eDreams ODIGEO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

eDreams ODIGEO Bundle

eDreams ODIGEO navigates a competitive landscape shaped by intense rivalry and significant buyer power, as customers readily switch between online travel agencies. The threat of new entrants, while present, is somewhat mitigated by established brand recognition and technology investments. Understanding these forces is crucial for any player in the online travel sector.

The complete report reveals the real forces shaping eDreams ODIGEO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The airline and hotel sectors show increasing consolidation, with a few dominant global companies now controlling substantial market share. This concentration grants major airlines and hotel chains significant influence over online travel agencies such as eDreams ODIGEO.

For instance, in 2024, the top five global hotel groups continued to expand their portfolios, and major airline alliances solidified their dominance on key international routes. This allows them to exert considerable bargaining power, particularly for in-demand travel periods or popular destinations.

Their ability to control inventory, dictate terms, or promote direct booking channels can directly impact eDreams ODIGEO's access to desirable travel products, thereby increasing supplier leverage.

eDreams ODIGEO's reliance on sophisticated technology and global distribution systems (GDS) grants considerable bargaining power to providers of these essential services. These platforms are the backbone of the company's operations, enabling the aggregation of travel inventory and the execution of bookings.

The significant investment and integration required for these systems create high switching costs for eDreams ODIGEO, thereby strengthening the suppliers' position. For instance, Amadeus, a leading GDS provider, processes a substantial portion of global travel bookings, demonstrating its critical role in the industry. This dependence means that changes in pricing or service terms by GDS operators can directly impact eDreams ODIGEO's operational efficiency and overall cost structure.

Powerful airline and hotel brands, like Ryanair, can significantly leverage their brand strength to negotiate terms with Online Travel Agencies (OTAs) such as eDreams ODIGEO. These suppliers often promote direct bookings via their own platforms and loyalty programs, effectively bypassing intermediaries. This strategy can diminish the commission revenue for OTAs or compel them to offer more attractive pricing to retain customers.

The bargaining power of these direct suppliers is further amplified when they have strong brand recognition and a substantial customer base. For instance, in 2024, major airlines continued to invest heavily in their direct-to-consumer channels, aiming to capture a larger share of the booking value. This trend puts pressure on OTAs to demonstrate their value proposition beyond mere transaction facilitation, especially as commission rates can be a significant cost for suppliers.

Unique Inventory and Exclusive Deals

Suppliers offering unique inventory or exclusive travel deals can exert significant bargaining power over Online Travel Agencies (OTAs) like eDreams ODIGEO. This leverage allows them to dictate terms, potentially leading to less favorable conditions for the OTA if they wish to retain access to these sought-after products. For instance, a boutique hotel with a highly distinctive guest experience or an airline operating a limited number of exclusive routes can command better pricing or commission structures.

eDreams ODIGEO’s ability to maintain a comprehensive and attractive inventory hinges on its capacity to continually secure diverse travel options. In 2024, the travel industry saw continued demand for unique experiences, with searches for boutique accommodations and specialized tours increasing. This trend means that suppliers of such niche offerings are well-positioned to negotiate favorable terms, impacting the OTA’s cost of goods sold and overall profitability.

- Supplier Leverage: Hotels or airlines with unique inventory can demand higher prices or better terms.

- Inventory Dependence: OTAs need to secure a wide range of products to remain competitive.

- Market Trends: The 2024 demand for unique travel experiences strengthens supplier bargaining power.

- Negotiation Impact: Unfavorable terms from suppliers can affect an OTA's margins.

Impact of Subscription Model on Supplier Relations

eDreams ODIGEO's strategic shift towards a subscription-based Prime model is designed to cultivate a more dedicated customer following. This enhanced customer loyalty could significantly bolster its leverage when dealing with suppliers.

With a continually expanding base of valuable subscribers, projected to surpass 7 million members by March 2025, eDreams ODIGEO is positioned to negotiate more favorable terms. This predictable customer flow and increased lifetime value offer suppliers a consistent revenue stream, potentially leading to better deals and exclusive access for the company.

- Increased Negotiation Power: A larger, loyal subscriber base gives eDreams ODIGEO more weight in discussions with suppliers.

- Predictable Revenue Stream: The subscription model provides suppliers with a reliable forecast of customer volume.

- Enhanced Access to Deals: A strong subscriber base can unlock exclusive offers and partnerships with suppliers.

