Chang Hwa Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chang Hwa Bank Bundle

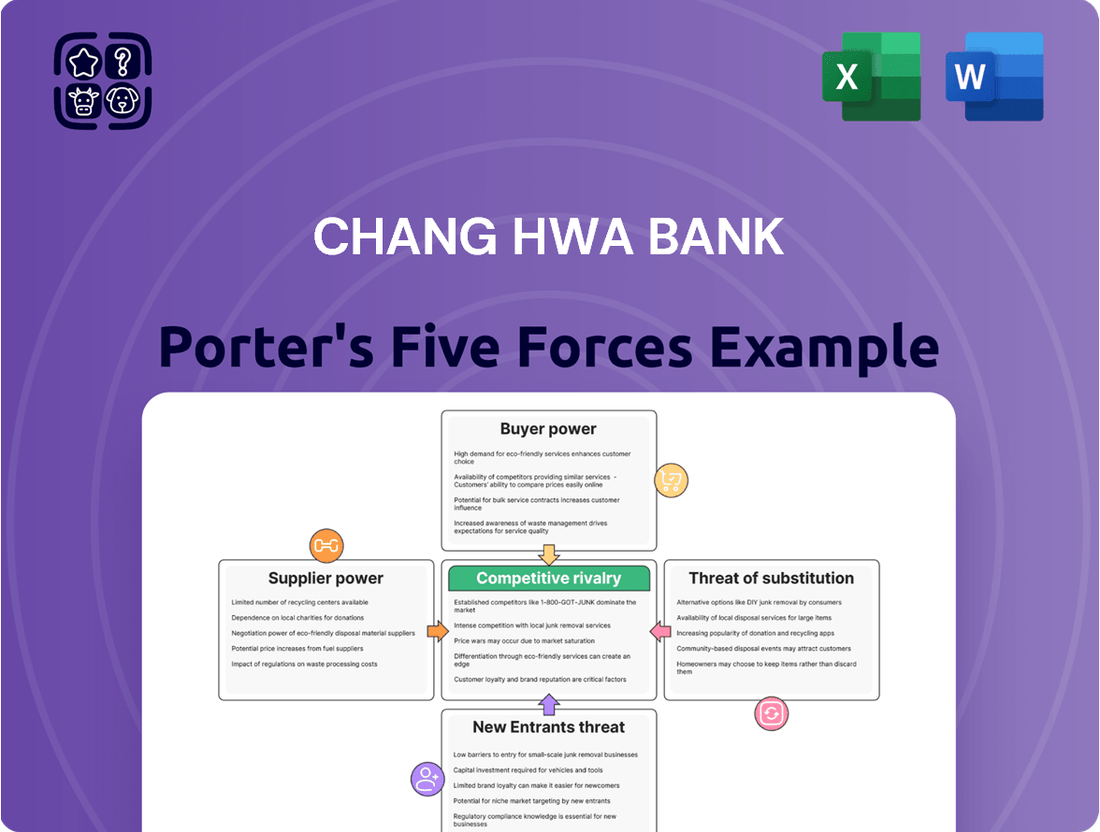

Chang Hwa Bank operates within a dynamic financial landscape, and a Porter's Five Forces analysis reveals the intricate web of competitive pressures it navigates. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chang Hwa Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Individual and corporate depositors are the primary suppliers of capital for Chang Hwa Bank. However, their individual bargaining power is significantly low due to the large and fragmented number of depositors. This widespread base reduces the leverage any single depositor can exert on the bank's terms. The stability of the bank's funding is reinforced by Taiwan's robust financial system, where household deposits accounted for approximately 66% of total system deposits as of 2024, ensuring a stable and diverse funding source.

Chang Hwa Bank depends on suppliers for critical technology infrastructure, software, and specialized financial services. While some services are standardized, key technology partners, especially those providing core banking systems, wield moderate bargaining power due to the specialized nature of their offerings and high switching costs. In 2024, Taiwanese banks are significantly increasing IT expenditure, with a focus on digital transformation. Chang Hwa Bank's active adoption of big data and AI to understand customer attributes and offer tailored financial products further solidifies reliance on these tech providers.

The bargaining power of human capital for Chang Hwa Bank is generally moderate to low, reflecting Taiwan's competitive banking job market. While skilled financial professionals are crucial, the broad supply of talent in 2024 limits significant leverage. However, specialized talent in areas like fintech, AI, and cybersecurity commands higher compensation and greater bargaining power, aligning with the bank's digital innovation focus. Chang Hwa Bank has launched its Bank 4.0 initiative to enhance competitiveness and attract these critical skills, acknowledging the evolving talent landscape.

