Cheil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cheil Bundle

Uncover the strategic positioning of this company's product portfolio with a glimpse into its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental drivers of its market success.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cheil Worldwide's Digital Marketing Solutions stand out as its dominant force, representing 54% of its total revenue in 2024 and climbing to 55% by the second quarter of 2025. This significant market share within the company's offerings mirrors the robust expansion of the global digital advertising market, which saw investments surpass $790 billion in 2024 and is anticipated to hit $1.1 trillion in 2025.

Cheil excels at crafting integrated marketing campaigns, a core offering that resonates with clients seeking unified brand messaging. Their digital expansion has significantly boosted agency work volume, reflecting a strong market appetite for these comprehensive solutions.

This integrated approach seamlessly blends advertising, digital, retail, and data analytics to create cohesive client experiences. For instance, in 2024, Cheil's focus on integrated digital strategies contributed to a notable uptick in client project acquisition, with digital services accounting for over 60% of new business wins.

Cheil Worldwide's North and Latin American operations are shining stars in its portfolio. These regions experienced robust double-digit growth in the second quarter of 2025, demonstrating Cheil's expanding influence and successful market penetration. This strong regional performance is a key driver of the company's overall financial health.

The growth in these markets is not just about revenue; it's about building a sustainable client base. Cheil has been actively securing new advertisers in both North and Latin America. This strategic client acquisition further solidifies the star status of these operations, indicating a bright future with continued expansion and profitability.

Retail Experience and Commerce Solutions

Cheil is doubling down on retail, seeing it as a prime area for expansion. This focus is smart, especially with the global retail media market on a rocket ship. It's expected to hit $177.1 billion by 2025, even overtaking total TV revenue.

Cheil's strength lies in blending traditional retail marketing with cutting-edge digital strategies. This allows them to craft compelling shopping experiences that resonate with today's consumers.

- Retail Media Market Growth: Projected to reach $177.1 billion globally in 2025, surpassing total TV revenue.

- Cheil's Strategic Focus: Strengthening core retail businesses to capitalize on this expansion.

- Key Differentiator: Expertise in integrating retail marketing with digital initiatives for enhanced customer engagement.

Data-Driven Marketing Analytics

Cheil Worldwide is significantly boosting its data-centric operations, employing sophisticated tools like Adobe's DMP and their own private DMPs. This allows for real-time analysis of consumer behavior, enabling the creation of highly effective and personalized marketing campaigns.

This focus on data analytics positions Cheil strongly in the rapidly expanding field of data-driven marketing. By understanding consumer actions instantly, they can fine-tune strategies for better results.

The growing emphasis on first-party data and privacy-compliant solutions further amplifies the appeal of Cheil's analytical services. In 2024, companies are increasingly prioritizing data privacy, making Cheil's approach a key advantage.

- Real-time Consumer Behavior Analysis: Cheil utilizes Adobe's DMP and proprietary DMPs to gain immediate insights into consumer actions.

- Personalized Campaign Optimization: This data allows for the delivery of tailored marketing messages that resonate with specific audiences.

- First-Party Data Strategy: Cheil's capabilities align with the market trend towards leveraging owned data for more effective marketing.

- Privacy-Safe Solutions: Their analytical approach respects data privacy, a crucial factor for consumers and regulators in 2024.

Cheil Worldwide's North and Latin American operations are clear stars in its portfolio, exhibiting robust double-digit growth in the second quarter of 2025. This expansion reflects successful market penetration and a growing client base, driven by strategic new advertiser acquisition in these regions.

