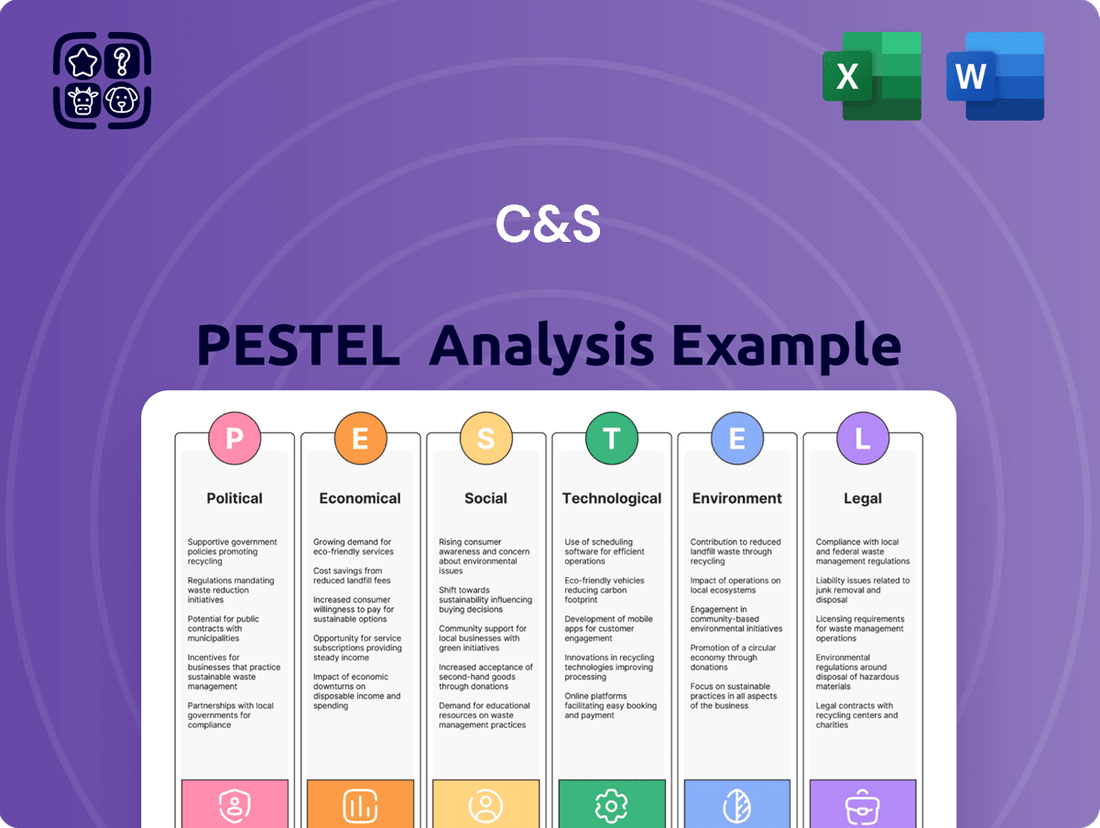

C&S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C&S Bundle

Unlock the critical external factors shaping C&S's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, empowering you to anticipate challenges and capitalize on opportunities. Download the full analysis now to gain a strategic advantage.

Political factors

South Korea's financial regulatory landscape is dynamic, with the Financial Services Commission (FSC) actively shaping policies. In 2024, the FSC continued its focus on investor protection and market stability, introducing stricter rules for digital asset exchanges and refining regulations for alternative investments. These changes directly influence how C&S Asset Management can structure its funds and manage client portfolios, particularly concerning risk management and compliance.

The geopolitical landscape, particularly inter-Korean relations and broader Northeast Asian dynamics, significantly shapes investor confidence and capital movement into South Korea. For C&S Asset Management, shifts in regional tensions directly affect financial market stability, influencing investment returns and client risk tolerance.

For instance, while specific data fluctuates, periods of heightened military exercises or diplomatic standoffs have historically correlated with increased market volatility. In 2024, ongoing developments in North Korea, coupled with evolving relationships between major regional powers like China, the US, and Japan, continue to be closely monitored by investors assessing South Korean assets.

South Korea's fiscal policy, with a projected government expenditure of approximately 657 trillion South Korean won (KRW) for 2024, influences economic liquidity and the bond market. The Bank of Korea's monetary policy, including its benchmark interest rate, which has remained at 3.50% as of early 2024, directly impacts borrowing costs and investment valuations for companies like C&S.

