Elanders Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elanders Bundle

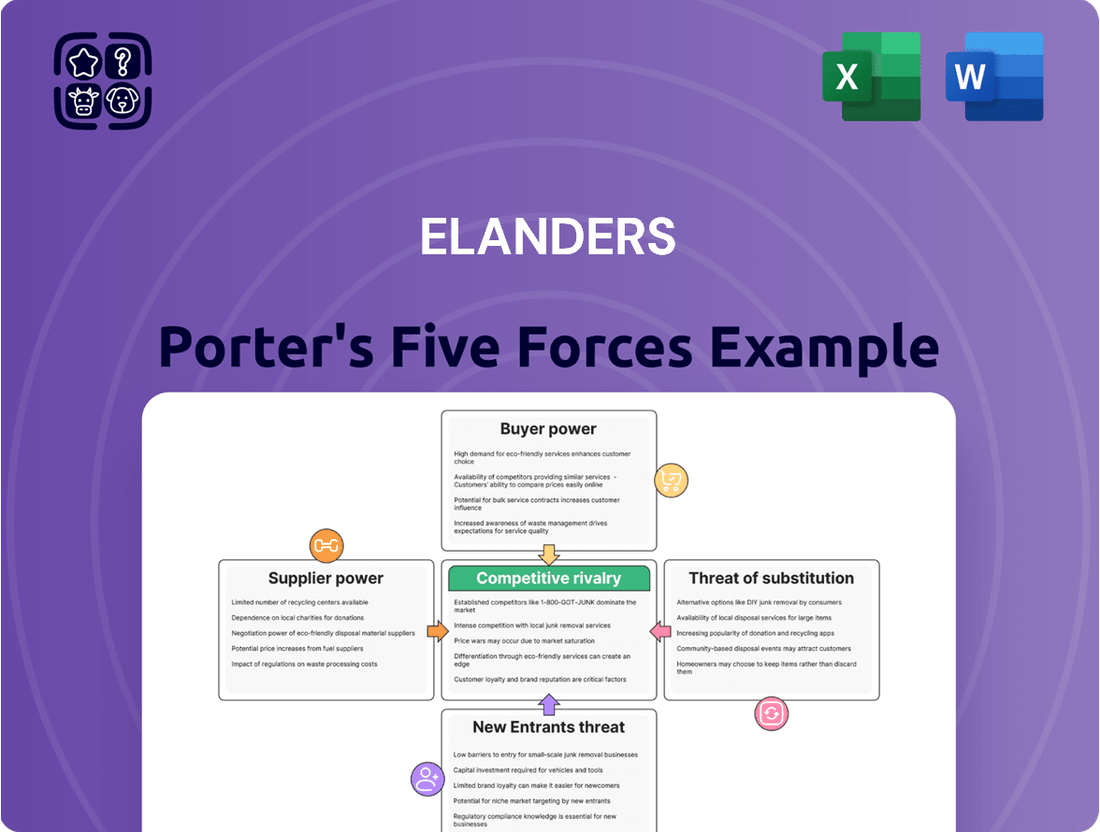

Elanders operates within a dynamic market shaped by intense competition, the bargaining power of its customers, and the constant threat of new entrants. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping Elanders’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Elanders' reliance on a limited number of suppliers for crucial raw materials like specialized paper or unique inks, particularly for its high-end print and packaging solutions, significantly bolsters supplier bargaining power. For instance, in 2024, the global paper market experienced price volatility, with some specialty paper producers seeing increased demand, giving them more leverage over buyers like Elanders.

The concentration of logistics providers in key operational regions also plays a role. If Elanders faces a situation where only a few dominant companies control essential warehousing or specialized transportation for its global operations, these suppliers can dictate terms, impacting Elanders' costs and operational flexibility.

Switching suppliers for Elanders can involve substantial costs. These include the expense of reconfiguring IT systems, such as integrating with their WMS CloudX, and the effort required to renegotiate contracts or requalify new vendors. These significant switching costs inherently grant existing suppliers greater bargaining power.

Elanders' strategy of offering global logistics solutions with a unified integration, while designed to simplify operations, also underscores the inherent complexities should they need to change supply chain partners. This interconnectedness means that a shift in one supplier could necessitate broader system adjustments.

