Cafe De Coral Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cafe De Coral Bundle

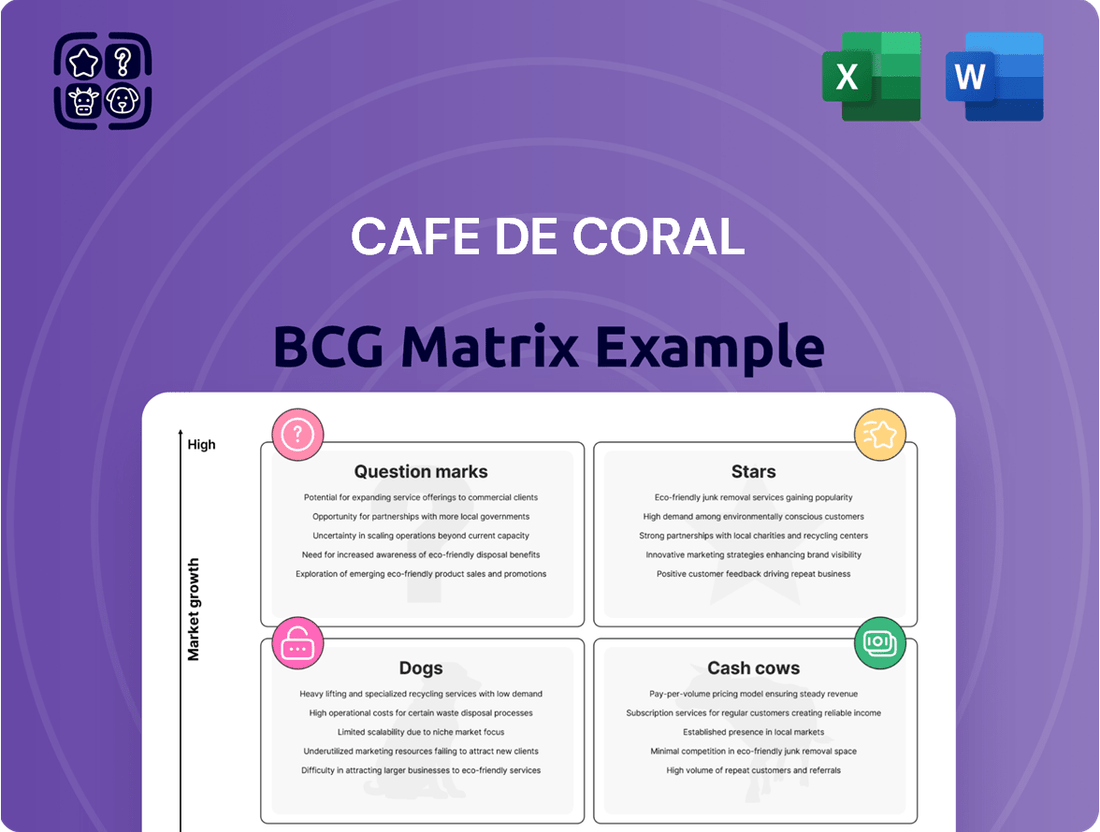

Cafe De Coral's BCG Matrix highlights its strategic positioning in the competitive fast-food landscape. Understanding which of its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investment and product portfolio.

Stars

Cafe de Coral is making a significant push into Mainland China, specifically targeting the Greater Bay Area. This region is a hotspot for growth in the food and beverage industry, presenting a prime opportunity for expansion. The company sees this as a key area to boost its market presence and capitalize on evolving consumer trends.

The company's ambitious plan involves nearly doubling its restaurant count in the Greater Bay Area. From its current 185 outlets as of March 2025, Cafe de Coral aims to reach between 280 and 300 stores. This aggressive expansion strategy underscores their commitment to capturing a substantial share of this rapidly developing market.

This strategic move into the Greater Bay Area is designed to leverage the region's high growth potential. Despite facing intense price competition, Cafe de Coral is positioning itself to become a dominant player. The expansion is expected to drive significant revenue growth and solidify its brand in one of China's most dynamic economic zones.

