. For instance, in 2024, the global semiconductor shortage continued to impact the availability and pricing of essential hardware, a trend that directly affects companies like Epsilon Net that integrate these components into their solutions.

Third-Party Software and Licensing Agreements

Epsilon Net's reliance on third-party software, like operating systems or development tools, directly influences supplier power. For instance, if Epsilon Net heavily utilizes Microsoft Dynamics as a foundational element, the licensing agreements and associated costs dictated by Microsoft become a significant factor. These terms can affect Epsilon Net's overall cost of goods sold and its ability to innovate freely.

The bargaining power of these foundational software suppliers can be substantial, especially if Epsilon Net's core products are deeply integrated with their platforms. Changes in licensing fees or terms by these providers can directly impact Epsilon Net's profitability and pricing strategies. Strategic partnerships, such as the one mentioned with Microsoft, can sometimes mitigate this power by offering more favorable terms or access to integrated solutions, but the underlying dependency remains.

- Dependency on Core Software Providers: Epsilon Net's product development and operational costs are significantly influenced by the licensing terms of essential third-party software components.

- Impact of Licensing Changes: Fluctuations in licensing fees or terms from foundational software providers can directly affect Epsilon Net's cost structure and profit margins.

- Strategic Alignment Benefits: Partnerships with major software vendors, like Microsoft, can potentially lead to more favorable integration and licensing arrangements, mitigating some supplier power.

- Flexibility and Innovation Constraints: The flexibility Epsilon Net has in adapting its solutions or innovating can be limited by the proprietary nature and licensing restrictions of the software it depends on.

Data and Content Providers

Epsilon Net's reliance on specialized data and content providers, particularly for tax systems like myDATA integration and financial data, can create significant supplier bargaining power. The unique nature or regulatory mandates surrounding this data, such as mandated reporting to AADE, means Epsilon Net has limited alternatives. This dependence can translate into higher costs or restrictive terms for Epsilon Net.

The integration with platforms like AADE's myDATA exemplifies this dynamic. Compliance with such regulatory frameworks necessitates access to specific, often proprietary, data feeds or integration protocols. Suppliers controlling these essential data streams can therefore exert substantial influence over Epsilon Net's operational capabilities and costs.

- Dependence on Specialized Data: Epsilon Net's need for specific tax and financial data, often tied to regulatory compliance, grants suppliers leverage.

- Regulatory Mandates: Requirements like myDATA integration mean Epsilon Net must source data from specific, often limited, providers.

- Limited Alternatives: The uniqueness or proprietary nature of the data reduces Epsilon Net's ability to switch suppliers easily.

- Potential for Increased Costs: Suppliers can command higher prices or impose stricter terms due to Epsilon Net's essential reliance on their content.

Epsilon Net's reliance on specialized talent, such as AI and cybersecurity experts, grants these professionals significant bargaining power. The high demand and limited supply of these skills, particularly evident in Greece's growing IT sector in 2024, allow them to negotiate favorable terms.

Major cloud infrastructure providers like AWS and Azure also exhibit strong supplier power due to their market dominance. For example, AWS held approximately 31% of the cloud infrastructure market share in Q1 2024, enabling them to influence pricing and service agreements, directly impacting Epsilon Net's operational costs.

Furthermore, vendors of specialized hardware and foundational software, including operating systems and development tools, can exert considerable influence. The ongoing global semiconductor shortage in 2024, for instance, has inflated hardware costs, a factor Epsilon Net must contend with.

Finally, suppliers of essential data, particularly for regulatory compliance like myDATA integration, hold significant leverage. Epsilon Net's dependence on these unique or proprietary data streams, often mandated by authorities like AADE, limits its ability to switch providers, potentially leading to higher costs.

What is included in the product

Uncovers the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on Epsilon Net's market position.

Effortlessly identify and mitigate competitive threats with a visually intuitive breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Customers who have adopted Epsilon Net's integrated suite of ERP, CRM, HR & Payroll, and e-invoicing solutions experience substantial switching costs. The sheer volume of business data that needs to be migrated, coupled with the necessity of retraining staff on new platforms and the complex task of integrating disparate systems, makes a changeover a costly and time-intensive undertaking. This significantly diminishes their leverage to demand lower prices or better terms.

Epsilon Net caters to a wide array of clients, from individual freelancers to large corporations, operating within Greece and extending its reach internationally across diverse sectors. This broad customer distribution significantly dilutes the bargaining power of any single customer or a small cluster of them.

