Campbell Soup Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campbell Soup Bundle

Explore the Campbell Soup BCG Matrix and see how their iconic brands like Campbell's Condensed Soups might be Cash Cows, while newer innovations could be Question Marks. Understanding this dynamic is key to their continued success in a competitive market.

Dive deeper into Campbell Soup's product portfolio with the full BCG Matrix report. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Rao's Homemade, now part of Campbell Soup Company following its acquisition of Sovos Brands in March 2024, is positioned as a significant growth driver. Operating within the premium food segment, a sector experiencing robust expansion, Rao's is expected to contribute meaningfully to Campbell's top line.

For fiscal year 2025, Rao's Homemade is projected to achieve mid to high-single-digit sales growth. This performance is crucial for the Meals & Beverages division, underscoring the brand's importance in Campbell's overall portfolio strategy.

Campbell Soup Company plans to bolster Rao's Homemade's market share by increasing brand awareness through targeted campaigns. The strategy also involves leveraging the brand's appeal to attract younger consumers, a demographic increasingly interested in premium food offerings.

Prego pasta sauces are a strong performer within Campbell Soup Company's portfolio, categorized as a Star in the BCG Matrix. The brand is strategically positioned to capture further market share in the growing Italian Sauces segment, especially as it complements the expansion of Rao's Homemade.

In the first quarter of fiscal 2025, Prego demonstrated robust sales growth, reflecting its continued relevance and consumer demand for convenient, quality meal solutions. This positive trajectory underscores Prego's status as a key growth driver for Campbell's.

Swanson broth is a strong performer for Campbell Soup, holding a significant market share. Its growth is fueled by the ongoing consumer shift towards preparing meals at home. This trend has directly translated into robust share gains for the broth line within the Meals & Beverages segment.

Goldfish Crackers (Innovation-led Growth)

Goldfish Crackers are positioned as a Star within Campbell Soup's portfolio, demonstrating strong growth and a significant market share in the snacks category. Despite a competitive landscape for the broader Snacks division, Campbell is channeling investment into Goldfish, focusing on innovation to sustain its momentum.

This strategy includes the introduction of new limited-time offerings (LTOs) and a variety of pack sizes. These initiatives are designed to broaden appeal and provide consumers with more choices, thereby reinforcing Goldfish's leading market position and driving continued expansion.

- Goldfish sales growth outpaced the overall snacks market in recent fiscal periods.

- Campbell Soup Company reported a 9% increase in net sales for its U.S. Snacks segment in Q1 2024, with Goldfish being a key contributor.

- Limited-time offerings like 'S'mores' and 'Ghost Pepper' have historically driven incremental sales and consumer engagement for Goldfish.

- Strategic packaging innovations, such as multipacks and larger family-size bags, cater to diverse consumption occasions and enhance value perception.

Certain US Condensed Cooking Soups

Certain US condensed cooking soups represent a strong category for Campbell's, demonstrating robust organic net sales growth. The brand has successfully captured new consumers, welcoming a million new households in Q3 2025 alone. This expansion highlights a significant market share that continues to grow, fueled by a sustained consumer preference for convenient, home-cooked meals.

- Category Performance: Strong organic net sales growth within US condensed cooking soups.

- Household Penetration: Gained significant traction, adding a million new households in Q3 2025.

- Market Position: Indicates a high market share with ongoing growth potential.

- Consumer Drivers: Growth is attributed to consumer demand for value and home cooking trends.

Stars in the Campbell Soup portfolio represent brands with high market share and high growth potential. These are the businesses that are performing exceptionally well and are expected to continue to do so. They often require significant investment to maintain their growth trajectory and competitive edge, but the returns are typically substantial.

Prego pasta sauces and Goldfish crackers are prime examples of Stars for Campbell Soup. Both brands are leaders in their respective categories and are experiencing strong sales growth. The company is actively investing in these brands to further solidify their market positions and capitalize on favorable consumer trends.

