Chobani Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chobani Bundle

Chobani, a disruptor in the yogurt market, faces significant competitive forces. While the threat of new entrants is moderate due to brand loyalty and economies of scale, the bargaining power of buyers, particularly large retailers, can exert pressure on pricing and product placement.

The full Porter's Five Forces Analysis reveals the real forces shaping Chobani’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Chobani's suppliers, especially dairy farmers, is a key factor. This power stems from how concentrated the suppliers are and how vital milk is to Chobani's operations. Milk is not just an ingredient; it's the core of their product.

Chobani's significant reliance on milk is evident in its purchasing volume. In 2024, Chobani was already a major buyer of raw milk in New York, acquiring over a billion pounds annually. With planned expansions, this figure is projected to climb to an impressive 6 billion pounds per year, underscoring the sheer scale of their milk procurement.

While Chobani's massive purchasing volume does grant it some negotiation leverage, the fundamental need for fresh, high-quality milk means suppliers retain substantial power. This is particularly true when specific quality standards or regional sourcing requirements are in play, limiting Chobani's alternatives.

Switching dairy suppliers presents Chobani with moderate costs. This involves building new relationships, verifying consistent milk quality, and potentially reconfiguring logistics for collection and transportation. These factors can create some friction when considering a change.

Chobani's strategic move towards vertical integration, including owning more of its supply chain, directly addresses and aims to reduce these supplier switching costs. This approach enhances their control over quality and reliability, as evidenced by their recognition as Processor of the Year in 2024.

The risk of dairy farmers directly entering the yogurt market by processing and selling their own products is minimal for Chobani. This is primarily due to the significant capital, specialized processing knowledge, and brand-building capabilities that most individual farmers do not possess. For instance, establishing a fully operational yogurt processing facility can cost tens of millions of dollars, a barrier that deters most smaller operations.

However, larger dairy cooperatives, with their greater resources and market reach, could theoretically pose a threat if they choose to expand into more sophisticated, value-added dairy items. These cooperatives might leverage their collective bargaining power and existing infrastructure to develop their own branded yogurt lines, directly competing with Chobani. As of 2024, major dairy cooperatives in the US collectively represent billions in revenue, giving them the financial muscle for such ventures.

Chobani's strategic investments in advanced processing facilities, such as their recent expansions in 2023 and 2024, effectively strengthen their control over the supply chain. By owning and operating state-of-the-art plants, Chobani reduces its reliance on external processors and gains greater efficiency, which in turn mitigates the potential bargaining power of suppliers who might otherwise consider forward integration.

Supplier Dependence on Chobani

The bargaining power of suppliers for Chobani is generally moderate. While Chobani is a significant buyer of milk, the dairy industry is fragmented with many individual farms. This means no single farm typically holds substantial leverage over Chobani in terms of pricing or terms. For instance, in 2023, the average U.S. dairy farm size continued to grow, with larger operations becoming more common, but the overall number of farms remains high, diluting individual supplier power.

Chobani's initiatives, such as its 'Milk Matters' program, foster stronger relationships with its milk suppliers. These programs, along with collaborations with entities like the World Wildlife Fund and the National Milk Producers Federation, underscore Chobani's commitment to sustainable and supportive sourcing practices. This creates a degree of interdependence, where Chobani relies on the quality and reliability of its suppliers, and suppliers benefit from Chobani's commitment to fair practices and long-term partnerships.

- Fragmented Dairy Industry: The U.S. had approximately 31,900 dairy farms in 2023, indicating a diverse supplier base for Chobani.

- 'Milk Matters' Program: This initiative highlights Chobani's focus on building strong, collaborative relationships with its milk producers, potentially reducing individual supplier leverage.

- Industry Partnerships: Collaborations with organizations like the National Milk Producers Federation demonstrate Chobani's engagement with broader dairy industry standards and supplier advocacy.

- Sustainable Sourcing Focus: Chobani's emphasis on sustainability can influence supplier relationships, potentially leading to more stable, albeit sometimes more costly, sourcing arrangements.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts a company's bargaining power. For Chobani's foundational Greek yogurt, dairy milk is the primary ingredient, and readily available, direct substitutes are scarce. This reliance on traditional dairy farmers inherently grants them considerable leverage.

While Chobani has expanded its product line to include items like oat milk yogurt, these alternative inputs do not directly replace the core dairy milk requirement for their flagship Greek yogurt. The supply chains for these non-dairy options involve different sets of suppliers, and the substitution effect is limited to Chobani's newer product categories rather than its core offerings.