Suppliers offering highly specialized or unique services, especially in areas like advanced supply chain technologies or niche printing capabilities, can wield significant bargaining power. If Elanders' integrated solutions depend on proprietary software or exclusive logistics networks from specific suppliers, these suppliers would naturally have more leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by Elanders' suppliers could significantly shift the balance of power. If suppliers, particularly those providing more standardized components or services, develop the capability and motivation to directly serve Elanders' end customers, they could bypass Elanders altogether. This scenario is more plausible for less complex, commoditized inputs within the supply chain.

For Elanders, this means suppliers could potentially offer integrated supply chain management or even print and packaging solutions directly to Elanders' client base. Such a move would directly challenge Elanders' core business model and revenue streams. While less likely for highly specialized or complex integrated solutions where Elanders adds substantial value, it remains a pertinent concern for more basic service offerings.

- Supplier Capability: Assess if key suppliers possess the technical expertise and infrastructure to replicate Elanders' service offerings.

- Market Incentive: Evaluate if suppliers see a profitable opportunity in directly accessing Elanders' customer base.

- Commoditization Risk: Identify which specific inputs or services within Elanders' operations are most susceptible to being offered directly by suppliers.

- Competitive Landscape: Consider how the broader market for print, packaging, and supply chain services influences supplier integration strategies.

Importance of Elanders to Suppliers

The volume of business Elanders provides to its suppliers significantly influences their bargaining power. When Elanders constitutes a substantial portion of a supplier's total revenue, that supplier's leverage diminishes, as they are more dependent on Elanders' continued patronage.

Conversely, if Elanders is just one of many clients for a supplier, the supplier holds greater bargaining power. This is because the supplier has alternative avenues for their products and services, making them less susceptible to Elanders' demands.

For instance, if a key supplier generates 30% of its annual revenue from Elanders, it is likely to be more accommodating to Elanders' pricing or terms. However, if Elanders accounts for only 2% of a supplier's business, that supplier can afford to be more assertive.

- Supplier Dependency: The extent to which suppliers rely on Elanders for their sales dictates their bargaining strength.

- Market Share: A supplier with a large market share may have more options and thus less incentive to concede to Elanders.

- Elanders' Purchasing Volume: Higher purchase volumes from Elanders can solidify its position as a valuable customer, potentially reducing supplier leverage.

Elanders' bargaining power with its suppliers is significantly influenced by the uniqueness of the products or services they provide. Suppliers offering highly specialized or proprietary components, such as advanced printing technologies or unique ink formulations, possess considerable leverage. This is amplified if Elanders' integrated solutions are critically dependent on these specialized inputs, making it difficult and costly to find alternatives.

The threat of suppliers integrating forward poses a substantial risk, particularly for commoditized inputs. If suppliers can directly serve Elanders' customers with their own print, packaging, or logistics services, they could bypass Elanders entirely, impacting revenue. This risk is more pronounced for less complex offerings where Elanders' value-add is minimal.

The relative size of Elanders as a customer to its suppliers is a key determinant of their bargaining power. When Elanders represents a significant portion of a supplier's revenue, the supplier is more incentivized to be accommodating. Conversely, if Elanders is a small client, the supplier holds greater leverage due to their independence from Elanders' business.

| Factor | Impact on Supplier Bargaining Power | Elanders' Situation |

|---|---|---|

| Supplier Specialization | High for unique/proprietary offerings | Crucial for high-end print/packaging |

| Forward Integration Threat | High for commoditized inputs | Potential for logistics/standard print |

| Customer Dependency | Low if Elanders is a small client | Varies by supplier; larger clients have more power |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Elanders' printing and packaging industry.

Quickly identify and address competitive threats with a visual, easy-to-understand overview of all five forces.

Customers Bargaining Power

Elanders operates across diverse sectors like Automotive, Electronics, Fashion, Health Care, and Industrial, with a global presence in Europe, Asia, and North America. This broad customer base generally dilutes individual customer power, but the concentration of revenue among a few large clients can significantly shift this dynamic.

If a handful of major customers represent a substantial portion of Elanders' total revenue, their ability to negotiate favorable terms, such as lower prices or extended payment periods, increases dramatically. This is a critical factor in assessing customer bargaining power.

For example, Elanders has explicitly stated that a downturn in demand from the Automotive sector, a key industry for them, has negatively impacted their financial performance. This highlights how a decline in demand from a concentrated customer segment can directly affect the company's profitability and operational results.

