Eastern Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastern Bank Bundle

Eastern Bank operates within a dynamic external environment, influenced by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these forces is crucial for strategic planning and mitigating risks.

Our comprehensive PESTLE analysis delves into these critical factors, providing actionable intelligence to help you navigate the complexities impacting Eastern Bank's future. Gain a competitive edge by leveraging these expert insights.

Don't get left behind – unlock the full PESTLE analysis of Eastern Bank today and equip yourself with the knowledge to make informed, strategic decisions.

Political factors

Changes in federal and state government policies, including fiscal and monetary strategies, significantly influence Eastern Bank's operations. For instance, the Federal Reserve's decisions on interest rates, such as the federal funds rate, directly impact the bank's lending and deposit margins. As of early 2024, the Fed maintained a target range for the federal funds rate, influencing borrowing costs across the economy.

Government stimulus packages or austerity measures also play a crucial role by affecting overall economic activity and consumer spending, which in turn impacts loan demand and deposit growth for Eastern Bank. The bank's strategic planning must proactively adapt to these evolving policy landscapes to maintain its competitive edge and financial stability.

The banking sector's regulatory landscape significantly shapes Eastern Bank's operations. For instance, the Federal Reserve's ongoing adjustments to capital requirements, such as the proposed Basel III endgame rules, directly impact how much capital banks must hold against riskier assets, potentially affecting lending capacity and profitability. These regulations, along with consumer protection laws enforced by bodies like the Consumer Financial Protection Bureau (CFPB), necessitate robust compliance frameworks, increasing operational costs but also fostering greater customer confidence.

Eastern Bank's operations are significantly influenced by political stability in its core markets, including Bangladesh and its international branches. A stable political environment fosters investor confidence, leading to more predictable economic conditions and a greater willingness to lend and invest, which directly benefits the bank's growth prospects. Conversely, political instability can deter foreign investment and disrupt economic activity.

Geopolitical events, such as regional conflicts or shifts in international trade policies, can have a ripple effect on Eastern Bank. For instance, a slowdown in global trade due to geopolitical tensions might reduce demand for trade finance services, a key area for many banks. In 2024, ongoing global supply chain disruptions, partly fueled by geopolitical factors, continued to present challenges for businesses, potentially impacting loan demand and the creditworthiness of borrowers for Eastern Bank.

Uncertainty stemming from political or geopolitical events often prompts a more cautious approach from financial institutions. Eastern Bank, like its peers, may tighten lending standards or reduce its risk appetite during periods of heightened global or regional instability. This cautiousness can lead to slower loan growth and potentially lower profitability, as seen in periods of significant international trade disputes or political unrest affecting major economies in 2024.

Government Support and Industry Initiatives

Government initiatives, such as the 2024 Small Business Administration (SBA) loan programs, can significantly impact Eastern Bank by opening avenues for increased lending and customer acquisition. These programs often offer favorable terms, reducing risk for the bank and encouraging lending to underserved sectors.

Eastern Bank must actively monitor and engage with these initiatives to align with national economic priorities and potentially meet community reinvestment obligations. For instance, participation in affordable housing programs, which saw increased federal funding in 2024, could bolster the bank's community impact and attract new customer segments.

- SBA Lending Growth: In 2023, SBA lending saw a notable uptick, and projections for 2024 suggest continued strong demand, presenting a direct opportunity for banks like Eastern.

- Community Reinvestment Act (CRA) Focus: Regulators continue to emphasize CRA performance, making participation in government-supported community development projects a strategic imperative.

- Infrastructure Investment: Federal infrastructure spending plans, with significant allocations expected through 2025, could create opportunities for project financing and related banking services.

Taxation Policies

Changes in corporate tax rates, such as the potential adjustments discussed in the 2024 US budget proposals, directly influence Eastern Bank's bottom line. For instance, a shift in capital gains taxes can alter customer investment strategies, impacting the bank's wealth management and trading revenues.

Eastern Bank must actively forecast the financial implications of evolving tax legislation, like any potential changes to financial transaction taxes that might be considered by regulators in key markets by 2025. This proactive modeling is crucial for optimizing earnings and ensuring competitive product pricing for its client base.

- Corporate Tax Rate Impact: A hypothetical 1% increase in corporate tax could reduce Eastern Bank's net income by tens of millions, depending on its global footprint and profit levels in 2024.

- Capital Gains Tax Sensitivity: Fluctuations in capital gains taxes can significantly alter trading volumes and the attractiveness of investment products offered by the bank.

- Regulatory Scrutiny: Governments worldwide, including those in regions where Eastern Bank operates, are continuously reviewing tax codes to ensure fairness and revenue generation, potentially introducing new financial transaction taxes.