- Limited Substitutes for Core Ingredient: Dairy milk has few direct substitutes for Greek yogurt production, enhancing supplier power.

- Diversification Impact: Chobani's move into non-dairy options like oat milk creates new supplier relationships but doesn't negate the core dairy dependency.

- Supplier Leverage: The lack of easy substitutes for dairy milk gives dairy farmers a stronger bargaining position with yogurt manufacturers like Chobani.

The bargaining power of Chobani's suppliers, particularly dairy farmers, is a significant factor, primarily due to the essential nature of milk and the scale of Chobani's operations. While Chobani's substantial purchasing volume in 2024, exceeding a billion pounds of raw milk annually in New York with projections to reach 6 billion pounds, grants some negotiation leverage, the fundamental need for high-quality milk limits alternatives.

The U.S. dairy industry, with approximately 31,900 farms in 2023, is largely fragmented, diminishing the power of individual suppliers. Chobani's 'Milk Matters' program and industry partnerships further foster collaborative relationships, creating interdependence. Crucially, the lack of direct substitutes for dairy milk in Greek yogurt production enhances the leverage of dairy farmers.

| Factor | Assessment | Impact on Chobani |

| Supplier Concentration | Fragmented (approx. 31,900 US dairy farms in 2023) | Moderate, as no single supplier dominates, but regional concentration can occur. |

| Importance of Input | Milk is the core ingredient for Greek yogurt. | High, giving suppliers significant leverage due to limited substitutes. |

| Switching Costs | Moderate (relationship building, quality verification, logistics) | Creates some friction, encouraging stable supplier relationships. |

| Threat of Forward Integration | Minimal for individual farmers; possible for large cooperatives. | Low for most, but large cooperatives with significant revenue could pose a threat. |

| Supplier Power Overall | Moderate to High | Suppliers have considerable power due to the essential nature of milk and limited substitutes. |

What is included in the product

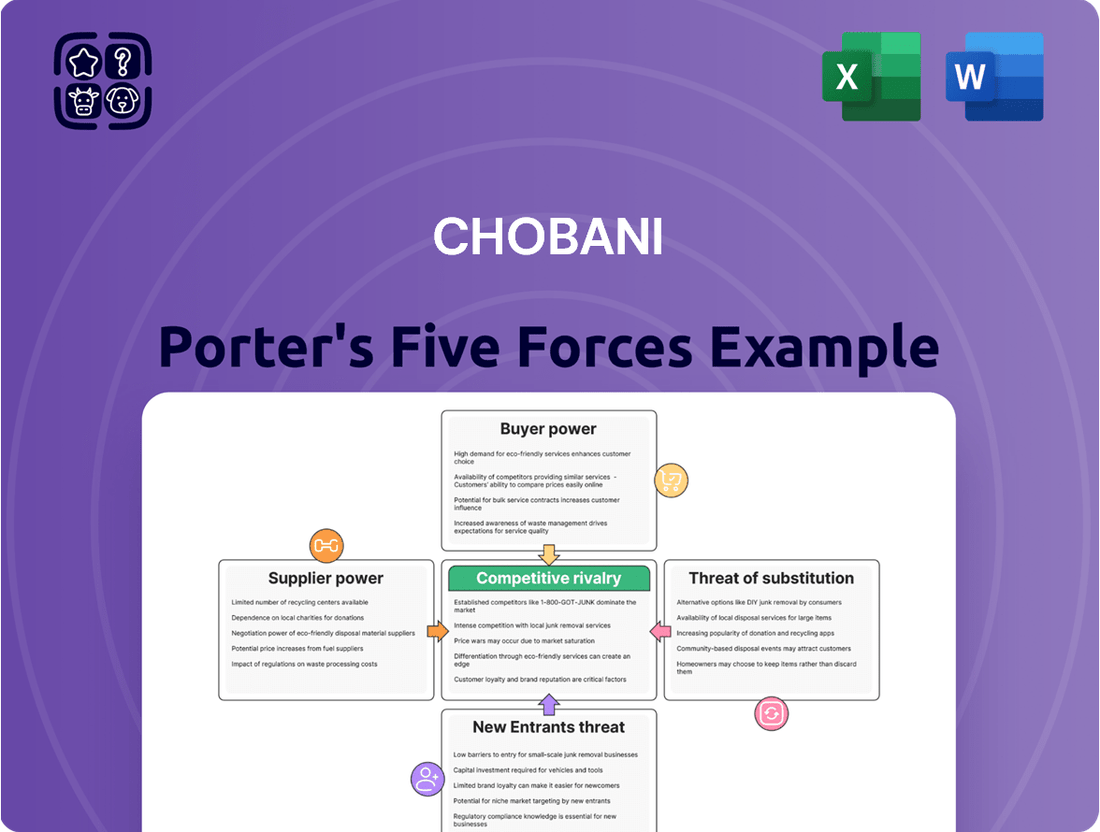

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Chobani's position in the highly competitive yogurt and food industry.