- Long-Term Customer Value: Suppliers benefit from the predictable lifetime value of Prime members.

The bargaining power of suppliers, particularly major airlines and hotel chains, is a significant factor for eDreams ODIGEO. As of 2024, the ongoing consolidation in the travel industry means fewer, larger entities hold considerable sway. These dominant players can leverage their market position, especially during peak travel seasons or for popular destinations, to negotiate more favorable terms.

eDreams ODIGEO's reliance on Global Distribution Systems (GDS) like Amadeus also concentrates power among these technology providers. The high costs associated with integrating and maintaining these systems create substantial switching barriers, reinforcing the GDS providers' leverage over OTAs.

Furthermore, powerful brands such as Ryanair actively promote direct bookings, aiming to capture more value and potentially reducing the need for intermediaries like eDreams ODIGEO. This direct-to-consumer push, intensified in 2024, pressures OTAs to offer competitive pricing and demonstrate added value beyond simple booking facilitation.

Suppliers offering unique or exclusive inventory, such as niche hotels or specialized tour operators, also wield significant bargaining power. The increasing consumer demand for unique experiences, noted in 2024, allows these suppliers to negotiate better terms, impacting an OTA's cost of goods sold.

| Supplier Type | Bargaining Power Factor | Impact on eDreams ODIGEO |

|---|---|---|

| Major Airlines/Hotel Chains | Market Consolidation, Brand Strength | Dictate terms, direct booking pressure, potential for higher commissions or lower inventory access. |

| GDS Providers (e.g., Amadeus) | High Switching Costs, Critical Infrastructure | Influence pricing, service terms, impacting operational efficiency and costs. |

| Suppliers of Unique Inventory | Niche Demand, Exclusive Offerings | Negotiate favorable pricing/commission, potentially limiting OTA access to sought-after products. |

