DOM Security Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DOM Security Bundle

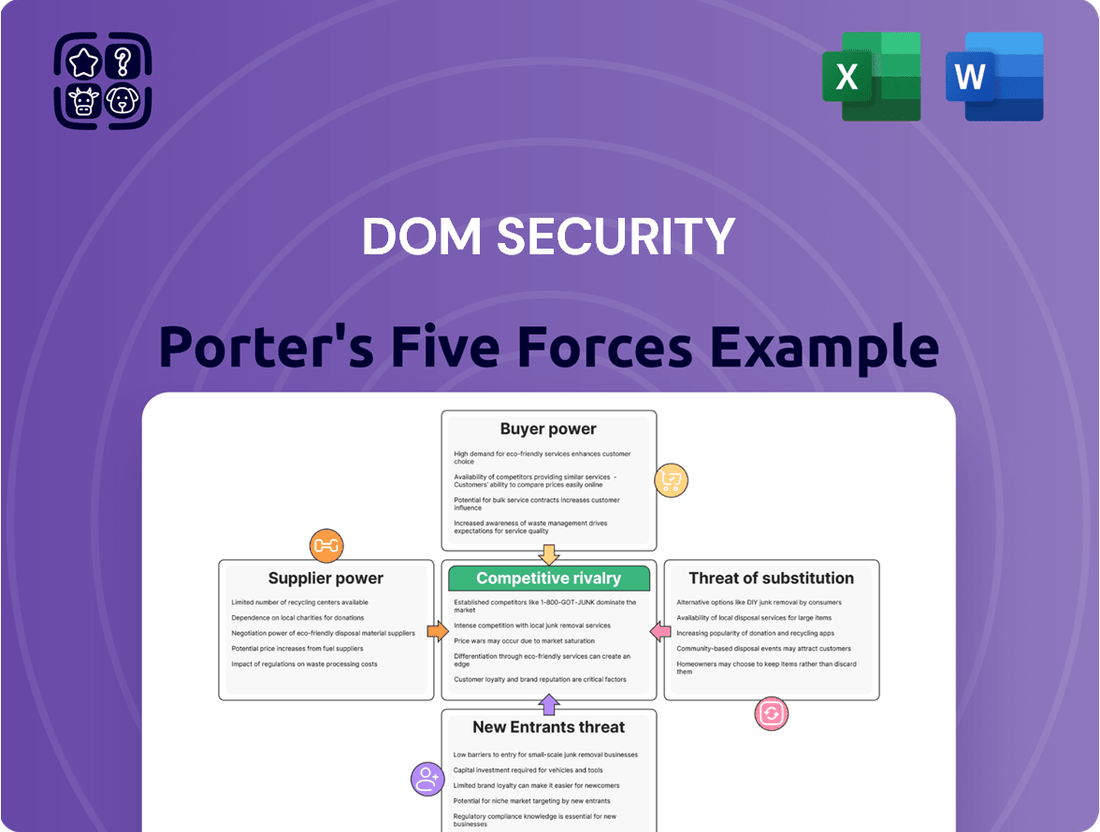

DOM Security operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DOM Security’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DOM Security's supplier power hinges on the concentration of manufacturers for specialized electronic and mechanical components, vital for its high-tech security solutions. A limited number of suppliers for these unique parts can significantly boost their leverage, potentially driving up costs for DOM Security. For instance, in 2024, the global market for advanced semiconductor components, often used in smart locks, was dominated by a handful of key players, giving them considerable pricing power.

The costs DOM Security faces when switching suppliers can be substantial, directly impacting supplier bargaining power. These costs include redesigning products to integrate new components, retooling manufacturing lines, and the lengthy process of re-certifying products, especially for security-sensitive applications. For instance, in 2024, a typical redesign and recertification process for a complex electromechanical security system could easily run into hundreds of thousands of dollars, potentially exceeding $500,000 depending on the scope.

Suppliers offering highly specialized or patented components, particularly for DOM Security's advanced biometric or IoT-enabled security systems, wield significant power. These unique inputs are critical for DOM Security's innovative product lines, giving suppliers leverage in negotiations. For instance, a supplier of a novel biometric sensor technology might command higher prices if no comparable alternatives exist in the market.

