Bublar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bublar Bundle

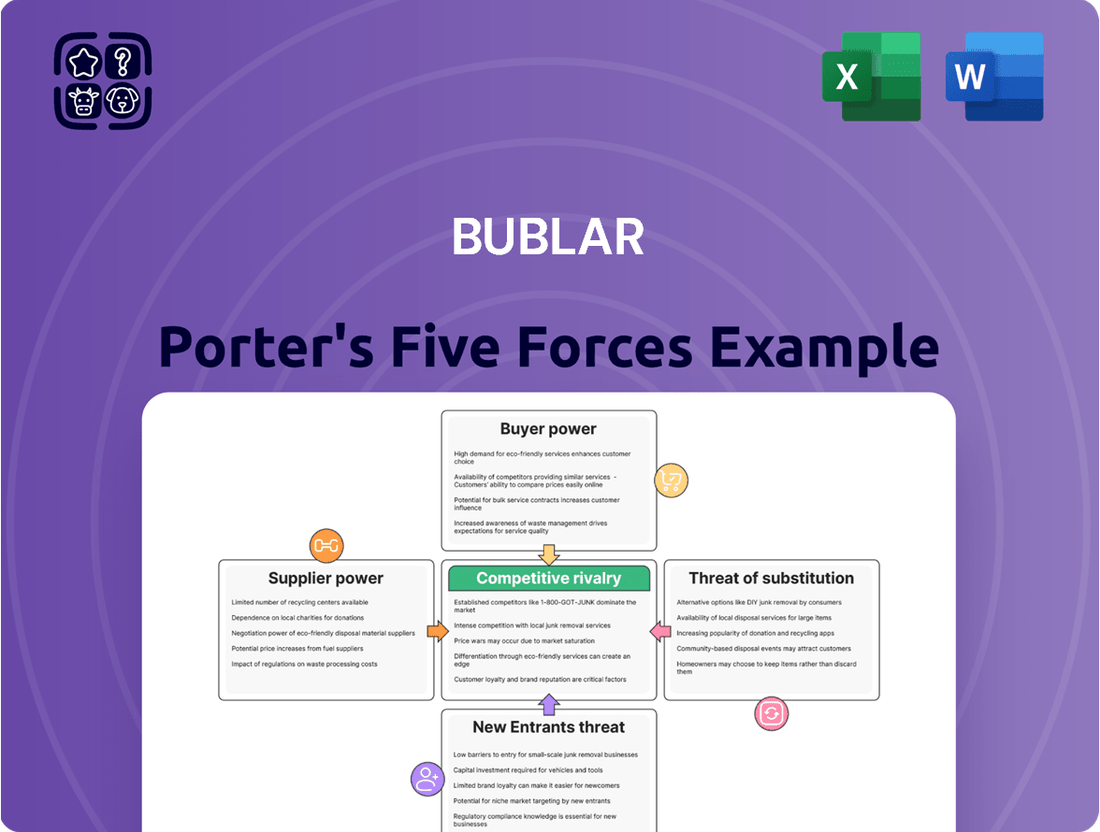

Bublar operates within a dynamic market where understanding competitive forces is paramount. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bublar’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bublar, now operating as Vobling, faces significant supplier power due to the concentrated nature of the augmented reality (AR) industry's key component providers. Companies like Qualcomm, a dominant force in XR chipsets, and Nvidia, a leader in GPUs essential for AR processing, hold substantial leverage. This limited supplier base means AR solution providers have fewer alternatives for critical hardware, directly impacting their ability to negotiate favorable terms.

Bublar and Vobling face significant switching costs when it comes to core development platforms like Unity. Migrating a complex AR/VR project built on Unity to another engine would incur substantial expenses, including potential new licensing fees and the cost of redeveloping significant portions of the codebase. For instance, a typical Unity project can involve thousands of hours of developer time, making a complete switch prohibitively expensive.

Many vital suppliers within the augmented reality (AR) sector hold exclusive technologies, patents, and intellectual property crucial for creating advanced AR applications. This distinct intellectual property makes it difficult for companies like Bublar/Vobling to easily duplicate or source alternatives for these specialized components or software features, thereby increasing supplier leverage.

