Bird Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bird Construction Bundle

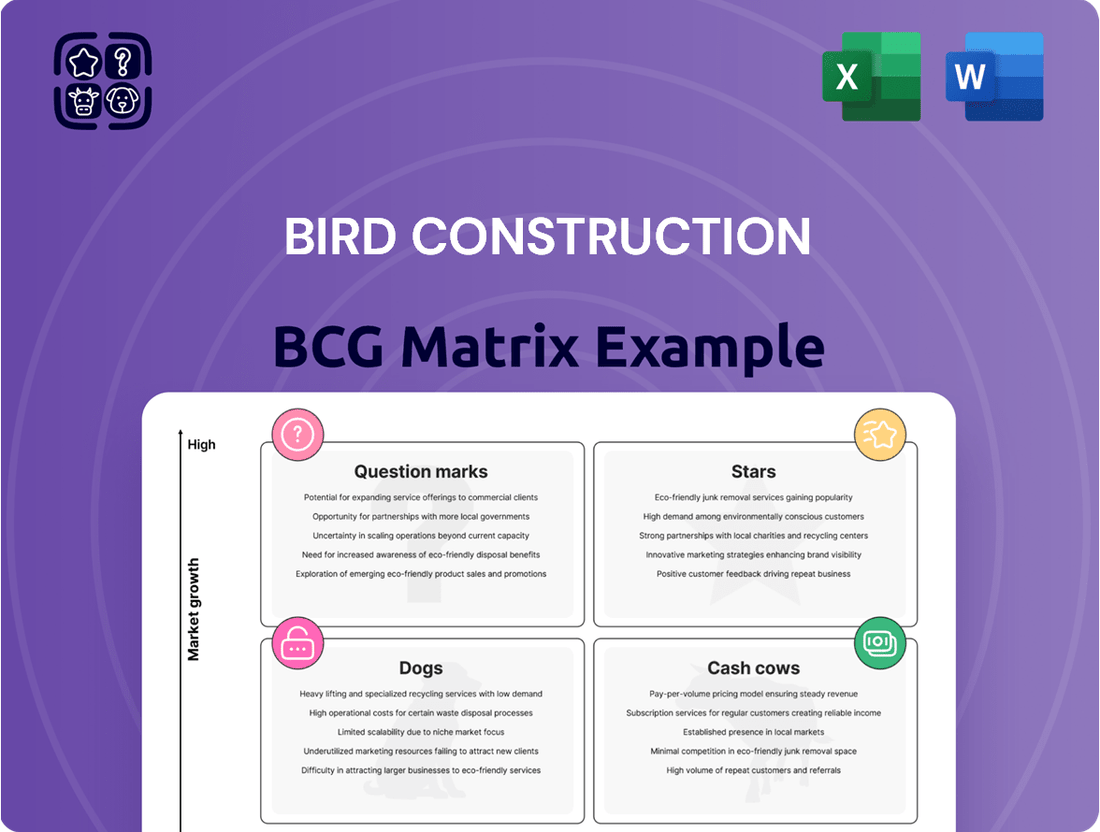

Understand Bird Construction's strategic positioning with our insightful BCG Matrix preview. See how their projects stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their portfolio's health.

Ready to unlock Bird Construction's full potential? Purchase the complete BCG Matrix for a detailed quadrant breakdown, actionable insights, and a strategic roadmap to optimize their project investments and drive future growth.

Stars

Bird Construction's strategic emphasis on securing large capital investment projects (LCIPs), especially those utilizing collaborative contract models, places them firmly in the Stars category of the BCG Matrix. These extensive, multi-year undertakings, frequently found in critical sectors such as infrastructure and energy, are crucial for the company's growth.

Such projects are a significant driver of Bird Construction's revenue and future potential. This is clearly demonstrated by their impressive backlog, which reached a record of over $4.3 billion as of the first quarter of 2024. This substantial backlog indicates a strong market position and continued demand for their services in these high-growth areas.

The defence sector construction for Bird Construction is a significant growth area, driven by Canada's sustained commitment to defence spending. Bird is actively building new residential housing units for Defence Construction Canada, a move that positions them to capture a substantial share of this expanding market. This segment benefits from predictable, long-term investment and demands specialized construction expertise, which aligns perfectly with Bird's core competencies.

