Dr. Martens Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Martens Bundle

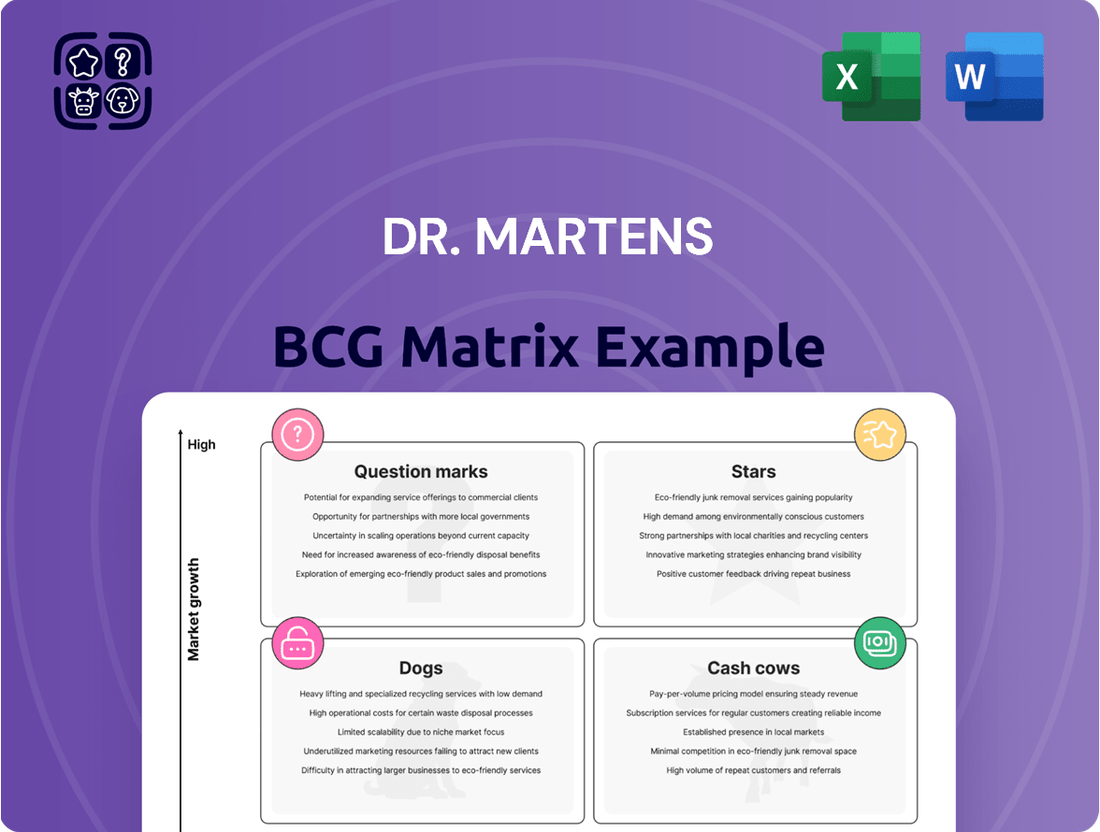

Are you curious about where Dr. Martens' iconic boots and newer ventures fit in the market? Understanding their BCG Matrix can reveal their strategic positioning – are they leading "Stars," reliable "Cash Cows," underperforming "Dogs," or promising "Question Marks"?

This glimpse is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Dr. Martens.

The complete BCG Matrix reveals exactly how Dr. Martens is positioned in the competitive footwear landscape. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Purchase now and get instant access to a beautifully designed Dr. Martens BCG Matrix that’s both easy to understand and powerful in its insights—delivered in Word and Excel formats.

This report goes beyond theory. The full version includes strategic moves tailored to Dr. Martens' actual market position—helping you plan smarter, faster, and more effectively.

Stars

Dr. Martens' direct-to-consumer (DTC) channel in the Americas has experienced a notable resurgence, returning to growth in the latter half of fiscal year 2025. This revitalization is particularly significant given the Americas' importance as a key market for the brand.

The turnaround was primarily fueled by an increase in full-price sales, signaling a strong recovery in consumer demand and the successful implementation of strategic initiatives. This positive trend suggests that Dr. Martens' efforts to enhance its DTC offering are resonating with customers.

This renewed momentum positions the Americas DTC channel as a critical growth driver for Dr. Martens. The company is likely to leverage this success to further expand its market share and solidify its presence in this vital region.

The APAC region, with Japan, China, and South Korea leading the charge, demonstrated remarkable and consistent growth for Dr. Martens through fiscal year 2025. This sustained strong performance underscores the brand's solid footing in the rapidly expanding Asian footwear market.