Impact of Inputs on Product Quality and Differentiation

The quality and technological advancement of components from suppliers significantly influence the performance and distinctiveness of DOM Security's offerings, including their high-security cylinders and sophisticated access control systems. For instance, in 2024, the demand for advanced biometric sensors in access control systems saw a notable increase, with suppliers of these specialized components holding considerable leverage. If these inputs are vital for upholding DOM's reputation for robust security, user convenience, and operational efficiency, the company might be more susceptible to supplier pricing and contractual stipulations to guarantee superior product outcomes.

DOM Security's reliance on specialized electronic components and precision-engineered mechanical parts means that suppliers of these critical inputs can exert considerable bargaining power. For example, a supplier of unique, patented locking mechanisms or advanced encryption chips could command higher prices if few alternatives exist. This dependence is amplified when these components are essential for meeting stringent industry certifications or customer-specific security requirements, as is often the case in high-security sectors.

- Critical Component Dependence: Suppliers of unique, patented locking mechanisms or advanced encryption chips can significantly influence DOM Security's costs and product innovation.

- Technological Sophistication: The availability of cutting-edge components, such as advanced biometric sensors, can give suppliers leverage due to limited alternatives.

- Industry Certifications: Components necessary for meeting stringent security certifications, like EN 1627 for burglary resistance, are often sourced from a select group of suppliers who hold considerable power.

- Reputation and Quality Assurance: Suppliers whose inputs are directly tied to DOM Security's reputation for reliability and security are in a strong position to negotiate terms.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for DOM Security. If DOM Security can easily source alternative materials for its mechanical locks or different electronic modules for its digital security systems, the leverage of any single supplier diminishes. This is crucial because having multiple viable options for key components, such as specialized alloys for lock cylinders or advanced microcontrollers for smart locks, allows DOM Security to negotiate more favorable terms and pricing. For instance, in 2024, the global market for specialty metals used in high-security locks saw increased production from new entrants, potentially offering DOM Security a wider array of suppliers and reducing reliance on established, higher-priced sources.

Consider these factors regarding substitute inputs:

- Component Versatility: The degree to which components used in DOM Security's products can be sourced from multiple suppliers or are interchangeable directly impacts supplier power.

- Technological Advancements: Emerging technologies that offer similar functionality to existing components but are produced by different suppliers can create substitutes. For example, advancements in biometric sensors could reduce reliance on traditional key-based electronic modules.

- Supplier Concentration: A low concentration of suppliers for critical inputs means DOM Security has more alternatives, thereby weakening the bargaining power of individual suppliers.

Suppliers to DOM Security can wield significant power when they provide unique, patented, or highly specialized components essential for the company's advanced security solutions, such as biometric access systems. This is particularly true if there are few alternative suppliers for these critical inputs. For instance, in 2024, the market for advanced encryption chips used in secure data transmission within smart locks was concentrated among a limited number of manufacturers, granting them considerable pricing influence.

The bargaining power of DOM Security's suppliers is also amplified by the costs associated with switching to a different supplier. These switching costs can include product redesign, retooling manufacturing equipment, and lengthy re-certification processes, especially for products meeting rigorous security standards. For example, in 2024, the cost to redesign and recertify a complex electromechanical security system to accommodate new components could easily exceed $500,000, making switching a significant financial hurdle.

| Factor | Impact on DOM Security | Example (2024) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Limited manufacturers for advanced encryption chips. |

| Switching Costs | High costs empower suppliers. | Over $500,000 for redesign/recertification of security systems. |

| Component Uniqueness | Unique components give suppliers leverage. | Patented locking mechanisms without viable alternatives. |

| Availability of Substitutes | More substitutes reduce supplier power. | Increased production of specialty metals for locks by new entrants. |

What is included in the product

This analysis examines the competitive landscape for DOM Security by dissecting the five forces that shape its industry: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly visualize competitive intensity across all five forces, enabling proactive strategy adjustments and mitigating potential market disruptions.

Customers Bargaining Power

DOM Security's customer base is quite varied, spanning residential, commercial, and industrial markets. This diversity means that the power customers hold can differ significantly depending on the segment.

