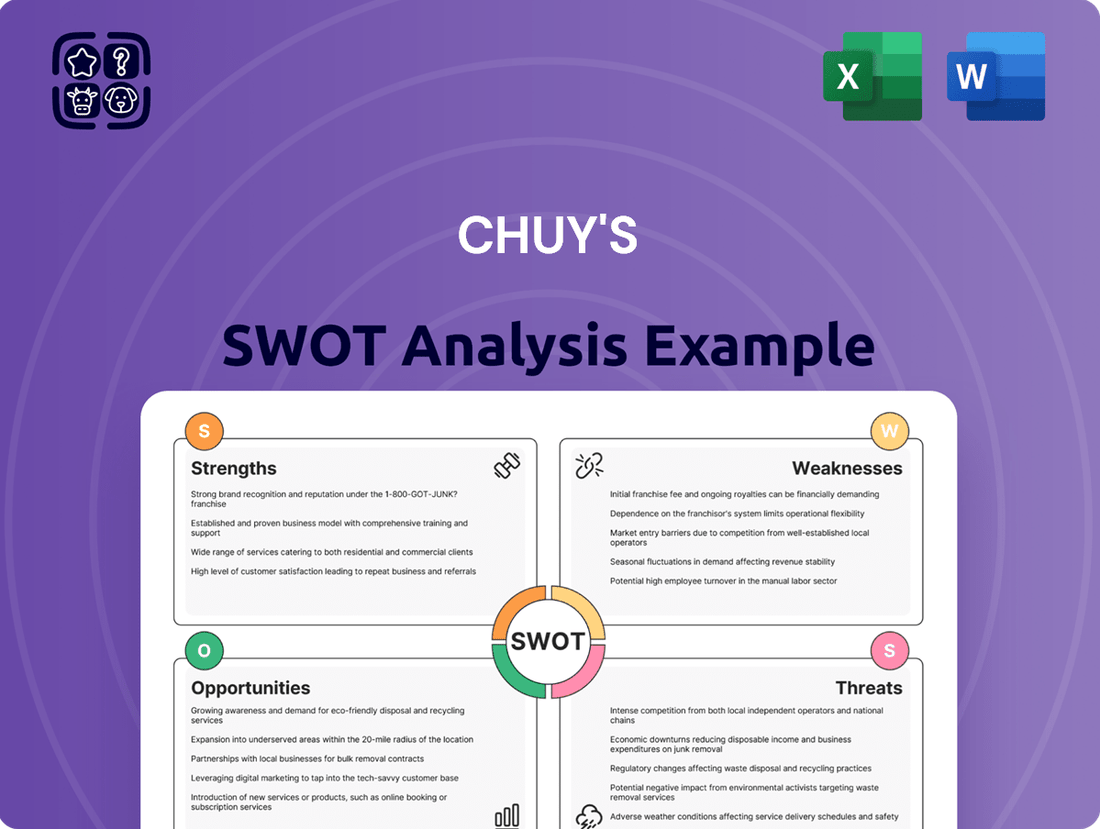

Chuy's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chuy's Bundle

Chuy's boasts a strong brand identity and loyal customer base, but faces increasing competition and potential rising food costs. Understanding these dynamics is crucial for navigating the competitive restaurant landscape.

Want the full story behind Chuy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chuy's distinctive Tex-Mex cuisine, characterized by its authentic, scratch-made dishes, provides a significant competitive advantage. This commitment to fresh ingredients and unique, flavorful recipes cultivates a strong brand identity and fosters customer loyalty.

Chuy's truly stands out with its fun, quirky, and eclectic dining atmosphere. Each restaurant boasts a unique 'unchained' look and feel, living up to their motto 'If you've seen one Chuy's, you've seen one Chuy's!' This distinctive ambiance really elevates the customer experience and encourages people to come back.

Chuy's boasts a strong brand identity, instantly recognizable for its vibrant Tex-Mex offerings and energetic dining experience. This distinctiveness has fostered a loyal customer base, a significant asset in the competitive restaurant industry.