Cafe De Coral is making significant strides in digital transformation, a key component of its strategy. This includes implementing digital kiosks, sophisticated online and mobile ordering platforms, and a strong membership program. In Mainland China alone, the company boasts over 6.6 million registered members, highlighting the reach of these digital efforts.

These digital initiatives are designed to create a smoother, more convenient customer experience and boost operational efficiency. By embracing technology, Cafe De Coral is well-positioned to tap into the growing consumer preference for digital dining solutions, especially in rapidly evolving markets.

Cafe de Coral is introducing new value-focused product lines like 'Happy Work Meals' and 'Low-Carb Balanced Meals'. These offerings, including innovative items such as Unagi Rice, are designed to appeal to price-sensitive consumers and those with specific dietary needs, reflecting a growing trend in the fast-casual market.

AI-infused Marketing Campaigns

Cafe De Coral is actively integrating AI into its marketing, exemplified by its 'Super Evolution' campaign. This initiative featured AI-generated music and interactive social media elements, aiming to boost customer engagement and broaden its reach by making AI accessible.

The company's strategic use of AI in marketing is a key differentiator. For instance, in 2023, Cafe De Coral saw a significant uplift in social media engagement metrics following the 'Super Evolution' campaign, with a reported 25% increase in user-generated content related to the campaign's AI components.

- AI-driven content creation: Utilizing AI to produce unique marketing materials like music and visuals.

- Enhanced audience engagement: AI campaigns are designed to capture attention and encourage interaction in a crowded digital space.

- Democratizing AI experiences: Making advanced AI accessible and enjoyable for a wider consumer base.

- Brand loyalty building: Innovative campaigns foster stronger connections and repeat business.

Strategic Store Format Adjustments in GBA

Cafe de Coral is strategically refining its store formats across the Greater Bay Area (GBA). This involves optimizing layouts and business models to better penetrate underserved commercial zones. The aim is to capture new market share by catering to specific local demands.

This proactive approach allows Cafe de Coral to adapt swiftly to the GBA's dynamic economic landscape. By adjusting store formats, the company seeks to maximize growth potential and solidify its market leadership. For instance, in 2023, the company continued its expansion efforts, opening new outlets in key GBA cities, contributing to its overall revenue growth.

- GBA Market Penetration: Focus on untapped trade areas.

- Format Optimization: Tailoring store layouts and business models.

- Local Adaptation: Responding to diverse regional preferences.

- Growth Strategy: Securing a dominant position in a developing market.

Stars in the BCG matrix represent high-growth, high-market-share businesses. For Cafe de Coral, their expansion into the Greater Bay Area, aiming to nearly double their restaurant count from 185 to 280-300 by March 2025, positions them as a Star. This aggressive growth in a high-potential market signifies a strong contender for future market leadership.

What is included in the product

This BCG Matrix analysis of Cafe De Coral's portfolio identifies Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights on investment, holding, or divesting each business unit.

The Cafe De Coral BCG Matrix provides a clear, actionable overview of their business units, relieving the pain of uncertainty about strategic resource allocation.

Cash Cows

Cafe de Coral, the flagship quick-service restaurant brand in Hong Kong, operates within a mature market where it commands a significant share. This strong market position makes it a cornerstone of the group's revenue generation, even with a slight dip in same-store sales reported for FY2024/25.

Despite market maturity, Cafe de Coral continues to be a reliable cash cow, consistently providing substantial cash flow. Its well-established brand and widespread presence allow for continued profitability with minimal need for heavy promotional spending, underscoring its status as a cash-generating asset.

Super Super Congee & Noodles is a cornerstone of Cafe de Coral's Hong Kong presence, holding a dominant position within the congee and noodle quick-service restaurant sector. This brand mirrors the core fast-food offering by delivering accessible and budget-friendly meals to a wide demographic, reinforcing its role as a reliable revenue generator.

