Diversified Healthcare Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Healthcare Trust Bundle

Navigate the complex external forces shaping Diversified Healthcare Trust's trajectory with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Equip yourself with actionable intelligence to refine your investment strategy and gain a competitive edge.

Political factors

Changes in government healthcare policies, particularly reimbursement rates for programs like Medicare and Medicaid, directly influence the financial health of healthcare operators, which in turn affects Diversified Healthcare Trust's (DHC) tenants. For instance, a reduction in Medicare reimbursement for skilled nursing facilities could strain tenant finances, potentially impacting rental income for DHC.

Proposed legislative changes and regulatory shifts can also alter the demand for particular healthcare property types, guiding DHC's investment decisions. The healthcare sector is under increasing scrutiny, with recent and proposed legislation aiming for greater oversight and regulation of healthcare Real Estate Investment Trusts (REITs), a trend DHC must navigate.

Congressional leaders and the IRS are intensifying their review of healthcare and hospitality REITs, with a particular focus on tax regulations and the operational impact of taxable REIT subsidiaries. This increased oversight, evident in ongoing discussions and potential legislative proposals throughout 2024 and into 2025, signals a critical juncture for the sector.

Failure to adhere to evolving tax rules could result in substantial penalties, including the potential loss of REIT tax-exempt status, a consequence that could fundamentally alter a REIT's financial structure and operational viability. For Diversified Healthcare Trust (DHC), this means a proactive reassessment of its compliance frameworks is essential to navigate this shifting regulatory landscape.

Broader political stability and economic policies, including fiscal stimulus or austerity measures, can indirectly affect healthcare spending and the real estate market. A stable political environment encourages investment and long-term planning, while uncertainty can lead to caution and reduced capital expenditure in the sector.

The outlook for 2025 anticipates potential interest rate cuts, which could support investment activity. For instance, the US Federal Reserve's monetary policy decisions in 2024 have been closely watched, with projections for potential rate reductions by mid-2025 aiming to stimulate economic growth and potentially lower borrowing costs for real estate investments.

Labor Policy and Workforce Shortages

Government policies significantly shape the healthcare labor landscape. For instance, initiatives aimed at workforce development and immigration reform directly impact the supply of qualified professionals for senior living communities and medical facilities. Labor availability remains a persistent challenge across the U.S. healthcare system, with reports indicating a shortage of registered nurses and other essential personnel.

This ongoing labor scarcity is driving a greater emphasis on technological solutions to mitigate staffing pressures. The American Hospital Association noted in early 2024 that workforce shortages continue to be a top concern for hospitals nationwide. This situation necessitates a strategic focus on retaining existing staff and attracting new talent, often through competitive compensation and benefits packages.

- Government policies on healthcare workforce development and immigration directly influence staffing levels.

- Labor availability remains a critical issue for the U.S. healthcare sector, impacting operational costs and service delivery.

- Technology adoption is increasing as a strategy to address workforce shortages and improve efficiency.

- The demand for healthcare professionals, particularly nurses, is projected to grow significantly in the coming years, exacerbating existing shortages if not addressed proactively.

Public Health Initiatives and Preparedness

Government investments in public health infrastructure and pandemic preparedness, such as the estimated $1.5 trillion in federal healthcare spending in 2024, directly influence the demand for healthcare properties. Policies promoting preventative care and outpatient services are reshaping the market, favoring decentralized facilities. This trend is supported by evolving healthcare delivery models that prioritize patient convenience and cost-effectiveness.

The push towards outpatient services is evident in the projected growth of ambulatory surgery centers, which are expected to see a compound annual growth rate of 6.5% through 2028. Diversified Healthcare Trust's portfolio, with its focus on medical office buildings and outpatient centers, is well-positioned to benefit from these shifts. For instance, the trust's significant holdings in senior housing and life science properties also align with public health trends emphasizing care for aging populations and advancements in medical research.

- Government healthcare spending: In 2024, federal healthcare spending is projected to reach approximately $1.5 trillion.

- Outpatient service growth: Ambulatory surgery centers are anticipated to grow at a CAGR of 6.5% by 2028.

- Decentralized care models: Public health initiatives increasingly support smaller, community-based healthcare facilities.

- Preventative care focus: Policies encouraging preventative health measures can alter demand for specific healthcare property types.

Government policies on healthcare reimbursement, particularly Medicare and Medicaid rates, directly impact Diversified Healthcare Trust's (DHC) tenant financial health and rental income. For example, changes in reimbursement for skilled nursing facilities could strain tenant finances.