For large commercial and industrial clients, their bargaining power is often substantial. These customers buy in large quantities and frequently need specialized, integrated solutions tailored to their specific needs. Their significant order volumes and strategic importance to DOM Security give them considerable leverage in negotiations.

In contrast, individual residential customers typically wield much less bargaining power on their own. While collectively they represent a significant market share, their individual purchase sizes are smaller, limiting their ability to influence pricing or terms.

The costs and complexities a customer faces when moving from DOM Security to a competitor significantly shape their bargaining power. For intricate, integrated security systems, such as those in large commercial properties requiring advanced access control, these switching costs can be substantial. Think about the expense and effort of re-installing hardware, retraining staff on new systems, and ensuring seamless integration with existing IT infrastructure. These hurdles effectively reduce a customer's ability to demand lower prices or better terms.

Conversely, for simpler, standalone products like mechanical locks, the barriers to switching are considerably lower. A customer can typically replace a mechanical lock with a competitor's product with minimal disruption and cost. This ease of switching grants customers more leverage when negotiating with DOM Security for these less integrated product lines.

Customer price sensitivity at DOM Security is not uniform. For instance, while a homeowner might seek a cost-effective deadbolt, a large corporation installing access control systems will weigh initial cost against durability, integration capabilities, and ongoing maintenance. This segmentation means that for basic products, price is a significant factor, but for advanced solutions, performance and reliability often trump cost.

The digital age has significantly amplified customer bargaining power. With readily available online reviews, detailed product comparisons, and accessible pricing information, buyers can easily assess value. For example, a facility manager can quickly compare the total cost of ownership for different electronic lock systems from various manufacturers, making them less reliant on single suppliers and more empowered to negotiate.

Threat of Backward Integration by Customers

While most of DOM Security's customer base consists of individuals or smaller businesses, large industrial or institutional clients, such as major corporations or government entities, could potentially explore developing their own proprietary security systems. This capability for backward integration, though infrequent, grants these significant customers a degree of negotiation power. They might leverage this potential to secure more competitive pricing or request highly customized security solutions from DOM Security.

The threat of backward integration by customers for DOM Security is generally low across its broad market segments. However, for specific large-scale projects or clients with exceptionally unique security requirements, the possibility exists. For instance, a large manufacturing plant requiring highly specialized access control systems might investigate in-house development if off-the-shelf solutions from DOM Security do not fully meet their stringent operational needs. This consideration, even if not acted upon, can influence pricing discussions.

- Low Overall Threat: Backward integration is uncommon for the majority of DOM Security's diverse customer base.

- Potential for Large Clients: Major industrial or institutional buyers may consider developing in-house solutions for specialized needs.

- Negotiating Leverage: The *potential* for backward integration provides these large customers with some bargaining power regarding pricing and customization.

- Impact on Tailored Solutions: This leverage can push DOM Security to offer more flexible or bespoke security offerings to retain these key accounts.

Importance of DOM's Products to Customer Operations

DOM Security's products are fundamental to how businesses manage access and ensure safety, directly influencing a customer's operational efficiency and compliance. For commercial and industrial clients, the need for dependable security solutions is non-negotiable.

This criticality means customers are often less sensitive to price when DOM Security's offerings are perceived as superior and indispensable. For instance, in 2024, the global security market, encompassing access control, was valued at over $100 billion, highlighting the significant investment businesses make in these essential systems.

- High Switching Costs: Implementing and integrating DOM Security's systems can involve significant upfront investment and technical expertise, making it costly and disruptive for customers to switch to a competitor.

- Essential Nature of Products: DOM Security's solutions are often integral to a customer's core operations, particularly in sectors like healthcare, finance, and critical infrastructure, where security breaches have severe consequences.

- Perceived Product Differentiation: When DOM Security offers advanced features, superior reliability, or specialized solutions that competitors cannot easily match, customers are less likely to have readily available substitutes, thereby reducing their bargaining power.

- Impact on Customer Operations: The direct link between DOM Security's products and a customer's safety, compliance, and operational continuity means that compromising on quality for price becomes a substantial risk for the customer.