Impact of Supply Chain Constraints

Global supply chain disruptions, exemplified by the persistent semiconductor shortages that continued into 2024, directly amplify the bargaining power of hardware suppliers. These constraints limit the availability and inflate the prices of critical components for AR hardware and development, forcing AR solution providers into greater reliance on their current suppliers.

This increased dependence significantly weakens the AR companies' ability to negotiate favorable terms, effectively shifting power towards the component manufacturers. For instance, the average lead time for semiconductors remained elevated throughout much of 2024, with some critical components experiencing delivery delays exceeding 52 weeks, according to industry reports.

- Supply Chain Volatility: Persistent global supply chain issues, including those affecting semiconductor production, continued to be a major factor in 2024, impacting the availability and cost of essential AR hardware.

- Increased Supplier Leverage: These constraints have led to AR solution providers facing higher costs and longer lead times, making them more reliant on existing suppliers and diminishing their negotiation power.

- Impact on AR Development: Delays in component delivery directly affect the production schedules and cost-effectiveness of AR devices and development projects.

- Market Dynamics: The situation underscores how external supply chain pressures can significantly strengthen the bargaining position of hardware suppliers within the AR ecosystem.

Importance of Supplier's Input to Product Quality

The quality and performance of Bublar/Vobling’s augmented reality solutions are directly tied to the advanced components and software provided by external suppliers. For instance, the clarity of high-resolution displays and the accuracy of tracking sensors are crucial for creating truly immersive AR experiences.

This dependence on top-tier inputs from third parties significantly bolsters the suppliers' leverage. If these suppliers can offer unique or proprietary technology, their ability to dictate terms increases, potentially impacting Bublar’s costs and product development timelines.

- High-Resolution Displays: Suppliers of advanced AR-compatible displays can command higher prices if their technology offers superior refresh rates or color accuracy, essential for realistic AR overlays.

- Precision Tracking Sensors: The accuracy of spatial tracking, vital for AR interaction, relies on specialized sensors. Suppliers of these critical components have considerable power if their technology is difficult to replicate.

- Development Tools and SDKs: Software development kits (SDKs) and specialized AR development platforms are often proprietary. Suppliers of these tools can influence pricing and access based on the uniqueness and essentiality of their offerings.

Bublar, now Vobling, faces considerable supplier power due to the concentrated nature of key augmented reality (AR) component providers. Limited options for critical hardware like XR chipsets from companies such as Qualcomm, and GPUs from Nvidia, mean AR firms have less leverage to negotiate favorable terms. This dependence is amplified by the fact that many vital AR suppliers possess exclusive technologies and patents, making it difficult to find alternatives.

The reliance on specialized suppliers, whose technologies are crucial for advanced AR applications, significantly strengthens their bargaining position. This is further exacerbated by global supply chain volatility, which continued to impact semiconductor availability and pricing throughout 2024. For instance, lead times for certain semiconductors extended beyond 52 weeks in 2024, increasing AR companies' dependence on existing suppliers and weakening their negotiation power.

The quality of AR solutions hinges on advanced components like high-resolution displays and precision tracking sensors. Suppliers of these unique or proprietary technologies can dictate terms, impacting development timelines and costs. For example, specialized AR development platforms and SDKs are often proprietary, giving their providers significant leverage over pricing and access.

| Supplier Type | Key Players | Impact on AR Firms | 2024 Data Point |

|---|---|---|---|

| XR Chipsets | Qualcomm | Limited alternatives, high dependence | Qualcomm's XR chipsets were integral to many new AR headset releases in 2024. |

| GPUs | Nvidia | Essential for AR processing power | Nvidia's GPUs continued to set performance benchmarks for AR applications in 2024. |

| AR Development Platforms | Unity Technologies | High switching costs, platform lock-in | Unity remained the dominant engine for AR/VR development, with significant investment in its AR Foundation framework. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bublar's augmented reality market position.

Instantly identify and prioritize competitive threats with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Bublar/Vobling's customer base is quite varied, reaching across gaming, entertainment, and even enterprise sectors. This includes major players like SAAB and SJ, showcasing a broad market reach.

The bargaining power of these customers isn't uniform. For instance, individual gamers might not wield much influence, but large corporate clients, especially those engaging in significant projects, can exert considerable leverage due to the scale and strategic nature of their investments.

Enterprise clients often require bespoke, integrated solutions. Once these complex systems are implemented, their investment in customization and integration can make them less likely to switch to a competitor, thereby moderating their long-term bargaining power.