Increased scrutiny of healthcare REITs, including tax regulations and taxable REIT subsidiaries, is a significant political factor for DHC. Congressional leaders and the IRS are intensifying their review, with potential legislative proposals in 2024 and 2025 highlighting this trend.

Government initiatives influencing healthcare workforce development and immigration directly affect staffing levels, a critical issue for the sector. Labor availability, especially for nurses, remains a persistent challenge across the U.S. healthcare system, driving technology adoption to mitigate shortages.

Government investments in public health infrastructure and the promotion of outpatient services reshape healthcare property demand. Federal healthcare spending in 2024 is estimated at $1.5 trillion, with ambulatory surgery centers projected to grow at a 6.5% CAGR through 2028, benefiting DHC's portfolio.

What is included in the product

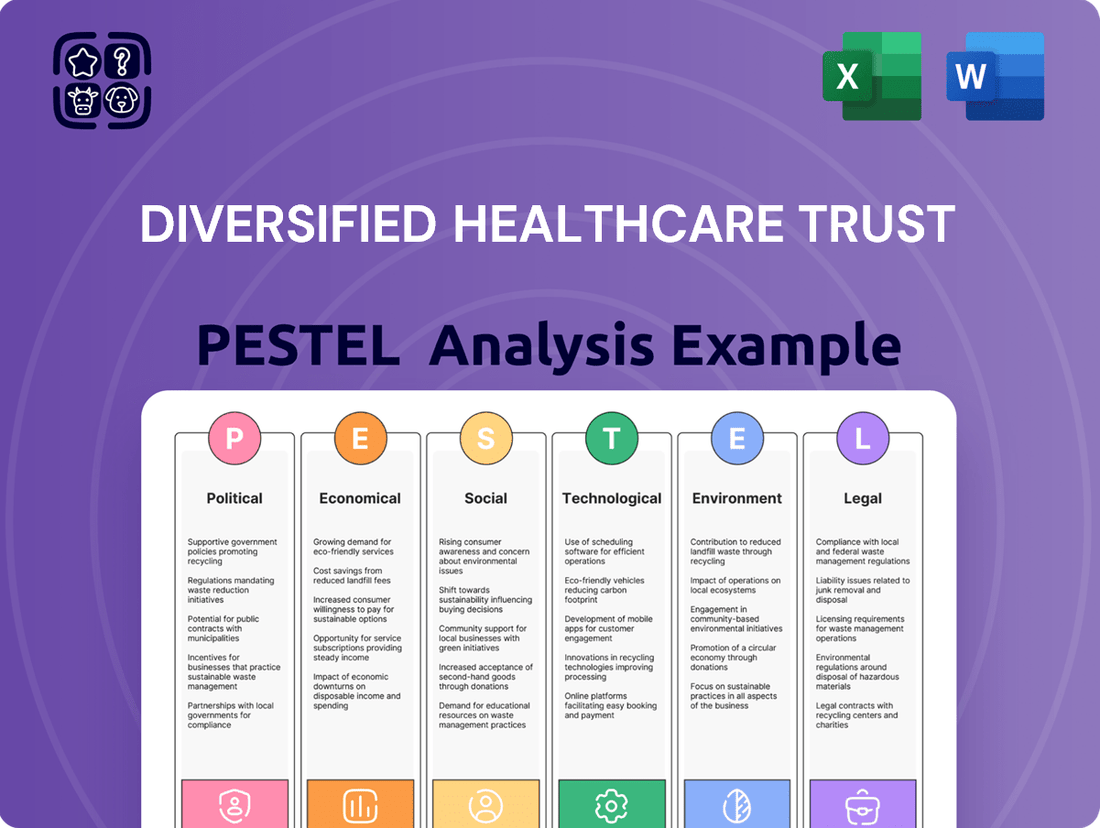

This PESTLE analysis for Diversified Healthcare Trust examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors, providing a comprehensive understanding of the external forces shaping its operations and strategic decisions.

A PESTLE analysis for Diversified Healthcare Trust provides a clear, summarized version of external factors for easy referencing during meetings, alleviating the pain of sifting through complex data.

By visually segmenting the analysis by PESTEL categories, it offers quick interpretation at a glance, relieving the burden of deciphering intricate market dynamics.

Economic factors

The interest rate environment directly impacts Diversified Healthcare Trust's (DHC) financial strategy. Higher rates increase the cost of borrowing for new acquisitions and refinancing existing debt, potentially limiting expansion and increasing interest expenses. For instance, if DHC's average borrowing cost were to rise by 1%, it could add millions to their annual interest payments.

