CW Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CW Group Bundle

Unlock the external forces shaping CW Group's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to shifting social demographics and technological advancements, understand the critical factors influencing their operations and future growth. This expertly crafted report provides actionable insights for strategic planning and competitive advantage. Download the full PESTLE analysis now to gain a deeper understanding and make informed decisions.

Political factors

Government healthcare policies, such as potential changes to pharmaceutical pricing regulations, significantly influence CW Group's profitability. For instance, in 2024, many nations continued to explore drug price negotiation frameworks, aiming to lower costs for consumers, which could impact the revenue streams for companies like CW Group.

Subsidies and public health initiatives also play a key role. Increased government funding for specific health programs in 2024, like those promoting preventative care or expanding access to certain treatments, could either boost demand for CW Group's relevant products or shift market focus, requiring strategic adaptation.

Consumer purchasing power for healthcare and beauty products is directly tied to these policies. When governments implement measures to make healthcare more affordable, it can free up disposable income for other purchases, potentially benefiting CW Group's beauty segment, but also indicates a broader sensitivity to pricing.

The overall demand for pharmaceutical and beauty products is shaped by these policy shifts. For example, if new regulations in 2024 make a particular type of medication more accessible, it could increase demand for related over-the-counter products or complementary beauty items that CW Group offers.

Adapting to these evolving policy landscapes is essential for CW Group to maintain its market share and ensure sustained profitability in the dynamic healthcare and consumer goods sectors.

International trade agreements and potential tariffs on imported pharmaceutical, healthcare, and beauty products directly influence CW Group's supply chain expenses and the accessibility of its goods. For instance, the USMCA, which replaced NAFTA, aimed to streamline trade within North America but also introduced new rules of origin that could impact sourcing strategies for companies like CW Group. Changes in these agreements, or the imposition of new tariffs, can escalate the cost of raw materials or finished products, potentially squeezing profit margins or necessitating price adjustments for consumers.

Protectionist policies enacted by various nations present a significant variable. For example, as of early 2024, the European Union continues to review and potentially adjust its trade policies, which could affect the import of certain beauty ingredients or finished pharmaceutical goods into the bloc. Such shifts can force companies to either absorb increased costs, find alternative suppliers which may not be as cost-effective, or pass these expenses onto their customer base, impacting overall sales volume and profitability.

Monitoring the evolving global trade landscape is therefore a critical component of CW Group's strategic sourcing and pricing frameworks. Decisions regarding where to source materials or manufacture products are heavily influenced by tariff rates and trade pacts. For example, understanding the implications of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) on member countries can inform long-term supply chain planning and market access strategies for CW Group's diverse product portfolio.

CW Group operates under the stringent oversight of global regulatory bodies like the FDA and EMA, which define quality, safety, and marketing standards for its pharmaceutical and beauty offerings. Adherence to Good Manufacturing Practice (GMP) is paramount, alongside meticulous product registration and advertising compliance. For instance, in 2024, the FDA continued to emphasize rigorous inspection protocols, impacting product launch timelines for many companies.

Failure to meet these evolving regulatory demands can trigger severe penalties, including costly product recalls and substantial damage to CW Group's brand reputation. In 2025, expect increased scrutiny on supply chain transparency and data integrity, areas where a single lapse could have significant financial repercussions.

Political Stability and Geopolitical Events

Geopolitical stability in regions crucial for CW Group's manufacturing, sourcing, and operational markets directly impacts supply chain integrity and consumer sentiment. For instance, ongoing geopolitical tensions in Eastern Europe, which continued into 2024, have demonstrably affected global shipping routes and energy prices. This instability can create significant logistical hurdles and currency volatility.

Conflicts and political unrest pose direct threats to predictable business operations and sustained growth. In 2024, reports indicated that several major shipping lanes experienced disruptions due to regional conflicts, leading to an estimated 15-20% increase in certain freight costs compared to pre-conflict periods. Such events necessitate agile contingency planning for CW Group.

A stable political environment is foundational for predictable operations and long-term business expansion. Countries with strong rule of law and predictable regulatory frameworks, such as Germany and Singapore, often offer more favorable conditions for investment and market entry. CW Group's presence in these markets benefits from this inherent stability.

Key considerations for CW Group regarding political factors include:

- Monitoring geopolitical flashpoints: Closely tracking regions like the South China Sea and the Middle East for potential supply chain disruptions.

- Assessing political risk in emerging markets: Evaluating the stability of governments and regulatory environments in key growth markets.

- Understanding trade policy shifts: Analyzing how changes in international trade agreements and tariffs, such as those potentially impacting US-China trade in 2024-2025, could affect CW Group's sourcing and sales.

- Evaluating currency exchange rate volatility: Hedging strategies to mitigate risks arising from fluctuating exchange rates influenced by political events.

Government Funding for Health and Wellness

Government funding for health and wellness initiatives directly impacts the market landscape for companies like CW Group. For instance, the U.S. government's commitment to expanding access to healthcare and promoting preventative measures, as seen in proposed budget increases for public health programs for 2024 and 2025, can foster demand for CW Group's offerings. Increased investment in areas such as mental health services or chronic disease management support could translate into greater market opportunities.

Conversely, shifts in government budgetary priorities can present challenges. If, for example, there are significant cuts to public health spending in key markets due to fiscal consolidation, this could reduce overall consumer purchasing power for health-related products and services, potentially impacting CW Group's revenue streams.

- Increased government allocation to preventative healthcare programs (e.g., obesity reduction, smoking cessation) creates direct demand for CW Group's wellness solutions.