The effort, time, and financial investment required for Elanders' clients to transition to a different supply chain management or print and packaging provider are often substantial. This is largely due to the deep integration of IT systems, the establishment of specific operational workflows, and the development of tailored solutions designed around each client's unique needs. For example, in 2024, many of Elanders' clients have invested heavily in custom-built ERP integrations that streamline their procurement and production processes with Elanders' platforms.

Consequently, these high switching costs significantly diminish the bargaining power of Elanders' customers. When it's difficult and expensive to change providers, clients are less likely to demand lower prices or more favorable terms, as the cost and disruption of switching outweigh the potential benefits. This sticky nature of Elanders' services is a key factor in its competitive advantage.

Elanders actively works to further optimize its clients' supply chains and boost operational efficiency, thereby increasing the value and stickiness of its offerings. By demonstrating tangible improvements in areas like inventory reduction or lead-time shortening, Elanders solidifies its client relationships, making it even harder for customers to consider alternative vendors.

Customer price sensitivity significantly impacts Elanders, particularly in highly competitive markets where buyers can easily switch suppliers if prices rise. This pressure forces Elanders to maintain cost efficiency to remain competitive.

The economic climate directly amplifies this sensitivity. For instance, Elanders observed a notable increase in customer price scrutiny during early 2025, a period marked by economic volatility and a general downturn in demand across several of its key sectors.

Availability of Substitute Services for Customers

Customers of Elanders, particularly those in the printing and logistics sectors, possess significant bargaining power due to the wide array of substitute services available. They can choose to bring logistics in-house, a move that is becoming more feasible for larger enterprises.

Alternatively, customers can opt to work with multiple smaller, specialized providers rather than a single integrated service like Elanders. This fragmentation of the supply chain allows them to cherry-pick the best services at the most competitive prices, directly diminishing the leverage of any single provider.

Furthermore, the printing industry itself sees customers exploring different printing methods and technologies, some of which may bypass traditional print service providers altogether. For instance, advancements in digital printing and on-demand manufacturing offer alternatives that can reduce reliance on established players.

The ease with which customers can identify and switch to these alternatives is a critical factor. In 2023, the global digital printing market was valued at approximately $23.6 billion, demonstrating a growing preference for flexible and often more cost-effective digital solutions, which directly enhances customer bargaining power against traditional print and logistics providers.

- In-house Logistics: Larger clients can develop their own logistics capabilities, reducing dependency on external providers.

- Multiple Smaller Providers: Customers can segment their needs and engage several specialized companies, increasing competition among suppliers.

- Alternative Printing Methods: Innovations in printing technology offer substitutes that may reduce the need for Elanders' core services.

- Market Data: The significant growth in the digital printing sector underscores the availability of viable alternatives for customers.

Threat of Backward Integration by Customers

Large customers, particularly those with significant purchasing volume, may explore bringing Elanders' core services, such as print production or supply chain management, in-house. This potential for backward integration is driven by the belief that internalizing these operations could lead to cost savings or enhanced control over critical processes. For instance, a major automotive manufacturer might assess if managing its own printed manuals and packaging internally is more efficient than outsourcing.

This threat of customers integrating backward directly amplifies their bargaining power. When customers possess the capability and willingness to produce goods or services themselves, they are less dependent on Elanders and can negotiate more aggressively on price and terms. This leverage is a key consideration in how Elanders structures its client relationships and pricing models.

Elanders actively works to mitigate this threat by emphasizing its value proposition. The company focuses on demonstrating how its expertise in optimizing supply chains and achieving operational efficiencies for clients can deliver superior results and cost advantages compared to in-house solutions. This includes highlighting economies of scale, specialized technology, and process innovation that might be difficult for individual customers to replicate.

- Customer Integration Potential: Large clients, especially those in sectors like automotive or consumer electronics, may evaluate bringing print and packaging operations in-house.

- Bargaining Power Impact: The credible threat of backward integration by customers significantly strengthens their negotiating position with Elanders.

- Elanders' Counter-Strategy: Elanders counters this by showcasing its ability to deliver cost efficiencies and supply chain optimization, making outsourcing more attractive than internalizing.

