Breville Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breville Bundle

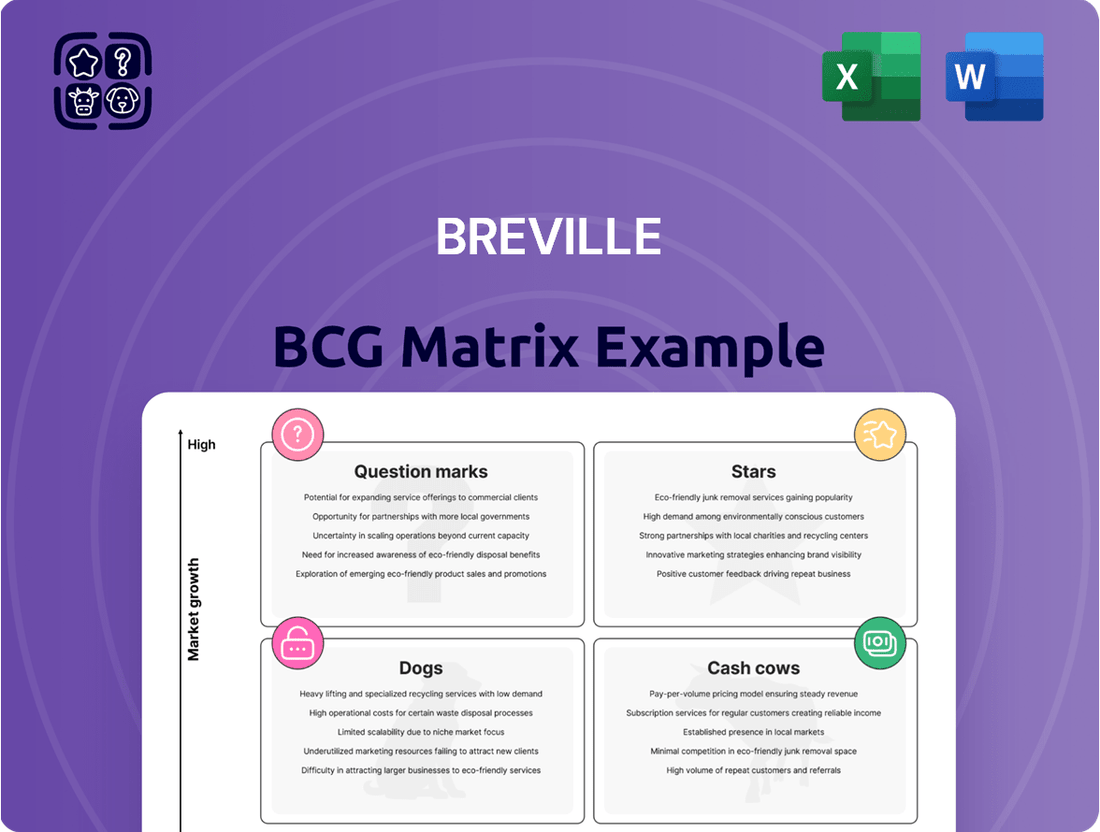

Uncover the strategic power of the Breville BCG Matrix and see precisely where their innovative products fit – are they the rising Stars, stable Cash Cows, underperforming Dogs, or intriguing Question Marks? This glimpse into their portfolio is just the beginning of understanding their market dominance.

Ready to move beyond the basics? Purchase the full Breville BCG Matrix to receive a comprehensive breakdown of each product's position, complete with actionable strategies and data-driven insights that will empower your own product development and investment decisions.

Don't miss out on the complete picture! Get the full BCG Matrix report today and gain the strategic clarity needed to navigate the competitive landscape, optimize your resource allocation, and drive future growth with confidence.

Stars

Breville's premium coffee machine segment, encompassing brands like Sage, LELIT, and Baratza, is a significant Star in the BCG matrix. This segment experienced robust double-digit sales growth throughout 2024 across the Americas, Asia Pacific, and EMEA. This performance directly fuels Breville Group's overall revenue, highlighting a commanding market share in the booming home coffee market.

