Digital Media Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Media Solutions Bundle

Digital Media Solutions faces a dynamic landscape shaped by intense rivalry and the looming threat of new entrants, while buyer power can shift rapidly depending on market trends. Understanding these forces is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Digital Media Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Digital Media Solutions (DMS) depends heavily on data to fine-tune its performance marketing efforts. The bargaining power of data providers can be substantial, particularly when it comes to unique or proprietary datasets essential for precise audience targeting.

This influence is shaped by factors such as the quality of the data, its exclusivity, and how easily DMS can switch to alternative data sources. For instance, in 2024, the market for first-party data, which is often more exclusive, saw increased demand, potentially bolstering the supplier's position.

Digital media solutions (DMS) often rely heavily on specialized technology and software vendors for their core platforms, including data analytics, ad serving, and content management. This reliance means suppliers of unique, high-performance software, especially those incorporating advanced AI and machine learning, can wield significant bargaining power. For instance, a DMS using a proprietary AI-driven audience segmentation tool developed by a single vendor faces higher switching costs and greater supplier influence compared to one using more commoditized, readily available solutions.

Publishers and media owners are crucial suppliers for performance marketing companies like DMS, providing the essential ad inventory. Their bargaining power is significant when they command large, highly engaged user bases or offer exclusive, high-impact ad placements that are difficult for competitors to replicate.

The digital media landscape's fragmentation plays a dual role; while it can dilute the power of smaller publishers, it amplifies the influence of those with substantial reach or unique content. For instance, in 2024, major social media platforms and premium content publishers continue to hold considerable sway due to their massive, loyal audiences, allowing them to dictate terms for ad space.

Talent (Skilled Professionals)

The digital media and performance marketing sector thrives on specialized skills. Professionals adept in data science, artificial intelligence (AI), ad technology, and strategic digital planning are in high demand. This intense need for expertise, especially in cutting-edge fields like AI and machine learning, significantly bolsters the bargaining power of these skilled individuals.

The scarcity of top-tier talent directly translates into higher compensation expectations and more favorable working conditions for these professionals. For companies like Digital Media Solutions (DMS), attracting and retaining these individuals is paramount to maintaining a competitive advantage and driving innovation in a rapidly evolving market.

- High Demand for AI/ML Specialists: The global demand for AI and machine learning talent saw a significant surge in 2024, with job postings for these roles increasing by an estimated 35% compared to the previous year, according to industry reports.

- Data Scientist Salaries: In 2024, the average salary for a data scientist in the digital media industry ranged from $120,000 to $180,000 annually, reflecting the specialized nature of their skills.

- Talent Retention Challenges: Companies in the digital media space reported an average employee turnover rate of 18% in 2024, largely attributed to competitive offers from other firms seeking specialized digital marketing expertise.

- Impact on Project Costs: The high cost of acquiring and retaining specialized talent can add 10-15% to the overall project costs for digital media solutions providers.

Cloud Infrastructure Providers

Digital Media Solutions (DMS) relies heavily on cloud infrastructure providers, making their bargaining power significant. The sheer volume of data and applications involved in digital media means that switching providers incurs substantial costs and technical challenges, limiting DMS's ability to negotiate aggressively.

The critical need for scalability and robust security features offered by these providers further solidifies their strong position. For instance, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominate the market, with AWS holding approximately 31% of the cloud infrastructure market share as of early 2024. This concentration of power means DMS has fewer viable alternatives, enhancing the suppliers' leverage.

- High Switching Costs: Migrating terabytes of digital media assets and complex operational software between cloud platforms can cost millions and take months, deterring frequent provider changes.

- Market Concentration: The top three cloud providers control a significant majority of the global cloud infrastructure market, reducing competition and increasing their pricing power.

- Essential Services: Cloud providers offer crucial services like data storage, processing, content delivery networks (CDNs), and AI/ML capabilities that are fundamental to DMS's operations and innovation.

The bargaining power of suppliers in digital media solutions (DMS) is significant, particularly for providers of unique data, specialized software, and premium ad inventory. For instance, in 2024, the demand for exclusive first-party data increased, strengthening suppliers' positions. Similarly, cloud infrastructure providers like AWS, holding around 31% of the market in early 2024, exert considerable influence due to high switching costs and the essential nature of their services.

