Da Cin Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Da Cin Construction Bundle

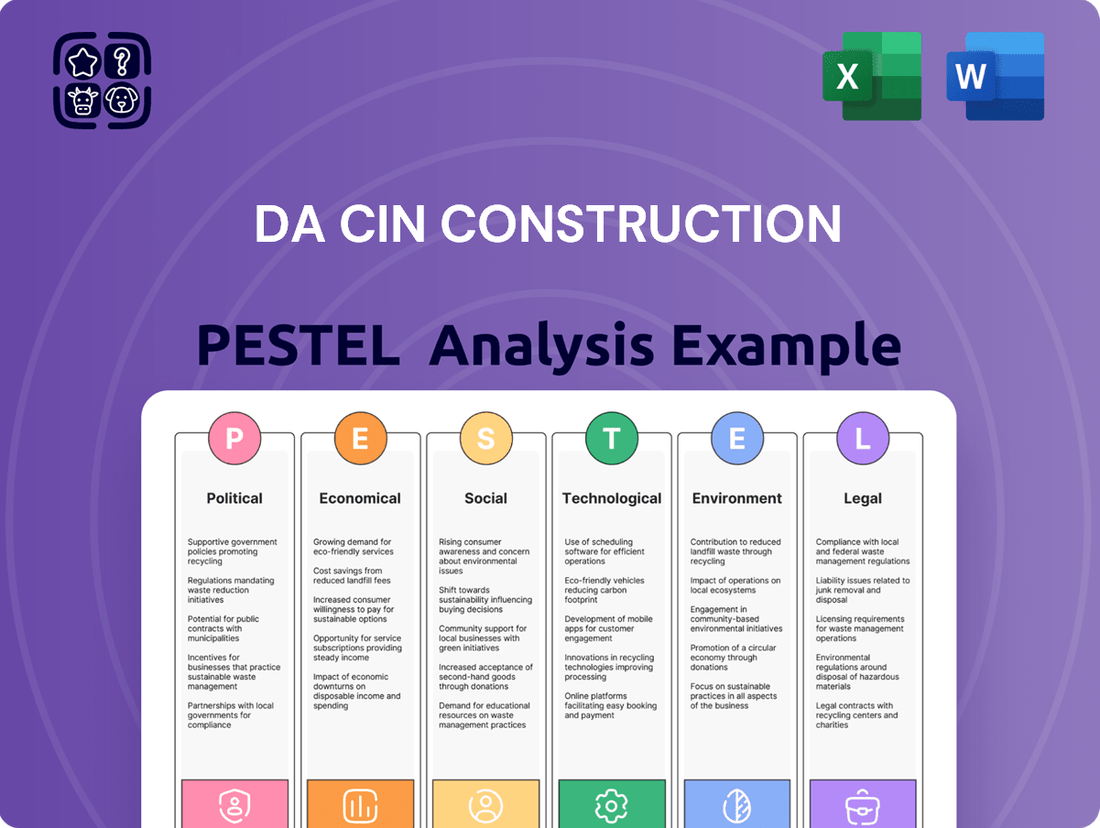

Navigate the complex external landscape affecting Da Cin Construction with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping their operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full report now and gain a critical competitive advantage.

Political factors

The Taiwanese government's robust commitment to infrastructure development presents a significant tailwind for construction firms. For 2025, a TWD 3.1 trillion ($101.2 billion) budget is earmarked for public infrastructure, marking a substantial 9.8% increase from 2024 levels. This proactive spending, coupled with plans to secure TWD 3-4 trillion ($97-129.3 billion) in capital for major projects and key industries, directly fuels demand within the construction sector.

These initiatives, with a particular focus on expanding railway networks and metro systems, are poised to create substantial opportunities. The anticipated growth in transportation infrastructure is expected to translate into increased project pipelines and revenue streams for companies like Da Cin Construction, benefiting from the government's strategic investment in national connectivity and development.

Taiwan's commitment to sustainability is a significant political factor, particularly with the enactment of the Climate Change Response Act in early 2024. This legislation establishes a clear net-zero emissions target for 2050 and introduces a carbon fee system for major polluters, directly impacting construction projects.

The government is actively promoting green building certifications and the adoption of eco-friendly materials. This policy direction creates a more favorable landscape for construction firms like Da Cin Construction that are equipped to handle sustainable building practices, potentially leading to increased demand for their specialized services.

Cross-strait relations and geopolitical stability in Taiwan significantly impact investor confidence and government spending priorities, indirectly affecting the construction sector. For instance, in early 2024, heightened tensions led to a slight dip in Taiwan's stock market, influencing overall economic sentiment which can curb public and private infrastructure investment.