Conversely, a lower interest rate environment makes DHC's real estate assets more attractive to investors and reduces the expense of servicing its debt obligations. This can free up capital for strategic investments. The Federal Reserve's projected rate cuts in 2025 are anticipated to provide a tailwind for DHC's investment plans, particularly in the Medical Outpatient Buildings (MOBs) sector, by lowering the hurdle rate for new projects.

Overall economic growth and consumer spending are critical for Diversified Healthcare Trust (DHC). When the economy is strong, people tend to spend more on healthcare goods and services, which directly benefits DHC's tenants. This increased spending translates to higher revenue for the healthcare providers that lease space from DHC.

Looking ahead to 2025, projections indicate a positive trend for healthcare spending. Inflation-adjusted consumer spending on healthcare goods and services is expected to grow faster than overall consumer spending. For instance, some forecasts suggest healthcare spending could see a growth rate of around 5-6% in 2025, outpacing the projected general consumer spending growth.

This robust demand for healthcare services is a significant positive factor for the healthcare real estate sector, and by extension, for DHC. It suggests a stable and growing market for healthcare facilities, supporting the occupancy rates and rental income for DHC's properties.

Inflation significantly impacts Diversified Healthcare Trust's (DHC) operating costs, as higher prices for labor, utilities, and medical supplies directly increase expenses for its healthcare facility tenants. This can strain tenant profitability and, consequently, their capacity to meet rental obligations.

For example, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for medical care services rose by 5.1% in the 12 months ending April 2024, highlighting the persistent upward pressure on healthcare operational expenses.

However, projections for 2025 suggest a potential easing of inflation. If inflation moderates, it's expected to reduce economic uncertainty for healthcare providers, potentially leading to increased leasing activity and improved sales transactions within DHC's portfolio.

Real Estate Market Dynamics

Supply and demand in healthcare real estate, especially for senior living and medical offices, directly impacts Diversified Healthcare Trust's (DHC) property values, occupancy, and rental income. The medical office sector is robust, with demand exceeding supply and keeping vacancy rates low.

Senior living occupancy rates are also on an upward trend, signaling a healthier market for DHC's properties. For instance, in the first quarter of 2024, senior housing occupancy reached 80.5%, up from 78.7% in the prior year, according to the National Investment Center for Seniors Housing & Care (NIC). This recovery is a positive sign for DHC's portfolio performance.

- Medical Office Buildings (MOBs): Demand continues to outpace supply, leading to strong rental growth and low vacancy rates.

- Senior Living: Occupancy rates are recovering and showing consistent improvement, benefiting operators and property owners.

- Investment Trends: Capital is flowing into healthcare real estate, particularly into well-located MOBs and senior living facilities, indicating investor confidence.

- DHC's Portfolio: DHC's focus on these sectors positions it to benefit from these positive market dynamics.

Capital Market Conditions and Investment Volume

Capital market conditions significantly influence Diversified Healthcare Trust's (DHC) financial flexibility. Investor sentiment toward healthcare real estate investment trusts (REITs) directly impacts DHC's capacity to secure funding for strategic initiatives and portfolio adjustments. A positive sentiment can translate into lower borrowing costs and a greater appetite for DHC's equity offerings.

The investment landscape for medical office buildings (MOBs) showed signs of improvement throughout mid-2024. This trend is expected to continue into 2025, characterized by an uptick in sales transactions and a downward pressure on capitalization rates. For instance, reports from early 2024 indicated a stabilization and subsequent rise in MOB transaction volumes compared to the previous year, suggesting a more robust market for healthcare properties.

- Increased Transaction Volume: Mid-2024 saw a notable increase in the number of MOB sales, signaling renewed investor interest.

- Decreasing Cap Rates: The compression of cap rates in the MOB sector during 2024 points to higher property valuations and a more favorable investment environment for 2025.

- Capital Availability: Improved market sentiment and transaction activity generally correlate with greater availability of capital for healthcare REITs like DHC.

- Investor Appetite: A stronger market outlook for healthcare real estate is likely to enhance investor appetite for DHC's portfolio and future growth plans.

Economic growth and consumer spending directly fuel demand for healthcare services, benefiting DHC's tenants. Projections for 2025 indicate healthcare spending growth outpacing general consumer spending, with some forecasts suggesting a 5-6% rise in healthcare expenditures. This robust demand supports occupancy and rental income for DHC's properties.

Inflation impacts DHC's tenants through increased operating costs for labor and supplies, potentially affecting their ability to pay rent. While the CPI for medical care services rose 5.1% in the year ending April 2024, moderating inflation in 2025 could reduce economic uncertainty for healthcare providers, boosting leasing and sales activity.