The direct-to-consumer channel within these key APAC markets has been particularly instrumental in driving this success. This focus on direct engagement highlights a strategic approach that resonates well with consumers in these dynamic economies.

Continued investment in the region, coupled with overwhelmingly positive consumer reception, points to a significant opportunity for Dr. Martens to maintain and potentially increase its market share. The brand's ability to connect with local tastes while upholding its core identity is a key differentiator.

Dr. Martens is actively pursuing growth through strategic introductions of new product families like Buzz, Zebzag, and Lowell. The Buzz collection, in particular, has shown significant success by drawing in a substantial number of new customers, signaling a positive reception and strong potential for future expansion. This focus on innovative product lines is designed to capture a larger share of the market as consumer tastes continue to shift.

Strategic Collaborations

Strategic collaborations are a key driver for Dr. Martens, particularly in maintaining their position in dynamic market segments. These partnerships, like the recent ones with MM6 Maison Margiela and Palace Skateboards, significantly amplify brand visibility and desirability.

These limited-edition drops, often featuring innovative takes on iconic boot designs, consistently achieve sell-out status, underscoring strong consumer demand within specific, trend-conscious niches. For instance, the MM6 Maison Margiela collaboration in early 2024 was met with immediate sell-outs across multiple styles.

Such strategic alliances allow Dr. Martens to stay relevant, attracting younger demographics and expanding their market share in fashion-forward areas. This approach helps them tap into new customer bases, bolstering their presence in segments that are highly influenced by current trends and influencer marketing.

- High-Profile Collaborations: Recent partnerships with MM6 Maison Margiela and Palace Skateboards generated substantial brand buzz.

- Rapid Sell-Outs: Limited-edition releases frequently sell out quickly, indicating strong demand in niche markets.

- Demographic Expansion: These collaborations help Dr. Martens attract new, younger customer segments.

- Market Relevance: Partnerships are crucial for maintaining brand appeal in trend-driven fashion landscapes.

Sustainability-Focused Collections

Dr. Martens is actively investing in sustainability, exemplified by its use of recycled leather in the Genix Nappa line. This strategic move caters to a rapidly expanding demographic of environmentally aware shoppers, a significant trend across the entire footwear industry.

The brand’s commitment extends to services like repairs and resale platforms, further enhancing its appeal to consumers prioritizing eco-friendly choices. These initiatives are not just about corporate responsibility; they are strategically positioned to capture substantial future market share and drive growth.

- Market Trend: The global sustainable footwear market is projected to reach $13.08 billion by 2027, growing at a CAGR of 5.4%.

- Consumer Behavior: A 2023 survey indicated that 66% of consumers globally are willing to pay more for sustainable products.

- Dr. Martens' Position: The company's sustainability efforts are aligning with this powerful consumer shift, potentially boosting brand loyalty and sales.

Dr. Martens' strategic product introductions, like the Buzz collection, have successfully attracted a significant influx of new customers. This indicates that the brand’s innovation in product families is a key driver for market expansion and captures emerging consumer preferences.

The brand’s strategic collaborations, such as those with MM6 Maison Margiela and Palace Skateboards, demonstrate a powerful ability to generate hype and sell out limited-edition items rapidly. These partnerships are crucial for maintaining relevance and attracting younger, trend-conscious demographics.

These successful collaborations and new product launches suggest that Dr. Martens is effectively targeting and expanding into new market segments. This positions these initiatives as potential Stars in the BCG matrix, showing high growth potential and market share.

Dr. Martens' investment in sustainability, including recycled materials and circular services, aligns with a growing consumer demand for eco-conscious products. This focus is strategically designed to capture future market share and enhance brand loyalty in an increasingly environmentally aware market.

What is included in the product

Dr. Martens' BCG Matrix analyzes its product lines based on market share and growth.

It helps identify which lines to invest in, manage for cash, or divest.

Dr. Martens BCG Matrix offers a clear, one-page overview to identify strategic opportunities and address underperforming business units.

Cash Cows

The Classic 1460 Boot is undeniably Dr. Martens' Cash Cow. This iconic 8-eye boot is globally recognized, a testament to its durability, distinctive design, and rich cultural heritage. It consistently drives significant revenue for the brand.

This flagship product enjoys an exceptionally loyal customer base that spans various demographics, underscoring its enduring appeal. The 1460 boot's consistent performance generates a steady, high-margin cash flow for Dr. Martens.

Remarkably, its established brand recognition means that marketing investment for the 1460 boot is relatively low, further enhancing its profitability. In fiscal year 2023, Dr. Martens reported that boots accounted for a substantial portion of its sales, with the 1460 being the primary driver.