Any escalation or de-escalation of these tensions can trigger shifts in public works projects and foreign investment flows. For example, a perceived increase in stability might encourage more foreign direct investment into large-scale infrastructure, a key driver for construction firms like Da Cin.

Government Procurement Regulations

Government procurement regulations significantly shape the landscape for construction firms like Da Cin Construction. Taiwan's 'Government Procurement Act' is the primary framework governing public construction contracts. Recent discussions around amendments aim to foster a more competitive and efficient procurement environment, with potentially increased penalties for non-compliance. This directly impacts Da Cin's strategy for securing public works projects.

Staying ahead of these regulatory shifts is crucial for Da Cin Construction, especially given its specialization in public sector projects. The government's commitment to enhancing fair competition and procurement efficiency, as evidenced by ongoing drafting of amendments, means that contractors must maintain rigorous compliance. For instance, recent government spending on infrastructure projects in Taiwan reached approximately NT$500 billion in 2023, highlighting the importance of understanding and adhering to procurement rules for a significant portion of the market.

- Regulatory Updates: Amendments to Taiwan's 'Government Procurement Act' are in development, focusing on fair competition and efficiency.

- Compliance Imperative: Da Cin Construction, as a public works specialist, must ensure strict adherence to evolving procurement laws.

- Market Significance: Taiwan's infrastructure spending, exceeding NT$500 billion in 2023, underscores the critical nature of government contracts.

Public-Private Partnerships (PPPs) Promotion

The Taiwanese government's increased emphasis on public-private partnerships (PPPs) presents a significant opportunity for Da Cin Construction. By actively encouraging private sector investment in public infrastructure, the government is creating new project pipelines. For instance, the Ministry of Economic Affairs reported that as of the end of 2023, 117 PPP projects were initiated, with a total investment value of NT$580 billion (approximately US$18 billion).

The expansion of eligible PPP projects to encompass green energy, digital infrastructure, and resource recycling facilities broadens Da Cin Construction's potential market. This strategic shift aligns with global trends towards sustainable development and technological advancement. In 2024, the Executive Yuan approved a NT$1.2 trillion (approximately US$37 billion) plan for digital infrastructure development, a significant portion of which is expected to be delivered through PPPs.

Furthermore, the introduction of 'paid PPP' models, where the government acts as a service purchaser, offers Da Cin Construction more flexible revenue streams. This model can de-risk projects for private partners by ensuring a consistent demand for services. The Ministry of Transportation and Communications has indicated that it will pilot paid PPP models for several new highway maintenance contracts in 2025, aiming to improve service quality and efficiency.

- Expanded PPP Scope: Green energy, digital infrastructure, and resource recycling are now eligible, opening new sectors for Da Cin Construction.

- Increased Investment: The government's commitment to PPPs is substantial, with NT$580 billion invested in projects initiated by the end of 2023.

- Digital Infrastructure Push: A NT$1.2 trillion plan for digital infrastructure in 2024-2025 will likely leverage PPPs.

- Paid PPP Models: New service-purchasing arrangements offer Da Cin Construction potentially more stable revenue.

Taiwan's political landscape heavily influences the construction sector, with government infrastructure spending acting as a primary driver. For 2025, a significant TWD 3.1 trillion ($101.2 billion) budget is allocated to public infrastructure, reflecting a 9.8% increase from 2024, directly boosting opportunities for firms like Da Cin Construction.

The government's commitment to sustainability, exemplified by the 2024 Climate Change Response Act and its 2050 net-zero target, encourages eco-friendly building practices. This policy shift favors companies adept at green construction, potentially increasing demand for their specialized services.

Geopolitical stability, particularly cross-strait relations, impacts investor sentiment and government spending priorities, indirectly affecting construction projects. Fluctuations in these relations can alter public works project pipelines and foreign investment, influencing the overall market for construction services.

Government procurement regulations, governed by Taiwan's 'Government Procurement Act,' are crucial for Da Cin Construction's public sector projects. Ongoing amendments aim to enhance competition and efficiency, necessitating strict compliance from contractors to navigate the market effectively.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Da Cin Construction, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making, identifying potential threats and opportunities within Da Cin Construction's operating landscape.

This PESTLE analysis for Da Cin Construction offers a clear, summarized version of external factors, simplifying strategic discussions and ensuring all stakeholders understand key market dynamics.

Economic factors

The Taiwan construction market is showing robust growth, with a projected expansion of 1.9% in 2024 and a stronger 3.6% in 2025. This positive trend is directly linked to the recovery and growth seen in manufacturing and export sectors, which often spur further development.

Looking ahead, the industry is anticipated to maintain a healthy average annual growth rate of 4.2% between 2026 and 2028. Key drivers for this sustained expansion include significant investments planned for crucial infrastructure projects, such as transportation networks, renewable energy facilities, and essential housing developments.