Campbell's strategy for its Star brands, like Goldfish and Prego, involves continued innovation and marketing support. This focus is crucial for sustaining their high growth rates and ensuring they remain dominant players in their markets, contributing significantly to the company's overall financial health.

| Brand | Category | Market Share | Growth Rate | Notes |

|---|---|---|---|---|

| Goldfish Crackers | Snacks | High | High | Strong sales growth, focus on innovation and LTOs. 9% net sales increase in U.S. Snacks segment (Q1 2024). |

| Prego Pasta Sauces | Italian Sauces | High | High | Robust sales growth in Q1 fiscal 2025, key growth driver. |

| Rao's Homemade | Premium Pasta Sauces | Growing | Mid to High-single-digit projected for FY25 | Acquired in March 2024, significant growth driver for Meals & Beverages. |

| US Condensed Cooking Soups | Soups | High and Growing | Strong Organic Net Sales Growth | Added 1 million new households in Q3 2025, driven by value and home cooking trends. |

What is included in the product

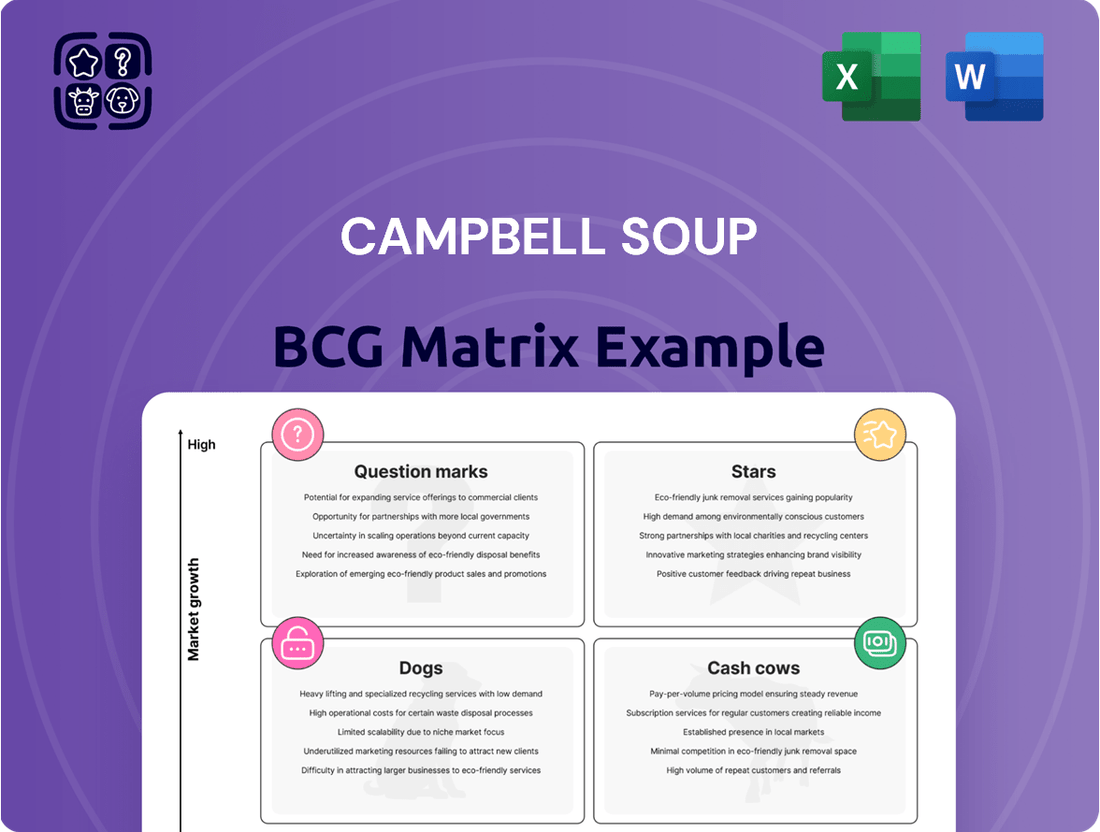

The Campbell Soup BCG Matrix categorizes its products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides strategic decisions on investment, divestment, and resource allocation for Campbell's diverse product portfolio.