The scarcity of specialized talent, such as AI/ML experts, also empowers these individuals, driving up compensation and retention challenges for DMS. The global demand for AI and machine learning talent saw a 35% surge in job postings in 2024, with data scientists earning between $120,000 and $180,000 annually.

Major publishers and social media platforms, controlling vast and engaged audiences, can dictate terms for ad placements, amplifying their supplier power. This dynamic is evident as these platforms continue to command premium pricing for their reach and targeting capabilities.

| Supplier Category | Key Factors Influencing Power | 2024 Data/Trends |

|---|---|---|

| Data Providers | Data exclusivity, quality, availability of alternatives | Increased demand for first-party data |

| Software Vendors | Proprietary technology, switching costs, AI/ML integration | High reliance on specialized AI tools |

| Publishers/Media Owners | Audience size and engagement, ad placement exclusivity | Major platforms maintain significant influence |

| Talent Pool | Demand for specialized skills (AI/ML, Data Science) | 35% surge in AI/ML job postings; Data Scientist salaries $120k-$180k |

| Cloud Infrastructure | Market concentration, switching costs, essential services | AWS market share ~31%; High migration costs |

What is included in the product

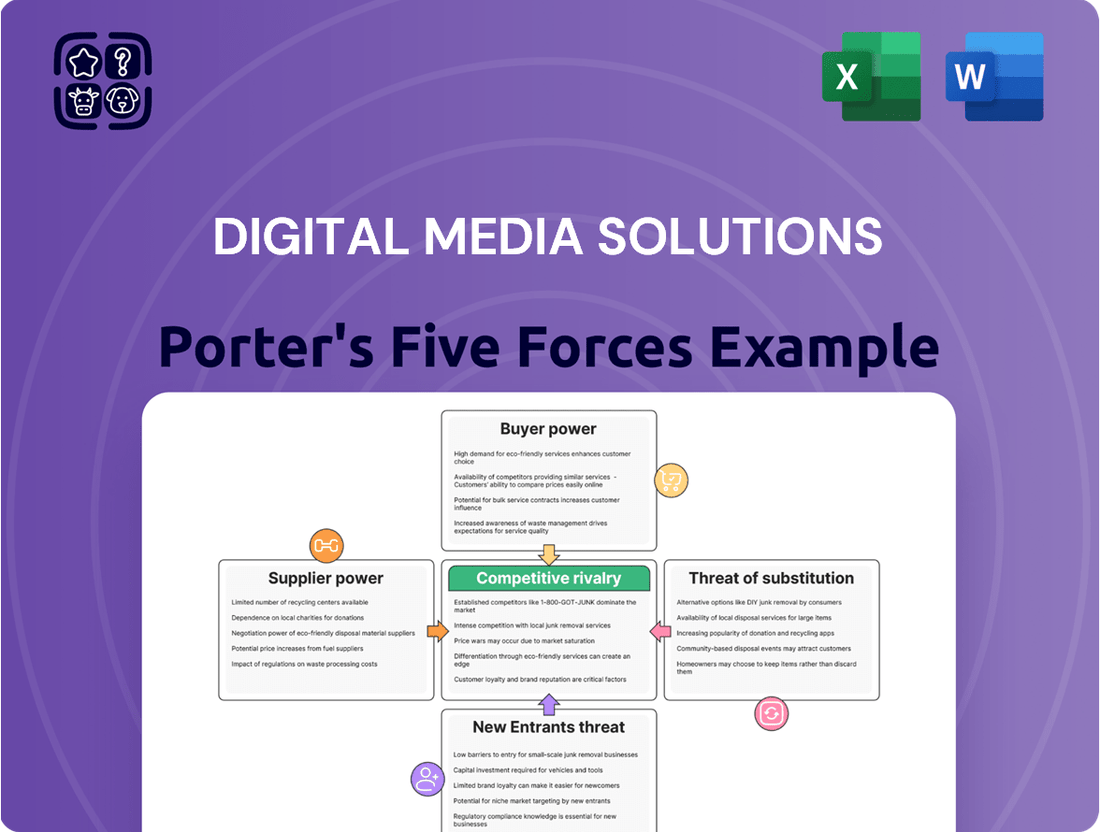

This analysis dissects the competitive forces shaping the digital media solutions market, from buyer and supplier power to the threat of new entrants and substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Digital Media Solutions (DMS) faces considerable bargaining power from its large enterprise clients, particularly within sectors like insurance, financial services, and education. These clients represent substantial portions of DMS's revenue, often wielding significant advertising budgets that allow them to negotiate favorable terms. For instance, a major insurance company might allocate tens of millions of dollars annually to digital advertising, giving them leverage to demand customized solutions and competitive pricing from DMS.