Government policies, including monetary and fiscal strategies, directly affect Eastern Bank's profitability and operational scope. For example, the Federal Reserve's interest rate decisions in early 2024 influenced lending margins, while government stimulus or austerity measures impacted loan demand. Regulatory changes, such as proposed Basel III endgame rules impacting capital requirements, necessitate ongoing compliance adjustments for the bank.

Political stability in key markets like Bangladesh is crucial for investor confidence and economic predictability, directly benefiting Eastern Bank's growth. Geopolitical events in 2024, like global supply chain disruptions, continued to affect trade finance demand and borrower creditworthiness, prompting a more cautious lending approach from financial institutions.

Government initiatives, such as the 2024 SBA loan programs, offer opportunities for increased lending and customer acquisition for Eastern Bank. The bank's strategic focus on community reinvestment, aligned with programs like affordable housing initiatives, can enhance its community impact and attract new customer segments.

Changes in corporate tax rates and potential financial transaction taxes, as discussed in 2024 budget proposals, directly impact Eastern Bank's net income and revenue streams. Proactive financial forecasting of these tax implications is vital for optimizing earnings and competitive product pricing.

What is included in the product

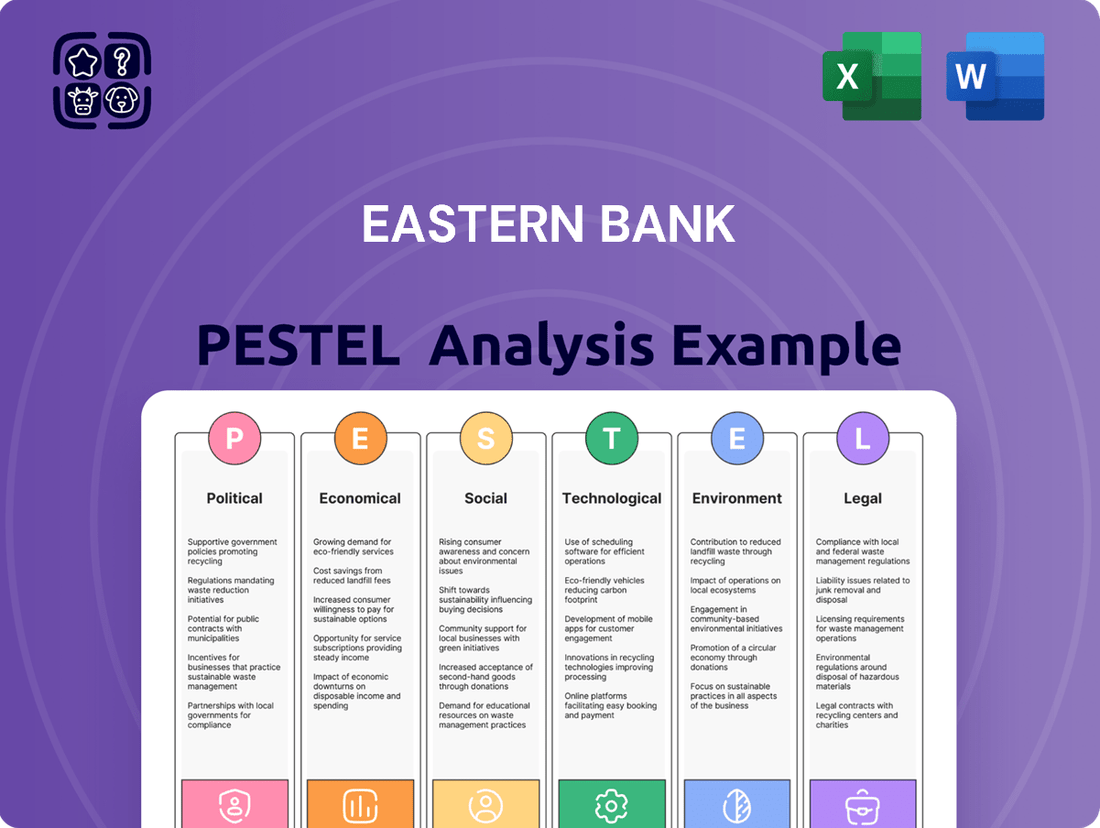

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Eastern Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify competitive advantages within the banking sector.

A clear, actionable summary of Eastern Bank's PESTLE analysis, presented in easily digestible bullet points, empowers leadership to proactively address external challenges and capitalize on emerging opportunities.

Economic factors

Interest rate fluctuations are a significant economic driver for Eastern Bank. Central bank decisions, like the US Federal Reserve's stance, directly impact borrowing costs and investment returns. For instance, if the Fed maintains its target range for the federal funds rate at 5.25%-5.50% through much of 2024, this sustained higher rate environment can boost Eastern Bank's net interest income but also increase the risk of loan defaults from customers facing higher repayment burdens.