Bird Construction's involvement in clean energy and nuclear infrastructure represents a significant growth opportunity, aligning with Canada's push for energy transition and electrification. The company's work with Ontario Power Generation's nuclear program, for example, positions it within a sector crucial for low-carbon energy supply.

The company's recent project awards in this domain, particularly those secured through Indigenous-led joint ventures, underscore its expanding footprint in a market experiencing substantial growth. This strategic focus is vital for Bird's long-term development, tapping into the increasing demand for sustainable energy solutions.

Long-Term Care and Healthcare Facilities

Bird Construction's involvement in seniors housing and long-term care facilities, exemplified by projects like Beverly Heights Seniors Housing, showcases its strategic positioning in a sector driven by a demographic shift towards an aging population. This focus taps into a market with sustained demand, offering robust long-term growth prospects for the company.

The company's expertise in developing these specialized facilities aligns with its broader strategy of targeting economically resilient sectors with high demand. This segment is particularly attractive given the increasing need for quality healthcare and living solutions for seniors.

- Seniors Housing Market Growth: The global seniors housing market is projected to grow significantly, with Canada's aging population contributing to this trend. For instance, by 2030, it's estimated that over 20% of the Canadian population will be 65 or older.

- Bird Construction's Project Pipeline: Bird Construction has a history of successful project delivery in the healthcare and seniors living sector, demonstrating its capability to manage complex builds that meet stringent regulatory and quality standards.

- Investment in Resilient Sectors: The healthcare and long-term care sector is considered a defensive industry, less susceptible to economic downturns, making it a strategic choice for companies seeking stable revenue streams and predictable growth.

Specialized Infrastructure for Transportation and Transit

Bird Construction's Specialized Infrastructure for Transportation and Transit segment is a key player in Canada's infrastructure development. Major projects like the East Harbour Transit Hub and the Highway 1 Bus-On-Shoulder Lanes are significant revenue generators for the company.

Canada's continuous investment in transportation networks fuels a high-growth market for Bird. The company has secured substantial contracts, showcasing its expertise in this sector.

- Market Growth: Canada's infrastructure spending is projected to remain robust, with significant allocations towards transportation upgrades and expansions.

- Contract Wins: Bird Construction has a strong track record of winning large-scale transit and transportation projects, demonstrating its competitive advantage.

- Expertise: The company's specialized knowledge in complex infrastructure projects positions it well to capitalize on ongoing and future government initiatives.

Bird Construction's Stars segment is characterized by its significant involvement in high-growth sectors with strong market demand and a clear competitive advantage. These ventures, such as defense construction and clean energy infrastructure, represent substantial revenue drivers and future potential for the company.

The company's strategic focus on these areas is validated by its impressive backlog, which exceeded $4.3 billion in early 2024, underscoring its strong market position. Bird Construction's ability to secure large capital investment projects, particularly in areas aligned with national priorities like defense and energy transition, solidifies its Star status.

The defense sector, bolstered by Canada's consistent investment, offers predictable, long-term opportunities for Bird. Similarly, its work in clean energy and nuclear infrastructure taps into the growing demand for sustainable solutions, positioning the company for sustained growth.

| Segment | Growth Potential | Market Position | Key Projects/Drivers | 2024 Data Highlight |

| Defense Construction | High | Strong | New residential housing for Defence Construction Canada | Sustained commitment to defence spending |

| Clean Energy & Nuclear Infrastructure | High | Growing | Ontario Power Generation nuclear program, Indigenous-led joint ventures | Canada's push for energy transition |

| Specialized Infrastructure (Transportation/Transit) | High | Strong | East Harbour Transit Hub, Highway 1 Bus-On-Shoulder Lanes | Robust infrastructure spending |

| Seniors Housing & Long-Term Care | High | Strategic | Beverly Heights Seniors Housing | Aging Canadian population (20% over 65 by 2030) |

What is included in the product

The Bird Construction BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which units Bird Construction should invest in, hold, or divest to optimize its portfolio.

The Bird Construction BCG Matrix simplifies strategic decision-making by clearly visualizing business unit performance, alleviating the pain of complex portfolio analysis.