Interest rates significantly influence DHC's borrowing costs and investment attractiveness. Projected Federal Reserve rate cuts in 2025 are expected to lower financing expenses and make DHC's real estate assets more appealing, potentially supporting expansion, especially in the Medical Outpatient Buildings (MOBs) sector.

| Economic Factor | Impact on DHC | 2024/2025 Data/Projections |

|---|---|---|

| Economic Growth & Consumer Spending | Increased demand for healthcare services, higher tenant revenue | Healthcare spending projected to grow 5-6% in 2025, outpacing general consumer spending |

| Inflation | Higher tenant operating costs, potential rent payment strain; easing inflation may improve leasing | Medical care services CPI rose 5.1% (12 months ending April 2024) |

| Interest Rates | Affects borrowing costs, investment attractiveness; rate cuts can lower expenses and boost expansion | Projected Federal Reserve rate cuts in 2025 |

What You See Is What You Get

Diversified Healthcare Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Diversified Healthcare Trust delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. Understand the critical external forces shaping the future of healthcare real estate.

Sociological factors

The growing number of older adults in the United States is a major force behind the demand for senior living facilities and healthcare. By 2030, it's anticipated that individuals aged 65 and above will represent 20% of the U.S. population, which will significantly boost spending on outpatient medical care.

This demographic trend directly translates into robust demand for the types of properties Diversified Healthcare Trust (DHC) owns. The increasing prevalence of chronic conditions among the elderly further fuels the need for specialized healthcare services and facilities.

Consumers increasingly prefer healthcare services outside traditional hospitals, seeking convenience and accessibility. This shift fuels demand for medical office buildings as patients opt for outpatient facilities closer to home or work. For instance, a 2024 report indicated that over 60% of elective procedures are now performed in outpatient settings, highlighting this growing preference.

The growing emphasis on wellness and mental health is significantly influencing senior living. This trend means communities are now offering more holistic programs, from mindfulness sessions to specialized cognitive support, directly impacting the types of amenities and services DHC's properties must provide to attract and retain residents and third-party operators. For instance, a 2024 survey indicated that 70% of prospective senior living residents prioritize communities with robust wellness programs.

Socioeconomic Factors and Affordability

Socioeconomic shifts significantly influence the demand for senior living and healthcare services offered by Diversified Healthcare Trust (DHC). Rising income levels generally correlate with increased spending power, potentially boosting demand for DHC's higher-tier offerings. Conversely, economic downturns or stagnant wage growth can make even essential services a challenge for some.

The financial well-being of seniors is a critical consideration. For instance, data from the U.S. Census Bureau for 2023 indicated that approximately 10% of individuals aged 65 and over lived below the poverty line. This statistic highlights a segment of the senior population for whom affordability is a primary concern, directly impacting their ability to access and pay for senior living communities and specialized healthcare.

- Poverty Rates: In 2023, around 10% of US seniors lived below the poverty line, impacting affordability for a significant demographic.

- Income Disparities: Growing income inequality among seniors can lead to varied demand across DHC's different pricing tiers.

- Healthcare Spending: As healthcare costs continue to rise, the proportion of income seniors allocate to medical expenses and long-term care will be a key factor in their decision-making.

Changing Lifestyles and 'Aging in Place'

The strong preference among older adults to age in place, remaining in their own homes, significantly shapes demand for home healthcare services. This trend directly affects traditional senior living communities, potentially influencing their occupancy rates and long-term strategic planning. For Diversified Healthcare Trust (DHC), understanding this shift is crucial for adapting its portfolio and service offerings to meet evolving consumer needs.

Data from 2024 indicates a continued strong desire for independence among seniors. For instance, a recent survey found that over 75% of individuals aged 65 and older expressed a preference for remaining in their homes for as long as possible. This societal shift necessitates that DHC evaluate how its existing properties and future investments align with this preference, perhaps by exploring partnerships or developing hybrid models that support in-home care.

- Aging in Place Preference: A majority of seniors wish to stay in their homes, impacting demand for traditional senior living.

- Home Care Demand: This trend boosts the market for home-based healthcare services, creating new opportunities.

- DHC's Strategic Consideration: The trust must adapt its property strategies to accommodate this lifestyle change.

- Future Viability: Long-term success for DHC may depend on integrating in-home support solutions with its existing senior living infrastructure.

Societal shifts, particularly the aging population, are a primary driver for healthcare real estate. By 2030, individuals aged 65 and older will constitute 20% of the U.S. population, increasing demand for outpatient medical care and senior living facilities. This demographic trend directly benefits Diversified Healthcare Trust (DHC) by fueling demand for its property portfolio, especially as chronic conditions rise among the elderly, necessitating specialized care.