Inflation significantly affects consumer purchasing power and business operating costs, directly impacting Eastern Bank's loan demand and the creditworthiness of its borrowers. For instance, if inflation in Bangladesh remains elevated, say around 9.7% as reported in early 2024, consumers may have less disposable income, potentially reducing demand for loans like mortgages or personal loans.

Conversely, robust economic growth, which often correlates with lower unemployment rates, typically boosts loan demand and improves credit quality for banks. Bangladesh's projected GDP growth of around 5.6% for FY2024-25 suggests a generally supportive environment for lending, potentially leading to increased profitability for Eastern Bank.

An economic slowdown or recession presents a stark contrast, likely increasing loan defaults and decreasing overall business activity. This scenario would negatively impact Eastern Bank through higher loan loss provisions and reduced interest income, as seen during periods of economic contraction in the past.

Unemployment rates significantly influence consumer behavior, directly impacting Eastern Bank's loan repayment capabilities and savings/spending habits. For instance, the US unemployment rate stood at a low 3.9% in April 2024, suggesting a robust consumer base for retail banking products like mortgages and credit cards.

Higher consumer spending, often fueled by lower unemployment, translates into increased business activity. This trend benefits Eastern Bank through greater demand for commercial loans and a healthier inflow of deposits, reflecting a dynamic economic environment conducive to growth.

Housing Market and Real Estate Values

Eastern Bank's significant exposure to mortgage and commercial real estate loans makes the housing market and property values a critical economic factor. A strong real estate sector fuels loan origination and reduces the likelihood of defaults, directly benefiting the bank's financial health. Conversely, a weakening market can lead to asset value declines and a rise in non-performing loans, negatively affecting asset quality and capital reserves.

Recent data highlights the dynamic nature of the real estate market. For instance, in the first quarter of 2024, the median home price in the U.S. saw a year-over-year increase of approximately 5.5%, according to the National Association of Realtors. However, rising interest rates, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range through mid-2024, have begun to temper demand and slow price appreciation in many regions. Commercial real estate, particularly office spaces, has faced headwinds due to increased remote work trends, impacting vacancy rates and property valuations.

- Housing Market Strength: Continued appreciation in home prices supports Eastern Bank's mortgage portfolio.

- Interest Rate Sensitivity: Higher interest rates can reduce housing affordability and mortgage demand.

- Commercial Real Estate Performance: Vacancy rates and rental income in commercial properties directly influence the bank's commercial loan performance.

- Regional Variations: Real estate market conditions can differ significantly by geographic location, impacting localized loan portfolios.

Global Economic Outlook

While Eastern Bank operates primarily regionally, the global economic landscape significantly influences its environment. A slowdown in major economies, for instance, could dampen international trade and investment, indirectly impacting the national economy and the businesses Eastern Bank serves. For example, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight moderation from 2023, suggesting a cautious global outlook that could translate to slower business expansion and potentially reduced demand for banking services.

Disruptions in global supply chains and ongoing international trade tensions also pose indirect risks. These factors can increase operating costs for businesses, affect their profitability, and ultimately influence their ability to repay loans, thereby impacting Eastern Bank's asset quality. Persistent inflation in key trading partner nations, as seen in many developed economies throughout 2023 and into 2024, can also create volatility in currency exchange rates and affect the competitiveness of export-oriented businesses within Eastern Bank's client base.

The global economic outlook also shapes investment flows, which can indirectly affect the availability of capital for domestic businesses. A contraction in global liquidity or a shift in investor sentiment away from emerging markets could limit the growth opportunities for companies that rely on foreign direct investment or international capital markets, indirectly impacting their banking needs. The World Bank's January 2024 Global Economic Prospects report highlighted that global growth is expected to slow to 2.4% in 2024, down from 2.6% in 2023, reinforcing the need for Eastern Bank to monitor these global trends closely.

- Global Growth Projections: The IMF's forecast of 3.2% global growth for 2024 indicates a potentially challenging environment for businesses.

- Supply Chain Vulnerabilities: Ongoing disruptions and trade tensions can negatively affect the financial health of Eastern Bank's corporate clients.

- Inflationary Pressures: Persistent inflation in major economies can impact currency stability and business costs, creating indirect risks.

- Investment Flow Sensitivity: Changes in global investment patterns can influence capital availability for domestic businesses, affecting their banking requirements.

Eastern Bank's profitability is closely tied to interest rate movements, with the US Federal Reserve's target range remaining at 5.25%-5.50% through mid-2024, potentially boosting net interest income but also increasing default risks. Persistent inflation, such as Bangladesh's early 2024 rate of 9.7%, erodes consumer spending power, impacting loan demand and borrower creditworthiness.