Regulated cost of funds from the central bank

The Central Bank of the Republic of China (Taiwan) acts as a primary supplier of funds for banks like Chang Hwa Bank, wielding significant control over monetary policy and key interest rates. For instance, the Central Bank maintained its benchmark discount rate at 1.875% as of March 2024. Consequently, Chang Hwa Bank, much like its competitors, possesses very limited power to negotiate these regulated costs of funds. The central bank's consistent, moderate interest rate policy helps mitigate systemic risks across the financial sector.

- Central Bank of the Republic of China (Taiwan) sets the discount rate, which was 1.875% in March 2024.

- Chang Hwa Bank has minimal power to negotiate these dictated rates.

- This regulated cost reduces individual bank leverage over funding sources.

- The Central Bank's policy fosters stability, decreasing systemic financial risks.

Diversified funding sources mitigate supplier concentration

Chang Hwa Bank significantly mitigates supplier bargaining power by diversifying its funding beyond traditional customer deposits. The bank actively utilizes various sources, including issuing bank debentures and engaging in interbank borrowing, which reduces its reliance on any single funding provider category. This strategic approach ensures robust funding resilience and stability, further supported by a deeply diversified retail deposit base as of 2024.

- Diversified funding sources include bank debentures and interbank borrowing.

- Reduced dependence on any single category of financial suppliers.

- Enhanced funding resilience through a broad retail deposit base in 2024.

Overall, the bargaining power of suppliers for Chang Hwa Bank is moderate, influenced by a mix of factors.

While a fragmented depositor base and diversified funding sources, including bank debentures and interbank borrowing, reduce leverage from capital providers, critical technology partners and the Central Bank of the Republic of China (Taiwan) exert stronger influence.

The Central Bank's benchmark discount rate, at 1.875% in March 2024, directly impacts the cost of funds. Additionally, the increasing demand for specialized fintech and AI talent in 2024 slightly elevates human capital bargaining power.

Chang Hwa Bank's strategic diversification of funding and investment in digital transformation helps manage these varied pressures, ensuring resilience.

| Supplier Type | Bargaining Power | 2024 Impact |

|---|---|---|

| Depositors | Low | Fragmented base, ~66% household deposits in Taiwan's system. |

| Central Bank | High | Discount rate at 1.875% (March 2024). |

| Tech Providers | Moderate | Increased IT expenditure, high switching costs. |

What is included in the product

This analysis dissects the competitive forces shaping Chang Hwa Bank's market, evaluating the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes.

Instantly identify and address competitive threats with a visually intuitive breakdown of Chang Hwa Bank's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Taiwan's banking sector is highly saturated and competitive, featuring 39 domestic banks and numerous other financial institutions as of early 2024. This intense competition empowers customers, both individual and corporate, granting them significant bargaining power. They can easily switch between banks to find better rates, lower fees, and superior services. This high customer mobility and market saturation have historically squeezed net interest margins for Taiwanese banks, impacting their profitability.

For many retail financial products, customers face low switching costs. Standardized offerings like deposit accounts, credit cards, and personal loans allow customers to easily compare and move to more favorable terms. This empowers consumers, pressuring banks like Chang Hwa to maintain competitive pricing and attractive features. In 2024, the highly competitive Taiwanese banking market, with over 30 domestic banks, underscores this pressure, as Chang Hwa Bank offers a comprehensive suite of these products.

Increased transparency through digital platforms has empowered customers, as online banking and comparison websites allow them to easily compare financial products. This ready access to information, evident in the 2024 surge in digital banking adoption across Taiwan, significantly strengthens customer bargaining power. Chang Hwa Bank actively addresses this by committing to digital financial innovation, offering services through its official website and mobile app, which saw a 15% increase in active users in early 2024.

Moderate power of corporate clients

Large corporate clients hold moderate bargaining power over Chang Hwa Bank compared to individual customers. This is due to their substantial transaction volumes and the viable option of transferring their business to competing financial institutions. These larger entities often secure more favorable terms for services like corporate loans and trade finance.

- In 2024, Chang Hwa Bank continued to balance its portfolio, with corporate loans forming a significant part of its asset base.

- Major corporate clients, particularly those with strong credit ratings, possess leverage to negotiate lower interest rates on substantial credit lines.

- The bank's corporate banking segment, which includes services for SMEs and large enterprises, accounted for a notable portion of its revenue.

- The competitive Taiwanese banking sector means corporate clients can readily seek better deals from other institutions, enhancing their negotiation stance.