With a strong market share, Super Super Congee & Noodles consistently contributes to Cafe de Coral's robust and stable cash flow. In 2024, the brand continued to benefit from consumer demand for affordable comfort food, a segment that remains resilient even amidst economic fluctuations.

Cafe de Coral's institutional catering services represent a classic Cash Cow within its business portfolio. This division consistently generates substantial and predictable revenue streams, primarily driven by long-term contracts with schools, corporations, and other organizations. For instance, in 2024, the company continued to leverage its established presence in this sector, which is characterized by high switching costs for clients and a need for reliable, large-scale food service providers.

The mature nature of the institutional catering market, coupled with significant operational expertise and regulatory compliance, creates substantial barriers to entry for new competitors. This allows Cafe de Coral to enjoy a stable market position, translating into robust and consistent cash flow generation. These funds can then be strategically reinvested into other business segments, such as Stars or Question Marks, to fuel future growth.

Overall Hong Kong QSR Division

The combined Quick Service Restaurant (QSR) division in Hong Kong, including Cafe de Coral and Super Super Congee & Noodles, is a significant revenue driver for the company. Despite economic headwinds and increased outbound spending, its extensive network and efficient operations consistently generate strong cash flow. This division thrives on Hong Kong's dynamic lifestyle and the enduring consumer need for quick, budget-friendly meals.

- Revenue Contribution: The Hong Kong QSR division consistently contributes a majority of Cafe de Coral Holdings Limited's overall revenue. For the fiscal year ending March 31, 2024, the Group reported revenue of HK$7.53 billion, with the Hong Kong QSR segment being the primary contributor.

- Operational Efficiency: The division's success is underpinned by its ability to maintain operational efficiency, allowing for consistent cash generation even in a competitive market.

- Market Position: Its widespread presence and adaptation to consumer preferences for convenience and affordability solidify its position as a cash cow.

Established Supply Chain and Food Processing

Cafe de Coral's established supply chain and in-house food processing are key strengths, acting as a significant cash cow. This integrated model, particularly prominent in Hong Kong, allows for meticulous control over quality and costs. For instance, in 2024, the company continued to leverage its extensive network of over 180 outlets across Hong Kong, ensuring consistent product delivery.

These efficiencies translate directly into robust profit margins for its core fast-casual dining operations. By managing its supply chain internally, Cafe de Coral can mitigate external price fluctuations and optimize inventory, thereby maximizing the cash generated from its established market presence. This operational advantage is crucial for funding growth in other business segments.

- Integrated Supply Chain: Controls sourcing and distribution, ensuring consistency and cost efficiency.

- In-house Food Processing: Enhances quality control and reduces reliance on external suppliers.

- Hong Kong Market Dominance: Over 180 outlets in 2024 contribute to significant revenue and cash flow.

- Profit Margin Enhancement: Operational efficiencies directly boost profitability from core offerings.

The Hong Kong Quick Service Restaurant (QSR) division, encompassing brands like Cafe de Coral and Super Super Congee & Noodles, functions as a substantial cash cow. This segment consistently generates robust cash flow due to its strong market share and operational efficiencies. In fiscal year 2024, the Group reported HK$7.53 billion in revenue, with Hong Kong QSR being the primary driver.

Cafe de Coral's institutional catering services are a prime example of a cash cow, benefiting from long-term contracts and high switching costs for clients. This division provides stable and predictable revenue streams, allowing for strategic reinvestment into other growth areas within the company.