Enterprise clients in the augmented reality (AR) market are keenly focused on return on investment (ROI), making them price-sensitive. This means Bublar and its subsidiary Vobling face pressure to offer competitive pricing and clearly demonstrate the value proposition of their AR solutions. For instance, a recent survey indicated that 65% of enterprise IT decision-makers consider cost a primary factor when evaluating new technology, directly impacting their willingness to invest in AR.

In the gaming and entertainment spheres, consumer price sensitivity for AR applications can be quite high. The prevalence of free-to-play models and a vast ocean of digital content mean that consumers expect significant value to justify any expenditure. This necessitates that Bublar's offerings provide truly compelling and unique experiences to stand out and command a price point.

For more standardized augmented reality applications, particularly in the consumer gaming sector, customer switching costs can be quite low. This is because there are many alternative AR experiences available, making it easy for users to move from one to another.

If Bublar/Vobling's offerings are not significantly unique or deeply integrated into a client's operational processes, customers possess greater flexibility to switch to a competitor. This inherent ease of transition amplifies the bargaining power of these customers.

In 2024, the AR market saw continued growth, with consumer AR applications representing a significant portion. For instance, the global AR market was projected to reach hundreds of billions of dollars by 2025, with a substantial share attributed to consumer-facing applications where differentiation is key to retaining customers.

Customer Knowledge and Access to Information

As augmented reality (AR) technology becomes more common, customers are gaining a much better understanding of what's out there, how much it costs, and what the industry standards are. This increased awareness, fueled by online reviews and comparisons, gives buyers more leverage. For instance, a 2024 report by Statista indicated that over 60% of consumers research products extensively online before making a purchase, a trend that directly impacts how they negotiate with AR providers like Bublar.

Well-informed buyers can easily spot offerings that aren't unique and then push for better deals or terms. This ability to compare and contrast empowers them to demand more value, putting pressure on companies like Bublar/Vobling to differentiate their services and justify their pricing. The growing accessibility of detailed product information means customers are less likely to accept standard offers without question.

- Increased Customer Information: A significant majority of consumers now conduct thorough online research before buying.

- Leverage through Comparison: Customers can easily compare AR solutions, pricing, and features, strengthening their negotiation position.

- Demand for Differentiation: Educated buyers are more likely to seek unique value propositions and negotiate for better terms.

- Pressure on Providers: This customer empowerment can lead to price competition and a need for AR companies to clearly demonstrate their unique selling points.

Potential for Backward Integration by Large Enterprises

Large enterprises, especially those heavily invested in R&D and digital transformation, may explore developing their own augmented reality (AR) solutions. This potential for backward integration, though demanding significant capital and expertise, acts as a potent bargaining tool for these customers. For instance, major tech companies often have the resources to build proprietary AR platforms, reducing their reliance on external providers.

This looming threat compels AR solution providers to maintain competitive pricing and deliver exceptional value to retain these influential clients. The mere possibility of a large customer bringing AR development in-house pressures AR companies to innovate and offer compelling service packages, ensuring they remain the preferred choice.

Consider the gaming industry where major studios possess the technical acumen to develop custom AR engines, potentially reducing their need for third-party AR software. This scenario highlights the bargaining power customers wield due to the threat of backward integration.

- Customer Leverage: Large enterprises can leverage their financial strength and technical capabilities to develop in-house AR solutions.

- R&D Investment: Companies with substantial R&D budgets, like those in the automotive or aerospace sectors, are more likely to consider backward integration for AR development.

- Competitive Pressure: The potential for backward integration forces AR providers to offer superior value and competitive pricing to secure and retain large enterprise clients.

- Strategic Advantage: For customers, developing proprietary AR technology can offer a significant competitive advantage and greater control over their digital strategies.

The bargaining power of customers for augmented reality (AR) solutions like those offered by Bublar and Vobling is influenced by several factors. Increased customer information, driven by extensive online research, empowers buyers to compare offerings and negotiate better terms. For instance, a 2024 Statista report found over 60% of consumers research products extensively online before purchase, directly impacting negotiation leverage.

The potential for large enterprise clients to develop their own AR solutions, known as backward integration, also significantly increases their bargaining power. This threat compels AR providers to maintain competitive pricing and deliver exceptional value to retain these key customers. Major tech firms often possess the resources to build proprietary AR platforms, reducing their reliance on external providers.