- Government-funded vaccination campaigns or public health awareness drives can indirectly boost consumer interest in health and wellness products.

- Budgetary constraints leading to reduced public spending on health services may dampen demand for non-essential health items offered by CW Group.

- Policy changes favoring specific health sectors, like telehealth or mental health, can create niche opportunities for CW Group to align its product development.

Government healthcare policies, such as potential changes to pharmaceutical pricing regulations, significantly influence CW Group's profitability. For instance, in 2024, many nations continued to explore drug price negotiation frameworks, aiming to lower costs for consumers, which could impact the revenue streams for companies like CW Group. Subsidies and public health initiatives also play a key role; increased government funding for specific health programs in 2024, like those promoting preventative care, could boost demand for CW Group's relevant products. Consumer purchasing power for healthcare and beauty products is directly tied to these policies; when governments make healthcare more affordable, it can free up disposable income for other purchases, potentially benefiting CW Group's beauty segment.

What is included in the product

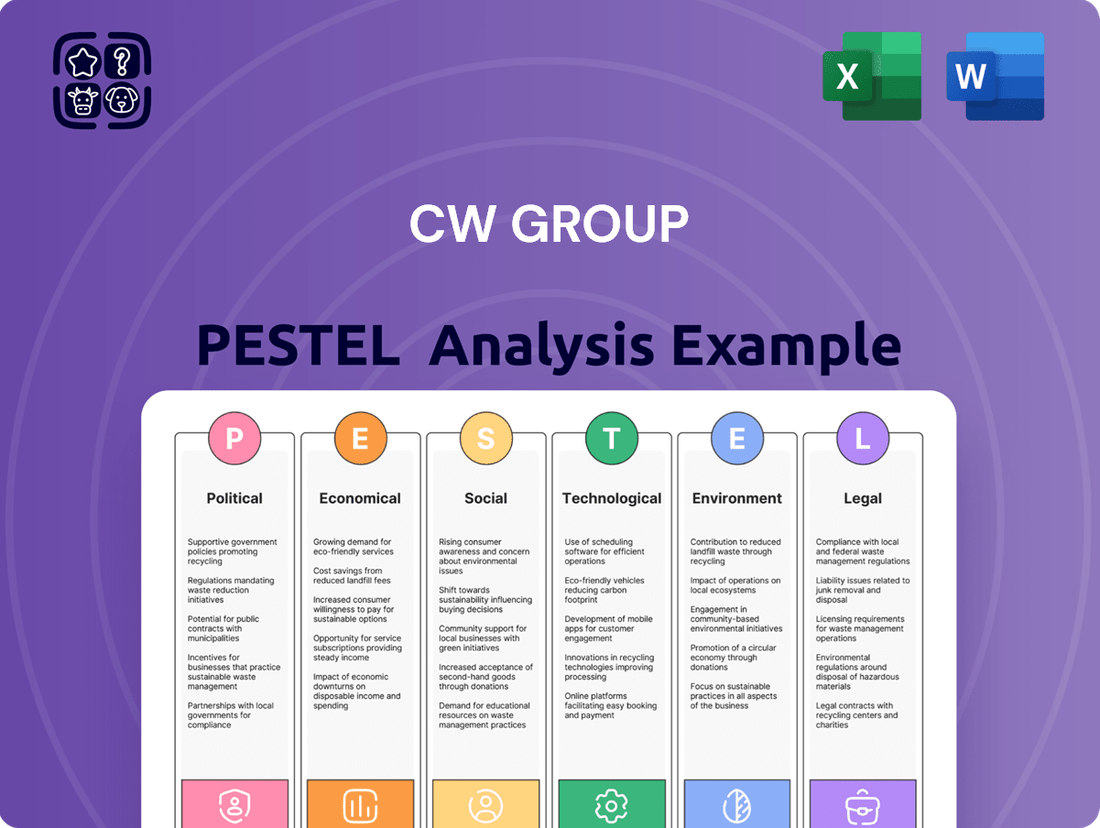

The CW Group's PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal landscapes impacting the business.

It provides actionable insights into external forces that shape opportunities and threats for the CW Group's strategic decision-making.

Provides a concise overview of the CW Group's PESTLE analysis, streamlining complex external factors into actionable insights for strategic decision-making.

Helps identify and mitigate potential external threats and capitalize on emerging opportunities by clearly outlining political, economic, social, technological, environmental, and legal influences.

Economic factors

Consumer spending and disposable income are critical drivers for companies like CW Group, particularly in sectors such as pharmaceuticals, healthcare, and beauty. When consumers have more money left after essential expenses, they tend to spend more on non-prescription health items and cosmetics. For instance, in the US, real disposable personal income saw an increase of 3.2% in the first quarter of 2024, suggesting a potential boost for these discretionary purchases.

However, economic headwinds can quickly shift consumer priorities. During periods of high inflation or recessionary fears, individuals often cut back on non-essential goods. This means that while demand for vital medicines remains relatively stable, spending on beauty and wellness products might decline. The US Consumer Price Index (CPI) rose by 3.4% year-over-year in April 2024, indicating ongoing inflationary pressures that could impact discretionary spending patterns.

CW Group's sales trajectory is thus intrinsically linked to the overall economic vitality of the regions it operates in. A robust economy with growing disposable incomes generally translates to higher sales for the company, especially for its beauty and wellness segments. Conversely, economic contractions or significant drops in consumer confidence can dampen sales, forcing a strategic re-evaluation of product offerings and marketing efforts.