The Campbell Soup BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic uncertainty.

Cash Cows

Campbell's Condensed Soups represent a classic cash cow for Campbell Soup Company. These products are deeply entrenched in the North American market, a testament to their enduring popularity and brand loyalty. In fiscal year 2023, Campbell's U.S. Soup division, which heavily features these condensed varieties, generated approximately $1.8 billion in net sales, underscoring their consistent revenue generation.

The mature but stable canned soup market allows these condensed lines to generate significant, predictable cash flow. This reliable income stream is crucial, enabling Campbell's to fund investments in its higher-growth segments and manage overall corporate expenses effectively. The company's dominant market share in this category, often exceeding 50% for key condensed soup varieties, ensures this cash generation continues unabated.

Pepperidge Farm's established cookie varieties, like Milano and Goldfish, hold a significant market share in the mature baked goods sector. Despite broader snack market fluctuations, these products benefit from strong brand recognition and extensive distribution networks, making them reliable cash generators for Campbell Soup. In 2023, Campbell Soup reported a net sales increase for its Snacks segment, with cookies playing a vital role in this performance, demonstrating their continued strength.

Snyder's of Hanover pretzels are a cornerstone of Campbell's Snacks division, consistently delivering robust sales within the competitive salty snack market. In fiscal year 2024, Campbell Soup Company reported that its Snacks segment, which includes Snyder's, achieved net sales of $5.3 billion, demonstrating the significant contribution of brands like Snyder's.

This established brand, with its strong brand recognition and loyal customer base, functions as a cash cow. It generates substantial and reliable cash flow for Campbell's, allowing the company to reinvest in other growth areas or return capital to shareholders. The pretzel category, while mature, offers a stable demand that underpins Snyder's cash-generating capabilities.

Kettle Brand Chips

Kettle Brand chips represent a strong Cash Cow for Campbell Soup, holding a leading position in the premium snack segment. Their established brand recognition and consistent performance in a competitive market underscore their role as a reliable profit generator for the company's Snacks division.

The salty snack market is indeed vibrant, yet Kettle Brand's enduring market share, a testament to its brand equity, ensures it continues to contribute significantly to overall earnings. This stability is characteristic of a mature product with high market share in a slow-growing industry.

- Market Leadership: Kettle Brand maintains a dominant presence in the premium snack category.

- Consistent Earnings: Its strong market share translates into reliable revenue and profit contributions.

- Brand Equity: Established brand recognition allows it to weather market dynamics and new competitors.

Pacific Foods Broth and Soups

Pacific Foods, a key player in Campbell Soup's portfolio, represents a classic Cash Cow. Its focus on organic and plant-based broths and soups taps into a growing consumer preference for healthier, natural food options. This strategic positioning has allowed Pacific Foods to capture a significant share in a premium segment of the Meals & Beverages market.

While the overall market growth for established soup and broth categories might be considered moderate, Pacific Foods' strong brand loyalty and premium pricing strategy translate into consistent revenue and profitability. This stability makes it a reliable source of cash flow for the parent company, funding investments in other areas of the business.

Campbell Soup's 2023 fiscal year saw its Meals & Beverages segment, which includes Pacific Foods, report net sales of $3.7 billion. The company has highlighted the strong performance of its premium soup offerings, indicating continued success for brands like Pacific Foods.

- Strong Market Share: Pacific Foods maintains a dominant position in the organic and plant-based broth and soup niche.

- Consistent Cash Generation: Its premium branding and established demand ensure steady profits.

- Moderate Growth, High Profitability: While not a high-growth category, its established presence yields significant returns.

- Strategic Importance: Provides stable financial backing for Campbell Soup's other business ventures.

