Belfor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Belfor Bundle

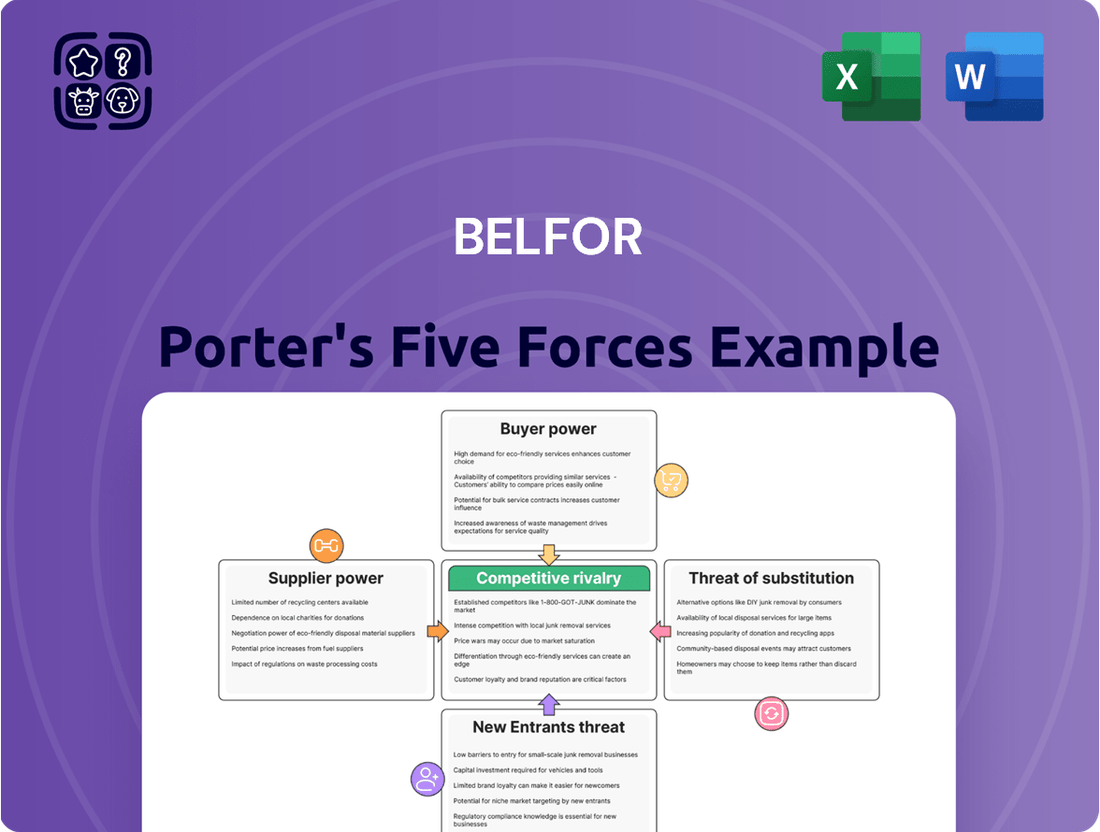

Porter's Five Forces Analysis reveals the intense competitive landscape for Belfor, highlighting significant threats from new entrants and the bargaining power of buyers. Understanding these dynamics is crucial for navigating its market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Belfor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Belfor's reliance on specialized equipment, including industrial dehumidifiers and advanced drying systems, positions suppliers of these niche technologies with moderate bargaining power. If these suppliers offer unique capabilities or hold significant intellectual property, it can limit Belfor's alternatives and increase switching costs. For instance, a supplier of proprietary thermal imaging technology crucial for damage assessment could command higher prices.

The availability of highly trained and certified restoration professionals, such as IICRC-certified technicians for water, fire, and mold remediation, is a critical factor for Belfor. A scarcity of these specialized workers or a surge in demand for subcontractors skilled in complex structural repairs or environmental cleanup can significantly enhance their bargaining power. This increased leverage can lead to higher labor costs, potentially affecting Belfor's project timelines and overall profitability, especially in areas with frequent disaster events.

Belfor sources a diverse array of building materials, including drywall, lumber, insulation, and flooring. The market for these items is largely characterized by commodity products, meaning there are many different companies that can supply them. This abundance of options generally weakens the bargaining power of individual material suppliers when dealing with a large buyer like Belfor.