The bargaining power of customers for DOM Security is generally moderate, influenced by customer segmentation and product type. Large clients with significant order volumes and specialized needs possess more leverage, particularly for complex integrated systems where switching costs are high. Conversely, individual residential customers have limited individual power, though their collective market share is substantial. Increased transparency in pricing and product comparisons online has also empowered buyers.

DOM Security's products are often critical for operational efficiency and compliance, making customers less price-sensitive for superior or indispensable solutions. For example, the global security market, including access control, was valued at over $100 billion in 2024, indicating substantial business investment in these essential systems.

High switching costs, the essential nature of security products, and perceived product differentiation by DOM Security all contribute to reducing customer bargaining power. The risk of operational disruption or security breaches makes customers hesitant to compromise on quality for price.

| Customer Segment | Bargaining Power Factors | Impact on DOM Security |

|---|---|---|

| Large Commercial/Industrial | High volume, specialized needs, high switching costs | Moderate to High leverage on pricing and customization |

| Residential | Low individual volume, low switching costs for basic products | Low individual leverage, collective influence |

| Government/Institutional | Potential for backward integration, critical security needs | Moderate leverage, particularly for bespoke solutions |

What You See Is What You Get

DOM Security Porter's Five Forces Analysis

This preview shows the exact DOM Security Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape, including threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry, all presented in a comprehensive, ready-to-use format.

Rivalry Among Competitors

The physical security market is a battleground, teeming with a diverse array of competitors. From global giants to niche specialists, companies like DOM Security face constant pressure. This intense rivalry is fueled by a market poised for substantial growth, with projections showing it reaching USD 120.83 billion by 2025 and a remarkable USD 196.07 billion by 2032.

This significant market expansion, driven by escalating security needs and rapid technological innovation, naturally intensifies the competition among established players. Companies are constantly innovating and vying for market share, making it a dynamic and challenging environment for all participants.

Competitive rivalry in the security sector is intense, driven by a rapid pace of product differentiation and innovation. Companies like DOM Security are heavily invested in developing advanced digital locking systems and sophisticated access control solutions. This push is fueled by the integration of cutting-edge technologies such as artificial intelligence (AI), the Internet of Things (IoT), and biometrics, all of which are becoming increasingly standard in the market.

DOM Security's strategy of offering integrated solutions, spanning from traditional mechanical systems to modern digital ones, necessitates substantial and ongoing research and development (R&D) expenditures. This commitment is crucial for distinguishing its product portfolio from that of competitors. Many rivals are also actively introducing their own innovative products, making it a constant challenge to maintain a competitive edge and capture market share through unique value propositions.

The physical security and access control markets are experiencing robust growth, with access control alone anticipated to reach USD 15.07 billion by 2025. This expansion naturally draws in new competitors, intensifying the rivalry among existing players.

Companies like DOM Security are actively pursuing strategic acquisitions to bolster their market standing. For instance, DOM Security's acquisition of Viro in 2023 exemplifies this trend, demonstrating a proactive approach to consolidating market share and enhancing competitive capabilities in a dynamic environment.

Converging Technologies and Solution Integration

The security industry is witnessing a significant trend where physical security and cybersecurity are merging, with components being integrated into single, cohesive systems. This convergence means competitors are increasingly offering unified solutions and cloud-based platforms. For DOM Security, this necessitates ensuring its products can easily connect with other security systems and deliver intelligent automation.

For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting the growing importance of integrated solutions. Companies like Axis Communications and Genetec are actively promoting their converged physical and cybersecurity offerings. This competitive pressure requires DOM Security to adapt its strategy to remain competitive in a landscape where comprehensive, interconnected security is becoming the norm.

- Convergence of Physical and Cyber Security: A major industry shift is the integration of physical security (like access control) with cybersecurity measures, creating more robust protection.

- Cloud-Based and Integrated Systems: Competitors are heavily investing in cloud-based platforms and unified security management systems, offering end-to-end solutions.

- Market Demand for Automation: There's a growing customer expectation for intelligent automation and seamless integration across different security technologies.

- Competitive Landscape: Companies like Genetec and Milestone Systems are leading in offering integrated physical and cybersecurity solutions, setting a high bar for DOM Security.