What is included in the product

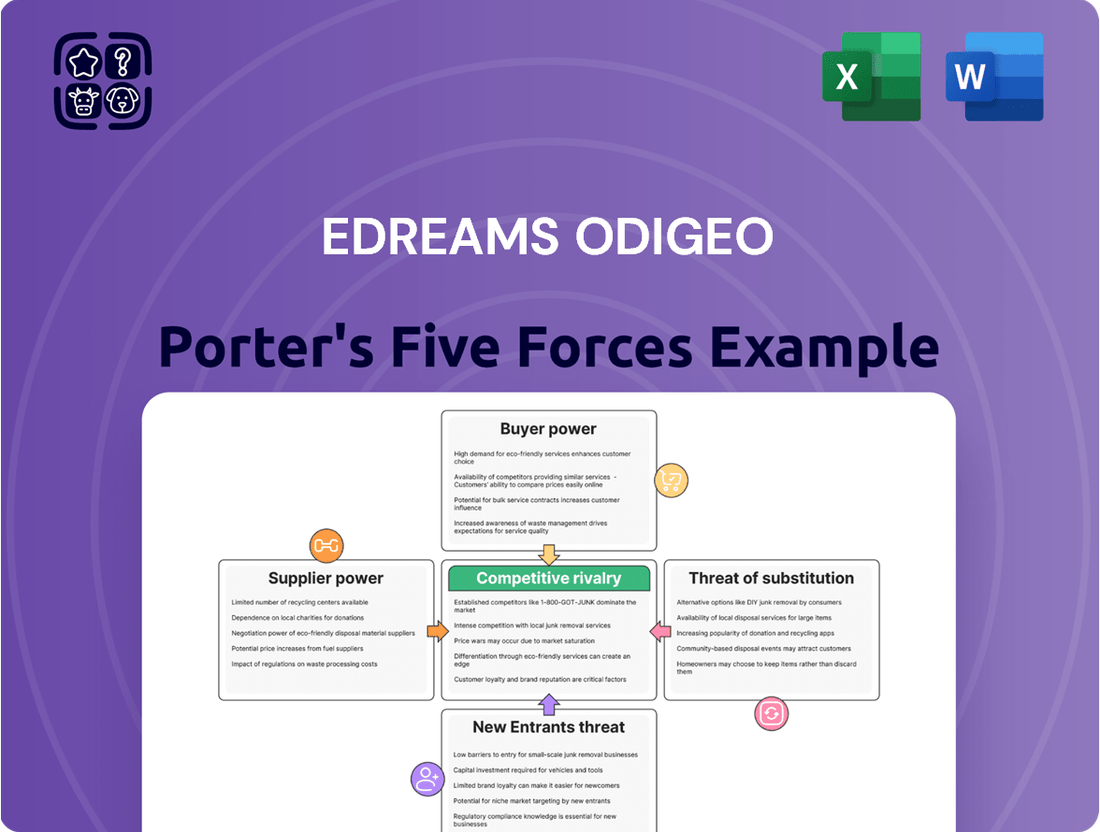

This analysis dissects eDreams ODIGEO's competitive environment, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the online travel agency sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of eDreams ODIGEO's Porter's Five Forces.

Customers Bargaining Power

Customers in the online travel sector are very sensitive to price, and the proliferation of comparison websites and tools amplifies this. This accessibility to compare prices across numerous platforms, including direct airline and hotel bookings, significantly bolsters their negotiation leverage. For instance, in 2023, a significant portion of online travel bookings were influenced by price comparisons, with many consumers using aggregators before making a final decision.

The cost for a customer to switch from one online travel agency like eDreams ODIGEO to another, or even to booking directly with airlines or hotels, is quite low. This means customers can easily move between platforms if they find a better price or a more appealing service elsewhere.

This low switching cost gives customers significant bargaining power. They are not locked into any particular platform and can readily seek out the best value. For eDreams ODIGEO, this necessitates a constant focus on offering competitive pricing and an excellent user experience to retain its customer base.

In 2023, the online travel market saw continued growth, with many travelers prioritizing deals and ease of comparison, reinforcing the impact of low switching costs. For instance, a significant percentage of online travel bookings are influenced by price comparison, highlighting customer agility.

The internet has dramatically leveled the playing field for travelers, significantly reducing information asymmetry. Customers can now access a wealth of data on flights, hotels, and destinations, including detailed reviews and pricing comparisons from numerous providers.

This readily available information empowers consumers to thoroughly research and compare options before committing to a booking. For instance, in 2024, online travel agencies (OTAs) like eDreams ODIGEO reported that a significant percentage of their customers utilize comparison tools before making a purchase, highlighting the impact of information availability.

Consequently, customers are better equipped to demand greater value and actively challenge the pricing strategies of travel companies. This transparency puts pressure on providers to offer competitive rates and superior service to attract and retain business.

Threat of Direct Booking

The threat of direct booking significantly impacts the bargaining power of customers for online travel agencies like eDreams ODIGEO. Customers can bypass intermediaries and book flights, accommodations, and car rentals directly with service providers. This direct channel offers consumers more control and potentially better pricing, which can reduce their reliance on OTAs.

This direct booking trend exerts downward pressure on the commissions and profit margins eDreams ODIGEO can achieve. As more customers opt for direct channels, OTAs must work harder to justify their existence and the fees they charge. For instance, in 2024, a significant percentage of travel bookings, estimated to be over 50% for certain segments, were made directly through airline or hotel websites, highlighting the strength of this trend.

- Direct Booking Trend: Consumers increasingly book directly with airlines, hotels, and car rental companies, bypassing online travel agencies (OTAs).

- Margin Pressure: This direct booking capability puts downward pressure on the commissions and profit margins that OTAs like eDreams ODIGEO can earn.

- Value Proposition: eDreams ODIGEO must demonstrably add value beyond mere aggregation to retain customers and mitigate the threat of direct booking.

- Market Share Impact: In 2024, direct bookings accounted for over 50% of certain travel segments, underscoring the competitive challenge for OTAs.

Influence of the Prime Subscription Model

The Prime subscription model is a strategic move by eDreams ODIGEO to directly counter the bargaining power of its customers. By offering exclusive benefits like discounts and tailored deals, the company aims to cultivate loyalty and reduce price sensitivity. This approach is designed to lock customers into the ecosystem, making them less likely to shop around for better prices from competitors.

This strategy is proving effective, with the company reporting over 7 million Prime members by the end of fiscal year 2025. This significant subscriber base creates a substantial barrier to switching for many customers. The perceived value of ongoing benefits and accumulated loyalty rewards increases the cost of changing providers, thereby diminishing individual customer leverage.

- Prime Membership Growth: eDreams ODIGEO reported exceeding 7 million Prime members by the end of fiscal year 2025.