This brand loyalty is a testament to their consistent quality and unique atmosphere. For instance, Chuy's has consistently been recognized in local "best of" lists, reinforcing their strong community presence and customer preference.

Robust Off-Premise Sales Growth

Chuy's has shown impressive resilience by adapting to evolving consumer habits, notably through its expanding off-premise sales channels. This strategic pivot has been a significant driver of growth.

In the first quarter of 2024, off-premise sales represented a substantial 29% of Chuy's total revenue, highlighting the segment's increasing importance. This growth not only broadens the company's customer base but also diversifies its revenue streams, making it less reliant on traditional dine-in traffic.

- Off-Premise Dominance: Off-premise sales captured approximately 29% of total revenue in Q1 2024.

- Adaptability: Demonstrates success in catering to changing consumer preferences for convenience.

- Revenue Diversification: Expands reach and creates new avenues for financial growth.

Strategic Acquisition by Darden Restaurants

Chuy's strategic acquisition by Darden Restaurants in October 2024 for $605 million represents a significant strength. This integration grants Chuy's access to Darden's vast operational scale and deep market insights, crucial for navigating the competitive restaurant landscape. The deal allows Chuy's to leverage Darden's robust data analytics capabilities to refine customer understanding and drive targeted growth strategies.

The acquisition provides Chuy's with enhanced resources for strategic planning and operational improvements. Darden's established expertise in areas like supply chain management and marketing can directly benefit Chuy's, potentially leading to greater efficiency and stronger brand positioning. This partnership is poised to accelerate Chuy's expansion and solidify its market presence.

- $605 million acquisition deal by Darden Restaurants in October 2024.

- Access to Darden's **significant scale** and **extensive data and insights**.

- Leveraging Darden's **rigorous strategic planning** capabilities for future growth.

Chuy's unique Tex-Mex flavor profile and scratch-made approach create a strong culinary identity that resonates with customers, fostering significant brand loyalty. This commitment to quality ingredients and authentic recipes distinguishes Chuy's in a crowded market.

The restaurant's vibrant and eclectic atmosphere, with each location offering a distinct design, provides a memorable dining experience that encourages repeat visits. This commitment to a fun, quirky ambiance is a key differentiator.

Chuy's demonstrated adaptability, particularly with its successful expansion of off-premise sales, which accounted for approximately 29% of total revenue in Q1 2024. This strategic pivot caters to evolving consumer preferences for convenience and diversifies revenue streams.

The October 2024 acquisition by Darden Restaurants for $605 million provides Chuy's with substantial resources, including Darden's vast operational scale and data analytics capabilities, positioning it for accelerated growth and enhanced market presence.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Unique Culinary Identity | Authentic, scratch-made Tex-Mex cuisine. | Drives strong brand recognition and customer loyalty. |

| Distinctive Atmosphere | Eclectic, "unchained" restaurant designs. | Creates a memorable and differentiated customer experience. |

| Off-Premise Sales Growth | Adaptability to changing consumer habits. | Off-premise sales were ~29% of revenue in Q1 2024. |

| Strategic Acquisition | Acquired by Darden Restaurants for $605 million in Oct 2024. | Provides access to Darden's scale, data, and strategic planning expertise. |

What is included in the product

Analyzes Chuy's’s competitive position through key internal and external factors, highlighting its unique brand appeal and potential for expansion while acknowledging operational challenges and market competition.

Offers a clear, organized framework to identify and address Chuy's competitive weaknesses and external threats, transforming potential challenges into actionable strategies.

Weaknesses

Chuy's faced a notable challenge with a 5.2% decline in comparable restaurant sales during the first quarter of 2024 when measured against the same period in 2023. This dip was attributed to a combination of factors, including a one-week shift in the calendar and adverse weather patterns that likely deterred customer traffic.