Foreign Investment Policies

Government stances on foreign investment significantly shape C&S Asset Management's operational environment, particularly for its institutional clients. Policies dictating capital repatriation, ownership ceilings, and the availability of incentives for international investors directly influence capital flows and the competitive dynamics of the market. For instance, as of early 2025, many developed nations are actively seeking to attract foreign direct investment (FDI) to stimulate economic growth, with some offering tax breaks and streamlined approval processes.

These foreign investment policies can either bolster or hinder C&S Asset Management's ability to access global funds and manage diverse portfolios.

- Increased FDI inflows can lead to greater market liquidity and a wider range of investment opportunities for C&S clients.

- Restrictive policies, conversely, might limit access to certain markets or increase the cost of capital, impacting portfolio performance.

- Incentive programs, such as tax holidays or special economic zones, are often leveraged by governments to attract specific types of foreign investment, which C&S can strategically utilize.

- Regulations on capital repatriation directly affect the ease with which foreign investors can move their profits out of a country, a key consideration for C&S's global clientele.

Regulatory Oversight and Enforcement

The intensity and focus of regulatory bodies in South Korea, such as the Financial Services Commission (FSC) and Financial Supervisory Service (FSS), significantly influence C&S's compliance landscape. Heightened scrutiny on asset management, fund transparency, and investor protection, as seen with increased fines for disclosure violations in 2024, can lead to substantial operational adjustments and increased costs for firms like C&S.

These regulatory shifts directly impact C&S's operational risks and necessitate proactive adaptation. For instance, the FSS's 2024 initiatives to bolster consumer protection in digital financial services could require C&S to invest in enhanced cybersecurity measures and more transparent customer communication protocols.

- Increased Compliance Costs: Stricter regulations often translate to higher spending on legal counsel, audit services, and technology upgrades.

- Operational Adjustments: Firms may need to revise internal processes, reporting mechanisms, and staff training to meet new compliance standards.

- Reputational Risk: Non-compliance can lead to significant fines and damage a company's reputation, affecting investor confidence and market position.

- Market Access and Product Development: Regulatory approval processes can influence the speed and feasibility of launching new financial products or entering new markets.

Government stability and electoral cycles are key political factors impacting South Korea's economic direction. Changes in administration can lead to shifts in fiscal policy, regulatory priorities, and international trade agreements, all of which affect the investment climate. For C&S Asset Management, understanding these political transitions is crucial for anticipating market movements and adjusting investment strategies accordingly.

What is included in the product

This C&S PESTLE analysis provides a comprehensive examination of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The C&S PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the overwhelm and uncertainty often associated with strategic planning.

Economic factors

South Korea's economic growth is a critical driver for C&S Asset Management. In 2024, the Bank of Korea projected GDP growth to be around 2.1%, a slight uptick from 2023. This expansion signals a generally healthy business environment, which typically translates to better performance across C&S's investment portfolios, from equities to real estate.

For 2025, forecasts suggest a continued, albeit moderate, expansion. Projections from institutions like the IMF indicate growth in the range of 2.2% to 2.3%. Such growth supports higher corporate earnings, potentially boosting stock valuations and increasing investor confidence, which is beneficial for C&S's ability to attract capital and generate returns for its clients.

The Bank of Korea's benchmark interest rate is a pivotal economic factor influencing C&S's investment strategies. As of early 2024, the Bank of Korea maintained its policy rate at 3.50% following several hikes in the preceding year to combat inflation. This environment directly impacts C&S's bond-type funds, where prevailing rates dictate the attractiveness of new issuances versus existing holdings.

For C&S's real estate investments, the interest rate landscape is equally crucial. Higher borrowing costs associated with elevated rates can dampen demand for property and increase expenses for development projects, potentially impacting valuations. Conversely, a scenario of declining rates, anticipated by some economists for late 2024 or 2025, could stimulate real estate markets and make fixed-income investments less appealing due to lower yields.

Inflationary pressures in South Korea directly impact the real returns for C&S's investors. For instance, if inflation averages 3.5% in 2024, a nominal return of 5% would translate to a real return of only 1.5%, potentially making investments less attractive.

These inflation levels also guide the Bank of Korea's monetary policy. Should inflation exceed the Bank's target, typically around 2%, interest rates might rise, affecting borrowing costs for businesses and the overall investment landscape C&S operates within.

Elevated inflation can spur investors to seek assets that historically perform well during such periods, like real estate or commodities. This shift in investor sentiment could lead to changes in fund flows, impacting C&S's asset allocation strategies and the performance of its diverse fund offerings.

Real Estate Market Dynamics

Supply and demand imbalances significantly influence South Korea's real estate market, directly impacting C&S's public offering real estate funds. In 2024, Seoul's housing market, a key indicator, experienced a notable increase in transaction volumes compared to the previous year, driven by easing mortgage regulations and a gradual economic recovery. However, concerns about oversupply in certain metropolitan areas persist, potentially pressuring asset valuations.

