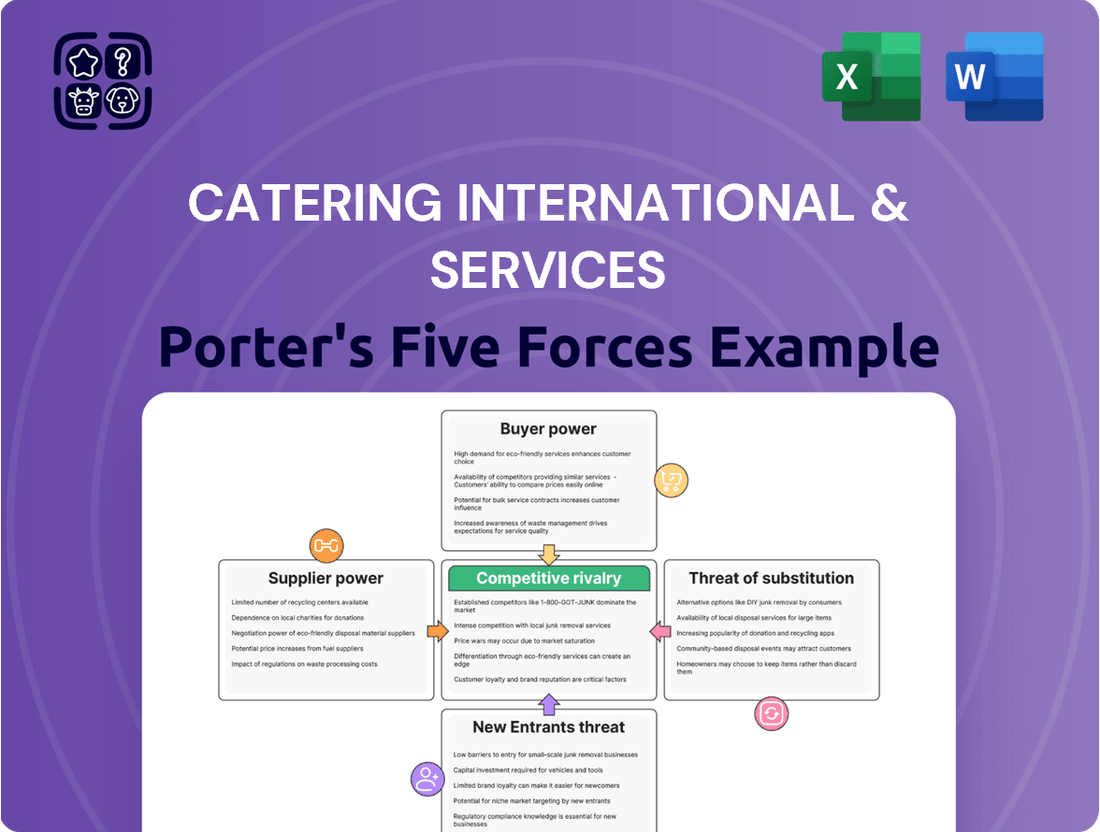

Catering International & Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Catering International & Services Bundle

This brief snapshot only scratches the surface of the competitive landscape for Catering International & Services. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for strategic positioning. Unlock the full Porter's Five Forces Analysis to explore Catering International & Services’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration for Catering International & Services (CIS) is a key factor in their bargaining power. When only a few suppliers can provide specialized food items for remote sites or unique construction equipment, these suppliers gain leverage to influence pricing and terms. For instance, if a particular type of freeze-dried food essential for remote operations is sourced from only two global manufacturers, CIS's ability to negotiate favorable pricing is diminished.

Operating in remote and often challenging locations, as CIS does, naturally limits the pool of available suppliers. This scarcity can amplify the bargaining power of the few companies capable of meeting CIS's stringent logistical and product requirements. In 2024, reports indicated that the cost of specialized logistics for remote catering services saw an average increase of 7-10% due to these supply chain constraints.

