Bellsystem24 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bellsystem24 Bundle

Bellsystem24 navigates a competitive landscape shaped by moderate buyer power and the looming threat of substitutes. Understanding these forces is crucial for any stakeholder seeking to grasp the company's strategic position.

The complete report reveals the real forces shaping Bellsystem24’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technological infrastructure providers, such as cloud service providers and CRM software vendors, is substantial for companies like Bellsystem24. These suppliers often possess unique, mission-critical offerings and can hold dominant market positions, allowing them to influence pricing and contract terms.

Bellsystem24's reliance on scalable infrastructure and specialized software means that disruptions or significant price increases from these tech suppliers can directly impact operational costs and service delivery. For instance, major cloud providers like Amazon Web Services (AWS) or Microsoft Azure, which saw significant revenue growth in 2024, can leverage their market share to negotiate favorable terms.

The availability and cost of skilled labor, especially agents proficient in multiple languages or with specialized technical skills, directly impacts Bellsystem24's operational expenses. In 2024, many regions experienced tight labor markets, driving up wages and recruitment costs for specialized roles. For instance, a report from ManpowerGroup indicated a significant global shortage of skilled workers, with IT and customer service roles being particularly affected.

When Bellsystem24 faces challenges in finding and retaining these skilled individuals, it can lead to increased training investments and potentially higher outsourcing costs if internal capacity is insufficient. This scarcity effectively grants labor a form of supplier power, as their specialized skills become a critical, and sometimes limited, resource that the company needs to secure.

Suppliers providing unique contact center software, sophisticated analytics, or AI-driven technologies can wield significant influence. Bellsystem24's dependence on these specialized tools for operational efficiency and service distinction can make changing providers expensive and complicated.

This reliance can weaken Bellsystem24's position when negotiating terms with these key technology vendors.

Data and Cybersecurity Service Providers

The bargaining power of data and cybersecurity service providers for Bellsystem24 is considerable, driven by the escalating demands for data privacy and the constant evolution of cyber threats. Bellsystem24's reliance on these specialized services for data integrity and regulatory compliance makes them essential, potentially increasing their cost. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $424.5 billion by 2030, indicating strong demand and supplier leverage.

The critical nature and specialized expertise required for robust data security and compliance solutions significantly bolster the leverage of these suppliers. Bellsystem24 must secure these services to maintain trust and operational continuity, limiting its ability to negotiate aggressively on price or terms.

- Increasing Regulatory Landscape: Stricter data protection laws like GDPR and CCPA empower suppliers of compliant solutions.

- High Demand for Specialized Skills: The shortage of cybersecurity professionals and niche expertise strengthens supplier positions.

- Critical Business Function: Data security is non-negotiable for Bellsystem24, reducing its power to switch providers easily.

- Market Growth: The expanding cybersecurity market (projected CAGR of 10.2% from 2023-2030) reflects high demand, benefiting suppliers.

Real Estate and Facilities Providers

The bargaining power of real estate and facilities providers for Bellsystem24 is a nuanced factor, particularly for its physical contact centers. In 2024, the cost of commercial real estate in major urban centers, where many contact centers are located, continued to be a significant expense. For instance, average office rental rates in Tokyo, a key market for Bellsystem24, remained robust, influencing the operational costs for physical sites.

This supplier power is amplified by location scarcity and lease terms. Bellsystem24's ability to secure favorable lease agreements for its physical facilities can directly impact its cost structure. The availability of suitable, large-scale office spaces equipped for contact center operations is not always abundant, giving landlords a degree of leverage, especially in high-demand periods or prime business districts.

- Real Estate Costs: In 2024, prime office rental rates in major Japanese cities, where Bellsystem24 operates physical contact centers, presented a significant cost factor.

- Location Scarcity: Limited availability of suitable, large-scale facilities in desirable business locations can increase supplier bargaining power.

- Lease Terms: The negotiation of lease agreements, including duration and renewal clauses, allows real estate providers to influence Bellsystem24's operational expenses.

- Hybrid Models: For hybrid operational models, the need for physical infrastructure still grants real estate providers some leverage, albeit less than for fully physical operations.