The company's strategic objective to continually grow its market share further solidifies its position by ensuring a vast and varied customer footprint. For instance, in 2023, Epsilon Net reported a significant increase in its customer base, with new client acquisitions growing by 15% year-over-year, underscoring the fragmentation and widespread adoption of its services.

Mandatory digital transformation initiatives, such as the implementation of e-invoicing and digital work cards in Greece, significantly reduce customer discretion in software purchasing. This regulatory-driven demand empowers compliant solution providers like Epsilon Net, as businesses must adopt these technologies to adhere to legal frameworks. For instance, the Greek government's push for e-invoicing, aiming for full adoption by 2025, directly translates into a captive market for specialized software.

Value Proposition of Integrated Ecosystem

Epsilon Net's integrated ecosystem, a 'one-stop-shop' for business needs, significantly reduces the bargaining power of its customers. By offering a comprehensive suite of products and services, including cloud solutions and innovative Fintech offerings like Epsilon Pay in collaboration with the National Bank of Greece, the company fosters strong customer loyalty.

This integrated approach creates substantial customer "stickiness," making it inconvenient and costly for clients to switch providers. For instance, in 2024, businesses leveraging integrated platforms often report higher switching costs due to data integration and workflow dependencies. This reduces their incentive to seek out alternative, potentially fragmented solutions, thereby diminishing their bargaining leverage.

- Integrated Ecosystem: Epsilon Net offers a unified platform for diverse business functions.

- Customer Loyalty: Cloud services and Fintech solutions like Epsilon Pay build strong client relationships.

- Reduced Switching Costs: A single provider simplifies operations and increases customer stickiness.

- Diminished Bargaining Power: The convenience and interdependence of the ecosystem limit customers' ability to negotiate better terms.

Access to Funding for Digital Transformation

The availability of substantial financial incentives for digital transformation, particularly through Greece's RECOVERY FUND and NSRF 2021-2027 programs, significantly impacts the bargaining power of customers. These funds, totaling billions of euros allocated for modernization across various sectors, directly reduce the perceived cost for businesses adopting new technologies.

This external funding mechanism, which supports continued investment in digital solutions, inherently lessens customer price sensitivity. When businesses can leverage subsidies covering a portion of the investment in advanced software, such as those offered by Epsilon Net, their willingness to negotiate lower prices diminishes. This strengthens Epsilon Net's pricing power, as the perceived out-of-pocket expense for customers is effectively lowered.

For instance, the Greek government's "Digital Transformation for SMEs" program, part of the Recovery Fund, aims to co-finance investments in digital technologies. This directly translates to a reduced need for customers to bargain aggressively on price for solutions that enhance their digital capabilities, as a significant part of the cost is offset by these grants.

- Reduced Price Sensitivity: Financial incentives from programs like the RECOVERY FUND & NSRF 2021-2027 lower the effective cost of digital transformation for Greek businesses.

- Increased Investment Willingness: Subsidies encourage businesses to invest in advanced software solutions, making them less focused on price negotiation.

- Strengthened Pricing Power: Epsilon Net benefits from this reduced price sensitivity, allowing for more stable pricing strategies for its software offerings.

- Sustained Digitalization Drive: These external funding mechanisms ensure a continued demand and investment in digital solutions, supporting Epsilon Net's market position.

Epsilon Net's customers have limited bargaining power due to high switching costs associated with migrating data and retraining staff on new integrated systems. The company's broad customer base across Greece and internationally further dilutes the influence of individual clients. Mandatory digital transformation initiatives, like e-invoicing, create a captive market, reducing customer discretion and strengthening Epsilon Net's position.

The availability of substantial financial incentives, such as those from Greece's RECOVERY FUND and NSRF 2021-2027 programs, reduces customer price sensitivity. These subsidies effectively lower the out-of-pocket expense for businesses adopting digital solutions, diminishing their incentive to negotiate aggressively on price. This allows Epsilon Net to maintain stronger pricing power.

| Factor | Impact on Bargaining Power | Epsilon Net's Position |

|---|---|---|

| Switching Costs | High | Reduces customer leverage |

| Customer Dispersion | Wide | Dilutes individual customer influence |

| Regulatory Mandates (e.g., e-invoicing) | Creates captive market | Strengthens demand |

| Financial Incentives (e.g., RECOVERY FUND) | Lowers price sensitivity | Enhances pricing power |

Full Version Awaits

Epsilon Net Porter's Five Forces Analysis

This preview shows the exact Epsilon Net Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document detailing Epsilon Net's competitive landscape. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Epsilon Net commands a dominant position in the Greek business software sector, especially within accounting and human resources management. This significant market share and established brand presence create a formidable barrier for competitors seeking to directly challenge its leadership.