The sheer volume of business these large enterprises provide means they can exert pressure on DMS through demands for bespoke features, tailored reporting, and preferential service levels. Their capacity to switch to alternative digital media providers or even develop in-house marketing capabilities presents a direct threat to DMS's market position and pricing power. In 2024, the trend of large enterprises consolidating their digital marketing spend with fewer, more strategic partners further amplifies this customer bargaining power.

Digital Media Solutions (DMS) serves around 4,550 small and medium-sized businesses (SMBs). While individual SMBs usually have less sway than larger corporations, the sheer volume of these businesses can create a collective impact. Their bargaining power is often constrained by their need for affordable, trackable digital advertising and their typically limited internal marketing expertise.

Digital Media Solutions (DMS) operates in sectors like insurance and education, where clients have unique regulatory and marketing needs. This specialization means customers often require tailored solutions that generic providers can't offer.

The bargaining power of these clients is somewhat tempered by the need for specialized expertise and strict compliance. For instance, the insurance industry demands adherence to data privacy laws like GDPR and CCPA, which can make switching providers complex and costly, thereby reducing customer leverage.

In 2024, the demand for compliant digital marketing in regulated industries remained high, with companies like those in financial services and healthcare investing significantly in secure and privacy-focused solutions. This trend suggests that customers with highly specific, compliance-driven needs may exhibit lower bargaining power when they find a provider that perfectly meets those demands.

Measurable Results and ROI Demands

Performance marketing clients, by their very nature, are intensely focused on measurable results and a demonstrable return on investment (ROI). This characteristic significantly amplifies customer bargaining power. Digital Media Solutions' (DMS) core value is directly linked to its ability to execute campaigns that are not only scalable and cost-effective but also, crucially, measurable.

Clients can readily evaluate the efficacy of campaigns and have a low barrier to switching vendors if performance benchmarks aren't met. For instance, in 2024, the average client in the digital advertising space expects to see a minimum 3:1 ROI on their ad spend, with many demanding higher figures. This pressure forces DMS to constantly innovate and prove its worth through tangible outcomes.

- Measurable Outcomes: Clients prioritize campaigns with clear Key Performance Indicators (KPIs) like cost per acquisition (CPA) and click-through rates (CTR).

- ROI Scrutiny: In 2024, many businesses are scrutinizing ad spend more than ever, demanding quantifiable financial returns.

- Switching Costs: The relative ease of switching between digital media providers, coupled with the demand for measurable results, empowers clients.

- Performance Benchmarking: Clients can easily compare DMS's performance against industry averages and competitors, further strengthening their negotiating position.

Access to In-House Capabilities or Other Agencies

Customers in the digital media solutions space possess significant bargaining power due to their ability to develop in-house digital marketing capabilities or to readily switch to numerous other performance marketing agencies. This accessibility to alternatives, coupled with the relative ease of transitioning between providers, amplifies customer leverage, particularly within the highly competitive digital advertising landscape.

The digital media solutions market in 2024 saw a robust demand for specialized services, yet the proliferation of agencies offering everything from SEO to social media management meant clients had ample choice. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, indicating a vast number of potential service providers vying for client attention.

- Client Retention Challenges: Agencies face pressure to consistently deliver measurable results to prevent clients from exploring in-house options or competitor agencies.

- Price Sensitivity: The availability of multiple agencies and the option for self-sufficiency can drive down prices as providers compete for market share.

- Demand for Flexibility: Clients often seek flexible contracts and service packages, leveraging their power to dictate terms that suit their evolving needs.

Customers in digital media solutions wield considerable power, especially large enterprises with substantial ad budgets. Their ability to demand tailored services, negotiate pricing, and threaten to switch providers or develop in-house capabilities puts pressure on DMS. In 2024, the trend of large clients consolidating their spending further amplified this leverage.

Performance-focused clients, driven by measurable ROI, can easily assess campaign effectiveness and switch vendors if benchmarks aren't met. For instance, many businesses in 2024 expected at least a 3:1 ROI on ad spend, compelling DMS to continuously prove its value through tangible outcomes.