However, the dynamic can shift. During periods of exceptionally high demand, such as in the aftermath of widespread natural disasters where Belfor's services are critically needed, major material suppliers might gain temporary leverage. This increased power stems from potential supply chain bottlenecks and the sheer volume of materials required, making it harder for Belfor to switch suppliers quickly for large-scale projects.

Fuel and Transportation Services

The bargaining power of suppliers in fuel and transportation services for Belfor is a key consideration. As a company that relies heavily on rapid deployment of crews and equipment, fuel and transportation represent a substantial operational cost. While fuel itself is a commodity, its price fluctuations can directly affect Belfor's bottom line.

In 2023, global average crude oil prices, a primary driver of fuel costs, experienced significant volatility, with Brent crude averaging around $82 per barrel. This volatility underscores the sensitivity of Belfor's operational expenses to energy markets.

- Fuel Costs: Global oil price volatility directly impacts Belfor's fuel expenses. For instance, a sustained increase in crude oil prices, as seen periodically in 2023 and early 2024, can significantly raise operating costs.

- Fleet Vehicle Suppliers: While the market for fleet vehicles and maintenance services is generally competitive, specialized equipment or long-term service contracts could grant some suppliers leverage. However, the broad availability of automotive and maintenance providers typically limits extreme supplier power.

- Transportation Logistics: For specialized transportation needs, such as heavy equipment hauling, the number of qualified providers might be smaller, potentially increasing supplier influence. Yet, the overall logistics market remains robust, offering alternatives.

- Impact on Profitability: Managing these supplier relationships and mitigating cost fluctuations is crucial for maintaining profitability in Belfor's service-driven business model.

Insurance and Risk Management Services

Insurance providers, essential for covering the inherent risks in disaster recovery, wield considerable bargaining power over Belfor. These suppliers, often large and consolidated, offer specialized coverage for general liability, professional indemnity, and workers' compensation, crucial for high-risk restoration work.

The specialized nature of these insurance products and the potential for substantial claims grant insurers significant leverage, directly impacting Belfor's operational costs and overall risk exposure.

- High concentration of insurance providers: A limited number of large insurers dominate the market for specialized business insurance.

- Specialized coverage requirements: Disaster recovery services necessitate unique and often costly insurance policies.

- Potential for large claims: The nature of restoration work can lead to significant insurance payouts, increasing supplier leverage.

- Regulatory compliance: Adherence to insurance mandates for contractors influences supplier choice and negotiation power.

Suppliers of specialized restoration equipment and proprietary technologies hold moderate bargaining power, particularly if their offerings are unique or protected by intellectual property, increasing Belfor's switching costs. Conversely, suppliers of common building materials face limited leverage due to the competitive nature of that market, though this can shift during periods of high demand following natural disasters.

The bargaining power of suppliers is a critical factor for Belfor, influencing operational costs and strategic flexibility. While many of Belfor's material needs are met by a competitive commodity market, the availability of specialized labor and the cost of fuel and transportation present more significant areas where suppliers can exert influence.

In 2024, the ongoing demand for skilled restoration technicians, particularly those certified in advanced remediation techniques, continues to give these professionals increased leverage. This is further exacerbated by a general labor shortage in skilled trades. Similarly, fluctuations in global energy markets, with crude oil prices remaining a key variable, directly impact Belfor's fuel and logistics expenses.

| Supplier Category | Bargaining Power Factor | Impact on Belfor | 2024 Data/Trend |

|---|---|---|---|

| Specialized Equipment | Uniqueness of Technology, IP | Potential for higher prices, limited alternatives | Moderate, dependent on specific tech providers |

| Building Materials | Market Competition, Volume | Generally low, but can increase during demand spikes | Competitive, but supply chain disruptions remain a risk |

| Skilled Labor | Scarcity of Certified Professionals | Higher labor costs, potential project delays | High, driven by demand and labor shortages |

| Fuel & Transportation | Global Oil Prices, Logistics Capacity | Increased operational costs, impact on profitability | Volatile; Brent crude prices averaged around $83/barrel in Q1 2024 |

| Insurance Providers | Market Concentration, Specialized Needs | Higher insurance premiums, increased risk management costs | High, due to consolidation and specialized risk coverage |

What is included in the product

Analyzes the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes impacting Belfor's industry.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategy development.