The Classic 1461 shoe stands as a cornerstone of Dr. Martens' offerings, a true Cash Cow in their BCG Matrix. Its iconic design and consistent appeal across diverse fashion movements guarantee steady sales, making it a reliable generator of profit. This enduring popularity means the 1461 requires minimal marketing investment, allowing it to contribute significantly to Dr. Martens' bottom line.

The Core Leather Footwear Range, featuring classic boots and shoes with Goodyear welt construction and AirWair soles, represents Dr. Martens' heritage and quality.

These products enjoy robust brand loyalty and a reputation for durability, enabling them to command high profit margins.

This category constitutes a stable and predictable revenue source, needing minimal additional investment to maintain its strong market presence.

In 2024, Dr. Martens reported that its core boot styles continued to be the primary driver of sales, underscoring their status as a cash cow.

Established E-commerce Platform

Dr. Martens' established e-commerce platform is a significant asset, acting as a primary conduit for its high-margin classic footwear. This digital channel offers direct access to consumers, bypassing intermediaries and enhancing profitability for core products.

Even amidst broader revenue fluctuations, the digital segment has demonstrated remarkable resilience. For instance, in the first half of fiscal year 2024, Dr. Martens reported that its Direct-to-Consumer (DTC) channel, which heavily relies on e-commerce, saw a revenue increase of 4% on a constant currency basis, reaching £180.9 million. This highlights the platform's consistent performance and its role as a stable revenue generator.

- Digital Channel Strength The e-commerce platform is crucial for selling high-margin classic products directly to consumers.

- Resilient Performance The digital segment has shown steady gains, contributing positively to overall revenue streams.

- Global Reach and Efficiency It provides a scalable and efficient sales pipeline, ensuring consistent access to a global customer base.

- Profitability Driver This established online presence directly supports the profitability of Dr. Martens' core offerings.

Global Brand Recognition and Heritage

Dr. Martens leverages its extensive global brand recognition and a heritage stretching back over six decades. This deep-rooted history allows the company to maintain a strong connection with consumers, transcending fleeting fashion trends. The brand's authenticity is a key driver of customer loyalty, supporting premium pricing strategies for its iconic footwear.

This powerful brand equity translates directly into consistent cash flow generation. Dr. Martens enjoys enduring demand for its core products, underpinned by its authentic identity. The company maintains a relatively stable market share, a testament to its established position and customer devotion.

- Global Brand Recognition: Dr. Martens is recognized worldwide, a significant asset for its cash cow status.

- Heritage and Authenticity: A decades-long history fuels customer loyalty and supports premium pricing.

- Consistent Cash Flow: The enduring demand for its core products ensures stable revenue streams.

- Stable Market Share: The brand's established presence allows it to hold its ground in the competitive footwear market.

The Classic 1460 and 1461 styles, alongside the broader Core Leather Footwear Range, are Dr. Martens' undisputed cash cows. These products benefit from immense brand loyalty and a heritage that allows for premium pricing and minimal marketing spend, generating consistent, high-margin profits. Their enduring appeal ensures a stable revenue stream, crucial for funding other business ventures.

| Product Category | BCG Matrix Status | Key Characteristics | Financial Contribution |

| Classic 1460 Boot | Cash Cow | Iconic design, global recognition, high customer loyalty | Significant, steady revenue driver |

| Classic 1461 Shoe | Cash Cow | Enduring popularity, low marketing needs, consistent sales | Reliable profit generator |

| Core Leather Footwear | Cash Cow | Durable, high-margin, strong brand equity | Stable and predictable revenue source |

| E-commerce Platform | Enabler of Cash Cows | Direct consumer access, enhanced profitability for core products | Supports and increases cash cow revenue |

What You’re Viewing Is Included

Dr. Martens BCG Matrix

The Dr. Martens BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase, offering a clear strategic overview of their product portfolio. This preview accurately represents the final, professionally formatted report, ready for immediate integration into your business analysis or presentations. You are viewing the exact same BCG Matrix file that will be downloadable post-purchase, providing you with expert-level strategic insights without any hidden steps. This is not a sample; the Dr. Martens BCG Matrix you preview is the actual, analysis-ready file that will be yours to edit, print, or share after your purchase.

Dogs

Dr. Martens has seen a significant drop in its wholesale revenue, with the Americas experiencing a particularly sharp decline due to softer order volumes. This underperformance in key regions suggests this channel may represent a low-growth, low-share segment within the brand's portfolio.

The company is actively managing this channel, even using it to offload older inventory, a common tactic for underperforming product lines. This strategic shift aims to optimize distribution by reducing dependence on certain wholesale relationships.