Rising inflation poses a significant challenge, directly impacting CW Group's operational costs. For instance, in early 2024, global inflation rates, while moderating from 2023 peaks, remained elevated in many regions, pushing up the price of essential commodities and transportation. This translates to higher purchasing costs for CW Group's suppliers, who then pass these increases onto the company, potentially squeezing profit margins if these costs cannot be fully absorbed or reflected in final product pricing.

Managing inventory levels and optimizing supply chain logistics are therefore paramount for CW Group in this inflationary climate. By implementing strategies to reduce waste and improve efficiency, the company can better mitigate the impact of rising input costs. For example, adopting just-in-time inventory systems or negotiating longer-term supply contracts can provide a buffer against price volatility, ensuring more predictable cost structures.

Fluctuations in interest rates directly affect CW Group's cost of capital. For instance, if the Federal Reserve raises its benchmark interest rate, borrowing for expansion projects or even day-to-day operations becomes more expensive. This can put a squeeze on margins and make previously viable investments less attractive.

In 2024, the market has seen a cautious approach to rate cuts by central banks globally. For CW Group, this means that securing loans for significant capital expenditures, such as opening new retail locations or investing in advanced supply chain technology, will likely carry higher interest burdens compared to periods of lower rates. This directly impacts the financial feasibility of growth plans.

Access to favorable credit terms remains a critical enabler of CW Group's expansion strategy. A robust credit profile allows the company to negotiate better loan conditions, which is vital for funding acquisitions or undertaking large-scale internal development. Without this access, the company's growth trajectory could be significantly hampered.

For example, if CW Group needs to finance the acquisition of a competitor, higher prevailing interest rates in 2024-2025 could increase the overall cost of that acquisition by millions, impacting the return on investment calculations and potentially leading to a reassessment of the deal's attractiveness.

Exchange Rate Volatility

CW Group's international presence across markets like Australia, New Zealand, China, and Ireland means it's directly impacted by fluctuating exchange rates. This volatility influences both the cost of goods purchased from overseas and the real value of earnings generated in foreign currencies. For instance, if the Australian Dollar strengthens significantly against the Euro, CW Group's revenues booked in AUD will translate into fewer Euros, potentially impacting profitability.

A strengthening Australian Dollar, for example, would make imported raw materials or finished goods cheaper for CW Group. Conversely, a weaker Australian Dollar would increase the cost of these imports. This dynamic requires careful management of supply chains and pricing strategies to absorb or pass on these currency-driven cost changes. The Reserve Bank of Australia’s target cash rate, influencing the AUD, is a key factor to monitor.

To navigate these currency risks, CW Group likely employs hedging strategies. These can include forward contracts or options to lock in exchange rates for future transactions, thereby providing greater certainty over costs and revenues. The effectiveness of these hedges depends on accurate forecasting of currency movements and the specific financial instruments used.

- Exchange Rate Impact: Fluctuations in currencies such as the AUD, NZD, CNY, and EUR directly affect CW Group's import costs and the repatriated value of international sales.

- Currency Strength: A strong local currency generally lowers import costs but reduces the value of foreign earnings, while a weak currency has the opposite effect.

- Hedging Necessity: Proactive use of financial instruments like forward contracts is often essential to mitigate the financial risks associated with unpredictable exchange rate movements.

- Economic Indicators: Monitoring central bank policies, such as interest rate decisions by the Reserve Bank of Australia or the European Central Bank, is crucial for anticipating currency shifts.

Market Growth in Pharmaceutical and Retail Sectors

The pharmaceutical and retail sectors in CW Group's operating regions are experiencing robust growth, directly influencing the company's expansion opportunities. An aging global population, coupled with rising health awareness and a persistent increase in chronic diseases, continues to fuel demand for pharmaceutical products and related retail services. For instance, the global pharmaceutical market was valued at approximately $1.57 trillion in 2023 and is projected to reach $2.19 trillion by 2027, growing at a CAGR of around 8.6%.

CW Group's strategic resource allocation hinges on understanding these market dynamics. Analyzing specific regional market forecasts, such as the projected 7-9% annual growth for the European pharmaceutical retail market through 2026, allows for more effective identification of high-potential areas and investment opportunities. This data-driven approach is crucial for maintaining a competitive edge and ensuring sustained growth.

- Aging Demographics: Globally, the proportion of individuals aged 65 and over is projected to reach 16.4% by 2050, a significant driver for pharmaceutical demand.

- Rising Health Consciousness: Increased consumer focus on preventative health and wellness is boosting sales in both pharmaceutical and health-focused retail segments.

- Chronic Disease Prevalence: Conditions like diabetes and cardiovascular disease, which require ongoing medication, contribute substantially to market expansion.

- Market Growth Forecasts: The pharmaceutical wholesale market alone was projected to grow by over 5% annually in key developed markets between 2024 and 2025.

Consumer spending power directly influences demand for CW Group's health and beauty products. With real disposable incomes showing modest growth in early 2024, there's potential for increased discretionary spending. However, persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, can erode purchasing power, making consumers more cautious about non-essential purchases.

Rising inflation increases operational costs for CW Group, as seen with elevated commodity and transportation prices globally in early 2024. This necessitates efficient supply chain management and pricing strategies to maintain profit margins. Interest rate policies also impact the cost of capital, with global central banks maintaining cautious stances on rate cuts throughout 2024, making borrowing for expansion more expensive.