The costs for Catering International & Services (CIS) to switch suppliers can be quite significant, particularly when dealing with comprehensive services like facility management or extensive catering contracts. These expenses often encompass the process of evaluating and approving new vendors, the legal and administrative effort of drafting and finalizing new agreements, and the operational adjustments needed to integrate new supply chains or technologies.

Furthermore, CIS might incur costs related to retraining its workforce to handle different product specifications or operational systems introduced by a new supplier. For instance, a shift in food suppliers might necessitate new storage protocols or preparation techniques, adding to the overall switching burden.

These substantial switching costs effectively increase the bargaining power of CIS's current suppliers. The financial and operational disruption involved in changing providers means CIS is less likely to switch, giving existing suppliers leverage in price negotiations and contract terms.

Suppliers who provide highly specialized or unique products and services, like advanced purification systems for remote camp water or specialized logistics for defense contracts, hold significant bargaining power. When these offerings are crucial for Catering International & Services (CIS) and hard for others to replicate, these suppliers can dictate higher prices and more advantageous terms, especially within CIS's specialized market segments.

Threat of Forward Integration by Suppliers

The threat of suppliers like major food distributors or construction firms integrating forward to offer remote site support services directly to CIS clients is a notable concern. Such a move could directly challenge CIS's core business, potentially leading to increased competition and a reduction in CIS's market share. For instance, a large food service provider with existing infrastructure and logistics could leverage its scale to offer bundled catering and remote support solutions.

While this forward integration poses a potential risk, it's often tempered by the significant capital investment and operational complexities inherent in managing remote sites. These operations require specialized expertise in logistics, personnel management, and often, adherence to stringent safety and regulatory standards, which can act as a barrier to entry for many suppliers. The high upfront costs and the need for a dedicated, skilled workforce make this a less immediate or likely threat for many potential entrants compared to simply supplying goods.

- Complexity Barrier: The intricate nature of remote site management, including logistics, specialized labor, and regulatory compliance, presents a significant hurdle for suppliers considering forward integration.

- Capital Intensity: Establishing the necessary infrastructure and operational capabilities for remote site services demands substantial capital, making it a less attractive proposition for many suppliers.

- Market Specialization: CIS's established expertise and client relationships in the remote site services sector create a competitive advantage that is difficult for suppliers to replicate quickly or cost-effectively.

Importance of CIS to Supplier's Business

The degree to which a supplier relies on Catering International & Services (CIS) for its revenue significantly shapes its bargaining power. If CIS constitutes a substantial percentage of a supplier's total sales, that supplier will likely be more amenable to negotiating favorable pricing and terms to secure continued business. For instance, if a key catering equipment supplier derived 25% of its annual revenue from CIS in 2024, it would have a strong incentive to maintain that relationship.

Conversely, if CIS represents a minor client for a supplier, the supplier has less motivation to compromise on price or other contractual conditions. This is because the loss of CIS's business would have a minimal impact on the supplier's overall financial performance. For example, if a specialty food ingredient provider only saw 1% of its 2024 revenue coming from CIS, it would possess greater leverage in price negotiations.

- Supplier Dependence: A supplier's reliance on CIS for a large portion of its revenue directly correlates to increased bargaining power for CIS.

- Revenue Contribution: For example, if a supplier's 2024 financial reports indicate that CIS accounted for over 15% of their sales, they are likely to offer more competitive terms.

- Client Size Impact: Conversely, if CIS is a small client, representing less than 2% of a supplier's 2024 revenue, the supplier's ability to dictate terms is enhanced.

- Relationship Value: The perceived long-term value of the CIS account influences a supplier's willingness to concede on price or service levels.

The bargaining power of suppliers for Catering International & Services (CIS) is significantly influenced by supplier concentration and the uniqueness of their offerings. When few suppliers can provide essential specialized items for remote operations, their ability to dictate terms increases, as seen with specialized food or equipment providers. The cost and complexity involved in switching suppliers, encompassing vendor evaluation, legal processes, and operational adjustments, further solidify the leverage of existing suppliers, making CIS less inclined to change providers.