Customers Bargaining Power

Insurance companies stand out as Belfor's most significant indirect customers, wielding considerable influence over the restoration industry. Their ability to direct policyholders to specific vendors and dictate the terms, scope, and pricing of repair work grants them substantial bargaining power.

With their consolidated purchasing power and vast networks, insurers can steer a large volume of business, which puts significant leverage on restoration companies like Belfor. This often translates into competitive bidding processes, the establishment of standardized pricing structures, and the enforcement of rigorous service level agreements to ensure efficient and cost-effective claims handling.

Belfor's operational success and revenue streams are therefore closely tied to its ability to cultivate and maintain strong, collaborative relationships with these insurance giants. Meeting their exacting demands and demonstrating consistent value are paramount for securing and retaining a steady flow of restoration projects, especially considering the competitive landscape where insurers can easily switch between preferred vendors.

Large commercial and industrial clients wield substantial bargaining power due to the significant investments and operational continuity at stake in property restoration. These sophisticated buyers often engage in rigorous bidding processes, seeking tailored solutions and demanding rapid, reliable outcomes.

Their capacity to compare offers and, in some cases, manage smaller restoration tasks internally, allows them to negotiate favorable terms. For instance, a major manufacturing plant facing a significant water damage event in 2024 might solicit bids from several restoration firms, potentially delaying the project if pricing or service guarantees aren't met, thereby pressuring Belfor on pricing and service delivery.

Residential homeowners, while individually possessing limited direct bargaining power with restoration companies like Belfor due to the often urgent nature of their needs and a lack of specialized knowledge, exert influence through their insurance providers. These homeowners prioritize reliability, speed, and compassionate service during stressful events, and their satisfaction directly impacts Belfor's reputation and future contract opportunities, especially as insurance companies often steer policyholders toward preferred vendors.

Government and Public Sector Entities

Government and public sector entities, such as municipal building departments or federal agencies, often procure restoration services for public infrastructure and facilities. For instance, in 2024, many local governments continued to invest in infrastructure repair and maintenance, with significant portions of their budgets allocated to such projects.

These clients typically operate with stringent budget limitations and engage in competitive bidding processes. This means they prioritize transparency, strict adherence to regulations, and often mandate specific certifications or the inclusion of disadvantaged business enterprises in their contracts, thereby amplifying their bargaining power by demanding cost-effectiveness and compliance with public policy objectives.

- Government Procurement Focus: Public sector clients prioritize cost-effectiveness and compliance in restoration service contracts.

- Budgetary Constraints: Strict budget limitations empower these entities to negotiate favorable terms.

- Competitive Bidding: The competitive bidding process intensifies customer bargaining power by driving down prices.

- Regulatory Requirements: Mandates for certifications and disadvantaged business participation further strengthen their negotiating position.

Urgency of Service Needs

In immediate disaster scenarios, the urgency of property restoration services significantly reduces customer bargaining power. Clients facing events like floods or fires prioritize rapid response and damage mitigation to prevent further financial and property loss. This critical need allows companies like Belfor to secure fair pricing and terms during emergency situations, as speed and effectiveness are paramount.

For instance, during a widespread natural disaster, the sheer volume of demand coupled with the time-sensitive nature of repairs can lead to a temporary shift in leverage towards the service provider. While long-term customer relationships and overall satisfaction are vital for sustained business, the immediate crisis often dictates the terms of engagement.

- Urgency Drives Demand: In disaster recovery, the immediate need for services like water damage restoration or fire damage cleanup limits a customer's ability to negotiate extensively on price or terms.

- Mitigation is Key: Property owners are willing to pay a premium for rapid intervention to prevent secondary damage, such as mold growth after water intrusion or structural compromise after a fire.

- Belfor's Position: This urgency allows Belfor to command pricing that reflects the specialized equipment, skilled labor, and immediate availability required, ensuring business continuity and profitability during critical periods.

- Market Dynamics: In 2024, the increasing frequency and severity of extreme weather events globally are expected to further amplify the urgency of restoration services, potentially strengthening the bargaining position of capable providers.

Insurance companies are significant customers for Belfor, wielding considerable power by directing policyholders and dictating terms, scope, and pricing. Their consolidated purchasing power and extensive networks allow them to steer substantial business, leading to competitive bidding and standardized pricing structures. Maintaining strong relationships with these insurers is crucial for Belfor's revenue, as they can easily switch preferred vendors.