Instantly identify and address competitive pressures with a comprehensive Chobani Porter's Five Forces analysis, simplifying strategic planning.

Customers Bargaining Power

Chobani faces a market where consumers are indeed sensitive to price, particularly with the vast array of yogurt options available. The company’s strategic decision to price its Greek yogurt around $1 per cup upon its launch was a deliberate move to capture market share by making a healthier, premium product more accessible, directly addressing consumer price expectations.

The bargaining power of customers is significantly influenced by the wide availability of alternative products in the yogurt market. Consumers can easily switch to other brands if they are not satisfied with Chobani's offerings, due to numerous choices readily accessible.

Chobani faces stiff competition from established giants like Danone and Yoplait, as well as specialized brands such as Fage. Furthermore, the burgeoning market for plant-based alternatives, including oat, almond, and soy yogurts, presents an even broader selection for consumers, intensifying competitive pressures.

In 2024, the yogurt market continued to see strong competition, with private label brands capturing a notable market share, often at lower price points. This dynamic reinforces consumer choice and their ability to exert bargaining power by opting for more budget-friendly alternatives.

Chobani has built significant customer loyalty by emphasizing natural ingredients and quality, supported by robust digital marketing. This strong brand recognition means some customers are less sensitive to price changes, thereby mitigating their bargaining power.

Information Availability to Customers

Customers today have unprecedented access to information, significantly boosting their bargaining power. They can easily compare product ingredients, nutritional values, and pricing across various brands, forcing companies to be more competitive and transparent.

Chobani leverages this by highlighting its commitment to natural ingredients and health benefits. This transparency appeals to consumers who actively research and prioritize these aspects, making them more informed and discerning buyers.

- Information Accessibility: Consumers can readily find details on product sourcing, nutritional content, and pricing online and through various media.

- Price Sensitivity: Increased information availability often leads to greater price sensitivity among customers.

- Chobani's Transparency: Chobani's open communication about its natural ingredients and health advantages directly addresses the information needs of its target market.

- Consumer Empowerment: Informed consumers are better equipped to negotiate for better value, influencing product development and pricing strategies.

Switching Costs for Customers

Switching costs for customers in the yogurt market are typically quite low. This means consumers can easily try a new brand without much hassle or expense. For Chobani, this translates into needing to consistently offer appealing products and competitive pricing to keep customers loyal.

Consumers can readily switch between various yogurt brands and types based on factors like taste, current deals, or what they perceive as good value. This ease of switching directly impacts Chobani, requiring them to stay agile in their marketing and product development.

- Low Switching Costs: Customers face minimal barriers when moving from one yogurt brand to another.

- Consumer Choice: The yogurt aisle offers a wide variety of options, empowering consumers to experiment.

- Price Sensitivity: Promotions and perceived value play a significant role in purchasing decisions.

- Chobani's Challenge: The company must continuously innovate and offer value to retain its customer base.

Customer bargaining power remains a significant force for Chobani, driven by the sheer volume of choices available and consumers' increasing access to product information. In 2024, the yogurt market continued to be highly competitive, with private label brands offering substantial value, often at lower price points, directly challenging premium brands like Chobani and reinforcing consumer ability to seek out the best deals.

The ease with which consumers can switch between brands, coupled with their heightened awareness of ingredients, nutrition, and pricing, empowers them to demand more from manufacturers. Chobani’s strategy of emphasizing natural ingredients and health benefits aims to build loyalty, but the low switching costs mean that price promotions and perceived value remain critical factors in many purchasing decisions.

| Factor | Impact on Chobani | 2024 Context |

|---|---|---|

| Product Availability | High | Numerous yogurt brands and plant-based alternatives available. |

| Information Accessibility | High | Consumers easily compare prices, ingredients, and nutritional data online. |

| Price Sensitivity | Moderate to High | Private label brands and promotions influence choices. |

| Switching Costs | Low | Minimal barriers to trying new brands. |

Full Version Awaits

Chobani Porter's Five Forces Analysis

This preview showcases the complete Chobani Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the Greek yogurt market. The document you see here is precisely what you'll download immediately after purchase, providing a ready-to-use, professionally formatted strategic assessment. You'll gain valuable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all within this exact file.

