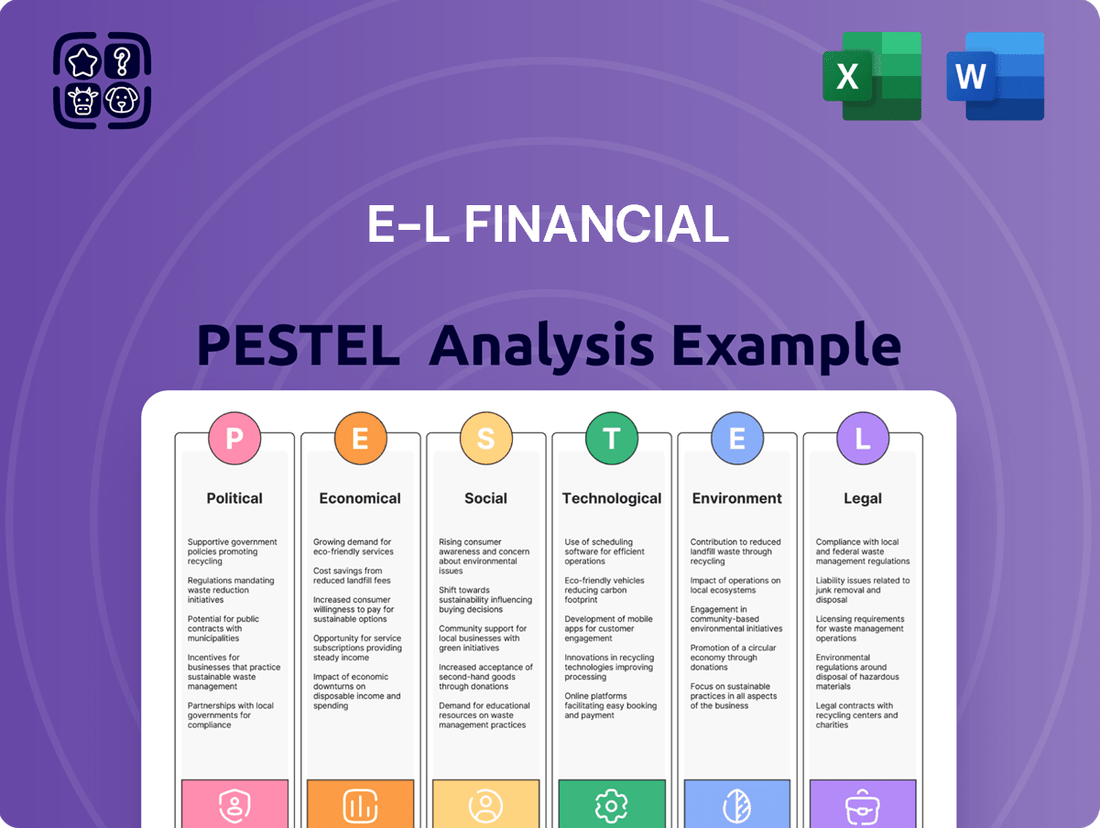

E-L Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-L Financial Bundle

Unlock the critical external factors shaping E-L Financial's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces impacting the company. Gain a competitive advantage by understanding these complex dynamics. Download the full report now for actionable intelligence.

Political factors

Government policy and regulation significantly shape the financial services landscape, directly impacting E-L Financial's operations in life insurance and wealth management. Shifts in tax legislation, insurance mandates, or investment frameworks can alter profitability and strategic planning. For example, Empire Life, an E-L Financial subsidiary, must comply with OSFI's capital adequacy standards, such as the Life Insurance Capital Adequacy Test (LICAT).

Political stability in E-L Financial's key operating markets is paramount for safeguarding its investments. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in early 2022, have continued to influence global markets, leading to increased volatility in equity and fixed income sectors throughout 2023 and into early 2024. This instability directly impacts E-L Financial's diversified portfolio by potentially devaluing assets in affected regions and creating broader market uncertainty.

Trade disputes and evolving international relations also pose significant risks. The imposition of tariffs or the disruption of supply chains, as seen in various US-China trade discussions, can negatively affect multinational corporations within E-L Financial's holdings. In 2024, the global trade landscape remains dynamic, with ongoing negotiations and potential policy shifts that require careful monitoring to mitigate adverse impacts on investment returns.

International trade policies and agreements significantly shape the economic landscape for E-L Financial, impacting its diverse investments, particularly in natural resources. For instance, the United States' trade deficit with China stood at $279.4 billion in 2023, highlighting the substantial flow of goods and the potential impact of revised trade terms on companies involved in international commerce.