Chuy's is particularly vulnerable to spikes in commodity prices, especially for key ingredients like beef. For instance, the U.S. Department of Agriculture reported that average Choice beef cutout prices saw a notable increase in late 2023 and early 2024, impacting restaurant input costs.

Furthermore, the restaurant industry, including Chuy's, is grappling with persistent labor cost inflation. Minimum wage hikes and increased competition for hourly workers in 2024 continue to put upward pressure on payroll expenses, potentially squeezing profit margins if these costs cannot be fully passed on to consumers through menu pricing.

Chuy's heavily relies on its core markets, particularly in the Southern and Southeastern United States, where a substantial portion of its restaurants are located. This concentration, while beneficial for brand recognition, presents a weakness if these markets experience downturns or increased competition.

Planned expansion, a key growth strategy, carries the inherent risk of new unit cannibalization. While Chuy's management reportedly doesn't see this as a major issue, opening new locations within proximity of existing ones could dilute sales at established restaurants, especially in those concentrated core markets.

Impact of Economic Volatility on Consumer Spending

Economic volatility poses a significant threat to Chuy's, as it directly impacts consumer confidence and discretionary spending. During periods of economic uncertainty, customers tend to cut back on non-essential purchases like dining out, which can lead to a noticeable drop in traffic for casual dining establishments such as Chuy's. For instance, in late 2023 and early 2024, persistent inflation and concerns about a potential recession led many consumers to reduce their spending on dining, a trend that continues to be a factor in the current economic climate.

This susceptibility to broader economic trends means Chuy's performance is intrinsically linked to factors outside its direct control. The restaurant industry, in general, experienced a slowdown in growth in 2023 compared to the post-pandemic recovery, with some analysts predicting a further moderation in 2024 due to ongoing economic headwinds. This industry-wide challenge directly affects Chuy's ability to consistently drive customer traffic and maintain revenue growth.

- Reduced Discretionary Spending: Inflationary pressures and economic uncertainty can cause consumers to prioritize essential goods over dining out, impacting Chuy's customer base.

- Lower Customer Traffic: Economic downturns often correlate with a decline in foot traffic for restaurants as consumers become more budget-conscious.

- Sensitivity to Consumer Confidence: Chuy's success is tied to consumer sentiment; negative economic outlooks can deter patrons from visiting.

- Industry-Wide Impact: The broader restaurant sector faces similar challenges, suggesting that Chuy's struggles are not isolated but part of a larger industry trend.

Integration Challenges Post-Acquisition

Integrating acquired companies can be tricky, and Chuy's faces this head-on with its acquisition by Darden. A significant hurdle could be merging different company cultures and operational styles. For instance, Chuy's, with its distinct brand identity, might find it challenging to align with Darden's established corporate structure and processes. This could lead to friction and hinder the smooth operation of the combined entity.

Furthermore, the relocation of Chuy's headquarters to Orlando, following the acquisition, presents another layer of complexity. This move necessitates the integration of IT systems, supply chains, and administrative functions. In 2024, companies often spend millions on IT integration alone, with failure rates for such projects being notoriously high. Ensuring seamless data migration and system compatibility will be critical to avoid operational disruptions.

The fact that Chuy's will become an indirect, wholly-owned subsidiary of Darden also introduces potential integration challenges. This structure might require significant adjustments to reporting lines, decision-making processes, and overall governance. Given Darden's scale, managing this transition effectively will be paramount. For example, in similar multi-brand restaurant acquisitions, it has taken an average of 18-24 months for full operational integration, impacting initial profitability.

- Cultural Clashes: Potential misalignment between Chuy's unique brand culture and Darden's corporate structure.

- System Integration: Challenges in merging IT, supply chain, and administrative systems following the headquarters' relocation.

- Operational Adjustments: Navigating the complexities of becoming an indirect, wholly-owned subsidiary within a larger corporate framework.

- Employee Retention: Maintaining morale and retaining key talent during the integration period, which can be a significant drain on resources.