Rivalry Among Competitors

The yogurt and broader cultured dairy market is intensely competitive, featuring a multitude of established brands and an increasing number of new entrants. Chobani faces significant rivalry from major food corporations such as Danone, which held a substantial 26% market share in the US yogurt market as of early 2024, alongside other prominent players like General Mills with its Yoplait brand, Fage, and Stonyfield Farm.

Beyond these large-scale competitors, Chobani must also contend with a growing landscape of smaller, specialized brands that often cater to specific dietary needs or flavor preferences. Furthermore, the proliferation of private label offerings from major grocery retailers presents a constant challenge, as these brands frequently compete on price, directly impacting market share and consumer choice.

The U.S. yogurt market, once a high-growth sector, is now experiencing a slowdown. Projections indicated Chobani's annual revenue growth would be less than 1% from 2021 to 2025. This deceleration means companies must actively compete for existing customers rather than benefiting from a rapidly expanding pie, increasing rivalry.

Chobani has built its brand on differentiating through natural ingredients and high-quality Greek yogurt, consistently introducing innovations like high-protein and zero-sugar options. For instance, in 2024, Chobani continued to expand its plant-based offerings, a segment that saw significant growth across the dairy aisle.

However, the competitive landscape is fierce, with rivals like Fage and Oikos also heavily investing in product innovation. These competitors frequently launch new flavors, convenient formats such as drinkable yogurts, and a growing array of plant-based alternatives, making it increasingly difficult for Chobani to sustain a distinct market advantage.

Advertising and Promotional Activities

Competitive rivalry in the yogurt market is intense, significantly amplified by robust advertising and promotional efforts from all key participants. Chobani itself is a major investor in marketing, allocating an estimated $150 million in 2024. This substantial budget is strategically deployed across various channels, including digital campaigns, social media engagement, and collaborations with influencers, all aimed at cultivating strong brand recognition and customer loyalty.

This high level of marketing expenditure is not merely a choice but a necessity, driven by the equally aggressive strategies employed by competitors such as General Mills and Danone. These companies also pour significant resources into their promotional activities, creating a dynamic and competitive landscape where visibility and consumer connection are paramount. The constant barrage of advertising from all sides means that staying top-of-mind requires continuous and substantial investment.

- Chobani's 2024 Marketing Budget: Approximately $150 million.

- Key Marketing Channels: Digital campaigns, social media, influencer partnerships.

- Competitive Response: High marketing spend is a direct reaction to rivals' aggressive strategies.

- Industry Trend: Extensive advertising and promotion are characteristic of the entire yogurt sector.

Exit Barriers

Exit barriers in the food manufacturing sector, particularly for companies like Chobani, are substantial. These include the massive capital invested in specialized, large-scale production facilities and the significant human capital involved in operations. For instance, Chobani's commitment to building a new $1.2 billion plant in New York underscores the high fixed costs associated with maintaining and operating such specialized assets.

These considerable investments and the difficulty in repurposing or selling specialized food processing equipment mean that exiting the market is a costly and complex decision. This situation traps companies within the industry, intensifying competition among existing players as they are less likely to divest or scale back operations easily.

- High Capital Investment: Food manufacturers often invest heavily in specialized machinery and facilities, making divestiture challenging.

- Specialized Assets: Dairy processing plants, for example, have limited alternative uses, increasing the cost of exiting.

- Workforce Commitments: Significant investments in training and retaining a skilled workforce also contribute to exit barriers.

- Chobani's Investment: Chobani's $1.2 billion New York plant represents a major commitment, raising its own exit barriers.

Competitive rivalry in the yogurt market is intense, with Chobani facing off against giants like Danone and General Mills, as well as a growing number of niche and private label brands. This crowded marketplace, coupled with a slowing growth rate for the overall U.S. yogurt market, compels companies to fight harder for market share. Chobani's strategy of innovation in areas like plant-based options is met by similar efforts from competitors, leading to a constant need for differentiation.

The high cost of advertising and promotion, with Chobani investing around $150 million in 2024, highlights the aggressive nature of this rivalry. Competitors also allocate substantial resources to marketing, making it a necessity for survival and visibility. This continuous investment in brand building and consumer engagement is a defining characteristic of the yogurt industry.