Exchange rate volatility, particularly for currencies like the AUD, NZD, and EUR, affects CW Group's import costs and the value of its international earnings. For instance, a stronger AUD would lower import expenses but reduce the value of sales made in other currencies when repatriated. Proactive hedging strategies are crucial to mitigate these financial risks in an unpredictable global market.

| Economic Factor | Impact on CW Group | 2024/2025 Data Point/Trend |

|---|---|---|

| Consumer Spending & Disposable Income | Drives demand for health and beauty products. | US real disposable personal income increased 3.2% in Q1 2024. |

| Inflation | Increases operational costs (commodities, transport). | US CPI was 3.4% year-over-year in April 2024. |

| Interest Rates | Affects cost of capital for expansion and borrowing. | Central banks globally adopting cautious approach to rate cuts in 2024. |

| Exchange Rates | Impacts import costs and value of foreign earnings. | Monitoring key currencies like AUD, NZD, EUR is crucial. |

What You See Is What You Get

CW Group PESTLE Analysis

The preview you see here is the exact CW Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CW Group, providing crucial insights for strategic decision-making. You can trust that the detailed breakdown of market trends, competitive landscape, and potential challenges is precisely what you'll get. No surprises, just a complete, professionally structured PESTLE analysis ready for your review.

Sociological factors

The aging population in developed nations, a significant demographic trend, directly benefits CW Group by boosting demand for its core offerings like pharmaceuticals and healthcare services. For instance, in 2024, the World Health Organization reported that the global population aged 60 and over is projected to reach 2.1 billion by 2050, highlighting a sustained and growing market for age-related wellness products. This demographic shift necessitates a strategic focus on products and services catering to the health and longevity needs of this expanding segment.

Conversely, fluctuations in birth rates and migration patterns present both challenges and opportunities. Lower birth rates in some regions might temper demand for products aimed at younger demographics, while increased migration can create new market segments with distinct needs. For example, in 2023, many European countries continued to see below-replacement fertility rates, while migration provided demographic boosts in others. CW Group must remain agile, adapting its product portfolio to align with these evolving consumer bases, potentially through targeted marketing or product development for diverse cultural and age groups.

Consumers are increasingly prioritizing preventative health and wellness, a shift that significantly impacts purchasing decisions. This growing awareness fuels demand for natural products, vitamins, supplements, and organic beauty items, pushing companies like CW Group to adapt their offerings. For instance, the global dietary supplements market was valued at an estimated $173.8 billion in 2023 and is projected to grow, indicating a strong consumer commitment to proactive health management.

This trend moves beyond just traditional pharmaceuticals, encouraging diversification into areas like functional foods and health aids. CW Group needs to monitor these evolving consumer preferences, such as the rising interest in plant-based diets or personalized nutrition, to effectively tailor its product assortment and marketing strategies. This proactive approach is crucial for maintaining relevance and capturing market share in a health-conscious landscape.

Consumers increasingly prioritize convenience, with busy schedules driving demand for quick, easy solutions. This shift is evident in the booming online retail sector; in 2024, global e-commerce sales were projected to reach $7.5 trillion, a testament to evolving shopping habits.

CW Group must adapt by strengthening its e-commerce capabilities and optimizing delivery networks to cater to these preferences. Investing in user-friendly online platforms and efficient logistics is crucial for meeting customer expectations for speed and accessibility.

Furthermore, the growing adoption of digital health services indicates a broader societal trend towards tech-enabled convenience and personalized experiences. In 2025, the digital health market is expected to surpass $600 billion, highlighting consumers' comfort with and reliance on digital solutions for everyday needs.

Cultural Attitudes Towards Health and Beauty

Cultural attitudes towards health and beauty significantly shape consumer behavior, influencing demand for CW Group's offerings. For instance, in many Asian markets, a strong emphasis on fair skin drives demand for whitening products, a trend evident in the global skincare market which was projected to reach $149.2 billion in 2024. Conversely, Western markets often prioritize bronzed skin and anti-aging solutions, reflecting diverse beauty ideals.

CW Group's international success hinges on its ability to adapt marketing and product development to these varying cultural perceptions. Understanding local beauty standards, such as the growing popularity of natural ingredients in Europe or the focus on intricate makeup in parts of Latin America, is crucial for resonating with diverse consumer bases. This cultural sensitivity ensures that products and campaigns are relevant and appealing.

The perception of self-care also varies, impacting spending on wellness and beauty treatments. For example, data from 2024 indicates that consumers are increasingly investing in holistic wellness, blending physical health, mental well-being, and aesthetic appeal. This trend necessitates that CW Group considers a broader spectrum of health and beauty products and services.

- Global Skincare Market Growth: Projected to reach $149.2 billion in 2024, highlighting diverse regional demands for specific treatments like skin whitening.

- Holistic Wellness Trend: Consumers increasingly blend physical health, mental well-being, and aesthetic appeal, influencing product development and marketing strategies.

- Regional Beauty Standards: Western markets favor anti-aging and bronzed skin, while Asian markets show strong demand for skin whitening products.

- Natural Ingredients Appeal: Growing consumer preference in Europe for products formulated with natural ingredients.

Workforce Demographics and Skills

The availability of skilled pharmacists, retail staff, and logistics personnel is paramount for CW Group's operational efficiency. In 2024, the global pharmacy market faced a shortage of an estimated 300,000 pharmacists, highlighting the competitive landscape for talent. This scarcity directly impacts staffing levels and can drive up wage costs, a factor CW Group must actively manage.

Sociological factors like educational attainment and labor participation rates significantly influence the pool of potential employees. For instance, in many developed nations, an aging population may lead to lower labor participation rates among younger demographics, while increased focus on higher education can draw individuals away from retail and logistics roles. CW Group's strategy must account for these demographic shifts, as evidenced by a projected 2% decline in the working-age population in some key European markets by 2025.