Large commercial clients also possess strong bargaining power due to the critical nature of property restoration for their operations. These sophisticated buyers often conduct rigorous bidding, seek tailored solutions, and demand rapid, reliable outcomes. Their ability to compare offers and manage smaller tasks internally pressures Belfor on pricing and service delivery, as seen when a major manufacturing plant in 2024 might delay a project if terms aren't met.

While individual homeowners have limited direct power, they influence Belfor through their insurers. Homeowners prioritize reliability and speed, and their satisfaction impacts Belfor's reputation and future contracts. Government entities, like municipal departments, also exert power through strict budget limitations and competitive bidding processes, prioritizing cost-effectiveness and regulatory compliance.

In urgent disaster scenarios, Belfor's bargaining power temporarily increases as clients prioritize rapid response over price. The frequency of extreme weather events in 2024 further amplifies this urgency, allowing capable providers to command pricing reflecting immediate availability and specialized resources.

| Customer Segment | Bargaining Power Factors | Impact on Belfor |

|---|---|---|

| Insurance Companies | Consolidated purchasing power, vendor direction, pricing control | Pressure on pricing, need for strong relationships and service level agreements |

| Large Commercial/Industrial Clients | High stakes for operational continuity, rigorous bidding, comparison shopping | Demands for tailored solutions, rapid response, and competitive pricing |

| Residential Homeowners | Indirect influence via insurers, focus on reliability and speed | Reputation management, importance of customer satisfaction for insurer referrals |

| Government/Public Sector | Budget constraints, competitive bidding, regulatory compliance | Emphasis on cost-effectiveness, transparency, and adherence to mandates |

Preview the Actual Deliverable

Belfor Porter's Five Forces Analysis

This preview displays the complete Belfor Porter's Five Forces Analysis, offering a thorough examination of competitive forces. You are seeing the exact, professionally formatted document that will be available for immediate download upon purchase. This ensures you receive a ready-to-use, comprehensive strategic tool without any discrepancies or placeholder content.

Rivalry Among Competitors

The property restoration sector is incredibly fragmented, featuring a vast number of local, regional, and national businesses all vying for customers. While big names like Servpro and Paul Davis are well-known, the market also includes thousands of smaller, independent restoration companies, creating a crowded competitive landscape.

This intense competition often drives pricing down, particularly for routine or smaller restoration jobs. For instance, in 2024, industry reports indicated that average pricing for water damage restoration services saw a slight decrease in some regions due to the sheer volume of providers willing to take on projects, putting pressure on profit margins across the board.

While many restoration firms handle routine water and fire damage, Belfor stands out by offering specialized services like complex industrial restoration and large-loss recovery. This focus on niche capabilities lessens the direct impact of many smaller competitors.

Belfor's robust reputation for reliability and efficiency, especially in managing large-scale projects, allows it to command higher prices. This strong brand image also helps secure preferred vendor status with major insurance companies, thereby reducing direct price-based competition.

Competitive rivalry in the disaster recovery sector is significantly shaped by a company's geographic reach and its capacity to scale operations quickly. Larger entities like Belfor, boasting a broad network of facilities and a substantial workforce, are better positioned to manage widespread emergencies and cater to clients with multiple sites.

This extensive footprint allows Belfor to deploy resources efficiently across different regions, a crucial factor in disaster response. For instance, in 2024, Belfor's ability to mobilize teams across multiple states following significant weather events demonstrated this advantage. Smaller, regionally focused competitors often find themselves outmatched in such scenarios, facing intensified competition within their more confined operational zones.

Relationship with Insurance Carriers

Strong relationships with insurance carriers are a cornerstone of competitive rivalry in the restoration sector. Companies that secure preferred vendor status or participate in managed repair programs with major insurers benefit from a consistent flow of claims, a critical advantage in a fragmented market.

The competition to forge and maintain these insurer partnerships is intense. For instance, in 2024, major restoration firms actively pursued agreements with top-tier insurers like State Farm and Allstate, recognizing that these partnerships can account for a significant portion of their annual revenue, often exceeding 50% for preferred vendors.

These preferred vendor relationships streamline the claims process, reduce marketing costs associated with direct customer acquisition, and provide a more predictable revenue stream. This focus on insurer relationships means that companies not holding such agreements must invest more heavily in marketing and sales to secure comparable business volumes.

- Preferred Vendor Agreements: Key differentiator for securing consistent claims volume.

