Daktronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daktronics Bundle

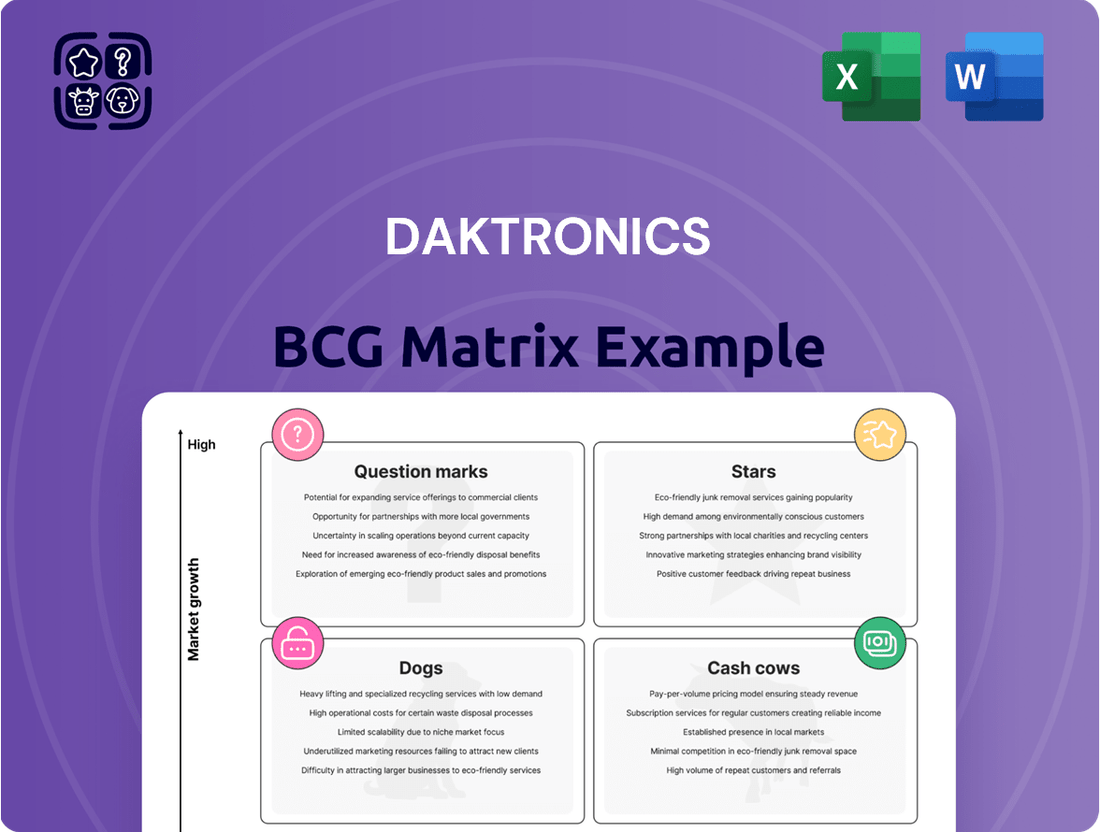

Daktronics' product portfolio, like its digital displays, is dynamic. Stars likely shine in high-growth markets, while Cash Cows provide steady profits. Dogs may need careful consideration, and Question Marks demand strategic assessment. This snapshot only scratches the surface.

Uncover the full Daktronics BCG Matrix and unlock strategic insights. Get detailed quadrant placements and data-driven recommendations. Make smarter investment decisions today!

Stars

Daktronics shines in the large venue sports market, dominating with displays in stadiums and arenas. This segment likely holds a significant market share for the company. Growth depends on stadium projects, but fan experience demand keeps it important. In 2024, Daktronics reported $960.4 million in total revenue.

Daktronics' commercial segment, especially out-of-home advertising, sees robust order growth, signaling market expansion. This area, including digital billboards, is a key business driver for the company. In 2024, the out-of-home advertising market is projected to reach $31.7 billion. This positions Daktronics well within a rising Star segment. The sector's growth supports its potential to become a Star.

Daktronics is experiencing robust growth in international markets, evidenced by a notable increase in international orders. This indicates high growth potential and market share gains for Daktronics globally. For fiscal year 2024, Daktronics reported international sales of $128.6 million, a 14.1% increase year-over-year. Continued strategic investment in international operations will be crucial to maintain and strengthen this Star segment.

High School Park and Recreation Displays

High School Park and Recreation displays represent a "Star" in Daktronics' BCG Matrix. This segment is experiencing robust order growth. The volume of projects, even if smaller, ensures a strong market presence and growth prospects. In 2024, Daktronics saw a 15% increase in orders within this sector, reflecting its dynamic growth. This category is a key driver for Daktronics' overall revenue, contributing significantly to its market position.

- Strong Order Growth: 15% increase in 2024.

- High Volume: Consistent demand from numerous projects.

- Market Presence: Significant contribution to overall revenue.

- Growth Potential: Expected continued expansion in the sector.