The threat of forward integration by suppliers, where they might offer direct services to CIS clients, is a potential concern. However, the substantial capital investment, specialized expertise, and regulatory compliance required for remote site management often act as significant barriers, mitigating this risk for many potential entrants. For instance, the complexity of managing logistics and personnel in remote defense contracts presents a high barrier to entry.

A supplier's dependence on CIS for revenue also plays a crucial role; higher dependence means greater negotiation flexibility for CIS. Conversely, if CIS represents a small portion of a supplier's business, the supplier holds more power. In 2024, a supplier deriving over 15% of its revenue from CIS would likely offer more competitive terms compared to one where CIS accounted for less than 2%.

| Factor | Impact on Supplier Bargaining Power | Example for CIS (2024 Data) |

|---|---|---|

| Supplier Concentration | High if few suppliers for specialized needs | Limited suppliers for remote site freeze-dried food |

| Switching Costs | High if significant financial/operational disruption | Costs for retraining staff for new food suppliers |

| Uniqueness of Offering | High if product/service is difficult to replicate | Advanced purification systems for remote camps |

| Supplier Dependence on CIS | Low if CIS is a small part of supplier revenue | Supplier revenue from CIS < 2% |

| Forward Integration Threat | Moderate due to high barriers to entry | Capital intensity for remote site services |

What is included in the product

This analysis provides a comprehensive overview of the competitive forces impacting Catering International & Services, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Easily identify and address competitive threats, from new entrants to substitute services, by visualizing the impact of each Porter's Five Force on Catering International & Services.

Customers Bargaining Power

Catering International & Services (CIS) serves large clients in sectors like oil and gas, mining, construction, and defense. These clients often award contracts with substantial financial values, making them crucial for CIS's revenue streams.

A concentrated customer base, where a few major clients account for a significant portion of sales, naturally grants these large customers increased bargaining power. Their ability to shift business to competitors can pressure CIS on pricing and contract terms.

In 2024, CIS's financial results highlighted the critical role of these key clients, with new contracts and renewals being primary drivers of performance. This underscores the leverage these entities hold in negotiations.

For clients operating in remote and challenging environments, switching from an established service provider like Catering International & Services (CIS) presents significant hurdles. The integrated nature of CIS's offerings, encompassing catering, facility management, and camp construction, means a change involves substantial logistical complexities and potential operational disruptions. This complexity inherently limits the bargaining power of customers.

Customers in sectors like oil and gas and mining, which are heavily influenced by commodity price swings, often exhibit significant price sensitivity regarding their operational expenditures. For instance, a 10% increase in the cost of essential services could directly impact a mining company's profitability by reducing their margin on extracted resources.

While the essential nature of remote site support services can somewhat buffer extreme price demands, clients will consistently look for the most economical options available. This means that even critical services are evaluated for cost-effectiveness, making price a persistent factor in purchasing decisions.

Catering International & Services (CIS) can effectively counter this by highlighting the value derived from its integrated solutions and proven operational efficiencies. Demonstrating how their services contribute to overall cost reduction and improved productivity, rather than just being a line item expense, is crucial for retaining and attracting these price-conscious clients.

Threat of Backward Integration by Customers

The threat of customers integrating backward into remote site support services, essentially performing these functions in-house, is generally low for companies like Catering International & Services. This is primarily because these services demand specialized expertise and significant logistical capabilities, especially in remote and challenging environments. For instance, managing catering, accommodation, and associated facility services in an oil rig or a remote mining camp requires a distinct set of skills and infrastructure that most clients in these sectors do not possess or wish to develop.

Large corporations in industries such as oil, gas, and mining are typically focused on their core competencies, like exploration and extraction. They often find it more efficient and cost-effective to outsource non-core functions like remote site support to specialized providers rather than diverting their capital and management attention to managing extensive catering and hospitality operations. This outsourcing trend is a significant factor in the low perceived threat of backward integration. In 2023, the global market for remote site services, encompassing catering and accommodation, was valued in the billions, indicating a strong reliance on specialized third-party providers.