The sheer volume of digital media solution providers in 2024, with the global digital advertising market exceeding $600 billion, offers clients numerous alternatives. This competitive landscape, coupled with the ease of switching, empowers customers to seek flexible terms and drive down prices.

| Factor | Impact on DMS | 2024 Data/Trend |

|---|---|---|

| Client Size & Budget | High leverage for large clients | Large enterprises often control tens of millions in ad spend. |

| Performance Focus | DMS must demonstrate clear ROI | Clients expect a minimum 3:1 ROI on ad spend. |

| Availability of Alternatives | Increased price sensitivity and demand for flexibility | Global digital ad market > $600 billion in 2024, indicating many providers. |

| In-house Capabilities | Potential for clients to reduce reliance on agencies | Growing trend for businesses to explore internal digital marketing teams. |

Preview Before You Purchase

Digital Media Solutions Porter's Five Forces Analysis

This preview showcases the complete Digital Media Solutions Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professional analysis you'll receive instantly after purchase, ensuring no surprises and immediate usability. You're looking at the actual, fully formatted document, ready to be downloaded and applied to your strategic planning.

Rivalry Among Competitors

The digital media solutions landscape is characterized by intense competition, with a vast array of companies vying for dominance. This fragmentation means that while established giants exist, numerous smaller, specialized firms also operate, fostering a dynamic environment where innovation is constant. For instance, the global digital advertising market alone was projected to reach over $600 billion in 2024, highlighting the sheer scale and the numerous participants competing within it.

The digital media solutions landscape is defined by relentless technological evolution, particularly in areas like artificial intelligence and machine learning. These advancements are fundamentally reshaping how advertisements are created, how workflows are managed, and how personalized experiences are delivered to consumers. For instance, AI-powered tools are now capable of generating ad copy and visuals, streamlining production processes that once took weeks into mere hours.

This constant innovation fuels intense competitive rivalry. Companies in this sector are compelled to make significant and ongoing investments in research and development simply to maintain their footing. The primary driver of this rivalry is the race to develop and deploy the most sophisticated and effective solutions, offering clients a distinct advantage in reaching and engaging their target audiences.

The financial implications are substantial; in 2024, major players in the digital advertising technology space, such as Google and Meta, continued to allocate billions of dollars towards R&D, with a significant portion dedicated to AI initiatives. This investment is crucial as companies vie to offer cutting-edge personalization engines and automated creative optimization, directly impacting client campaign performance and, consequently, market share.

The digital media solutions (DMS) landscape is highly competitive, often forcing companies to lower prices to attract clients. This intense rivalry directly impacts profit margins, as businesses vie to offer the most cost-effective solutions. For instance, the global digital advertising market, a key sector for DMS, was projected to reach approximately $685 billion in 2024, with significant portions driven by performance-based models.

Performance marketing, a core offering for many DMS providers, inherently focuses on measurable outcomes and return on investment (ROI). This emphasis on quantifiable results creates a competitive environment where providers are pressured to demonstrate efficiency, which can squeeze margins. Companies are constantly seeking ways to optimize campaigns and reduce customer acquisition costs to maintain profitability.

To counter this commoditization pressure, Digital Media Solutions must continually prove its unique value proposition. Simply delivering clicks or impressions is no longer enough; demonstrating a clear impact on client business objectives, such as increased sales or brand loyalty, is crucial. In 2024, clients are increasingly demanding transparency and demonstrable ROI, pushing DMS firms to innovate and differentiate beyond basic performance metrics.

Consolidation and M&A Activity

The digital media solutions market is actively consolidating. In 2023, global M&A deal volume in the media and entertainment sector reached $124 billion, demonstrating a strong appetite for strategic acquisitions. This trend is driven by larger companies seeking to absorb smaller, innovative firms to enhance their technological capabilities and expand their market reach.

This ongoing consolidation intensifies competitive rivalry. As market structures evolve with the emergence of more powerful entities through mergers, existing players face increased pressure to innovate and compete effectively. For instance, the acquisition of smaller ad-tech firms by major platforms aims to consolidate market power and control over advertising inventory.

- Market Consolidation: The digital media landscape is characterized by significant merger and acquisition (M&A) activity.

- Strategic Acquisitions: Larger companies are acquiring smaller, innovative players to gain market share, advanced technology, and specialized expertise.

- Increased Rivalry: These M&A activities reshape market structures, leading to heightened competition among emerging dominant entities.