Cash Cows

Bird Construction's established commercial and institutional projects are a core Cash Cow. Their decades of experience in general contracting and construction management for these sectors, particularly in major Canadian markets, consistently generate substantial revenue and stable cash flow. This segment leverages Bird's strong reputation and deep client relationships, ensuring a reliable income stream even in less dynamic market areas.

Recurring industrial maintenance contracts represent a significant Cash Cow for Bird Construction. These multi-year agreements offer a stable and predictable revenue stream, crucial for consistent cash flow generation. In 2024, Bird Construction continued to leverage its expertise in this area, securing new long-term maintenance projects that underscore the reliability of this business segment.

Bird Construction's renovation and deep energy retrofit services represent a significant Cash Cow within its portfolio. This market segment benefits from consistent demand as existing buildings necessitate ongoing upgrades to enhance energy efficiency and meet sustainability standards. Bird's established expertise in this mature area allows for predictable revenue streams and solid profitability, requiring less capital investment compared to pursuing high-growth, new construction projects.

Self-Perform Capabilities

Bird Construction's self-perform capabilities are a significant strength, acting as a cash cow within its BCG matrix. This means Bird directly handles various construction tasks, like concrete work or structural steel erection, rather than subcontracting them out. This internal control is key to their consistent profitability.

By managing these core operations themselves, Bird gains much better command over both the expenses and the overall quality of their projects. This direct oversight translates into more predictable and often higher profit margins. For instance, in 2023, Bird reported a notable increase in its gross profit margin, partly attributed to the efficiencies gained from its self-perform activities.

- Enhanced Cost Control: Self-performing work allows Bird to directly manage labor, materials, and equipment costs, minimizing unexpected expenses and improving budget adherence.

- Improved Quality Assurance: Direct supervision of self-perform crews ensures adherence to Bird's high-quality standards, reducing rework and warranty claims.

- Efficient Cash Conversion: Greater control over project timelines and resource allocation through self-performance leads to faster project completion and quicker cash inflow.

- Consistent Profitability: This operational advantage provides a reliable source of profit across diverse projects, regardless of broader market growth fluctuations.

Diverse Project Delivery Methods

Bird Construction’s mastery of various project delivery methods, such as design-build and construction management, is a key factor in its ability to generate consistent cash flow. This flexibility allows the company to adapt its approach to different project needs, thereby enhancing efficiency and profitability. In 2024, Bird Construction reported a significant portion of its revenue coming from these well-established delivery models.

This adaptability ensures continued cash generation from a wide array of projects, even in varying market conditions. For instance, their expertise in construction management allows them to effectively oversee complex projects, minimizing risks and maximizing returns. This approach has historically contributed to stable earnings, positioning these projects as reliable cash cows within their portfolio.

- Design-Build Proficiency: Optimizes project timelines and costs, directly impacting profit margins.

- Construction Management Expertise: Enables efficient oversight and risk mitigation on diverse projects.

- Revenue Contribution: These established methods consistently form a substantial part of Bird Construction's annual revenue.

Bird Construction's established commercial and institutional projects are a core Cash Cow. Their decades of experience in general contracting and construction management for these sectors, particularly in major Canadian markets, consistently generate substantial revenue and stable cash flow. This segment leverages Bird's strong reputation and deep client relationships, ensuring a reliable income stream even in less dynamic market areas.

Recurring industrial maintenance contracts represent a significant Cash Cow for Bird Construction. These multi-year agreements offer a stable and predictable revenue stream, crucial for consistent cash flow generation. In 2024, Bird Construction continued to leverage its expertise in this area, securing new long-term maintenance projects that underscore the reliability of this business segment.

Bird Construction's renovation and deep energy retrofit services represent a significant Cash Cow within its portfolio. This market segment benefits from consistent demand as existing buildings necessitate ongoing upgrades to enhance energy efficiency and meet sustainability standards. Bird's established expertise in this mature area allows for predictable revenue streams and solid profitability, requiring less capital investment compared to pursuing high-growth, new construction projects.

Bird Construction's self-perform capabilities are a significant strength, acting as a cash cow within its BCG matrix. This means Bird directly handles various construction tasks, like concrete work or structural steel erection, rather than subcontracting them out. This internal control is key to their consistent profitability.