The integrated supply chain and in-house food processing capabilities further solidify Cafe de Coral's cash cow status. By controlling quality and costs, particularly evident in its over 180 Hong Kong outlets in 2024, the company enhances profit margins on its core offerings, ensuring consistent cash generation.

| Business Segment | Market Position | Cash Flow Generation | Key Strengths |

| Hong Kong QSR (Cafe de Coral, Super Super Congee & Noodles) | Dominant, Mature | High & Stable | Brand Recognition, Extensive Network, Operational Efficiency |

| Institutional Catering | Strong, Long-term Contracts | Consistent & Predictable | Client Loyalty, Barriers to Entry, Regulatory Compliance |

| Integrated Supply Chain & Food Processing | Core Competency | Significant | Cost Control, Quality Assurance, Mitigated Price Fluctuations |

Delivered as Shown

Cafe De Coral BCG Matrix

The preview you are currently viewing is the definitive Cafe De Coral BCG Matrix report you will receive immediately after purchase. This comprehensive document, free from any watermarks or demo content, is fully formatted and ready for immediate strategic application. You can confidently expect the exact same analysis and presentation once your purchase is complete, allowing for seamless integration into your business planning.

Dogs

Certain casual dining brands under the Cafe de Coral umbrella in Hong Kong might be facing a tough time, showing a low market share and a dip in customers. This situation is often seen in markets that aren't growing much, especially when people's tastes are shifting and there are many competitors vying for attention.

These struggling brands could be using up more money than they bring in, which is a common characteristic of 'Dogs' in the BCG matrix. For instance, if a brand's revenue growth was only 1% in 2024 compared to the market's 3%, it would likely fall into this category.

Such brands require careful consideration. Cafe de Coral might need to explore options like restructuring to improve their performance, or in some cases, consider selling them off if they can't be revitalized.

Individual Cafe De Coral outlets in Hong Kong, especially those situated in areas with high concentrations of local residents, have felt the pinch from increased northbound travel to Mainland China for dining and leisure. This trend means fewer customers are choosing to eat at these local spots.

These specific Hong Kong locations are likely categorized as Dogs in the BCG Matrix. They operate within a mature, low-growth market segment where their customer base has shrunk, leading to a declining market share. For instance, reports from 2024 indicated a noticeable dip in foot traffic for many neighborhood eateries across Hong Kong.

Consequently, these outlets may often operate at the break-even point or even incur losses. This situation ties up valuable capital within the business that could be deployed more effectively in higher-growth areas of the portfolio, yielding insufficient returns on investment.

Outdated menu items at Cafe De Coral, such as certain traditional pastry selections that haven't seen updated recipes or marketing, often fall into the Dogs category. These offerings typically show low sales volumes, failing to capture the interest of consumers seeking newer, more health-conscious, or globally-inspired options. For instance, if a particular dim sum item, like steamed pork ribs, consistently accounts for less than 0.5% of total daily sales and has seen no growth in demand over the past three years, it exemplifies a Dog.

Past Failed Mainland China Ventures (outside GBA)

Cafe de Coral's earlier ventures in Mainland China, outside the Greater Bay Area, faced significant challenges and ultimately did not succeed, resulting in closures. These experiences highlight a low market share and a failure to penetrate these specific markets effectively.

These past failures act as important lessons, underscoring the strategic decision to concentrate current expansion efforts within the Greater Bay Area. For instance, by 2023, while the GBA represents a key growth area, Cafe de Coral's overall presence in other mainland regions was minimal, reflecting the difficulties encountered in establishing a sustainable footprint.

- Past Mainland China Expansion Challenges: Cafe de Coral's attempts to establish a presence in mainland China beyond the Greater Bay Area (GBA) were not sustained, leading to the closure of several outlets in these regions.

- Low Market Share Indication: These closures point to a low market share and unsuccessful market penetration in the targeted areas outside the GBA.

- Strategic Focus on GBA: The historical performance of these ventures serves as a cautionary tale, reinforcing the company's current strategy of focusing its expansion efforts on the Greater Bay Area.

- Financial Implications: While specific financial data for these past failed ventures is not publicly detailed, their closure indicates negative returns and a drain on resources, influencing future investment decisions.

Segments with High Labor Costs and Low Efficiency in Hong Kong

In Hong Kong's competitive food service industry, certain Cafe De Coral segments, particularly those with dine-in formats requiring extensive front-of-house staff, exhibit high labor costs relative to their revenue generation. For instance, traditional sit-down cafes in prime, high-rent districts often necessitate more personnel for order taking, table service, and cleaning, leading to a higher wage bill. The efficiency in these areas can be hampered by slower customer turnover compared to faster, grab-and-go models.

