BioMarin Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioMarin Pharmaceutical Bundle

BioMarin Pharmaceutical navigates a complex landscape shaped by intense rivalry and the significant bargaining power of buyers, particularly payers and patient advocacy groups. The threat of substitutes, while present, is somewhat mitigated by the unique nature of its rare disease treatments.

The complete report reveals the real forces shaping BioMarin Pharmaceutical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BioMarin Pharmaceutical's reliance on highly specialized raw materials, reagents, and cell lines for its advanced therapies, like gene therapies, places considerable bargaining power in the hands of its few, specialized suppliers. These unique inputs are critical for the complex manufacturing processes involved.

The proprietary nature of these essential components means BioMarin has limited alternatives, giving these suppliers leverage to influence pricing and supply continuity. For instance, in 2024, the cost of certain rare biological components saw an upward trend due to their specialized production requirements and limited global availability, directly impacting BioMarin's cost of goods sold.

BioMarin Pharmaceutical's reliance on proprietary manufacturing equipment for advanced therapies like enzyme replacement and gene therapies significantly amplifies supplier bargaining power. These specialized, often custom-built, facilities and machinery are not readily available from multiple vendors, creating a dependency. For instance, the complex processes involved in gene therapy production necessitate unique bioreactors and purification systems, where a limited number of suppliers can meet stringent regulatory and technical demands.

BioMarin's reliance on a highly specialized workforce, including scientists and manufacturing experts, grants significant bargaining power to individuals and teams with rare disease expertise. This scarcity means these skilled professionals can command higher compensation and better working conditions, directly impacting BioMarin's labor costs.

Furthermore, BioMarin often partners with Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) that possess unique capabilities in rare disease drug development and production. In 2024, the demand for specialized biotech manufacturing capacity outstripped supply, with many CMOs operating at near-full capacity. This situation allows these niche partners to negotiate more favorable terms, as their specialized knowledge and infrastructure are not easily substituted, increasing their leverage over BioMarin.

Intellectual Property and Licensing

Intellectual property and licensing play a crucial role in the bargaining power of suppliers for BioMarin Pharmaceutical. Key technologies or components essential for BioMarin's rare disease therapies might be protected by patents held by third parties. Licensing these essential technologies can grant licensors considerable leverage, directly impacting BioMarin's research and development expenses and its ability to bring treatments to market.

For instance, if a critical gene-editing technology or a novel delivery system is patented by another entity, that patent holder can dictate terms. This can translate into substantial royalty payments or upfront licensing fees, effectively increasing BioMarin's cost of goods sold. The exclusivity granted by such patents means BioMarin may have limited alternatives, further strengthening the supplier's position.

- Patent Protection: Suppliers holding patents on essential technologies for rare disease treatments can command higher licensing fees.

- Limited Alternatives: If a specific technology is unique and patented, BioMarin may have few or no viable substitutes, increasing supplier leverage.

- Development Costs: Licensing agreements can significantly influence BioMarin's overall development costs and profitability.

- Market Access: The terms of IP licenses can impact BioMarin's speed to market and its ability to secure market exclusivity.

Quality Control and Regulatory Compliance Services

Suppliers offering specialized quality control and regulatory compliance services are vital for pharmaceutical companies like BioMarin. These services are not easily substituted, especially given the rigorous standards in the industry. For instance, in 2024, the global pharmaceutical contract manufacturing market, which often includes quality control services, was valued at approximately $150 billion, highlighting the scale and importance of these specialized providers.

The bargaining power of these suppliers stems from their deep expertise in navigating complex regulatory landscapes, such as those set by the FDA and EMA. Their ability to ensure product safety and efficacy through advanced analytical testing and meticulous compliance documentation makes them indispensable. BioMarin, like other biopharmaceutical firms, relies heavily on these partners to maintain market access and avoid costly recalls or production halts. The cost of non-compliance can be astronomical, often running into millions of dollars in fines and lost revenue, thus reinforcing the suppliers' leverage.

- Specialized Expertise: Suppliers possess unique knowledge in pharmaceutical quality assurance and regulatory affairs, which is difficult for BioMarin to replicate internally.

- Regulatory Dependence: Adherence to stringent FDA, EMA, and other global health authority regulations necessitates reliance on accredited and expert third-party testing and compliance services.

- High Switching Costs: Transitioning to new quality control or regulatory compliance partners involves significant time, validation efforts, and potential disruptions to manufacturing and product release schedules.