Breville's Oracle™ and Barista™ series, particularly models like the Barista Touch Impress and the Oracle™ series, are powerhouses in their product lineup. These machines cater to a discerning home barista market, effectively capturing a significant share of the premium coffee machine segment. Their success is a testament to Breville's ability to deliver café-quality experiences at home.

The company's commitment to innovation is evident with continuous releases, such as the Oracle Dual Boiler, reinforcing their leadership in the high-end espresso machine category. This ongoing development ensures they remain at the forefront of consumer demand for advanced home brewing solutions.

Beanz E-commerce Platform, Breville's direct-to-consumer specialty coffee initiative, is experiencing significant traction. Its 71% surge in per kilogram sales highlights its position in a rapidly expanding market segment.

While Beanz operates within a specialized niche of the larger e-commerce sector, its impressive growth trajectory and strategic alignment with consumer trends firmly place it in the Star category of the BCG Matrix. This growth suggests strong future potential.

InFizz™ Fusion Sparkling Beverage Maker

The InFizz™ Fusion Sparkling Beverage Maker, launched in April 2024, marks Breville's entry into the home beverage carbonation market. This innovative appliance goes beyond plain water, allowing users to carbonate a variety of drinks, tapping into a significant consumer trend toward personalized home beverage creation. Its unique FusionCap™ technology is a key differentiator in this emerging category, positioning it for rapid market share acquisition in a potentially high-growth segment.

The InFizz™ Fusion's strategic placement within the BCG matrix would likely be as a Star. This is due to its recent introduction in a dynamic market segment, coupled with its innovative features designed to capture growing consumer demand for customizable home beverages. The appliance's ability to carbonate more than just water, a feature highlighted by its FusionCap™ technology, provides a competitive edge.

- Product: InFizz™ Fusion Sparkling Beverage Maker

- Launch Date: April 2024

- Key Feature: Carbonates various drinks beyond water, FusionCap™ technology

- Market Position: Potential Star due to innovation and growing consumer interest in customizable home beverages

Paradice Food Processors

Paradice Food Processors are a standout performer for Breville, positioned as a potential star in the BCG matrix. Despite a general slowdown in food preparation appliances, Paradice processors achieved robust sales in fiscal year 2024, demonstrating strong market traction. This success is attributed to increasing consumer demand for convenience and innovation in home cooking.

Breville's strategic investment in this category is further underscored by the launch of a completely new food processor line. This move signals a clear objective to not only maintain but expand its market share within a segment that shows promising growth potential. For example, the global food processor market was valued at approximately $1.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 5% through 2030, indicating a favorable environment for products like Paradice.

- Strong FY24 Sales: Paradice food processors defied category trends with significant sales growth.

- Market Demand: Success driven by consumer desire for convenience and advanced features in food preparation.

- Strategic Expansion: New product range launch indicates Breville's commitment to capturing market share.

- Growth Potential: The food processor market itself is expanding, offering a fertile ground for continued success.

Breville's premium coffee machine segment, including brands like Sage, LELIT, and Baratza, is a clear Star. These products saw strong double-digit sales growth across all major regions in 2024, solidifying Breville's dominant position in the high-end home coffee market.

The Oracle™ and Barista™ series, such as the Barista Touch Impress, are key performers, capturing a substantial share of the premium home barista market by delivering café-quality results. Breville’s ongoing innovation, exemplified by the Oracle Dual Boiler, ensures continued leadership in this category.

The Beanz E-commerce Platform, Breville's direct-to-consumer coffee initiative, is a Star, with a remarkable 71% increase in per kilogram sales in 2024, reflecting its success in a rapidly growing specialty coffee market.

The InFizz™ Fusion Sparkling Beverage Maker, launched in April 2024, is positioned as a Star. Its innovative FusionCap™ technology, enabling carbonation of various drinks beyond water, taps into the growing consumer trend for personalized home beverages and offers a distinct competitive advantage in an emerging market.