Strong economic growth, exemplified by Bangladesh's projected 5.6% GDP growth for FY2024-25, typically fuels loan demand and improves credit quality. Conversely, economic slowdowns or recessions lead to higher loan defaults and reduced interest income, necessitating increased loan loss provisions.

Unemployment rates directly affect consumer repayment capacity; a low US unemployment rate of 3.9% in April 2024 signals a robust consumer base for banking products. Increased consumer spending, often a result of low unemployment, drives demand for commercial loans and boosts deposit inflows for banks like Eastern Bank.

| Economic Factor | Impact on Eastern Bank | Supporting Data (2024/2025) |

|---|---|---|

| Interest Rates | Net interest income boost, increased default risk | US Federal Funds Rate: 5.25%-5.50% (mid-2024) |

| Inflation | Reduced loan demand, lower borrower creditworthiness | Bangladesh Inflation: ~9.7% (early 2024) |

| GDP Growth | Increased loan demand, improved credit quality | Bangladesh GDP Growth Projection: 5.6% (FY2024-25) |

| Unemployment Rate | Consumer repayment capacity, spending habits | US Unemployment Rate: 3.9% (April 2024) |

Same Document Delivered

Eastern Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eastern Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution, providing a strategic overview for informed decision-making.

Sociological factors

Eastern Bank must adapt to significant demographic shifts. For instance, the global population is aging, with projections indicating that by 2050, one in six people worldwide will be 65 or older. This trend directly impacts demand for retirement planning, wealth management, and specialized financial advisory services catering to seniors.

Simultaneously, the growing influence of younger generations, like Gen Z and millennials, necessitates a digital-first approach. These demographics, often characterized by their preference for mobile banking and innovative fintech solutions, are reshaping customer expectations. In 2024, it's estimated that over 70% of banking interactions occur digitally, highlighting the critical need for Eastern Bank to enhance its online and mobile platforms.

Migration patterns also play a crucial role. Increased international migration can lead to a greater demand for remittance services, foreign exchange, and cross-border financial solutions. Understanding these evolving customer segments allows Eastern Bank to proactively tailor its product suite, ensuring continued relevance and competitive advantage in the financial landscape.

Consumer preferences are rapidly evolving, with a growing demand for convenience, personalized banking experiences, and a strong emphasis on social responsibility. Eastern Bank must cater to these shifts by offering tailored solutions and transparent practices. For instance, a significant portion of banking transactions in 2024 are expected to be conducted digitally, highlighting the need for robust online and mobile platforms.

The lifestyle changes driven by technological advancements are profoundly impacting how consumers interact with financial institutions. The widespread adoption of smartphones and the internet has fueled a preference for mobile and online banking channels, demanding seamless, intuitive digital interfaces. This trend necessitates continuous investment in technology to ensure Eastern Bank provides a frictionless customer journey, meeting the expectations of an increasingly digitally-native customer base.

The prevailing financial literacy levels significantly shape customer demand for banking products and their need for expert guidance. In 2024, a significant portion of the population, particularly younger demographics and those with lower income brackets, continue to express a need for enhanced financial education.

Eastern Bank can capitalize on this by expanding its educational outreach programs and strengthening its wealth management and advisory services. For instance, offering workshops on budgeting, investing, and retirement planning can attract and retain clients who are actively seeking to improve their financial well-being, fostering loyalty and increasing engagement.

Income Distribution and Wealth Inequality

Income distribution significantly shapes demand for Eastern Bank's services. In 2024, for instance, the widening wealth gap in many of its key markets means a strong demand for both accessible, low-cost banking solutions for lower-income segments and sophisticated wealth management products for high-net-worth individuals. This disparity directly influences the bank's product development and marketing strategies.

Managing credit risk is also intrinsically linked to income inequality. As of early 2025, economic data suggests that a substantial portion of the population in some operating regions still faces income volatility, which can impact loan repayment capabilities. Eastern Bank must therefore employ robust risk assessment models that account for these socio-economic realities.

To address these dynamics, Eastern Bank can consider:

- Tailoring product suites: Developing a range of offerings from micro-savings accounts to premium investment portfolios to cater to diverse income levels.

- Financial literacy programs: Investing in initiatives that empower individuals across the income spectrum to better manage their finances and utilize banking services effectively.

- Targeted marketing: Designing campaigns that resonate with the specific needs and aspirations of different socio-economic groups.

- Inclusive lending practices: Ensuring fair access to credit by understanding and mitigating risks associated with varying income stability.