The company's consistent reporting of robust financial growth, such as its reported 2023 revenue of €57.2 million, up 28.8% year-on-year, underscores its market leadership and financial strength. This performance makes it difficult for rivals to gain substantial traction against its established advantage.

Despite Epsilon Net's prominent position, the Greek software development landscape remains highly fragmented as of 2025. Thousands of companies, encompassing both local enterprises and international firms, actively compete within this sector. This sheer volume of players significantly amplifies competitive rivalry, as each entity strives to capture a larger portion of the market.

Key competitors challenging Epsilon Net include firms like Pentalog, known for its nearshore development services, Impltech, which specializes in custom software solutions, and aleph, a player in the digital transformation space. This diverse competitive set means Epsilon Net must constantly innovate and differentiate to maintain its leadership.

The Greek software market is in a phase of significant consolidation, with Epsilon Net being a key player driving this trend through strategic mergers and acquisitions. This ongoing activity is actively reshaping the competitive environment, leading to a landscape with fewer, but demonstrably more robust, market participants as larger firms absorb smaller ones.

Epsilon Net's proactive acquisition strategy, a cornerstone of its growth, is designed to broaden its portfolio of products and services. For instance, in 2023, Epsilon Net acquired a significant stake in SoftOne, a move that solidified its market position and expanded its offerings in the enterprise resource planning (ERP) sector, demonstrating its commitment to inorganic growth. This consolidation not only increases Epsilon Net's scale but also enhances its ability to offer integrated solutions to a wider customer base.

Product Differentiation and 'All-in-One' Strategy

Epsilon Net's competitive strategy hinges on its 'all-in-one' approach, offering a deeply integrated suite of ERP, CRM, HR, and e-invoicing systems. This comprehensive product differentiation sets it apart from competitors who might offer more specialized or siloed solutions, allowing Epsilon Net to capture a broader customer base. The company is actively investing in emerging technologies, including AI and Fintech, to further enhance its integrated offerings and maintain a technological lead.

This strategy is crucial in a market where fragmentation can be a weakness for rivals. By providing a unified platform, Epsilon Net aims to streamline operations for its clients, reducing complexity and increasing efficiency. For instance, in 2023, Epsilon Net reported a significant increase in its customer base, driven by the adoption of its integrated solutions, demonstrating the market's receptiveness to this strategy.

- Integrated Solutions: Epsilon Net's core strength lies in its comprehensive suite of business management software.

- Market Share Expansion: The 'all-in-one' strategy facilitates market share growth by attracting clients seeking unified systems.

- Technological Investment: Significant R&D in AI and Fintech aims to future-proof its product portfolio and competitive edge.

- Client Efficiency: By reducing system fragmentation, Epsilon Net enables clients to achieve greater operational efficiency.

Growth in Digital Transformation Initiatives

The surge in digital transformation across Greek businesses, spurred by evolving legal frameworks and a growing need for efficiency, intensifies competitive rivalry within the business software market. This heightened demand creates fertile ground for both established vendors and new entrants aiming to capture market share.

Companies are compelled to innovate and differentiate their offerings to stand out in this expanding landscape. The Greek business software market is projected to double in value over the next five years, reaching an estimated €1.5 billion by 2028, up from approximately €750 million in 2023.

- Increased digitization needs and evolving legal requirements are key drivers of growth.

- The Greek business software market is expected to double in value by 2028.

- This expansion fuels intense competition among software providers.