This forecast suggests a favorable and expanding environment for companies like Da Cin Construction, offering ample opportunities for new projects and business development within the Taiwanese market.

Taiwan's construction sector is benefiting from substantial public and private investment, creating a fertile ground for companies like Da Cin Construction. The government is channeling significant funds into large-scale infrastructure projects, with a particular focus on enhancing railway and transportation networks. This strategic push is designed to modernize the nation's connectivity and stimulate economic activity.

Further bolstering this trend, Taiwan is actively encouraging private sector participation in public infrastructure development. Projections indicate that private investment in these vital areas is anticipated to surpass NT$236.4 billion, equivalent to approximately US$7.3 billion, by 2025. This substantial influx of capital from both public and private sources presents considerable opportunities for Da Cin to secure new contracts and expand its project portfolio.

Taiwan's construction sector saw a downturn in 2023, largely attributed to elevated interest rates and dampened investor sentiment. However, projections indicate a return to growth starting in 2024. For instance, the Taiwan Institute of Economic Research (TIER) projected construction output to grow by 2.1% in 2024, a notable rebound from the estimated contraction in 2023.

Despite the anticipated recovery, Da Cin Construction must remain vigilant. Persistent high interest rates, coupled with ongoing elevated construction material costs, could still present significant hurdles, potentially causing contractions in specific market segments. Effective management of financing costs and project expenditures will be crucial for navigating these economic conditions.

Manufacturing and Export Activity Influence

The construction sector in Taiwan, particularly for companies like Da Cin Construction, thrives on robust manufacturing and export performance. When industrial production ramps up and exports grow, there's a natural increase in the need for new factories, warehouses, and associated commercial spaces, which are key areas for Da Cin. This direct correlation means that positive trends in Taiwan's manufacturing and export markets often translate into more projects and revenue opportunities for the company.

Taiwan's export value saw a significant increase, reaching approximately NT$22.7 trillion in 2023, indicating strong global demand for its manufactured goods. This trend is expected to continue into 2024, with projections suggesting further growth driven by sectors like semiconductors and electronics. Consequently, the demand for industrial and commercial construction projects is likely to remain elevated.

- Manufacturing Output: Taiwan's industrial production index rose by 4.5% year-on-year in the first quarter of 2024, signaling a healthy expansion in manufacturing activity.

- Export Growth: Exports of goods and services contributed positively to GDP growth in late 2023 and early 2024, with key export categories showing resilience.

- Construction Demand: Increased manufacturing output directly fuels demand for new industrial facilities and expansions, benefiting construction firms like Da Cin.

- Economic Linkage: The strong performance of Taiwan's export-oriented economy provides a stable foundation for investment in infrastructure and commercial development.

Foreign Direct Investment (FDI) Trends

Taiwan saw a dip in overall Foreign Direct Investment (FDI) approvals in the first nine months of 2023, with both the number of projects and their value decreasing compared to previous periods. This trend could mean fewer large-scale, diverse construction opportunities generally.

However, specific sectors are attracting significant international attention. The data center industry, in particular, is experiencing a surge in interest from global investors. Additionally, while the industrial sector experienced a contraction in 2023, it's poised for a rebound in 2024, driven by substantial investments in key areas like semiconductors, battery manufacturing, and recycling initiatives.

These evolving FDI patterns directly impact construction firms like Da Cin. The anticipated growth in data centers and the revitalization of the industrial sector, especially in high-tech manufacturing and green technologies, signal a shift in demand towards specialized construction capabilities. Da Cin may find more opportunities in building advanced manufacturing facilities and energy-efficient data infrastructure.

- FDI Approvals in Taiwan (Jan-Sep 2023): Total number and value of projects declined.

- Key Growth Sectors: Increasing international interest in data centers.

- Industrial Sector Outlook (2024): Expected recovery driven by semiconductor, battery manufacturing, and recycling investments.

- Impact on Construction: Shift in demand towards specialized infrastructure and advanced manufacturing facilities.

Taiwan's construction sector is projected to grow by 1.9% in 2024 and accelerate to 3.6% in 2025, driven by strong manufacturing and export performance. This growth is supported by significant public and private investment in infrastructure, with private investment in public projects expected to reach approximately US$7.3 billion by 2025. Despite a 2023 downturn due to high interest rates, the sector is recovering, though persistent high costs remain a concern.

The strong performance of Taiwan's export-oriented economy, with export value reaching NT$22.7 trillion in 2023, directly fuels demand for industrial and commercial construction. Industrial production saw a 4.5% year-on-year rise in Q1 2024, indicating a healthy manufacturing expansion that translates into more projects for construction firms. This economic linkage provides a stable foundation for continued development.