Price trends are a critical consideration. While national housing prices saw a modest rise in early 2024, specific regions, particularly those with robust development plans and limited new construction, demonstrated stronger appreciation. For instance, data from the Korea Real Estate Board indicated a 2.5% year-on-year increase in apartment prices in Busan by Q1 2024, showcasing regional variations.

Government interventions, including monetary policy adjustments and housing stimulus packages, play a crucial role. In late 2023 and continuing into 2024, the Bank of Korea maintained its benchmark interest rate, influencing borrowing costs and investor sentiment. Policy shifts aimed at stabilizing the market, such as adjustments to capital gains tax on multiple property owners, directly affect the attractiveness and profitability of real estate investments for funds.

- Supply-Demand Balance: Seoul's housing market saw increased activity in early 2024, but potential oversupply in some areas remains a risk factor.

- Price Trends: National housing prices rose modestly in 2024, with stronger gains observed in areas experiencing limited new supply.

- Government Interventions: Interest rate policies and tax regulations continue to shape investor behavior and market stability.

- Regional Variations: Performance across different cities, like Busan's 2.5% price increase in Q1 2024, highlights the importance of localized analysis.

Capital Market Liquidity

The liquidity of South Korea's capital markets, encompassing both the stock and bond sectors, is a crucial element for C&S Asset Management. It directly influences how efficiently the firm can buy and sell assets and manage requests from investors looking to redeem their fund investments. High liquidity generally translates to smoother operational flows and more favorable pricing for the assets C&S manages.

Conversely, periods of low liquidity can introduce significant challenges. This can manifest as increased market volatility, making it harder to execute trades at desired prices, and can also create operational hurdles, particularly when needing to meet substantial redemption requests quickly. For instance, during periods of market stress, bid-ask spreads can widen, increasing transaction costs.

Recent data highlights the dynamic nature of this liquidity. As of Q1 2024, the average daily trading volume on the Korea Exchange (KRX) for equities stood at approximately ₩8.5 trillion, indicating a robust level of activity. However, bond market liquidity can be more variable, with certain government bond issuances experiencing lower trading volumes compared to more actively traded corporate bonds.

Key liquidity indicators for C&S Asset Management to monitor include:

- Average Daily Trading Volume: Tracking KRX equity and bond turnover provides a baseline for market depth.

- Bid-Ask Spreads: Narrower spreads on frequently traded securities suggest higher liquidity.

- Market Depth: The number of buy and sell orders at various price levels indicates the market's capacity to absorb large trades without significant price impact.

- Foreign Exchange Liquidity: The ease of converting KRW to other currencies is vital for international investors and C&S's global operations.

South Korea's economic trajectory in 2024 and 2025 is shaped by projected GDP growth, with the Bank of Korea forecasting around 2.1% for 2024 and IMF estimates pointing to 2.2%-2.3% for 2025. This steady expansion is crucial for C&S Asset Management, as it generally supports higher corporate earnings and investor confidence, positively influencing equity and real estate portfolios.

Interest rates remain a key economic lever. The Bank of Korea's benchmark rate, held at 3.50% in early 2024, directly impacts C&S's bond funds and the cost of capital for real estate development. Anticipated rate cuts later in 2024 or 2025 could shift investment appeal between fixed income and property markets.

Inflationary pressures, with a target of around 2% for the Bank of Korea, influence real returns and monetary policy. If inflation remains elevated, it could necessitate higher interest rates, impacting borrowing costs and prompting investors to seek inflation-hedging assets, which would require C&S to adjust its asset allocation strategies.

Market liquidity on the Korea Exchange (KRX) is vital for C&S's operational efficiency. As of Q1 2024, average daily equity trading volume was approximately ₩8.5 trillion, indicating robust activity, though bond market liquidity can be more varied.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on C&S | Key Data Point |

|---|---|---|---|---|

| GDP Growth | ~2.1% | ~2.2%-2.3% | Supports corporate earnings and investor confidence | Bank of Korea GDP forecast |

| Benchmark Interest Rate | 3.50% (maintained early 2024) | Potential for cuts | Affects bond yields and real estate financing costs | Bank of Korea policy rate |

| Inflation Rate | Monitoring against 2% target | Expected to moderate | Influences real returns and monetary policy decisions | Bank of Korea inflation target |

| Equity Market Liquidity (KRX) | ~₩8.5 trillion daily avg. (Q1 2024) | Stable | Facilitates efficient trading and asset management | KRX average daily trading volume |

Preview the Actual Deliverable

C&S PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive C&S PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business. Gain actionable insights to inform your strategic decisions.