Shifts in trade tariffs or the imposition of new barriers can directly affect the profitability of businesses within E-L Financial's portfolio. Consider the automotive sector, where tariffs on steel and aluminum, implemented in prior years, led to increased production costs for manufacturers, a factor E-L Financial would need to assess when evaluating investments in that industry.

Given E-L Financial's global investment footprint, the company remains inherently exposed to international economic and political shifts. For example, the ongoing trade negotiations between the European Union and the United Kingdom post-Brexit continue to influence market access and regulatory alignment, creating both opportunities and risks for businesses operating across these regions.

Government Spending and Fiscal Policy

Government spending and fiscal policy decisions, including those from central banks regarding interest rates, significantly shape financial markets and the profitability of companies like E-L Financial. For instance, the Bank of England maintained its base rate at 5.25% through early 2024, a key factor influencing investment income.

E-L Financial's investment income and the performance of its life insurance and wealth management divisions are directly affected by these interest rate environments. Higher rates can boost investment returns, while lower rates might compress them.

Broader economic stimuli or austerity measures also play a critical role. For example, the UK's GDP growth was projected to be around 0.5% in 2024, indicating a cautious economic outlook that could influence consumer spending and investment appetite.

- Interest Rate Environment: The Bank of England's base rate remained at 5.25% in early 2024, impacting E-L Financial's investment yields.

- Fiscal Stimulus/Austerity: Government fiscal stances can either boost or dampen economic activity, affecting client investment capacity.

- Economic Growth Projections: Forecasts for GDP growth, such as the UK's 0.5% for 2024, signal the broader economic climate E-L Financial operates within.

Industry-Specific Political Support or Opposition

Government policies directly influence E-L Financial's operations. For instance, the 2024 US infrastructure bill, allocating $1.2 trillion, could stimulate real estate development, potentially boosting E-L's real estate investments. Conversely, new regulations on financial products, such as stricter capital requirements introduced by the Basel III endgame proposals expected to be fully implemented by 2025, could impact profitability in their financial services segment.

E-L Financial's diversified nature means it's exposed to a range of political decisions. Policies promoting green finance or sustainable investments, which gained traction in 2024 with increased ESG mandates, could create new opportunities. However, shifts in international trade agreements or geopolitical tensions can also introduce volatility, affecting cross-border financial transactions and foreign real estate holdings.

- Government support for infrastructure projects: The $1.2 trillion US infrastructure bill passed in 2024 offers potential growth avenues for E-L Financial's real estate division through increased construction and property demand.

- Financial product regulation: Ongoing implementation of Basel III endgame proposals by 2025 could necessitate adjustments in capital allocation for E-L Financial's banking and investment arms.

- ESG policy impact: The growing emphasis on environmental, social, and governance (ESG) factors in 2024 could drive investment towards sustainable real estate and financial products, aligning with E-L's diversified portfolio.

- Geopolitical and trade policy: E-L Financial must monitor international relations and trade policies, as these can significantly affect global investment flows and currency valuations in 2024-2025.

Government policies directly influence E-L Financial's operations, from insurance regulations to investment frameworks. For instance, the Canadian federal budget for 2024 focused on affordability and housing, which could indirectly impact E-L Financial's mortgage and real estate investment portfolios. Furthermore, shifts in tax laws, such as proposed changes to capital gains inclusion rates, can significantly alter investment returns and client strategies.

Political stability is crucial for E-L Financial's global investments. Geopolitical events, like ongoing conflicts or trade disputes, create market volatility. For example, the continued tensions in Eastern Europe and the evolving US-China relationship in 2024 necessitate careful risk management for E-L Financial's international assets.

Government fiscal policies, including interest rate decisions by central banks, directly affect E-L Financial's investment income. The Bank of Canada's decision to hold its key policy rate at 5.00% through early 2024 illustrates this impact on borrowing costs and investment yields.

| Policy Area | E-L Financial Impact | Example/Data (2024-2025) |

|---|---|---|

| Fiscal Policy | Influences interest rates, economic growth, and investment returns. | Bank of Canada key policy rate at 5.00% (early 2024). |

| Taxation | Affects profitability and client investment strategies. | Potential changes to capital gains inclusion rates in Canada. |

| Regulation | Shapes operational compliance and capital requirements. | OSFI's LICAT for insurance subsidiaries like Empire Life. |

| Trade Policy | Impacts cross-border investments and global market access. | Ongoing US-China trade relations and their effect on global supply chains. |

What is included in the product

This E-L Financial PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's strategic landscape.