- 2023 Data: Global M&A deal volume in the media and entertainment sector was approximately $124 billion in 2023, underscoring the active consolidation trend.

Differentiated Offerings and Specialization

Companies in the digital media solutions sector often carve out their competitive advantage through unique offerings and focused expertise. For instance, some players distinguish themselves by leveraging proprietary data analytics platforms or specialized technological capabilities. This specialization can be particularly effective in niche markets, such as the insurance or education sectors, where tailored solutions are highly valued.

The degree of rivalry is significantly influenced by how easily competitors can mimic these differentiating factors. If a competitor can replicate a proprietary data set or a specialized technology, the advantage diminishes. Conversely, if these differentiators are truly unique and difficult to reproduce, they can create a more sustainable competitive moat, thereby moderating the intensity of rivalry.

- Proprietary Data: Firms invest heavily in data collection and analysis to offer unique insights, a key differentiator.

- Technological Innovation: Development of unique algorithms or platforms provides a competitive edge.

- Vertical Specialization: Focusing on specific industries like healthcare or finance allows for deeper expertise and tailored solutions.

- Replicability: The ease with which competitors can copy these specializations directly impacts the intensity of rivalry.

Competitive rivalry in digital media solutions is fierce, driven by rapid technological advancements and a crowded marketplace. Companies must constantly innovate and invest in R&D to stay ahead. For example, the global digital advertising market was projected to exceed $600 billion in 2024, indicating the high stakes and numerous players involved.

This intensity is further fueled by the need for demonstrable ROI, pushing providers to optimize campaigns and reduce costs, which can pressure profit margins. The trend of market consolidation, with $124 billion in media and entertainment M&A in 2023, also reshapes the competitive landscape, creating larger entities that intensify rivalry for remaining players.

| Key Factor | Description | Impact on Rivalry | 2024 Projection/Data |

|---|---|---|---|

| Market Size | Vast and growing digital media solutions market. | Attracts numerous competitors, increasing rivalry. | Global digital advertising market projected over $600 billion. |

| Technological Change | Rapid evolution of AI, machine learning, and other tools. | Forces continuous investment in R&D, creating a race for innovation. | AI adoption in ad creative generation is rapidly increasing. |

| Consolidation | Mergers and acquisitions are common. | Emergence of larger players intensifies competition for others. | Media & Entertainment M&A reached $124 billion in 2023. |

| Differentiation | Reliance on proprietary data, tech, or niche specialization. | Rivalry intensity depends on how easily these differentiators can be replicated. | Specialized solutions for sectors like healthcare are in demand. |

SSubstitutes Threaten

While digital media solutions are increasingly prevalent, traditional advertising channels such as television, radio, print, and outdoor advertising continue to serve as viable substitutes. These channels, though often less precisely measurable than their digital counterparts, possess the capability to reach vast and diverse audiences, presenting a latent threat to digital media's dominance, particularly for broad brand awareness initiatives.

For instance, in 2024, television advertising, despite its challenges, still commanded a significant portion of global ad spend, estimated to be around $140 billion. Similarly, radio advertising maintained its presence, with global revenues projected to reach approximately $20 billion in 2024. This continued investment underscores their persistent appeal for reaching certain demographics and achieving widespread recognition, acting as a substitute for purely digital strategies.

Companies increasingly opt for in-house marketing teams, bypassing external agencies. This trend is particularly strong among larger corporations seeking direct control over their digital advertising budgets and proprietary data, a significant substitute for Digital Media Solutions (DMS).

For instance, a 2024 survey indicated that over 60% of mid-to-large enterprises are either expanding their in-house marketing capabilities or have recently established them, aiming for better campaign agility and cost-efficiency.

This internal development allows businesses to tailor strategies precisely to their brand identity and market nuances, potentially reducing the perceived value proposition of outsourcing to firms like DMS.

Organic marketing strategies, like search engine optimization (SEO) and content marketing, offer an alternative to paid advertising for digital media solutions. These methods build brand authority and customer relationships over time, reducing reliance on direct ad spend.

While organic growth can be slower, its long-term value is significant. For instance, a strong organic social media presence can generate consistent leads without the per-click costs associated with paid campaigns, a key consideration for businesses in 2024.

Direct Sales and Business Development

Businesses can bypass digital media solutions by employing direct sales teams and engaging in traditional business development. This approach is especially potent for B2B markets or companies with high-value, niche products, allowing for personalized customer acquisition and relationship building.