Global and Regional Market Dynamics

The competitive landscape for DOM Security is intensely shaped by both global and regional forces. While the physical security market is inherently global, regional nuances significantly impact competitive dynamics. In 2024, North America led the physical security market, capturing more than 37% of worldwide revenue, highlighting the importance of regional market penetration.

DOM Security, with its established position in the European locking solutions sector, encounters robust competition. This rivalry comes from large, multinational corporations with broad product portfolios and extensive distribution networks, as well as formidable regional competitors who possess deep understanding of local market needs and regulatory environments. Navigating this complex competitive terrain requires DOM Security to develop and implement distinct strategies tailored to the unique characteristics of each geographical market it serves.

- North America's Dominance: In 2024, North America accounted for over 37% of the global physical security market revenue.

- European Strength: DOM Security has a strong foothold in the European locking solutions market.

- Dual Competitive Threat: Rivalry stems from both global security giants and potent regional players.

- Strategic Imperative: Tailored market strategies are crucial for success across diverse geographical regions.

Competitive rivalry is a defining characteristic of the physical security market, impacting companies like DOM Security. The sector's growth, projected to reach USD 196.07 billion by 2032, attracts numerous players, from global conglomerates to specialized firms. This intense competition is further amplified by the rapid pace of technological integration, such as AI and IoT, pushing companies to continuously innovate their offerings.

DOM Security's strategy of offering integrated mechanical and digital security solutions requires significant R&D investment to differentiate itself from rivals. The market's expansion, with access control alone expected to hit USD 15.07 billion by 2025, also invites new entrants, intensifying existing rivalries. Strategic acquisitions, like DOM Security's purchase of Viro in 2023, are key tactics to consolidate market position.

The convergence of physical and cybersecurity is a major trend, with companies like Axis Communications and Genetec offering unified solutions. This necessitates that DOM Security ensures its products integrate seamlessly with other security systems and leverage intelligent automation to remain competitive. North America, which led the physical security market with over 37% of global revenue in 2024, underscores the importance of regional market penetration for all players.

| Key Competitor Metric | 2024 Data/Projection | Impact on DOM Security |

| Global Physical Security Market Growth | Projected to reach USD 196.07 billion by 2032 | Intensifies rivalry as market expands |

| Access Control Market Size | Projected to reach USD 15.07 billion by 2025 | Attracts new entrants, increasing competition |

| North America Market Share | Over 37% of global revenue in 2024 | Highlights need for strong regional strategies |

| Technological Integration (AI, IoT) | Increasingly standard in product offerings | Requires continuous R&D investment for differentiation |

SSubstitutes Threaten

The most significant threat of substitutes for DOM Security stems from the relentless advancement of security technology. Traditional mechanical and electromechanical locks are increasingly being replaced by sophisticated smart and digital security systems.

The growing integration of smart home technologies and the proliferation of Internet of Things (IoT) enabled devices present a clear substitution risk, potentially diverting consumer preference away from purely mechanical security solutions. For instance, the global smart lock market was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a substantial shift towards digital alternatives.

The increasing prevalence of software-based and cloud-native security solutions poses a significant threat of substitution for traditional hardware-focused access control systems. Cloud-based access control and SaaS models are gaining traction due to their inherent advantages in remote management, enhanced scalability, and seamless integration capabilities. For instance, the global cloud access control market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear customer preference shift towards these more flexible and digitally integrated solutions.

These software-centric alternatives allow for greater agility and often come with subscription-based pricing, which can be more attractive than upfront hardware investments for some businesses. While physical locking hardware remains a fundamental component of security, the ability to manage and control access entirely through software interfaces, offering features like real-time monitoring and audit trails, directly substitutes the need for extensive physical hardware deployments in certain use cases.

The rise of DIY security solutions and mobile credentials presents a significant threat of substitutes for traditional access control systems like those offered by DOM Security. These alternatives are becoming increasingly sophisticated and accessible, appealing to a segment of the market that prioritizes cost savings and ease of use. For example, the global smart home security market, which includes many DIY options, was projected to reach over $60 billion by 2024, indicating a substantial and growing alternative for consumers.