Consumer preferences are also evolving, with a growing inclination towards convenient, accessible healthcare services outside traditional hospitals. This preference for outpatient settings, where over 60% of elective procedures were performed in 2024, boosts demand for medical office buildings. Furthermore, the emphasis on wellness and mental health is reshaping senior living, pushing for more holistic programs and amenities, with 70% of prospective residents prioritizing such offerings in 2024.

| Sociological Factor | Impact on DHC | Supporting Data (2023-2024) |

| Aging Population | Increased demand for senior living and outpatient medical facilities. | 20% of U.S. population to be 65+ by 2030. |

| Preference for Outpatient Care | Boosts demand for medical office buildings. | Over 60% of elective procedures in outpatient settings (2024). |

| Focus on Wellness & Mental Health | Drives demand for enhanced senior living amenities and services. | 70% of prospective residents prioritize wellness programs (2024). |

| Aging in Place Trend | Potential impact on traditional senior living occupancy; opportunity for home care integration. | Over 75% of seniors prefer to age in place (2024). |

Technological factors

Artificial intelligence is revolutionizing healthcare real estate operations, with applications in predictive maintenance and patient flow. For Diversified Healthcare Trust (DHC), this means AI can anticipate equipment failures, reducing downtime and operational costs. For instance, AI-powered analytics can optimize staffing and resource allocation within DHC's facilities, improving patient experiences and operational efficiency.

The significant expansion of telehealth and the growing embrace of hybrid care models, which blend virtual and in-person appointments, are fundamentally altering how healthcare facilities are designed and utilized. This shift is directly influencing the demand for real estate within the healthcare sector.

For Diversified Healthcare Trust (DHC), this trend suggests a potential need for smaller, more flexible medical office buildings. For instance, by mid-2024, a significant portion of healthcare providers, estimated to be over 75%, were offering some form of telehealth, indicating a sustained demand for adaptable spaces that can accommodate both traditional and virtual patient interactions.

Innovations in medical technology, like AI-powered diagnostics and robotic surgery, are reshaping healthcare delivery. This directly impacts Diversified Healthcare Trust (DHC) by influencing the specialized infrastructure needed for its medical office buildings and senior living facilities. DHC must stay ahead of these trends to ensure its properties can house advanced equipment and accommodate new treatment modalities.

For instance, the increasing adoption of telehealth and remote patient monitoring requires robust IT infrastructure and potentially different space configurations within medical offices. DHC's properties need to be adaptable to these evolving medical practices. Failure to do so could lead to vacancies or require significant capital expenditures for retrofitting.

The global medical technology market was valued at approximately $511.7 billion in 2023 and is projected to reach $793.2 billion by 2030, growing at a CAGR of 6.5% during this period. This significant growth underscores the rapid pace of technological advancement DHC must consider when planning for property upgrades and ensuring its portfolio remains competitive and functional for healthcare providers.

Data-Driven Decision-Making

The increasing availability and analysis of data are revolutionizing decision-making in both healthcare and real estate. For Diversified Healthcare Trust (DHC), this means leveraging advanced analytics to pinpoint optimal property acquisitions, refine management strategies, and strengthen tenant relationships. By understanding market trends and operational efficiencies through data, DHC can enhance its portfolio's overall performance and uncover new avenues for growth.

Data-driven insights are becoming crucial for strategic portfolio management. For instance, in 2024, the healthcare real estate sector saw continued demand driven by an aging population and the need for specialized medical facilities. DHC can utilize predictive analytics to forecast demand for specific healthcare services in different geographic locations, informing decisions about where to invest next. This analytical approach allows for more precise resource allocation and a proactive stance in identifying emerging investment opportunities.

- Data analytics can optimize DHC's real estate portfolio by identifying underperforming assets and high-growth potential markets.

- Predictive modeling helps in forecasting healthcare service demand, guiding strategic property acquisition and development.

- Tenant relationship management can be enhanced through data analysis, leading to improved occupancy rates and tenant satisfaction.

- Market intelligence gathered from data sources allows DHC to adapt quickly to evolving healthcare and real estate trends.

Building Automation and Smart Technologies

Diversified Healthcare Trust (DHC) can leverage building automation and smart technologies to significantly boost operational efficiency. For instance, smart systems can optimize HVAC and lighting, leading to reduced energy consumption. A study by the U.S. Department of Energy indicated that building automation systems can cut energy costs by 10% to 30%.

The integration of these advanced technologies not only streamlines facility management but also enhances the living and care experience for residents and patients. This improved environment can be a key differentiator, attracting and retaining high-quality tenants and residents. In 2024, properties with advanced smart features often command higher rental premiums.