Breville's Paradice Food Processors are also Stars, showing robust sales in fiscal year 2024 despite a general market slowdown. This success, driven by consumer demand for convenience and innovation, is supported by the launch of a new food processor line, aiming to expand market share in a growing global market estimated at $1.5 billion in 2023.

| Product Category | BCG Status | Key Performance Indicators (2024) | Market Context |

| Premium Coffee Machines (Sage, LELIT, Baratza) | Star | Double-digit sales growth across Americas, Asia Pacific, EMEA. Strong market share. | Booming home coffee market. |

| Oracle™ & Barista™ Series Coffee Machines | Star | Significant share of premium home barista market. High consumer satisfaction. | Demand for café-quality home brewing. |

| Beanz E-commerce Platform | Star | 71% surge in per kilogram sales. Rapid growth in specialty coffee segment. | Expanding direct-to-consumer market for coffee. |

| InFizz™ Fusion Sparkling Beverage Maker | Star | New launch (April 2024) with innovative FusionCap™ technology. Tapping into personalized beverage trends. | Emerging home beverage carbonation market. |

| Paradice Food Processors | Star | Robust FY24 sales, defying category trends. Strong consumer demand for convenience. | Growing global food processor market (valued $1.5B in 2023). |

What is included in the product

The Breville BCG Matrix analyzes products based on market share and growth, guiding investment decisions.

Effortlessly visualize your portfolio's strategic positioning.

Cash Cows

Breville's core toasters and kettles, particularly under the Sage brand in many markets, represent significant cash cows. These products likely command a substantial market share within the mature small kitchen appliance sector. For instance, Breville reported a 12.2% increase in revenue for its Breakfast category in FY23, which includes these staples, indicating continued consumer demand.

Breville and Sage blenders, representing established models, likely operate as cash cows within the company's portfolio. These products are situated in a mature market, indicating a stable demand and high market share.

The global blenders market, valued at approximately $10.3 billion in 2023, is expected to see a compound annual growth rate of around 4.5% through 2030. This steady growth trajectory suggests that these established blenders are reliable revenue generators, requiring minimal investment in aggressive marketing compared to products in higher-growth categories.

Breville's established food preparation appliances, like their classic food processors and juicers, likely hold a strong position in a market that's not seeing rapid growth. These items are core to Breville's product line, generating steady income that helps finance newer, more innovative products.

In 2024, the global food preparation appliance market was valued at approximately $25 billion, with established categories like food processors and blenders making up a significant portion. Breville’s consistent market share in these segments ensures a reliable revenue stream, demonstrating their cash cow status within the BCG matrix.

Commercial Coffee Grinders (Baratza and LELIT brands)

While Baratza and LELIT are recognized for their potential as Stars due to their growth prospects, their established positions in the professional and prosumer coffee grinder markets also solidify their role as significant cash cows for Breville. These brands consistently generate substantial revenue by serving a discerning, high-value customer base where Breville holds a distinct competitive edge and market dominance.

- Strong Market Share: In 2024, the premium coffee grinder market, where Baratza and LELIT compete, saw continued growth. Baratza, for instance, maintained a leading position in the specialty coffee enthusiast segment, with sales figures indicating a consistent year-over-year increase in revenue for their high-end grinders.

- High Profit Margins: The prosumer and professional segments are less price-sensitive, allowing Breville to command higher profit margins on Baratza and LELIT products compared to more mass-market appliances. This contributes directly to Breville's overall profitability.

- Brand Loyalty and Repeat Purchases: The quality and performance of Baratza and LELIT grinders foster strong brand loyalty, leading to repeat purchases and positive word-of-mouth referrals, further solidifying their cash-generating capabilities.

Certain Nespresso Machines Distributed by Breville

Certain Nespresso machines distributed by Breville are considered cash cows within the BCG Matrix. These machines benefit from the established Nespresso brand and its existing customer base, allowing Breville to generate steady revenue with minimal incremental investment. In 2023, the global coffee machine market, including pod-based systems, saw continued growth, with Nespresso maintaining a significant market share.