To counter these challenges and secure a competent workforce, CW Group's investment in training and attractive employment conditions becomes critical. This includes offering competitive salaries, benefits, and professional development opportunities. For example, companies that invest in upskilling their employees often see a 15-20% increase in retention rates, a vital metric in today's tight labor market.

- Skills Gap: A global deficit in skilled pharmacists and retail staff impacts recruitment and operational capacity.

- Demographic Shifts: Aging populations and evolving educational priorities in key markets present challenges to labor availability.

- Talent Competition: Increased demand for skilled workers drives up wage expectations, affecting labor costs.

- Investment in People: Prioritizing training and appealing employment packages is essential for attracting and retaining qualified personnel.

Sociological factors significantly shape CW Group's market landscape, driven by demographic shifts and evolving consumer values. The aging global population, for instance, directly fuels demand for CW Group's healthcare and pharmaceutical offerings, a trend projected to continue as the over-60 population is expected to reach 2.1 billion by 2050. Simultaneously, a growing emphasis on preventative health and wellness, evidenced by the global dietary supplements market's estimated $173.8 billion valuation in 2023, pushes the company towards expanding its portfolio into related areas.

Consumer preferences for convenience and digital solutions are also paramount. The projected $7.5 trillion in global e-commerce sales for 2024 underscores the need for robust online platforms and efficient logistics. Furthermore, diverse cultural attitudes towards beauty and self-care necessitate tailored product development and marketing strategies, acknowledging regional differences such as the demand for skin whitening products in Asia versus anti-aging solutions in Western markets.

Labor availability and skill sets are critical operational considerations. A global shortage of skilled pharmacists, estimated at 300,000 in 2024, highlights the competitive talent market. Demographic shifts, including declining birth rates and aging workforces in some regions, further complicate labor availability, prompting CW Group to prioritize investment in employee training and attractive compensation packages to ensure a skilled workforce and maintain operational efficiency.

| Sociological Factor | Impact on CW Group | Supporting Data (2023-2025 Projections) |

| Aging Population | Increased demand for healthcare and pharmaceuticals | Global population aged 60+ to reach 2.1 billion by 2050 (WHO) |

| Preventative Health Focus | Growth in supplements, wellness products | Global dietary supplements market valued at $173.8 billion (2023) |

| Convenience & Digitalization | Need for strong e-commerce and logistics | Global e-commerce sales projected to reach $7.5 trillion (2024) |

| Cultural Beauty Standards | Requirement for localized marketing and product adaptation | Global skincare market projected at $149.2 billion (2024) |

| Labor Availability & Skills | Challenges in recruitment, need for talent investment | Estimated 300,000 pharmacist shortage globally (2024) |

Technological factors

The surge in e-commerce, particularly within the pharmaceutical and beauty sectors, presents a significant technological factor for CW Group. In 2024, global e-commerce sales are projected to reach over $6 trillion, with online health and beauty product sales showing particularly strong growth.

To stay ahead, CW Group needs to bolster its digital infrastructure, focusing on intuitive mobile apps and streamlined online purchasing experiences. Investments in advanced logistics for efficient last-mile delivery are also crucial to meet consumer expectations for speed and convenience.

Leveraging data analytics for personalized marketing campaigns is another key technological imperative. By understanding consumer behavior online, CW Group can tailor product recommendations and promotions, enhancing customer engagement and driving sales. This approach saw a 20% increase in conversion rates for many online retailers in 2023.

Automation in warehousing and logistics is a game-changer for companies like CW Group. Think about robots handling picking and packing in distribution centers, or autonomous vehicles moving goods. This isn't just futuristic; it's happening now. For example, by 2024, the global warehouse automation market was projected to reach over $30 billion, a significant jump reflecting increased adoption. Such advancements can slash labor costs and dramatically speed up how quickly orders get to customers, a crucial competitive edge.

Artificial intelligence (AI) and machine learning are also transforming operations. AI can analyze vast amounts of data to predict demand with greater accuracy, helping CW Group manage inventory more effectively and avoid stockouts or overstocking. This intelligent forecasting allows for better resource allocation. Furthermore, AI-powered tools can personalize customer interactions and even dynamically adjust pricing, directly impacting profitability by capturing more value and improving customer satisfaction.

Technological progress in pharmaceuticals is rapidly changing the landscape of drug discovery, development, and manufacturing. Innovations like biotechnology and advanced therapies are not only creating new types of treatments but also influencing regulatory requirements. For CW Group, a retailer and wholesaler, these advancements mean a constantly evolving product pipeline and the need to adapt to increasingly complex pharmaceutical categories. Staying abreast of these changes is crucial for ensuring access to the latest and most effective treatments for consumers.

Data Analytics and Cybersecurity

The growing amount of consumer data CW Group gathers presents a significant opportunity for crafting more personalized marketing campaigns and gaining deeper customer insights. For instance, leveraging data analytics can help identify trends in consumer preferences, potentially leading to more targeted product development and service offerings. This capability is becoming increasingly vital in the competitive landscape of 2024 and 2025.

However, this data accumulation also brings a heightened responsibility for robust cybersecurity. Protecting sensitive personal and health information is paramount, especially with the increasing sophistication of cyber threats. A data breach could severely damage CW Group's reputation and lead to substantial financial penalties, underscoring the need for cutting-edge security measures.