Switching costs for more standardized AR applications, particularly in consumer gaming, tend to be low due to the availability of numerous alternative experiences. This ease of transition amplifies customer leverage, pushing AR companies to clearly differentiate their services and justify their pricing to avoid losing clients to competitors.

| Factor | Impact on Bargaining Power | Supporting Data/Example |

|---|---|---|

| Customer Information & Research | Increases power through easy comparison and price awareness. | 60%+ of consumers research online before buying (Statista, 2024). |

| Backward Integration Threat | Empowers large clients to develop in-house solutions, pressuring providers. | Major tech companies can build proprietary AR platforms. |

| Switching Costs (Consumer AR) | Low switching costs give customers flexibility to move between providers. | Abundance of alternative AR gaming experiences. |

| Price Sensitivity (Enterprise) | High focus on ROI makes enterprise clients price-conscious. | 65% of enterprise IT decision-makers cite cost as a primary factor (Industry Survey). |

Same Document Delivered

Bublar Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Bublar Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning.

Rivalry Among Competitors

The augmented reality market is booming, with projections indicating a global market size of $198 billion by the end of 2025, a figure that underscores the intense competition. This substantial growth acts as a magnet, drawing in a diverse array of companies, from tech behemoths to nimble startups, all eager to capture a piece of this expanding market.

Bublar, operating within this dynamic landscape, faces significant competitive rivalry. The rapid pace of market expansion fuels this rivalry, as new entrants and existing players alike continuously innovate and strategize to gain a competitive edge and secure market share in the burgeoning AR sector.

The augmented reality market is intensely competitive, largely due to the presence of major tech players like Google, Microsoft, Apple, Meta, and Sony. These giants bring substantial financial muscle, extensive R&D capabilities, and deeply integrated ecosystems to the table.

For instance, in 2024, Apple's Vision Pro headset launch signaled a significant commitment to the spatial computing space, backed by its massive brand loyalty and developer community. Similarly, Meta continues to invest billions in its Reality Labs division, aiming to build out the metaverse, which heavily relies on AR advancements.

These established companies can afford to absorb higher development costs and offer bundled hardware and software solutions, creating a formidable barrier for smaller, specialized AR firms like Bublar/Vobling. Their ability to leverage existing user bases and distribution channels further intensifies the competitive landscape, making market leadership a challenging pursuit.

Bublar, through its Vobling brand, carves out its competitive space by concentrating on high-quality, immersive augmented reality (AR) experiences. This niche focus targets sectors such as gaming, entertainment, and specialized enterprise solutions, setting it apart from broader, less specialized competitors.

Sustained success in this arena hinges on a relentless pursuit of innovation and the consistent delivery of superior product quality. Building and nurturing strong client relationships is paramount for differentiation, ensuring Bublar stands out in a crowded marketplace.

Key competitive advantages for Bublar lie in its development of unique AR features, the robustness of its technological platforms, and its ability to provide highly tailored solutions that precisely meet client needs.

Consolidation and Strategic Acquisitions

The augmented and virtual reality (AR/VR) sector, where Bublar operates, has experienced significant consolidation. This trend is driven by companies aiming to bolster their market position and technological capabilities. For instance, Bublar's strategic acquisitions of Vobling and subsequently Goodbye Kansas exemplify this movement, integrating diverse expertise and expanding service portfolios.

These mergers and acquisitions are reshaping the competitive landscape, leading to the emergence of more formidable players. By combining resources and talent, these larger entities can offer more comprehensive solutions, thereby intensifying rivalry. This consolidation signals a maturing market where scale and integrated offerings are becoming crucial for competitive advantage.

- Bublar's Acquisition Strategy: Bublar acquired Vobling in 2021 and Goodbye Kansas in 2022, demonstrating a clear pattern of growth through strategic M&A.

- Market Maturation: The AR/VR industry is moving beyond early adoption, with companies seeking efficiency and broader market reach via consolidation.

- Intensified Rivalry: Larger, integrated companies formed through acquisitions present a greater competitive challenge to smaller, specialized AR/VR firms.