By managing these core operations themselves, Bird gains much better command over both the expenses and the overall quality of their projects. This direct oversight translates into more predictable and often higher profit margins. For instance, in 2023, Bird reported a notable increase in its gross profit margin, partly attributed to the efficiencies gained from its self-perform activities.

- Enhanced Cost Control: Self-performing work allows Bird to directly manage labor, materials, and equipment costs, minimizing unexpected expenses and improving budget adherence.

- Improved Quality Assurance: Direct supervision of self-perform crews ensures adherence to Bird's high-quality standards, reducing rework and warranty claims.

- Efficient Cash Conversion: Greater control over project timelines and resource allocation through self-performance leads to faster project completion and quicker cash inflow.

- Consistent Profitability: This operational advantage provides a reliable source of profit across diverse projects, regardless of broader market growth fluctuations.

Bird Construction’s mastery of various project delivery methods, such as design-build and construction management, is a key factor in its ability to generate consistent cash flow. This flexibility allows the company to adapt its approach to different project needs, thereby enhancing efficiency and profitability. In 2024, Bird Construction reported a significant portion of its revenue coming from these well-established delivery models.

This adaptability ensures continued cash generation from a wide array of projects, even in varying market conditions. For instance, their expertise in construction management allows them to effectively oversee complex projects, minimizing risks and maximizing returns. This approach has historically contributed to stable earnings, positioning these projects as reliable cash cows within their portfolio.

- Design-Build Proficiency: Optimizes project timelines and costs, directly impacting profit margins.

- Construction Management Expertise: Enables efficient oversight and risk mitigation on diverse projects.

- Revenue Contribution: These established methods consistently form a substantial part of Bird Construction's annual revenue.

Bird Construction's established commercial and institutional projects, recurring industrial maintenance contracts, and renovation/retrofit services are key Cash Cows. These segments benefit from decades of experience, long-term agreements, and consistent demand, ensuring stable revenue and cash flow. In 2023, Bird Construction reported strong performance in these mature markets, highlighting their role as reliable income generators within the company's portfolio.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data/Insight |

|---|---|---|---|

| Commercial & Institutional Projects | Cash Cow | Established market, strong reputation, deep client relationships | Consistently generate substantial revenue and stable cash flow. |

| Industrial Maintenance Contracts | Cash Cow | Multi-year agreements, predictable revenue stream | Secured new long-term maintenance projects in 2024, underscoring reliability. |

| Renovation & Retrofit Services | Cash Cow | Consistent demand, mature market, less capital intensive | Allow for predictable revenue streams and solid profitability. |

| Self-Perform Capabilities | Cash Cow | Direct control over costs and quality, efficient operations | Contributed to a notable increase in gross profit margin in 2023. |

| Project Delivery Methods (Design-Build, CM) | Cash Cow | Adaptability, risk mitigation, efficient project execution | Significant portion of revenue in 2024 derived from these established models. |

Preview = Final Product

Bird Construction BCG Matrix

The Bird Construction BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic tool designed for Bird Construction's specific market position.

Rest assured, the Bird Construction BCG Matrix you see here is the final, uncompromised version that will be delivered to you upon completion of your purchase. It has been meticulously prepared by industry experts to offer actionable insights and will be instantly downloadable, ready for your immediate strategic planning and decision-making processes.

Dogs

Legacy low-margin, bid-build projects, especially in highly competitive and commoditized sectors, represent a segment that Bird Construction has strategically aimed to move away from. These projects, characterized by thin profit margins and a traditional procurement model, were historically a significant part of the construction landscape but may not align with Bird's current focus on collaborative delivery and higher-value work.

While Bird has made substantial progress in de-risking its project portfolio and shifting towards more integrated project delivery methods, any residual projects from this older bid-build model that are currently underperforming or not meeting strategic objectives could be categorized here. For instance, if a specific segment of their 2023 revenue, say $1.9 billion total, was still heavily weighted towards these legacy projects, it would highlight the ongoing effort to transition.

