Chick-fil-A Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chick-fil-A Bundle

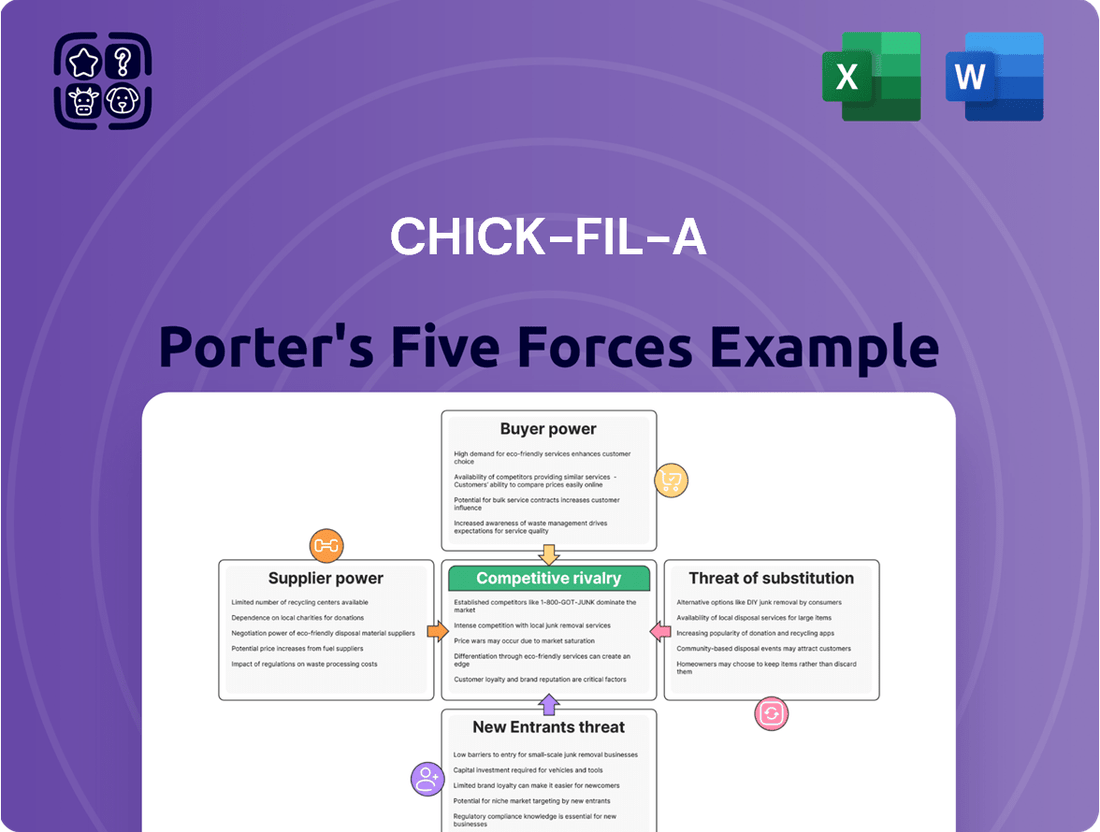

Chick-fil-A navigates a competitive landscape with moderate buyer power, thanks to its strong brand loyalty and differentiated product. However, the threat of substitutes is significant, as consumers have numerous fast-food and casual dining options. The company also faces a moderate threat of new entrants, with the fast-food industry being accessible but capital-intensive.

The full analysis reveals the real forces shaping Chick-fil-A’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chick-fil-A's immense scale and substantial purchasing volume significantly diminish the bargaining power of its suppliers. This allows the company to negotiate favorable terms and competitive pricing for critical inputs, including its signature chicken. For instance, with revenues surpassing $20 billion in 2024, Chick-fil-A leverages this financial strength to its advantage in supplier negotiations.

Chick-fil-A's ability to source key ingredients like chicken and buns from multiple suppliers significantly diminishes the bargaining power of these suppliers. This multi-sourcing approach grants Chick-fil-A considerable flexibility, lessening its reliance on any single provider.

By fostering a competitive landscape among its suppliers, Chick-fil-A can effectively manage costs and maintain consistent product quality. For instance, in 2024, the company's robust supply chain allowed it to absorb some of the inflationary pressures impacting the food industry, with chicken prices seeing fluctuations but overall stability due to diversified sourcing. This strategy is crucial in a market where commodity prices can be volatile.