Growing demand for digital and personalized services

Customers now wield significant bargaining power, driven by an increasing demand for seamless digital experiences and tailored financial solutions. This shift means banks, including Chang Hwa Bank, must innovate digitally or risk losing customers to more agile competitors. In 2024, digital banking adoption continued its upward trend, with a notable percentage of consumers prioritizing mobile and online channels for transactions and advisory services. Chang Hwa Bank is actively addressing this by investing in fintech, enhancing its digital financial services based on evolving customer needs.

- Customer expectation for digital-first services increased significantly in 2024, impacting bank retention.

- Chang Hwa Bank leverages fintech to develop personalized digital offerings, aiming to meet these evolving demands.

- Failure to provide intuitive online platforms empowers customers to switch to competitors with superior digital solutions.

- The emphasis on digital innovation is crucial for maintaining customer loyalty and market share in the competitive banking sector.

Customers hold significant bargaining power over Chang Hwa Bank due to Taiwan's saturated banking sector with 39 domestic banks in 2024. Low switching costs for retail products and increased digital transparency, evidenced by a 15% increase in Chang Hwa Bank's digital users in early 2024, empower consumers. Large corporate clients also wield moderate influence, leveraging transaction volumes for better terms. This necessitates continuous digital innovation from the bank to retain its customer base.

| Metric | Value (2024) | Impact |

|---|---|---|

| Taiwanese Banks | 39 | High Competition |

| CHB Digital User Growth | 15% | Increased Transparency |

| Retail Switching Cost | Low | Customer Mobility |

Preview Before You Purchase

Chang Hwa Bank Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This preview offers a comprehensive look at the Chang Hwa Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the institution. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the banking sector. Understanding these forces is crucial for developing effective strategies to maintain and enhance Chang Hwa Bank's competitive position.

Rivalry Among Competitors

The Taiwanese banking industry faces intense competitive rivalry, with over 30 domestic and foreign banks vying for market share in a mature landscape. This saturation, evident in 2024, drives aggressive pricing and product innovation, pressuring profitability across the sector. Chang Hwa Bank maintains a satisfactory market position, navigating this fierce competition by leveraging its established customer base and digital service enhancements. The continuous struggle for deposits and loan growth necessitates strategic differentiation to sustain margins.

Chang Hwa Bank faces fierce competition from both large, government-controlled banks and aggressive private-sector financial holding companies in Taiwan. Major players like CTBC Bank, Cathay United Bank, and Bank of Taiwan are designated as Domestic Systemically Important Banks (D-SIBs), holding significant market influence. While the market share of government-owned banks has trended down, it remains substantial, with state-owned banks collectively holding around 50% of total banking assets as of early 2024. This competitive pressure demands ongoing strategic adaptation and differentiation for Chang Hwa Bank.

Rivalry in the Taiwanese banking sector is fierce, driven by both price competition, like interest rates on loans and deposits, and non-price factors such as service quality and digital capabilities. This intense competition has historically pressured bank profitability, with many institutions reporting single-digit net interest margins. Chang Hwa Bank actively competes by offering a wide range of financial services and leveraging its evolving digital platforms, adapting to an environment where digital transactions continue to grow in 2024.

Rise of digital-only banks increases competitive pressure

The rise of digital-only banks significantly intensifies competitive rivalry for Chang Hwa Bank. Taiwan saw the launch of three online-only banks, LINE Bank, Rakuten International Commercial Bank, and Next Bank, between 2021 and 2022. These digital natives operate with considerably lower overheads, allowing them to offer more competitive rates and innovative services, attracting a growing segment of customers. This shift is creating a dynamic landscape where traditional banks like Chang Hwa Bank must innovate to maintain their market share against agile digital challengers and other financial platforms.

- Taiwan’s three digital banks, launched in 2021-2022, include LINE Bank, Rakuten International Commercial Bank, and Next Bank.

- Digital banks often boast lower operating costs, enabling more competitive product offerings in 2024.

- The competitive landscape in 2024 is marked by increased rivalry among platforms, digital-only banks, and incumbent commercial banks.

Focus on wealth management and fee-based income

With ongoing pressure on net interest margins, banks are increasingly focusing on competitive rivalry in wealth management and fee-based income. This involves offering a broader array of investment products, insurance, and financial advisory services to attract and retain affluent clients. Chang Hwa Bank actively operates a wealth management business as a core part of its service portfolio. This strategic shift is crucial as fee income diversifies revenue streams. For example, many Taiwanese banks, including Chang Hwa Bank, saw continued growth in wealth management fees in early 2024, highlighting this intense competitive arena.

- Banks prioritize fee income growth due to tightening net interest margins.