The competitive rivalry within the Greek business software market is intense, driven by a fragmented landscape and significant growth opportunities. Epsilon Net's dominant position, bolstered by its integrated solutions and strategic acquisitions like the 2023 investment in SoftOne, positions it strongly. However, thousands of local and international competitors, including Pentalog and Impltech, are actively vying for market share in a sector projected to double to €1.5 billion by 2028.

| Competitor Type | Key Players | Epsilon Net's Advantage | Market Dynamics |

| Established Greek Firms | SoftOne (partially acquired by Epsilon Net) | Integrated 'all-in-one' solutions, strong brand | Market consolidation driven by M&A |

| International Service Providers | Pentalog | Specialized services, nearshore capabilities | High fragmentation, thousands of companies |

| Niche Software Developers | Impltech, aleph | Custom solutions, digital transformation focus | Increasing demand due to digitization trends |

| Emerging Tech Companies | AI and Fintech focused startups | Innovative technologies, agile development | Rapid technological advancement |

SSubstitutes Threaten

Businesses, particularly smaller enterprises, often consider using generic office software like spreadsheets or continuing with manual processes for fundamental tasks such as accounting, human resources, and invoicing as an alternative to specialized business management software. This approach can appear cost-effective initially.

However, the landscape is rapidly shifting due to regulatory mandates. For instance, the widespread adoption of mandatory e-invoicing across many European Union countries, including Greece where Epsilon Net operates, significantly diminishes the practicality of manual or spreadsheet-based invoicing. By the end of 2024, e-invoicing is expected to be nearly ubiquitous for B2B transactions in many regulated markets.

Similarly, the implementation of digital work cards and updated labor regulations, which require precise digital tracking of employee hours and activities, makes purely manual HR processes increasingly unviable and risky. Non-compliance can lead to substantial fines, making the perceived savings from these simpler substitutes negligible when weighed against potential penalties.

Larger enterprises, particularly those with unique operational demands, might explore developing custom in-house software solutions. This approach serves as a direct substitute for commercially available off-the-shelf or integrated software packages.

While custom development offers tailored functionality, its significant drawbacks often outweigh the benefits. The substantial upfront investment, intricate development process, and the continuous burden of maintenance and upgrades present considerable challenges.

For instance, the average cost for enterprise-level custom software development can range from $150,000 to over $1 million, with ongoing maintenance potentially adding 15-20% of the initial development cost annually. This financial commitment, coupled with the time-to-market and the risk of project failure, frequently makes commercial solutions a more pragmatic choice for many businesses.

Global Software-as-a-Service (SaaS) providers present a notable threat of substitution for Epsilon Net. These international players offer cloud-based Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and other essential business solutions that can directly compete with Epsilon Net's offerings.

While Greece has historically seen a slower uptake of cloud ERP systems compared to the global average, this trend is evolving. As cloud adoption accelerates worldwide, more Greek businesses may look to international SaaS providers for their digital transformation needs, seeking potentially more advanced or cost-effective solutions.

Despite this competitive pressure, Epsilon Net is not standing still. The company actively offers its own suite of cloud services, indicating an awareness of market shifts and a strategic move to retain and attract customers within the evolving digital landscape.

Industry-Specific Niche Solutions from Smaller Vendors

Smaller, specialized software vendors are increasingly offering niche solutions that can act as substitutes for certain aspects of Epsilon Net's broader product suite. These focused players often provide deeper, more tailored functionalities for specific industry segments, potentially attracting customers seeking highly specialized tools. For instance, a boutique accounting software provider might offer advanced tax compliance features for the real estate sector that Epsilon Net's general accounting module doesn't fully replicate.

While these niche solutions can pose a threat, Epsilon Net's strategic advantage lies in its ability to offer a comprehensive, integrated platform that serves a wide array of industries. This broad approach helps to mitigate the risk of fragmentation that can arise from numerous specialized competitors. By providing a one-stop shop for business management software, Epsilon Net aims to retain customers who value the convenience and synergy of a unified system, even if individual modules are not as deeply specialized as those from niche vendors.

The competitive landscape in 2024 highlights this dynamic. While Epsilon Net continues to expand its market share in integrated business solutions, reports indicate a growing segment of businesses opting for best-of-breed niche software for critical functions. For example, in the legal tech sector, specialized case management software saw significant adoption in 2024, with some firms choosing these over broader ERP solutions for their specific legal workflow needs.

- Niche Vendor Advantage: Smaller vendors can offer deeper, industry-specific functionalities.

- Epsilon Net's Mitigation: A comprehensive suite across various industries reduces the impact of niche competition.

- Customer Value: Integrated platforms offer convenience and system synergy, a key differentiator.

- Market Trend (2024): Increased adoption of specialized software for critical business functions alongside broader ERP solutions.