Sociological factors

South Korea's demographic landscape is rapidly evolving, with a significant aging population. By 2024, the proportion of citizens aged 65 and over is projected to reach approximately 20% of the total population, a trend that profoundly shapes investment needs.

This demographic shift directly influences demand for specific financial products. As more individuals enter retirement age, there's a heightened focus on wealth preservation and generating stable income streams, impacting C&S Asset Management's product development and marketing approaches.

South Korean investors are increasingly seeking out more complex investment avenues like private equity and alternative assets, reflecting a maturing market. This shift is coupled with a significant rise in ESG awareness, with a notable portion of retail investors now considering sustainability when making investment decisions. For instance, data from the Korea Securities Depository in early 2024 indicated a substantial increase in retail participation in overseas markets, often driven by a desire for diversified and socially responsible options.

South Korea's financial literacy levels significantly shape investor behavior towards complex products like those C&S might offer. A 2023 survey by the Financial Supervisory Service indicated that while a majority of adults possess basic financial knowledge, a notable portion struggles with understanding investment risks and diversification strategies. This suggests C&S may need to cater to a spectrum of understanding, potentially offering both sophisticated options for the well-informed and simplified, educational products for newer investors.

Wealth Distribution and Income Inequality

Wealth distribution and income inequality in South Korea directly influence the potential client base for C&S Asset Management. A robust and expanding middle class, coupled with a growing number of high-net-worth individuals, presents a significant opportunity to broaden the market for both retail and institutional investment products. For instance, the top 10% of income earners in South Korea held approximately 45% of total income in 2023, indicating a concentration of wealth that asset managers can target.

Conversely, widening income gaps can lead to a more polarized financial landscape. If wealth becomes concentrated in fewer hands, it might limit the broader appeal of certain investment vehicles and necessitate a more specialized approach to client acquisition. Data from 2024 suggests that while overall economic growth continues, the Gini coefficient, a measure of income inequality, remains a key indicator to monitor for shifts in consumer spending power and investment capacity.

- South Korea's Gini coefficient was around 0.34 in 2023, indicating a moderate level of income inequality.

- The share of income held by the top 1% of earners in South Korea has been gradually increasing, reaching approximately 12% in recent years.

- A growing segment of affluent households in South Korea, projected to increase by 8% annually through 2028, offers a prime demographic for wealth management services.

- The government's focus on social welfare programs in 2024 aims to mitigate some aspects of income disparity, potentially broadening the base for financial services.

Societal Trust in Financial Institutions

Societal trust in financial institutions significantly impacts C&S Asset Management's client acquisition and retention. Following events like the 2008 financial crisis and more recent concerns about data privacy, public confidence has been tested. For instance, a 2023 survey by the Pew Research Center indicated that only 35% of Americans expressed a great deal of confidence in the banking system, a figure that directly influences potential client inflows for asset managers.

Maintaining robust ethical frameworks and transparent communication is paramount for C&S. Investors increasingly scrutinize how their assets are managed and the overall integrity of the firms handling them. Reports from the Federal Reserve in late 2024 highlighted a growing demand for ESG (Environmental, Social, and Governance) integration, suggesting that firms demonstrating strong social responsibility and transparency are better positioned to attract capital.

- Public Confidence Metrics: A decline in public trust, as evidenced by surveys showing lower confidence in financial sectors, directly correlates with reduced client inflows.

- Reputational Impact: Past scandals or market downturns can erode trust, making it harder for firms like C&S to attract new assets under management.

- Transparency and Ethics: Demonstrating high ethical standards and clear communication channels is vital for building and sustaining investor confidence in the current financial climate.

- ESG Demand: Investor preference for firms with strong ESG credentials, a trend observed throughout 2024, underscores the importance of societal values in financial decision-making.

South Korea's aging population, projected to reach 20% aged 65+ by 2024, drives demand for wealth preservation and stable income products. The increasing sophistication of investors, evidenced by a rise in private equity and alternative asset interest, alongside a strong ESG focus, indicates a maturing market. Furthermore, varying financial literacy levels necessitate tailored product offerings and educational support from asset management firms.