Bellsystem24 faces significant supplier power from providers of specialized contact center technology, including AI-driven solutions and advanced analytics platforms. The unique nature of these offerings and the high switching costs for integrated systems mean these suppliers can command favorable terms, impacting Bellsystem24's operational efficiency and service differentiation.

The bargaining power of skilled labor, particularly for specialized roles in customer service and technology, is a critical consideration. In 2024, many markets experienced shortages in these areas, driving up wage demands and making it harder for companies like Bellsystem24 to secure and retain talent, thus increasing operational costs.

Providers of essential IT infrastructure, such as cloud services, also hold substantial power due to their market dominance and the mission-critical nature of their offerings. Bellsystem24's reliance on these scalable platforms means that price adjustments or service changes from major providers can directly affect the company's cost structure and service delivery capabilities.

| Supplier Type | Key Considerations for Bellsystem24 | Impact on Bargaining Power | 2024 Data/Trends |

| Technology Providers (AI, Analytics, CRM) | Unique, integrated solutions; High switching costs | High | Continued strong demand for AI in customer service, with providers leveraging specialized IP. |

| Skilled Labor (Multilingual Agents, Tech Specialists) | Scarcity of specialized skills; High training costs | High | Labor shortages persisted in 2024, particularly for roles requiring specific language or technical proficiencies. |

| Cloud Service Providers (AWS, Azure) | Dominant market share; Mission-critical infrastructure | Substantial | Cloud spending continued to rise in 2024, with providers maintaining strong pricing power. |