Chuy's faces vulnerability due to its concentrated market presence, primarily in the Southern and Southeastern U.S. This reliance on specific regions makes it susceptible to localized economic downturns or increased competitive pressures. Furthermore, the company's expansion strategy carries the risk of cannibalizing sales from existing locations if new restaurants are opened too close to established ones, a concern amplified by its market concentration.

Same Document Delivered

Chuy's SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Chuy's has a strong growth trajectory, with plans to launch 6 to 8 new restaurants in its core markets during 2024. This expansion strategy is further bolstered by new location openings slated for both 2025 and 2026, indicating a sustained commitment to increasing its physical footprint.

This aggressive development, which benefits from the backing of Darden Restaurants, offers a substantial opportunity for Chuy's to achieve significant unit growth. The company can leverage this momentum to penetrate both established and entirely new geographic markets, thereby broadening its customer base and revenue streams.

Chuy's acquisition by Darden Restaurants in 2023 unlocks significant opportunities through Darden's vast scale and resources. This partnership grants Chuy's access to Darden's extensive data analytics capabilities, allowing for more precise customer insights and targeted marketing campaigns, a crucial advantage in the competitive casual dining sector.

The integration with Darden's robust supply chain management promises enhanced operational efficiencies and potential cost savings for Chuy's. Darden's proven strategic planning frameworks and results-oriented culture are expected to drive improved performance and foster a more disciplined approach to growth initiatives, building on Chuy's existing brand strength.

Chuy's can capitalize on pent-up consumer demand through strategic menu innovation and targeted marketing. By introducing new, appealing dishes and promoting value-driven offers, especially via social media, they can attract more customers. For instance, in Q1 2024, Chuy's reported a 4.1% increase in comparable restaurant sales, indicating a positive response to their strategies.

Growth in Off-Premise Dining and Technology Adoption

The ongoing surge in online ordering and delivery platforms offers Chuy's a significant avenue to bolster its off-premise sales. This trend, which saw substantial acceleration in recent years, continues to be a dominant force in the restaurant industry, with many consumers prioritizing convenience.

Furthermore, Chuy's can capitalize on increased investment in technology to streamline operations. Implementing solutions like self-serve kiosks, for instance, could lead to improved labor efficiency and a reduction in operational costs, directly impacting the bottom line.

- Continued growth in off-premise dining: Industry data from 2024 indicates that off-premise sales continue to represent a substantial portion of total restaurant revenue, with digital orders driving much of this growth.

- Technology adoption for efficiency: Investments in technology like kiosks can reduce wait times and labor needs, potentially improving throughput and customer satisfaction.

- Expanding digital presence: Enhancing online ordering systems and partnerships with third-party delivery services can broaden Chuy's reach and capture a larger share of the convenience-driven market.

- Cost-saving through automation: Implementing technology can lead to optimized staffing and reduced waste, contributing to better cost management in a competitive environment.

Adapting to Shifting Consumer Preferences for Value and Quality

Consumers are increasingly seeking both affordability and high quality, a trend that presents a significant opportunity for Chuy's. By carefully balancing price points with the perceived value of their offerings, the company can attract and retain a broader customer base. This involves not only optimizing ingredient sourcing but also communicating the quality inherent in their dishes.

Chuy's can capitalize on this by identifying operational efficiencies that translate into cost savings, which can then be passed on to customers or reinvested in enhancing the dining experience. For instance, if Chuy's can demonstrate a 5% reduction in food waste through improved inventory management by Q4 2024, this could directly impact their ability to offer competitive pricing without compromising on their signature fresh ingredients.

Furthermore, maintaining and promoting customization options allows guests to tailor their meals to their specific needs and budgets, reinforcing the perception of value. Offering flexible portion sizes or ingredient substitutions can cater to a wider range of consumer preferences and price sensitivities.

- Value Proposition Enhancement: Focus on communicating the quality of fresh, made-from-scratch ingredients to justify price points.