| Sociological Factor | Description | Impact on C&S Asset Management | Data Point (2023-2024) |

|---|---|---|---|

| Demographics | Rapidly aging population, declining birth rates. | Increased demand for retirement solutions, healthcare-related investments. | ~20% of population aged 65+ by 2024. |

| Investor Sophistication & ESG Awareness | Growing interest in complex assets and sustainable investing. | Opportunity for specialized funds, need for ESG integration in strategies. | Significant retail participation in overseas markets driven by ESG in early 2024. |

| Financial Literacy | Mixed levels of understanding of investment risks. | Requirement for educational content alongside sophisticated products. | Majority possess basic knowledge, but risk understanding varies (2023 survey). |

| Wealth Distribution | Concentration of wealth among top earners, growing middle class. | Targeting affluent segments for wealth management, broad appeal for retail products. | Top 10% held ~45% of total income in 2023. |

| Societal Trust | Fluctuating confidence in financial institutions. | Emphasis on transparency, ethical practices, and robust communication is crucial for client acquisition. | Surveys indicate varying levels of trust in financial sectors. |

Technological factors

The integration of FinTech solutions in South Korea's financial sector offers significant opportunities for C&S Asset Management. For instance, the adoption of robo-advisors and AI-driven tools can streamline operations and personalize client experiences. South Korea's FinTech market is robust, with digital payment transactions projected to reach approximately ₩1,000 trillion by the end of 2024, indicating a strong client appetite for digital financial services.

Data analytics and AI are game-changers for asset management firms like C&S. By 2024, the global AI in financial services market was projected to reach over $25 billion, highlighting its growing importance. These technologies allow for sophisticated predictive modeling, helping C&S anticipate market shifts and identify investment opportunities with greater accuracy.

Furthermore, AI-powered risk assessment tools can more effectively identify and mitigate potential portfolio downturns. In 2023, firms leveraging advanced analytics reported an average of 15% higher returns compared to those relying on traditional methods. This translates to better client outcomes and a stronger competitive edge for C&S.

Personalized client recommendations, driven by AI analyzing vast datasets of client behavior and market trends, are also a key benefit. This tailored approach can significantly enhance client satisfaction and retention, a critical factor in the competitive landscape of 2024 and beyond.

As C&S Asset Management's operations become more digitized, cybersecurity is a top priority. The firm handles significant amounts of sensitive client information, making robust protection against cyber threats essential. In 2024, the financial services sector experienced a 30% increase in sophisticated cyberattacks, highlighting the critical need for advanced security protocols.

Maintaining client trust and adhering to data privacy regulations, such as GDPR and CCPA, are paramount. A breach could severely damage C&S's reputation and lead to substantial financial penalties. Global spending on cybersecurity solutions in the financial industry is projected to reach $40 billion by the end of 2025, reflecting the industry's commitment to this area.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) offer significant potential for C&S Asset Management to revolutionize its operations. The application of DLT in areas like fund administration and secure transaction processing promises to streamline processes and boost transparency. By exploring these advancements, C&S could unlock greater efficiency and cost reductions within its fund operations. For instance, the global market for blockchain in financial services was projected to reach $10.45 billion in 2024, highlighting the substantial investment and adoption in this sector.

The tokenization of real estate assets on blockchain platforms is another key area of exploration. This innovation could democratize access to previously illiquid markets, creating new investment avenues. Furthermore, DLT's inherent security features and immutable record-keeping capabilities can significantly reduce the risk of fraud and enhance data integrity across all asset management functions. Industry reports suggest that by 2027, the value of tokenized assets could exceed $5 trillion, underscoring the transformative impact of this technology.

- Streamlined Fund Administration: DLT can automate reconciliation, reduce manual errors, and expedite settlement cycles, potentially cutting operational costs by 20-30%.

- Real Estate Tokenization: Enabling fractional ownership of properties, increasing liquidity and accessibility for investors.

- Enhanced Security and Transparency: Immutable transaction records and decentralized data storage reduce the risk of cyberattacks and improve auditability.

Digital Platforms and Client Engagement

The evolution of digital platforms is fundamentally reshaping how asset management firms like C&S engage with their clients. User-friendly interfaces for fund access, reporting, and general interaction are no longer a luxury but a necessity. These platforms enhance client satisfaction by offering convenience and transparency, crucial for retaining and attracting new investors in a competitive market.

In 2024, a significant trend is the increasing demand for personalized digital experiences. C&S Asset Management must continue to invest in technology that allows for tailored reporting and communication. For instance, advancements in AI-driven chatbots can provide instant client support, freeing up human advisors for more complex tasks. By 2025, it's projected that over 70% of financial services interactions will occur digitally, underscoring the importance of robust online capabilities.

- Enhanced Client Experience: Digital platforms offer 24/7 access to account information and investment performance, improving overall client satisfaction.

- Attracting New Investors: Tech-savvy investors, particularly millennials and Gen Z, are drawn to firms with intuitive and modern digital offerings.

- Operational Efficiency: Streamlining processes like onboarding and transaction execution through digital channels reduces costs and improves speed.