- Wealth management services include diverse investment products and financial advice.

- Chang Hwa Bank actively competes in the wealth management sector.

- Taiwanese banks reported robust wealth management fee growth in early 2024.

Competitive rivalry in Taiwan’s banking sector is intense, with over 30 banks vying for market share in a mature landscape, pushing aggressive pricing and digital innovation in 2024. Chang Hwa Bank faces stiff competition from major D-SIBs, private banks, and agile digital-only banks like LINE Bank. This rivalry drives a focus on fee-based income, with wealth management seeing robust growth in early 2024. The continuous struggle for deposits and loan growth necessitates strategic differentiation to sustain margins.

| Metric | 2024 Data | Implication for CHB |

|---|---|---|

| Number of Banks | Over 30 | High market saturation |

| State-Owned Bank Asset Share | ~50% (early 2024) | Significant competition from incumbents |

| Digital Bank Launches | 3 (2021-2022) | Increased competition from agile players |

SSubstitutes Threaten

Financial technology firms and electronic payment providers present a significant threat by offering substitute services for traditional banking functions like payments, money transfers, and even consumer lending. The establishment of Taiwan's unified cross-platform e-payment system, which saw transactions grow to over NT$1.8 trillion in 2024, has intensified competition among these service providers. While these entities are not full-service banks, they effectively erode the transaction-based revenue streams of traditional players such as Chang Hwa Bank. This shift is notable as mobile payment penetration in Taiwan reached approximately 80% by mid-2024, reflecting a strong consumer preference for digital alternatives.

Peer-to-peer (P2P) lending platforms present a growing threat by offering alternative financing, directly connecting borrowers with investors and bypassing traditional banks like Chang Hwa Bank. While Taiwan's P2P market is still emerging, with an estimated transaction volume reaching around NT$10 billion by early 2024, it represents a significant substitute for core banking products, particularly for small and medium-sized enterprises and individuals. These platforms often provide more competitive interest rates or faster loan approvals, attracting segments of the bank's potential customer base. The continued development and increasing adoption of these digital lending solutions could erode Chang Hwa Bank's market share in traditional loan products.

Digital assets like cryptocurrencies are an emerging, though volatile, substitute for traditional financial products offered by Chang Hwa Bank. While not yet mainstream, their growing adoption poses a long-term threat as investors seek alternative avenues for savings and wealth accumulation. For instance, global cryptocurrency market capitalization reached over $2.5 trillion in early 2024, reflecting increased investor interest. New regulatory frameworks, such as the EU's MiCA regulation for Virtual Asset Service Providers (VASPs) effective January 2025, signal a more formalized environment that could further legitimize these substitutes and attract traditional banking customers.

Direct investment in capital markets

Individuals and corporations increasingly opt for direct investment in capital markets, bypassing bank-managed wealth services or traditional deposits. The proliferation of user-friendly online brokerage platforms, like those seeing significant growth in Taiwan's retail investor base in 2024, makes direct stock and bond purchases highly accessible. This ease of access presents a compelling substitute, particularly for younger investors.

- Taiwan's retail brokerage accounts increased by over 1.5 million in 2023, indicating a strong trend towards direct investment.

- The rise of commission-free trading options further incentivizes direct participation over traditional bank services.

Corporate self-financing and issuance of commercial paper

Large corporations increasingly bypass traditional bank loans, choosing self-financing through retained earnings or direct issuance of commercial paper and bonds. This disintermediation represents a significant substitute for corporate lending services, especially for well-established entities like those in Taiwan. For example, the outstanding amount of commercial paper in Taiwan reached approximately NT$2.2 trillion by early 2024, reflecting companies accessing capital markets directly. This trend reduces reliance on banks such as Chang Hwa Bank for their financing needs.

- By Q1 2024, Taiwan's commercial paper outstanding amount was around NT$2.2 trillion.

- Corporate bond issuance in Taiwan reached over NT$1.5 trillion in 2023.

- Many large firms leverage robust cash flows for internal funding.

- Direct capital market access offers competitive interest rates.