For instance, in 2024, many enterprise software companies continued to rely heavily on direct sales, with a significant portion of their revenue attributed to these channels, demonstrating the enduring strength of personal interaction in closing complex deals. This often involves extensive networking and building direct relationships, which can be more effective than broad digital campaigns for certain segments.

- Direct Sales Effectiveness: B2B companies often find direct sales yield higher conversion rates for complex, high-ticket items.

- Networking as a Substitute: Industry events and personal connections remain crucial for B2B lead generation, offering an alternative to digital outreach.

- Relationship-Driven Markets: Sectors with long sales cycles or requiring deep trust, such as financial services or specialized manufacturing, frequently favor direct engagement.

- Cost-Benefit Analysis: While digital advertising can offer scale, direct sales can provide a more predictable and often higher ROI for specific customer profiles.

Emerging Technologies and Platforms

The digital media landscape is constantly reshaped by emerging technologies, presenting potent substitutes for existing solutions. For instance, the proliferation of retail media networks, which leverage shopper data for targeted advertising, offers an alternative to traditional digital ad placements. By 2024, retail media ad spending was projected to reach $61.1 billion in the US alone, demonstrating a significant shift in advertiser priorities.

Furthermore, advancements in areas like shoppable streaming TV and sophisticated AI-powered conversational agents provide new avenues for consumer engagement and brand interaction. These platforms can directly influence purchasing decisions, potentially diminishing the reliance on established performance marketing channels. The increasing adoption of AI in marketing is expected to grow, with AI in marketing market size estimated to reach $107.3 billion by 2028, indicating a strong trend toward these innovative substitutes.

- Retail Media Networks: Offering targeted advertising leveraging shopper data, projected US spending to reach $61.1 billion in 2024.

- Shoppable Streaming TV: Integrating direct purchase options within video content, enhancing consumer engagement and bypassing traditional ad models.

- AI-Driven Conversational Agents: Providing personalized brand interactions and support, potentially reducing the need for traditional performance marketing.

- AI in Marketing Market Growth: Expected to reach $107.3 billion by 2028, signaling a significant industry trend towards AI-powered solutions.

Traditional advertising channels like television and radio remain significant substitutes, with global TV ad spend estimated around $140 billion in 2024. Businesses also increasingly bring marketing in-house, with over 60% of mid-to-large enterprises expanding these capabilities in 2024 for better control and cost-efficiency.

Organic strategies such as SEO and content marketing offer an alternative to paid digital ads, building long-term authority. Furthermore, direct sales, especially in B2B markets, continue to be effective for high-value products, with many enterprise software companies heavily relying on these channels in 2024.

Emerging technologies also present substitutes, with US retail media ad spending projected to reach $61.1 billion in 2024, offering targeted advertising. Advancements like shoppable streaming TV and AI-driven conversational agents provide new engagement avenues, with the AI in marketing market expected to reach $107.3 billion by 2028.

| Substitute Category | Example | 2024 Relevance/Data |

|---|---|---|

| Traditional Media | Television Advertising | Estimated global ad spend: ~$140 billion |

| Internal Capabilities | In-house Marketing Teams | >60% of mid-to-large enterprises expanding capabilities |

| Organic Strategies | SEO & Content Marketing | Builds authority, reduces per-click costs |

| Direct Engagement | Direct Sales (B2B) | High conversion for complex, high-ticket items |

| Emerging Digital Channels | Retail Media Networks | US ad spending projected: $61.1 billion |

| Emerging Digital Channels | AI in Marketing | Market size projected to reach $107.3 billion by 2028 |

Entrants Threaten

Launching a digital media solutions company, especially one focused on performance marketing like DMS, demands substantial upfront capital. This includes building sophisticated proprietary technology platforms, robust data infrastructure, and advanced analytics tools to effectively compete and deliver results for clients.

The digital advertising market, while expanding, presents a high barrier to entry due to these significant technology and data investment requirements. For instance, companies need to invest heavily in AI-driven ad optimization engines and real-time data processing capabilities, which can easily run into millions of dollars annually.

This substantial capital outlay acts as a formidable deterrent for potential new entrants, effectively limiting the threat of new companies easily entering the performance marketing space and challenging established players like DMS.