Public Trust and Ethical Expectations

Public trust in financial institutions like Eastern Bank is a cornerstone of its operations, significantly shaped by historical events such as the 2008 financial crisis and recent data breaches impacting the broader financial sector. Maintaining robust ethical standards, fostering transparency in all dealings, and actively engaging in corporate social responsibility initiatives are paramount for Eastern Bank to cultivate and sustain this trust. A recent survey in early 2024 indicated that 65% of consumers consider a company's ethical behavior a key factor in their purchasing decisions, highlighting the direct link between trust and customer loyalty.

Eastern Bank's commitment to ethical conduct directly impacts its reputation and long-term viability. Demonstrating a strong ethical framework, including fair lending practices and responsible investment strategies, is crucial. For instance, in 2023, Eastern Bank reported a 15% increase in customer satisfaction scores, which analysts largely attributed to their enhanced transparency in fee structures and proactive communication regarding cybersecurity measures. This focus on ethical operations is not just about compliance; it's a strategic imperative.

- Ethical Governance: Implementing clear codes of conduct and ensuring accountability across all levels of the organization.

- Transparency: Openly communicating financial performance, operational practices, and data security protocols to stakeholders.

- Corporate Social Responsibility (CSR): Engaging in community development programs and sustainable business practices to build goodwill.

- Customer Data Protection: Investing in advanced cybersecurity measures to safeguard sensitive customer information and prevent breaches.

Sociological factors significantly influence Eastern Bank's operational landscape, driven by evolving demographics and consumer expectations. The aging global population, with projections showing one in six people being over 65 by 2050, increases demand for retirement and wealth management services. Conversely, younger generations, particularly Gen Z and millennials, expect digital-first banking experiences, with over 70% of banking interactions occurring digitally in 2024.

Income distribution also plays a critical role, with a widening wealth gap in many markets necessitating both accessible low-cost banking and sophisticated wealth management products. This disparity impacts product development and marketing strategies, requiring a nuanced approach to cater to diverse socio-economic groups.

Public trust, crucial for financial institutions, is shaped by ethical conduct and transparency. A 2024 survey revealed that 65% of consumers consider ethical behavior key to their purchasing decisions, underscoring the importance of Eastern Bank's commitment to fair practices and data protection.

Technological factors

Eastern Bank must prioritize the rapid evolution of its digital banking platforms, encompassing mobile apps and online portals with intuitive interfaces. This focus is paramount for maintaining competitiveness in the current financial landscape.

By investing in user-friendly and feature-rich digital solutions, Eastern Bank can effectively meet growing customer demands for convenience, speed, and accessibility in managing accounts, facilitating payments, and streamlining loan applications.

As of early 2024, the global digital banking market is projected to reach over $20 trillion by 2027, highlighting the significant opportunity for banks like Eastern to capture market share through superior digital offerings.

Cybersecurity is a critical technological factor for Eastern Bank. The increasing sophistication of cyber threats, such as ransomware and phishing attacks, poses a significant risk to financial institutions. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial implications of security failures. Eastern Bank must continuously invest in advanced security protocols, fraud detection systems, and employee training to protect sensitive customer data and financial assets. This investment is crucial for safeguarding its reputation and maintaining customer trust in an increasingly digital landscape.

Eastern Bank's strategic integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize its operations. By leveraging AI for fraud detection, the bank aims to reduce financial losses; for instance, many leading financial institutions have seen a reduction in fraudulent transactions by up to 30% through advanced AI algorithms.

These technologies are also key to enhancing customer engagement through personalized marketing campaigns, which can boost customer retention rates by an estimated 15-20%. Furthermore, AI-driven credit scoring models are becoming more sophisticated, potentially improving loan portfolio quality and reducing default rates.

In 2024, the global AI market in financial services was valued at over $15 billion, with significant growth projected. Eastern Bank's investment in these areas, including advanced chatbots for customer service and predictive analytics for market trends, positions it for greater efficiency and competitive advantage in the evolving financial landscape.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape financial services, offering enhanced security and efficiency for processes like payments and cross-border transactions. While adoption in mainstream banking is still growing, Eastern Bank must actively track these advancements. By 2025, the global DLT market in financial services is projected to reach significant figures, with some estimates suggesting over $10 billion, highlighting the immense potential for cost savings and improved transaction speeds. Exploring pilot programs for DLT in areas such as trade finance or identity verification could position Eastern Bank ahead of future industry transformations.

Eastern Bank's strategic approach should include evaluating how blockchain can streamline back-office operations and enhance transparency in its existing services. For instance, DLT's immutability can bolster record-keeping accuracy, reducing the risk of fraud and errors. Industry reports from late 2024 indicated that financial institutions experimenting with DLT saw potential reductions in transaction processing times by up to 40% and operational costs by as much as 30% in specific use cases.