Chang Hwa Bank faces substantial threats from various substitutes. Fintech firms and e-payment platforms, with Taiwan's mobile payment penetration at 80% by mid-2024, significantly erode transaction revenues. Peer-to-peer lending and direct capital market investments also bypass traditional banking, as seen with Taiwan's retail brokerage accounts increasing by over 1.5 million in 2023. Additionally, large corporations increasingly self-finance, with Taiwan's commercial paper outstanding at NT$2.2 trillion by early 2024.

| Substitute Type | 2024 Data Point | Impact on Bank |

|---|---|---|

| Fintech/E-payments | Taiwan mobile payment penetration: ~80% (mid-2024) | Erodes transaction fees |

| P2P Lending | Taiwan P2P transaction volume: ~NT$10 billion (early 2024) | Reduces loan originations |

| Corporate Self-Financing | Taiwan commercial paper outstanding: ~NT$2.2 trillion (early 2024) | Decreases corporate lending demand |

Entrants Threaten

The Taiwanese banking sector faces a low threat from new entrants, primarily due to substantial capital requirements. Establishing a new commercial bank in Taiwan necessitates a minimum paid-in capital of NTD 10 billion, a significant financial hurdle. This high capital outlay, rigorously enforced by the Financial Supervisory Commission (FSC), effectively deters most potential new players. For instance, as of 2024, no new commercial bank licenses have been issued, underscoring the strict regulatory environment and the difficulty of market entry.

New entrants into Taiwan's banking sector face a formidable regulatory barrier, primarily governed by the Financial Supervisory Commission (FSC).

Prospective banks must adhere to stringent requirements, including capital adequacy ratios, with Taiwanese banks often exceeding Basel III minimums, and robust anti-money laundering regulations.

Compliance with evolving corporate governance standards and comprehensive consumer protection laws, actively enforced by the FSC in 2024, significantly raises the entry cost.

This complex framework, designed to ensure financial stability, acts as a substantial disincentive for potential competitors, safeguarding established institutions like Chang Hwa Bank.

Established banks like Chang Hwa Bank benefit significantly from deeply rooted customer relationships and strong brand recognition, cultivated over more than a century since its founding in 1903. This extensive history fosters trust, making it challenging for new entrants to penetrate the market. A new bank would face substantial hurdles, needing considerable investment in marketing and brand-building efforts to mirror Chang Hwa Bank's long-standing reputation. In the competitive 2024 Taiwanese banking landscape, incumbents hold a distinct advantage, as evidenced by their stable customer bases and market share, which deters potential newcomers.

Economies of scale of existing players

The economies of scale enjoyed by established banks like Chang Hwa Bank present a substantial barrier for new entrants. Large incumbents can spread their operational, technological, and marketing costs across a vast customer base, achieving a significantly lower cost per customer. This efficiency makes it incredibly difficult for any new bank to compete on price or operational expenditure from the outset. Chang Hwa Bank, as of 2024, leverages its strong market presence and established franchise to maintain this cost advantage, making entry less attractive.

- Chang Hwa Bank reported net income of NT$11.85 billion for 2023, showcasing its operational scale.

- The bank’s digital infrastructure, developed over years, reduces per-transaction costs significantly.

- Marketing reach for established banks far exceeds what a new entrant could immediately achieve.

- Taiwan's banking sector saw an average return on assets (ROA) of around 0.6% in 2023, reflecting mature market competition.

Limited entry of digital-only banks

The Financial Supervisory Commission (FSC) has approved only three digital-only banks, including LINE Bank and Next Bank, indicating a limited entry point for new competitors. This cautious regulatory stance significantly controls the overall threat of new entrants for established institutions like Chang Hwa Bank. While the number of new licenses is restricted, the presence of these digital banks still intensifies competitive pressure within the financial sector as of 2024, particularly in digital service offerings.

- Only three digital-only bank licenses granted by FSC.

- Regulatory caution limits market disruption from new players.

- New digital banks increase competitive pressure on digital services.

- Chang Hwa Bank faces evolving competition in 2024.

The threat of new entrants for Chang Hwa Bank is low, primarily due to the substantial NTD 10 billion minimum capital requirements and strict regulatory hurdles set by the Financial Supervisory Commission (FSC).

Established banks like Chang Hwa Bank benefit from deep customer relationships, brand recognition since 1903, and significant economies of scale, making it difficult for new players to compete effectively on cost or market penetration.

As of 2024, the FSC's cautious approach, with only three digital-only bank licenses granted, further limits the overall market disruption from new competitors. This regulatory environment safeguards incumbents.

| Barrier Type | Impact on New Entrants | 2024 Data Point |

|---|---|---|

| Capital Requirements | High financial hurdle | NTD 10 billion minimum paid-in capital |

| Regulatory Strictness | Complex compliance costs | No new commercial bank licenses issued |

| Market Saturation | Difficulty gaining market share | Taiwan ROA ~0.6% (2023) |

Porter's Five Forces Analysis Data Sources

Our Chang Hwa Bank Porter's Five Forces analysis leverages data from annual reports, financial statements, and regulatory filings. We also incorporate insights from industry research reports, market share data, and competitor announcements.