The digital media solutions sector demands highly specialized expertise, particularly in areas like ad technology, data science, and performance optimization. This need for skilled professionals acts as a significant barrier for new entrants, as acquiring this knowledge base is both time-consuming and expensive.

Furthermore, attracting and retaining top talent, especially those with advanced skills in artificial intelligence and machine learning, presents a considerable challenge. For instance, in 2024, the demand for AI specialists outstripped supply, leading to salary increases of up to 20% for experienced professionals in the field, making it costly for newcomers to build a competitive team.

Digital Media Solutions (DMS) benefits from exclusive access to proprietary data and deeply entrenched relationships with a distinguished clientele, often referred to as a 'blue-chip client base,' within particular industry sectors. This creates a significant barrier for new competitors.

New entrants would find it exceedingly difficult to replicate DMS's data advantage and cultivate comparable trust and client connections, especially when targeting large enterprise clients who often have complex needs and established vendor partnerships.

Regulatory and Privacy Complexities

The escalating complexity of data privacy regulations, such as GDPR and CCPA, coupled with intense scrutiny of digital advertising, forms a formidable barrier for new entrants in the digital media solutions space. New players must invest heavily in legal counsel and sophisticated technical infrastructure to ensure compliance, a significant hurdle that deters many potential competitors.

For instance, as of early 2024, the global privacy management software market was projected to reach over $3.5 billion, highlighting the substantial investment required for compliance. This regulatory landscape necessitates specialized expertise that startups often lack.

- Significant upfront investment in legal and compliance teams.

- Need for robust data security and privacy infrastructure.

- Risk of substantial fines for non-compliance, estimated to reach billions globally for major violations.

- Constant adaptation to evolving privacy laws and consumer expectations.

Brand Recognition and Reputation

Established digital media solutions providers, such as DMS, leverage significant brand recognition and a history of delivering tangible results, which is a substantial barrier for newcomers. In 2024, advertisers continued to prioritize platforms and partners with a proven ability to demonstrate return on investment (ROI) and maintain high levels of reliability.

New entrants must overcome the considerable hurdle of building trust and credibility in a crowded marketplace. This often requires substantial investment in marketing and sales to even begin competing with established brands that already command advertiser attention and loyalty.

- Brand Loyalty: Advertisers often stick with known entities, making it difficult for new entrants to gain initial traction.

- Reputational Capital: A strong reputation for performance and transparency, built over years, is a key differentiator.

- Trust Factor: In a sector where budget allocation is critical, advertisers lean towards established players they trust to deliver measurable outcomes.

The threat of new entrants in the digital media solutions sector is considerably low due to substantial capital requirements for technology development and data infrastructure. Companies need to invest heavily in AI-driven optimization and real-time data processing, easily costing millions annually, which deters many startups.

Furthermore, the demand for specialized expertise in ad tech, data science, and AI/ML creates a significant barrier. In 2024, the shortage of AI specialists led to salary hikes of up to 20%, making it costly for new firms to build competitive teams.

Established players like DMS also benefit from proprietary data access and strong client relationships, which are difficult for newcomers to replicate, especially with large enterprises valuing trust and proven results.

The evolving landscape of data privacy regulations, such as GDPR and CCPA, necessitates significant investment in legal and technical infrastructure for compliance, adding another layer of difficulty for new entrants. The global privacy management software market's projected growth to over $3.5 billion by early 2024 underscores these compliance costs.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | Building proprietary tech and data infrastructure. | High barrier, requires millions in investment. | AI optimization engines cost millions annually. |

| Specialized Expertise | Need for AI, data science, and ad tech talent. | Expensive to acquire and retain skilled professionals. | AI specialist salaries increased up to 20%. |

| Proprietary Data & Client Relationships | Access to unique data and established client trust. | Difficult to replicate, especially for enterprise clients. | Blue-chip clients have complex, long-term partnerships. |

| Regulatory Compliance | Adherence to evolving privacy laws (GDPR, CCPA). | Requires significant legal and technical investment. | Privacy management software market >$3.5 billion. |

| Brand Recognition & Trust | Proven track record and advertiser loyalty. | New entrants struggle to build credibility and gain traction. | Advertisers prioritize proven ROI and reliability. |

Porter's Five Forces Analysis Data Sources

Our Digital Media Solutions Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from key players, and insights from reputable trade publications. This blend of quantitative and qualitative information allows for a robust assessment of competitive intensity.