The bargaining power of Elanders' customers is influenced by several factors, including the availability of substitutes and the potential for in-house production. Customers in the printing and logistics sectors benefit from a wide array of alternative service providers, including the option to manage logistics internally, which is becoming more feasible for larger enterprises. This allows them to negotiate more favorable terms.

The threat of customers bringing services in-house, such as print production or supply chain management, directly increases their negotiating leverage. For example, a major automotive manufacturer might consider internalizing its printed manuals and packaging operations if it believes it can achieve cost savings or better control. In 2024, many clients are evaluating these backward integration possibilities.

Elanders counters this by emphasizing its expertise in supply chain optimization and operational efficiencies, aiming to demonstrate that outsourcing offers superior results and cost advantages compared to internalizing these functions. The company highlights its economies of scale and specialized technology as key differentiators.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example (2023-2025) |

| Availability of Substitutes | High | Global digital printing market valued at ~$23.6 billion in 2023, indicating strong alternative options. |

| Potential for Backward Integration | Significant | Large clients in automotive and electronics sectors actively assess bringing print and packaging operations in-house. |

| Customer Price Sensitivity | Elevated | Increased price scrutiny observed by Elanders in early 2025 due to economic volatility. |

| Switching Costs | High (Mitigates Power) | Clients invested in custom ERP integrations with Elanders in 2024, increasing integration complexity. |

Preview the Actual Deliverable

Elanders Porter's Five Forces Analysis

This preview showcases the comprehensive Elanders Porter's Five Forces Analysis, detailing competitive intensity and industry attractiveness. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can confidently expect to download this complete and professionally written report, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The supply chain management and print and packaging sectors are highly fragmented, featuring a wide array of participants. These range from massive global logistics corporations to highly specialized, smaller niche providers, creating a dynamic competitive landscape for Elanders.

Elanders, with its extensive reach across approximately 20 countries and a workforce of nearly 7,000 individuals, contends with competition from both large, established international firms and agile, regionally focused players. This broad competitive base necessitates continuous adaptation and strategic positioning.

A slower industry growth rate naturally amplifies competitive rivalry. When the overall market pie isn't expanding quickly, companies must aggressively vie for existing customers and market share. This dynamic forces businesses to innovate, cut costs, or engage in more aggressive pricing strategies to capture a larger slice of a more stagnant pie.

While the digital printing packaging market, a key area for Elanders, is expected to grow substantially, the broader logistics and print sectors may see more moderate or even fluctuating growth. For instance, industry reports from late 2024 indicated a mixed outlook for traditional print services, contrasting with the robust digital segment. Elanders itself acknowledged in its early 2025 reports that it was navigating volatile market conditions, which included experiencing organic net sales reductions, underscoring the impact of slower growth in certain operational areas on competitive pressures.

Elanders distinguishes itself by offering integrated solutions that blend print, packaging, and supply chain management with e-commerce capabilities, aiming to streamline client operations. This comprehensive approach is designed to lessen direct competition based purely on price.

However, the competitive landscape remains intense if other players in the market can effectively match these multifaceted service offerings. For instance, in 2024, the global print and packaging market, a key area for Elanders, was projected to reach over $1 trillion, indicating significant market size and potential for numerous competitors vying for market share.

Exit Barriers

High exit barriers can trap companies in an industry, even when they are not profitable, thereby intensifying competitive rivalry. Elanders, like many in the printing and packaging sector, faces such challenges. For instance, specialized machinery and long-term supply or customer agreements can make it difficult and costly to cease operations or divest assets.

Elanders has actively worked to mitigate these pressures. In 2023, the company continued its strategic focus on consolidation and cost reduction. This included measures to optimize its production capacity, a crucial step in managing the impact of high exit barriers. Such actions demonstrate a proactive approach to navigating a landscape where exiting can be financially prohibitive.

- High Exit Barriers: Specialized assets and long-term commitments can prevent unprofitable firms from leaving the market, leading to sustained competitive pressure.

- Elanders' Strategy: The company has implemented structural changes aimed at consolidating capacity and reducing operational costs.

- Market Impact: These efforts are designed to improve Elanders' competitive position within an industry where exiting is often difficult and expensive.

Strategic Importance of the Industry

The supply chain and logistics sector is fundamental to the success of countless businesses, making it a hotbed for intense competition. Companies vie for dominance, aiming to become indispensable partners by offering superior efficiency and cost savings.