Chick-fil-A cultivates strategic, long-term relationships with its suppliers, a key factor in managing supplier bargaining power. This approach fosters loyalty and can lead to more favorable terms and consistent quality, as seen in their emphasis on fresh, high-quality ingredients. For example, their commitment to sourcing chicken from suppliers who meet specific animal welfare standards, a practice they've highlighted for years, demonstrates a willingness to invest in relationships that align with their brand values.

While exclusive agreements with certain suppliers might create a degree of dependency, they often translate into cost efficiencies and a more predictable supply chain. This can be particularly advantageous for a high-volume operator like Chick-fil-A, ensuring they can meet demand without compromising on product standards. Their ability to negotiate favorable pricing due to the scale of their operations further strengthens their position.

Furthermore, Chick-fil-A's initiative to support local farms not only enhances its community engagement but also bolsters its negotiation leverage. By fostering these local partnerships, they can often secure unique ingredients and build a more resilient supply network, which can be more responsive to their specific needs and potentially offer competitive pricing compared to larger, more generalized distributors.

Standardized Inputs

The bargaining power of suppliers for Chick-fil-A is notably constrained by the standardized nature of many of its core inputs. For instance, chicken, a fundamental component of its menu, is largely a commodity. This means Chick-fil-A can readily switch between different poultry suppliers without significant disruption or loss of quality, thereby reducing its reliance on any single provider. Similarly, the buns used for its signature sandwiches are often sourced from bakeries that produce standardized products, further limiting supplier leverage.

This standardization directly translates into lower switching costs for Chick-fil-A. When inputs are easily interchangeable, suppliers find it harder to demand higher prices or dictate terms. This flexibility is a crucial element in Chick-fil-A's strategy to maintain cost control and operational efficiency across its vast network of restaurants. In 2023, the U.S. poultry industry alone was valued at over $50 billion, highlighting the scale of this market and the potential for competitive sourcing.

- Standardized Inputs: Chicken and buns are largely commoditized, allowing for easy supplier substitution.

- Reduced Switching Costs: Standardization minimizes the expense and effort required to change suppliers.

- Limited Supplier Leverage: This flexibility weakens individual suppliers' ability to dictate prices or terms.

- Supply Chain Efficiency: Standardization contributes to cost management and operational consistency for Chick-fil-A.

Low Threat of Forward Integration

The threat of suppliers integrating forward into the fast-food industry, particularly to compete with established players like Chick-fil-A, is generally low. This is because suppliers typically do not possess the necessary infrastructure, established brand recognition, or the complex operational expertise required to run a large-scale restaurant chain. For instance, a chicken supplier would face immense challenges in replicating Chick-fil-A's customer loyalty and efficient service model.

This lack of forward integration capability significantly diminishes the bargaining power of suppliers. They are unlikely to leverage the threat of entering the market themselves as a means to negotiate better terms with Chick-fil-A. In 2024, the capital investment required to build even a single restaurant location can easily run into hundreds of thousands of dollars, a substantial barrier for most suppliers.

- Low Threat of Forward Integration: Suppliers generally lack the capital, brand equity, and operational know-how to enter the fast-food market.

- High Barriers to Entry for Suppliers: Establishing a successful fast-food operation requires significant investment in real estate, supply chain management, marketing, and customer service, which are outside the typical scope of suppliers.

- Reduced Supplier Bargaining Power: The inability of suppliers to credibly threaten forward integration limits their leverage in price negotiations with large chains like Chick-fil-A.

Chick-fil-A's substantial purchasing volume, exceeding $20 billion in revenue in 2024, significantly reduces the bargaining power of its suppliers. The company's ability to source key ingredients like chicken and buns from multiple providers further limits any single supplier's leverage. This diversified sourcing strategy allows Chick-fil-A to negotiate favorable terms and maintain cost control, even amidst market volatility.

| Factor | Chick-fil-A's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Purchasing Volume | High (>$20 billion revenue in 2024) | Lowers supplier power |

| Supplier Diversification | High (multiple sources for key ingredients) | Lowers supplier power |

| Input Standardization | High (commoditized inputs like chicken) | Lowers supplier power |

| Switching Costs | Low (due to standardized inputs) | Lowers supplier power |

| Threat of Forward Integration | Low (suppliers lack required infrastructure/brand) | Lowers supplier power |

What is included in the product

This analysis of Chick-fil-A's competitive landscape reveals how its strong brand loyalty and operational efficiency mitigate buyer power and the threat of substitutes, while also examining the intense rivalry within the fast-food industry.