- Managed Repair Programs: Insurers directing work to pre-approved restoration companies.

- Revenue Impact: Preferred vendors can see over 50% of revenue tied to insurer relationships in 2024.

- Competitive Advantage: Reduced need for direct customer acquisition and marketing spend.

Investment in Technology and Training

Ongoing investment in advanced restoration technology, like specialized drying equipment and moisture detection tools, alongside robust employee training and certifications such as IICRC, significantly differentiates companies in this sector. For instance, Belfor, a prominent player, consistently invests in cutting-edge technology to enhance service efficiency and compliance. This commitment allows them to offer superior solutions, attracting clients who value quality and professionalism, thereby mitigating direct price competition.

Firms that prioritize these technological and training advancements can command higher prices and build stronger client loyalty. This strategic focus creates a notable barrier to entry for less capitalized or less committed competitors. In 2024, the restoration industry saw continued demand for specialized services, with companies highlighting their technological capabilities as a key selling point. This investment strategy helps foster a more stable competitive landscape by rewarding expertise and innovation.

- Technological Investment: Companies like Belfor invest in advanced drying, moisture detection, and project management software.

- Employee Training: Continuous training and certifications, such as IICRC, are crucial differentiators.

- Client Attraction: Quality and professionalism attract clients, reducing focus on price alone.

- Competitive Barrier: These investments create a barrier for less sophisticated competitors.

Competitive rivalry in property restoration is fierce, driven by a fragmented market with numerous local and national players. While many firms compete on price for standard jobs, companies like Belfor differentiate through specialized services and strong insurer relationships. This intense competition pressures profit margins, especially for less specialized providers.

Belfor's competitive edge is bolstered by its extensive geographic reach, allowing it to manage large-scale disasters more effectively than smaller, regional competitors. In 2024, its ability to deploy resources across multiple states for widespread weather events highlighted this advantage. This scale reduces direct competition within localized markets.

Securing preferred vendor status with major insurance carriers is a critical battleground, with companies like Belfor leveraging these relationships for consistent claims volume. In 2024, these partnerships accounted for over 50% of revenue for many preferred vendors, significantly reducing their reliance on direct customer acquisition.

Investment in advanced technology and employee certifications, such as IICRC, further separates leading firms. Belfor's commitment to these areas in 2024 allowed it to offer superior solutions, attracting clients who prioritize quality and professionalism over price alone, thereby creating a competitive barrier.

| Competitive Factor | Belfor's Approach | Impact on Rivalry | 2024 Data/Trend |

|---|---|---|---|

| Market Fragmentation | Operates nationally with a broad network | Intensifies rivalry for smaller players | High volume of local competitors |

| Specialization | Focus on large-loss and industrial restoration | Reduces direct competition with smaller firms | Growing demand for specialized services |

| Insurer Relationships | Secures preferred vendor status | Provides consistent claims volume, reduces marketing needs | Over 50% of revenue for preferred vendors |

| Technology & Training | Invests in advanced equipment and certifications | Differentiates on quality, commands higher prices | Key selling point for attracting quality clients |

SSubstitutes Threaten

For minor property damage, homeowners increasingly consider do-it-yourself (DIY) solutions as a substitute for professional restoration. This can involve tackling small water leaks, odor removal, or cosmetic repairs. While not a replacement for significant damage, this DIY trend directly impacts the lower-tier services offered by companies like Belfor.

While general contractors can handle reconstruction, they often lack the specialized skills and equipment for initial damage mitigation and sanitation. Property owners might opt for a general contractor directly for reconstruction if the damage is purely structural and doesn't involve complex environmental issues like mold or hazardous materials, bypassing specialized restoration firms.

However, general contractors typically do not possess the advanced training, certifications, or dedicated machinery that companies like Belfor utilize for thorough damage control. This makes them an imperfect substitute, as their capabilities usually end at rebuilding rather than comprehensive restoration and decontamination.

In situations where a property suffers catastrophic damage, insurance providers may classify it as a total loss or offer a cash buyout instead of covering restoration costs. This outcome, while not a direct service substitution, effectively eliminates the need for restoration companies like Belfor.

In 2024, the average homeowners insurance claim for catastrophic damage, such as from major floods or fires, often exceeded $50,000, with some reaching hundreds of thousands of dollars. Insurers make the total loss determination by comparing the estimated repair costs to the property's pre-loss market value, often using a threshold of 75-80% of the value.