Elanders' core strategy revolves around this very principle: bolstering client efficiency and trimming operational expenses. This focus underscores the industry's strategic significance and the competitive pressure to deliver tangible value.

- Industry Vital Role: Supply chain and logistics are critical enablers for global commerce, impacting everything from manufacturing to final delivery.

- Competitive Intensity: The strategic importance fuels fierce rivalry, with companies constantly innovating to secure market share and client loyalty.

- Elanders' Value Proposition: Elanders directly addresses this by prioritizing operational efficiency and cost reduction for its customers.

- Market Dynamics: In 2024, the logistics sector saw continued consolidation and a strong emphasis on technological integration to manage complex global networks.

The competitive rivalry within Elanders' operating sectors is substantial due to a fragmented market structure and the presence of numerous global and regional players. This intensity is further amplified by slower industry growth rates in certain segments, forcing companies to battle for existing market share, often through cost efficiencies and innovation. Elanders' integrated service model aims to differentiate itself, but the sheer size of the global print and packaging market, projected to exceed $1 trillion in 2024, means competition remains a significant factor.

| Metric | Elanders (Approx.) | Industry Trend (2024) |

|---|---|---|

| Global Print & Packaging Market Size | N/A (Company Specific) | >$1 Trillion |

| Number of Countries Operated In | ~20 | N/A (Company Specific) |

| Employee Count | ~7,000 | N/A (Company Specific) |

| Digital Printing Packaging Growth | Strong Segment Focus | Substantial Growth Projected |

| Traditional Print Services Outlook | Navigating Volatility | Mixed/Moderate Growth |

SSubstitutes Threaten

The threat of substitutes for Elanders' supply chain management services is significant. Clients can choose to manage their logistics internally, a trend potentially accelerated by advancements in AI-driven planning tools. Alternatively, the rise of flexible, cloud-based software allows companies to build their own self-managed logistics platforms, bypassing external providers. Traditional, less integrated logistics providers also represent a substitute, offering simpler services that might appeal to cost-conscious clients.

The threat of substitutes is amplified when these alternatives offer a compelling price-performance trade-off. If a substitute can deliver similar or even better results for less money, customers are more likely to switch, putting pressure on Elanders' pricing and profitability.

Digital printing in packaging is a prime example of this threat. Its ability to handle personalized runs and eliminate traditional prepress expenses makes it a strong contender, especially for clients with evolving customization demands. This trend is evident as the global digital printing market for packaging is projected to reach over $23 billion by 2027, indicating significant adoption.

Furthermore, for certain clients, optimizing their in-house logistics operations can present a more cost-effective solution than outsourcing to a company like Elanders. This internal efficiency reduces the need for external print and packaging services, directly impacting Elanders' market share and revenue potential.

Customers' willingness to switch to alternative solutions hinges on the perceived advantages and potential drawbacks. Factors like how easy it is to switch, worries about data safety, and the overall value seen in bundled services versus separate ones all play a significant role. Elanders' strategy of offering integrated solutions is designed to make customers less likely to seek out substitutes.

Evolution of Digital Technologies

The rapid advancement of digital technologies presents a significant threat of substitutes for Elanders' traditional print and packaging offerings. Innovations like AI-powered supply chain management tools can offer more efficient and cost-effective alternatives for businesses looking to manage their product distribution and marketing materials. For instance, companies might opt for fully digital marketing campaigns or on-demand, localized printing solutions that bypass traditional, large-scale print runs.

Elanders' strategic pivot towards digital print and its development of proprietary solutions like WMS CloudX demonstrate a proactive response to this evolving landscape. This suggests an understanding that the threat isn't just about alternative printing methods, but also about entirely digital communication and fulfillment strategies. In 2024, the global digital printing market was valued at approximately USD 25.3 billion, with projections indicating continued growth, highlighting the increasing adoption of digital alternatives.

- Digital Marketing Dominance: Increased investment in digital advertising and content marketing by businesses can reduce reliance on printed collateral.

- On-Demand Printing: Advances in digital printing allow for smaller, localized print runs, potentially substituting for larger, consolidated print orders.

- E-commerce Integration: Seamless integration of e-commerce platforms and digital fulfillment services can reduce the need for physical packaging and printed inserts.