Multi-Factor Authentication and Biometric Advancements

The increasing sophistication of multi-factor authentication (MFA) and biometric technologies presents a significant threat of substitution for traditional access control methods, including those offered by DOM Security. As these advanced authentication solutions become more widespread and cost-effective, they can directly replace existing systems that rely on physical keys or less secure digital credentials. For instance, by 2024, the global market for biometrics in identity verification was projected to reach over $10 billion, highlighting the rapid adoption and potential for these technologies to displace older security paradigms.

The continuous innovation in biometrics, such as fingerprint, facial, and iris recognition, along with the development of more robust MFA protocols, offers enhanced security and user experience. This makes them attractive alternatives for businesses and individuals seeking to upgrade their security infrastructure. For example, studies in 2023 indicated a significant reduction in unauthorized access incidents for organizations that implemented advanced MFA compared to those relying solely on passwords.

The threat of substitutes is amplified by the accessibility of these new technologies. Companies are increasingly integrating these advanced authentication methods into their product offerings, making them readily available and potentially more appealing than legacy systems. This trend suggests that DOM Security must continually innovate to remain competitive against these evolving, high-security alternatives.

- Biometric Market Growth: The global biometrics market is expanding rapidly, with projections indicating continued strong growth through 2025.

- MFA Adoption Rates: Increased adoption of MFA by organizations globally is a key indicator of its effectiveness as a substitute for less secure methods.

- Technological Advancements: Continuous improvements in the accuracy, speed, and security of biometric and MFA technologies make them increasingly viable substitutes.

- Cost-Effectiveness: As these technologies mature, their cost-effectiveness improves, lowering the barrier to adoption for a wider range of users.

Integrated Building Management Systems

The rise of integrated building management systems (BMS) presents a significant threat of substitutes for DOM Security. As buildings increasingly adopt unified platforms that control everything from HVAC and lighting to security, customers may opt for a single vendor for all building operations. This trend could divert spending away from specialized security providers.

For instance, in 2024, the global smart building market, which heavily features integrated BMS, was valued at approximately $80 billion, with projections indicating continued robust growth. Companies offering comprehensive smart building solutions, rather than just security, can become attractive alternatives.

- Integrated BMS as a Substitute: Customers might choose a single, comprehensive BMS provider, reducing the need for separate, specialized security systems.

- Interoperability is Key: DOM Security must ensure its solutions can seamlessly integrate with various BMS platforms to avoid being sidelined.

- Smart Building Market Growth: The expanding smart building sector, valued at tens of billions of dollars annually, highlights the increasing demand for integrated solutions.

The threat of substitutes for DOM Security is substantial, driven by the rapid evolution of technology and changing consumer preferences. Traditional mechanical locks face direct competition from smart locks and IoT-enabled devices, a market segment that saw significant growth in 2023 and is expected to continue expanding. Furthermore, the increasing adoption of software-based access control and cloud-native solutions offers greater flexibility and scalability, appealing to a market seeking integrated digital management. These advancements in digital security directly substitute the need for purely hardware-based solutions in many applications.

| Technology Substitute | 2023 Market Value (Approx.) | Projected Growth Driver |

|---|---|---|

| Smart Locks | $3.5 billion | Increased smart home adoption and convenience |

| Cloud Access Control | $2.5 billion | Demand for remote management and scalability |

| Biometrics in Identity Verification | Over $10 billion (projected by 2024) | Enhanced security and user experience |

Entrants Threaten

The security industry, especially for manufacturers like DOM Security that innovate across mechanical, electromechanical, and digital locking systems, demands substantial upfront capital. This includes significant investment in advanced manufacturing equipment, ongoing research and development for new technologies, and the protection of intellectual property through patents.

These high capital requirements act as a considerable barrier, deterring potential new competitors. For instance, establishing a state-of-the-art manufacturing facility for precision security components can easily run into tens of millions of dollars, a sum that many new businesses simply cannot afford to raise.

DOM Security benefits from an established brand reputation and customer trust in a market where security and reliability are paramount. This is crucial, as a 2024 survey indicated that 78% of consumers prioritize brand trust when purchasing security products.