It provides actionable insights for informed decision-making, identifying potential risks and opportunities within the external macro-environment.

The E-L Financial PESTLE Analysis offers a clear, summarized version of the full analysis, relieving the pain point of information overload for easy referencing during meetings or presentations.

Economic factors

Interest rate shifts are a critical economic factor for E-L Financial. For its financial services, especially life insurance and wealth management, these fluctuations directly influence profitability and investment strategies. Favorable rate movements were noted as a positive contributor to Empire Life's net income in Q1 2025.

For E-L Corporate, rising interest rates can present a dual challenge. On one hand, the value of existing fixed-income securities within its investment portfolio may decline. Conversely, higher borrowing costs can impact the feasibility and returns of real estate investments, a key area for the company.

E-L Financial's strategy of acquiring and managing a diverse portfolio means its performance is closely tied to market swings. When markets are turbulent, the value of its holdings can fluctuate significantly, directly impacting the company's bottom line.

This sensitivity was evident in the first quarter of 2025, when E-L Financial reported a net loss on its investments. This contrasts sharply with the net gain achieved in the same period of 2024, highlighting how market conditions can dramatically alter investment returns.

Inflation presents a significant challenge for E-L Financial, as it erodes the real value of investment returns and diminishes consumer purchasing power, directly impacting demand for life insurance and wealth management services. For instance, if inflation averages 3% in 2024, a 5% nominal return on an investment would only yield a 2% real return, a crucial consideration for long-term wealth accumulation strategies.

While deflation is less prevalent, it carries its own set of risks, primarily by depressing asset values and potentially leading to reduced investment activity. Should deflationary pressures emerge, E-L Financial must be prepared to manage portfolios in an environment where asset prices are falling, which can negatively affect profitability and client confidence.

Navigating these economic pressures is fundamental to E-L Financial's objective of generating sustained long-term value. The firm's strategy in 2024 and 2025 will likely involve robust risk management and adaptive investment approaches to mitigate the adverse effects of both inflationary and deflationary economic cycles.

Economic Growth and Consumer Spending

Economic growth directly fuels consumer spending, impacting their capacity to invest in financial products. As economies expand, disposable incomes typically rise, enabling individuals to allocate more towards life insurance, wealth management services, and other financial instruments. For instance, the U.S. economy experienced robust growth in 2024, with GDP projected to expand by around 2.5%, bolstering consumer confidence and spending power.

This heightened consumer wealth, a byproduct of strong economic performance, translates into increased demand across various financial sectors. Real estate and natural resource investments often see a corresponding uptick as consumers feel more secure and have greater capital available for such ventures. In 2024, global real estate markets, particularly in developed economies, showed signs of recovery, partly driven by this improved consumer financial health.

- Global GDP growth in 2024 is estimated to be around 3.2%, according to IMF projections, indicating a generally positive economic environment.

- U.S. consumer spending, a key driver of economic activity, increased by an annualized rate of 3.1% in the first quarter of 2024.

- The average savings rate in developed nations remained stable in early 2024, providing a cushion for discretionary spending and investments.

- Emerging markets are expected to contribute significantly to global growth, potentially increasing demand for financial services in those regions throughout 2024-2025.

Currency Exchange Rate Movements

Currency exchange rate movements present a significant consideration for E-L Financial, given its global investment portfolio. Fluctuations in foreign exchange can directly impact the Canadian dollar value of its overseas assets and income streams, thereby influencing the company's overall financial performance.

For instance, if the Canadian dollar strengthens against a currency in which E-L Financial holds substantial investments, the reported value of those investments in CAD terms will decrease. Conversely, a weakening Canadian dollar would boost the reported value of foreign holdings.

As of late 2024, major currency pairs like USD/CAD have shown volatility. For example, the USD/CAD rate has traded within a range, with the Bank of Canada and the US Federal Reserve's monetary policy decisions being key drivers. A sustained appreciation of the CAD against the USD, for example, could negatively impact E-L Financial's earnings reported in Canadian dollars from its US-based operations or investments.

- Impact on Investment Value: A stronger CAD reduces the CAD equivalent of foreign assets.

- Effect on Earnings: Adverse currency movements can lower reported international profits.

- 2024/2025 Outlook: Anticipated interest rate differentials between Canada and other major economies will continue to influence exchange rates.

- Risk Mitigation: E-L Financial may employ hedging strategies to manage currency exposure.