While the threat of full backward integration is minimal, some clients might consider handling very basic support functions internally. However, even these limited attempts often prove inefficient compared to engaging a dedicated service provider. The complexity of supply chains, regulatory compliance, and the need for specialized personnel in remote locations make it a substantial barrier for most clients to bring these services in-house effectively. For example, ensuring food safety standards and managing waste disposal in isolated areas requires specific protocols that outsourcing partners are equipped to handle.

- Low Likelihood of Backward Integration: Clients in sectors like oil, gas, and mining typically lack the specialized expertise and logistical infrastructure required for remote site support services.

- Focus on Core Competencies: Major corporations prioritize their primary business operations, making outsourcing of non-core functions like catering and facility management a more strategic choice.

- Logistical and Regulatory Hurdles: Managing supply chains, ensuring compliance, and handling personnel in remote or challenging locations present significant challenges for in-house execution.

- Market Reliance on Specialists: The substantial global market for remote site services underscores the industry's dependence on specialized third-party providers rather than in-house capabilities.

Availability of Alternative Service Providers

The presence of alternative service providers significantly influences the bargaining power of customers for Catering International & Services (CIS). While CIS has carved out a niche, the broader catering and hospitality sector includes global players like Newrest, which also offer remote site services and facility management. This means customers aren't solely reliant on CIS, granting them more leverage.

For instance, in 2023, the global remote site services market was valued at approximately USD 120 billion, indicating a substantial competitive landscape. The availability of companies with comparable global reach and integrated service portfolios empowers clients to negotiate terms more aggressively. CIS must therefore focus on demonstrating unique value and service excellence to retain its competitive edge.

- Global Competitors: Companies like Newrest offer similar remote site and facility management services, directly challenging CIS.

- Customer Leverage: The existence of these alternatives allows customers to compare offerings and negotiate better pricing or service terms.

- Market Size: The global remote site services market, estimated at around USD 120 billion in 2023, highlights the competitive nature of the industry.

- Differentiation Imperative: CIS needs to continuously differentiate its services to mitigate the increased bargaining power of its customers.

The bargaining power of customers for Catering International & Services (CIS) is moderate, influenced by the concentrated nature of its client base and the essential, yet potentially price-sensitive, nature of its services. While clients in sectors like oil and gas and mining are vital, their ability to negotiate is somewhat tempered by the logistical complexities of switching providers, especially in remote locations.

However, price sensitivity remains a key factor, as evidenced by the constant search for cost-effectiveness. CIS must therefore emphasize the value of its integrated solutions and operational efficiencies to counter this pressure. The threat of backward integration by clients is low, as they typically focus on core competencies, making outsourcing a strategic advantage.

The competitive landscape, with global players like Newrest offering similar services, further empowers customers to negotiate, making differentiation and service excellence critical for CIS.

| Factor | Impact on CIS | Reasoning |

|---|---|---|

| Customer Concentration | Moderate to High | A few large clients represent significant revenue, granting them leverage. |

| Switching Costs | Low to Moderate | Logistical complexities in remote sites limit easy switching, but not entirely. |

| Price Sensitivity | Moderate | Clients in commodity-driven sectors are cost-conscious, pressuring CIS on pricing. |

| Threat of Backward Integration | Low | Clients lack specialized expertise and focus on core operations. |

| Availability of Substitutes | Moderate | Global competitors offer similar services, increasing customer options. |

Preview Before You Purchase

Catering International & Services Porter's Five Forces Analysis

This preview showcases the complete Catering International & Services Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the industry. You're looking at the actual document; once purchased, you'll gain instant access to this comprehensive report, ready for immediate use and strategic planning.

Rivalry Among Competitors

The remote site support services sector features a mix of large global companies and niche specialists. This means Catering International & Services (CIS) operates in an environment with diverse competitive pressures.