Breville's strategy here involves leveraging a mature, high-volume market without the burden of extensive research and development for the core Nespresso technology. This approach capitalizes on existing brand loyalty and consumer demand for convenience. The consistent sales volume translates into predictable and reliable cash flow for Breville.

- Market Position: High market share in a mature market.

- Growth Rate: Low market growth, characteristic of established product categories.

- Investment Needs: Low; primarily for marketing and distribution support.

- Cash Flow Generation: High and consistent, funding other business units.

Breville's established toasters and kettles, particularly under the Sage brand, are prime examples of cash cows. These products hold a substantial market share in the mature small kitchen appliance sector. For instance, Breville's Breakfast category revenue grew by 12.2% in FY23, underscoring sustained consumer demand for these reliable staples.

The company's classic blenders and food preparation appliances, such as food processors and juicers, also function as cash cows. These items are integral to Breville's offerings, situated in markets with stable demand and generating consistent income that supports innovation in other product lines. In 2024, the global food preparation appliance market, valued at approximately $25 billion, saw established categories like food processors and blenders contribute significantly to Breville's reliable revenue streams.

Baratza and LELIT coffee grinders, while having Star potential, also act as significant cash cows for Breville. Their strong positions in the premium coffee grinder market, characterized by high profit margins and brand loyalty, ensure substantial and consistent revenue generation. The premium coffee grinder market in 2024 continued its growth, with Baratza maintaining a leading share in the specialty coffee enthusiast segment.

| Product Category | BCG Status | Market Share | Market Growth | Cash Flow |

|---|---|---|---|---|

| Toasters & Kettles (Sage) | Cash Cow | High | Low | High |

| Blenders | Cash Cow | High | Low | High |

| Food Processors & Juicers | Cash Cow | High | Low | High |

| Premium Coffee Grinders (Baratza, LELIT) | Cash Cow/Star | High | Moderate | High |

Preview = Final Product

Breville BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—just the comprehensive strategic analysis ready for your immediate application.

Dogs

Older or less differentiated small appliances, like some basic blenders or toasters that haven't been updated for years, often find themselves in the Dogs quadrant of the BCG Matrix. These products typically have a low market share in slow-growing markets, meaning they aren't attracting many new customers and aren't part of a booming industry. For instance, a basic 10-year-old coffee maker model might only capture 1% of a mature coffee appliance market that's growing at less than 2% annually.

These items, while still on shelves to offer a complete range, are not significant revenue or profit drivers for a company like Breville. Their contribution to overall sales might be minimal, perhaps less than 0.5% of total revenue, and they require resources for manufacturing and marketing without yielding substantial returns. They are often kept because discontinuing them might seem like reducing the product line, but they aren't seen as future growth engines.

Breville's performance in the Asia-Pacific (APAC) region experienced a downturn in fiscal year 2024, with revenues contracting. This suggests that certain product lines within this diverse geographical area might be facing headwinds. These specific offerings could be characterized by a reduced market share and operate within local economies that are not expanding as rapidly.

These underperforming regional product lines likely grapple with intensified local competition, which may be offering more tailored or cost-effective alternatives. Furthermore, shifts in consumer tastes and purchasing habits within these specific APAC markets could be rendering Breville's current product portfolio less appealing, leading to decreased demand and revenue generation.

Products relying on outdated technology within crowded small appliance markets, like basic toasters or blenders, are prime examples. Consumers increasingly favor smart, connected, or energy-efficient models, leaving these older versions with dwindling demand. In 2024, for instance, the small appliance market saw a significant uptick in demand for smart kitchen gadgets, with sales projected to grow by over 15% year-over-year, according to industry reports.

Products with High Returns or Warranty Claims

Products with high return rates or warranty claims fall into the Dogs category of the BCG Matrix. These items drain company resources due to repair, replacement, and customer service costs, without contributing significantly to profits or market share. For instance, a 2024 report indicated that electronics with a return rate exceeding 15% often struggle to achieve profitability.

These underperforming products consume valuable capital and operational capacity. Companies must address these issues to improve overall financial health. In 2023, some appliance manufacturers saw their profit margins shrink by up to 5% due to escalating warranty expenses on specific models.