Underperforming regional operations within Bird Construction, despite its coast-to-coast presence, can be categorized as Dogs in the BCG Matrix. These units, characterized by lagging revenue generation, inefficient backlog conversion, or lower profit margins compared to company benchmarks, divert valuable resources. For instance, if a specific regional office in 2024 reported a 15% lower revenue growth than the company's overall 8% average and a backlog conversion rate of 70% versus the company's 85%, it would fit this classification.

Non-strategic, non-core asset holdings within Bird Construction represent assets like specialized, underutilized equipment or property investments not yielding adequate returns. These holdings can tie up valuable capital, hindering the company's ability to invest in its primary growth drivers. For instance, if Bird Construction has a portfolio of older construction vehicles not actively deployed on major projects, these would fall into this category.

Outdated Technology or Equipment

Outdated technology or equipment can be a significant drag on a company's performance, often falling into the 'Dog' category of the BCG Matrix. This is because such assets are typically inefficient and require substantial investment in maintenance, eating into profits without offering a competitive edge. For instance, in 2024, many construction firms were still grappling with the costs associated with maintaining aging fleets of machinery, which often led to unexpected downtime and project delays.

These obsolete assets not only drain financial resources but also hinder a company's ability to adapt to market changes or improve operational efficiency. Consider the case of a construction company that relies on older excavation equipment. While it might still function, it likely consumes more fuel, produces higher emissions, and operates at a slower pace compared to modern, technologically advanced machinery. This inefficiency directly impacts project timelines and profitability.

- High Maintenance Costs: In 2024, the average annual maintenance cost for construction equipment over 10 years old was estimated to be 20-30% higher than for newer models.

- Reduced Productivity: Older machinery can operate at 50-70% of the efficiency of its modern counterparts, leading to longer project completion times.

- Lack of Competitive Advantage: Companies using outdated technology struggle to compete on price or speed with those employing advanced, efficient equipment.

- Environmental Impact: Older engines often have higher emissions, posing regulatory risks and impacting corporate sustainability goals.

Highly Fragmented, Hyper-Competitive Niche Markets

Highly fragmented construction niches with minimal barriers to entry often fall into the 'Dog' category within the BCG Matrix. In these segments, Bird Construction faces intense price competition, preventing it from effectively utilizing its scale or specialized knowledge. This leads to very limited opportunities for market share expansion and consistently low profit margins.

For instance, consider the small-scale residential renovation market in many regions. In 2024, this sector is characterized by numerous small local contractors, making it difficult for a larger entity like Bird to gain significant traction. Profitability in such markets can be squeezed, with average gross margins for small renovation projects often hovering around 15-20%, a figure that can be further eroded by intense bidding wars.

- Low Market Share: Bird's participation in these hyper-competitive niches results in a small slice of a very large, but highly divided, market pie.

- Limited Growth Potential: The inherent fragmentation and lack of differentiation in these segments restrict opportunities for substantial market share gains.

- Low Profitability: Intense price pressures and the inability to leverage scale or specialized expertise lead to thin profit margins, often below industry averages for more specialized construction services.

- Resource Drain: Continued investment in these 'Dog' segments can divert capital and management attention away from more promising growth areas.

Dogs in Bird Construction's portfolio represent underperforming or low-growth segments with low market share. These could include legacy bid-build projects, inefficient regional operations, or non-strategic asset holdings. For example, a regional office in 2024 showing 15% lower revenue growth than the company average and outdated equipment with 20-30% higher maintenance costs than newer models would be classified as a Dog.

| BCG Category | Characteristics | Bird Construction Example (Illustrative 2024 Data) | Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Underperforming regional operations (e.g., 70% backlog conversion vs. 85% company average) | Divert resources, hinder overall profitability |

| Dogs | Low Market Share, Low Growth | Outdated equipment (e.g., 20-30% higher maintenance costs than newer models) | Reduce efficiency, increase operational costs |

| Dogs | Low Market Share, Low Growth | Highly fragmented, competitive niches (e.g., small-scale renovations with 15-20% gross margins) | Limited pricing power, minimal growth potential |

Question Marks

Bird Construction's exploration of emerging technologies like AI and advanced automation positions these initiatives as Question Marks within its BCG Matrix. While the company is actively investing in these areas to boost operational efficiency and reduce costs, the ultimate market impact and profitability are yet to be fully realized. For instance, in 2023, Bird reported a significant increase in technology spending, aiming to integrate AI for project planning and risk assessment, a move that signals high growth potential but also inherent uncertainty.