Interest rate fluctuations directly impact E-L Financial's profitability and investment strategies, particularly in its life insurance and wealth management sectors. Favorable rate movements were noted as a positive contributor to Empire Life's net income in Q1 2025, while higher borrowing costs can affect real estate investments.

Market volatility significantly influences E-L Financial's diverse portfolio, with turbulence leading to substantial fluctuations in asset values. This sensitivity was evident in Q1 2025, when E-L Financial reported a net loss on investments, contrasting with a net gain in Q1 2024.

Inflation erodes the real value of investment returns and consumer purchasing power, impacting demand for financial products. For example, 3% inflation in 2024 would reduce a 5% nominal investment return to a 2% real return, a critical factor for long-term wealth accumulation.

Economic growth fuels consumer spending and investment capacity. Robust U.S. GDP growth of around 2.5% in 2024 bolstered consumer confidence and spending, benefiting financial sectors and real estate markets.

| Economic Factor | 2024/2025 Impact on E-L Financial | Key Data/Outlook |

|---|---|---|

| Interest Rates | Affects profitability of financial services, investment portfolio values, and borrowing costs. | Favorable rate movements contributed positively to Q1 2025 net income. |

| Market Volatility | Causes significant fluctuations in the value of investment holdings. | Q1 2025 saw a net loss on investments, contrasting with a Q1 2024 net gain. |

| Inflation | Reduces real investment returns and consumer purchasing power. | 3% inflation in 2024 would yield a 2% real return on a 5% nominal investment. |

| Economic Growth | Increases consumer spending and capacity for financial investments. | U.S. GDP projected to grow ~2.5% in 2024, boosting consumer confidence. |

| Currency Exchange Rates | Impacts the CAD value of overseas assets and income streams. | USD/CAD volatility noted in late 2024; interest rate differentials are key drivers. |

Preview the Actual Deliverable

E-L Financial PESTLE Analysis

The preview shown here is the exact E-L Financial PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting E-L Financial. You can be confident that what you see is precisely what you'll get.

Sociological factors

Canada's population is indeed aging, with the proportion of individuals aged 65 and over projected to reach 23% by 2030, up from 19.4% in 2021. This demographic trend directly influences the demand for financial products and services that cater to later life stages. E-L Financial's subsidiary, Empire Life, is well-positioned to capitalize on this, offering a range of life insurance, retirement income solutions, and wealth management services crucial for Canadians navigating their post-working years.

The increasing number of seniors means a greater need for products like annuities, guaranteed income funds, and estate planning services. For instance, the average Canadian retirement savings balance in 2024 is a key consideration for many, and understanding how these savings are managed and supplemented is vital. E-L Financial's strategic focus on these areas, through Empire Life's offerings, allows it to align with the evolving needs of a significant and growing consumer segment.

Consumer trust and financial literacy are crucial for E-L Financial's success in offering insurance and investment products. A recent survey indicated that only 45% of Canadians feel confident managing their finances, highlighting a significant need for improved financial education and accessible products. When consumers don't trust institutions or understand financial concepts, they are less likely to engage with complex offerings.

E-L Financial's core mission directly tackles these barriers by aiming to simplify financial products for Canadians. By focusing on speed and ease of use, the company seeks to build stronger client relationships and encourage greater participation in the financial markets. This approach is vital in a landscape where low financial literacy can lead to missed opportunities and financial vulnerability.

Shifting lifestyle and health trends significantly impact life and health insurance. Growing consumer focus on preventative care and wellness, for instance, is driving demand for insurance products that integrate health monitoring and rewards. This trend is evident in the projected growth of the global digital health market, which was valued at approximately $200 billion in 2023 and is expected to reach over $600 billion by 2030, indicating a strong consumer appetite for health-conscious solutions.

Social Responsibility and ESG Expectations

Societal expectations around Environmental, Social, and Governance (ESG) principles are increasingly shaping investment strategies and corporate standing. For E-L Financial, while its core operations are not carbon-intensive, the lack of public engagement in specific climate initiatives might draw stakeholder scrutiny. For instance, a 2024 survey by PwC revealed that 70% of investors consider ESG factors in their investment decisions, a significant jump from previous years.

This growing emphasis means that even companies in traditionally less impactful sectors need to demonstrate their commitment to sustainability and ethical practices. Stakeholders, including customers and employees, are looking for more than just financial performance; they seek alignment with broader societal values. This could translate into pressure for E-L Financial to articulate its ESG strategy more clearly, especially as regulatory bodies globally, such as the SEC, continue to refine ESG disclosure requirements.

- Investor Demand: A significant portion of global assets under management, estimated to be over $37 trillion as of early 2025, are now influenced by ESG criteria.