For fiscal year 2024, Dr. Martens reported a 10% drop in wholesale revenue, highlighting the challenges faced in this distribution channel. This decline was largely attributed to a strategic decision to reduce the number of wholesale partners and manage inventory more tightly.

Dr. Martens has been working to clear out older, less popular product lines, especially through wholesale in the US. This strategy aims to reduce excess inventory that might be weighing down the company's performance. These fragmented lines often represent styles that have low market share and little prospect for future growth, essentially tying up valuable capital.

These types of products are prime candidates for divestiture or even discontinuation. By streamlining its product offerings, Dr. Martens can focus resources on more promising and profitable items. For example, in fiscal year 2024, the company reported a decline in wholesale revenue, partly attributed to efforts to manage inventory and focus on core product lines, indicating a strategic shift away from these slower-moving items.

The UK market, a historical stronghold for Dr. Martens, has become a significant headwind, contributing to the brand's overall revenue dip. This core market is classified as 'challenging' within the broader EMEA region, signaling subdued growth and potential market share erosion for certain product categories.

The current macroeconomic climate and consumer spending patterns in the UK are creating a difficult operating environment. For instance, in the fiscal year ending March 2024, Dr. Martens reported a 10% decline in revenue in its EMEA region, with the UK being a primary driver of this contraction.

This performance in the UK suggests that Dr. Martens may need to adapt its product offerings or marketing strategies to better resonate with current consumer preferences and economic realities. A strategic re-evaluation of product fit and market positioning is likely necessary to navigate these headwinds effectively.

Past Vegan Line Iterations with Quality Issues

Dr. Martens' early attempts at a vegan footwear line encountered notable quality issues, leading to consumer dissatisfaction. Reports surfaced of poor durability and even product recalls stemming from concerns over chemical exposure in some of these earlier vegan models.

These past iterations, despite the company's ongoing commitment to sustainable alternatives, likely suffered from a damaged reputation and diminished market appeal. If these specific products continue to impact consumer perception or remain in the market, they represent a classic 'dog' in the portfolio, requiring substantial product development or discontinuation.

- Durability Concerns: Early vegan models received complaints about materials not holding up as well as traditional leather.

- Chemical Exposure Issues: Some units were subject to recalls due to chemical safety concerns, impacting consumer trust.

- Tarnished Brand Image: These quality problems likely led to a negative perception of Dr. Martens' vegan offerings.

- Low Market Appeal: Consequently, these specific products would have struggled to gain traction and sales in a competitive market.

Ineffective 'Channel-First' Marketing Approach

Dr. Martens recognized its 'channel-first' marketing, heavily favoring direct-to-consumer (DTC) sales, was a significant misstep. This approach proved ineffective in attracting new customer demographics and expanding market reach.

The over-reliance on DTC meant that certain product lines and geographic regions suffered from stagnant sales and limited market penetration. This narrow focus directly contributed to the underperformance of some offerings within the company's portfolio.

- Ineffective Customer Reach: The 'channel-first' strategy, particularly its emphasis on DTC, failed to engage broader customer segments.

- Stagnating Sales: This limited reach led to underperformance in specific product categories and markets.

- Market Penetration Issues: The narrow marketing focus hindered the company's ability to penetrate new customer bases.

- Need for Reset: Products falling into the 'dog' category due to this approach require a complete reevaluation of their marketing strategy.

Dr. Martens' early vegan footwear lines represent a classic 'dog' in the BCG matrix due to significant quality issues, including durability concerns and chemical exposure incidents. These problems led to consumer dissatisfaction and a tarnished brand image for these specific offerings. The company's previous 'channel-first' marketing strategy, heavily favoring direct-to-consumer sales, also contributed to the underperformance of certain product lines by limiting market penetration and failing to attract new customer demographics.

| Product Category | Market Growth | Market Share | BCG Matrix Classification |

| Early Vegan Footwear | Low | Low | Dog |

| Wholesale (Americas) | Low | Low | Dog |

| Wholesale (UK) | Low | Low | Dog |

Question Marks

Dr. Martens' strategic push into the sandals category positions it as a potential 'question mark' within the BCG Matrix. The brand is actively working to expand its offerings, evidenced by the launch of new Spring/Summer 2025 collections featuring models like the Mattison platform sole. This move taps into a growing global footwear market that favors casual comfort.

While the overall footwear market is expanding, Dr. Martens' existing market share within the sandal segment is likely modest when contrasted with its established dominance in the boot market. This presents an opportunity in a high-growth area with considerable, though yet to be fully realized, potential.