- Software Solutions: AI and cloud-based software can manage customer communications and product information digitally, diminishing the need for printed catalogs or manuals.

Regulatory and Environmental Factors

The increasing global emphasis on sustainability and digital transformation presents a significant threat of substitutes for traditional packaging solutions. For instance, a growing consumer and regulatory push for recyclable and low-carbon packaging formats directly favors alternative printing methods, such as digital printing, which can offer more efficient material usage and reduced waste. Elanders' proactive stance on sustainability, including its commitment to Science Based Targets, positions it to potentially leverage these shifts rather than be undermined by them.

Elanders' 2024 sustainability report highlights a reduction in CO2 emissions per ton of product by 15% compared to 2020, demonstrating a tangible move towards more environmentally friendly operations. This focus on reducing environmental impact makes its offerings more competitive against less sustainable substitutes. The company's investment in digital printing technologies, which align with these eco-conscious trends, further mitigates the threat by offering solutions that meet evolving market demands.

- Growing demand for sustainable packaging: Consumers and businesses are increasingly prioritizing eco-friendly options, driving the adoption of recyclable and low-carbon materials.

- Digital printing as a substitute: Digital printing technologies offer advantages in material efficiency and waste reduction, making them a viable alternative to conventional printing methods.

- Elanders' sustainability initiatives: The company's commitment to Science Based Targets and demonstrable reductions in CO2 emissions (e.g., 15% reduction per ton of product in 2024 vs. 2020) bolster its position.

- Strategic alignment with market trends: Elanders' investments in digital printing capabilities directly address the shift towards more sustainable and digitally-driven packaging solutions.

The threat of substitutes for Elanders' core offerings is a dynamic challenge, particularly from digital alternatives and in-house capabilities. Companies can increasingly manage logistics and marketing materials through digital platforms, reducing reliance on traditional print and packaging services. For instance, the global digital printing market for packaging was valued at approximately USD 25.3 billion in 2024, indicating a strong market shift towards digital solutions.

These substitutes often present a compelling price-performance ratio, especially as advancements in AI and cloud-based software enhance efficiency. The ability for clients to build self-managed logistics platforms or opt for entirely digital marketing campaigns directly bypasses the need for external print and packaging providers like Elanders. This trend is further supported by the growing demand for sustainable packaging, where digital printing can offer material efficiency and reduced waste, aligning with market preferences.

Elanders' strategic investments in digital printing and proprietary solutions like WMS CloudX are crucial responses to this threat. By offering integrated and digitally-enabled services, Elanders aims to increase customer stickiness and differentiate itself from simpler, standalone substitute offerings. The company's commitment to sustainability, demonstrated by a 15% reduction in CO2 emissions per ton of product in 2024 compared to 2020, also positions its services as more attractive against less eco-friendly alternatives.

| Substitute Area | Key Drivers | Elanders' Response/Mitigation |

|---|---|---|

| Digital Marketing & Communication | Cost-effectiveness, reach, personalization, reduced reliance on print collateral | Developing integrated digital solutions, focusing on e-commerce integration |

| In-house Logistics Management | Control, potential cost savings, AI-driven planning tools | Offering advanced supply chain management services, cloud-based solutions |

| Digital Printing Technologies | Flexibility, on-demand capabilities, sustainability benefits, reduced waste | Investing in digital printing, offering personalized print runs |

| Software & Cloud Solutions | Efficiency, data management, automation of customer communication | Proprietary solutions like WMS CloudX, enhancing digital service offerings |

Entrants Threaten

The capital required to establish a competitive presence in global supply chain management and print/packaging is substantial. Companies need to invest heavily in advanced manufacturing technologies, sophisticated IT systems for tracking and management, and establishing a robust physical infrastructure, including warehouses and distribution centers. This high barrier to entry deters many potential new players from entering the market.

Elanders, for instance, operates across 20 countries with a vast network of facilities, showcasing the immense capital commitment necessary to achieve such global reach. This scale of investment, encompassing everything from specialized printing presses to complex logistics software, makes it exceptionally difficult for smaller or less capitalized firms to compete effectively against established giants like Elanders.