While overall FDI approvals saw a dip in early 2023, key sectors like data centers are attracting significant international interest, and the industrial sector is expected to rebound in 2024 with investments in semiconductors and green technologies. This shift indicates a growing demand for specialized construction capabilities in advanced manufacturing and energy infrastructure.

| Economic Factor | 2023 (Estimate/Actual) | 2024 (Projection) | 2025 (Projection) |

|---|---|---|---|

| Construction Sector Growth | -1.5% (Estimated) | 1.9% | 3.6% |

| Private Investment in Public Infrastructure | NT$210 billion (Approx.) | NT$225 billion (Approx.) | NT$236.4 billion (Approx. US$7.3 billion) |

| Industrial Production Index | ~3.0% (Annual Growth) | 4.5% (Q1 YoY) | Projected continued growth |

| Export Value | NT$22.7 trillion | Projected growth | Projected continued growth |

Full Version Awaits

Da Cin Construction PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying this Da Cin Construction PESTLE Analysis. This preview offers a transparent look at the comprehensive insights you'll gain. You'll receive the complete, professionally formatted document, ready for immediate use in your strategic planning.

Sociological factors

Taiwan's demographic shift, marked by a declining birth rate and an increasingly elderly population, directly contributes to a shrinking labor pool. This societal trend is acutely felt across various sectors, with the construction industry facing a particularly acute crisis.

The construction sector in Taiwan is grappling with a severe deficit of skilled professionals and a significant shortage of tens of thousands of laborers. For Da Cin Construction, this presents a critical hurdle in ensuring it has access to the necessary human capital to execute projects effectively.

Workplace safety is a significant concern in the construction sector, particularly in Taiwan. Between 2021 and 2023, the industry sadly recorded 305 fatalities among older workers, underscoring the urgent need for enhanced safety protocols.

Da Cin Construction must therefore place a premium on worker well-being. Implementing comprehensive health and safety programs is crucial not only to protect its employees but also to safeguard the company's reputation and operational continuity.

Taiwan's rapid urbanization is a significant force, fueling demand across the construction sector, from homes to offices and crucial transport links. By 2024, a substantial 80.2% of the population resided in urban areas, a trend that has spurred considerable investment in smart city initiatives and modern housing solutions.

This persistent shift towards urban living translates into ongoing, robust opportunities for companies like Da Cin Construction. The company is well-positioned to capitalize on the sustained demand for both residential and commercial property developments driven by this demographic trend.

Cultural Perceptions of Construction Work

Cultural perceptions significantly impact the construction workforce in Southeast Asia, and Taiwan is no exception. The industry there grapples with a less-than-stellar reputation, often viewed as demanding and less prestigious, which can make it challenging to attract migrant workers. This perception is a hurdle for companies like Da Cin Construction, potentially limiting their access to a vital labor pool.

Furthermore, within Taiwan itself, construction jobs often offer lower salaries when stacked against opportunities in other sectors. This wage disparity makes it tough for domestic companies to draw in and keep skilled professionals. For instance, while specific comparative salary data for 2024-2025 is still emerging, general trends in Taiwan's labor market indicate that tech and service industries frequently outpace construction in compensation packages.

To counter these sociological factors, Da Cin Construction might need to actively work on improving the industry's image and offering more compelling employment packages. This could involve:

- Enhanced Training Programs: Investing in skill development and certification to elevate the perceived value of construction roles.

- Competitive Compensation: Reviewing and potentially increasing wages and benefits to align with or exceed other industries.

- Improved Working Conditions: Focusing on safety, work-life balance, and career progression pathways to make construction more attractive.

- Targeted Recruitment Campaigns: Developing marketing strategies that highlight the positive aspects and opportunities within the construction sector.

Social Welfare and Public Services Demand

The social welfare sector is receiving significant attention in Taiwan's government spending. For 2025, 26.5% of the central government budget is earmarked for social welfare initiatives. This substantial allocation highlights a governmental commitment to expanding services and infrastructure in this area.

A key component of this social welfare push involves promoting the construction of elderly and long-term care facilities throughout Taiwan. This focus directly addresses the needs of an aging population and signals a growing demand for specialized construction services in this niche.

While Da Cin Construction has a broad portfolio, this increasing emphasis on social welfare infrastructure presents a clear avenue for growth. The company's expertise in diverse construction projects can be leveraged to capitalize on the demand for new and improved care facilities.

- Budget Allocation: 26.5% of Taiwan's 2025 central government budget is dedicated to social welfare.

- Key Initiative: Promotion of construction for elderly and long-term care facilities.

- Market Opportunity: Growing demand for specialized construction in the social welfare sector.

- Da Cin's Position: Potential to leverage existing construction capabilities for new social welfare projects.