Effortlessly identify competitive threats and opportunities by visualizing Chick-fil-A's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Customers in the fast-food sector wield considerable influence, primarily because there are so many other places to eat and it's so easy to switch. If a customer isn't happy with Chick-fil-A, they can simply go to a competitor without much hassle or expense.

This ease of switching means Chick-fil-A must consistently offer excellent food and good prices to keep customers coming back. For instance, in 2023, the fast-food industry saw intense competition, with brands like McDonald's and Popeyes vying for market share, underscoring the need for strong customer retention strategies.

Consumers are showing a greater awareness of prices, particularly with inflation impacting their budgets and a growing number of less expensive dining options available. This means Chick-fil-A faces pressure to keep its prices competitive, even when its own operating costs are on the rise.

The sheer size of the fast-food industry, projected to exceed $300 billion in sales for 2024, underscores the vast array of choices consumers have. This competitive landscape directly influences customer bargaining power, as they can easily switch to a lower-priced competitor if they perceive Chick-fil-A's offerings as too expensive.

Chick-fil-A enjoys remarkable brand loyalty and customer satisfaction, even amidst a highly competitive fast-food landscape. This dedication significantly curbs the bargaining power customers might otherwise wield.

The company's commitment to service and quality has consistently placed it at the top of customer satisfaction surveys. In fact, Chick-fil-A achieved a remarkable score of 83 in both 2024 and 2025, marking its eleventh consecutive year of leading the industry in this regard.

This deep-seated loyalty means customers are far less likely to switch to a competitor based solely on minor price differences, effectively diminishing their power to negotiate better terms or prices.

Information Availability

Customers today have unprecedented access to information, especially concerning food options and pricing. Online platforms and review sites allow them to easily compare Chick-fil-A’s offerings and prices against competitors like McDonald’s, Wendy’s, and Popeyes. This transparency directly enhances their bargaining power, as they can readily identify the best value and make informed choices based on their preferences and budget.

The ease of accessing detailed product information, including ingredients, nutritional facts, and customer reviews, empowers consumers. For instance, a quick search can reveal price differences for a chicken sandwich meal across major fast-food chains. This readily available data means customers are less reliant on a single provider and can easily switch if they perceive better value elsewhere, thereby increasing their leverage.

- Informed Decision-Making: Consumers can research menu items, prices, and quality across multiple fast-food brands with just a few clicks.

- Price Transparency: Online tools and apps allow for easy price comparisons, putting pressure on brands like Chick-fil-A to remain competitive.

- Access to Reviews: Customer feedback and ratings on various platforms provide insights into product quality and service, influencing purchasing decisions.

Digital Engagement and Loyalty Programs

Chick-fil-A's robust digital engagement, with digital channels contributing over 30% of its 2024 sales, significantly strengthens customer loyalty. The Chick-fil-A One loyalty program, boasting more than 50 million members, further solidifies this by offering tangible rewards and personalized experiences. These initiatives effectively reduce the likelihood of customers switching to competitors, thereby mitigating their bargaining power.

- Digital Sales Growth: Over 30% of Chick-fil-A's 2024 sales were generated through digital channels, highlighting a strong customer preference for online ordering and engagement.

- Loyalty Program Reach: The Chick-fil-A One program has amassed over 50 million members, indicating widespread adoption and a significant base of repeat customers.

- Customer Retention Incentives: Rewards and personalized experiences offered through the loyalty program create strong incentives for customers to remain with Chick-fil-A, diminishing their inclination to explore alternatives.

While customers in the fast-food sector generally have significant bargaining power due to numerous alternatives and ease of switching, Chick-fil-A's exceptional brand loyalty and customer satisfaction substantially diminish this power. Its consistent top-tier customer service, evidenced by an 83 score in 2024 and 2025, makes customers less likely to switch for minor price variations.