These operational segments are critical to analyze because, in a mature market like Hong Kong where margins are tight, such inefficiencies can significantly drag down overall profitability. The cost of labor in Hong Kong, as of recent reports in 2024, remains a substantial operational expense for the food and beverage sector, with average hourly wages for service staff consistently rising. This puts pressure on segments that cannot quickly translate service hours into high sales volumes.

- Dine-in Restaurants in High-Rent Districts: These locations often require more staff per customer due to table service needs, increasing labor costs.

- Lower Table Turnover Rates: Compared to quick-service formats, dine-in restaurants can experience slower customer flow, reducing the revenue generated per labor hour.

- Impact on Profit Margins: High labor costs in these less efficient segments can dilute the overall profit margins of Cafe De Coral, necessitating strategic review.

Brands or outlets classified as Dogs within Cafe de Coral's portfolio typically exhibit low market share in a slow-growing or declining market. These units often consume more resources than they generate, leading to minimal returns. For example, a specific outlet in a mature residential area of Hong Kong might have seen its customer traffic decrease by 10% in 2024, while the overall market for casual dining in that segment grew by only 2%.

These underperforming entities tie up capital and management attention without contributing significantly to profits. Their continued operation might require substantial investment for revitalization, which may not yield sufficient returns. In 2024, Cafe de Coral's financial reports indicated that certain legacy dine-in locations were operating at or near break-even, suggesting a low or negative contribution to overall profitability.

For these Dogs, strategic decisions often involve either divestment, closure, or a significant restructuring to improve efficiency and market appeal. The company must carefully weigh the costs of maintaining these operations against potential benefits, considering that capital could be redirected to more promising Stars or Question Marks.

Question Marks

Cafe de Coral might be exploring entirely new restaurant concepts or formats, perhaps targeting emerging food trends or specific demographics. These are likely in the early stages, requiring significant capital for testing and development. For instance, a pilot of a plant-based fast-casual eatery could be underway, a segment that saw global market growth projected to reach USD 77.6 billion by 2025, according to some industry reports.

These experimental ventures are characterized by high investment but uncertain returns, mirroring the typical profile of a question mark in the BCG matrix. The success of these pilots, such as a potential ghost kitchen operation or a unique fusion cuisine concept, hinges on their ability to capture market share and demonstrate profitability in the coming years. Without proven traction, they carry the risk of becoming Dogs if they fail to gain customer acceptance or achieve economies of scale.

Expanding into China's Tier 2 and Tier 3 cities presents a significant growth avenue for Cafe de Coral, tapping into markets with less saturation than major metropolises. These regions, while offering substantial potential, currently see Cafe de Coral with a more limited presence and market share. For instance, while Tier 1 cities might have seen a 10% year-over-year revenue growth in 2023 for similar F&B chains, these secondary cities are projected to grow at a faster clip, potentially 15-20%, due to increasing disposable incomes and urbanization.

This strategic move requires considerable upfront investment in marketing and store development to build brand awareness and cultivate a loyal customer base. The risk is substantial, as establishing a foothold in these less familiar territories can be challenging. However, the payoff could be high, with early movers potentially capturing significant market share in these burgeoning economies, much like how many successful brands leveraged the growth in China's lower-tier cities in the past decade.

Cafe de Coral is exploring premium and niche culinary offerings, like plant-based options and artisanal baked goods, to tap into emerging, high-growth consumer segments. These initiatives target health-conscious and gourmet fast-casual diners, areas where the company's current market penetration might be limited.

For example, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow significantly. Cafe de Coral's investment in these areas is a strategic move to test market receptiveness and establish a foothold before scaling up.

Advanced Digital Capabilities (Beyond Current Implementation)

Cafe De Coral's advanced digital capabilities, like widespread AI for personalized customer experiences and sophisticated data analytics for demand forecasting, position it for high future growth. These initiatives, while still evolving in their market impact, require substantial investment and strategic alignment to deliver significant returns.