Substantial exit barriers, such as the massive capital tied up in specialized production facilities like Chobani's $1.2 billion New York plant, further intensify competition. These high fixed costs and the difficulty in repurposing specialized assets mean that companies are less likely to leave the market, keeping the competitive pressure high among existing players.

| Competitor | Estimated 2024 Market Share (US Yogurt) | Key Product Focus |

|---|---|---|

| Danone | ~26% | Greek yogurt, plant-based, traditional yogurt |

| General Mills (Yoplait) | Significant | Traditional yogurt, Greek yogurt, dairy-free options |

| Fage | Significant | Authentic Greek yogurt, high protein |

| Stonyfield Farm | Significant | Organic yogurt, probiotic-rich options |

SSubstitutes Threaten

The primary substitutes for Chobani's Greek yogurt are other traditional dairy products. These include conventional yogurts, cottage cheese, and fermented dairy options like kefir. Consumers can readily switch to these alternatives if they prefer a different taste, texture, or find them more budget-friendly. For instance, the U.S. yogurt market, a significant segment where Chobani operates, saw sales reach approximately $9.5 billion in 2023, indicating a robust market with diverse consumer choices beyond just Greek yogurt.

The threat from plant-based alternatives is substantial and expanding, encompassing options like oat milk, almond milk, soy milk, and plant-based yogurts. Chobani has recognized this shift by expanding its own product line to include oat milk and coffee creamers.

The plant-based food market's valuation of $36.3 billion in 2024 underscores a significant consumer movement towards these alternatives. This trend is fueled by evolving dietary preferences, increasing lactose intolerance, and growing environmental consciousness.

Consumers have a vast selection of alternative breakfast and snack choices that can easily replace yogurt. Items like cereals, oatmeal, fresh fruit, blended smoothies, and various snack bars all vie for consumer attention during breakfast and snack times. In 2024, the global breakfast cereal market alone was valued at approximately $40 billion, highlighting the significant competition.

These substitutes are not only plentiful but also increasingly convenient and diverse, directly challenging yogurt's market share. For instance, the ready-to-drink smoothie market saw significant growth in 2024, with many consumers opting for these portable and nutritious options over traditional yogurt cups.

Functional Beverages and Supplements

The growing popularity of functional beverages and health supplements poses a significant substitution threat to Chobani's traditional yogurt offerings. Consumers are actively seeking products that support gut health, and drinks like kombucha, kefir, and various probiotic-rich beverages can satisfy this demand. For instance, the global functional food and beverage market was valued at over $200 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards these alternatives.

These alternatives offer convenience and targeted health benefits, directly competing with yogurt's role in a healthy diet. The supplement market, in particular, has seen robust growth, with many consumers opting for concentrated forms of nutrients and probiotics. This trend means that even if consumers are interested in gut health, they might bypass yogurt altogether for a more specialized product.

Key substitutes include:

- Probiotic drinks: Such as kombucha, kefir, and specialized probiotic shots.

- Nutrient-dense supplements: Including probiotic capsules and powders.

- Other fermented foods: Like sauerkraut and kimchi, which also offer gut health benefits.

- Plant-based alternatives: Some of which are fortified with probiotics or other functional ingredients.

Homemade Alternatives

While a smaller threat, the trend of at-home yogurt making or preparing other healthy snacks from scratch can also serve as a substitute for purchased yogurt products. This option, though requiring effort, caters to consumers seeking greater control over ingredients and freshness. For instance, a 2024 survey indicated that approximately 15% of consumers are actively exploring or engaging in DIY food preparation, including yogurt, to manage costs and dietary needs.

The threat of substitutes for Chobani's Greek yogurt is significant, driven by a wide array of alternatives that cater to diverse consumer preferences and needs. These range from traditional dairy products and plant-based options to convenient breakfast items and functional beverages. The sheer availability and evolving nature of these substitutes mean consumers have many choices beyond yogurt.

| Substitute Category | Examples | 2024 Market Insight |

|---|---|---|

| Traditional Dairy | Conventional yogurt, cottage cheese, kefir | U.S. yogurt market valued at ~$9.5 billion (2023) |

| Plant-Based Alternatives | Oat milk, almond milk, soy yogurt | Plant-based food market valued at $36.3 billion (2024) |

| Convenient Breakfast/Snacks | Cereal, oatmeal, smoothies, snack bars | Global breakfast cereal market valued at ~$40 billion (2024) |

| Functional Beverages/Supplements | Kombucha, probiotic shots, supplements | Global functional food/beverage market >$200 billion (2023) |

Entrants Threaten

The cultured dairy market presents a moderate to low threat from new entrants, primarily because establishing a presence demands significant capital. Building state-of-the-art manufacturing plants, acquiring specialized equipment, and developing robust distribution channels are all incredibly costly endeavors. For instance, Chobani itself has invested over a billion dollars in expanding its processing capabilities, highlighting the substantial financial commitment needed to compete effectively.