Investing in advanced data analytics tools and stringent security protocols is no longer optional but a critical driver of competitive advantage and customer trust. Companies that effectively manage and secure data are better positioned to innovate and build lasting relationships. By 2025, it's estimated that global spending on cybersecurity solutions will exceed $300 billion, highlighting the industry's focus on this area.

- Data Volume Growth: The sheer volume of data generated by consumers continues to expand exponentially, presenting both opportunities and challenges for businesses.

- Personalization Potential: Advanced analytics can unlock highly personalized marketing and customer experiences, driving engagement and loyalty.

- Cybersecurity Imperative: Robust cybersecurity is essential to protect sensitive data, prevent breaches, and maintain consumer trust.

- Investment Trends: Significant investments are being made in data analytics platforms and cybersecurity solutions to gain a competitive edge.

Telehealth and Remote Healthcare Services

The rapid expansion of telehealth and remote healthcare services presents a dual impact on traditional pharmacy models. While it might reduce walk-in traffic for routine prescriptions, it simultaneously opens up significant opportunities for CW Group. This shift in patient care delivery necessitates adaptation, with potential for new distribution channels and service offerings becoming crucial for sustained growth.

CW Group can strategically leverage this technological trend by integrating with burgeoning telehealth platforms. Offering virtual consultations or prescription fulfillment directly through these digital channels could capture a new segment of the market. For instance, by 2024, it's estimated that 80% of healthcare systems will have implemented some form of telehealth, a trend projected to continue growing, highlighting the urgency for CW Group to engage with these services.

- Increased Prescription Volume: Telehealth platforms can drive higher prescription volumes, which CW Group can service through expanded delivery networks.

- New Service Revenue: Offering virtual pharmacist consultations or medication management services can create new revenue streams.

- Enhanced Accessibility: Partnerships with telehealth providers can improve access to CW Group's services for patients in remote or underserved areas.

- Data Integration: Seamless integration with telehealth EMRs can streamline prescription processing and improve patient data accuracy.

Technological advancements are reshaping CW Group's operational landscape, demanding agile adaptation. The accelerating growth of e-commerce, projected to surpass $6 trillion globally in 2024, especially in pharmaceuticals and beauty, necessitates robust digital infrastructure and efficient last-mile logistics. Furthermore, AI and automation are critical for optimizing inventory, predicting demand, and streamlining warehouse operations, with the warehouse automation market alone expected to exceed $30 billion by 2024.

The rise of telehealth, with an estimated 80% of healthcare systems adopting it by 2024, presents new avenues for CW Group to integrate services and expand its reach. This shift requires strategic partnerships with telehealth platforms to facilitate prescription fulfillment and potentially offer virtual consultations, thereby capturing a growing market segment.

Data analytics is pivotal for personalized marketing, with a 20% conversion rate increase observed in 2023 for online retailers employing this strategy. However, the exponential growth in consumer data underscores the paramount importance of cybersecurity, as global spending on security solutions is anticipated to surpass $300 billion by 2025, crucial for safeguarding sensitive information and maintaining customer trust.

Legal factors

CW Group navigates a complex web of pharmaceutical regulations that dictate how it sells, stores, and dispenses medications. These rules cover everything from the licensing of pharmacies and pharmacists to how prescription drugs are scheduled and how advertising is managed.

Failure to comply can lead to significant legal repercussions, including hefty fines and the potential loss of operating licenses. For instance, in 2024, regulators continued to emphasize strict enforcement of Good Pharmacy Practice (GPP) guidelines across major markets, impacting inventory management and dispensing protocols.

The dynamic nature of these regulations, including evolving drug scheduling and updated advertising standards, requires CW Group to maintain constant vigilance. Staying abreast of these changes, such as new data privacy requirements for prescription sales implemented in early 2025 in several European countries, is crucial for uninterrupted operations.

Consumer protection laws significantly shape CW Group's retail landscape, dictating standards for product safety, accurate labeling, and fair trading practices. These regulations directly influence how CW Group operates, ensuring products sold meet stringent safety benchmarks and that consumers receive clear, truthful information. For instance, the EU's General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must not endanger the safety or health of persons. In 2024, the European Commission continued its focus on enforcing these regulations, with a notable increase in market surveillance activities targeting online sales platforms, which CW Group actively utilizes.

Adherence to consumer rights legislation is paramount for building and maintaining consumer trust, a critical asset in the competitive retail sector. Laws ensuring fair trading and transparent pricing, such as those enforced by the Competition and Markets Authority (CMA) in the UK, require CW Group to avoid misleading advertising and implement clear return policies. Failure to comply can lead to substantial fines; for example, in 2023, several major retailers faced penalties for unfair pricing practices. CW Group's proactive approach to handling consumer complaints efficiently and transparently is therefore essential to mitigate reputational damage and potential legal disputes.

CW Group must navigate a complex web of labor laws, including those governing minimum wages, working conditions, and employee benefits. For instance, in 2024, many countries saw adjustments to minimum wage rates, impacting labor costs for companies with significant workforces. Compliance with anti-discrimination statutes is also paramount to avoid costly litigation and maintain a positive public image.

Shifts in unionization trends and workplace safety standards directly influence CW Group's operational expenditures and human resource strategies. For example, updated occupational safety regulations introduced in late 2024 in several key markets necessitated investments in new safety equipment and training programs, adding to overheads.

Upholding equitable labor practices is not just a legal requirement but a strategic imperative for CW Group. By fostering fair treatment and robust employee relations, the company can mitigate the risk of legal challenges and cultivate a motivated workforce, which is crucial for sustained productivity and talent retention.