| Region | Growth (Q2 2025) | Key Driver |

|---|---|---|

| North America | Double-Digit | New Advertiser Acquisition |

| Latin America | Double-Digit | Market Penetration |

What is included in the product

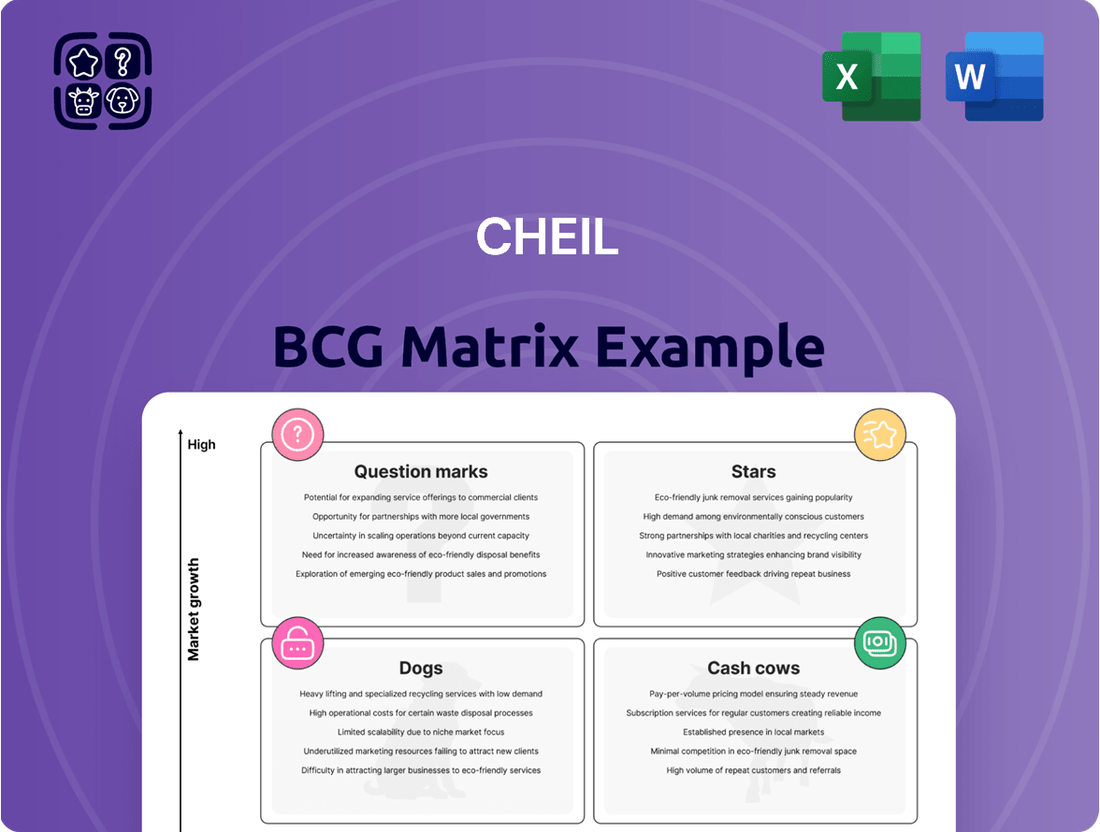

The Cheil BCG Matrix offers a strategic overview of a company's product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides guidance on resource allocation, highlighting which units to invest in, hold, or divest for optimal growth and profitability.

A clear visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Established Above-The-Line (ATL) advertising remains a solid performer for Cheil, even as digital channels grow. In Q2 2025, this segment saw a 16% increase, driven by key clients such as Netflix, Coway, and Nongshim. This growth from non-affiliated advertisers highlights the enduring value and market presence of traditional advertising, contributing a stable revenue stream.

While ATL advertising represented approximately 15-16% of Cheil's overall business in 2025, its consistent performance and growth from major clients underscore its status as a cash cow. These established relationships in a mature market require less incremental investment for continued revenue generation, allowing Cheil to leverage its existing infrastructure and expertise effectively.

Below-The-Line (BTL) advertising and event marketing are significant contributors to Cheil's portfolio, representing a robust 30% of its overall business. In 2024, this segment experienced a substantial 19% growth, fueled by major international events like the Olympics.

This mature market segment is where Cheil has cemented a strong presence, likely due to its consistent involvement in major recurring events and its deep-rooted client relationships. The high profit margins and steady cash flow derived from these projects firmly place BTL advertising and event marketing in the cash cow category for Cheil.

Cheil Worldwide's enduring partnership with Samsung, its founding client, remains a bedrock of its financial stability. This relationship, established when Cheil was created to serve Samsung exclusively, continues to generate substantial and predictable revenue streams.

The dedicated Samsung Business unit within Cheil's current structure highlights the agency's sustained high market share with this crucial client. This deep, long-term client connection is a hallmark of a cash cow, ensuring consistent cash flow for the company.