The company's strong digital presence, with over 30% of 2024 sales from digital channels, and the vast Chick-fil-A One loyalty program, with over 50 million members, further solidify customer retention. These factors create a barrier to switching, effectively reducing customers' leverage to demand lower prices or better terms.

Customers are well-informed, able to easily compare Chick-fil-A’s offerings and pricing against competitors like McDonald's and Wendy's through online platforms. This transparency, however, is countered by Chick-fil-A’s perceived value and loyalty programs, which mitigate the impact of price comparisons on their decision to switch.

| Factor | Impact on Chick-fil-A | Supporting Data (2024/2025) |

|---|---|---|

| Ease of Switching | High (Industry Standard) | N/A (General Industry Trait) |

| Brand Loyalty | Lowers Customer Bargaining Power | 83 Customer Satisfaction Score (11th Consecutive Year Leading) |

| Digital Engagement & Loyalty Programs | Lowers Customer Bargaining Power | >30% of Sales from Digital Channels; >50 Million Chick-fil-A One Members |

| Price Sensitivity & Information Access | Increases Customer Bargaining Power | Easy online price comparisons available |

Preview the Actual Deliverable

Chick-fil-A Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Chick-fil-A Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the fast-food industry. This professionally formatted analysis provides actionable insights into Chick-fil-A's strategic positioning and competitive advantages.

Rivalry Among Competitors

The fast-food arena is a crowded marketplace, with established giants and new entrants constantly battling for consumer attention and dollars. Chick-fil-A finds itself in direct contention with powerhouses like McDonald's, KFC, Popeyes, and Wendy's, all of whom offer comparable menu items and dining experiences.

This fierce competition often translates into pressure on pricing and a relentless drive for menu innovation and service enhancements. For instance, in 2023, the quick-service restaurant sector saw continued growth, with average unit volumes remaining robust, underscoring the ongoing demand but also the need for differentiation.

The fast-food industry, while a growth sector, presents a dynamic competitive landscape. Chick-fil-A's impressive systemwide sales of $22.7 billion in 2024 underscore its success, but this very growth attracts new entrants and spurs existing players to innovate and expand their offerings.

This intensified rivalry is evident in Chick-fil-A's own performance metrics. The company's sales growth decelerated to 5.4% in 2024, marking its slowest growth rate in at least 18 years. This slowdown suggests a maturing market where differentiation and operational excellence become even more critical to maintaining market share.

Chick-fil-A's competitive edge is built on its distinct focus on high-quality food and unparalleled customer service, setting it apart from many rivals. This commitment has fostered strong brand loyalty, allowing them to maintain a premium position in the fast-food market.

The fast-casual dining landscape, however, is intensely competitive, with rivals constantly striving to innovate, particularly in the hotly contested 'chicken sandwich wars.' For instance, Popeyes' 2019 launch of its chicken sandwich reportedly led to significant sales boosts and market share gains, demonstrating the impact of successful product innovation.

Chick-fil-A must therefore remain agile, balancing its core offerings with strategic menu enhancements. The challenge lies in consistently delivering the expected high quality while introducing new items that resonate with consumers, a delicate act required to sustain its competitive advantage against a backdrop of continuous industry evolution.

Brand Loyalty and Customer Service

Chick-fil-A's exceptional brand loyalty, consistently recognized with 11 consecutive years of top customer satisfaction rankings, creates a significant competitive moat. This dedicated customer base acts as a buffer against aggressive competitive strategies from rivals, helping Chick-fil-A maintain its market share. The company’s distinct operating model and deeply ingrained customer-centric culture are the bedrock of this enduring loyalty.

This strong customer affinity translates into tangible benefits:

- High Customer Retention: Loyal customers are more likely to return, reducing the need for costly customer acquisition efforts.

- Pricing Power: Brand loyalty can allow for premium pricing compared to less differentiated competitors.

- Positive Word-of-Mouth: Satisfied and loyal customers become brand advocates, driving organic growth.

- Resilience to Competition: Even with intense competition, Chick-fil-A's loyal following ensures a stable revenue stream.

Operational Efficiency and Expansion

Chick-fil-A's franchised model, emphasizing operational consistency and efficiency, creates a high bar for competitors. This streamlined approach ensures a predictable customer experience, a significant advantage in a crowded market.