Data Privacy and Protection Regulations

Regulations like the General Data Protection Regulation (GDPR) significantly impact CW Group's operations, particularly in Europe, mandating stringent rules for customer data handling. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Implementing robust data governance is therefore crucial for safeguarding customer information and preserving stakeholder trust, especially as data breaches continue to be a significant concern for businesses worldwide. In 2023, the average cost of a data breach globally reached $4.45 million, underscoring the financial imperative of strong data protection measures.

CW Group must navigate a complex web of national data protection laws beyond GDPR, each with its own set of requirements for data collection, storage, and usage. These regulations are constantly evolving, requiring continuous monitoring and adaptation of internal policies. A proactive approach to data privacy not only mitigates legal risks but also enhances customer confidence, a key differentiator in today's competitive market. For example, the California Consumer Privacy Act (CCPA) provides consumers with rights regarding their personal information, setting a precedent for similar legislation in other regions.

- GDPR fines can reach up to 4% of global annual turnover or €20 million.

- The average cost of a global data breach in 2023 was $4.45 million.

- National data protection laws require continuous policy adaptation.

- Robust data governance protects customer information and builds trust.

Mergers & Acquisitions and Competition Law

CW Group's ambitious growth, often involving mergers and acquisitions, faces significant scrutiny under competition laws. For instance, a proposed merger between CW Group and Sigma Healthcare in early 2024 would require thorough review by antitrust authorities like the European Commission or the U.S. Federal Trade Commission to prevent any undue market concentration.

These regulatory bodies assess whether a combined entity would stifle competition, leading to higher prices or reduced innovation for consumers. The approval process can be lengthy, often involving detailed economic analysis and potential divestitures of certain business units to satisfy competition concerns.

Key considerations for CW Group in 2024-2025 include:

- Antitrust Review: Ensuring proposed M&A deals do not create monopolies or significantly reduce market competition.

- Regulatory Filings: Complying with stringent reporting requirements in jurisdictions where CW Group operates and intends to merge or acquire.

- Pre-Merger Notification: Adhering to mandatory notification periods for transactions exceeding certain revenue thresholds, such as the Hart-Scott-Rodino Act in the US.

- Compliance Costs: Budgeting for legal counsel and economic consultants to navigate complex regulatory landscapes, which can add millions to transaction costs.

Failure to secure necessary regulatory approvals can result in blocked deals, substantial fines, and reputational damage, impacting CW Group's strategic objectives and financial performance.

CW Group operates under stringent pharmaceutical regulations governing drug sales, storage, and dispensing, with continued emphasis on Good Pharmacy Practice (GPP) in 2024. Evolving data privacy rules for prescription sales, like those implemented in several European countries in early 2025, necessitate constant vigilance to avoid penalties.

Consumer protection laws mandate product safety and accurate labeling, with increased market surveillance of online platforms in 2024 impacting CW Group's retail operations. Adherence to fair trading and transparent pricing laws is crucial to prevent substantial fines, as seen with other retailers in 2023.

Labor laws concerning wages and working conditions, alongside updated occupational safety regulations in late 2024, directly impact CW Group's operational costs. Compliance with anti-discrimination statutes is vital to mitigate litigation risks and maintain a positive employer brand.

Data protection laws like GDPR, with fines up to 4% of global annual turnover, and evolving national regulations require robust data governance. The average cost of a global data breach in 2023 was $4.45 million, highlighting the financial imperative for CW Group to protect customer information.

CW Group's growth through mergers and acquisitions faces scrutiny under competition laws, with antitrust reviews in 2024-2025 assessing market concentration. Failure to comply with pre-merger notifications and regulatory approvals can lead to blocked deals and significant financial penalties.

Environmental factors

Growing consumer and regulatory pressure for corporate sustainability, including reduced carbon footprint and eco-friendly packaging, significantly impacts CW Group's supply chain and product offerings. For instance, by 2024, global consumer spending on sustainable products was projected to exceed $150 billion, a trend directly influencing sourcing and manufacturing decisions for companies like CW Group.

Embracing sustainable practices can enhance brand image and attract environmentally conscious customers. A 2023 report indicated that 70% of consumers are willing to pay more for products from sustainable brands. This presents a clear opportunity for CW Group to differentiate itself and capture market share.

Conversely, failing to adopt green initiatives could lead to negative public perception and potential regulatory penalties. For example, in 2025, stricter emissions standards are expected to be implemented across several key markets, potentially increasing operational costs for businesses not prepared for the transition.

CW Group's operations are significantly impacted by regulations governing the disposal of pharmaceutical waste, packaging materials, and general retail waste. These rules dictate how the company handles everything from expired medications to the cardboard boxes used for shipping, directly influencing operational procedures and associated costs.

Compliance with safe disposal protocols for pharmaceuticals is paramount, alongside initiatives to boost recycling of packaging materials. For instance, in 2024, the European Union's Extended Producer Responsibility (EPR) schemes continued to tighten requirements for packaging waste, potentially increasing costs for companies like CW Group if recycling rates aren't met.

The company must adhere to stringent legal frameworks for the secure and environmentally sound disposal of pharmaceutical waste, a sector often subject to specific hazardous waste management laws. Failure to comply can lead to substantial fines and reputational damage, underscoring the legal and ethical necessity of robust waste management practices.

Promoting recycling for packaging materials not only helps meet regulatory targets but also contributes to CW Group's sustainability goals. Many regions are seeing increased landfill taxes and incentives for circular economy models, making efficient waste reduction and recycling a financially prudent strategy in 2025.