Internal Facility Maintenance Teams

Large commercial and industrial clients often maintain in-house facility maintenance teams. These teams can address minor property damage or emergency cleanup needs, acting as a direct substitute for external restoration firms in smaller-scale situations. This internal capability can limit the demand for specialized restoration services for less severe incidents.

While internal teams can handle routine maintenance and minor repairs, their capacity for large-scale disasters or highly specialized remediation is typically limited. For instance, a significant fire or water damage event often requires specialized equipment and expertise that in-house teams may not possess. This limitation often necessitates the outsourcing of major restoration projects, even for clients with substantial internal maintenance resources.

- Limited Scope: Internal teams are generally equipped for minor damage, not extensive disaster recovery.

- Expertise Gap: Specialized remediation techniques and advanced equipment are often beyond in-house capabilities.

- Scalability Issues: Large-scale events can overwhelm the resources of internal maintenance departments.

- Cost-Effectiveness: For major incidents, professional restoration firms may offer more cost-effective solutions due to specialized tools and trained personnel.

Ignoring the Damage or Delayed Action

While not a direct substitute in the traditional sense, the threat of inaction or delayed action by property owners, particularly in the residential sector, presents a passive form of substitution for restoration services. Many property owners, facing financial limitations or simply underestimating the severity of minor damage, opt to postpone professional repairs. This avoidance strategy, while bypassing immediate restoration costs, can lead to compounding issues and significantly higher expenses down the line, effectively substituting immediate professional intervention with future, more extensive, and costly remediation.

This passive substitution is driven by several factors. Financial constraints are a primary driver, especially for homeowners managing tight budgets. For instance, a 2024 survey indicated that nearly 40% of homeowners delayed essential home repairs due to cost concerns. Furthermore, a lack of awareness regarding the potential for secondary damage, such as mold growth from undetected water leaks, or a simple underestimation of the problem's scope, contributes to this delay. This 'do nothing' approach, though not a direct competitive offering, effectively bypasses the demand for immediate restoration services.

- Delayed Action as Substitution: Property owners may opt to ignore minor damage, effectively substituting professional restoration services with procrastination.

- Financial Constraints: Budget limitations are a significant driver, with many homeowners delaying repairs due to cost, as reported in 2024 surveys.

- Underestimation of Risk: Lack of awareness about secondary damage or underestimating the problem's severity encourages inaction.

- Long-Term Cost Implications: This passive substitution leads to further deterioration and potentially much higher remediation costs in the future.

The threat of substitutes for Belfor's services comes from various sources, including DIY solutions for minor damage and general contractors for reconstruction. While these options may appear cost-effective initially, they often lack the specialized expertise and equipment necessary for comprehensive restoration, potentially leading to greater long-term costs.

In 2024, the increasing trend of homeowners undertaking minor repairs themselves, often referred to as DIY, directly impacts the lower-end service offerings of restoration companies. For example, tackling small water leaks or odor removal without professional help bypasses the need for specialized mitigation services.

General contractors, while capable of reconstruction, typically do not possess the advanced training or specialized equipment for critical mitigation and sanitation phases. This means that for damage extending beyond simple structural repairs, they are an imperfect substitute for firms like Belfor.

The option for an insurance provider to declare a property a total loss, offering a cash payout instead of covering restoration, effectively eliminates the need for restoration services. In 2024, major catastrophic damage claims frequently surpassed $50,000, with insurers often deeming properties a total loss if repair costs exceed 75-80% of the pre-loss value.

Entrants Threaten

Entering the property restoration sector, particularly to compete with a company like Belfor, demands a substantial capital outlay. This includes acquiring specialized equipment, such as extensive vehicle fleets, industrial-grade dehumidifiers, air scrubbers, thermal imaging cameras, and sophisticated drying apparatus. For instance, a single industrial water damage restoration truck can cost upwards of $100,000 to $200,000 fully equipped.

The sheer cost of building and maintaining a comprehensive inventory of such advanced machinery presents a formidable barrier. Startups often find it challenging to secure the necessary financing to match the operational capacity and technological sophistication of established players like Belfor, thereby limiting the immediate threat of new entrants.

The property restoration industry, including areas like water damage and fire restoration, requires specific skills and certifications, such as those from the IICRC. Building a team with this specialized knowledge and keeping them trained is a significant investment of both time and money.