- Critical Nature of Services: The failure of these services can lead to severe consequences, including product recalls, manufacturing shutdowns, and reputational damage, giving suppliers considerable influence.

BioMarin Pharmaceutical faces significant supplier bargaining power due to the highly specialized nature of its raw materials, manufacturing equipment, and intellectual property. The limited number of qualified suppliers for critical components in gene and enzyme therapies means BioMarin has few alternatives, allowing these suppliers to influence pricing and terms. For instance, in 2024, the scarcity of specialized biological inputs and advanced manufacturing equipment, often protected by patents, allowed suppliers to negotiate higher prices, impacting BioMarin's cost of goods sold and R&D expenses.

| Factor | Impact on BioMarin | 2024 Data/Trend |

|---|---|---|

| Specialized Raw Materials | High supplier leverage due to limited alternatives and proprietary nature. | Upward price trends for rare biological components due to specialized production. |

| Proprietary Manufacturing Equipment | Dependency on a few vendors for unique bioreactors and purification systems. | Increased demand for specialized biotech manufacturing capacity outstripped supply. |

| Intellectual Property & Licensing | Licensors of critical gene-editing or delivery technologies command significant leverage. | Licensing fees directly influence R&D costs and time-to-market for therapies. |

| Quality Control & Regulatory Services | Reliance on expert third-party services for compliance with FDA/EMA standards. | Global pharmaceutical contract manufacturing market (incl. QC) valued around $150 billion in 2024. |

What is included in the product

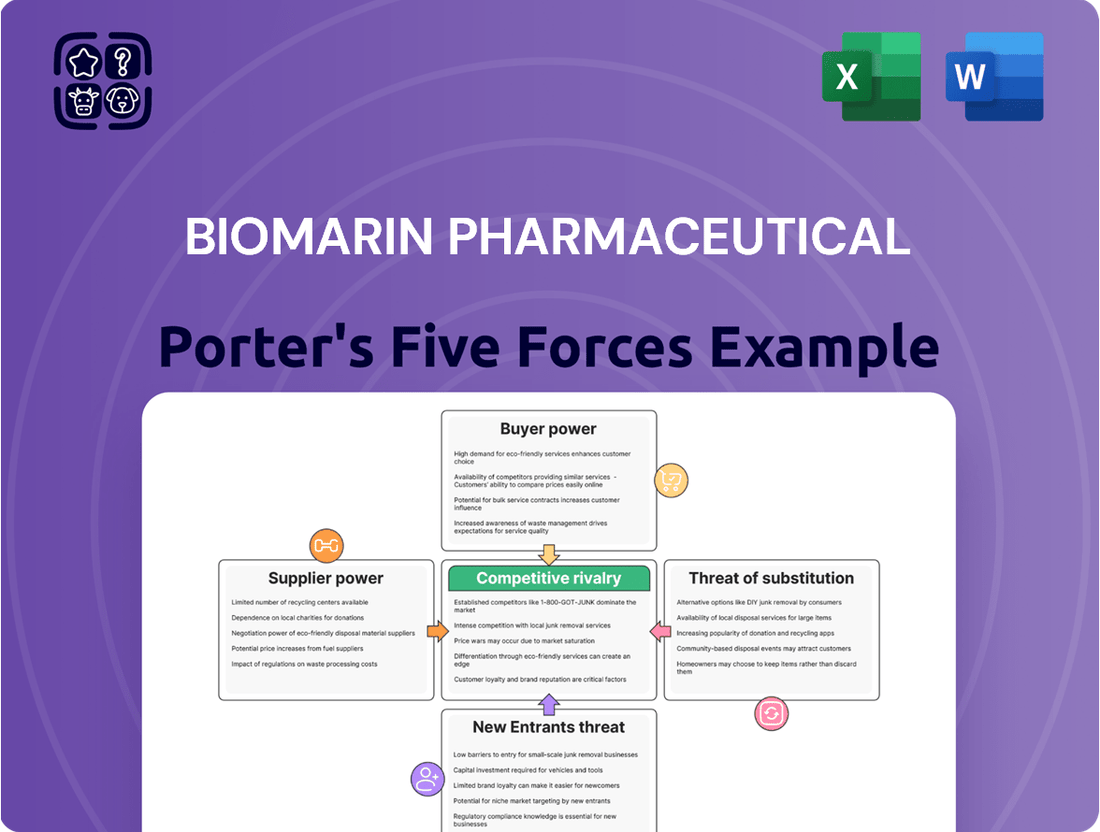

This Porter's Five Forces analysis for BioMarin Pharmaceutical examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the rare disease pharmaceutical market.