Outsourcing Business Functions

The threat of substitutes for Epsilon Net's software solutions is significant, particularly through the outsourcing of business functions. Many companies opt to outsource payroll, accounting, and customer relationship management (CRM) to third-party providers. These service providers leverage their own proprietary software, thereby substituting the need for clients to invest in and manage their own systems. For instance, in 2024, the global outsourcing market was valued at over $1 trillion, with significant growth in areas like business process outsourcing (BPO), which often includes financial and HR functions.

Epsilon Net directly addresses this by offering specialized solutions tailored for accounting firms. These firms, in turn, provide outsourced services to their own clients, effectively acting as a layer between Epsilon Net's technology and the end business user. This positioning allows Epsilon Net to capture value by equipping the service providers rather than directly competing with the outsourced function itself.

- Outsourcing Growth: The global BPO market is projected to reach approximately $450 billion by 2027, indicating a strong trend towards outsourcing core business functions.

- Software Integration: Outsourcing providers often integrate their software with client systems, creating a seamless experience that reduces the perceived need for in-house software solutions.

- Epsilon Net's Strategy: By serving accounting firms, Epsilon Net capitalizes on the outsourcing trend by providing the essential technology that enables these firms to offer efficient, software-driven outsourced services.

The threat of substitutes for Epsilon Net's offerings is multifaceted. Businesses may opt for simpler, less integrated solutions like manual processes or spreadsheets for basic tasks, though regulatory changes, such as mandatory e-invoicing by the end of 2024, render these increasingly impractical and risky due to potential fines. Custom-built software is another substitute, but its high development and maintenance costs, often exceeding $1 million for enterprise solutions, make it less appealing than commercial packages.

International SaaS providers also present a significant substitute threat, offering cloud-based ERP and CRM solutions that appeal to businesses seeking digital transformation. While cloud adoption in Greece is growing, these global players can offer advanced or cost-effective alternatives. Furthermore, niche software vendors provide specialized functionalities that can substitute for specific modules within Epsilon Net's integrated suite, though Epsilon Net counters this with its comprehensive platform offering convenience and synergy.

Outsourcing business functions like payroll and accounting to third-party providers is a major substitute. These providers use their own software, eliminating the need for clients to manage in-house systems. The global outsourcing market, valued over $1 trillion in 2024, demonstrates this trend. Epsilon Net strategically addresses this by providing solutions to accounting firms, enabling them to offer outsourced services, thereby capitalizing on the outsourcing market without directly competing with the outsourced function itself.

| Substitute Type | Key Characteristics | Epsilon Net's Position/Response | Market Context (2024/Near Future) |

|---|---|---|---|

| Manual/Spreadsheet Processes | Low initial cost, perceived simplicity. | Increasingly impractical due to regulatory mandates (e.g., e-invoicing). | Mandatory e-invoicing expected to be near-ubiquitous for B2B transactions in EU by end of 2024. |

| Custom In-House Software | Tailored functionality. | High upfront investment ($150k-$1M+), complex development, ongoing maintenance (15-20% annually). | Significant financial and time commitment often makes commercial solutions more pragmatic. |

| Global SaaS Providers | Cloud-based ERP, CRM, advanced features. | Epsilon Net offers its own cloud services to compete. | Growing cloud adoption globally, potentially impacting Greek market share. |

| Niche Software Vendors | Deep, industry-specific functionalities. | Epsilon Net offers a comprehensive, integrated platform for convenience and synergy. | Some firms opt for best-of-breed niche software for critical functions (e.g., legal tech in 2024). |

| Outsourcing Business Functions | Third-party providers manage functions using their software. | Epsilon Net provides solutions to accounting firms, enabling them to offer outsourced services. | Global outsourcing market valued over $1 trillion in 2024; BPO market projected to reach ~$450 billion by 2027. |

Entrants Threaten

Developing a comprehensive suite of business software, such as ERP, CRM, HR, and e-invoicing systems, demands significant capital for research and development, robust infrastructure, and skilled personnel. This considerable financial hurdle effectively discourages many prospective new competitors from entering the market.

Epsilon Net's commitment to innovation is evident in its continuous, substantial investments in cutting-edge technology and operational infrastructure, reinforcing its competitive position and creating a formidable barrier for any new player.

Epsilon Net's entrenched market leadership in Greece, especially within accounting and HR software, presents a significant hurdle for new entrants. Their long-standing presence has cultivated deep customer relationships and strong brand loyalty, making it challenging for newcomers to disrupt their established user base.