Taiwan's aging population and declining birth rate create a critical labor shortage in construction, impacting Da Cin Construction's ability to secure skilled workers. The industry's safety record, with 305 worker fatalities between 2021-2023, necessitates enhanced safety measures and worker well-being initiatives.

Urbanization, with 80.2% of Taiwan's population living in urban areas by 2024, fuels demand for residential and commercial construction, presenting opportunities for Da Cin Construction. However, the sector struggles with a negative image and lower wages compared to other industries, making it difficult to attract and retain talent.

| Sociological Factor | Impact on Da Cin Construction | Mitigation Strategies |

|---|---|---|

| Demographic Shift (Aging Population, Declining Birth Rate) | Shrinking labor pool, shortage of skilled workers. | Invest in training, explore automation, attract migrant workers. |

| Workplace Safety Concerns | Reputational risk, potential operational disruptions. | Implement robust safety protocols, invest in safety training, focus on worker well-being. |

| Urbanization Trends | Increased demand for residential and commercial projects. | Capitalize on smart city initiatives and modern housing development. |

| Industry Perception & Wages | Difficulty attracting and retaining domestic talent. | Improve industry image, offer competitive compensation and benefits, enhance working conditions. |

Technological factors

The construction sector's embrace of Building Information Modeling (BIM) is accelerating worldwide, with Taiwan showing significant uptake. This technology allows for detailed digital building models, fostering better teamwork, minimizing mistakes, and streamlining timelines and budgets across a project's life. For Da Cin Construction, integrating BIM presents a clear path to boosting project outcomes and operational efficiency.

The construction industry is increasingly demanding efficient project management, fueling the adoption of Building Information Modeling (BIM) software. Taiwan's 'National Project of Hope' highlights a national focus on digital infrastructure, encouraging digital transformation in the built environment. Da Cin can leverage these trends by integrating smart construction solutions to enhance competitiveness and streamline operations.

Taiwan is a leader in green construction, pushing forward with eco-friendly materials like low-carbon cement and smart glass that boost energy efficiency. This focus on sustainability is a significant technological trend impacting the construction sector.

The industry is also adopting energy-saving equipment, such as LED lighting and advanced elevators designed for reduced energy consumption. For Da Cin Construction, integrating these innovations can lead to more competitive and environmentally responsible projects.

By embracing these advanced materials and techniques, Da Cin can not only improve its operational efficiency but also meet the growing demand for sustainable building solutions. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, presenting a clear opportunity.

Automation and Robotics in Construction

The construction industry globally, and likely in Taiwan, is seeing increased adoption of automation and robotics to combat persistent labor shortages. This trend is particularly relevant for Da Cin Construction as Taiwan faces an aging population, which is projected to exacerbate workforce challenges in the coming years. For instance, in 2023, the construction sector in many developed economies reported significant difficulties in finding skilled labor, with some estimates suggesting a deficit of over 2 million workers in the US alone.

Da Cin could strategically invest in and integrate these advanced technologies to enhance operational efficiency, improve safety standards, and potentially reduce project timelines. The global market for construction robotics was valued at approximately USD 1.5 billion in 2022 and is projected to grow substantially, reaching over USD 5 billion by 2030, indicating a strong market trend towards automation.

- Labor Shortage Mitigation: Automation can address Taiwan's demographic shifts and potential construction workforce gaps.

- Productivity Gains: Robotics can perform repetitive or dangerous tasks more efficiently than manual labor, boosting output.

- Enhanced Safety: Automated systems can reduce human exposure to hazardous construction environments, leading to fewer accidents.

- Technological Advancement: Early adoption positions Da Cin to benefit from innovations in AI-driven construction management and robotic execution.

Data Analytics and Project Management Software

Building Information Modeling (BIM) is revolutionizing how construction managers like those at Da Cin collect and process data. BIM allows for the efficient gathering of information from diverse project elements, crucial for today's intricate builds. This technology is becoming indispensable for managing the sheer volume of data generated on large-scale construction sites.

The escalating complexity of modern construction projects demands advanced tools for effective collaboration and workflow management. Da Cin can leverage sophisticated project management software to ensure seamless integration of different project phases and disciplines. These platforms are vital for streamlining operations and proactively addressing potential risks.

Data analytics and advanced project management software offer Da Cin significant opportunities to improve decision-making and project oversight. For instance, in 2024, the global construction project management software market was valued at approximately USD 3.5 billion, with projections indicating continued growth. By adopting these tools, Da Cin can gain deeper insights into project performance, resource allocation, and cost forecasting.

- BIM integration streamlines data collection from various engineering and architectural disciplines.

- Increased project complexity drives the need for advanced collaboration and risk mitigation tools.