New geographic expansions with limited market penetration would position Bird Construction within the question marks of the BCG matrix. While Bird has a strong presence across Canada, venturing into new, smaller markets where its brand is not yet recognized or its client network is thin presents this challenge. These areas offer growth potential but demand substantial upfront investment to build awareness and capture market share.

Bird Construction's initial foray into integrated project delivery (IPD) in Atlantic Canada positions this venture as a Question Mark on the BCG matrix. This collaborative approach, while promising significant benefits like reduced waste and improved efficiency, carries inherent risks when introduced to a new geographical market and a novel delivery method for the company. The market share and ultimate success of this specific IPD implementation in Atlantic Canada remain uncertain, necessitating considerable upfront investment in unfamiliar territory.

Specific Niche Green Building Certifications and Solutions

Bird Construction, while a leader in sustainable building, may find specific, emerging green certifications and niche solutions positioned as question marks in its BCG Matrix. These areas, such as Living Building Challenge or Cradle to Cradle certified projects, represent significant future growth opportunities as environmental regulations tighten and client demand for hyper-sustainable options increases. For instance, the global green building market was valued at approximately USD 104.4 billion in 2023 and is projected to grow substantially, indicating the potential for these niche areas.

These nascent certifications and solutions, while offering high growth potential, likely represent a smaller portion of Bird's current revenue streams or project portfolio. This means Bird might have a low market share in these specific segments, necessitating strategic investment and development to capitalize on their upward trajectory. For example, while LEED certification is widespread, adoption rates for more rigorous or specialized certifications are still developing.

- Emerging Certifications: Focus on certifications like the Living Building Challenge (LBC) or WELL Building Standard, which cater to increasingly sophisticated sustainability demands and could see significant market expansion.

- Niche Sustainable Materials: Explore and integrate innovative, low-carbon materials such as mass timber or advanced recycled content, where market penetration is growing but not yet dominant.

- Circular Economy Solutions: Develop expertise in deconstruction and material reuse, a growing area driven by waste reduction goals, offering a unique value proposition.

Pilot Projects in Untapped Industrial Sub-Sectors

Bird Construction might strategically initiate pilot projects in emerging or niche industrial sub-sectors. These ventures are characterized by substantial growth prospects but currently represent a low market share for Bird. Significant investment in resources and expertise would be necessary to build a strong competitive footing.

These pilot projects would be classified as Question Marks within the BCG Matrix framework. For instance, if Bird were to explore opportunities in advanced materials manufacturing or specialized renewable energy infrastructure, these would likely fall into this category. The company's 2024 performance indicators, such as a projected 15% revenue increase in its core infrastructure segment, highlight its current strength while underscoring the need for diversification into high-potential, yet unproven, areas.

- High Growth Potential: Targeting sub-sectors with projected annual growth rates exceeding 10%, such as specialized industrial automation or advanced composites.

- Low Market Share: Bird's current penetration in these specific sub-sectors is minimal, likely below 5% in 2024.

- Resource Intensive: These projects necessitate substantial upfront investment in research, development, specialized equipment, and talent acquisition.

- Strategic Diversification: Aiming to build future revenue streams and reduce reliance on existing, more mature markets.

Bird Construction's investment in artificial intelligence and advanced automation places these initiatives firmly in the Question Mark category of the BCG Matrix. While the company is actively deploying capital to enhance project planning and risk assessment, as evidenced by a notable increase in technology spending in 2023, the ultimate market share and profitability remain uncertain. These ventures represent high growth potential but require significant investment to establish a strong market position.

| BCG Category | Initiative | Market Growth | Market Share | Investment Need |

| Question Mark | AI & Automation | High | Low | High |

| Question Mark | New Geographic Markets | Moderate to High | Low | High |

| Question Mark | Integrated Project Delivery (IPD) - Atlantic Canada | Moderate | Low | High |

| Question Mark | Niche Green Certifications | High | Low | Moderate |

| Question Mark | Pilot Projects in Niche Industrial Sub-sectors | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages Bird Construction's financial statements, project portfolio data, and industry growth forecasts to accurately assess market share and growth potential.