Players like Newrest are prominent, offering extensive catering and facility management services for remote locations, directly challenging CIS's market share. The competitive landscape is thus quite active.

While CIS demonstrated robust financial results in 2024, with revenues surpassing €400 million, it is not operating in a vacuum. The presence of numerous competitors, both large and small, intensifies rivalry.

The market for remote site support services, including offshore catering and defense logistics, is showing robust growth. This expansion is a key factor influencing competitive rivalry.

The global offshore catering services market is anticipated to reach around $2.3 billion by 2032, with a projected compound annual growth rate (CAGR) of 7.1%. Additionally, the defense logistics market is set for substantial growth between 2024 and 2032.

This upward trend in industry growth can actually temper intense rivalry. When the pie is getting bigger, companies are more inclined to focus on capturing new opportunities and expanding their operations rather than engaging in aggressive competition for a static market share.

Catering International & Services (CIS) distinguishes itself by providing a complete suite of remote site support. This includes everything from catering and hospitality to facility management and even camp construction, particularly in tough locations. This integrated approach sets them apart from competitors who might offer only a single service.

CIS places a strong emphasis on improving the well-being of people working at these remote sites, alongside boosting operational efficiency. They achieve this through customized, people-focused, innovative, and eco-friendly solutions. For instance, in 2024, CIS reported a significant increase in client satisfaction scores related to improved living conditions at their managed sites, a direct result of these tailored services.

This robust differentiation strategy directly impacts competitive rivalry. By offering a more comprehensive and value-added service package, CIS can lessen the pressure of direct price competition. Clients are often willing to pay a premium for the reliability, quality, and holistic support that CIS provides, making them less likely to switch to a lower-cost, less integrated provider.

Switching Costs for Customers

The integrated and complex nature of remote site services, such as those provided by Catering International & Services (CIS), creates significant switching costs for clients. These costs are not merely financial but also involve operational disruptions and the time required to re-establish reliable service chains.

For instance, a client relying on CIS for a complete package of catering, accommodation, and facility management at a remote mining or construction site would face substantial hurdles in changing providers. This includes the potential need to re-negotiate contracts, retrain staff on new systems, and manage the logistical complexities of onboarding a new supplier, all of which can delay project timelines and increase overall expenditure.

- High Setup Costs: New providers often require significant upfront investment to establish infrastructure and logistics at remote locations.

- Operational Disruption: Switching can interrupt essential services, impacting employee morale and operational efficiency.

- Contractual Obligations: Existing long-term contracts with performance clauses can make early termination costly.

- Integration Complexity: The bundled nature of remote site services means a client is not just switching one service, but an entire operational ecosystem.

Exit Barriers

High exit barriers significantly fuel competitive rivalry within the catering services sector, particularly for global players like CIS. These barriers include substantial investments in specialized assets such as remote operational camps and dedicated equipment, which are not easily redeployed or sold, locking companies into the industry. For example, companies in this space often have extensive logistical networks and proprietary technologies that are industry-specific.

Long-term contracts, a common feature in the industry, further cement companies’ commitments, making early exits financially punitive. This creates a situation where even underperforming firms may continue to operate, intensifying competition as they fight for market share to recover their investments. CIS’s operational footprint across more than 20 countries underscores the scale of these commitments.

- Specialized Assets: Catering companies often invest in unique infrastructure like mobile kitchens, specialized transport, and remote site facilities that have limited alternative uses, increasing the cost of exiting.

- Long-Term Contracts: Many catering contracts, especially in sectors like oil and gas or defense, span several years, creating significant financial obligations and disincentives for early withdrawal.

- Global Operational Presence: Maintaining operations in diverse geographical locations requires substantial upfront and ongoing investment in legal, logistical, and human capital, making a complete withdrawal complex and costly.

- Brand Reputation: A company's reputation for reliability and service continuity is crucial; exiting a market abruptly can damage its global brand, impacting future business opportunities.