The company's aggressive expansion strategy, including innovative formats like digital-only locations and enhanced drive-thrus, directly escalates competitive pressure. For instance, Chick-fil-A added over 150 new restaurants in 2023, pushing its total to over 3,000 locations across the United States and Canada.

- Franchised Model: Standardized processes and training ensure consistent quality and service, making it difficult for rivals to replicate.

- Operational Streamlining: Efficient kitchen workflows and drive-thru management contribute to faster service times, a key differentiator.

- Expansion Strategy: Continued domestic growth and international exploration, alongside new store formats, intensify rivalry by increasing market presence.

- 2023 Performance: Chick-fil-A reported over $23 billion in system-wide sales in 2023, underscoring its market strength and competitive impact.

The competitive rivalry within the fast-food industry is intense, with Chick-fil-A facing off against major players like McDonald's, KFC, and Popeyes. These competitors offer similar chicken-centric menus and strive for customer loyalty through aggressive pricing, menu innovation, and service improvements. Chick-fil-A's systemwide sales reached $22.7 billion in 2024, but its growth slowed to 5.4%, indicating the market's increasing saturation and the need for continuous differentiation to maintain its strong position.

Chick-fil-A's success is partly due to its exceptional customer service and high-quality food, which have cultivated a loyal customer base. This loyalty, evidenced by 11 consecutive years of top customer satisfaction rankings, provides a significant buffer against competitors. However, rivals are actively innovating, as seen with Popeyes' impactful chicken sandwich launch in 2019, which demonstrated how product innovation can quickly shift market dynamics.

The company's strategic expansion, adding over 150 new locations in 2023, further intensifies this rivalry by increasing its market presence and accessibility. This growth, coupled with its efficient franchised model and customer-centric culture, creates a high operational standard that competitors must strive to match, making the landscape a continuous battle for market share and consumer preference.

| Competitor | 2023 Systemwide Sales (Est.) | Key Competitive Actions |

|---|---|---|

| McDonald's | $100+ billion | Menu innovation (McCrispy chicken sandwich), value deals, digital ordering enhancements |

| KFC | ~$30 billion | Focus on chicken variety, limited-time offers, international expansion |

| Popeyes | ~$5 billion | Continued promotion of chicken sandwich, expansion of menu items, focus on brand experience |

| Wendy's | ~$20 billion | Breakfast menu expansion, value-driven promotions, digital investment |

SSubstitutes Threaten

Home-cooked meals represent a significant substitute for fast-food dining, including Chick-fil-A. Consumers increasingly view preparing food at home as a healthier and more budget-friendly option, especially with rising restaurant prices. For instance, the average cost of dining out for a family of four in 2024 can easily exceed $60, making home cooking a compelling alternative.

Chick-fil-A faces significant competition from a wide array of substitute food service options. Casual dining establishments, coffee shops, and other quick-service restaurants all provide alternatives that cater to various consumer preferences, whether it's for different cuisines, price points, or convenience factors.

For instance, the broader fast-casual and quick-service restaurant market in the U.S. saw substantial growth. In 2024, this segment is projected to continue its upward trajectory, with sales expected to reach hundreds of billions of dollars, indicating a large pool of consumers readily switching between different dining experiences based on immediate needs and desires.

The increasing consumer focus on health presents a significant threat to Chick-fil-A. As more people seek out nutritious options, demand for alternatives like salad-centric fast-casual restaurants, plant-based meals, and fresh produce grows. This trend is evident in the market, with the global plant-based food market projected to reach $74.2 billion by 2030, indicating a substantial shift in consumer preferences.

Meal Kits and Online Tutorials

The increasing popularity of meal kit services and free online cooking tutorials presents a significant threat of substitutes for fast-food chains like Chick-fil-A. These alternatives empower consumers to prepare restaurant-quality meals in their own kitchens, offering both convenience and potential cost savings compared to dining out.

For instance, the global meal kit delivery service market was valued at approximately $17.2 billion in 2023 and is projected to grow substantially. This accessibility to ingredients and step-by-step instructions, often available through platforms like YouTube and TikTok, directly competes with the convenience factor that has long been a cornerstone of fast-food success.

