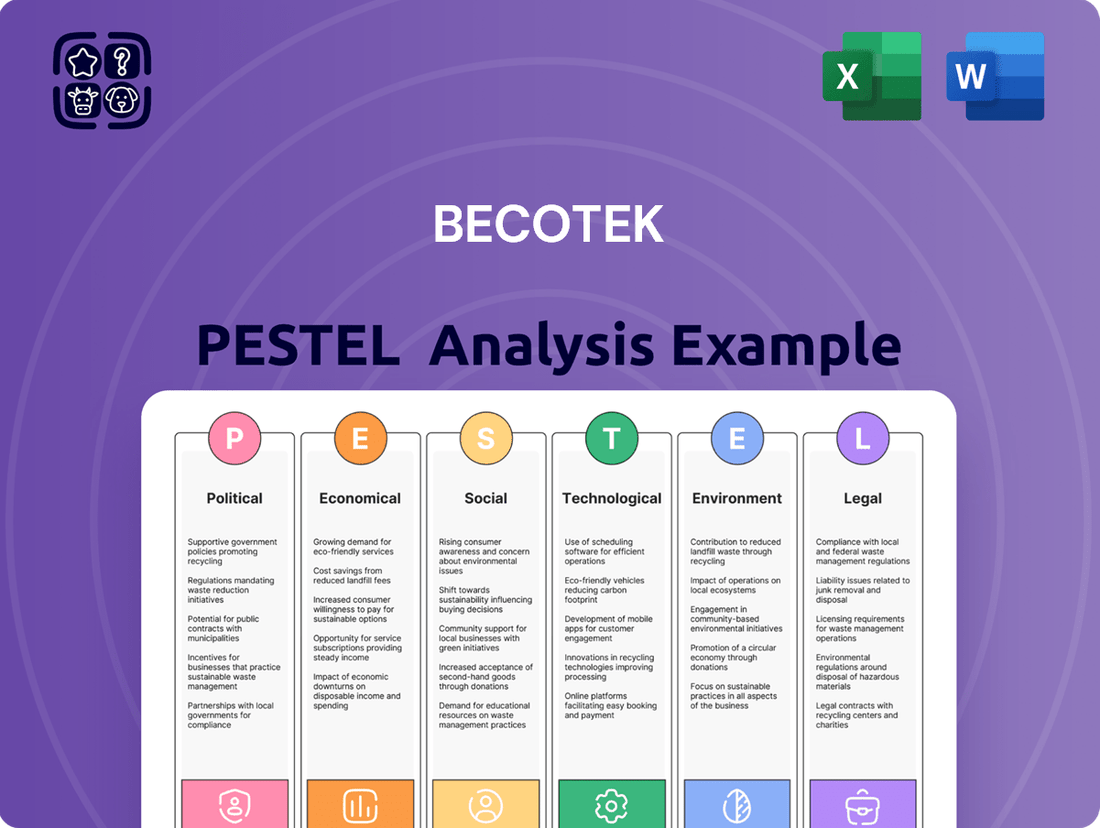

BecoTek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BecoTek Bundle

Unlock the critical external factors shaping BecoTek's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play to anticipate challenges and seize opportunities. This expertly crafted report provides actionable intelligence for strategic planning and competitive advantage. Download the full version now and gain the clarity needed to navigate BecoTek's future effectively.

Political factors

The Norwegian government's commitment to industrial growth is evident in its March 2025 white paper, which identifies six key priorities. These include ensuring access to affordable, clean energy and a skilled workforce, fostering innovation, and improving market access for domestic industries. These policy directions are crucial for companies like BecoTek, as they directly shape the operational landscape and growth opportunities within sectors projected for significant expansion in 2025, including increased exports and job creation.

The Norwegian government's commitment to bolstering its defence industry, notably through NOK 967 million in funding for production capacity, directly benefits companies like BecoTek. A significant portion, NOK 342 million, is specifically allocated to support small and medium-sized enterprises within this sector.

This strategic investment, part of the Nansen programme, is designed to address the escalating global demand for military hardware from Norway, Ukraine, and other allied nations. BecoTek's expertise in metal components and bespoke solutions positions it favorably to capitalize on these expanded opportunities.

Consequently, BecoTek is well-placed to secure new contracts and forge vital partnerships within the defence supply chain, leveraging the increased government expenditure and the heightened need for specialized military equipment.

Norway's participation in the European Free Trade Association (EFTA) has led to the signing of modernized trade agreements, including a significant one with Ukraine in April 2025 and ongoing negotiations with MERCOSUR. These accords are designed to enhance trade flows and improve market access for Norwegian companies.

These agreements typically involve the reduction or elimination of tariffs on various product categories, benefiting sectors like industrial goods, which are relevant to BecoTek's steel and metal components. For instance, the EFTA-Ukraine agreement aims to liberalize trade, potentially removing duties that currently impact export competitiveness.