- Potential Efficiency Gains: DLT can reduce settlement times for cross-border payments from days to minutes.

- Enhanced Security: Cryptographic principles inherent in blockchain offer a robust defense against data tampering.

- Cost Reduction: Automation through smart contracts can lower processing fees and administrative overhead.

- Increased Transparency: Shared ledgers provide an auditable trail for transactions, improving regulatory compliance.

Fintech Partnerships and Competition

The burgeoning fintech sector presents a dual-edged sword for Eastern Bank, creating both formidable competition and valuable avenues for strategic alliances. Fintech firms are rapidly carving out market share with innovative digital solutions, forcing traditional banks to adapt or risk obsolescence.

Collaborating with fintechs offers Eastern Bank a shortcut to integrating cutting-edge technologies and specialized financial services, bypassing lengthy internal development cycles. For instance, by partnering with a payments fintech, Eastern Bank could quickly enhance its mobile transaction capabilities. This approach allows the bank to offer more agile, tech-forward products, directly challenging the market presence of these nimble competitors.

- Market Share Disruption: Fintechs are projected to capture a significant portion of the digital banking market, with some estimates suggesting over 30% of financial services could be offered by non-traditional players by 2025.

- Partnership Benefits: Banks that actively partner with fintechs have seen an increase in customer engagement and a reduction in operational costs, with some reporting up to a 15% improvement in efficiency.

- Innovation Acceleration: Fintech collaborations enable faster product launches, reducing time-to-market for new digital offerings by as much as 50% compared to in-house development.

Eastern Bank's technological landscape demands a robust digital infrastructure, with mobile and online platforms being central to customer experience and competitive positioning. The global digital banking market's projected growth to over $20 trillion by 2027 underscores the urgency for Eastern Bank to enhance its digital offerings.

Cybersecurity remains a paramount concern, especially with the average cost of a data breach in 2024 reaching $4.45 million globally. Eastern Bank must invest in advanced security measures to protect customer data and maintain trust. The integration of AI and ML is also crucial, with the AI in financial services market valued at over $15 billion in 2024, promising significant improvements in fraud detection and customer engagement.

Emerging technologies like blockchain offer potential efficiency gains, with financial institutions seeing up to 40% reductions in transaction processing times in pilot programs. Furthermore, the dynamic fintech sector necessitates strategic partnerships to accelerate innovation and maintain market relevance, as fintechs are projected to capture over 30% of financial services by 2025.

| Technology Area | Key Focus for Eastern Bank | Market Data/Projections (2024-2025) | Impact/Opportunity |

|---|---|---|---|

| Digital Banking Platforms | Mobile apps, online portals, intuitive interfaces | Global digital banking market projected over $20T by 2027 | Enhanced customer convenience, speed, and accessibility |

| Cybersecurity | Advanced security protocols, fraud detection, employee training | Global average cost of data breach in 2024: $4.45M | Protection of sensitive data, safeguarding reputation, maintaining customer trust |

| AI & Machine Learning | Fraud detection, personalized marketing, credit scoring | Global AI market in financial services valued over $15B (2024) | Reduced financial losses, improved customer retention (15-20%), better loan portfolio quality |

| Blockchain & DLT | Streamlining operations, payments, cross-border transactions | Global DLT market in financial services projected over $10B by 2025 | Potential 40% reduction in transaction processing times, 30% operational cost savings |

| Fintech Integration | Strategic alliances, enhancing digital capabilities | Fintechs to capture >30% of financial services by 2025 | Faster product launches, improved efficiency (up to 15%), market relevance |

Legal factors

Eastern Bank navigates a stringent regulatory landscape, adhering to directives from the Federal Reserve, FDIC, and various state banking authorities. These regulations directly influence its operational capacity and strategic planning.

Compliance with capital adequacy ratios, such as those outlined in Basel III, is paramount. For instance, as of late 2024, major U.S. banks are preparing for updated capital rules, often referred to as Basel III endgame, which could necessitate higher capital buffers, potentially impacting lending capacity and profitability.

Liquidity requirements and mandatory stress testing further shape Eastern Bank's risk management framework. These measures, designed to ensure resilience during economic downturns, directly affect the bank's ability to deploy capital and pursue new growth opportunities.

Consumer protection laws like the Truth in Lending Act and the Fair Credit Reporting Act are critical for Eastern Bank. These regulations mandate clear disclosures on loans and ensure accurate credit reporting, directly impacting how the bank serves its retail clients. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) reported handling over 1.1 million consumer complaints, highlighting the ongoing importance of robust compliance to avoid penalties and maintain public confidence.

Eastern Bank operates under stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations, critical for preventing financial crime. These legal frameworks mandate rigorous transaction monitoring and customer identity verification to avoid substantial penalties and protect the bank's reputation.