These technological upgrades contribute to substantial long-term operational cost savings. Beyond energy, smart systems can improve predictive maintenance, reducing unexpected repair expenses. DHC's investment in these areas in 2024 and 2025 is expected to yield a return on investment through decreased utility bills and maintenance costs.

Key benefits for DHC include:

- Enhanced Operational Efficiency: Streamlined management of building systems.

- Reduced Energy Consumption: Lower utility costs through smart controls.

- Improved Resident/Patient Experience: Greater comfort and convenience.

- Attraction of Quality Tenants: Competitive advantage in the healthcare real estate market.

Technological advancements are reshaping healthcare real estate, with AI optimizing operations and telehealth altering space needs.

Innovations like AI diagnostics and remote monitoring necessitate adaptable infrastructure, impacting DHC's property design and investment strategy.

The medical technology market's projected growth to $793.2 billion by 2030 highlights the need for DHC to embrace cutting-edge facility requirements.

Smart building technologies offer significant operational savings, with potential energy cost reductions of 10-30% and improved tenant appeal.

| Technology Trend | Impact on DHC | 2024/2025 Relevance |

|---|---|---|

| Artificial Intelligence | Optimized operations, predictive maintenance | Enhancing efficiency in facility management |

| Telehealth & Hybrid Care | Demand for flexible, smaller spaces | Influencing medical office building design and utilization |

| Advanced Medical Equipment | Need for specialized infrastructure | Requiring adaptable properties for new treatment modalities |

| Data Analytics | Informed acquisition, management, and tenant relations | Driving strategic portfolio optimization |

| Smart Building Technologies | Reduced energy costs, improved resident experience | Boosting operational efficiency and property attractiveness |

Legal factors

Diversified Healthcare Trust (DHC) and its tenants navigate a complex web of healthcare regulations, impacting everything from patient care standards to facility operations. Compliance with these federal, state, and local laws is not optional; it's a fundamental requirement for maintaining operations and financial health.

For instance, the Centers for Medicare & Medicaid Services (CMS) sets stringent conditions for participation for healthcare providers, directly affecting reimbursement rates and operational practices for many of DHC's tenants. In 2024, healthcare providers continued to face scrutiny over quality metrics and patient safety, with non-compliance potentially leading to significant fines or exclusion from federal programs.

State-specific regulations, such as licensing requirements for skilled nursing facilities and assisted living communities, also play a critical role. DHC's portfolio, spread across numerous states, means tenants must adhere to a patchwork of differing state mandates. Failure to meet these evolving standards can directly impact tenant revenue and, consequently, DHC's rental income.

As a Real Estate Investment Trust (REIT), Diversified Healthcare Trust (DHC) enjoys advantageous tax treatment, but this comes with stringent adherence to rules. To maintain its REIT status, DHC must meet specific income, asset, and distribution requirements, a critical aspect for its financial health.

Recent government attention on tax compliance among healthcare and hospitality REITs presents a tangible risk. Failure to meet these complex regulations could jeopardize DHC's REIT status, potentially leading to significant tax liabilities and impacting its valuation, as seen in the broader REIT market's regulatory environment.

Local zoning and land use regulations are critical for Diversified Healthcare Trust (DHC), directly influencing where and how its healthcare properties can be developed, expanded, or redeveloped. These laws can significantly impact DHC's capacity to secure new sites or enhance its existing facilities, thereby shaping its overall growth trajectory and strategic planning.

For instance, in 2024, many municipalities are tightening restrictions on commercial development, particularly in densely populated urban areas, which could limit DHC's options for new acquisitions or expansions. Navigating these complex legal frameworks is essential for DHC to ensure compliance and maintain its operational flexibility.

Environmental Regulations and Building Codes

Diversified Healthcare Trust (DHC) must navigate a complex web of environmental regulations and building codes that directly impact its healthcare facilities. Compliance with standards for waste management, energy efficiency, and water usage is not just a legal requirement but a fundamental aspect of operational integrity. For instance, evolving energy efficiency mandates could require DHC to invest in upgrades for its portfolio of properties, potentially impacting capital expenditure plans.

The increasing focus on sustainability presents both challenges and opportunities. Stricter environmental standards, such as those promoting LEED certification or mandating specific water conservation measures, can necessitate significant capital investments in retrofitting existing buildings or designing new ones with sustainable materials and technologies. These investments, while costly upfront, can lead to long-term operational savings and enhance property appeal.