Instantly understand BioMarin's competitive landscape with a clear, one-sheet Porter's Five Forces analysis, simplifying complex market pressures for strategic clarity.

Effortlessly adapt BioMarin's Five Forces model to new data or shifts in the rare disease market, providing agile insights for proactive strategy adjustments.

Customers Bargaining Power

BioMarin's primary customers are powerful payers like government health agencies and large private insurers. These entities wield significant influence through negotiations on drug formularies and reimbursement policies, directly impacting BioMarin's market access and pricing strategies for its specialized rare disease treatments.

The bargaining power of customers in the rare disease sector, like BioMarin Pharmaceutical, is nuanced. While small patient populations might suggest less collective power, the life-or-death nature of many treatments for these conditions significantly reduces the leverage of individual patients or their immediate families in price negotiations.

However, patient advocacy groups often become powerful forces. These organizations can lobby for policy changes, influence regulatory bodies, and raise public awareness, thereby exerting considerable pressure on pharmaceutical companies regarding access and affordability. For instance, in 2024, advocacy groups played a crucial role in securing expanded access programs for several novel gene therapies targeting rare genetic disorders.

For patients with rare genetic diseases, once stabilized on a BioMarin therapy, switching to another treatment presents substantial clinical risks and logistical hurdles. This effectively raises the switching costs for these individuals.

These elevated switching costs significantly diminish the immediate bargaining power of individual patients to seek out or demand alternative treatments, solidifying BioMarin's position.

Clinical Efficacy and Unmet Need

The clinical efficacy and life-saving nature of BioMarin's therapies significantly diminish customer bargaining power. For rare genetic diseases with high unmet medical needs, such as those treated by BioMarin, patients and their insurers have limited alternatives. This scarcity of comparable treatments means BioMarin can command premium pricing, as the value proposition—often the difference between life and severe disability—is immense.

For instance, BioMarin's treatments for conditions like hemophilia A or phenylketonuria (PKU) address severe, chronic, and often life-threatening diseases where effective alternatives are scarce or non-existent. This lack of substitutes grants BioMarin considerable pricing power. In 2023, BioMarin reported strong revenue growth, with Roctavian, a gene therapy for hemophilia A, contributing significantly, underscoring the market's acceptance of high-value therapies for unmet needs.

- High Unmet Need: BioMarin focuses on rare genetic diseases where few or no treatment options exist, enhancing its pricing leverage.

- Transformative Therapies: The life-altering impact of its drugs reduces customer sensitivity to price.

- Limited Substitutes: The absence of direct competitors for many of its niche treatments strengthens BioMarin's market position.

- Value-Based Pricing: BioMarin can justify higher prices due to the significant clinical benefit and quality-of-life improvements its therapies offer.

Governmental Pricing and Reimbursement Controls

Many nations, especially in Europe, impose stringent price and reimbursement controls on pharmaceuticals, particularly for expensive rare disease treatments. This regulatory landscape significantly amplifies the bargaining power of national healthcare systems, which act as substantial customers. These systems effectively dictate market entry conditions and pricing for companies like BioMarin.

For instance, in 2024, the UK's National Institute for Health and Care Excellence (NICE) continued its rigorous cost-effectiveness assessments, influencing how much the National Health Service (NHS) would pay for new therapies. Similarly, Germany's G-BA (Federal Joint Committee) plays a crucial role in determining reimbursement levels through its early benefit assessment process.

- Governmental Price Controls: Countries like France and Spain have historically negotiated drug prices directly with manufacturers, limiting BioMarin's pricing flexibility.

- Reimbursement Policies: Reimbursement decisions by bodies such as the Australian Pharmaceutical Benefits Advisory Committee (PBAC) can significantly impact patient access and sales volumes.

- Global Pricing Pressure: The existence of price controls in major markets creates a benchmark that can pressure BioMarin to adopt more moderate pricing strategies worldwide.

- Negotiating Leverage: National health insurers and government agencies, acting as consolidated buyers, possess considerable leverage to negotiate discounts and favorable terms for high-value treatments.