Established brands like Chobani, Danone, and General Mills command significant brand loyalty and have deeply entrenched distribution networks. This makes it incredibly difficult for newcomers to gain traction. For instance, in 2024, major dairy and plant-based yogurt brands consistently held prime shelf space in over 90% of US grocery stores, a feat requiring substantial investment and time for any new player to replicate.

Newcomers face significant hurdles in securing a steady, high-quality supply of raw milk, a critical input for yogurt production, especially at the volume Chobani operates. For instance, in 2023, the U.S. dairy herd size saw a slight decrease, intensifying competition for available milk.

Chobani's established, vertically integrated supply chain and strong partnerships with dairy farmers, exemplified by its 'Milk Matters' program, provide a substantial competitive moat. This allows Chobani to ensure consistent quality and availability, a difficult advantage for new entrants to replicate quickly.

Regulatory Hurdles and Food Safety Standards

The food industry, especially dairy, faces intense scrutiny through food safety regulations and quality control. Newcomers must invest heavily in compliance, testing, and certifications, making market entry challenging.

For example, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce strict Good Manufacturing Practices (GMPs) and Hazard Analysis and Critical Control Points (HACCP) systems, which require substantial upfront capital for new entrants in the yogurt market.

- Stringent Food Safety: Dairy products are highly regulated to prevent contamination and ensure consumer safety.

- Cost of Compliance: New entrants need significant capital for facilities, processes, and certifications to meet these standards.

- Regulatory Expertise: Navigating complex food safety laws requires specialized knowledge and ongoing investment.

- Quality Control Investment: Maintaining high-quality standards necessitates robust testing and monitoring systems from day one.

Experience and Expertise in Product Development

The threat of new entrants in the yogurt market, particularly concerning experience and expertise in product development, is moderate for Chobani. Developing appealing and consistent yogurt products, especially specialized ones like Greek yogurt or diverse non-dairy options, requires significant research, development, and production expertise. Chobani's history of innovation and its ability to adapt to changing consumer preferences, such as high-protein and zero-sugar options, makes it difficult for new, inexperienced players to compete effectively.

New entrants face substantial hurdles in replicating Chobani's established product development capabilities. For instance, the complex fermentation processes for Greek yogurt and the formulation challenges for plant-based alternatives demand specialized knowledge and significant investment in R&D. Chobani's 2023 net sales reached $1.7 billion, reflecting its established market presence and consumer trust built on consistent quality and innovation.

- Product Complexity: Creating high-quality Greek yogurt or sophisticated non-dairy alternatives requires advanced food science knowledge and precise manufacturing processes.

- R&D Investment: Significant capital is needed for research and development to innovate and meet evolving consumer demands for health and ingredient transparency.

- Brand Reputation: Chobani has cultivated a strong brand image associated with quality and innovation, making it challenging for new entrants to gain consumer trust quickly.

- Operational Expertise: Mastering the supply chain, production scaling, and quality control for a diverse product portfolio demands years of operational experience.

The threat of new entrants in the yogurt market is generally low to moderate due to high capital requirements for manufacturing, distribution, and regulatory compliance. Established brands like Chobani benefit from significant brand loyalty and entrenched distribution networks, making it difficult for newcomers to gain shelf space and consumer trust. Securing a consistent supply of high-quality raw milk also presents a challenge for new players.

| Factor | Impact on New Entrants | Chobani's Advantage |

|---|---|---|

| Capital Investment | High (Manufacturing, Equipment) | Established Infrastructure |

| Distribution & Brand Loyalty | Difficult to Replicate | Extensive Networks, Strong Brand Recognition |

| Raw Material Sourcing | Challenging (Milk Supply) | Vertically Integrated Supply Chain, Farmer Partnerships |

| Regulatory Compliance | Costly (Food Safety, Quality Control) | Existing Compliance Systems |

Porter's Five Forces Analysis Data Sources

Our Chobani Porter's Five Forces analysis is built upon a foundation of reliable data, including Chobani's annual reports, industry-specific market research from firms like IBISWorld, and broader economic data from sources such as Statista.