- Reputational Risk: Companies with weak ESG profiles can face reputational damage, impacting customer loyalty and talent acquisition.

- Regulatory Landscape: Evolving ESG regulations worldwide are pushing companies towards greater transparency and accountability in their social and environmental impact.

Workforce Demographics and Talent Acquisition

Attracting and keeping talented individuals in finance and investment is crucial for E-L Financial's success. As of early 2025, the demand for specialized financial skills remains high, with reports indicating a persistent talent gap in areas like data analytics and cybersecurity within the sector.

Adapting to evolving workforce expectations is also key. The preference for flexible work arrangements, including remote and hybrid models, continues to shape how companies operate. For instance, a recent survey of financial professionals showed that over 60% would consider leaving a job if remote work options were unavailable.

Furthermore, a strong focus on diversity and inclusion is becoming a significant differentiator. Companies that actively promote D&I are better positioned to attract a wider talent pool and foster innovation. By 2024, over 70% of surveyed companies reported that D&I initiatives positively impacted their ability to recruit top talent.

- Talent Demand: High demand for specialized financial skills, particularly in data analytics and cybersecurity, persists into 2025.

- Remote Work Preference: A majority of financial professionals prioritize remote or hybrid work options.

- Diversity & Inclusion Impact: D&I initiatives are increasingly vital for attracting skilled professionals and driving innovation in the financial sector.

Societal shifts, like the aging Canadian population, directly impact demand for financial services, with those 65+ expected to be 23% of the population by 2030. This demographic trend necessitates a focus on retirement income and wealth management solutions, areas where E-L Financial's subsidiary, Empire Life, is strategically positioned. Consumer trust and financial literacy remain critical, as only about 45% of Canadians feel confident managing their finances, creating an opportunity for E-L Financial to simplify products and enhance client engagement.

Technological factors

The financial services sector is heavily invested in digital transformation, with cloud adoption seen as crucial for staying competitive. For E-L Financial, this means optimizing its financial services and wealth management operations through technology to boost efficiency and customer experience.

By mid-2024, over 70% of financial institutions globally were actively pursuing cloud strategies, aiming to streamline processes and enhance data security. E-L Financial's commitment to leveraging these technological advancements directly impacts its ability to meet evolving customer expectations and stringent regulatory requirements in the dynamic financial landscape.

Cybersecurity and data privacy are absolutely critical for E-L Financial, given the highly sensitive client information and substantial assets managed. The threat of data breaches is a constant concern, making strong security protocols and adherence to data protection laws essential for maintaining trust and operational integrity.

In 2024, the financial services sector continued to be a prime target for cyberattacks, with reports indicating that the average cost of a data breach for financial institutions reached $5.90 million in 2023, according to IBM's Cost of a Data Breach Report. This underscores the significant financial and reputational risks E-L Financial faces if its defenses are compromised.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is non-negotiable. E-L Financial must invest heavily in advanced cybersecurity technologies and ongoing employee training to safeguard against sophisticated threats, ensuring robust protection of client data and maintaining regulatory compliance throughout 2024 and into 2025.

Artificial intelligence (AI) and automation are rapidly transforming the financial services sector. By 2024, it's estimated that AI will be used in over 80% of customer service interactions, a significant leap from previous years. For E-L Financial, this presents a powerful opportunity to streamline operations, from enhancing customer support with intelligent chatbots to fortifying cybersecurity defenses.

While challenges like data privacy and the complexity of integrating truly agentic AI remain, the potential benefits are substantial. Automation can significantly boost IT efficiency and improve project management by automating repetitive tasks, freeing up human capital for more strategic initiatives. For instance, AI-powered analytics are projected to save financial institutions billions annually by identifying fraud and optimizing trading strategies.

Fintech Innovation and Competition

The fintech landscape is rapidly evolving, presenting both challenges and opportunities for established players like E-L Financial. New fintech firms are disrupting traditional financial services, from payments and lending to wealth management and insurance, often with more agile and customer-centric approaches. For instance, by the end of 2024, global fintech investment was projected to reach over $150 billion, indicating a significant influx of capital driving innovation.

To stay competitive, E-L Financial must actively monitor these technological advancements and consider integrating them into its own offerings. This could involve partnering with fintech startups, acquiring promising technologies, or developing in-house solutions. Failing to adapt could lead to a loss of market share to more digitally savvy competitors.

Key areas of fintech innovation impacting E-L Financial include:

- Robo-advisors: Automated investment platforms offering lower fees and accessible portfolio management.