The bargaining power of customers for BioMarin Pharmaceutical is notably constrained by the critical nature and limited alternatives for its rare disease treatments. While large payers like government health agencies and private insurers hold significant sway, the life-saving impact of BioMarin's therapies often reduces their leverage in price negotiations. For example, in 2024, BioMarin's continued success with treatments for conditions like severe hemophilia A, where alternatives are scarce, demonstrates this dynamic, with revenue from its hemophilia franchise remaining a key growth driver.

| Factor | Impact on BioMarin | Example/Data (2023-2024) |

|---|---|---|

| Limited Substitutes | High | BioMarin's therapies for conditions like PKU and hemophilia A have few direct competitors, allowing for premium pricing. |

| Switching Costs | High | Patients stabilized on BioMarin's treatments face significant clinical risks if they switch, reducing their ability to demand lower prices. |

| Patient Advocacy | Moderate to High | Advocacy groups can influence policy and access, as seen in 2024 with their push for expanded access to gene therapies for rare disorders. |

| Governmental Controls | Moderate | Stringent price and reimbursement controls in markets like the UK (NICE) and Germany (G-BA) in 2024 can limit pricing flexibility. |

Full Version Awaits

BioMarin Pharmaceutical Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for BioMarin Pharmaceutical, detailing the competitive landscape and strategic positioning within the rare disease sector. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any alterations or placeholders. You are looking at the actual document, which will be instantly accessible for your strategic planning and business development needs upon completion of your transaction.

Rivalry Among Competitors

BioMarin Pharmaceutical thrives in specialized rare genetic disease markets, where direct competition is often limited. However, within these niches, rivalry can be fierce as companies compete for small patient pools and the prestige of being first to market with a breakthrough therapy.

For instance, in the phenylketonuria (PKU) market, BioMarin's Palynziq faces competition from Biomarin's own Kuvan and other emerging therapies, illustrating the concentrated nature of rivalry in these specialized areas. The high cost of developing treatments for rare diseases also acts as a barrier to entry, further shaping the competitive landscape.

Competitive rivalry at BioMarin is intensely fueled by the relentless pursuit of groundbreaking therapies. Companies are locked in a race to develop novel, more effective, or safer treatments, particularly in areas like enzyme replacement, protein, and gene therapies. This constant drive to innovate creates substantial pressure, as seen in BioMarin's substantial R&D investments, which reached approximately $879 million in 2023, underscoring the high stakes in bringing new solutions to market.

BioMarin Pharmaceutical's competitive rivalry is significantly shaped by its ability to navigate the intricate landscape of clinical trials and secure regulatory approvals from bodies like the FDA and EMA. Success in these areas is a key differentiator, allowing companies to bring life-changing therapies to market faster.

The pursuit of superior clinical data and expedited approval pathways intensifies rivalry, as companies vie to capture market share by demonstrating greater efficacy and safety. For instance, BioMarin's hemophilia A gene therapy, Roctavian, received FDA approval in 2023, highlighting the importance of these milestones in the competitive arena.

Market Access and Reimbursement Strategies

Competitive rivalry significantly intensifies when it comes to securing favorable market access and reimbursement from payers worldwide. Pharmaceutical companies, including BioMarin, must actively demonstrate the clinical and economic value of their treatments to ensure widespread patient availability, which directly impacts revenue streams.

Companies compete by presenting robust health economic data, showcasing how their therapies offer a net benefit to healthcare systems. This often involves sophisticated cost-effectiveness analyses and budget impact models tailored to different national healthcare systems. For instance, in 2024, the average cost of gene therapy treatments can range from hundreds of thousands to millions of dollars per patient, necessitating strong value propositions to justify these expenditures.

- Value Demonstration: Companies invest heavily in real-world evidence generation and pharmacoeconomic studies to prove the long-term benefits and cost savings associated with their therapies.

- Reimbursement Negotiations: Intense negotiations occur with government health agencies and private insurers to establish pricing and coverage policies.

- Market Access Hurdles: Navigating diverse regulatory requirements and payer landscapes across different countries presents a significant competitive challenge.

- Patient Advocacy: Engaging with patient advocacy groups is crucial for building support and influencing reimbursement decisions, especially for rare disease treatments.

Patent Protection and Biosimilar/Gene Therapy Competition

BioMarin’s reliance on its existing product portfolio, particularly for rare genetic diseases, means that the expiration of key patents, or the development of competing therapies, presents a significant threat. For instance, while BioMarin has seen success with treatments like Naglazyme, the landscape for rare disease therapies is evolving rapidly. The emergence of biosimilars for protein-based therapeutics, or novel gene therapy approaches developed by competitors, could erode BioMarin's market share and pricing power. This necessitates a proactive strategy of continuous innovation and pipeline development to counter these competitive pressures.