- Data analytics in construction project management can improve decision-making accuracy by up to 15% according to industry reports.

- Software adoption allows for real-time monitoring of project progress, budget, and resource utilization.

Technological advancements are reshaping construction, with Building Information Modeling (BIM) adoption accelerating in Taiwan, enhancing collaboration and efficiency. The push for digital infrastructure, exemplified by Taiwan's national projects, encourages smart construction integration for Da Cin. Furthermore, the growing demand for sustainable building materials, valued at approximately $250 billion globally in 2023, presents a significant opportunity for eco-friendly innovation.

Automation and robotics are increasingly vital to address labor shortages, a growing concern with Taiwan's aging population. The global construction robotics market, valued at around USD 1.5 billion in 2022, is set to expand significantly, offering Da Cin a path to improved efficiency and safety. Advanced project management software, with a global market of approximately USD 3.5 billion in 2024, is also crucial for managing complex projects and improving decision-making.

| Technological Factor | Description | Impact on Da Cin Construction | Relevant Data/Trend |

| BIM Adoption | Digital modeling for enhanced project planning and execution. | Improved collaboration, reduced errors, and cost savings. | Taiwan's increasing BIM uptake. |

| Automation & Robotics | Use of machines for repetitive or hazardous tasks. | Mitigates labor shortages, boosts productivity, and enhances safety. | Global construction robotics market projected to exceed USD 5 billion by 2030. |

| Green Construction Tech | Eco-friendly materials and energy-efficient systems. | Meets sustainability demands, potentially reduces operational costs. | Global green building materials market valued at ~$250 billion in 2023. |

| Project Management Software | Digital tools for workflow, data analysis, and risk management. | Streamlines operations, improves decision-making, and real-time monitoring. | Global market valued at ~$3.5 billion in 2024, with continued growth. |

Legal factors

Taiwan's construction sector operates under a robust legal framework, encompassing detailed regulations for labor and national health insurance, ensuring worker welfare. For instance, the National Health Insurance program in Taiwan covers a significant portion of the population, with contributions often shared between employers and employees, impacting Da Cin's operational costs.

Occupational health and safety precautions are also strictly mandated, with penalties for non-compliance. These regulations are designed to minimize workplace accidents, a critical concern in the construction industry, where Taiwan reported a notable number of industrial accidents in recent years, underscoring the importance of Da Cin's adherence.

Furthermore, construction contracts in Taiwan are subject to laws that clearly define the allocation of risks associated with legal changes. This contractual clarity is vital for Da Cin to manage potential liabilities and ensure project stability, especially given the dynamic nature of regulatory environments.

Da Cin Construction's operations are significantly shaped by Taiwan's Government Procurement Act. This legislation dictates how public works projects are tendered, evaluated, and executed, making strict adherence essential for securing and performing government contracts. For instance, in 2023, government procurement spending in Taiwan reached an estimated NT$1.5 trillion, highlighting the substantial market Da Cin operates within.

Staying compliant means meticulously following procedures for tender submissions and contract fulfillment, including transparent pricing and quality standards. The Act is regularly updated; recent amendments in 2024 have focused on enhancing fair competition and streamlining dispute resolution processes, requiring Da Cin to continuously adapt its internal policies and practices to remain in good standing.

Taiwan's 'Climate Change Response Act', effective early 2024, introduces a carbon fee system for major polluters. Regulations detailing carbon fee collection were finalized in August 2024, targeting entities emitting over 25,000 tonnes of carbon dioxide annually.

Da Cin Construction must now meticulously evaluate its carbon emissions and strategize operational adjustments to adhere to these environmental mandates and potential carbon pricing mechanisms.

Building Codes and Green Building Certifications

Taiwan's commitment to sustainability is evident in its building regulations. The EEWH (Ecology, Energy Saving, Waste Reduction, and Health) certification system is a key driver, with new public buildings mandated to achieve Building Energy Efficiency Class 1. This focus on energy efficiency and environmental health directly impacts construction projects like those undertaken by Da Cin Construction.

Further strengthening these green building initiatives, proposed regulations will require photovoltaic (PV) installations on most new, expanded, or renovated buildings exceeding a specified size threshold. For instance, in 2024, Taiwan's Ministry of Economic Affairs announced plans to boost solar power capacity by 1.5 GW annually, with building-integrated photovoltaics (BIPV) playing a significant role.

Da Cin Construction must actively adapt to these evolving legal frameworks. This includes ensuring all projects comply with current and upcoming building codes, particularly those related to energy efficiency and renewable energy integration. Pursuing relevant certifications like EEWH will be crucial for market access and demonstrating environmental responsibility.

- EEWH Certification: Taiwan's green building standard, focusing on ecology, energy saving, waste reduction, and health.