- Digital Payments: Seamless and instant transaction solutions that are increasingly preferred by consumers.

- Insurtech: Technology-driven solutions improving insurance underwriting, claims processing, and customer experience.

- Blockchain and Digital Assets: Potential for enhanced security, transparency, and new financial products.

Blockchain and Distributed Ledger Technology

While blockchain and distributed ledger technologies (DLT) might not be an immediate, day-to-day concern for E-L Financial, their long-term disruptive potential in financial transactions, record-keeping, and smart contracts within insurance and investment sectors warrants careful consideration. E-L Financial should proactively assess how these evolving technologies could reshape its operational landscape and client offerings.

The adoption of blockchain in financial services is steadily growing. For instance, by the end of 2024, the global blockchain in finance market was projected to reach over $10 billion, with significant growth anticipated in the coming years. This indicates a tangible shift towards DLT integration.

- Smart Contracts: DLT enables self-executing contracts with the terms of the agreement directly written into code, potentially streamlining claims processing and investment agreements.

- Enhanced Security and Transparency: Blockchain's immutable ledger offers a highly secure and transparent method for managing financial records, reducing fraud and improving audit trails.

- Operational Efficiency: DLT can automate many back-office processes, reducing costs and increasing the speed of transactions, which is crucial for financial institutions like E-L Financial.

Technological advancements are reshaping the financial landscape, pushing E-L Financial to embrace digital transformation for enhanced efficiency and customer engagement. The firm must prioritize robust cybersecurity measures, as the financial sector remains a prime target for cyberattacks, with the average cost of a data breach in 2023 reaching $5.90 million. Furthermore, the increasing integration of AI and automation, with AI expected in over 80% of customer service interactions by 2024, presents opportunities for streamlined operations and improved analytics.

Legal factors

E-L Financial, operating as Empire Life, navigates a complex web of financial services regulations. Compliance is paramount, covering its life insurance, wealth management, and investment operations. These rules are designed to ensure solvency and protect policyholders and investors.

Key regulatory bodies like the Office of the Superintendent of Financial Institutions Canada (OSFI) impose strict capital adequacy requirements. For instance, Empire Life must adhere to the Life Insurance Capital Adequacy Test (LICAT) ratio, a critical metric for financial health. As of the first quarter of 2024, Empire Life reported a strong LICAT ratio of 246%, well above the regulatory minimum.

Legal frameworks governing corporate governance, such as those dictating shareholder meeting procedures, board composition, and share repurchase authorizations, significantly influence E-L Financial's operations. These regulations ensure transparency and accountability, directly affecting strategic decisions and investor confidence.

E-L Financial's recent announcement of a 100-for-1 stock split and a normal course issuer bid are prime examples of how corporate actions are intertwined with legal compliance. Both initiatives require stringent regulatory approval and must adhere to established shareholder rights, impacting the company's capital structure and share valuation.

E-L Financial operates under a rigorous framework of Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) laws. These regulations are paramount for financial institutions to prevent the flow of illicit funds and safeguard the global financial system. In 2024, global AML spending was projected to reach approximately $25 billion, underscoring the significant investment required for compliance.

Adherence to AML/ATF mandates is not merely a legal obligation but a cornerstone of E-L Financial's operational integrity. This necessitates the implementation of sophisticated internal controls, including customer due diligence, transaction monitoring, and suspicious activity reporting. Failure to comply can result in substantial penalties, reputational damage, and operational disruptions, making robust compliance a strategic imperative.

Data Protection and Privacy Laws

E-L Financial navigates a complex landscape of data protection and privacy laws, crucial given its handling of sensitive personal and financial information. Compliance with regulations like GDPR, CCPA, and emerging national data residency mandates is paramount, especially for its wealth management and insurance divisions. These laws dictate how customer data is collected, stored, processed, and shared, impacting everything from marketing to client onboarding.

The evolving nature of these regulations presents ongoing challenges. For instance, the increasing focus on data residency means E-L Financial must ensure data for specific regions is stored within those geographical boundaries, which can affect operational efficiency and cost. Consent management, a core component of privacy laws, requires transparent and granular control for customers over how their data is used. Furthermore, stringent breach notification requirements mean that any security incident could trigger immediate and potentially costly reporting obligations to both regulators and affected individuals.

- GDPR Fines: As of late 2024, companies have faced significant fines under GDPR, with some reaching tens of millions of Euros for data privacy violations, underscoring the financial risk of non-compliance.

- Data Breach Costs: The average cost of a data breach globally in 2024 was estimated to be over $4.5 million, a figure E-L Financial must actively mitigate.