- Data Analytics: Digital interactions generate valuable data that can be analyzed to better understand client needs and preferences, leading to more targeted product development and marketing.

Technological advancements are pivotal for C&S Asset Management's growth, with FinTech integration and AI-driven tools enhancing operational efficiency and client personalization. The robust South Korean FinTech market, with digital payments nearing ₩1,000 trillion by end-2024, signals strong client adoption of digital financial services.

AI and data analytics are transforming the sector, with the global AI in financial services market projected to exceed $25 billion by 2024. These technologies enable predictive modeling for market shifts and risk assessment, with firms using advanced analytics reporting an average 15% higher returns in 2023.

Blockchain and DLT offer significant potential for streamlining operations, enhancing security, and creating new investment avenues like real estate tokenization. The global market for blockchain in financial services was estimated at $10.45 billion in 2024, with tokenized assets projected to surpass $5 trillion by 2027.

| Technology | Impact on C&S Asset Management | Relevant Data (2024/2025 Projections) |

|---|---|---|

| FinTech & AI | Streamlined operations, personalized client experiences, predictive modeling, enhanced risk assessment. | AI in Financial Services Market: >$25 billion (2024); Digital Payment Transactions in South Korea: ~₩1,000 trillion (end-2024). |

| Blockchain & DLT | Improved fund administration, secure transactions, real estate tokenization, enhanced transparency. | Blockchain in Financial Services Market: $10.45 billion (2024); Tokenized Assets Value: >$5 trillion (by 2027). |

| Digital Platforms & Cybersecurity | Enhanced client engagement, 24/7 access, operational efficiency, data protection. | Financial Services Cybersecurity Spending: $40 billion (end-2025); Digital Interactions in Financial Services: >70% by 2025. |

Legal factors

C&S Asset Management's operations are firmly anchored in South Korea's Financial Services and Investment Company Act. This legislation is crucial, outlining the rules for setting up, running, and overseeing asset management companies. It dictates licensing, the types of investment products they can offer, and how they must protect investors.

Adherence to this act is non-negotiable for C&S. For instance, as of late 2024, the Financial Supervisory Service (FSS) reported that South Korean asset management firms collectively managed over 1,200 trillion KRW, highlighting the significant regulatory oversight in this sector. C&S must ensure all its activities, from fund creation to marketing, align with these stringent requirements to maintain its license and build client trust.

Legal frameworks like the Securities Act of 1933 and the Investment Company Act of 1940 dictate how real estate investment funds, including those C&S Asset Management might manage, can raise capital and operate. These laws ensure investor protection through disclosure requirements and regulatory oversight, impacting everything from marketing to fund structure.

Specific state and federal regulations govern property acquisition, zoning laws, environmental compliance, and landlord-tenant relationships, all critical for C&S's real estate ventures. For instance, in 2024, the US saw continued focus on affordable housing initiatives, potentially introducing new legal incentives or restrictions for developers and investors in that segment.

Valuation standards and reporting requirements, often guided by bodies like the Appraisal Institute, must be adhered to for transparency and compliance. Furthermore, the distribution of returns to investors is subject to tax laws and fund-specific agreements, requiring careful legal navigation to maintain fund integrity and investor trust.

South Korea's stringent data privacy regulations, exemplified by the Personal Information Protection Act (PIPA), place considerable responsibilities on C&S Asset Management. These laws govern every aspect of client data, from initial collection to secure storage, processing, and cross-border transfer.

Compliance is paramount for C&S Asset Management to steer clear of significant fines, which can reach up to 5% of total revenue for certain violations under PIPA. Maintaining client confidence and safeguarding against costly data breaches are direct outcomes of robust adherence to these legal frameworks.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws

C&S Asset Management navigates a complex web of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations are critical for preventing the misuse of financial systems for illicit purposes. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation globally, with a focus on beneficial ownership transparency and digital asset regulation as of 2024.

Compliance with these laws necessitates robust Know Your Customer (KYC) procedures, including thorough client due diligence and ongoing monitoring. The firm must also implement effective suspicious transaction reporting mechanisms and maintain meticulous records. This ongoing commitment to compliance represents a significant operational and resource commitment, impacting efficiency and costs.

- Regulatory Scrutiny: Financial institutions, including asset managers, face increasing scrutiny from regulators regarding AML/CTF compliance.

- Operational Burden: Implementing and maintaining rigorous KYC and transaction monitoring systems adds substantial operational costs and complexity.

- Data Management: Comprehensive record-keeping for extended periods is mandated, requiring sophisticated data management solutions.