What is included in the product

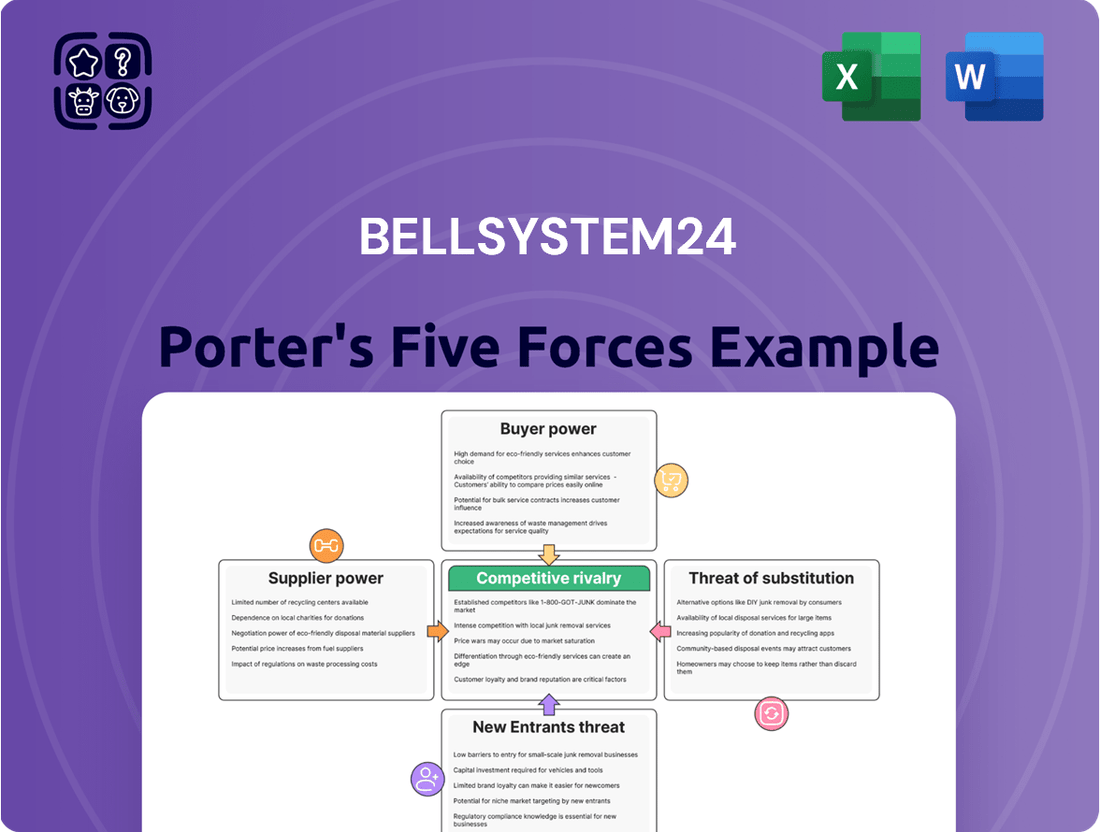

This analysis dissects the competitive forces impacting Bellsystem24, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the customer service industry.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Bellsystem24 serves a significant number of large corporate clients who require extensive business process outsourcing and contact center services. These substantial clients often possess considerable financial resources and intricate needs, which grants them significant influence in negotiating advantageous terms, pricing structures, and service level agreements.

The sheer volume of business that these large clients represent amplifies their capacity to shape contract conditions. For instance, in 2023, Bellsystem24's revenue was approximately ¥120 billion, with a substantial portion likely derived from these major corporate accounts, underscoring their bargaining power.

For standardized contact center services, switching costs for customers can be quite low. If a new provider offers comparable technology and service quality, businesses can transition relatively easily. This flexibility allows customers to readily seek out competitive pricing and switch if they're unhappy with current offerings.

Bellsystem24 needs to consistently prove its value to keep clients. In 2024, the global contact center outsourcing market was valued at approximately $11.5 billion, indicating a highly competitive landscape where customer retention is paramount. This low switching cost dynamic means Bellsystem24 must focus on delivering exceptional service and innovative solutions to maintain its market position.

The business process outsourcing (BPO) and contact center industry is quite crowded, with many companies, both within Japan and globally, offering their services. This means customers aren't limited to just one or two options when they need these services.

With so many BPO providers available, customers can easily shop around. They can compare different companies' services, pricing, and quality. This competition gives customers leverage, allowing them to negotiate for lower prices or push for more advanced services that add extra value to their business.

For instance, a significant portion of the global BPO market is served by a multitude of providers. In 2024, the global BPO market was valued at over $285 billion, with a substantial number of these companies competing for contracts. This sheer volume of choices directly translates to increased bargaining power for the customers seeking these services.

In-house Capabilities

Bellsystem24's customers, particularly large corporate clients, possess considerable bargaining power due to their ability to bring contact center operations and Business Process Outsourcing (BPO) functions in-house. This is especially true for core business activities or when handling highly sensitive data.

The option to insource provides clients with significant leverage during contract negotiations. If the cost-benefit analysis leans towards managing these functions internally, clients can simply choose to cease using Bellsystem24's services. This latent capability acts as a powerful negotiating tool, influencing pricing and service level agreements.

- Insourcing Option: Corporate clients can choose to manage BPO functions internally, particularly for core competencies.

- Negotiating Leverage: The threat of insourcing gives customers significant power in price and service negotiations.

- Cost-Benefit Analysis: Clients evaluate the economic viability of internal management versus external outsourcing.

Customization and Integration Demands

Customers frequently require bespoke solutions that integrate smoothly with their current IT infrastructure. This demand, while fostering loyalty post-implementation, grants them leverage during initial negotiations. They can push for extensive customization without substantial price increases, straining Bellsystem24's resources for development and integration.

The complexity inherent in these customization requests is a tool clients can use to their advantage. For instance, a significant portion of Bellsystem24's revenue in 2024 was derived from projects involving complex system integrations, indicating the prevalence of this customer demand.

- Customization Pressure: Customers often leverage the need for tailored solutions to negotiate favorable terms, impacting Bellsystem24's pricing power.

- Integration Complexity: The demand for seamless integration adds technical challenges and costs, which customers may expect to be absorbed.

- Resource Strain: Meeting these intricate demands can stretch Bellsystem24's development and implementation teams, potentially delaying other projects.

- Negotiation Leverage: The ability to demand extensive customization without a significant price premium highlights the customer's bargaining strength in securing tailored services.