Rapid Technological Advancements and Innovation Cycles

The augmented reality (AR) sector, where Bublar and Vobling operate, is a hotbed of rapid technological change. Innovations in AR hardware, such as lighter and more powerful headsets, alongside advancements in AI for more sophisticated object recognition and interaction, are constantly reshaping the landscape. For companies like Bublar, this means a relentless need to invest in research and development to stay ahead.

This continuous innovation cycle demands agility. Companies must not only develop new technologies but also integrate them quickly into their offerings to maintain a competitive edge. For instance, the AR market saw significant growth in 2023, with IDC reporting worldwide spending on AR/VR reaching $22.4 billion, an increase of 40.1% over 2022, highlighting the pace of adoption and development.

Failure to keep pace with these technological leaps can be detrimental. Rivals who are quicker to adopt and innovate can capture market share and establish themselves as leaders, leaving slower-moving companies behind. The pressure is on for firms to constantly refine their AR solutions, from development platforms to user experiences, to avoid becoming obsolete.

- Hardware Advancements: Continued improvements in AR glasses and mobile AR capabilities.

- AI Integration: Enhanced AI for object recognition, scene understanding, and user interaction.

- Development Platforms: Evolution of AR development tools and SDKs, making creation more accessible and powerful.

- R&D Investment: Companies like Bublar must allocate significant resources to R&D to remain competitive.

The competitive rivalry within the augmented reality market is fierce, driven by the presence of tech giants like Apple and Meta. These large players leverage substantial R&D budgets and established ecosystems, creating significant barriers for smaller firms. For example, Apple's 2024 Vision Pro launch and Meta's ongoing Reality Labs investments highlight their commitment to AR innovation.

SSubstitutes Threaten

Traditional software and 2D digital solutions represent a significant threat of substitutes for augmented reality (AR) experiences. For many enterprise and consumer needs, existing applications, websites, or static digital content can fulfill the same basic functions. For example, product visualization can be achieved through high-quality images or videos rather than interactive AR models, and employee training can still be delivered effectively via conventional e-learning platforms.

While AR offers unique advantages like enhanced engagement and immersion, the cost-effectiveness and widespread familiarity of these established digital tools make them compelling alternatives. In 2024, the global market for traditional software, including enterprise resource planning (ERP) and customer relationship management (CRM) systems, continued to grow, with the ERP market alone projected to reach over $60 billion. This indicates a robust and deeply entrenched ecosystem of solutions that AR must compete against, often on price and ease of adoption.

Virtual Reality (VR) presents a partial threat to Augmented Reality (AR) by offering a fully simulated environment that can replace AR in specific applications. For instance, in scenarios demanding complete immersion, such as advanced flight simulators or intricate surgical training, VR might be favored over AR overlays. This is because VR provides a more controlled and all-encompassing experience, which can be crucial for skill acquisition in high-stakes environments.

Bublar, through its Vobling subsidiary, is directly involved in VR development, which positions the company to both compete with and leverage this substitute technology. The company's dual focus means it can cater to markets where VR is the preferred solution, such as in the gaming sector. In 2023, the global VR market was valued at approximately $28.9 billion, with projections indicating continued growth, highlighting the significant demand for immersive experiences that VR fulfills.

In sectors like manufacturing and architecture, physical prototypes and traditional in-person training remain viable substitutes for augmented reality (AR) solutions. For instance, the automotive industry still heavily relies on physical clay models for design refinement, a process that can be time-consuming and expensive, yet offers a tactile fidelity that digital simulations may not fully replicate.

Non-Interactive Media and Information Delivery

Non-interactive media, such as traditional videos, documentaries, and even static articles, present a viable substitute for augmented reality (AR) applications, particularly when the primary goal is information delivery or entertainment. These established formats can satisfy basic informational needs without requiring users to engage with specialized AR hardware or software, thus lowering the barrier to access.

For instance, a user seeking to learn about historical landmarks might opt for a documentary or a detailed online article over an AR application that overlays historical information onto the user's view of the actual location. This preference stems from the widespread availability and familiarity of these non-interactive alternatives.

The threat of substitutes is amplified by the cost and accessibility of AR technology. While AR adoption is growing, the need for compatible devices and potentially higher data consumption compared to streaming video or reading articles means that simpler, more accessible content forms will continue to serve as strong substitutes.

- Accessibility: Non-interactive media requires less specialized hardware than AR, making it accessible to a broader audience.