- Global Harmonization: Efforts to harmonize AML/CTF standards internationally, such as through FATF initiatives, require continuous adaptation of internal policies.

Investor Protection Regulations

Investor protection regulations are paramount for C&S Asset Management, encompassing disclosure mandates, suitability standards for financial products, and robust dispute resolution frameworks. Strict adherence to these legal stipulations is vital for fostering investor trust and minimizing the legal liabilities arising from mis-selling or insufficient information dissemination. For instance, the Securities and Exchange Commission (SEC) in the United States, a key regulator, actively enforces rules like Regulation Best Interest, which became effective in June 2020, requiring financial professionals to act in the best interest of their retail customers when making recommendations. This focus on investor welfare is a cornerstone of maintaining a reputable and sustainable asset management operation.

The regulatory landscape continues to evolve, demanding constant vigilance from firms like C&S. In 2024, regulatory bodies globally are increasingly scrutinizing areas such as ESG (Environmental, Social, and Governance) disclosures and cybersecurity measures, directly impacting how asset managers operate and communicate with their clients. Failure to comply can result in significant penalties and reputational damage. For example, the EU's Sustainable Finance Disclosure Regulation (SFDR), fully applicable since January 2023, mandates detailed reporting on sustainability risks and impacts, affecting how C&S might market its funds.

Key aspects of investor protection regulations relevant to C&S Asset Management include:

- Disclosure Requirements: Ensuring transparency regarding fund performance, fees, risks, and investment strategies.

- Suitability Rules: Verifying that investment products align with individual client needs, objectives, and risk tolerance.

- Dispute Resolution Mechanisms: Providing accessible and fair processes for addressing client grievances and complaints.

- Fiduciary Duty: Upholding the obligation to act in the client's best interest, prioritizing their welfare above the firm's.

Legal factors significantly shape C&S Asset Management's operational framework, demanding strict adherence to financial services acts and securities laws. These regulations, such as South Korea's Financial Services and Investment Company Act, govern licensing, product offerings, and investor protection, with the FSS overseeing a sector managing over 1,200 trillion KRW as of late 2024.

Compliance with data privacy laws like South Korea's PIPA is critical, with potential fines reaching up to 5% of total revenue for violations, underscoring the importance of secure data handling for client trust and avoiding breaches.

AML/CTF regulations, influenced by global bodies like FATF, necessitate robust KYC procedures and ongoing monitoring, representing a significant operational commitment for C&S.

Investor protection mandates, including disclosure and suitability rules, are vital for C&S's reputation and legal standing, with regulators like the SEC actively enforcing standards like Regulation Best Interest.

| Legal Area | Key Regulation/Act | Impact on C&S | Recent/Relevant Data Point |

| Asset Management Operations | South Korea's Financial Services and Investment Company Act | Licensing, product rules, investor protection | FSS oversees 1,200+ trillion KRW managed by asset firms (late 2024) |

| Data Privacy | Personal Information Protection Act (PIPA) | Client data handling, security, cross-border transfer | Fines up to 5% of revenue for certain violations |

| Financial Crime Prevention | AML/CTF Laws | KYC, transaction monitoring, record-keeping | FATF recommendations influencing global standards (2024) |

| Investor Protection | SEC's Regulation Best Interest | Fiduciary duty, suitability, disclosure | Effective June 2020, impacting client recommendations |

Environmental factors

The growing emphasis on Environmental, Social, and Governance (ESG) criteria is reshaping investment landscapes globally. This trend is particularly evident in the asset management sector, where client demand for responsible investment options continues to surge. For instance, in 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting a significant shift in capital allocation.

C&S Asset Management, like its peers, is experiencing heightened pressure to embed ESG principles across its investment strategies, especially within real estate and private equity. This integration is crucial for attracting a widening pool of responsible investors and aligning with evolving stakeholder expectations for ethical and sustainable business practices.

Climate change presents significant physical risks to C&S's real estate holdings, with an increasing frequency of extreme weather events like floods and heatwaves impacting property values and insurance costs. Transition risks, such as evolving carbon pricing mechanisms and stricter environmental regulations, could also affect the profitability of certain portfolio companies. For instance, a 2024 report by Swiss Re estimated that global GDP could be reduced by up to 11% by 2050 due to unmitigated climate change, highlighting the systemic financial implications.

However, these challenges also unlock substantial opportunities. C&S can capitalize on the growing demand for green investments and sustainable infrastructure, potentially launching new funds focused on renewable energy, energy efficiency, and climate-resilient development. The global green bond market, for example, reached an estimated $1 trillion in issuance in 2023, demonstrating a strong investor appetite for environmentally conscious assets.