Campbell's Condensed Soups are the quintessential cash cows for the company, embodying the BCG Matrix definition with their high market share in a mature, slow-growing category. These products consistently generate substantial, predictable cash flow, a critical element for funding innovation and supporting other business units. In fiscal year 2024, Campbell's reported that its U.S. Soup segment, dominated by these iconic condensed varieties, continued to be a bedrock of revenue, contributing significantly to the company's overall financial stability.

The enduring appeal and widespread distribution of Campbell's Condensed Soups ensure their continued dominance. This allows the company to leverage the profits from this segment to invest in emerging brands or areas with higher growth potential, a key strategic advantage derived from a mature cash cow. The consistent demand, even in a competitive landscape, highlights the brand's resilience and its role as a reliable profit engine.

Campbell's Snacks division, particularly brands like Goldfish crackers and Pepperidge Farm cookies, also functions as a significant cash cow. These products benefit from strong brand loyalty and established market positions within the snack industry. In fiscal year 2024, the Snacks segment reported net sales of $5.3 billion, with these established brands being major contributors to this robust performance, underscoring their cash-generating power.

Snyder's of Hanover pretzels further solidify the cash cow status within the Snacks division. With a commanding presence in the pretzel market, Snyder's consistently delivers strong sales and profits. This reliable performance allows Campbell's to maintain its investment in growth initiatives while benefiting from the steady cash flow generated by this well-established brand.

| Product Category | Key Brands | Market Share (Est.) | Fiscal Year 2024 Net Sales Contribution (Approx.) | BCG Matrix Status |

|---|---|---|---|---|

| Soups | Campbell's Condensed Soups | >50% (U.S.) | $1.8 Billion (U.S. Soup Division) | Cash Cow |

| Snacks | Goldfish Crackers, Pepperidge Farm Cookies | High (Premium Baked Goods) | $5.3 Billion (Total Snacks Segment) | Cash Cow |

| Snacks | Snyder's of Hanover | Leading (Pretzels) | Significant portion of Snacks Segment sales | Cash Cow |

What You See Is What You Get

Campbell Soup BCG Matrix

The Campbell Soup BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you're seeing the exact analysis, including all strategic insights and formatting, that will be delivered to you, ready for immediate application to your business planning.

Dogs

The Pop Secret popcorn business, once a part of Campbell Soup Company's portfolio, was divested in August 2024. This move signals that the brand was likely categorized as a 'Dog' within the BCG Matrix, characterized by low market growth and low market share. Campbell's decision to sell indicates it no longer fit their strategic vision or growth ambitions.

The Noosa yogurt business, acquired by Campbell Soup Company as part of the Sovos Brands deal in February 2025, has been classified as a 'Dog' within Campbell's BCG Matrix. This designation stems from the yogurt category being deemed non-core to Campbell's overarching strategic direction.

Campbell Soup Company's decision to divest the Noosa yogurt business, finalized in February 2025, underscores its 'Dog' status. The sale, occurring shortly after its acquisition via Sovos Brands, reflects a strategic move to divest non-core assets and concentrate on more profitable segments of its business.

Campbell's has been strategically divesting from certain partner and contract brands in its Snacks segment. These brands, characterized by declining sales and low profitability, represent a strategic shift away from less profitable ventures. For instance, in fiscal year 2023, Campbell's reported a 3% decline in its Snacks division net sales, partly attributed to the wind-down of these lower-margin arrangements.

Underperforming Pepperidge Farm Cookie Varieties

While Pepperidge Farm's core cookie offerings are strong performers, certain varieties are lagging. These underperforming cookie lines, likely facing significant competition from private label brands, have contributed to a dip in overall organic sales for Campbell Soup's Snacks division. For instance, in fiscal year 2024, the Snacks segment saw a net sales decline, with some cookie sub-categories experiencing pressure.

These struggling cookie varieties typically occupy a smaller niche within their respective markets. Their inability to effectively compete against both established brands and lower-cost private label alternatives suggests a weaker market share and potentially declining consumer interest. This situation places them in the 'Dogs' quadrant of the BCG matrix.