Competitive rivalry is a significant force for Catering International & Services (CIS), given the presence of both global giants and specialized niche players. While CIS reported revenues exceeding €400 million in 2024, the sector's growth, projected to see the offshore catering market reach $2.3 billion by 2032, attracts and sustains numerous competitors. CIS differentiates itself through a comprehensive service offering and a focus on client well-being, which helps mitigate direct price-based competition.

The intensity of rivalry is further shaped by high switching costs for clients, stemming from the integrated nature of remote site services and contractual obligations. These barriers, coupled with substantial investments in specialized assets and global operational footprints, create high exit barriers for companies, meaning even less successful firms remain active participants, thus sustaining competitive pressure.

| Competitor Type | Key Characteristics | Impact on CIS Rivalry |

|---|---|---|

| Global Players | Extensive service offerings, large operational scale | Direct competition for major contracts, economies of scale |

| Niche Specialists | Focused services, localized expertise | Competition in specific service segments or regions |

| New Entrants | Innovative solutions, potentially lower cost structures | Disruption potential, pressure on pricing and service models |

SSubstitutes Threaten

The primary substitute for Catering International & Services (CIS) integrated remote site services is for clients to manage these operations themselves. While large companies might possess the resources, the specialized expertise, logistical complexities, and the non-core nature of these services in remote, often hazardous environments make in-house provision a less attractive and less efficient option for most.

For instance, a significant portion of the workforce in sectors like mining and oil & gas, where CIS operates, is deployed in remote locations. Managing the catering, accommodation, and facility maintenance for these dispersed workforces requires a dedicated infrastructure and a deep understanding of local supply chains and regulatory frameworks, which many clients lack.

In 2024, companies are increasingly focused on core competencies, making outsourcing non-essential services like remote site management a strategic decision to improve efficiency and reduce operational overhead. The inherent difficulties in sourcing, transporting, and maintaining supplies and personnel in challenging geographies further amplify the appeal of specialized providers like CIS.

The rise of decentralized or modular solutions presents a significant threat. Customers might choose to bypass integrated providers like Catering International & Services (CIS) by contracting individual services such as catering, facility management, or construction separately from different specialized firms. This fragmented approach, while offering perceived flexibility, can introduce substantial coordination challenges and increase the overall management burden for clients.

Technological advancements can introduce indirect substitutes for traditional catering services. For example, highly automated or AI-driven facility management systems, coupled with remote monitoring capabilities, could potentially lessen the reliance on extensive on-site human staffing for certain aspects of service delivery. This trend is observable as companies increasingly invest in smart building technologies to optimize operations.

However, the core of catering and hospitality inherently involves human interaction and personalized guest experiences. While technology can enhance efficiency, it struggles to fully replicate the nuanced service and customer engagement that define the industry. For instance, in 2024, the global market for event technology, while growing, still primarily focuses on augmenting rather than replacing human service in hospitality settings.

Local, Smaller Service Providers

Local, smaller service providers can indeed present a threat of substitution, particularly in specific geographic markets. These entities might compete on price, offering niche services at a lower cost point than a global player like Catering International & Services (CIS). For instance, a regional catering company in a developed market might undercut CIS on a standard event catering contract.

However, the substitutability is often limited when considering CIS's core strengths. These smaller providers typically lack the extensive global footprint, the ability to manage complex, integrated facility services across multiple sites, and the specialized experience required for remote or challenging operational environments. This means they are generally not a direct substitute for the comprehensive solutions CIS provides to large corporations or organizations with international operations.

The threat is more pronounced for isolated or less complex service components. For example, while a local food supplier might substitute for a small part of CIS's catering operations, they cannot replace the end-to-end facility management or the logistical expertise needed for large-scale projects. In 2024, the market for specialized, localized services continues to grow, but the demand for integrated, globally managed solutions remains robust, especially within the sectors CIS serves.

- Limited Scope: Smaller local providers often focus on specific service areas, lacking the broad capabilities of CIS.