Bellsystem24's customers, particularly large corporate clients, hold significant bargaining power. This is driven by their ability to switch providers due to low switching costs for standardized services and the option to insource operations. The global contact center outsourcing market, valued at approximately $11.5 billion in 2024, and the broader BPO market exceeding $285 billion in the same year, highlight the competitive landscape where customer retention is key. Furthermore, the demand for highly customized solutions can also be leveraged by clients to negotiate favorable terms, potentially straining Bellsystem24's resources.

| Factor | Impact on Bellsystem24 | Customer Leverage |

|---|---|---|

| Client Size & Volume | High revenue dependency | Ability to negotiate bulk discounts and favorable terms |

| Switching Costs (Standard Services) | Low retention risk | Freedom to seek competitive pricing and switch providers easily |

| Insourcing Option | Potential loss of business | Leverage to dictate pricing and service levels; threat of bringing operations in-house |

| Market Competition | Pressure on pricing and service innovation | Wide array of choices allows for comparison shopping and negotiation |

| Customization Needs | Increased development costs | Negotiating power to demand tailored solutions without significant price premiums |

Same Document Delivered

Bellsystem24 Porter's Five Forces Analysis

This preview showcases the complete Bellsystem24 Porter's Five Forces Analysis, offering a detailed examination of industry competition. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The contact center and business process outsourcing (BPO) industry is incredibly fragmented, meaning there are a lot of companies out there. This includes everything from small, local operations to massive global corporations. Bellsystem24 has to compete with all of them, which really heats things up.

This intense competition, with so many players fighting for the same business, naturally pushes prices down. It also means companies like Bellsystem24 need to constantly find new ways to stand out from the crowd and offer services that are truly different and better than what others provide.

The market for basic customer support and general business process outsourcing (BPO) services faces significant commoditization pressure, making price a key competitive factor. This trend forces companies like Bellsystem24 to actively seek differentiation through advanced offerings.

Bellsystem24 must innovate by integrating AI, providing advanced analytics, and developing specialized industry knowledge to move beyond cost-based competition. In 2024, the global BPO market was valued at approximately $271.2 billion, with a substantial portion attributed to customer care services, highlighting the intense competition in this segment.

Competitors are heavily investing in AI and automation, driving a technology race to boost efficiency and cut costs. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant portions dedicated to operational enhancements.

Bellsystem24 needs to match these rapid technological advancements to stay competitive. This necessitates substantial capital investment and strategic planning to integrate new AI and automation solutions effectively.

Falling behind in this technological evolution could significantly erode Bellsystem24's market position and ability to offer cost-effective services compared to rivals.

Talent Acquisition and Retention

Bellsystem24 faces significant competitive rivalry in acquiring and retaining talent. The battle for skilled contact center agents, IT specialists, and BPO professionals is fierce, directly impacting operational costs and service quality.

This talent scarcity can lead to increased labor expenses, as companies must offer competitive salaries and benefits to attract and keep valuable employees. For instance, in 2024, the average hourly wage for contact center agents in many developed markets saw an upward trend, reflecting this competitive pressure.

- Talent Competition: Rivals actively recruit from the same limited pool of skilled BPO and IT professionals.

- Cost Inflation: Intense competition for talent drives up labor costs, impacting profitability.

- Quality Impact: Difficulty in attracting and retaining staff can compromise service quality and operational consistency.

- Retention Strategies: Companies must invest in attractive compensation packages and positive work environments to retain their workforce.

Geographic Expansion and Niche Specialization

Rivalry in the BPO sector is intensifying as companies like Transcom Worldwide and Concentrix expand their global reach. For instance, Transcom has been actively acquiring companies in North America and Asia, aiming to broaden its service offerings and client base. Bellsystem24 needs to consider similar strategic geographic moves or focus on deepening its expertise in high-growth niches, such as AI-powered customer service solutions, to counter these broad-based expansions.

Niche specialization is another key battleground. Competitors are carving out specific market segments, like healthcare or financial services BPO, to build deep domain knowledge and tailored solutions. Bellsystem24's strategy must involve either identifying underserved niches where it can excel or bolstering its capabilities in existing high-demand sectors to maintain a competitive edge against both generalist providers and highly specialized players.

- Geographic Expansion: Competitors like Teleperformance are investing heavily in emerging markets, with significant growth reported in their Latin American operations in 2024.