- Consent Management Platforms: The market for consent management platforms is projected to grow significantly, indicating the increasing importance and complexity of obtaining and managing user consent for data processing.

- Regulatory Scrutiny: Financial services remain a top target for data protection regulators, with an expected increase in enforcement actions throughout 2025.

Real Estate and Natural Resources Regulations

E-L Financial's real estate and natural resources investments are directly shaped by a complex web of legal and regulatory requirements. These include zoning laws that dictate land use, environmental protection statutes governing development and resource extraction, and the necessity of obtaining specific permits for operations. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce stricter regulations on water quality and emissions, potentially increasing compliance costs for real estate developers and resource extraction companies within E-L's portfolio.

Navigating these legal landscapes is crucial for maintaining investment viability and profitability. Changes in legislation, such as potential updates to endangered species protections impacting land use or new mandates for carbon emissions reporting in the energy sector, can significantly alter operational costs and project timelines.

- Zoning Laws: Affecting land development potential and property values.

- Environmental Regulations: Governing pollution control, waste management, and conservation efforts.

- Resource Extraction Permits: Mandating compliance for mining, oil, and gas operations.

- Land Use Planning: Influencing urban development and agricultural land preservation.

E-L Financial's operations are intrinsically linked to evolving legal frameworks governing financial services and corporate conduct. Compliance with regulations from bodies like OSFI, which oversees capital adequacy through metrics such as the LICAT ratio, is critical. For instance, E-L Financial maintained a robust LICAT ratio of 246% in Q1 2024, exceeding regulatory minimums and demonstrating financial resilience.

Furthermore, adherence to Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) laws is a non-negotiable aspect of its business, requiring substantial investment in compliance systems. The global AML spending in 2024 was estimated at $25 billion, highlighting the scale of these efforts. Data protection laws, including GDPR and CCPA, also impose strict requirements on handling sensitive customer information, with GDPR fines reaching tens of millions of Euros for violations in late 2024.

Legal factors also extend to E-L Financial's investment activities, particularly in real estate and natural resources, where zoning laws, environmental regulations, and specific permits dictate operational feasibility and costs. The average cost of a data breach globally in 2024 exceeded $4.5 million, underscoring the financial imperative for robust data privacy compliance.

Environmental factors

Climate change poses significant physical risks to E-L Financial's portfolio, particularly concerning real estate and natural resource investments. Extreme weather events like hurricanes, floods, and wildfires, which are projected to increase in frequency and intensity, can directly impact property values and the operational viability of assets. For example, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, causing an estimated $92.9 billion in damages, highlighting the tangible financial consequences.

As governments worldwide accelerate their efforts to combat climate change through policy, E-L Financial must navigate the inherent transition risks. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could impact industries E-L Financial invests in by imposing costs on carbon-intensive imports, potentially altering investment valuations.

Stricter emissions standards, like those being phased in for new vehicles in many developed nations through 2025, can affect the profitability and operational models of companies within E-L Financial's portfolio, particularly those in the automotive or logistics sectors. Changes in energy policies, such as subsidies for renewable energy or phase-outs of fossil fuels, directly influence the viability and returns of natural resource investments.

Furthermore, evolving energy policies can indirectly impact E-L Financial's real estate holdings. For example, mandates for energy-efficient buildings, which are becoming more common, could increase operational costs for older properties or necessitate significant capital expenditure for upgrades, affecting net operating income and property valuations by 2025.

Resource scarcity, particularly water stress, poses a significant environmental challenge that can directly impact investments. For E-L Financial, this means that companies heavily reliant on water resources, such as agriculture or certain manufacturing sectors, might face increased operational costs or even disruptions. For instance, projections indicate that by 2040, over 5 billion people could experience water scarcity, a stark reality that will affect supply chains and profitability for many businesses.

Biodiversity Loss and Ecosystem Services

The accelerating loss of biodiversity and the degradation of essential ecosystem services present tangible risks for investments, especially those tied to natural resources and real estate. For instance, a decline in pollinator populations, a key aspect of biodiversity, directly impacts agricultural yields, potentially affecting companies reliant on these crops. The United Nations estimates that around one million animal and plant species are now threatened with extinction, many within decades, highlighting the scale of this challenge.

As ecosystems weaken, the services they provide, such as clean water, fertile soil, and climate regulation, diminish. This erosion of natural capital can lead to increased operational costs for businesses, supply chain disruptions, and reduced property values. The World Economic Forum's 2024 Global Risks Report identified biodiversity loss and ecosystem collapse as one of the top long-term threats, underscoring its financial implications.