Global Network and Operational Efficiency

Cheil's expansive global network, boasting 52 offices in 44 countries, is a cornerstone of its operational strength. This mature asset, while demanding upkeep, enables seamless worldwide service delivery and robust operational efficiency, directly contributing to consistent gross profit generation. In 2024, overseas operations continued to be a significant driver of Cheil's financial performance, highlighting the network's enduring value.

- Global Footprint: 52 offices across 44 countries.

- Operational Advantage: Facilitates integrated service delivery and efficiency.

- Financial Contribution: Overseas business is a key source of gross profits.

- Maturity: Represents a stable, albeit maintained, asset.

Core Public Relations Services

Core Public Relations Services represent a foundational offering for Cheil Worldwide, integral to its broader marketing capabilities. This segment is characterized by its maturity within the marketing landscape, often translating into predictable, long-term client relationships and consistent revenue generation.

Cheil's extensive global reach and varied clientele are significant assets in this area. These factors likely contribute to a substantial market share in public relations, a segment known for its stability even if growth is more moderate compared to other marketing disciplines.

- Mature Market Segment: Public relations is a well-established service with predictable demand.

- Stable Revenue Streams: Long-term retainers are common, providing consistent income.

- Global Reach Advantage: Cheil's international footprint allows it to serve a diverse and extensive client base in PR.

- Market Share in PR: Cheil likely holds a notable position in the PR market due to its scale and experience.

Cheil's established ATL advertising, particularly with major clients like Netflix and Coway, continues to be a strong performer. Despite the rise of digital, this segment saw a 16% increase in Q2 2025, demonstrating its role as a stable revenue generator. Its contribution, around 15-16% of Cheil's business in 2025, requires minimal new investment, solidifying its cash cow status.

Below-The-Line (BTL) advertising and event marketing, representing 30% of Cheil's business, grew by 19% in 2024. This mature segment, bolstered by consistent involvement in major events and deep client ties, offers high profit margins and predictable cash flow, characteristic of a cash cow.

The enduring relationship with Samsung, Cheil's founding client, provides substantial and predictable revenue. This long-term partnership, evident in the dedicated Samsung Business unit, ensures consistent cash flow, a key indicator of a cash cow.

Cheil's extensive global network of 52 offices in 44 countries, a mature asset, drives operational efficiency and consistent gross profit. Overseas operations were a significant driver of financial performance in 2024, underscoring the network's stable contribution.

| Segment | 2025 (Q2) Growth | 2024 Growth | Estimated % of Business (2025) | BCG Status |

|---|---|---|---|---|

| ATL Advertising | 16% | N/A | 15-16% | Cash Cow |

| BTL Advertising & Event Marketing | N/A | 19% | 30% | Cash Cow |

| Samsung Business | N/A | N/A | Significant Contributor | Cash Cow |

| Global Network Operations | N/A | Key Driver | N/A | Cash Cow |

Preview = Final Product

Cheil BCG Matrix

The preview you are currently viewing is the complete and final Cheil BCG Matrix report you will receive immediately after your purchase. This means you get the exact same professionally formatted and analysis-ready document, free from any watermarks or demo content, ready for immediate integration into your strategic planning.

Dogs

Cheil Worldwide's investment in EVR Studio, a metaverse content producer, highlights a challenging area within their portfolio. In the first quarter of 2025, this venture resulted in a valuation loss of 20 billion won.

Despite the metaverse's overall growth potential, EVR Studio currently represents a significant drain on Cheil's profitability. This situation places it firmly in the 'dog' category of the BCG matrix, indicating a low market share and low growth potential, requiring careful strategic review.

Highly niche traditional print media buying, while part of Cheil's overall growth in ATL advertising, could be classified as a dog within the BCG matrix. This is because the global print media market has been in a steady decline, with advertising spending on print newspapers and magazines shrinking significantly.

For instance, in 2024, global print advertising revenue is projected to continue its downward trend, exacerbating the challenge for any agency solely focused on this segment. If Cheil's involvement in this niche is minimal and not integrated into larger, more diversified media strategies, it represents a low market share in a low-growth or declining sector, characteristic of a dog.