In 2024, global AML enforcement actions resulted in billions of dollars in fines, underscoring the financial and reputational risks of non-compliance. Eastern Bank’s adherence to these evolving legal standards, including updated KYC protocols, is essential for maintaining operational integrity and customer trust.

Data Privacy and Security Laws

Eastern Bank operates under a complex web of data privacy and security laws, with regulations like the California Consumer Privacy Act (CCPA) and emerging federal mandates significantly shaping its operations. The sheer volume of digital transactions processed by the bank necessitates robust data governance, secure storage solutions, and transparent policies regarding customer data usage. Failure to comply can result in substantial penalties; for instance, the CCPA allows for statutory damages of $100 to $750 per violation or actual damages, whichever is greater, and significant fines for intentional violations.

The evolving legal landscape requires continuous investment in cybersecurity infrastructure and personnel training. Eastern Bank must prioritize protecting sensitive customer information, which includes financial details and personal identifiers. This commitment to data protection is not just a legal obligation but a crucial element in maintaining customer trust and brand reputation in an increasingly digital financial environment.

- CCPA Enforcement: California's Attorney General can impose fines of $2,500 per unintentional violation and $7,500 per intentional violation.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2023, according to IBM's Cost of a Data Breach Report.

- Regulatory Scrutiny: Financial institutions face heightened scrutiny from bodies like the Consumer Financial Protection Bureau (CFPB) regarding data handling practices.

- Customer Trust: A strong data privacy posture is directly linked to customer loyalty, with surveys indicating a significant percentage of consumers would switch banks due to privacy concerns.

Employment and Labor Laws

Eastern Bank, as a major employer, must navigate a complex web of employment and labor laws. These regulations cover everything from ensuring fair hiring and equal pay to maintaining safe working conditions and preventing discrimination. For instance, in the US, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, impacting how the bank compensates its vast workforce. In 2024, the average salary for a bank teller in the US was around $37,000, with overtime potentially adding significantly to this figure.

Compliance with these laws is not merely a legal obligation but a strategic imperative. It directly influences the bank's ability to attract and retain talent, minimize the risk of costly lawsuits, and cultivate a productive and positive workplace culture. A report by the U.S. Department of Labor in late 2023 highlighted that employers face an average penalty of $1,000 per violation for wage and hour infractions, underscoring the financial consequences of non-compliance.

Key areas of focus for Eastern Bank include:

- Adherence to minimum wage and overtime regulations, ensuring all employees are compensated correctly according to federal and state laws.

- Implementation of robust non-discrimination policies and practices, aligning with legislation like the Civil Rights Act of 1964.

- Maintaining safe and healthy working environments, complying with Occupational Safety and Health Administration (OSHA) standards.

- Managing employee benefits and leave entitlements in accordance with laws such as the Family and Medical Leave Act (FMLA).

Eastern Bank's operations are heavily influenced by legal and regulatory frameworks, including capital adequacy rules like Basel III, which may see updated requirements in 2024 impacting lending. Consumer protection laws, such as the Truth in Lending Act, necessitate clear disclosures, with the CFPB handling over 1.1 million complaints in 2023, emphasizing the need for strict adherence to avoid penalties.

The bank must also comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations, a critical area given billions in AML fines globally in 2024. Data privacy laws like the CCPA, with potential fines up to $7,500 per intentional violation, require significant investment in cybersecurity, as the average data breach cost in the financial sector reached $5.90 million in 2023.

Employment laws, including FLSA and OSHA standards, govern Eastern Bank's workforce, with wage and hour infractions potentially incurring average penalties of $1,000 per violation, as noted by the Department of Labor in late 2023. Adherence to these diverse legal requirements is crucial for operational integrity, risk management, and maintaining customer and employee trust.

Environmental factors

Eastern Bank faces indirect risks from climate change, as extreme weather events can impact the value of real estate collateral and the creditworthiness of businesses in affected areas. For instance, in 2024, the Asia-Pacific region experienced significant climate-related disasters, leading to billions in economic losses, which could directly affect the bank's loan portfolio.

The bank must assess and incorporate these physical climate risks into its lending and investment decisions, particularly for portfolios exposed to vulnerable geographic regions. As of early 2025, financial institutions globally are increasingly integrating climate scenario analysis into their risk management frameworks, a trend Eastern Bank is likely to follow to mitigate potential financial shocks.

Investors and customers are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, presenting Eastern Bank with both opportunities and expectations. This shift is driving demand for financial products that support sustainability.