Consequently, adopting sustainable practices within sectors heavily dependent on healthy ecosystems is becoming increasingly critical for long-L Financial's resilience and long-term value. Companies that proactively manage their environmental footprint and invest in nature-based solutions may find themselves better positioned to navigate these evolving risks and potentially unlock new opportunities.

- Risk to Investments: Degradation of biodiversity and ecosystem services can negatively impact sectors like agriculture, forestry, and real estate, leading to reduced productivity and asset devaluation.

- Economic Impact: The loss of ecosystem services, such as pollination and water purification, is estimated to cost the global economy trillions of dollars annually.

- Growing Importance of Sustainability: For long-L Financial, integrating sustainable practices and investing in nature-positive solutions will be crucial for mitigating risks and ensuring long-term financial health.

- Global Recognition of Threat: Organizations like the UN and World Economic Forum consistently rank biodiversity loss as a significant global risk with substantial economic consequences.

Environmental, Social, and Governance (ESG) Integration

While E-L Financial operates in a sector not typically associated with heavy carbon emissions, the broader financial landscape is increasingly shaped by environmental, social, and governance (ESG) considerations. Investors and stakeholders are placing greater emphasis on sustainability, prompting companies like E-L Financial to potentially integrate environmental factors into their investment strategies and public disclosures. This shift reflects a growing awareness of the long-term risks and opportunities associated with climate change and resource management.

Currently, there is no readily available public information indicating E-L Financial's direct participation in specific climate-focused initiatives or programs. This absence of public engagement on climate action could be a point of scrutiny for investors prioritizing ESG performance. As the demand for transparent ESG reporting grows, E-L Financial may need to develop and communicate its approach to environmental stewardship.

The global push for net-zero emissions by 2050, as highlighted by initiatives like the Paris Agreement, influences investment flows and corporate behavior across all industries. For financial institutions, this translates into pressure to align their portfolios with climate goals and to offer sustainable investment products. For instance, by the end of 2024, sustainable investment assets under management globally are projected to reach significant figures, demonstrating the market's appetite for ESG-aligned strategies.

- Growing ESG Investment: Global sustainable investment assets are expected to surpass $50 trillion by the end of 2025, indicating a strong market preference for ESG-integrated strategies.

- Investor Scrutiny: A significant percentage of institutional investors, often exceeding 70%, now incorporate ESG factors into their investment decisions, increasing pressure on all companies for transparency.

- Regulatory Trends: Governments worldwide are implementing stricter environmental regulations and disclosure requirements, which will likely impact financial sector operations and reporting in 2024 and beyond.

- Climate Risk Awareness: Financial institutions are increasingly recognizing climate-related risks, such as physical damage from extreme weather events and transition risks from policy changes, as material to their long-term stability.

Environmental factors present tangible physical and transition risks to E-L Financial's investments. Extreme weather events, exacerbated by climate change, directly impact asset values, as evidenced by the $92.9 billion in damages from U.S. billion-dollar disasters in 2023. Policy shifts, like the EU's CBAM and stricter emissions standards, create transition risks, potentially altering company valuations and operational models by 2025.

Resource scarcity, particularly water stress, and biodiversity loss pose significant threats to sectors reliant on natural capital. Projections of widespread water scarcity by 2040 and the extinction of a million species within decades highlight the economic implications of ecosystem degradation. These environmental challenges necessitate proactive management and sustainable practices for long-term financial resilience.

| Environmental Factor | Impact on E-L Financial | Supporting Data/Trend |

|---|---|---|

| Climate Change (Physical Risks) | Reduced asset values, increased operational costs due to extreme weather. | 2023 U.S. billion-dollar disasters: $92.9 billion in damages. |

| Climate Change (Transition Risks) | Altered investment valuations due to new regulations and policies. | EU's CBAM phased in from Oct 2023; stricter vehicle emissions by 2025. |

| Resource Scarcity (Water) | Increased operational costs and supply chain disruptions for water-dependent businesses. | Projected water scarcity for over 5 billion people by 2040. |

| Biodiversity Loss | Reduced productivity and asset devaluation in agriculture, forestry, and real estate. | UN: ~1 million species threatened with extinction. |

PESTLE Analysis Data Sources

Our E-L Financial PESTLE Analysis is built on a robust foundation of data from official government agencies, reputable financial institutions, and leading market research firms. We meticulously gather insights on economic indicators, regulatory changes, technological advancements, and social trends to provide a comprehensive view.