Cheil's legacy internal systems, if outdated and costly to maintain, could be categorized as Dogs in the BCG Matrix. These might include older IT infrastructure or inefficient operational processes that don't align with modern, data-driven strategies. For instance, a 2024 report highlighted that companies often spend 70-80% of their IT budget on maintaining legacy systems, diverting funds from innovation.

These systems can significantly hinder Cheil's agility and ability to adapt to market changes. If these legacy platforms require substantial resources for upkeep without offering significant current utility or a clear modernization plan, they represent a drain on efficiency and innovation potential. Such systems can also impede the integration of new technologies, a crucial factor in today's competitive landscape.

Non-Strategic Small Regional Agencies

Non-strategic small regional agencies within Cheil's portfolio, if they exist and haven't achieved substantial market penetration or seamless integration into the global network, would be classified as dogs. These units likely represent a drain on resources with little to no significant return on investment, struggling to expand their presence in their local markets.

The company's reported successes in regional growth suggest that any areas experiencing stagnation are likely underperforming. For instance, if Cheil were to have acquired a small agency in a market where overall advertising spend grew by a modest 3% in 2024, but that agency’s revenue remained flat, it would fit the dog profile.

- Resource Drain: Agencies with minimal market share consume operational capital and management attention without contributing proportionally to overall revenue or strategic goals.

- Low ROI: These entities typically offer a negative or negligible return on investment, hindering the profitability of the parent company.

- Integration Challenges: Failure to integrate effectively into Cheil's global operations means they cannot leverage the network's scale or shared best practices, further limiting their potential.

- Market Stagnation: In 2024, many smaller regional markets saw advertising spend increase by 2-5%, yet these agencies failed to capitalize, indicating a fundamental lack of competitive advantage or strategic alignment.

Unsuccessful Pilot Programs or Niche Offerings

Unsuccessful pilot programs or niche offerings within Cheil's portfolio would be categorized as Dogs in the BCG Matrix. These are initiatives that, despite investment, have failed to gain significant market traction or adoption. For instance, if Cheil launched a highly specialized digital marketing service targeting a very narrow industry segment in 2023, and by mid-2024 it had only secured a handful of clients with negligible revenue contribution, this would exemplify a Dog.

These types of ventures typically represent a drain on resources without generating substantial returns. Consider a hypothetical scenario where Cheil invested $5 million in developing an AI-powered customer sentiment analysis tool for a specific niche market in late 2022. By the end of 2023, the tool had only been adopted by 5 small businesses, generating only $100,000 in revenue. This low market share and low growth potential firmly places it in the Dog category.

The key characteristic is the lack of market demand or competitive viability. Such offerings might include experimental pilot programs that didn't scale, or highly specialized services that simply didn't resonate with the intended audience. For example, a new augmented reality advertising solution Cheil piloted in early 2024 with a few select clients might have shown poor engagement rates, leading to its discontinuation by the end of the year, marking it as a Dog.

Key indicators for identifying Dogs include:

- Low Market Share: Minimal adoption by clients or target audience.

- Stagnant or Declining Revenue: Little to no revenue generation relative to investment.

- High Development or Operational Costs: Significant expenditure without commensurate returns.

- Lack of Scalability: Inability to grow beyond its initial niche or pilot phase.

Dogs in Cheil's portfolio are business units or investments with low market share in low-growth or declining markets. These segments often consume resources without generating significant returns, demanding strategic evaluation for potential divestment or restructuring. For instance, Cheil's investment in EVR Studio, a metaverse content producer, resulted in a 20 billion won valuation loss in Q1 2025, placing it in the dog category due to its current drain on profitability and uncertain growth prospects.

Similarly, highly niche traditional print media buying, despite being part of Cheil's ATL advertising growth, is a dog due to the global print media market's steady decline. In 2024, global print advertising revenue continues its downward trend, making this segment a low-growth, low-share area. Legacy internal systems, if outdated and costly to maintain, also fall into this category, as companies in 2024 often spend 70-80% of their IT budget on such systems, hindering innovation.

Question Marks

Advanced AI and Generative AI solutions, while not yet a dominant force in Cheil's current market share, represent a significant high-growth frontier. These technologies are poised to revolutionize content creation, enable more dynamic decision-making, and optimize entire marketing campaigns.