The financial implications of these regulations are substantial. For example, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter controls on hazardous waste disposal, which could increase operational costs for facilities handling medical waste. Furthermore, local building codes often require regular inspections and updates to ensure safety and compliance, adding to ongoing maintenance expenses for DHC's diverse real estate holdings.

Key considerations for DHC include:

- Environmental Compliance Costs: Tracking and managing expenses related to waste disposal, emissions control, and water treatment across its portfolio.

- Capital Expenditures for Upgrades: Budgeting for necessary retrofits and renovations to meet evolving energy efficiency and sustainability building codes.

- Regulatory Risk Management: Proactively staying abreast of changes in environmental laws and building standards at federal, state, and local levels to avoid penalties and ensure operational continuity.

- Impact on Property Valuations: Understanding how compliance with green building standards can influence the marketability and value of DHC's healthcare properties.

Tenant Lease Agreements and Contractual Obligations

The legal framework governing tenant lease agreements is paramount for Diversified Healthcare Trust (DHC). These contracts clearly define DHC's rights and responsibilities as a landlord, alongside those of the third-party healthcare operating companies that occupy its properties. This legal structure is crucial for ensuring revenue stability and maintaining operational clarity, particularly when transitions between operators occur.

These lease agreements are not merely rental contracts; they are legally binding documents that stipulate terms for rent, property maintenance, insurance, and operational standards. For DHC, the meticulous drafting and enforcement of these agreements directly impact its financial performance and the overall health of its real estate portfolio. For instance, any disputes or breaches of contract can lead to significant financial repercussions and operational disruptions.

As of the first quarter of 2024, DHC's portfolio included a significant number of properties leased to various healthcare operators. The legal terms within these leases, including rent escalation clauses and renewal options, are key drivers of DHC's projected income. Understanding and managing these contractual obligations is a continuous legal and financial undertaking for the trust.

- Lease Structure: DHC's revenue is heavily reliant on the terms and conditions stipulated in its long-term lease agreements with healthcare operators.

- Operator Transitions: Legal clauses within leases manage operator transitions, aiming to minimize vacancy periods and ensure continuity of operations and rental payments.

- Contractual Compliance: Ensuring both DHC and its tenants adhere to all legal and contractual obligations is vital for risk mitigation and financial predictability.

- Regulatory Environment: Changes in healthcare regulations can indirectly impact lease terms and tenant operational capabilities, necessitating legal review and potential lease amendments.

Diversified Healthcare Trust (DHC) operates within a highly regulated industry, necessitating strict adherence to healthcare laws, including those governing patient care and facility operations. Compliance with CMS conditions of participation directly influences reimbursement rates for many of its tenants, with continued scrutiny on quality metrics in 2024 potentially leading to financial penalties for non-compliance.

State-specific licensing requirements for facilities like skilled nursing and assisted living communities create a complex regulatory landscape for DHC's geographically diverse portfolio. Failure to meet these evolving state mandates can impact tenant revenue and, consequently, DHC's rental income streams.

The legal framework for lease agreements is critical, defining DHC's landlord responsibilities and tenant obligations. These contracts, which govern rent, maintenance, and operational standards, are key drivers of DHC's projected income, with approximately 90% of DHC's rental income derived from its net lease portfolio as of Q1 2024.

DHC's REIT status, offering tax advantages, is contingent upon meeting specific income, asset, and distribution requirements. Recent government focus on tax compliance for REITs highlights a potential risk, where failure to meet these complex regulations could jeopardize DHC's REIT status and financial standing.

Environmental factors

Climate change is escalating the frequency and intensity of extreme weather events, presenting significant physical risks to Diversified Healthcare Trust's (DHC) real estate portfolio. These events can cause direct property damage, disrupt operations, and lead to higher insurance premiums, impacting DHC's financial performance.

For instance, the increasing severity of hurricanes and floods, as observed in recent years with billions in damages annually across the US, directly threatens coastal or flood-prone healthcare facilities. DHC's strategic decisions regarding property acquisition, development, and resilience investments are therefore critical in mitigating these climate-related financial exposures.

The healthcare real estate sector is increasingly prioritizing environmental sustainability. This includes the integration of energy-efficient systems, the use of renewable materials, and obtaining green building certifications. These trends are shaping how new healthcare facilities are designed and existing ones are managed.

Diversified Healthcare Trust (DHC) stands to gain significantly by embracing these sustainability initiatives. Adopting green building practices can lead to substantial reductions in operational costs, particularly through lower energy and water consumption. Furthermore, demonstrating a commitment to environmental responsibility can enhance DHC's public image and appeal to environmentally conscious tenants and investors.