- Cost Optimization: Implement strategies to reduce operational costs, potentially leading to more competitive pricing or enhanced value-adds.

- Customization Flexibility: Expand or highlight existing customization options to empower guests to control their spending and preferences.

- Market Trend Alignment: Directly address the growing consumer demand for both quality and affordability in the casual dining sector.

Chuy's strategic expansion, with 6-8 new restaurants planned for 2024 and further openings in 2025 and 2026, positions it for significant unit growth. This expansion, supported by Darden Restaurants' resources, allows Chuy's to enter new markets and broaden its customer base.

Leveraging Darden's data analytics and supply chain management offers Chuy's enhanced customer insights and operational efficiencies. The integration aims to improve performance and foster disciplined growth, building on Chuy's existing brand strength.

Chuy's can tap into consumer demand through menu innovation and targeted marketing, as evidenced by a 4.1% increase in comparable restaurant sales in Q1 2024. The ongoing growth in online ordering and delivery also presents a substantial opportunity to increase off-premise sales.

Investing in technology, such as self-serve kiosks, can streamline operations, improve labor efficiency, and reduce costs. Industry data from 2024 shows off-premise sales continue to be a major revenue driver, with digital orders leading this growth.

Chuy's can enhance its value proposition by balancing affordability with high-quality, fresh ingredients. For example, a 5% reduction in food waste by Q4 2024 could directly support more competitive pricing.

| Opportunity Area | Key Action | Potential Impact | Supporting Data/Fact |

| Market Expansion | Execute planned new restaurant openings | Increased unit count and revenue | 6-8 new restaurants in 2024; openings planned for 2025-2026 |

| Operational Synergy | Utilize Darden's data analytics and supply chain | Improved customer insights and cost savings | Darden's acquisition provides access to these resources |

| Sales Channel Growth | Boost online ordering and delivery | Expanded customer reach and off-premise sales | Off-premise sales remain a substantial revenue driver in 2024 |

| Value Perception | Communicate ingredient quality and offer customization | Attract and retain price-sensitive customers | Consumer demand for affordability and quality is high |

Threats

Chuy's faces a crowded marketplace, with many restaurants vying for customer attention in both casual dining and the popular Tex-Mex niche. This crowded field means constant pressure on pricing and the need to continually innovate to capture and retain market share.

The casual dining sector, in particular, is known for its high churn and the constant introduction of new concepts, making it challenging for any single player to maintain a dominant position. For instance, as of late 2024, industry reports indicate that casual dining same-store sales growth has remained sluggish, often in the low single digits, highlighting the intense battle for consumer dollars.

The Tex-Mex segment itself is robust, with established national chains and a multitude of local favorites. This means Chuy's must not only differentiate itself from broader casual dining competitors but also from other Tex-Mex specialists, potentially impacting its ability to raise prices or expand profitably without significant effort.

Ongoing inflation in labor and commodity costs, particularly for key ingredients like beef and cheese, presents a substantial threat to Chuy's. For instance, the US Producer Price Index for food away from home saw a notable increase in late 2024, impacting restaurant input costs. If Chuy's cannot pass these rising expenses onto consumers through menu price adjustments, its profit margins could be squeezed significantly.

Economic downturns pose a significant threat to Chuy's, as they often lead to a sharp decline in consumer confidence. This can directly impact discretionary spending, making dining out a less attractive option for many households.

In 2024, for instance, inflation and rising interest rates have already put pressure on household budgets, potentially curbing spending on non-essential items like restaurant meals. A sustained economic slowdown could see consumers cutting back further, directly affecting Chuy's sales volume and overall revenue.

Changes in Consumer Dietary Preferences and Health Trends

Shifting consumer tastes toward healthier, plant-based, or other evolving culinary trends represent a significant threat to Chuy's. If the company's menu doesn't keep pace with these changes, it could alienate a growing segment of the market. For example, the plant-based food market in the U.S. was valued at approximately $7.4 billion in 2023 and is projected to grow substantially.