New Product Innovation (e.g., Flip-Chip COB LED)

Daktronics is focusing on new product innovation, such as Flip-Chip COB LED displays. These advancements could become Stars within the BCG Matrix, especially if they gain market share. Successful adoption of these technologies can drive future growth and revenue for Daktronics. This strategic investment in new products is key to staying competitive in the display market.

- Daktronics' R&D spending in 2024 was approximately $20 million, reflecting a commitment to innovation.

- The global LED display market was valued at $7.2 billion in 2024 and is expected to grow.

- Flip-Chip COB LED technology offers improved performance and efficiency.

Daktronics’ Stars include its dominant large venue sports displays, alongside high-growth segments like commercial out-of-home advertising and expanding international markets. The High School Park and Recreation displays also shine, showing a robust 15% increase in orders in 2024. New product innovations, supported by $20 million in 2024 R&D, represent future Star potential. These areas drive significant revenue and market share for the company.

| Star Segment | 2024 Performance/Metric | Contribution |

|---|---|---|

| Large Venue Sports | Dominant Market Share | Key Revenue Driver |

| Out-of-Home Advertising | $31.7 Billion Market Projection | Robust Order Growth |

| International Markets | $128.6 Million Sales (14.1% YoY Increase) | High Growth Potential |

| High School Park & Recreation | 15% Increase in Orders | Strong Market Presence |

| New Product Innovation | $20 Million R&D Spending | Future Growth Engine |

What is included in the product

Daktronics' BCG Matrix analysis maps its products, guiding investment, holding, or divesting decisions.

Clean, distraction-free view optimized for C-level presentation.

Cash Cows

Daktronics, with its long-standing presence, holds a strong reputation in the electronic scoreboard market. This segment, though not a high-growth area, ensures consistent revenue and cash flow. For example, in fiscal year 2024, Daktronics reported $843.1 million in net sales. The established demand for scoreboards and Daktronics' leadership position indicates lower investment needs relative to higher-growth areas.

Daktronics' installed displays need constant upkeep, creating a steady revenue stream. This service generates recurring income, a key trait of a Cash Cow. For example, in 2024, service and other revenues accounted for a significant portion of Daktronics' overall sales. These contracts often have high-profit margins.

The replacement and upgrade market represents a stable revenue stream for Daktronics. As displays age, upgrades and replacements become necessary, ensuring consistent demand. Daktronics benefits from established customer relationships, which supports steady cash flow. For 2024, Daktronics reported a 10% increase in services and other revenues, showcasing the importance of this segment.

Transportation Displays (Mature Applications)

Daktronics' transportation displays, such as those in airports and train stations, represent a mature market. These displays, vital for arrival and departure information, provide a steady revenue stream. While infrastructure projects may offer some growth, the core business is likely stable with modest growth rates. In 2024, Daktronics reported $860.5 million in net sales.

- Mature Market: Focus on established needs like arrival/departure boards.

- Stable Revenue: Core business generates consistent income.

- Low Growth: Growth potential tied to infrastructure projects.

- 2024 Net Sales: $860.5 million.

Standard Digital Billboards (Non-Premium Locations)

Standard digital billboards in non-premium locations are cash cows for Daktronics. This segment provides a reliable income stream, though growth is moderate. They offer a steady, predictable revenue source compared to more innovative display types. In 2024, billboard advertising revenue in the US reached $8.6 billion.

- Consistent Revenue: Stable, predictable income with limited growth potential.

- Mature Market: Less aggressive growth compared to other segments.

- Operational Efficiency: Established infrastructure and operations.

- Steady Demand: Continuous demand from a diverse client base.

Daktronics' Cash Cows are mature market segments, including scoreboards, service contracts, transportation displays, and standard billboards, which consistently generate stable revenue. These areas require lower investment while providing predictable cash flow and strong profit margins. In fiscal year 2024, Daktronics reported $860.5 million in net sales, significantly bolstered by these reliable segments. The focus is on maintaining market share and operational efficiency.

| Segment | Market Maturity | Revenue Stability |

|---|---|---|

| Scoreboards | Mature | High, consistent |

| Service & Upgrades | Mature | High, recurring (10% increase in 2024) |

| Transportation Displays | Mature | High, steady |

| Standard Billboards | Mature | High, predictable ($8.6B US revenue in 2024) |

What You See Is What You Get

Daktronics BCG Matrix

The preview displays the same Daktronics BCG Matrix report you'll own after buying. Get the fully formatted document with insightful market data and strategic recommendations, ready to integrate into your business strategy.

Dogs

Older display tech faces declining demand, marking them as Dogs in Daktronics' portfolio. These technologies often have low market share and growth. For example, in 2024, sales of legacy LED products might have seen a 5% decrease. High maintenance expenses further strain their viability.

Underperforming or niche transportation display applications for Daktronics could include specific areas with low adoption. These applications face strong competition. They likely hold low market share and limited growth potential. For instance, consider displays in older transit systems or those using outdated tech. Daktronics' 2024 revenue was $883.6 million; focusing on these areas may not be a priority.