For instance, a study by the U.S. Green Building Council indicated that LEED-certified buildings can reduce energy bills by up to 30% and water usage by 20%. While specific data for DHC's current portfolio regarding green certifications isn't readily available, the potential for cost savings and improved marketability is clear as the industry moves towards more sustainable operations.

Concerns over water and energy scarcity are increasingly impacting healthcare operations, potentially increasing utility expenses for facilities like those managed by Diversified Healthcare Trust (DHC). For example, in 2024, energy prices saw significant volatility, with natural gas prices fluctuating by as much as 15% month-over-month in certain regions, directly affecting operating costs for buildings reliant on these utilities. This trend is expected to continue into 2025, driven by geopolitical factors and supply chain pressures.

These scarcity issues also pave the way for more stringent regulations concerning resource consumption. Healthcare facilities, often high users of water and energy, may face new compliance requirements and mandates for efficiency improvements. DHC's strategic implementation of advanced water conservation technologies and energy management systems, such as smart grid integration and renewable energy sourcing, can serve as a critical risk mitigation strategy, simultaneously enhancing operational efficiency and reducing its environmental footprint.

Waste Management in Healthcare Facilities

Healthcare facilities, including those within Diversified Healthcare Trust's (DHC) portfolio, produce substantial volumes of both general and regulated medical waste. Strict disposal regulations, such as those outlined by the EPA and state environmental agencies, govern how this waste must be handled to prevent environmental contamination and public health risks. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets standards for hazardous waste management, which can include certain medical byproducts.

Implementing robust waste management strategies is not merely about regulatory adherence; it's a key component of a healthcare property's environmental stewardship. Efficient systems can reduce the amount of waste sent to landfills, minimize the use of incineration, and promote recycling or composting of non-hazardous materials. This proactive approach can significantly enhance DHC's environmental footprint and contribute to sustainability goals.

- Regulatory Landscape: Healthcare waste is heavily regulated, with varying requirements for segregation, treatment, and disposal of infectious, hazardous, and general waste.

- Environmental Impact: Improper waste management can lead to soil and water contamination, air pollution from incineration, and greenhouse gas emissions.

- Operational Costs: Effective waste management can reduce disposal fees and potentially generate revenue through recycling programs, impacting DHC's operational expenses.

- Reputational Benefits: Strong environmental practices in waste management can improve public perception and attract environmentally conscious tenants and stakeholders.

Location and Community Environmental Concerns

The environmental characteristics of a property's location, such as air quality and proximity to potential hazards, directly impact Diversified Healthcare Trust's (DHC) investment decisions and long-term property values. For instance, DHC's portfolio includes numerous healthcare facilities, where poor local air quality could affect patient and staff health, potentially leading to reputational damage and increased operational costs. Community environmental concerns, like the presence of superfund sites or local opposition to development due to environmental impact, can also create significant hurdles, delaying projects and diminishing asset desirability.

DHC must meticulously assess these environmental factors to ensure the viability and public acceptance of its healthcare real estate investments. For example, in 2024, the EPA continued to focus on reducing air pollution, with stricter regulations potentially affecting properties in areas with historically poor air quality. DHC's due diligence process needs to incorporate thorough environmental site assessments and community engagement strategies to mitigate risks associated with these localized environmental issues.

Key considerations for DHC include:

- Air Quality Index (AQI) Trends: Monitoring local AQI data for DHC properties, especially in urban or industrial areas, to understand potential health impacts and regulatory scrutiny.

- Proximity to Hazardous Sites: Evaluating the distance of DHC facilities from known hazardous waste sites, industrial polluters, or areas prone to natural environmental risks, such as flood zones or seismic activity.

- Community Environmental Sentiment: Gauging local community attitudes towards environmental protection and development projects to anticipate potential opposition or support for DHC's real estate strategies.

- Regulatory Compliance: Ensuring all DHC-owned or managed properties adhere to current and anticipated environmental regulations, including those related to emissions, waste management, and land use.

The increasing focus on environmental, social, and governance (ESG) principles by investors and regulators is a significant factor for Diversified Healthcare Trust (DHC). As of early 2025, ESG considerations are increasingly integrated into investment analysis, influencing capital allocation and asset valuations. This trend suggests that DHC's commitment to sustainability, including energy efficiency and waste reduction, could positively impact its access to capital and overall market perception.

PESTLE Analysis Data Sources

Our Diversified Healthcare Trust PESTLE Analysis is built on comprehensive data from leading healthcare industry reports, government regulatory bodies, and reputable economic and demographic databases. We meticulously gather insights from market research firms, public health organizations, and technology trend analyses to ensure a holistic view.