- Cost-Effectiveness: Producing and consuming traditional media is often less expensive than developing and experiencing AR content.

- Familiarity: Users are accustomed to consuming information and entertainment through established non-interactive channels, reducing the perceived need for AR solutions.

Emergence of Competing Immersive Technologies

The immersive technology sector is rapidly evolving, with mixed reality (MR) and other extended reality (XR) solutions emerging as potential substitutes. These technologies can offer alternative ways to blend digital and physical worlds, potentially diminishing the need for purely augmented reality (AR) or virtual reality (VR) experiences. For instance, Meta's Quest 3, released in late 2023, features advanced mixed reality capabilities, allowing users to interact with both virtual and real environments, thereby presenting a more integrated XR solution.

Companies in this space must remain agile and focused on continuous innovation to stay ahead of these developing alternatives. The pace of technological advancement means that what is a unique offering today could be a standard feature tomorrow. For example, Apple's Vision Pro, launched in early 2024, showcases a sophisticated spatial computing approach that could redefine user interaction with digital content, acting as a significant substitute for existing AR/VR hardware.

The threat of substitutes is amplified by the potential for new hardware and software breakthroughs that could unlock novel interaction methods. These advancements might create entirely new categories of immersive experiences that fulfill similar needs to current AR applications but through different technological means. The market for immersive technologies is projected to grow significantly, with IDC forecasting worldwide spending on AR/VR to reach $120.7 billion in 2024, highlighting the competitive pressure from evolving substitute technologies.

- Dynamic XR Landscape: The broader immersive technology market is dynamic, with ongoing developments in mixed reality (MR) and other forms of extended reality (XR) potentially offering alternative solutions that blend aspects of AR and VR.

- Novel Interaction Methods: New hardware and software advancements could lead to novel ways of interacting with digital content in the real world, creating new forms of substitution.

- Innovation Imperative: Companies must continually innovate to outpace these evolving alternatives and maintain their competitive edge in the immersive technology space.

- Market Growth and Competition: With worldwide spending on AR/VR projected to reach $120.7 billion in 2024, the threat of substitutes is significant as new technologies emerge to capture market share.

The threat of substitutes for augmented reality (AR) remains significant, primarily from traditional digital solutions and alternative immersive technologies. Established software, 2D content, and even physical prototypes can often fulfill similar functional needs, albeit with less interactivity or immersion. The widespread availability, lower cost, and user familiarity of these existing alternatives present a continuous challenge for AR adoption.

Virtual Reality (VR) and emerging Mixed Reality (MR) solutions also act as substitutes, offering different approaches to blending digital and physical experiences. As these technologies advance, they can capture market segments where their specific immersive qualities are preferred. The dynamic nature of the XR landscape necessitates ongoing innovation from AR providers to maintain relevance and competitive advantage.

| Substitute Category | Key Characteristics | 2024 Market Relevance/Data |

|---|---|---|

| Traditional Software & 2D Digital | Familiarity, Cost-effectiveness, Broad Accessibility | Global ERP market projected over $60 billion in 2024. |

| Virtual Reality (VR) | Full Immersion, Controlled Environments | Global VR market valued at approx. $28.9 billion in 2023, with continued growth. |

| Mixed Reality (MR) & Extended Reality (XR) | Blends Digital/Physical Worlds, Novel Interaction | Worldwide AR/VR spending forecast to reach $120.7 billion in 2024. |

| Physical Prototypes & In-Person Training | Tactile Fidelity, Established Processes | Automotive industry continues significant investment in physical design models. |

Entrants Threaten

Venturing into the augmented reality (AR) solutions sector, especially for creating advanced platforms or complex enterprise applications, demands considerable upfront capital for research, development, infrastructure, and skilled personnel. This significant financial hurdle naturally discourages many potential new competitors from entering the market.

For instance, in 2024, the global AR market was projected to reach hundreds of billions of dollars, with a substantial portion dedicated to R&D. Companies like Bublar, with their established Vobling platform, have already incurred significant sunk costs and accumulated invaluable expertise, creating a strong competitive advantage that new entrants would struggle to match.

Developing advanced augmented reality (AR) solutions, like those Bublar focuses on, requires deep expertise in 3D modeling, computer vision, artificial intelligence, and specialized software engineering. The AR industry in 2024 continues to see a high demand for these niche skills, with many tech companies competing for a limited pool of talent. This scarcity makes it difficult and time-consuming for new entrants to assemble the necessary skilled teams.