- Niche Specialization: Companies focusing on cybersecurity BPO, a rapidly growing field, are seeing substantial revenue increases, with some reporting over 25% year-over-year growth in 2024.

- Strategic Positioning: Bellsystem24 must analyze market trends to determine whether broad geographic reach or deep specialization in areas like digital transformation services offers the most sustainable competitive advantage.

Bellsystem24 operates in a highly competitive landscape with numerous players, from small local firms to global giants, all vying for market share. This intense rivalry, especially in commoditized services like basic customer support, drives down prices and necessitates constant innovation. For instance, the global BPO market, valued at roughly $271.2 billion in 2024, demonstrates the sheer scale of competition.

Competitors are aggressively investing in AI and automation to enhance efficiency, creating a technology arms race. This trend is evident in the projected growth of the AI market, which is expected to reach hundreds of billions of dollars in 2024, with a significant portion allocated to operational improvements. Bellsystem24 must keep pace with these advancements to avoid losing ground.

The struggle for skilled talent is another critical aspect of this rivalry. Companies are competing fiercely for experienced contact center agents and IT professionals, leading to increased labor costs. In 2024, average hourly wages for contact center agents saw an upward trend in many developed economies, underscoring the pressure on talent acquisition and retention.

| Competitor Focus | 2024 Market Trend | Impact on Bellsystem24 |

|---|---|---|

| Geographic Expansion (e.g., Transcom) | Growth in North America & Asia | Requires strategic geographic moves or niche focus |

| Niche Specialization (e.g., Cybersecurity BPO) | Over 25% YoY growth in specialized fields | Need to identify underserved niches or deepen existing expertise |

| AI & Automation Investment | Significant portion of global AI market spend | Necessitates capital investment to integrate advanced solutions |

| Talent Acquisition & Retention | Upward wage trends for agents | Pressure to offer competitive compensation and improve work environment |

SSubstitutes Threaten

The most direct substitute for Bellsystem24's outsourced customer service is a client's choice to handle these functions internally. Many businesses, particularly those dealing with highly sensitive customer data or core strategic functions, might consider bringing customer service operations in-house to exert tighter control and ensure data privacy. This internal management is a constant alternative that potential clients weigh when evaluating outsourcing partners.

The increasing sophistication of AI-powered chatbots and virtual assistants presents a significant threat of substitutes for Bellsystem24's core contact center services. These automated solutions, driven by advancements in natural language processing, can handle a growing range of customer inquiries and self-service tasks, directly competing with human-led support. For instance, in 2024, many businesses are investing heavily in AI to manage customer interactions, with some reports indicating that AI can handle up to 80% of routine customer service queries, thereby reducing the reliance on traditional call centers.

Customers are increasingly turning to self-service options like FAQs and online knowledge bases to solve their problems. This trend directly impacts companies like Bellsystem24, as it means fewer customers will need to contact a call center for basic support. For instance, a 2024 survey indicated that over 70% of consumers prefer self-service options for simple queries, a significant increase from previous years.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) presents a significant threat of substitutes for Business Process Outsourcing (BPO) services like those offered by Bellsystem24. RPA enables companies to automate routine, rule-based tasks internally, bypassing the need for external BPO providers for specific functions. This internal automation capability directly competes with traditional outsourced services.

For instance, a company might previously outsource data entry or customer service query handling to a BPO firm. However, with advancements in RPA, they can now implement software robots to perform these tasks more efficiently and cost-effectively in-house. This reduces the overall demand for external BPO support for such processes.

- RPA adoption is growing: Gartner predicted that worldwide RPA software revenue would reach $3.5 billion in 2021, an increase of 19.5% from 2020, indicating a strong trend towards internal automation.

- Cost savings drive adoption: Companies are increasingly looking to RPA to reduce operational costs, with many reporting significant savings compared to manual labor or outsourced services.

- Internal capabilities reduce outsourcing needs: As businesses build their internal RPA expertise, their reliance on external BPO providers for automatable tasks diminishes.