Established players like Elanders benefit significantly from economies of scale in procurement, manufacturing, and IT infrastructure. This means they can produce goods or services at a lower per-unit cost than a new entrant could initially achieve. For instance, Elanders' large-scale printing operations allow for bulk purchasing of paper and ink, securing better pricing. In 2023, Elanders reported total revenues of SEK 7,533 million, indicating a substantial operational base that new competitors would struggle to match in terms of cost efficiency.

Furthermore, Elanders leverages economies of scope by offering integrated solutions across its diverse service offerings, from printing to supply chain management. This synergy allows them to spread fixed costs over a broader range of activities, enhancing cost-effectiveness. A new entrant would likely need to invest heavily to replicate this breadth of services, making it difficult to compete on overall value and cost simultaneously.

Building a strong brand and fostering customer loyalty in the intricate world of supply chain and print services is a marathon, not a sprint. It requires substantial and sustained investment. Elanders has cultivated deep, long-standing relationships across diverse customer segments, which translates into a significant degree of loyalty, making it harder for newcomers to poach their established client base.

Access to Distribution Channels

New entrants often struggle to build effective distribution channels, a significant barrier to entry. Elanders, with its established global network and diverse customer relationships, presents a formidable challenge in this regard. Gaining access to these same channels requires substantial investment and time, making it difficult for newcomers to compete effectively.

Elanders' existing relationships with key customers and its integrated supply chain provide a competitive advantage. For instance, in 2024, Elanders reported a strong presence across Europe and North America, serving industries ranging from automotive to telecommunications. This widespread reach makes it harder for new players to penetrate the market and secure comparable distribution agreements.

- Established Global Footprint: Elanders operates in multiple countries, offering a wide distribution network.

- Customer Relationships: Long-standing partnerships with major clients create loyalty and access barriers.

- Integrated Supply Chain: Elanders' control over its supply chain enhances efficiency and delivery reliability, which is difficult for new entrants to replicate.

- Market Penetration: The company's ability to reach diverse customer segments limits opportunities for new competitors.

Regulatory and Policy Barriers

Regulatory and policy barriers present a substantial hurdle for new companies looking to enter the printing and packaging industry. Navigating complex international trade regulations, stringent environmental standards, and evolving data privacy laws, such as the EU's Corporate Sustainability Reporting Directive (CSRD), demands significant investment in compliance and operational adjustments. For instance, the CSRD, which began its phased implementation in 2024, requires extensive sustainability disclosures, a considerable undertaking for any new entrant lacking established reporting frameworks.

Elanders, as an established player, is proactively addressing these regulatory landscapes. The company's ongoing efforts to align with and implement directives like the CSRD demonstrate a commitment to future-proofing its operations and maintaining a competitive edge. This preparedness allows Elanders to mitigate the risks associated with regulatory changes, which can deter less prepared newcomers.

- Compliance Complexity: New entrants face significant costs and expertise requirements to meet diverse international trade, environmental, and data privacy regulations.

- CSRD Impact: The EU's Corporate Sustainability Reporting Directive (CSRD), with its 2024 implementation, necessitates robust sustainability reporting, a challenge for startups.

- Elanders' Preparedness: Elanders' active engagement in complying with these regulations positions it favorably against potential new market entrants.

- Barrier to Entry: The sheer weight of regulatory compliance acts as a significant deterrent, increasing the cost and complexity of market entry.

The threat of new entrants for Elanders is moderate, largely due to significant capital requirements, established brand loyalty, and the complexity of global distribution networks. New players need substantial investment to match Elanders' scale and integrated service offerings, making market entry challenging.

Economies of scale and scope offer Elanders a cost advantage, as they can procure materials and operate efficiently across their diverse services. For instance, Elanders' 2023 revenue of SEK 7,533 million highlights their substantial operational base, which new entrants would struggle to replicate in terms of cost efficiency and market reach.

| Factor | Impact on New Entrants | Elanders' Advantage |

|---|---|---|

| Capital Requirements | High (advanced tech, IT, infrastructure) | Established global footprint and infrastructure |

| Economies of Scale/Scope | Limited initial cost efficiency | Lower per-unit costs through bulk purchasing and integrated services |

| Brand Loyalty & Relationships | Difficult to build quickly | Deep, long-standing customer partnerships |

| Distribution Channels | Challenging to access | Extensive global network and diverse customer agreements |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Elanders leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and competitor press releases to provide a comprehensive view of the competitive landscape.