For instance, reports from late 2023 indicated that the average salary for an AR/VR developer in major tech hubs could exceed $150,000 annually, reflecting the premium placed on this specialized knowledge. Bublar, with its established history and Vobling's prior work, has cultivated a significant advantage through its experienced workforce and accumulated technical know-how, creating a substantial barrier for newcomers trying to match its capabilities.

Building a proprietary augmented reality platform, much like Bublar's, demands significant investment in research and development, alongside robust intellectual property protection. Newcomers must contend with the immense cost and time required to create comparable technology from the ground up, all while navigating a landscape already shaped by existing patents and industry norms.

The intellectual property barrier presents a substantial challenge for potential new entrants. For instance, companies like Unity Technologies, a major player in AR development, hold numerous patents related to their engine, which underpins many AR applications. This established IP makes it difficult for new entrants to quickly develop and offer truly differentiated AR solutions without infringing on existing rights or incurring substantial licensing fees.

Established Client Relationships and Trust

Established client relationships and trust are formidable barriers to entry, particularly within the business-to-business enterprise sector. Cultivating deep trust and securing enduring contracts with major clients is a lengthy process, demanding a solid track record and robust relationship management. For instance, Bublar, through its subsidiary Vobling, has forged significant relationships with clients such as SAAB. This existing client base represents a substantial hurdle for nascent competitors aiming to penetrate these high-value markets.

New entrants would necessitate substantial investments in sales and marketing initiatives to effectively challenge these entrenched relationships. The ability to demonstrate reliability and deliver consistent value over time is paramount, a testament to the difficulty new players face in dislodging established, trusted vendors.

- Significant Investment Required: New entrants must allocate considerable resources to sales, marketing, and building a verifiable track record to even begin competing for enterprise clients.

- Long Sales Cycles: Enterprise deals, especially in specialized B2B segments, often involve protracted sales cycles, further extending the time and cost for new players to gain traction.

- Demonstrated Success: Proven case studies and testimonials from major clients, like SAAB's engagement with Vobling, serve as powerful endorsements that new entrants lack initially.

Intense Competition from Existing Players

The augmented reality (AR) market, while expanding, already hosts a multitude of established companies. Tech titans and niche AR specialists alike contribute to a highly competitive environment. For instance, in 2024, the global AR market was valued at approximately $20 billion, with projections indicating substantial growth, yet this expansion is occurring within a crowded field.

Newcomers would find it challenging to gain traction against well-capitalized, experienced companies that possess established customer relationships and robust distribution networks. These incumbents often benefit from brand recognition and economies of scale, making it difficult for new entrants to compete effectively on price or reach.

- Established Market Presence: Major players like Apple, Google, and Meta have significant AR investments and existing user bases.

- High Capital Requirements: Developing advanced AR technology and marketing effectively requires substantial financial resources, estimated in the hundreds of millions for leading platforms.

- Brand Loyalty and Ecosystems: Existing companies leverage their established brands and integrated ecosystems to retain customers, posing a barrier to adoption for new AR solutions.

The threat of new entrants in the AR solutions sector, particularly for complex platforms like Bublar's, is moderated by substantial barriers. High capital requirements for R&D, infrastructure, and talent, coupled with the need for specialized expertise in areas like AI and computer vision, deter many potential competitors. For instance, the global AR market was projected to reach hundreds of billions of dollars in 2024, underscoring the significant investment needed.

Furthermore, established intellectual property and the difficulty in replicating proprietary technology create significant hurdles. Newcomers must navigate existing patents and the substantial costs associated with developing comparable AR capabilities. The scarcity of AR talent in 2024, with developers earning over $150,000 annually in tech hubs, exacerbates this challenge for new entrants seeking to build skilled teams.

Existing client relationships and the trust built over time, exemplified by Bublar's work with SAAB, also act as a strong deterrent. The long sales cycles and the need for a proven track record in the B2B enterprise market mean new entrants face considerable time and financial investment to gain initial traction. This makes it difficult for them to displace established players with demonstrated success.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bublar leverages data from company investor relations, industry-specific market research reports, and publicly available financial statements. This blend ensures a comprehensive understanding of competitive dynamics.