Alternative Communication Channels

The rise of alternative communication channels poses a significant threat to Bellsystem24. Social media direct messaging, in-app support, and community forums allow companies to interact with customers directly, bypassing traditional contact center services. For instance, a significant portion of customer service inquiries, estimated to be over 40% by some reports in 2024, are now being handled through these digital avenues.

If client companies can effectively manage these channels internally, their reliance on external providers like Bellsystem24 diminishes. This can lead to a reduction in demand for outsourced voice and email support. Many businesses are investing in their own customer relationship management (CRM) systems and digital engagement platforms to manage these interactions, aiming for greater control and cost efficiency.

- Social Media Messaging: Platforms like LINE, WhatsApp, and Facebook Messenger are increasingly used for customer service.

- In-App Support: Many mobile applications now integrate chat or messaging features for direct customer assistance.

- Community Forums: Companies are fostering online communities where customers can help each other, reducing the need for direct support.

- Direct Management: Clients taking these communication channels in-house reduces the outsourcing market for traditional contact centers.

The threat of substitutes for Bellsystem24's services is significant and multifaceted, driven by technological advancements and evolving customer preferences. Companies can opt for in-house customer service, leveraging internal resources and tighter control over sensitive data. Furthermore, the rise of AI-powered chatbots and sophisticated self-service options like FAQs and knowledge bases directly compete with traditional contact center functions, as many customers now prefer resolving issues independently. By 2024, over 70% of consumers favored self-service for straightforward inquiries, a trend that diminishes the need for outsourced support. Robotic Process Automation (RPA) also enables businesses to automate routine tasks internally, reducing their reliance on external BPO providers for functions like data entry or basic query handling.

| Substitute Type | Description | Impact on Bellsystem24 | 2024 Trend/Data Point |

|---|---|---|---|

| In-house Handling | Clients manage customer service internally. | Reduces demand for outsourced services. | Clients seek tighter control over sensitive data. |

| AI Chatbots/Virtual Assistants | Automated customer interaction. | Handles routine queries, reducing need for human agents. | AI can manage up to 80% of routine customer queries. |

| Self-Service Options | FAQs, knowledge bases, online portals. | Customers resolve issues independently, bypassing contact centers. | Over 70% of consumers prefer self-service for simple queries. |

| Robotic Process Automation (RPA) | Internal automation of routine tasks. | Decreases need for external BPO for specific functions. | Growing adoption for cost reduction and efficiency. |

| Alternative Communication Channels | Social media, in-app support, community forums. | Bypasses traditional contact centers if managed internally. | Over 40% of inquiries handled via digital avenues. |

Entrants Threaten

Entering the contact center and BPO sector, particularly for a company like Bellsystem24, necessitates a substantial initial investment. This includes acquiring cutting-edge technology for customer interaction management, building resilient IT infrastructure, and establishing secure data centers. For instance, the global contact center market was valued at approximately $45.5 billion in 2023 and is projected to grow, indicating the scale of investment required to compete effectively.

This high capital expenditure acts as a significant deterrent for potential new entrants. Establishing a competitive and scalable operation from scratch demands considerable financial resources, making it a substantial hurdle for smaller or less capitalized firms looking to enter the market.

New entrants into the business process outsourcing (BPO) sector, like Bellsystem24, must surmount the hurdle of assembling a workforce possessing specialized skills. This includes expertise in areas such as advanced customer interaction management, sophisticated technical support, in-depth data analysis, and niche industry-specific BPO operations.

The acquisition and retention of this highly skilled talent represent a substantial cost and a significant barrier. For instance, in 2024, the average cost to hire a skilled BPO professional in many developed markets can range from $5,000 to $15,000, reflecting the demand for specialized knowledge. This difficulty in sourcing and keeping such talent makes it challenging for new companies to compete effectively against established players like Bellsystem24, who have already invested in developing their human capital.

Bellsystem24, like many established players in the business process outsourcing (BPO) sector, leverages a strong brand reputation and deeply ingrained client trust. This is a significant barrier for newcomers. For instance, in 2024, securing contracts with major corporations often hinges on a proven track record of reliability and data security, areas where incumbents have a distinct advantage.