- Convenience: Meal kits deliver pre-portioned ingredients, reducing prep time.

- Cost-Effectiveness: Home cooking can be cheaper than frequent fast-food purchases.

- Skill Development: Online tutorials offer accessible culinary education, fostering home cooking.

- Variety: Consumers can explore diverse cuisines and recipes not always available at fast-food outlets.

Convenience Stores and Grocery Store Prepared Foods

Convenience stores and grocery store prepared food sections present a notable threat of substitutes for Chick-fil-A. Consumers increasingly seek quick meal solutions, and these alternatives often provide a broader variety of options, from grab-and-go sandwiches to full meal kits. For instance, many grocery chains now boast extensive deli counters and pre-packaged meals, catering to busy individuals. In 2024, the prepared foods segment within the grocery industry continued its robust growth, with many analysts projecting double-digit increases in sales for this category as consumers prioritize convenience and value.

- Growing Consumer Preference: A significant portion of consumers, particularly those with limited time, are turning to grocery stores and convenience stores for ready-to-eat meals.

- Price Competitiveness: These substitutes can often offer competitive pricing, especially when considering bundled deals or loyalty programs available at major grocery chains.

- Variety and Customization: The sheer breadth of choices, from salads to hot entrees, provides a level of variety that can be more appealing than a focused fast-food menu for some customers.

- Accessibility: With a pervasive presence in most communities, convenience and grocery stores offer unparalleled accessibility for quick meal purchases.

The threat of substitutes for Chick-fil-A is substantial, encompassing a wide range of alternatives that cater to evolving consumer preferences for convenience, health, and value. Home-cooked meals, fueled by rising dining-out costs, with a family of four potentially spending over $60 for a single meal in 2024, represent a primary substitute. Additionally, the growing popularity of meal kit services, a market valued at approximately $17.2 billion in 2023, and readily available online cooking tutorials empower consumers to replicate restaurant-quality meals at home, directly challenging the convenience proposition of fast food.

Beyond home preparation, the broader food service landscape offers numerous substitutes. Casual dining, coffee shops, and other quick-service restaurants compete by offering diverse cuisines and price points. Furthermore, the increasing consumer demand for healthier options is driving growth in segments like salad-centric fast-casual eateries and plant-based meals, with the global plant-based food market projected to reach $74.2 billion by 2030. Even convenience stores and grocery store prepared food sections are becoming formidable substitutes, with their prepared foods segment experiencing robust growth in 2024, offering consumers convenient and often more varied meal solutions.

| Substitute Category | Key Appeal | 2024 Relevance/Data Point |

|---|---|---|

| Home-Cooked Meals | Cost savings, Health control | Average family meal cost out >$60 |

| Meal Kit Services | Convenience, Variety, Skill development | Market valued at $17.2 billion (2023) |

| Health-Focused Alternatives | Nutritious options, Plant-based | Plant-based market projected $74.2 billion (2030) |

| Grocery/Convenience Stores | Convenience, Variety, Accessibility | Prepared foods segment showing double-digit growth |

Entrants Threaten

While launching a small eatery might be manageable, replicating Chick-fil-A's extensive network demands significant capital. This includes securing prime real estate, construction, outfitting kitchens with specialized equipment, and building a robust supply chain. For instance, in 2024, the average cost to open a Chick-fil-A franchise alone ranged from $342,000 to $1,725,000, illustrating the substantial initial outlay required.

The sheer scale and established infrastructure of Chick-fil-A present a formidable barrier. Developing a comparable supply chain, distribution network, and brand recognition takes years and immense financial backing. These high fixed costs and the time required to establish these operational efficiencies make it exceedingly difficult for new entrants to compete effectively on a similar scale in the current market.

Chick-fil-A's exceptional brand recognition and deeply loyal customer base act as a formidable barrier to new entrants. Establishing a similar level of trust and affinity demands substantial time, significant marketing expenditure, and unwavering commitment to quality and service. With revenues surpassing $20 billion in 2024, Chick-fil-A's market dominance underscores this challenge for any aspiring competitor.

Chick-fil-A's formidable supply chain, featuring proprietary distribution centers, significantly raises the barrier for new entrants. This established infrastructure ensures consistent quality and availability, a feat difficult and costly for newcomers to replicate quickly. In 2023, Chick-fil-A reported over $23 billion in system-wide sales, a testament to its operational prowess.