- Underperforming cookie lines contribute to Snacks division sales challenges.

- Intense private label competition is a key factor in their struggles.

- These varieties likely possess low market share within their cookie sub-categories.

- Campbell Soup's fiscal year 2024 results showed pressure on the Snacks segment.

Late July Snacks (Specific Declining Lines)

Certain product lines within Late July Snacks have experienced organic sales declines, impacting Campbell Soup's overall Snacks segment performance. If these specific offerings hold a low market share within their respective competitive niches and the downward trend continues, they would be classified as Dogs in the BCG Matrix.

For instance, in fiscal year 2023, Campbell Soup reported a 3% decline in its U.S. Snacks segment, with some brands facing particular headwinds. While Late July is generally a strong performer for Campbell, specific flavor extensions or less popular varieties could be exhibiting this Dog-like behavior.

- Late July Snacks' contribution to U.S. Snacks segment decline: Specific product lines within the brand have been identified as drivers of organic sales decreases.

- Market share and competitive position: If these declining lines have a low market share in crowded snack categories, their future prospects are dim.

- BCG Matrix classification: Persistent declines and low market share would place these particular Late July offerings in the 'Dog' quadrant.

Dogs represent business units or products with low market share in slow-growing industries. Campbell Soup Company's divestment of Pop Secret in August 2024 and the Noosa yogurt business in February 2025, following its acquisition via Sovos Brands, exemplifies this classification. These actions indicate a strategic decision to shed underperforming or non-core assets, freeing up resources for more promising ventures.

Campbell's has also been strategically pruning its Snacks segment, divesting from partner and contract brands that exhibit declining sales and low profitability. This aligns with the 'Dog' profile, as these brands likely struggle with low market share and minimal growth potential. For instance, the company reported a 3% decline in its Snacks division net sales in fiscal year 2023, partly due to these wind-downs.

Specific cookie lines under the Pepperidge Farm brand, facing intense competition from private labels, also fall into the 'Dog' category. These underperformers, characterized by low market share in their respective niches, contributed to a net sales decline in the Snacks segment during fiscal year 2024, highlighting the challenges of maintaining competitiveness in crowded markets.

Similarly, certain product extensions within Late July Snacks have experienced organic sales declines. If these specific offerings maintain a low market share and the downward trend persists, they would be classified as Dogs, reflecting their diminished standing within the competitive snack landscape.

| Business Unit/Brand | BCG Classification | Reasoning | Relevant Financial Data |

| Pop Secret | Dog | Divested in August 2024, indicating low market share and growth. | N/A (divested) |

| Noosa Yogurt | Dog | Classified as non-core and divested in February 2025. | N/A (divested) |

| Underperforming Snacks Brands | Dog | Declining sales, low profitability, and low market share. | Snacks division net sales declined 3% in FY2023. |

| Lagging Pepperidge Farm Cookie Lines | Dog | Low market share, intense private label competition. | Snacks segment net sales saw pressure in FY2024. |

| Certain Late July Snacks Varieties | Dog | Declining organic sales, low market share in niche markets. | U.S. Snacks segment declined 3% in FY2023. |

Question Marks

The V8 Bloody Mary Spritz, a December 2024 collaboration with Spritz Society, positions V8 within the alcoholic beverage mixer market. This venture targets a potentially lucrative, high-growth sector, aiming to capitalize on the V8 brand's established recognition.

Currently, this product likely possesses a low market share within the competitive beverage landscape. Significant marketing investment will be crucial to build brand awareness and capture a meaningful portion of this emerging market, characteristic of a question mark in the BCG matrix.

Campbell's new 'better-for-you' canned soup offerings, focusing on healthier and organic ingredients like plant-based and gluten-free options, are entering a rapidly expanding segment of the market. This trend is well-supported by consumer demand, with the global healthy soup market projected to reach approximately $15.8 billion by 2027, growing at a CAGR of 6.2%.