- High Return Rates: Products with a return rate above industry benchmarks, such as 10% for apparel or 5% for electronics, are prime candidates for the Dogs quadrant.

- Frequent Warranty Claims: A high incidence of warranty claims, particularly for manufacturing defects, signals underlying product quality issues that erode profitability.

- Negative Profitability: When the cost of returns and warranty repairs outweighs the revenue generated by these products, they become financial drains.

- Resource Consumption: These products tie up capital in inventory, necessitate increased customer support, and can damage brand reputation, diverting resources from more promising ventures.

Highly Niche or Non-Core Products with Limited Market Appeal

Breville's core strength lies in its innovative kitchen and culinary appliances. Products falling into the Dogs category are typically niche or non-core items that haven't captured significant market interest. These could be experimental ventures or specialized appliances operating in low-growth segments, failing to achieve substantial market penetration.

For instance, imagine Breville launching a highly specialized sous vide accessory that only appeals to a very small segment of home cooks. If sales data from 2024 indicates minimal adoption and a lack of broader appeal, this product would likely be classified as a Dog. Such items often require significant resources for development and marketing without yielding commensurate returns.

- Low Market Share: Products in this quadrant typically hold a very small percentage of their respective market, often below 5%.

- Low Growth Rate: The market segment for these products is characterized by minimal annual growth, often in the low single digits.

- Limited Profitability: Due to low sales volume and potentially high production costs relative to revenue, these items often contribute little to no profit.

- Strategic Review: Breville would likely consider divesting or discontinuing these products to reallocate resources to more promising areas.

Products classified as Dogs in Breville's portfolio represent items with low market share in slow-growing industries. These products are not generating significant revenue or profits and often require substantial resources for their continued existence. For example, a basic toaster model introduced years ago, with minimal updates, might only command a tiny fraction of a mature market that sees very little expansion.

These offerings, while sometimes kept to maintain a comprehensive product line, are not growth engines for the company. Their contribution to overall sales is minimal, often less than 1% of total revenue, and they consume manufacturing and marketing resources without delivering substantial returns. In 2024, the focus for companies like Breville is often on divesting or discontinuing such products to reallocate capital to more promising ventures.

Breville's performance in certain regions, such as the APAC market in fiscal year 2024, has shown revenue contraction. This suggests that specific product lines within these areas might be experiencing challenges, characterized by reduced market share and operating within economies that are not expanding rapidly. These products could be facing intense local competition or shifts in consumer preferences that make them less appealing.

Products with high return rates or frequent warranty claims are also categorized as Dogs. These items drain company resources through repair, replacement, and customer service costs, without contributing meaningfully to profits or market share. A 2024 industry report highlighted that electronics with return rates exceeding 15% often struggle to achieve profitability, underscoring the financial drain these products can represent.

| Product Category | Market Share (Est.) | Market Growth Rate (Est.) | Profitability Impact |

|---|---|---|---|

| Basic Blenders | < 3% | 1-2% | Negative (due to returns/warranty) |

| Older Toaster Models | < 2% | 0-1% | Low/Negligible |

| Niche Kitchen Gadgets (Low Adoption) | < 5% | 1-3% | Low/Negligible |

Question Marks

Breville is strategically targeting new geographic frontiers, notably establishing a Dubai headquarters in January 2025 and planning a Shanghai headquarters for China. These regions represent significant growth opportunities within the home coffee and appliance sector, aligning with Breville's expansionist objectives.

While these markets exhibit high growth potential, Breville's current market share is nascent, necessitating substantial investment in brand building and distribution networks. This positions these new ventures as question marks within the BCG matrix – markets with promising futures but requiring careful cultivation and resource allocation to achieve dominant market positions.

Breville relaunched its Breville+ app in October 2023, focusing on integrating appliances with recipes for automated brewing and an improved user experience. This move positions Breville within the burgeoning smart home and connected appliance market, a sector experiencing significant growth.