The environmental footprint of CW Group's vast supply chain, encompassing everything from manufacturing to final delivery, faces mounting scrutiny. Key concerns include greenhouse gas emissions generated by global transportation networks and the intensive resource usage inherent in production processes. For instance, shipping and logistics alone accounted for over 14% of global CO2 emissions in 2023, highlighting a significant area for CW Group's potential impact.

Responsible sourcing of raw materials is another critical environmental factor. Ensuring that suppliers adhere to sustainable practices, such as minimizing water usage and promoting biodiversity, is paramount. Reports from 2024 indicate that industries with complex supply chains, like those often found in manufacturing, can see significant reductions in their environmental impact by focusing on ethical material procurement.

By actively assessing and implementing strategies to reduce these environmental impacts, CW Group can not only enhance operational efficiency but also significantly bolster its reputation. Meeting the growing stakeholder demand for demonstrable environmental responsibility is becoming a key differentiator in the market, with many investors now factoring ESG (Environmental, Social, and Governance) performance into their decision-making processes.

Climate Change and Extreme Weather Events

Climate change is a significant environmental factor impacting businesses like CW Group. More frequent and intense extreme weather events, such as floods, hurricanes, and heatwaves, pose a substantial risk. These events can directly disrupt CW Group's supply chains, making it harder to source materials and deliver products. For instance, in 2024, several regions experienced unprecedented rainfall leading to widespread flooding, which caused significant delays in global shipping routes.

The physical infrastructure of CW Group, including distribution centers and retail stores, is also vulnerable. Severe storms can cause damage, leading to temporary or permanent closures, affecting sales and customer access. In early 2025, a series of powerful storms across the North Atlantic disrupted port operations for weeks, impacting inventory availability for retailers in affected areas. Building climate resilience is therefore crucial for CW Group's long-term operational stability and financial performance.

- Increased Frequency of Extreme Weather: Global average temperatures have risen, contributing to more volatile weather patterns. The World Meteorological Organization reported a 30% increase in weather-related disasters between 2000 and 2020.

- Supply Chain Vulnerability: Disruptions can lead to stockouts and increased costs. The average cost of supply chain disruptions rose by 40% in 2023 compared to the previous year, according to a Moody's Analytics report.

- Infrastructure Risk: Damage to warehouses or stores can result in significant repair costs and lost revenue. In 2024, infrastructure damage from extreme weather events globally was estimated to exceed $100 billion.

- Consumer Access Impact: Extreme weather can prevent customers from reaching physical stores, affecting foot traffic and sales. For example, prolonged heatwaves in summer 2024 led to a notable decrease in mall traffic in several major cities.

Water Usage and Treatment

While CW Group isn't a major industrial water consumer, its facilities, especially larger ones or those involved in specific product processes, do utilize water. For instance, in 2024, water consumption for operational needs across similar service-oriented businesses can range from a few thousand to tens of thousands of gallons per month, depending on facility size and specific activities like cleaning or cooling.

Regulatory landscapes concerning water conservation and wastewater treatment are increasingly stringent, impacting operational costs and compliance strategies. In 2025, expect continued emphasis on reducing water footprints, with potential for new local or national mandates on discharge quality and water efficiency metrics.

Focusing on efficient water usage and robust wastewater treatment practices is crucial for CW Group's environmental compliance and demonstrates responsible resource management. Companies adhering to best practices in water stewardship often see reduced utility bills and enhanced brand reputation, aligning with growing consumer and investor demand for sustainability.

- Water Conservation: Implementing water-saving fixtures and optimizing processes can reduce consumption by 10-20% in facilities.

- Wastewater Treatment: Compliance with discharge permits, which vary by region, is essential to avoid fines and environmental damage.

- Resource Stewardship: Proactive water management contributes to corporate social responsibility and can mitigate future supply risks.

CW Group must navigate evolving consumer and regulatory demands for sustainability, influencing its supply chain and product development. For example, by 2024, global spending on sustainable products was projected to surpass $150 billion. Stricter emissions standards expected in 2025 could increase operational costs for less prepared businesses.

The company's waste management practices, particularly for pharmaceutical and packaging waste, are dictated by stringent regulations. In 2024, the EU's Extended Producer Responsibility schemes tightened packaging waste requirements, impacting companies that don't meet recycling targets. Adherence to hazardous waste disposal laws is critical to avoid substantial fines.

CW Group's environmental impact, especially from its supply chain, faces scrutiny regarding greenhouse gas emissions from logistics. Shipping and logistics contributed over 14% of global CO2 emissions in 2023. Responsible sourcing of raw materials, with an emphasis on supplier sustainability, is also paramount for reducing the company's overall footprint.

Climate change presents significant risks through increased extreme weather events, disrupting supply chains and potentially damaging infrastructure. In 2024, unprecedented rainfall caused widespread shipping delays globally. Building climate resilience is vital for CW Group's long-term operational stability and financial health.

| Environmental Factor | Impact on CW Group | Data/Trend |

| Sustainability Demands | Supply chain and product strategy adjustments | Global sustainable product spending projected > $150 billion (2024) |

| Waste Management Regulations | Operational costs, compliance requirements | EU EPR schemes tightening packaging waste rules (2024) |

| Climate Change/Extreme Weather | Supply chain disruption, infrastructure risk | Logistics CO2 emissions ~14% of global total (2023) |

| Water Usage & Discharge | Operational costs, regulatory compliance | Water efficiency mandates expected to increase (2025) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable economic databases, and leading industry analysis reports. This ensures that every aspect of the macro-environment is grounded in accurate, up-to-date information.