- Building Energy Efficiency Class 1: A mandatory target for new public buildings, indicating high energy performance.

- PV Installation Mandates: Upcoming rules requiring solar panel integration on various building types above a certain size.

- Market Trends: Growing demand for sustainable construction, driven by government policy and public awareness.

Labor Laws and Migrant Worker Policies

Taiwanese labor laws mandate that construction companies like Da Cin secure essential labor and national health insurance for all employees. This legal framework ensures a baseline of worker protection and financial security.

To combat ongoing labor shortages in the construction sector, Taiwan has actively pursued international agreements, notably with India, to facilitate the entry of migrant workers. While specific industry allocations and quotas are still being finalized, these initiatives represent a significant policy shift aimed at bolstering the workforce. For Da Cin, understanding and adhering to the evolving regulations surrounding migrant worker employment, including visa requirements and labor contracts, is crucial for effective workforce management and compliance.

- Mandatory Insurance: Da Cin must provide labor and national health insurance for all its workers, a key legal requirement.

- Migrant Worker Agreements: Taiwan's agreements, such as with India, aim to address labor shortages, impacting Da Cin's potential labor pool.

- Policy Navigation: Da Cin needs to stay abreast of regulations concerning migrant workers to ensure legal and ethical employment practices.

Da Cin Construction must navigate Taiwan's evolving legal landscape, including the recent 'Climate Change Response Act' effective early 2024, which introduces carbon fees for major polluters, with collection details finalized in August 2024. This mandates Da Cin to monitor and manage its carbon footprint to comply with these new environmental regulations and potential carbon pricing mechanisms.

Furthermore, the Government Procurement Act significantly influences Da Cin's access to public projects, with 2023 government procurement spending in Taiwan estimated at NT$1.5 trillion. Recent 2024 amendments focus on fair competition and dispute resolution, requiring Da Cin to maintain updated compliance strategies.

Taiwan's push for green buildings, exemplified by the EEWH certification and mandatory Building Energy Efficiency Class 1 for new public buildings, directly impacts Da Cin's project design and execution. Upcoming regulations mandating photovoltaic installations on new buildings further underscore the need for Da Cin to integrate renewable energy solutions into its portfolio.

Labor laws, including mandatory insurance and evolving regulations for migrant workers, are critical operational considerations for Da Cin. Taiwan's agreements, such as with India, to address construction labor shortages highlight the need for Da Cin to stay informed on employment practices and compliance.

| Legal Factor | Impact on Da Cin Construction | Relevant Data/Regulations |

| Climate Change Response Act | Carbon emission monitoring and reduction strategies required. | Effective early 2024; carbon fee collection details finalized August 2024. |

| Government Procurement Act | Strict adherence for public project tenders and execution. | 2023 government procurement spending: NT$1.5 trillion; 2024 amendments focus on fair competition. |

| Green Building Regulations (EEWH, PV Mandates) | Integration of energy efficiency and renewable energy solutions. | Mandatory EEWH certification; upcoming PV installation requirements for new buildings. |

| Labor Laws & Migrant Worker Policies | Compliance with insurance mandates and evolving workforce regulations. | Mandatory labor and health insurance; agreements with countries like India to address labor shortages. |

Environmental factors

Taiwan's commitment to net-zero emissions by 2050, supported by interim targets for 2030, 2032, and 2035, directly impacts construction firms like Da Cin. The introduction of a domestic carbon fee in 2024 signals a tangible cost for carbon emissions, incentivizing greener practices.

As Taiwan integrates its economy into the global carbon market, Da Cin Construction faces growing pressure to demonstrably lower its carbon footprint. This includes adopting sustainable materials and energy-efficient construction methods to comply with evolving regulations and potentially leverage carbon credits.

Sustainable architecture is increasingly vital in Taiwan's real estate sector, with green building standards becoming a key consideration for developers like Da Cin Construction. Taiwan's own EEWH (Ecology, Energy saving, Waste reduction, Health) green building certification system is a prime example of this trend.

As of January 2024, Taiwan had certified a significant number of projects, with over 12,585 buildings or projects achieving EEWH certification. This widespread adoption indicates a strong market demand for environmentally responsible construction.

Da Cin Construction can leverage this environmental factor to its advantage by focusing on designing and building projects that not only meet but surpass these established green building standards. This commitment to sustainability can differentiate Da Cin in the competitive Taiwanese market, potentially attracting environmentally conscious clients and investors.

Taiwan's commitment to sustainability is driving a shift towards eco-friendly building materials, with initiatives promoting low-carbon cement and recycled aggregates. This policy aims to significantly cut construction-related emissions, with the construction sector being a major contributor to Taiwan's carbon footprint. Da Cin can leverage these material innovations to improve project durability and environmental performance.