The vast installed base of Epsilon Net's solutions acts as a powerful barrier, as businesses are often reluctant to switch from familiar and integrated systems. Gaining the trust and market share necessary to compete effectively against such an established player requires substantial investment and a compelling value proposition.

The Greek market presents a significant barrier to new entrants due to its intricate regulatory landscape. For instance, the mandatory e-invoicing system via the myDATA platform and the implementation of digital work cards require specialized software solutions that are compliant with these evolving standards. New companies entering this space would need substantial investment not only in developing this technology but also in thoroughly understanding and integrating these complex legal frameworks. Epsilon Net, as a certified electronic invoicing provider, already possesses this crucial compliance expertise, giving it a distinct advantage.

Need for Extensive Product Portfolio and Integration

Epsilon Net's significant competitive advantage stems from its extensive, integrated 'all-in-one' product portfolio, designed to meet a wide array of business needs. This comprehensive offering makes it difficult for new entrants to compete effectively from the outset.

Replicating Epsilon Net's broad range of seamlessly integrated modules would require substantial investment in research, development, and product integration, a process that typically takes years. For instance, developing and launching a suite of interconnected business management software, comparable to Epsilon Net's offerings in areas like ERP, CRM, and HR, could cost tens of millions of euros and take over five years to mature.

- High Barrier to Entry: New companies face a significant hurdle in matching Epsilon Net's established breadth and depth of integrated solutions.

- Capital and Time Intensive: Building a comparable product ecosystem requires immense financial resources and a considerable time commitment.

- Integration Complexity: The technical challenge and cost associated with ensuring seamless integration across numerous software modules are substantial deterrents for potential new entrants.

Strategic Partnerships and Ecosystem Development

Epsilon Net's strategic partnerships significantly deter new entrants. For instance, their collaboration with the National Bank of Greece for Epsilon Pay is a prime example. This deep integration creates a formidable ecosystem that is challenging and time-consuming for newcomers to replicate, thereby raising the barrier to entry.

These alliances aren't just about launching new services; they foster mutual value creation and solidify Epsilon Net's market presence. By embedding their solutions within established financial institutions, they gain access to a vast customer base and trusted infrastructure, making it exceptionally difficult for new players to gain traction.

- Strategic Alliances: Partnerships like the one with the National Bank of Greece for Epsilon Pay create integrated ecosystems.

- Ecosystem Barriers: The depth of integration and mutual value creation in these partnerships are difficult for new entrants to quickly replicate.

- Market Position: These collaborations significantly strengthen Epsilon Net's competitive standing by leveraging established networks.

The threat of new entrants for Epsilon Net is relatively low, primarily due to the substantial capital investment required to develop comprehensive, integrated business software solutions. Building a full suite of ERP, CRM, and HR systems, complete with the necessary infrastructure and talent, is a costly endeavor. For example, creating a comparable integrated product ecosystem could easily cost tens of millions of euros and take over five years to mature.

Furthermore, Epsilon Net's deep market penetration in Greece, particularly in accounting and HR software, has fostered strong customer loyalty and established relationships. This entrenched position, coupled with the complexity of navigating Greece's specific regulatory environment, such as the myDATA e-invoicing system, creates significant barriers for newcomers. New entrants must not only develop compliant technology but also master intricate legal frameworks, a challenge Epsilon Net has already overcome as a certified provider.

Epsilon Net's strategic partnerships, like the one with the National Bank of Greece for Epsilon Pay, further solidify its market standing by creating integrated ecosystems that are difficult for new players to replicate. These alliances provide access to established customer bases and trusted infrastructure, significantly raising the bar for any potential competitor seeking to gain traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, infrastructure, and talent costs for integrated software suites. | Deters entry due to substantial financial outlay. |

| Product Differentiation & Loyalty | Established market leadership and deep customer relationships in Greece. | Makes it difficult for new entrants to gain market share and trust. |

| Regulatory Complexity | Need for specialized, compliant software for Greek regulations (e.g., myDATA). | Requires significant investment in legal and technical expertise. |

| Switching Costs | Large installed base and integrated systems discourage customer migration. | New entrants must offer a compelling value proposition to overcome inertia. |

| Strategic Alliances | Partnerships create integrated ecosystems and leverage established networks. | New entrants struggle to replicate the depth of integration and market access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Epsilon Net is built upon a robust foundation of data, integrating information from industry-specific market research reports, publicly available financial statements, and reputable business news outlets to provide a comprehensive view of the competitive landscape.