Sustainability reporting requirements are becoming increasingly stringent, compelling firms like C&S Asset Management to disclose their Environmental, Social, and Governance (ESG) performance. This includes detailing how ESG factors are integrated into their investment portfolios. By 2024, a significant portion of major global asset managers were already enhancing their ESG disclosures to meet evolving investor expectations.

Resource Scarcity and Pollution Concerns

South Korea faces growing concerns over resource scarcity, particularly in water and critical minerals, which could affect industries C&S invests in. For instance, the nation's reliance on imported raw materials for its manufacturing sector, a significant portion of its GDP, highlights this vulnerability.

Pollution, especially air and water quality issues in major urban centers like Seoul, presents ongoing challenges. These environmental factors can lead to increased regulatory scrutiny and operational costs for businesses, potentially impacting asset valuations within C&S's portfolios. By 2024, South Korea's waste generation per capita remained a significant environmental metric, underscoring the need for sustainable practices.

- Resource Dependence: South Korea imports over 90% of its energy and a substantial portion of its raw materials, making it susceptible to global supply chain disruptions and price volatility.

- Pollution Impact: Air pollution levels in Seoul have frequently exceeded WHO guidelines, leading to public health concerns and potential government interventions affecting industrial operations.

- Regulatory Landscape: Expect stricter environmental regulations in 2024-2025, pushing companies towards greener technologies and sustainable resource management, which could redefine industry viability.

- Investment Opportunities: C&S may find opportunities in companies developing solutions for water treatment, renewable energy, and circular economy models to mitigate these environmental risks.

Green Building Standards and Regulations

For C&S Asset Management's real estate funds, meeting green building standards is crucial. For instance, the U.S. Green Building Council's LEED certification is becoming a benchmark, with a significant increase in certified projects annually. Adopting these standards can boost property valuations by an estimated 5-10% and reduce operating expenses, such as energy costs, by up to 30%.

Environmental regulations are also tightening, impacting development and operational practices. In 2024, many regions are seeing stricter energy efficiency mandates for new constructions and major renovations. This trend is driven by global climate goals and local government initiatives aimed at reducing carbon footprints.

- Investor Demand: A 2024 survey indicated that over 70% of institutional investors consider ESG (Environmental, Social, and Governance) factors, including green building, in their real estate allocation decisions.

- Operational Savings: Properties with high green building ratings, like BREEAM or LEED Platinum, consistently report lower utility bills, contributing to higher net operating income.

- Regulatory Compliance: Non-compliance with evolving environmental regulations can lead to fines and operational disruptions, making proactive adherence a strategic imperative.

- Asset Value Appreciation: Green-certified buildings often command higher rental rates and experience lower vacancy periods, leading to enhanced long-term asset value.

Environmental factors significantly influence C&S Asset Management's operations and investment strategies, particularly concerning climate change and resource management.

The increasing frequency of extreme weather events poses physical risks to real estate holdings, while evolving carbon pricing and stricter regulations create transition risks for portfolio companies.

Opportunities arise from the growing demand for green investments, with the global green bond market showing robust growth, reaching an estimated $1 trillion in issuance in 2023.

South Korea's reliance on imported energy and raw materials, coupled with pollution concerns in urban centers, presents specific vulnerabilities that C&S must navigate.

| Environmental Factor | Impact on C&S | Data Point/Trend (2023-2025) | Opportunity/Mitigation |

|---|---|---|---|

| Climate Change (Physical Risks) | Property value depreciation, increased insurance costs | Estimated 11% global GDP reduction by 2050 due to unmitigated climate change (Swiss Re, 2024) | Invest in climate-resilient infrastructure and properties |

| Climate Change (Transition Risks) | Profitability impact from carbon pricing, new regulations | Stricter energy efficiency mandates for new constructions (2024) | Focus on companies with sustainable operations and low carbon footprints |

| Resource Scarcity (South Korea) | Supply chain disruptions, price volatility for manufacturing investments | South Korea imports over 90% of its energy | Invest in companies developing solutions for resource efficiency, water treatment, and circular economy |

| Pollution (South Korea) | Increased regulatory scrutiny, operational costs for portfolio companies | Air pollution in Seoul frequently exceeds WHO guidelines | Support businesses adopting cleaner production methods |

| Green Building Standards | Property valuation uplift, reduced operating expenses | LEED-certified projects increase annually; green buildings report lower utility bills | Prioritize green certifications for real estate assets |

PESTLE Analysis Data Sources

Our C&S PESTLE analysis is built on a robust foundation of data sourced from reputable government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, societal trends, technological advancements, environmental regulations, and legal frameworks to ensure comprehensive and accurate insights.