- Loyalty and Retention: The subscription model fosters customer loyalty by offering exclusive discounts and personalized offers.

- Increased Switching Costs: Prime membership creates higher switching costs, encouraging repeat business and strengthening customer relationships.

- Reduced Bargaining Power: By increasing loyalty and switching costs, the Prime model effectively lowers the bargaining power of individual customers.

Customers possess significant bargaining power due to the ease of price comparison across numerous platforms and direct booking options. This transparency, amplified by comparison websites, forces eDreams ODIGEO to maintain competitive pricing and strong customer value propositions. The threat of customers booking directly with airlines or hotels, a trend that saw over 50% of certain travel segments booked directly in 2024, directly pressures OTA margins.

eDreams ODIGEO's Prime subscription model, boasting over 7 million members by fiscal year 2025, aims to counter this by fostering loyalty and increasing switching costs. This strategy effectively reduces individual customer leverage by creating a more committed customer base less inclined to seek alternative providers.

| Factor | Impact on eDreams ODIGEO | Customer Bargaining Power |

|---|---|---|

| Price Sensitivity & Comparison Tools | Requires competitive pricing, limits margin flexibility | High |

| Low Switching Costs | Customers easily move to competitors or direct bookings | High |

| Information Availability | Empowers customers to demand better value | High |

| Direct Booking Trend (e.g., >50% in segments in 2024) | Threatens intermediary role, pressures commissions | High |

| Prime Subscription (7M+ members FY25) | Increases loyalty, raises switching costs | Reduced |

Preview the Actual Deliverable

eDreams ODIGEO Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape of eDreams ODIGEO through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the online travel agency sector.

Rivalry Among Competitors

The online travel sector is incredibly crowded, featuring a multitude of global and regional Online Travel Agencies (OTAs). This intense saturation means companies like MakeMyTrip, Ixigo, Despegar, Skyscanner, and lastminute.com are all vying for the same customers, driving fierce price wars and a constant need for new features and services.

Competitors in the online travel agency (OTA) space frequently employ aggressive pricing, running frequent promotional campaigns and investing heavily in marketing to win customers. This intense rivalry directly impacts eDreams ODIGEO, as such tactics can significantly squeeze profit margins across the industry.

The battle for online visibility is particularly fierce, with companies vying for top positions in search engine results and on popular advertising platforms. For instance, in 2024, the digital advertising spend in the travel sector continued to be substantial, with OTAs allocating significant portions of their budgets to secure clicks and bookings.

In the competitive online travel agency (OTA) landscape, differentiation hinges on a wide array of services, intuitive user interfaces, and cutting-edge technology like AI for personalized recommendations. eDreams ODIGEO distinguishes itself through its Prime subscription program, designed to foster customer loyalty and build a more stable revenue stream than purely transactional models.

This Prime membership offers exclusive discounts and benefits, aiming to lock in customers and encourage repeat bookings. For instance, in 2024, eDreams ODIGEO reported that Prime members accounted for a significant portion of their bookings, demonstrating the program's effectiveness in driving engagement and reducing reliance on price-sensitive, one-off customers.

Global Reach and Market Penetration

Competitive rivalry is intense among Online Travel Agencies (OTAs) due to their global reach and aggressive market penetration strategies. Many OTAs, including eDreams ODIGEO which operates in 44 markets, compete with rivals that also have a significant international footprint and aim to capture diverse customer segments worldwide. This global presence means companies are constantly vying for market share across various geographies.

The ability to effectively localize services, understand regional nuances, and adapt offerings is paramount for success in this competitive landscape. Companies that can tailor their platforms and marketing to specific markets often gain a distinct advantage. For instance, Booking Holdings and Expedia Group, major global players, invest heavily in localized content and customer support to strengthen their penetration in key regions.

- Global Operations: Major OTAs like Booking Holdings and Expedia Group operate in hundreds of countries, creating a highly competitive environment for eDreams ODIGEO.

- Market Penetration Efforts: Companies continuously invest in marketing and technology to expand their reach and capture market share in both established and emerging travel markets.

- Localization is Key: Success hinges on adapting services, pricing, and customer support to meet the specific needs and preferences of travelers in different regions.

- Intense Price Competition: The drive for market penetration often leads to aggressive pricing strategies, putting pressure on profit margins for all players.