Cheil's investment in developing proprietary Generative AI tools and expanding its service portfolio in this domain places these initiatives squarely in the question mark quadrant. While current market penetration may be low, the future potential for these cutting-edge applications is substantial, indicating a strategic focus on future growth.

New geographic market penetration for Cheil, while potentially lucrative, places them in the question mark category of the BCG matrix. These are markets where Cheil, despite its global reach, is a relatively new entrant, actively working to build its presence and client base.

Emerging markets, often characterized by rapid economic expansion, present a high-growth opportunity. However, Cheil's market share in these new territories is typically low initially, as they navigate competition from established local businesses and invest heavily in establishing operations and brand recognition.

Cheil's strategy involves deepening its specialization in high-spending sectors like automotive, healthcare, travel, and food and beverage. This move aims to build significant expertise and attract major advertisers within these verticals.

While these markets boast substantial marketing budgets, Cheil's existing penetration may be modest, facing competition from entrenched competitors. For instance, the global automotive advertising market alone was projected to reach over $30 billion in 2024, highlighting the scale of opportunity but also the competitive landscape.

These targeted sectors represent high-growth opportunities, but Cheil must commit substantial investment to effectively capture significant market share. The healthcare advertising sector, for example, is expected to grow at a CAGR of around 7% through 2028, indicating strong future potential that requires strategic resource allocation.

Proprietary AdTech Development

Cheil's venture into proprietary AdTech development presents a significant question mark within its BCG matrix. While the advertising technology space is a rapidly evolving and intensely competitive arena, it also offers substantial growth potential through innovation.

If Cheil is actively developing its own AdTech solutions, these would likely represent a low market share currently. However, successful development could position them as crucial differentiators, potentially leading to substantial future market impact.

- High Investment, Uncertain Returns: Developing proprietary AdTech requires substantial R&D investment, with success not guaranteed in a market dominated by established players.

- Competitive Landscape: The AdTech sector saw global ad spending reach an estimated $600 billion in 2023, with companies like Google and Meta holding significant market share, making it challenging for new entrants.

- Potential for Disruption: Cheil's unique AdTech could offer advantages in data analysis, targeting, or automation, potentially disrupting existing workflows and client acquisition strategies.

Expansion into New Content Production Formats

Cheil's strategic move into specialized content production formats, like interactive experiences and advanced VR, presents a significant question mark. While the metaverse content investment in EVR Studio signals ambition, Cheil's established market share and demonstrable success in these nascent, high-growth areas remain unproven.

This expansion necessitates considerable investment to build capabilities and achieve competitive differentiation. For instance, the global VR content market, projected to reach $100 billion by 2027, offers immense potential, but Cheil's current position within this rapidly evolving landscape is still being defined.

- High Investment Needs: Scaling in specialized content requires substantial capital for technology, talent, and platform development.

- Uncertain Market Share: Cheil's current dominance in traditional advertising doesn't automatically translate to leadership in emerging formats like VR.

- Technological Evolution: Rapid advancements in VR and interactive technologies demand continuous adaptation and innovation.

- Competition Landscape: The specialized content arena is attracting diverse players, increasing competitive pressure.

Question Marks in Cheil's BCG matrix represent business units or initiatives with low market share in high-growth markets. These areas require significant investment to gain traction and have the potential to become stars if successful, or dogs if they fail to capture market share.

Cheil's focus on advanced AI and Generative AI solutions, new geographic market penetration, proprietary AdTech development, and specialized content production like VR all fall into this category. These are high-potential areas where Cheil is investing heavily but currently holds a relatively small market share.

The success of these Question Marks is critical for Cheil's future growth, as they aim to transform these low-share ventures into market-leading stars. For example, the global AI market was projected to exceed $1.5 trillion by 2027, underscoring the immense growth potential Cheil is targeting.

Navigating these Question Marks involves careful strategic planning, substantial resource allocation, and a keen understanding of evolving market dynamics and competitive landscapes.

| Initiative | Market Growth | Current Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Generative AI Solutions | High | Low | High | Star or Dog |

| New Geographic Markets | High | Low | High | Star or Dog |

| Proprietary AdTech | High | Low | High | Star or Dog |

| Specialized Content (VR) | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.