Low-margin, high-volume Daktronics products can be dogs if they drain resources without boosting profit or market share. In 2024, the company's gross profit margin was around 25%, and it's essential to pinpoint product lines below this. For example, inefficient production of low-priced items would be a drag. A thorough review of each product's profitability is crucial to make informed decisions.

Geographic Regions with Low Market Penetration and Slow Adoption

In some regions, Daktronics might find itself in "Dog" territory due to low market penetration and slow digital display adoption. These areas demand substantial upfront investment, potentially yielding modest returns quickly. For instance, the Asia-Pacific region showed varied growth in digital signage in 2023, with some countries lagging.

- Low adoption rates in specific areas can lead to decreased revenue.

- High marketing costs are needed to increase awareness.

- Competition from local providers increases.

- Slow growth needs reevaluation of the strategy.

Unsuccessful New Product Ventures

Dogs in Daktronics' portfolio represent products that haven't succeeded in a low-growth market. These ventures failed to capture substantial market share, indicating poor performance. Such products often become candidates for divestiture or complete discontinuation. This strategic move helps reallocate resources to more promising areas. For example, in 2024, Daktronics might have discontinued a specific LED display model due to low demand.

- Low Market Share: Products with limited market presence.

- Low Growth Market: Operating in a stagnant or declining sector.

- Divestiture Candidate: Likely to be sold off or eliminated.

- Resource Reallocation: Focus on more profitable segments.

Daktronics' Dogs include legacy display technologies and niche transportation applications, characterized by low market share and growth potential. These segments, like older LED models, often face declining demand, impacting the company's 2024 gross profit margin, which was around 25%. Such products are candidates for divestiture to reallocate resources effectively. This ensures focus on more promising ventures within Daktronics' portfolio.

| Metric | 2024 Performance | Strategic Implication |

|---|---|---|

| Market Share | Low | Divestiture Candidate |

| Market Growth | Low/Declining | Resource Reallocation |

| Profitability | Below 25% Gross Margin | Review for Discontinuation |

Question Marks

Daktronics has introduced Narrow Pixel Pitch (NPP) LED displays for indoor applications, tapping into a rising market. The company's success in this high-precision indoor display segment, compared to rivals, defines its position as a Question Mark. If Daktronics gains significant market share, this could evolve into a Star. Recent data shows the global LED display market was valued at $8.2 billion in 2024.

Daktronics' focus on enhanced control systems and software positions it in a promising, yet uncertain, market segment. This strategic move into integrated display solutions suggests high growth potential, aligning with industry trends. Considering current market share and the investment needed, this area is best categorized as a Question Mark. With the right execution, it has the potential to evolve into a Star, driving future revenue.

Daktronics' move into integrated solutions and content development is a strategic shift beyond manufacturing. The expansion into services aligns with the growing demand for complete display solutions, which saw an increase in 2024. Daktronics' investment and market positioning in this area will define its classification as a Question Mark within the BCG matrix. Whether it succeeds depends on its ability to capture market share against established competitors like Barco and Samsung, who had a combined market share of over 60% in the large-format display market in 2024.

Expansion in Niche 'Spectacular' Custom Installations

Daktronics' foray into 'Spectacular' custom LED installations is a Question Mark in their BCG Matrix. This niche market offers high growth potential, focusing on unique projects. Securing market share in these specialized areas requires significant investment. It remains uncertain if the investment will yield high returns.

- 2024: Daktronics reported $881.4 million in sales.

- 'Spectacular' projects require high upfront costs.

- Market share in these niches is competitive.

- Investment includes R&D and specialized teams.

Digital Transformation Initiatives and Related Offerings

Daktronics is investing in digital transformation, potentially creating new data-driven display services. These initiatives, while promising, face uncertain market adoption. The company's ability to monetize these offerings remains unclear. As of Q3 2024, Daktronics' R&D expenses increased due to these projects.

- Daktronics' focus on digital transformation includes data analytics and operational efficiency improvements.

- Uncertainty exists regarding the success and market acceptance of new digital offerings.

- Daktronics' Q3 2024 R&D expenses saw a rise, indicating investment in these initiatives.

- Monetization strategies for new digital services are still developing.

Daktronics’ Question Marks include high-growth areas like Narrow Pixel Pitch LED displays and integrated control systems. These segments require significant investment, with Q3 2024 R&D expenses increasing, and their market share is still developing. Success in these uncertain ventures, such as customized installations, could transform them into Stars, impacting future revenue.

| Area | Market Potential | 2024 Data |

|---|---|---|

| NPP LED Displays | High Growth | Global LED market: $8.2 billion |

| Integrated Solutions | Emerging Demand | Services demand increased |

| Digital Transformation | New Data Services | Q3 2024 R&D expenses rose |

BCG Matrix Data Sources

Daktronics' BCG Matrix uses financial reports, market growth data, competitor analysis, and industry forecasts for strategic decisions.