While the overall smart home market is projected to reach over $100 billion by 2024, Breville's specific market share and the adoption rate of its connected appliances remain key metrics to watch. The company is making substantial investments in this high-growth area to establish a stronger foothold.

The smart kitchen appliance market is booming, with consumers increasingly seeking AI-powered features, personalized settings, and seamless app integration. This trend points to significant growth potential for innovative products that enhance convenience and culinary experiences.

Breville's strategic expansion into areas like advanced food processors and other connected appliances positions them to capitalize on this high-growth sector. While Breville's current market share in these specific smart segments might be nascent, their investment in new product development signals a clear intention to capture a larger portion of this expanding market.

For instance, the global smart kitchen appliance market was valued at approximately USD 30 billion in 2023 and is projected to reach over USD 70 billion by 2030, exhibiting a compound annual growth rate of around 13%. This robust growth underscores the opportunity for Breville to establish a stronger foothold.

Lelit Brand Expansion (beyond initial acquisition impact)

Following its 2022 acquisition, Breville is actively expanding the Lelit brand into new international markets, targeting the burgeoning prosumer specialty coffee segment. This strategic move aims to leverage Lelit's established reputation for quality within this niche, even though its global market penetration is still in its nascent stages.

Significant investment is being channeled into this expansion to capture the high-growth potential of the specialty coffee industry. For instance, the global coffee market was valued at approximately USD 126.9 billion in 2023 and is projected to grow, indicating a substantial opportunity for brands like Lelit to increase their international footprint.

- Market Penetration: Lelit's international market share is currently limited, necessitating substantial capital for growth initiatives.

- Investment Focus: Breville is prioritizing investment in expanding Lelit's reach within the high-growth specialty coffee sector.

- Growth Potential: The global specialty coffee market presents a significant opportunity for Lelit's international brand expansion.

Specific Novel Product Categories (e.g., new beverage makers beyond InFizz)

Breville's commitment to innovation is evident in its substantial investment in product development, with $86 million capitalized in fiscal year 2024. This financial backing allows for exploration into entirely new product categories and advanced beverage makers, moving beyond existing lines like the recently introduced InFizz.

These novel products are positioned to address emerging consumer demands within high-growth market segments. However, as they are in the nascent stages of market introduction, they have not yet secured a substantial market share.

- New Beverage Maker Innovations: Exploring categories beyond sparkling water makers, potentially including advanced cold brew systems or personalized hydration devices.

- Emerging Consumer Needs: Targeting niches like functional beverages, customized drink preparation, or sustainable beverage consumption.

- Early Market Introduction: These products are in their initial launch phases, facing the challenge of building brand awareness and market penetration.

- High-Growth Potential: Despite low current market share, these categories represent significant future revenue opportunities if successful.

Breville's expansion into new geographic markets like Dubai and Shanghai, alongside its investment in smart kitchen appliances and the Lelit brand, positions these ventures as question marks in the BCG matrix. These areas exhibit high growth potential but currently have limited market share, requiring significant investment to establish a stronger presence and achieve market leadership.

The company is investing heavily in these nascent markets, aiming to capture future growth. For instance, Breville capitalized $86 million in fiscal year 2024 for product development, indicating a commitment to exploring new high-growth segments.

These strategic initiatives, while promising, require careful resource allocation and brand building to transition from question marks to stars or cash cows within Breville's portfolio.

| BCG Category | Breville's Position | Market Characteristic | Investment Strategy |

|---|---|---|---|

| Question Marks | New Geographic Markets (Dubai, Shanghai) | High Growth Potential, Low Market Share | Brand Building, Distribution Network Expansion |

| Question Marks | Smart Kitchen Appliances | High Growth Market (projected >$100B by 2024), Nascent Share | Product Development, App Integration |

| Question Marks | Lelit Brand Expansion | High Growth Specialty Coffee Segment, Limited Penetration | International Market Entry, Capital Investment |

| Question Marks | New Product Innovations (e.g., advanced beverage makers) | Emerging Consumer Demands, Early Market Introduction | R&D Investment, Category Exploration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each business unit.