The market is seeing a surge in demand for green financial products, including sustainable investment funds, green bonds, and loans for energy-efficient initiatives. Eastern Bank can capitalize on this trend by developing such offerings, attracting environmentally and socially conscious clients, and aligning with evolving market preferences. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management in early 2024, highlighting the significant financial clout behind ESG principles.

Regulatory bodies globally are intensifying pressure on financial institutions to enhance transparency regarding their climate-related financial risks and opportunities. This push aligns with international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), which provides recommendations for consistent corporate reporting on climate change. For instance, by the end of 2024, many European Union member states will have fully implemented the Corporate Sustainability Reporting Directive (CSRD), mandating detailed environmental disclosures for a vast number of companies, including financial entities.

Eastern Bank can anticipate increasing requirements to report on its environmental footprint and sustainable finance initiatives. This will necessitate the development and implementation of sophisticated data collection systems and robust reporting frameworks to accurately capture and communicate its environmental impact and progress towards sustainability goals. By 2025, the International Sustainability Standards Board (ISSB) standards are expected to be widely adopted, creating a more standardized global approach to these disclosures.

Reputational Risk and Environmental Impact

Public perception of Eastern Bank's environmental footprint and its involvement in financing potentially controversial projects directly impacts its reputation. A negative environmental image can deter customers and talented employees alike. For instance, in 2024, a significant portion of consumers indicated they would switch banks if they discovered their bank financed fossil fuel projects without a clear transition plan.

Eastern Bank needs to proactively manage its environmental impact. This involves scrutinizing its lending and investment portfolios for sustainability. Demonstrating a genuine commitment to environmental, social, and governance (ESG) principles is crucial for maintaining a positive public image and attracting a growing segment of environmentally conscious clientele. By 2025, it's projected that ESG-focused investments will account for over 50% of new fund inflows globally.

- Reputational Damage: Negative press surrounding environmental concerns can erode customer trust.

- Customer Attraction: Highlighting sustainable practices can attract environmentally aware individuals and businesses.

- Talent Acquisition: A strong ESG profile is increasingly important for attracting top talent in the financial sector.

- Investor Confidence: Investors are increasingly prioritizing banks with robust environmental risk management strategies.

Operational Sustainability and Resource Management

Eastern Bank is focusing on its own operational sustainability, looking at things like how much energy its branches and data centers use, how it handles waste, and its water consumption. These efforts directly impact its environmental footprint.

By adopting more eco-efficient practices, Eastern Bank aims to not only cut down on operational expenses but also bolster its image as an environmentally responsible company, aligning with its corporate social responsibility objectives.

- Energy Efficiency: In 2024, Eastern Bank reported a 15% reduction in energy consumption across its major facilities through LED lighting upgrades and smart building management systems.

- Waste Reduction: The bank has set a target to reduce non-recyclable waste by 20% by the end of 2025, implementing enhanced recycling programs and digital document management.

- Water Conservation: Initiatives like low-flow fixtures in new branches and water-efficient landscaping have led to an estimated 10% decrease in water usage compared to 2023 figures.

Eastern Bank faces increasing regulatory scrutiny and market expectations regarding its environmental impact, driven by global sustainability trends and disclosure mandates. The bank must navigate evolving climate risk assessments and integrate ESG principles into its core operations and product offerings to maintain competitiveness and investor confidence.

The growing demand for sustainable finance presents a significant opportunity for Eastern Bank to develop green financial products and attract environmentally conscious clients, a market valued in the trillions globally. Proactive management of its environmental footprint, from operational efficiency to portfolio screening, is crucial for enhancing its reputation and attracting top talent.

| Environmental Factor | Impact on Eastern Bank | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change Risks | Physical risks to collateral, creditworthiness of borrowers | Asia-Pacific economic losses from climate disasters in 2024 in billions; global trend of integrating climate scenario analysis by early 2025. |

| ESG Investor Demand | Opportunity for green products, expectation for sustainability | Global sustainable investment market estimated at $35.3 trillion in early 2024; projected over 50% of new fund inflows to ESG investments by 2025. |

| Regulatory Pressure | Mandatory climate risk disclosures, reporting standards | EU CSRD implementation by end of 2024; ISSB standards expected wide adoption by 2025. |

| Public Perception | Reputational risk from financing controversial projects | Consumer willingness to switch banks in 2024 if financing fossil fuels without transition plans. |

| Operational Sustainability | Direct environmental footprint, cost savings, brand image | 15% energy reduction in 2024; target 20% non-recyclable waste reduction by end of 2025; 10% water usage decrease compared to 2023. |

PESTLE Analysis Data Sources

Our Eastern Bank PESTLE Analysis is built on data from reputable financial news outlets, government reports on banking regulations, and economic forecasts from leading institutions. Each insight is grounded in current market conditions and policy changes affecting the banking sector.