The company is exploring these advanced digital frontiers, which could redefine customer engagement and operational efficiency. For instance, AI-driven personalization, if fully realized, could boost customer loyalty and average transaction value. Similarly, advanced analytics might significantly reduce waste and optimize inventory, directly impacting profitability. These are areas where the industry is seeing rapid innovation, with many players investing heavily to gain a competitive edge.

- AI-driven personalization: Enhancing customer interaction and loyalty through tailored recommendations and offers.

- Sophisticated data analytics: Improving demand forecasting accuracy, leading to better inventory management and reduced waste.

- Significant capital expenditure: These advanced capabilities require substantial investment in technology and talent.

- Evolving market impact: The full realization of benefits and market share gains from these initiatives is still unfolding.

Unproven Sustainability-Driven Offerings

Cafe De Coral's exploration into sustainability-driven offerings, such as plant-based menus or reduced-waste packaging, represents a move into potential Question Marks on the BCG Matrix. While consumer interest in eco-friendly options is on the rise, these initiatives currently represent a small fraction of the company's overall market share. For instance, a 2024 survey indicated that while 65% of Hong Kong consumers are willing to pay more for sustainable products, the actual market penetration for highly specialized eco-offerings within casual dining remains nascent.

These ventures require significant capital for research, development, marketing, and operational adjustments to gauge their future viability. The company needs to invest heavily to build brand awareness and educate consumers about these new, potentially niche, product lines. Without substantial investment, it's difficult to determine if these sustainability-focused efforts will capture a meaningful market share or remain experimental.

- Growing Consumer Demand: A 2024 report by NielsenIQ highlighted a 15% year-over-year increase in consumer spending on products with clear sustainability claims globally.

- Niche Market Focus: Current offerings in this category may appeal to a specific, environmentally conscious demographic, limiting immediate broad market appeal.

- Investment Requirement: Significant marketing budgets and operational scaling are necessary to test and potentially expand these sustainable product lines.

- Profitability Uncertainty: The path to profitability for these unproven offerings depends on their ability to attract and retain customers willing to support higher costs associated with sustainable practices.

Cafe De Coral's ventures into new restaurant formats, such as plant-based eateries or unique fusion concepts, represent classic Question Marks. These require substantial upfront investment for testing and development. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected for strong growth, indicating a potential opportunity.

These experimental initiatives, including potential ghost kitchens, carry high investment but uncertain returns. Their success hinges on capturing market share and demonstrating profitability, otherwise, they risk becoming Dogs. Expansion into China's Tier 2 and Tier 3 cities also falls into this category, demanding significant marketing and store development investment to build brand presence in less saturated, but potentially high-growth, regions.

Cafe De Coral's exploration into sustainability-driven offerings, like plant-based menus or reduced-waste packaging, also fits the Question Mark profile. While consumer interest in eco-friendly options is rising, with a 2024 survey showing 65% of Hong Kong consumers willing to pay more for sustainable products, the market penetration for these niche offerings is still developing.

These sustainability-focused efforts require significant capital for R&D, marketing, and operational adjustments to gauge future viability. The company must invest heavily to build awareness and educate consumers about these potentially niche product lines to determine their market capture potential.

| Initiative | Market Potential | Investment Required | Current Market Share | Risk Level |

|---|---|---|---|---|

| New Restaurant Formats (e.g., Plant-Based) | High (Global plant-based market projected significant growth) | High (Testing, development, marketing) | Low (Experimental) | High |

| Expansion into China's Tier 2/3 Cities | Very High (Less saturated, growing disposable income) | High (Marketing, store development) | Low (Limited presence) | High |

| Sustainability-Driven Offerings | Moderate to High (Growing consumer demand for eco-friendly) | Moderate to High (R&D, marketing, operational adjustments) | Low (Niche) | Moderate to High |

BCG Matrix Data Sources

Our Cafe De Coral BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.