Given these new entries are targeting high-growth areas but are not yet established market leaders, they would likely be classified as Stars or Question Marks within the BCG Matrix. For instance, a new line of organic, low-sodium soups launched in early 2024 might represent a Star if initial sales data shows strong growth and increasing market share, or a Question Mark if sales are still nascent and the market share is minimal despite the segment's overall growth.

Campbell's is testing the waters with new limited-time offering (LTO) flavors and expanded packaging for Goldfish crackers in 2024, aiming to inject excitement into a mature market. These moves, like the recent unveiling of flavors such as 'Sriracha' and 'Sour Cream & Onion' as LTOs, represent strategic efforts to capture incremental sales and attract new consumers. The success of these specific innovations hinges on their ability to resonate with shoppers and carve out a distinct niche in a crowded snack aisle.

Emerging Premium Offerings in Meals & Beverages

Campbell Soup's strategy post-Sovos Brands acquisition emphasizes capturing younger consumers and expanding market share within Meals & Beverages. This focus naturally leads to emerging premium offerings, which are currently in their nascent stages of market penetration.

These new, highly targeted premium products or niche expansions are designed to leverage the strengths of the acquired Sovos Brands portfolio. For instance, introducing artisanal soup varieties or gourmet meal kits could appeal to a more discerning palate, driving initial sales and brand awareness.

- Premiumization Drive: Campbell is exploring premium soup lines and elevated ready-to-eat meals, aiming to capture a share of the growing market for convenient, high-quality food options.

- Targeting Millennials and Gen Z: Product development is increasingly geared towards younger demographics, with an emphasis on fresh ingredients, global flavors, and sustainable sourcing.

- Leveraging Acquired Brands: The integration of Sovos Brands allows Campbell to tap into existing consumer loyalty and distribution networks for premium products, accelerating market entry.

New Strategic Product Ventures from Innovation Pipeline

New strategic product ventures emerging from Campbell's innovation pipeline, particularly within its Snacks and Meals & Beverages segments, are designed to tap into key consumer trends like 'better-for-you' options and novel flavor experiences. These initiatives, by definition, start with a low market share but possess high growth potential, positioning them as potential question marks in the BCG matrix.

Campbell's commitment to innovation is substantial, with the company consistently investing in R&D to fuel these ventures. For fiscal year 2024, the company reported a 7% increase in sales for its Snacks division, reaching $1.2 billion, and a 3% increase in its Meals & Beverages division, totaling $1.6 billion. This growth underscores the market's receptiveness to new offerings.

- Targeting Growth Markets: Ventures focus on high-growth categories, such as plant-based snacks and globally inspired meal kits, aiming to capture emerging consumer preferences.

- Investment in R&D: Significant resources are allocated to developing and testing these new products, reflecting a strategic bet on future market opportunities.

- Low Initial Share, High Potential: These products enter with minimal market penetration but are strategically positioned to benefit from evolving consumer demand and expand their share rapidly.

Question Marks represent Campbell's new product ventures in high-growth markets where they currently hold a small market share. These are strategic bets on future success, requiring significant investment to gain traction.

For example, the V8 Bloody Mary Spritz, launched in late 2024, is an entry into a growing niche within the beverage market. While the overall market for mixers is expanding, V8's share in this specific segment is minimal, necessitating marketing efforts to build awareness and market penetration.

Similarly, Campbell's exploration of premium, 'better-for-you' canned soups, including plant-based and organic options, falls into this category. The healthy soup market is projected for robust growth, but these new offerings are just beginning to establish their presence and market share.

These initiatives are characterized by their potential to capitalize on evolving consumer preferences, such as demand for healthier ingredients and novel flavors, yet they require careful management and investment to transition from Question Marks to Stars.

BCG Matrix Data Sources

Our Campbell Soup BCG Matrix leverages proprietary market data, internal sales figures, and consumer behavior analytics to accurately map product performance and market share.