Industry Consolidation and Acquisitions

The online travel sector has experienced significant consolidation, with major companies acquiring smaller competitors to expand their reach and capabilities. This trend intensifies rivalry by creating larger, more powerful entities with greater resources. For eDreams ODIGEO, staying adaptable and competitive is crucial to navigating this evolving market landscape.

For instance, in 2023, Booking Holdings continued its strategic acquisitions, bolstering its portfolio in various travel segments. eDreams ODIGEO itself has been active, having acquired Volaris in 2022, demonstrating a commitment to growth through consolidation. This ongoing consolidation means that competitive pressures are likely to remain high as market share shifts and larger players leverage acquired assets.

- Market Consolidation: The online travel agency (OTA) market has seen ongoing consolidation, with larger players acquiring smaller ones.

- Competitive Intensification: This consolidation can lead to increased rivalry as dominant firms gain market share and resources.

- eDreams ODIGEO's Strategy: eDreams ODIGEO must remain agile and competitive to effectively navigate this landscape.

- Acquisition Activity: Major players like Booking Holdings have continued acquisition efforts, as seen in 2023, while eDreams ODIGEO acquired Volaris in 2022.

The online travel agency market is characterized by intense competition, with numerous global and regional players aggressively pursuing market share. This rivalry often escalates into price wars and substantial investments in marketing and technology to attract and retain customers.

Companies like eDreams ODIGEO face constant pressure from rivals such as Booking Holdings and Expedia Group, who possess significant global reach and resources. In 2024, the digital advertising spend within the travel sector remained a key battleground, with OTAs allocating considerable budgets to secure online visibility and bookings.

Differentiation strategies, including loyalty programs like eDreams ODIGEO's Prime, are crucial for standing out. In 2024, Prime members represented a substantial portion of eDreams ODIGEO's bookings, highlighting the program's success in fostering customer retention and reducing reliance on purely transactional, price-sensitive customers.

The sector has also seen notable consolidation, with acquisitions by major players like Booking Holdings in 2023, and eDreams ODIGEO's acquisition of Volaris in 2022. This ongoing consolidation intensifies competition, as larger entities leverage expanded portfolios and resources to gain a competitive edge.

| Key Competitor | Global Presence (Approx. Countries) | 2023 Revenue (Approx. USD Billions) | Key Differentiation Strategy |

|---|---|---|---|

| Booking Holdings | 220+ | 23.4 | Extensive brand portfolio, strong global network |

| Expedia Group | 150+ | 12.8 | Diverse travel offerings, technology innovation |

| eDreams ODIGEO | 44 | 0.7 | Prime subscription, localized offerings |

SSubstitutes Threaten

The most significant substitute threatening eDreams ODIGEO is direct booking with airlines and hotels. Many travel providers actively encourage customers to book directly through their own websites. This can be seen in the increasing prevalence of loyalty programs and exclusive deals offered only to direct bookers, aiming to capture the full customer relationship and revenue. For instance, major airlines often highlight benefits like accrued frequent flyer miles or flexible change policies for direct bookings, directly bypassing online travel agencies (OTAs) like eDreams ODIGEO.

While their dominance has waned, traditional travel agencies persist as a substitute, especially for intricate travel plans, group reservations, or those seeking a personal touch. These agencies cater to a segment that values face-to-face consultation and tailored recommendations, often including less digitally inclined travelers.

Metasearch engines present a significant threat by offering consumers a consolidated view of travel deals. While eDreams ODIGEO owns Liligo, a metasearch engine, independent platforms like Kayak and Skyscanner aggregate offers from numerous Online Travel Agencies (OTAs) and direct suppliers. This aggregation allows travelers to easily compare prices and options, potentially bypassing direct bookings with OTAs like eDreams ODIGEO. For instance, in 2024, metasearch engines continued to be a dominant channel for travel discovery, with a substantial portion of online travel bookings originating from these platforms, directly impacting traffic flow to individual OTAs.

Alternative Transport and Accommodation Options

Beyond traditional flights and hotels, alternative transport and accommodation options present a significant threat of substitutes for eDreams ODIGEO. For instance, the growing popularity of train travel, especially in Europe, offers a viable alternative for shorter distances, potentially bypassing the need for air travel altogether. In 2023, European rail passenger numbers saw a notable increase, indicating a shift in consumer preference for certain routes.