New entrants face an uphill battle in replicating the credibility that Bellsystem24 has cultivated over years of consistent service delivery. The process of building trust, particularly for handling sensitive customer information and mission-critical operations, is a lengthy and resource-intensive endeavor, often taking a decade or more to establish a solid footing in the market.

Economies of Scale and Scope

Bellsystem24, like other established Business Process Outsourcing (BPO) providers, benefits significantly from economies of scale. This allows them to spread fixed costs over a larger volume of operations, leading to lower per-unit costs and enabling competitive pricing. For instance, in 2024, the global BPO market was valued at over $250 billion, with larger players capturing a substantial share due to their operational efficiencies.

New entrants face a considerable hurdle in matching these cost advantages. Operating at a smaller scale, they typically cannot achieve the same level of efficiency or negotiate favorable terms with suppliers, making it difficult to compete on price. This cost disadvantage can deter potential new players from entering the market, as achieving profitability from the outset is a significant challenge.

- Economies of Scale: Bellsystem24's large operational footprint allows for cost efficiencies that new, smaller entrants struggle to replicate.

- Cost Advantage: Scale directly translates into a cost advantage, making it harder for new companies to offer competitive pricing.

- Market Entry Barrier: The inability to immediately match existing cost structures acts as a significant barrier to entry for new BPO providers.

Regulatory Compliance and Data Security Requirements

The contact center and business process outsourcing (BPO) sector faces significant hurdles for new players due to rigorous regulatory compliance and data security mandates. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict rules on handling personal data. New entrants must allocate substantial resources to understand and implement these complex legal frameworks, alongside investing in advanced cybersecurity infrastructure to protect sensitive client information. This compliance is not optional; it represents a substantial and ongoing cost of doing business.

Navigating these requirements can be particularly challenging for smaller or less capitalized entrants. For example, in 2024, the average cost for a company to recover from a data breach was estimated to be around $4.73 million, highlighting the financial risk associated with inadequate security. Bellsystem24, like established players, must continuously invest in maintaining compliance and robust data protection, which acts as a deterrent for potential new competitors who may lack the capital or expertise to meet these standards.

- Stringent Data Privacy Laws: Regulations like GDPR and CCPA demand meticulous data handling, increasing operational complexity and cost for new entrants.

- Significant Cybersecurity Investment: New companies must invest heavily in advanced security measures to protect client data, a costly barrier to entry.

- High Compliance Costs: Meeting regulatory standards is a non-negotiable and expensive requirement, particularly impacting firms with limited financial resources.

- Operational Complexity: Understanding and adhering to diverse and evolving legal frameworks adds a layer of difficulty for market newcomers.

The threat of new entrants for Bellsystem24 is moderate, largely due to the high capital requirements and established brand loyalty in the contact center and BPO industry. Significant upfront investment in technology, infrastructure, and skilled talent poses a considerable barrier. For instance, the global BPO market size was estimated to exceed $250 billion in 2024, showcasing the scale of operations required to be competitive.

New companies must also overcome the challenge of building trust and a proven track record, which takes considerable time and consistent service delivery. Regulatory compliance and data security mandates, such as GDPR and CCPA, add further complexity and cost, requiring substantial investment in cybersecurity and legal expertise. The average cost to recover from a data breach in 2024 was around $4.73 million, underscoring the financial risks involved.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment in technology, infrastructure, and data centers. | Significant financial hurdle. |

| Talent Acquisition & Retention | Need for specialized skills in customer management, data analysis, etc. | Costly and time-consuming to build a skilled workforce. |

| Brand Reputation & Trust | Established players like Bellsystem24 benefit from long-term client relationships. | Difficult for newcomers to gain credibility and secure major contracts. |

| Economies of Scale | Larger firms have lower per-unit costs due to operational efficiencies. | New entrants struggle to compete on price. |

| Regulatory Compliance | Adherence to data privacy laws (e.g., GDPR, CCPA) and cybersecurity standards. | Increases operational complexity and costs, demanding significant investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bellsystem24 is built upon a foundation of robust data, including Bellsystem24's annual reports, investor relations disclosures, and industry-specific market research reports. We also incorporate insights from financial databases and competitive intelligence platforms to provide a comprehensive view of the competitive landscape.