Significant investment will be necessary for Dr. Martens to effectively compete and capture a meaningful share of the sandal market. This investment is crucial to build brand recognition and product appeal in a segment where competitors may already have a stronger foothold.

Dr. Martens is making a strategic push into bags and adjacent leather goods, aiming to broaden its appeal beyond its iconic footwear. This move is central to its 'Levers For Growth' strategy, signaling a clear intent to diversify revenue streams. While currently representing a modest portion of total sales, this segment is identified as a significant opportunity for expansion.

The company recognizes the potential for this category to contribute meaningfully to its future growth. This strategic pivot involves substantial investment in product design, targeted marketing campaigns, and enhanced distribution networks to build a robust presence in the competitive accessories market. The goal is to fully capitalize on the brand's established reputation for durable, stylish leather products.

Dr. Martens is strategically targeting new growth markets, aiming to expand its global footprint by employing capital-light distribution models. This approach involves leveraging partnerships with local distributors and establishing franchised stores, minimizing direct capital investment in these nascent territories.

These new geographical areas represent significant high-growth potential, yet Dr. Martens currently holds a minimal presence and market share within them. The company's 2024 financial reports indicated a strategic focus on international expansion, with particular emphasis on emerging markets in Asia and Latin America, where direct retail investment can be prohibitive initially.

The success of this strategy hinges on the brand's ability to effectively localize its product offerings and marketing efforts, coupled with forging robust strategic alliances. For instance, in 2024, Dr. Martens saw a notable uptick in sales in Southeast Asia, attributed to localized marketing campaigns and strong distributor relationships, demonstrating the viability of this capital-light approach.

Products Emphasizing Enhanced Comfort and Lightness

Dr. Martens is strategically prioritizing comfort and lightness in its product development, a move designed to capture the increasing consumer demand for versatile and easy-to-wear footwear. This focus on enhanced comfort and reduced weight represents a new strategic pillar for the brand, aiming to broaden its appeal beyond its traditional, more robust offerings.

These comfort-centric innovations, while aligned with current market trends, are still in their nascent stages of market penetration. Consequently, they require dedicated investment in marketing and product refinement to build significant market share. For instance, while Dr. Martens reported a 10% revenue increase in the fiscal year ending March 2024, reaching £1.05 billion, the contribution of these newer, lighter styles is still developing.

- Product Innovation: Focus on developing lighter materials and construction techniques for enhanced comfort.

- Market Alignment: Capitalizing on the growing consumer preference for comfortable, everyday footwear.

- Market Share: These comfort-focused lines are in the early stages of gaining traction.

- Investment Needs: Require sustained investment in marketing and product development to drive growth.

Strategic Shift to 'Consumer-First' Marketing

Dr. Martens is actively transitioning from a channel-centric to a consumer-focused marketing strategy. This pivot aims to deepen engagement and increase purchase frequency across its diverse product lines.

The new strategy emphasizes clearly communicating consumer benefits and delivering personalized experiences. This shift is expected to unlock significant growth opportunities for the brand's entire portfolio, reflecting a deliberate move to connect more directly with its customer base.

- Consumer Engagement Focus: Dr. Martens aims to boost direct consumer interaction, moving beyond traditional retail channels.

- Personalized Experiences: Tailoring marketing messages and product offerings to individual consumer needs is a core component.

- Portfolio Growth Driver: This strategic shift is designed to invigorate sales across all Dr. Martens product categories.

- Implementation is Key: The success of this consumer-first approach hinges on its seamless execution and broad consumer appeal.

Dr. Martens' expansion into sandals and accessories, alongside its push into new international markets with capital-light models, places these ventures firmly in the 'question mark' category of the BCG Matrix. These areas represent high-growth potential but currently hold a small market share, necessitating significant investment to capture market penetration and achieve success.

The brand's focus on comfort-centric footwear also falls into this category; while aligned with market trends, these products are still developing their market share. Dr. Martens' shift to a consumer-focused marketing strategy aims to support the growth of all its product lines, including these emerging 'question marks', by deepening customer engagement and driving purchase frequency.

| Strategic Area | BCG Category | Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| Sandals | Question Mark | High | Modest | Significant |

| Accessories (Bags, etc.) | Question Mark | High | Low | Substantial |

| New Geographic Markets (Capital-Light) | Question Mark | High | Minimal | Strategic & Operational |

| Comfort-Centric Footwear | Question Mark | Moderate to High | Developing | Marketing & Product Refinement |

BCG Matrix Data Sources

Our Dr. Martens BCG Matrix is informed by official company financial reports, detailed market share data, and industry growth forecasts to provide a comprehensive view.