Chuy's faces the risk of losing market share if its core offerings are perceived as less aligned with current health-conscious eating patterns. This could manifest in several ways:

- Decreased appeal to younger demographics: Younger consumers, in particular, are driving demand for healthier and more diverse food options.

- Competition from agile competitors: Restaurants that quickly adapt their menus to incorporate popular health trends or plant-based alternatives could draw customers away from Chuy's.

- Negative brand perception: A failure to adapt could lead to Chuy's being viewed as outdated or out of touch with modern consumer expectations.

Operational Challenges Related to Hiring and Retention

Chuy's faces significant operational hurdles in attracting and keeping skilled staff, a pervasive issue across the restaurant sector. This difficulty in hiring and retention can directly affect its financial performance and the consistency of customer service. For instance, in 2023, the US restaurant industry experienced an average turnover rate of around 70% for general managers, highlighting the scale of this challenge.

These staffing shortages can lead to increased training costs and a potential dip in service quality, impacting customer satisfaction and repeat business. Chuy's must navigate this competitive labor market, where competitive wages and benefits are crucial for securing and retaining talent.

- High Turnover: The restaurant industry often sees employee turnover rates exceeding 70%, impacting operational stability.

- Increased Costs: Difficulty in hiring leads to higher recruitment and training expenses for Chuy's.

- Service Impact: Understaffing or less experienced teams can degrade the customer dining experience.

- Competitive Labor Market: Chuy's must offer attractive compensation and work environments to combat industry-wide staffing issues.

Chuy's operates in a highly competitive casual dining landscape, facing pressure from numerous restaurants, especially within the popular Tex-Mex niche. This intense competition necessitates continuous innovation and careful pricing strategies to maintain market share, as evidenced by the low single-digit same-store sales growth often seen in the casual dining sector as of late 2024.

Rising inflation, particularly impacting key ingredients like beef and cheese, poses a significant threat to Chuy's profit margins. The US Producer Price Index for food away from home showed increases in late 2024, directly affecting input costs. Economic downturns also present a risk, as reduced consumer confidence can curb discretionary spending on dining out, a trend already visible in 2024 due to inflation and interest rates.

Shifting consumer preferences towards healthier and plant-based options could alienate a growing market segment if Chuy's menu does not adapt. The U.S. plant-based food market, valued at approximately $7.4 billion in 2023, is a clear indicator of this trend, with younger demographics increasingly driving demand for such options.

Staffing challenges, including high turnover rates common in the restaurant industry (around 70% for general managers in 2023), increase operational costs and can negatively impact service quality. Chuy's must navigate this competitive labor market by offering attractive compensation and work environments to retain talent and ensure consistent customer experiences.

| Threat Category | Specific Threat | Impact on Chuy's | Supporting Data/Context (2024/2025) |

|---|---|---|---|

| Market Competition | Crowded Casual Dining & Tex-Mex Sector | Pressure on pricing, need for constant innovation, difficulty gaining market share. | Casual dining same-store sales growth in low single digits (late 2024). |

| Economic Factors | Inflationary Costs (Labor & Commodities) | Squeezed profit margins if costs cannot be passed to consumers. | Producer Price Index for food away from home increased (late 2024). |

| Economic Factors | Economic Downturns / Reduced Discretionary Spending | Lower sales volume and revenue due to decreased consumer confidence. | Inflation and rising interest rates impacting household budgets (2024). |

| Consumer Trends | Shifting Preferences (Healthier, Plant-Based) | Risk of losing market share and appeal to younger demographics. | U.S. plant-based food market valued at ~$7.4 billion (2023), growing demand. |

| Operational Challenges | Labor Shortages & High Turnover | Increased operational costs, potential dip in service quality, higher training expenses. | Restaurant industry turnover rates exceeding 70% (2023). |

SWOT Analysis Data Sources

This Chuy's SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry analysis to provide a robust and actionable strategic overview.