New companies entering this market struggle to find, train, and keep employees with these crucial qualifications. This difficulty in assembling a qualified workforce acts as a substantial hurdle, deterring potential new competitors.

Established relationships with insurance carriers represent a significant hurdle for new entrants. These aren't just casual connections; they often involve formal preferred vendor programs and direct referral agreements that consistently funnel business to established players. For instance, in 2024, the property restoration market saw a continued reliance on these insurer partnerships, with major carriers actively managing their networks of approved service providers.

Brand Reputation and Trust

In the critical field of disaster recovery, where urgency and emotional distress are common, a firm's brand reputation and the trust it has cultivated are incredibly important. Clients, whether they own homes or businesses, need to be sure they are hiring a reliable and well-regarded company to manage the restoration of their property.

Established companies, such as Belfor, have spent years, even decades, building a strong reputation and widespread recognition. This deep-seated trust is a significant hurdle for new companies entering the market. For newcomers to gain traction, they typically need to make substantial investments in marketing campaigns and consistently deliver high-quality services to prove their worth and overcome the established players' credibility.

- Belfor’s extensive history, dating back to its founding in 1946, has allowed it to build a robust brand synonymous with disaster recovery.

- Customer testimonials and industry awards, often highlighted in marketing, serve as crucial trust signals that new entrants must replicate.

- The high cost of acquiring customer trust in a sensitive service sector means new entrants face a substantial barrier to entry, often requiring years of consistent performance.

Scalability and Rapid Response Capabilities

Belfor’s capacity to rapidly scale its operations, particularly in response to widespread disasters or managing numerous concurrent large-scale projects across diverse geographical regions, presents a formidable barrier to entry for potential competitors. This agility is underpinned by its substantial infrastructure, including a vast network of strategically located offices, specialized equipment, and a highly trained workforce, enabling swift and efficient deployment of resources where and when they are most needed.

Newcomers to the disaster recovery and property restoration market often struggle to match Belfor's established scale and immediate response capabilities. They typically lack the extensive physical presence, the comprehensive inventory of specialized equipment, and the depth of experienced personnel required to effectively compete on large, complex, multi-site projects. This deficit in infrastructure and resources inherently limits their ability to serve a broad market or to offer the same level of rapid, reliable service that established players like Belfor provide.

For instance, during a significant weather event, such as the widespread flooding experienced in parts of the United States in early 2024, the ability to mobilize hundreds of crews within hours is critical. New entrants, without a pre-existing network and logistical framework, would find it exceptionally challenging to deploy the necessary manpower and equipment to compete effectively against a company like Belfor, which has demonstrated this capability consistently.

- Scalability Advantage: Belfor's ability to quickly expand service capacity is a key differentiator.

- Infrastructure Barrier: New entrants often lack the necessary physical network and resources.

- Rapid Response: The speed of deployment in disaster scenarios is a significant hurdle for new companies.

- Geographic Reach: Managing multiple simultaneous, large-scale projects across wide areas requires extensive operational capacity.

The threat of new entrants into the property restoration sector, particularly when facing an established leader like Belfor, is significantly mitigated by the immense capital investment required. This includes acquiring specialized equipment, such as industrial-grade dehumidifiers and thermal imaging cameras, where a single equipped restoration truck can cost upwards of $200,000. Furthermore, the need for specific certifications like those from the IICRC necessitates substantial investment in training and workforce development, creating a high barrier for newcomers.

Established relationships with insurance carriers, often formalized through preferred vendor programs, are a critical competitive advantage in 2024, channeling consistent business to incumbents. Building a trusted brand reputation in a sensitive service sector also demands years of consistent performance and significant marketing investment, making it difficult for new entrants to gain traction against established players like Belfor.

Belfor's proven ability to rapidly scale operations and deploy resources across diverse geographical regions, especially during widespread disasters, presents a substantial hurdle. Newcomers often lack the extensive physical infrastructure, specialized equipment inventory, and experienced personnel to match this capacity, particularly for large, multi-site projects. For instance, the ability to mobilize hundreds of crews within hours, as demonstrated during significant weather events in early 2024, is a critical capability that new entrants struggle to replicate.

Porter's Five Forces Analysis Data Sources

Our Belfor Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and reputable trade publications. This comprehensive approach ensures a thorough understanding of competitive dynamics.