The competitive rivalry in the biopharmaceutical sector, especially for specialized treatments like those BioMarin offers, is directly impacted by patent lifecycles and the advent of alternative treatment modalities. As of early 2024, the pharmaceutical industry is witnessing increased investment in gene therapy and advanced biologics, signaling a future where patent cliffs could be more impactful. Companies are keenly aware that a drug’s patent expiration can open the door for competitors, including those developing biosimilars or entirely new therapeutic mechanisms, to enter the market. This dynamic underscores the critical need for sustained research and development to introduce next-generation therapies and maintain a competitive advantage.

- Patent Expirations: The eventual expiry of patents on BioMarin's key drugs, such as those for phenylketonuria (PKU) or mucopolysaccharidosis (MPS), will allow generic or biosimilar manufacturers to enter the market.

- Biosimilar Threat: For protein-based therapeutics, the development and approval of biosimilars by competitors can lead to significant price erosion and market share loss for the originator.

- Gene Therapy Advancements: The rapid progress in gene therapy research means that newer, potentially more effective or cost-efficient gene therapies could emerge, challenging BioMarin's current offerings.

- Innovation Imperative: BioMarin must continually invest in its R&D pipeline to develop novel therapies and next-generation treatments, ensuring it stays ahead of emerging competitive alternatives.

Competitive rivalry at BioMarin is intense, driven by the pursuit of breakthrough therapies in rare genetic diseases where innovation is paramount. Companies vie for market leadership through superior clinical data and expedited regulatory approvals, as demonstrated by BioMarin's Roctavian receiving FDA approval in 2023. The high cost of developing these specialized treatments acts as a barrier, but rivalry remains fierce among established players.

The race to secure market access and favorable reimbursement intensifies competition, with companies presenting robust health economic data to justify high treatment costs, which can exceed millions of dollars per patient in 2024. This necessitates strong value propositions and active engagement with payers and patient advocacy groups to ensure widespread availability.

Patent expirations and the emergence of alternative treatment modalities, particularly in gene therapy, pose significant competitive threats. BioMarin's continued investment in R&D, evidenced by its $879 million R&D expenditure in 2023, is crucial to counter the potential erosion of market share from biosimilars or next-generation therapies.

SSubstitutes Threaten

While BioMarin specializes in enzyme replacement and gene therapies, the threat of substitutes emerges from alternative scientific approaches. Competitors developing small molecule drugs, RNA-based therapies, or CRISPR gene editing could offer different ways to treat the same rare genetic conditions, potentially at lower costs or with different efficacy profiles.

The threat of substitutes for BioMarin Pharmaceutical's specialized therapies is present, particularly through off-label drug use and repurposed therapies. Physicians may prescribe existing, approved medications for different conditions if they demonstrate potential benefits, offering a lower-cost alternative. This is especially relevant when BioMarin's treatments carry a high price tag or face accessibility challenges.

For certain rare metabolic diseases, lifestyle and dietary interventions can act as substitutes for pharmaceutical treatments. These non-pharmacological approaches, while not curative, can help manage symptoms and potentially slow disease progression, particularly in less severe cases. For instance, strict low-phenylalanine diets are a cornerstone for managing phenylketonuria (PKU), a condition BioMarin treats with its drug Palynziq. In 2023, BioMarin reported Palynziq net product sales of $207.8 million, highlighting the market for PKU treatments.

Improved Diagnostic Capabilities and Early Intervention

Advances in diagnostic capabilities, particularly in areas like genetic sequencing and biomarker identification, pose a threat of substitution for BioMarin Pharmaceutical. These improvements can lead to earlier and more precise identification of rare genetic diseases. For instance, the increasing accessibility and decreasing cost of whole-genome sequencing, which fell by over 90% between 2015 and 2023, enables earlier detection. This earlier detection might allow for alternative, less intensive, or entirely different therapeutic approaches to emerge, potentially bypassing the need for BioMarin's specific enzyme replacement therapies or gene therapies.