Franchise Model and Owner-Operator Selection

Chick-fil-A's distinctive franchise model, which relies on carefully selected owner-operators rather than passive investors, significantly deters new entrants. This rigorous selection process, which saw only around 0.4% of applicants accepted in 2023 for their operator program, ensures a high level of operational excellence and brand consistency that is difficult for competitors to replicate quickly.

The emphasis on owner-operators who invest their own capital, typically around $10,000 to start, and are actively involved in day-to-day management, creates a strong operational backbone. This hands-on approach, coupled with Chick-fil-A's robust training and support systems, makes it challenging for new fast-food concepts to achieve comparable service quality and customer loyalty without substantial investment and time.

- High Barrier to Entry: The selective franchising process and the requirement for owner-operator involvement act as a significant deterrent.

- Operational Consistency: Owner-operators ensure uniform service and quality, a difficult standard for new competitors to match.

- Brand Reputation: Chick-fil-A's consistent customer experience, a result of its model, builds strong brand loyalty, making it harder for newcomers to gain traction.

Regulatory and Food Safety Standards

The fast-food sector, including major players like Chick-fil-A, faces significant hurdles for newcomers due to stringent regulatory and food safety standards. These requirements are not just bureaucratic checkboxes; they are critical for consumer trust and public health. For instance, the U.S. Food and Drug Administration (FDA) sets comprehensive guidelines for food handling, preparation, and labeling, which all businesses must meticulously follow. Failing to comply can lead to severe penalties, including fines and operational shutdowns, making the initial investment and ongoing compliance a substantial barrier.

Navigating this complex web of regulations is a major deterrent for potential new entrants. Obtaining necessary permits, licenses, and certifications from local, state, and federal agencies can be a lengthy and expensive undertaking. For example, in 2024, the average time to obtain all necessary permits for a new restaurant in a major metropolitan area could range from six months to over a year, with associated costs easily reaching tens of thousands of dollars. This process demands specialized knowledge and resources, which emerging businesses may lack, thereby protecting established brands like Chick-fil-A from immediate, widespread competition.

- High Compliance Costs: New entrants must invest heavily in meeting FDA and local health department standards for food safety, sanitation, and operational procedures.

- Permitting Delays: The process of securing all required health permits and business licenses can be time-consuming, delaying market entry and increasing initial capital requirements.

- Stringent Food Safety Protocols: Adherence to HACCP (Hazard Analysis and Critical Control Points) principles and other food safety management systems is mandatory, requiring specialized training and infrastructure.

- Ongoing Regulatory Scrutiny: Regular inspections and audits by health authorities necessitate continuous investment in maintaining compliance, adding to the operational burden for new businesses.

The threat of new entrants into the fast-food market, particularly when considering a competitor aiming to match Chick-fil-A's scale, is significantly mitigated by the immense capital requirements. Opening a Chick-fil-A franchise alone in 2024 could cost between $342,000 and $1,725,000, a substantial investment that deters many aspiring entrepreneurs.

Furthermore, Chick-fil-A's established operational infrastructure, including its proprietary supply chain and distribution network, represents a considerable barrier. Replicating this efficiency and scale takes years and vast financial resources, making it difficult for newcomers to compete on price or availability. The company's system-wide sales exceeding $23 billion in 2023 highlight the magnitude of its operational advantage.

Chick-fil-A's powerful brand recognition and customer loyalty, cultivated over decades, are also significant deterrents. Building a similar level of trust and affinity requires substantial marketing investment and a consistent, high-quality customer experience, which is challenging for new entrants to achieve quickly. Their revenues surpassing $20 billion in 2024 underscore this market dominance.

| Factor | Chick-fil-A Example (2024 Data) | Impact on New Entrants |

|---|---|---|

| Initial Franchise Cost | $342,000 - $1,725,000 | High capital barrier |

| System-wide Sales | Over $23 billion (2023) | Demonstrates scale and market penetration |

| Brand Revenue | Over $20 billion (2024) | Indicates strong customer loyalty and demand |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chick-fil-A is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and news articles detailing competitive strategies and consumer trends.