Resource efficiency is another key environmental focus, emphasizing the recycling of construction waste and reducing energy and water consumption in new builds. Taiwanese regulations are increasingly mandating these practices, encouraging a circular economy approach within the industry. By adopting these resource-efficient methods, Da Cin can align with national environmental targets and potentially reduce operational costs.

Renewable Energy Integration in Buildings

Taiwan's commitment to decarbonization is driving significant policy changes, such as proposed regulations mandating photovoltaic (PV) installations on most new, expanded, or renovated buildings exceeding a specific size. This move is a key component of Taiwan's strategy to achieve net-zero emissions by 2050, signaling a substantial shift towards greater renewable energy adoption. The government's increased investment in renewable energy infrastructure, projected to reach NT$1.4 trillion (approximately US$45 billion) by 2030, directly impacts the construction sector.

For Da Cin Construction, this presents a strategic imperative to integrate solar and other renewable energy solutions into its building designs and development strategies. Such integration not only ensures compliance with upcoming regulations but also aligns with growing market demand for sustainable and energy-efficient properties. For instance, by 2024, Taiwan's installed solar capacity reached over 10 GW, a figure expected to continue its upward trajectory, underscoring the expanding market for solar integration services.

- Regulatory Mandates: New Taiwanese regulations will require PV installations on most new, expanded, or renovated buildings above a certain size, pushing for greater renewable energy use.

- Net-Zero Commitment: This initiative supports Taiwan's national goal of achieving net-zero emissions by 2050, a critical driver for sustainable construction practices.

- Market Growth: With Taiwan's solar capacity exceeding 10 GW in 2024 and continued government investment, there's a growing market opportunity for construction firms adept at integrating renewable energy solutions.

- Strategic Adaptation: Da Cin Construction must proactively incorporate solar and other renewables into its designs to meet compliance, capture market demand, and enhance its competitive edge in a decarbonizing economy.

Climate Change Adaptation and Resilience

Taiwan is increasingly vulnerable to climate change impacts, with average air temperatures showing an upward trend. In response, the government launched the National Climate Change Adaptation Action Plan for 2023-2026, aiming to bolster the nation's adaptive capabilities. This initiative actively encourages the development and adoption of climate adaptation technologies, fostering new business avenues.

Da Cin Construction can capitalize on these trends by focusing on infrastructure projects designed for enhanced resilience against environmental shifts. This includes building more robust structures and developing innovative adaptive building solutions that can withstand extreme weather events, a growing concern in the region.

- Rising Temperatures: Taiwan's average temperatures have been increasing, necessitating more resilient construction.

- Government Action Plan: The 2023-2026 National Climate Change Adaptation Action Plan highlights opportunities in adaptive technologies and infrastructure.

- Business Opportunities: Da Cin can pursue projects focused on climate-resilient infrastructure and adaptive building designs.

Taiwan's environmental regulations are increasingly stringent, pushing for carbon neutrality by 2050 with interim targets. This includes a domestic carbon fee introduced in 2024, directly impacting construction costs and incentivizing greener practices for companies like Da Cin Construction.

The push for sustainable architecture is evident, with over 12,585 projects achieving Taiwan's EEWH green building certification by January 2024, reflecting strong market demand for eco-friendly construction.

Mandatory photovoltaic (PV) installations on new buildings and significant government investment in renewables, projected at NT$1.4 trillion by 2030, create opportunities for integrating solar solutions, especially as Taiwan's solar capacity surpassed 10 GW in 2024.

Taiwan's vulnerability to climate change, marked by rising temperatures, is addressed by the 2023-2026 National Climate Change Adaptation Action Plan, encouraging resilient infrastructure and adaptive building technologies.

| Environmental Factor | Impact on Da Cin Construction | Supporting Data/Initiatives |

|---|---|---|

| Carbon Neutrality Goals | Increased costs for emissions, need for sustainable materials and methods. | Net-zero by 2050, domestic carbon fee (2024), carbon market integration. |

| Green Building Standards | Demand for certified projects, differentiation through sustainability. | Over 12,585 EEWH certifications (Jan 2024), EEWH certification system. |

| Renewable Energy Integration | Opportunity in solar installations, compliance with new mandates. | Mandatory PV on new buildings, NT$1.4 trillion renewable investment (by 2030), >10 GW solar capacity (2024). |

| Climate Change Adaptation | Demand for resilient infrastructure and adaptive building solutions. | National Climate Change Adaptation Action Plan (2023-2026), rising average temperatures. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Da Cin Construction is meticulously crafted using data from reputable sources, including government construction sector reports, economic forecasts from leading financial institutions, and updated environmental regulations. We also incorporate insights from industry-specific publications and market research firms to ensure comprehensive coverage.