The shift towards earlier intervention, facilitated by these diagnostic advancements, could fundamentally alter treatment paradigms. If a disease can be effectively managed or even prevented with simpler interventions identified at an earlier stage, it directly competes with BioMarin's more complex and costly treatments. For example, in some metabolic disorders, early dietary interventions or small molecule therapies identified through advanced diagnostics could reduce the demand for gene therapy later in life. This presents a significant substitute threat as the market prioritizes less invasive and potentially more cost-effective solutions.

- Earlier Disease Detection: Enhanced diagnostic tools can identify rare diseases at earlier stages, potentially before significant progression necessitates BioMarin's current therapeutic interventions.

- Emergence of Alternative Therapies: Early diagnosis may pave the way for the development and adoption of substitute treatments, such as small molecules or gene editing technologies, that offer different mechanisms of action.

- Shift in Treatment Preferences: A growing emphasis on preventative or less invasive treatment strategies, driven by improved diagnostics, could reduce the market share for BioMarin's more complex, long-term therapies.

- Cost-Effectiveness of Substitutes: As diagnostic costs decrease and alternative treatments become more viable, the overall cost-effectiveness of substitute options may challenge BioMarin's pricing models.

Emergence of Curative or Superior Therapies

The most potent threat of substitution for BioMarin Pharmaceutical's products arises from the emergence of truly curative therapies or significantly more effective and safer treatments developed by competitors. For instance, a one-time gene therapy offering a permanent cure could directly displace existing chronic enzyme replacement therapies, a core area for BioMarin.

This threat is particularly acute in the rare disease space where BioMarin operates. The development of a single, highly effective treatment could render older, less efficient therapies obsolete, impacting BioMarin's market share and revenue streams. For example, if a competitor launches a gene therapy for a condition currently managed by BioMarin's enzyme replacement therapy, it could lead to a substantial shift in patient and physician preference.

- Curative Gene Therapies: A single-administration gene therapy could replace lifelong treatments, posing a significant substitution threat.

- Enhanced Efficacy and Safety: New drug modalities offering superior patient outcomes or reduced side effects can quickly gain market traction.

- Competitive R&D Pipelines: BioMarin faces constant pressure from other biopharmaceutical companies investing heavily in novel therapeutic approaches.

The threat of substitutes for BioMarin’s specialized therapies is significant, stemming from alternative therapeutic modalities and even non-pharmacological interventions. Competitors developing small molecule drugs, RNA-based therapies, or CRISPR gene editing offer different approaches to treating rare genetic diseases, potentially with different cost or efficacy profiles. Furthermore, lifestyle and dietary interventions can manage symptoms for certain conditions, like phenylketonuria (PKU), which BioMarin treats with Palynziq. In 2023, Palynziq generated $207.8 million in net product sales, indicating a market where non-drug interventions are a viable, albeit not curative, substitute.

| Therapeutic Modality | Potential Substitute Impact | Example Condition |

|---|---|---|

| Small Molecule Drugs | Lower cost, different efficacy | Various metabolic disorders |

| RNA-based Therapies | Alternative mechanism of action | Genetic disorders |

| CRISPR Gene Editing | Potential for permanent correction | Genetic disorders |

| Dietary/Lifestyle Interventions | Symptom management, cost-effective | Phenylketonuria (PKU) |

Entrants Threaten

Developing therapies for rare genetic diseases, BioMarin's focus, demands immense upfront investment in research and development. These endeavors can span many years and are often plagued by high failure rates. For instance, the average cost to bring a new drug to market has been estimated to be over $2 billion, a figure that disproportionately impacts smaller entities.

This substantial capital requirement acts as a significant barrier, deterring many potential new entrants from entering BioMarin's specialized markets. The sheer financial commitment needed to navigate the complex regulatory landscape and clinical trial processes makes it difficult for new companies to compete effectively against established players like BioMarin.

Stringent regulatory approval pathways represent a significant threat of new entrants in the biopharmaceutical sector, particularly for companies like BioMarin that focus on novel biologics and gene therapies. The process for these advanced treatments, especially those targeting rare diseases, is inherently complex, time-consuming, and capital-intensive. For instance, bringing a new drug to market typically involves multiple phases of clinical trials, with the entire process often taking over a decade and costing hundreds of millions, if not billions, of dollars. This creates a substantial barrier for potential new competitors who must demonstrate safety and efficacy to regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

The threat of new entrants in specialized manufacturing for biopharmaceuticals like BioMarin is significantly limited by the immense capital and technical expertise required. Producing complex biologics and gene therapies necessitates Good Manufacturing Practice (GMP)-compliant facilities, which are incredibly costly to build and maintain. For instance, the capital expenditure for a new cell therapy manufacturing facility can easily run into hundreds of millions of dollars, a substantial barrier for emerging players.