New entrants face the significant challenge of building similar credibility, a process that is both lengthy and expensive. For instance, achieving widespread brand recognition in the security sector can take years and substantial marketing investment, often exceeding millions of dollars.

Customers in the security sector are typically risk-averse, preferring proven solutions from trusted providers. This preference creates a substantial hurdle for newcomers, as convincing customers to switch from established, reliable brands requires overcoming deeply ingrained purchasing habits and a fear of compromise.

New companies entering the security market face significant hurdles in accessing established distribution channels, such as wholesalers, system integrators, and specialized sales teams catering to residential, commercial, and industrial sectors. DOM Security's existing relationships and network provide a crucial advantage, making it challenging for newcomers to reach their target customers efficiently.

DOM Security's established installation and maintenance service network represents another formidable barrier. Building a comparable infrastructure, including trained technicians and logistical support, requires substantial investment and time, which new entrants may struggle to match, thus limiting their ability to offer comprehensive solutions.

Regulatory Compliance and Industry Standards

The security industry, especially for high-security products and digital data protection, is heavily regulated. New companies must navigate a complex web of national and international compliance requirements, which can be a significant hurdle.

Meeting these standards requires substantial investment in testing, certification processes, and legal counsel. For instance, obtaining certifications like ISO 27001 for information security management can take months and cost tens of thousands of dollars, a cost that can deter smaller, less-resourced new entrants.

- Regulatory Burden: Compliance with standards like GDPR, CCPA, and various national security directives demands dedicated resources.

- Certification Costs: Obtaining key industry certifications, crucial for market access, can range from $10,000 to over $50,000 annually depending on the scope.

- Legal and Expertise Investment: New entrants often lack the in-house legal and compliance expertise to navigate these intricate requirements efficiently.

- Market Access Barriers: Failure to meet specific regulatory or certification standards can outright prevent a new company from participating in certain market segments, such as government contracts or critical infrastructure security.

Technological Complexity and Rapid Innovation

The technological complexity and rapid pace of innovation within the security sector act as a significant barrier to new entrants. Developing sophisticated access control systems, encompassing everything from mechanical locks to cutting-edge digital and biometric technologies, demands substantial investment in research and development, as well as a highly skilled engineering workforce. For instance, the global smart lock market, a key segment of DOM Security's offerings, was valued at approximately $3.5 billion in 2023 and is projected to grow substantially, indicating the capital required to compete.

New players entering the DOM Security market must not only replicate existing technological capabilities but also demonstrate a clear roadmap for future advancements. This includes integrating emerging technologies like artificial intelligence for threat detection, the Internet of Things for connected security ecosystems, and cloud computing for scalable data management. Failure to invest in and innovate with these technologies, which are increasingly expected by consumers and businesses alike, would render a new entrant uncompetitive.

- High R&D Investment: Companies need significant capital for ongoing research into new security technologies.

- Skilled Workforce Requirement: Expertise in areas like cryptography, AI, and cybersecurity is essential.

- Rapid Obsolescence: Existing technologies can quickly become outdated, necessitating continuous upgrades.

- Integration Challenges: Seamlessly integrating diverse technologies (mechanical, digital, biometric) is complex.

The threat of new entrants for DOM Security is moderate, primarily due to substantial capital requirements for advanced manufacturing and R&D. For example, establishing a state-of-the-art facility for precision security components can cost tens of millions of dollars. Furthermore, building brand trust and credibility in a risk-averse market takes considerable time and marketing investment, often exceeding millions of dollars.

Access to established distribution channels and service networks presents another significant barrier. New companies struggle to match DOM Security's existing relationships and infrastructure, which are crucial for reaching target customers and offering comprehensive solutions. The complex regulatory landscape and the need for costly certifications, potentially ranging from $10,000 to over $50,000 annually, also deter smaller players.

Finally, the rapid pace of technological innovation, requiring continuous investment in areas like AI and IoT, and the need for a highly skilled workforce create further entry barriers. The global smart lock market, for instance, was valued at approximately $3.5 billion in 2023, highlighting the investment needed to compete in key segments.

Porter's Five Forces Analysis Data Sources

Our DOM Security Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and cybersecurity threat intelligence platforms.