Peer-to-peer accommodation platforms, such as Airbnb, continue to challenge the traditional hotel market. These platforms provide a wider range of options and often more localized experiences, appealing particularly to budget-conscious travelers and those seeking unique stays. By mid-2024, Airbnb reported millions of active listings globally, demonstrating the scale of this substitute market.

Furthermore, the convenience and cost-effectiveness of bus services and car-sharing for specific journeys can also divert customers from online travel agencies like eDreams ODIGEO. These alternatives cater to different travel needs and priorities, forcing eDreams ODIGEO to remain competitive across various travel segments.

The threat of substitutes is amplified by:

- The increasing accessibility and affordability of train and bus networks in key European markets.

- The continued expansion and user adoption of peer-to-peer accommodation platforms, offering diverse lodging choices.

- The growing acceptance of ride-sharing and car-pooling services for intercity and local travel.

Package Tour Operators and Tour Operators

For travelers who prefer a completely organized vacation, traditional package tour operators and specialized tour operators present a significant substitute. They offer a convenient, all-inclusive solution that contrasts with the à la carte approach of online travel agencies (OTAs). These operators often combine flights, lodging, and activities, directly appealing to consumers prioritizing ease and simplicity.

These traditional operators can exert pressure on OTAs like eDreams ODIGEO by providing a different, often more curated, travel experience. For instance, in 2024, the global package holiday market continued to show resilience, with many consumers still valuing the security and convenience of pre-arranged itineraries. This segment often caters to specific demographics or travel styles, such as adventure tours or luxury escapes, which may not be as easily replicated by a purely online booking platform.

- Convenience Factor: Package tours offer a single point of purchase for multiple travel components, simplifying the booking process for customers.

- Bundled Value: Operators often leverage bulk purchasing power to offer competitive pricing on bundled flights, accommodation, and activities.

- Niche Market Appeal: Specialized operators can cater to specific interests, like eco-tourism or cultural immersion, attracting travelers seeking tailored experiences beyond standard OTA offerings.

The threat of substitutes for eDreams ODIGEO is substantial, encompassing direct bookings with airlines and hotels, traditional travel agencies, and metasearch engines. Travelers increasingly opt for direct booking due to loyalty programs and exclusive deals. Metasearch engines, like Kayak, aggregate offers, enabling easy price comparisons and potentially bypassing OTAs. In 2024, metasearch remained a dominant channel for travel discovery, impacting direct traffic to OTAs.

Alternative transport and accommodation options also pose a significant threat. The rise of train travel for shorter distances, with European rail passenger numbers increasing in 2023, offers a viable alternative to flights. Peer-to-peer accommodation platforms, such as Airbnb, which boasted millions of global listings by mid-2024, provide diverse and often budget-friendly lodging choices, directly competing with hotel bookings facilitated by OTAs.

Package tour operators present another substitute, offering convenience and bundled value that appeals to travelers seeking simplified planning. The global package holiday market showed resilience in 2024, with many consumers valuing the security of pre-arranged itineraries. Specialized operators further cater to niche travel interests, providing curated experiences that OTAs may not easily replicate.

| Substitute Category | Key Characteristics | Impact on eDreams ODIGEO | 2023/2024 Data Point |

|---|---|---|---|

| Direct Bookings | Loyalty programs, exclusive deals, direct customer relationship | Reduces OTA commission revenue | Major airlines often offer preferential terms for direct bookings. |

| Metasearch Engines | Price aggregation, comparison shopping | Diverts traffic and potential bookings from OTAs | A significant portion of online travel bookings originated from metasearch in 2024. |

| Alternative Accommodation | Peer-to-peer, unique stays, budget-friendly | Captures market share from traditional hotels booked via OTAs | Airbnb had millions of active listings globally by mid-2024. |

| Alternative Transport | Train, bus, car-sharing for shorter distances | Reduces demand for short-haul flights booked via OTAs | European rail passenger numbers saw a notable increase in 2023. |

| Package Tour Operators | All-inclusive, convenience, curated experiences | Appeals to travelers seeking simplified planning, bypassing à la carte OTA booking | The global package holiday market demonstrated resilience in 2024. |

Entrants Threaten

The threat of new entrants for eDreams ODIGEO is significantly mitigated by the substantial capital required to establish a competitive online travel agency (OTA). Building a global platform demands massive investment in sophisticated technology, extensive marketing campaigns to gain brand recognition, and forging robust partnerships with a wide array of airlines, hotels, and other travel service providers.