- Geographic Constraints: Their reach is typically regional, failing to match CIS's international presence.

- Experience Gap: CIS's experience in challenging and remote locations is a significant differentiator not easily replicated by local competitors.

- Integration Capabilities: The ability to provide integrated facility management and catering services is a key advantage for CIS over fragmented local offerings.

Shifts in Client Operations

A significant threat of substitutes for Catering International & Services (CIS) arises from fundamental shifts in how their clients operate. If industries like oil and gas or defense drastically alter their operational models, particularly by reducing reliance on remote locations or large fixed camps, demand for CIS's core services could diminish.

For instance, a hypothetical scenario where oil and gas companies pivot away from extensive remote exploration, or defense forces adopt less camp-dependent strategies, would directly impact CIS. This is because the need for catering, accommodation, and facility management in these remote settings is the bedrock of CIS's business model.

However, the inherent nature of these industries often necessitates continued remote support. Despite potential operational shifts, the fundamental requirements for supporting personnel in challenging or isolated environments are likely to persist, mitigating the complete erosion of demand from this substitute threat.

- Potential Client Operational Shifts: Reduced remote exploration in oil and gas or less reliance on large camps in defense operations.

- Impact on CIS: Direct decrease in demand for catering, accommodation, and facility management services.

- Mitigating Factor: The persistent need for remote support in these industries suggests the threat may not be absolute.

Clients opting for self-management of remote site operations represent a key substitute, though the specialized expertise and logistical demands often make this impractical. While some large corporations might have the capacity, the complexity of remote supply chains and regulatory environments favors outsourcing to specialists like Catering International & Services (CIS). In 2024, the trend of companies focusing on core competencies further strengthens the case for outsourcing non-essential services.

The rise of decentralized service models, where clients contract individual services like catering or facility management separately, poses another substitute threat. This fragmented approach can lead to coordination challenges and increased client management burdens, potentially outweighing perceived flexibility. For instance, a mining operation might contract catering from one firm and accommodation from another, increasing complexity.

Technological advancements, such as automated facility management systems, could reduce the need for extensive on-site human staffing for certain tasks. However, the core of hospitality remains human interaction, a factor technology struggles to fully replicate. The global event technology market, while growing, still primarily augments rather than replaces human service in hospitality settings as of 2024.

Smaller, local providers can offer a price-based substitute, particularly for niche services in specific markets. However, they typically lack CIS's global footprint, integrated service capabilities, and experience in challenging remote environments, limiting their effectiveness as a direct substitute for comprehensive solutions. In 2024, while specialized local services are expanding, the demand for integrated, globally managed solutions remains strong.

Entrants Threaten

Entering the comprehensive remote site support services market, as exemplified by Catering International & Services (CIS), demands significant upfront capital. New players must finance extensive infrastructure, specialized equipment, robust logistics, and the operational capacity for challenging global environments. For instance, establishing a new catering and facility management operation in a remote mining site could easily require millions of dollars in initial investment for kitchens, accommodation, transportation, and safety protocols.

Established players like Catering International & Services (CIS) enjoy significant cost advantages due to economies of scale. For instance, their large-scale procurement of food and supplies can lead to lower per-unit costs compared to smaller, newer competitors. This scale also translates into more efficient logistics and operational processes honed over years of experience.

New entrants face a steep uphill battle in matching the cost efficiencies of established firms. They would need substantial initial investment to achieve comparable purchasing power and build out the necessary infrastructure. Furthermore, the accumulated operational expertise of companies like CIS in managing complex, remote site catering operations is a critical barrier that newcomers would find difficult and time-consuming to replicate.

New companies entering the catering services market, especially in specialized sectors like oil and gas, mining, and defense, face a substantial challenge in accessing established distribution channels and client relationships. Catering International & Services (CIS) has cultivated deep, long-standing connections within these demanding industries, making it difficult for newcomers to penetrate. For instance, securing contracts in these sectors often relies on proven track records and trust, which new entrants must painstakingly build over time.