Strong Patent Protection and Intellectual Property

BioMarin Pharmaceutical benefits significantly from its robust patent portfolio, which acts as a formidable barrier against new entrants. The company possesses extensive patent protection on its current treatments and those in its development pipeline, making it incredibly difficult for competitors to enter the market with similar products.

The process of developing alternative therapies that circumvent existing patents, or attempting to challenge these patents directly, is both financially demanding and time-consuming. This complexity discourages potential new players from targeting the specific rare disease markets where BioMarin operates, effectively limiting the threat of new competition.

- Patent Exclusivity: BioMarin's therapies often benefit from market exclusivity periods granted by regulatory bodies, further solidifying their competitive advantage.

- R&D Investment: The high cost of research and development for rare disease treatments means that any new entrant would need substantial capital to compete effectively.

- Pipeline Strength: BioMarin's ongoing investment in its pipeline, with multiple promising assets, continually reinforces its intellectual property moat.

Established Relationships and Orphan Drug Designations

BioMarin Pharmaceutical benefits from deeply entrenched relationships with patient advocacy groups, key opinion leaders, and specialized rare disease clinics globally. These established networks are crucial for clinical trial recruitment and market access, creating a significant barrier for potential new entrants who lack such connections.

Orphan drug designations, a cornerstone of BioMarin's strategy, often grant extended periods of market exclusivity. For instance, by mid-2024, many of BioMarin's key therapies were still protected by these designations, effectively shielding them from direct competition for a considerable time and deterring new entrants.

- Established Patient Advocacy and KOL Networks: BioMarin's long-standing collaborations facilitate patient identification and treatment adherence, critical for rare disease markets.

- Orphan Drug Exclusivity: These designations provide extended market protection, a significant deterrent to new competitors. For example, Roctavian, approved in 2022, has market exclusivity in the EU until 2034 and in the US until 2037.

- High Development Costs for Rare Diseases: The specialized nature and high costs associated with developing treatments for rare diseases also act as a barrier, requiring substantial upfront investment that new entrants may struggle to secure.

The threat of new entrants for BioMarin Pharmaceutical is generally low due to the extremely high barriers to entry in the rare disease biotechnology sector. Significant capital investment is required for research, development, and navigating complex regulatory pathways, often exceeding billions of dollars per successful drug. For example, the average cost to bring a new drug to market is estimated to be over $2 billion, a substantial deterrent for new players.

BioMarin's strong patent portfolio and extended periods of market exclusivity, particularly through orphan drug designations, further solidify its position and discourage potential competitors. For instance, by mid-2024, many of BioMarin's key therapies were still protected by these designations, with Roctavian having exclusivity in the EU until 2034 and in the US until 2037.

The specialized manufacturing requirements for biologics and gene therapies, demanding costly GMP-compliant facilities, also present a significant hurdle. Building a new cell therapy manufacturing facility can cost hundreds of millions of dollars, making it difficult for emerging companies to compete. Furthermore, established relationships with patient advocacy groups and key opinion leaders create entrenched networks that are challenging for newcomers to replicate.

| Barrier Type | Description | Impact on New Entrants | Example for BioMarin |

|---|---|---|---|

| Capital Requirements | High R&D and manufacturing costs | Deters new entrants due to substantial upfront investment | Over $2 billion average cost to bring a drug to market |

| Regulatory Hurdles | Complex approval processes for novel therapies | Time-consuming and expensive, requiring extensive clinical trials | FDA and EMA approval pathways for gene therapies |

| Intellectual Property | Patents and market exclusivity | Prevents direct competition for extended periods | Orphan drug exclusivity (e.g., Roctavian until 2034/2037) |

| Manufacturing Expertise | Specialized GMP facilities for biologics | High capital expenditure for advanced manufacturing capabilities | Hundreds of millions for cell therapy facilities |

| Network Effects | Relationships with patient groups and KOLs | Crucial for patient recruitment and market access | Established global rare disease networks |

Porter's Five Forces Analysis Data Sources

Our BioMarin Pharmaceutical Porter's Five Forces analysis is built upon a foundation of comprehensive data, including BioMarin's annual reports and SEC filings, alongside industry-specific market research from firms like Evaluate Pharma and FierceBiotech.