This considerable upfront financial commitment acts as a formidable barrier, deterring many potential new players from entering the market. For instance, major OTA players often spend hundreds of millions of dollars annually on marketing and technology to maintain their market share and customer acquisition, a figure that is difficult for startups to match.

Building strong brand recognition and trust in the competitive travel sector is a long and costly journey. eDreams ODIGEO, having invested heavily over many years, enjoys significant customer loyalty, creating a formidable barrier for newcomers seeking to establish credibility and attract bookings. This deep-seated trust is a key factor in their sustained market presence.

The threat of new entrants in the online travel agency (OTA) space is significantly mitigated by powerful network effects and entrenched supplier relationships. Established players like eDreams ODIGEO have cultivated deep partnerships with a vast array of travel providers, including nearly 700 airlines.

Newcomers would struggle to match this extensive supplier network and the favorable terms that come with long-standing relationships. Securing competitive inventory and pricing is paramount for attracting and retaining customers, presenting a substantial barrier for any aspiring OTA.

Technological Complexity and Data Expertise

The technological complexity and data expertise required to operate in the online travel agency (OTA) space represent a significant hurdle for potential new entrants. Developing and maintaining a robust platform that can process millions of daily searches and bookings, seamlessly integrate with Global Distribution Systems (GDS), and effectively utilize artificial intelligence for personalized customer experiences demands substantial technological know-how and continuous capital infusion.

This intricate technological infrastructure, coupled with the necessity of managing and analyzing vast datasets, acts as a formidable barrier. For instance, in 2024, leading OTAs like Booking Holdings and Expedia Group invest billions annually in technology and data analytics to maintain their competitive edge and enhance user experience.

- High R&D Investment: Significant upfront and ongoing investment in software development, AI research, and data science teams is crucial.

- Data Integration Challenges: Establishing reliable integrations with numerous airline, hotel, and car rental GDS systems is technically demanding and time-consuming.

- AI and Personalization Expertise: New entrants need specialized skills in AI and machine learning to offer personalized recommendations and dynamic pricing, a core differentiator for established players.

- Scalability Demands: The platform must be built for extreme scalability to handle peak travel seasons and fluctuating user traffic efficiently.

Regulatory and Compliance Hurdles

The travel industry is heavily regulated, with consumer protection laws, data privacy mandates like GDPR, and specific licensing for travel agencies varying by country. For instance, in the EU, the Package Travel Directive sets stringent rules for tour operators and travel agents.

Navigating this complex web of compliance, including obtaining necessary licenses and adhering to evolving data protection standards, presents a substantial barrier for any new company looking to enter the market. In 2024, continued emphasis on consumer rights and data security means these regulatory costs and complexities are likely to remain significant deterrents.

- Consumer Protection Laws: Ensuring adherence to regulations that safeguard customer rights in booking, cancellations, and refunds.

- Data Privacy Regulations: Compliance with GDPR and similar global privacy laws, requiring robust data handling and security measures.

- Licensing and Permits: Obtaining and maintaining specific travel agency licenses and permits, which can differ significantly across operating regions.

- Industry-Specific Standards: Meeting operational and safety standards mandated by aviation and tourism authorities.

The threat of new entrants for eDreams ODIGEO is considerably low due to immense capital requirements for technology, marketing, and supplier partnerships. Established brand loyalty and extensive supplier networks, including relationships with nearly 700 airlines, create significant barriers.

The technological sophistication, including AI and data integration, along with navigating complex global regulations, further deters new players. For example, in 2024, major OTAs invest billions annually in technology, a scale difficult for startups to replicate.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in technology, marketing, and operations. | Very High |

| Brand Loyalty & Trust | Years of investment in building customer relationships. | High |

| Supplier Relationships | Extensive networks with airlines, hotels, etc., offering favorable terms. | Very High |

| Technological Complexity | Sophisticated platforms, AI, and data management needs. | High |

| Regulatory Compliance | Navigating diverse consumer protection and data privacy laws. | Medium |

Porter's Five Forces Analysis Data Sources

Our eDreams ODIGEO Porter's Five Forces analysis is built on a foundation of robust data, drawing from company annual reports, investor presentations, and financial statements to understand internal strategies and performance.

We supplement this with industry-specific market research reports, competitor websites, and news articles to capture external market dynamics and competitive pressures.