Regulatory and Compliance Hurdles

Navigating the complex web of regulations and compliance is a significant barrier for new entrants in the catering services sector, especially for companies like Catering International & Services (CIS) that operate in diverse and often sensitive international locations. These hurdles include understanding and adhering to varying safety standards, food handling protocols, and logistical requirements across different countries. For instance, CIS's experience in defense-related environments means they've already mastered stringent security clearances and operational compliances that newcomers would struggle to replicate.

The sheer volume of international regulations can be overwhelming. In 2024, companies expanding globally often face over 100 distinct regulatory frameworks per region, impacting everything from import/export licenses to labor laws. CIS's established infrastructure and expertise allow them to manage these complexities efficiently, effectively deterring new players who lack the resources and knowledge to do the same.

- Regulatory Complexity: New entrants must invest heavily in legal and compliance teams to understand and adhere to diverse international laws.

- Safety and Quality Standards: Meeting varied safety, hygiene, and quality certifications across multiple countries requires significant upfront investment and ongoing monitoring.

- Logistical Compliance: International operations involve navigating customs, import/export regulations, and transportation laws, adding layers of complexity.

- Defense Sector Specifics: Operating in defense contracts demands adherence to highly specialized security protocols and vetting processes, a steep learning curve for new entrants.

Brand Reputation and Specialised Expertise

Catering International & Services (CIS) has cultivated a robust brand reputation, recognized for delivering high-quality, integrated services, particularly in challenging environments. This established trust is a significant deterrent for potential newcomers.

The company's specialized expertise in niche areas such as remote logistics, catering to diverse international workforces, and efficient camp deployment further solidifies its market position. Building comparable proficiency and a similar level of customer confidence would demand substantial time and financial commitment from any new entrant.

- Brand Recognition: CIS's established name in remote and challenging service provision acts as a significant barrier.

- Specialized Skills: Expertise in logistics, diverse culinary needs, and rapid camp setup is not easily replicated.

- Investment Requirement: New entrants face high costs to match CIS's operational capabilities and reputation.

The threat of new entrants in the remote site support services market, as faced by Catering International & Services (CIS), is significantly mitigated by substantial capital requirements. New players must invest heavily in infrastructure, specialized equipment, and logistics to operate effectively in challenging global locations. For example, establishing a new remote catering operation in 2024 could easily require millions of dollars for kitchens, accommodation, and safety systems.

Economies of scale provide established firms like CIS with considerable cost advantages. Their large-scale procurement of food and supplies results in lower per-unit costs compared to smaller competitors, a benefit that new entrants would struggle to match without significant initial investment and time to build purchasing power.

Accessing established distribution channels and client relationships poses another major hurdle. CIS has cultivated deep ties within demanding sectors like oil and gas, mining, and defense, where trust and proven track records are paramount. Newcomers must invest considerable time and resources to build similar credibility.

Navigating the complex international regulatory landscape is a formidable barrier. CIS's experience in managing diverse safety, food handling, and logistical requirements across different countries is a critical advantage. In 2024, companies expanding globally often encounter over 100 distinct regulatory frameworks per region, demanding substantial legal and compliance resources that new entrants may lack.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for infrastructure, equipment, and logistics. | Significant financial barrier, requiring substantial funding. |

| Economies of Scale | Lower per-unit costs due to large-scale procurement and operations. | New entrants face higher initial operating costs. |

| Access to Distribution Channels | Established relationships with clients in niche sectors. | Difficult for new players to secure contracts and penetrate markets. |

| Regulatory Complexity | Adherence to diverse international safety, food handling, and logistical laws. | Requires extensive legal and compliance resources to navigate. |

| Brand Reputation & Expertise | Proven track record and specialized skills in remote operations. | New entrants need time and investment to build comparable trust and capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Catering International & Services is built upon a foundation of comprehensive data, including the company's official annual reports, industry-specific trade publications, and market research reports from reputable firms. This blend ensures a robust understanding of the competitive landscape.