For BecoTek, these developments translate into tangible opportunities for expanding their international reach. Reduced trade barriers and the potential for lower import duties in partner countries can significantly boost demand for their products, making them more competitive in global markets and opening avenues for increased export revenue.

Geopolitical Stability and Supply Chain Resilience

The global geopolitical landscape is in constant flux, presenting both risks and opportunities for businesses. This evolving environment underscores the critical importance of resilient and secure supply chains. For a company like BecoTek, understanding these shifts is paramount to navigating potential disruptions and capitalizing on emerging trends.

Norway's government is actively prioritizing industrial policies that bolster security and emergency preparedness. This strategic focus directly impacts supply chain resilience, potentially leading to increased support for domestic manufacturing and sourcing of essential components, such as metals. Such a policy direction could significantly benefit Norwegian companies like BecoTek.

- Increased Demand for Localized Production: Government initiatives may incentivize or mandate the use of domestically sourced materials, directly benefiting BecoTek's manufacturing capabilities.

- Reduced Supply Chain Vulnerability: A stronger emphasis on local sourcing mitigates risks associated with international trade disruptions, geopolitical tensions, and logistical challenges.

- Potential for Government Support: Policies aimed at enhancing national security and industrial self-sufficiency could translate into direct financial or regulatory support for companies like BecoTek that contribute to these goals.

Green Industrial Initiative

The Norwegian Government's Green Industrial Initiative, launched in March 2024, signals a strong commitment to fostering emission reductions and a robust green transition. This policy prioritizes the development of attractive jobs, assets, and welfare for the future, with a particular focus on manufacturing. Norway's existing strengths in leveraging new technologies for goods production position this initiative to be highly impactful.

BecoTek could benefit significantly if its operations align with these green industrial goals. The initiative may offer direct incentives, access to crucial funding, or create a more favorable competitive landscape for companies that actively integrate sustainable practices and cutting-edge green technologies. For instance, Norway aims to be a leader in offshore wind energy, a sector where BecoTek's technological capabilities could be highly relevant, potentially unlocking new revenue streams and strategic partnerships.

- Government Focus: Norway's March 2024 Green Industrial Initiative targets job creation, asset development, and welfare through emission reductions.

- Manufacturing Priority: The initiative specifically champions manufacturing, recognizing Norway's advanced technological clusters in production.

- Potential Benefits for BecoTek: Alignment with green goals may lead to incentives, funding, and competitive advantages through sustainable integration.

- Sector Relevance: Norway's push in offshore wind, for example, could present opportunities for BecoTek to leverage its technological expertise.

Norway's political landscape is characterized by a strong governmental push towards industrial growth and national security, as highlighted by its March 2025 white paper and significant defense funding. This focus on domestic production and supply chain resilience, exemplified by NOK 967 million allocated to the defense industry, creates a favorable environment for companies like BecoTek. Furthermore, modernized trade agreements, such as the one with Ukraine in April 2025, reduce barriers and enhance export opportunities.

What is included in the product

The BecoTek PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

BecoTek's PESTLE analysis provides a structured framework to identify and address external challenges, acting as a pain point reliever by offering clarity on market dynamics and potential disruptions.

Economic factors

Norway's manufacturing sector is on an upward trajectory, with output anticipated to reach around €115 billion by 2028. This represents a steady annual growth of 0.8% from 2023, indicating a robust industrial landscape.

Recent data from April 2025 reveals a positive trend, with industrial production experiencing a rebound and manufacturing output showing a notable increase. This suggests a healthy and potentially expanding demand for BecoTek's metal components within the Norwegian market.

Norway's steel market is showing promising signs, with demand anticipated to pick up in the latter half of 2024 and continue into 2025. This uplift is largely due to an improving economic climate, especially within the construction industry.

Looking ahead to 2025, the demand for specialized metals, such as stainless steel, is forecast to grow by 4%. This expansion is fueled by key sectors including construction, aerospace, and the rapidly growing electric vehicle (EV) market.

This positive outlook for precision metals presents a beneficial landscape for BecoTek. As a company focused on tailored metal solutions, the increasing demand across these vital industries aligns well with BecoTek's core business offerings.

Electricity prices for power-intensive industries in Norway saw a notable decrease of 10.4% in 2024, largely due to widespread adoption of long-term fixed-price contracts. This has provided a period of cost stability for businesses like BecoTek.

However, Norway is projected to face a significant power deficit in the early 2030s, which could necessitate increased electricity imports and potentially higher prices. This looming challenge underscores the importance of proactive energy management.

While current energy costs are favorable, BecoTek must consider the long-term implications of future energy availability and pricing on its operational expenses and overall competitiveness. Strategies focusing on energy efficiency and securing further long-term contracts will be crucial.

Wage Growth and Labor Costs

Wage growth in Norway's manufacturing sector has been robust, reaching 60,830 NOK per month in Q1 2025. Projections indicate this upward trend will continue into 2026 and 2027. This increase, with average basic monthly wages rising by 5% or more across most industries in the past year, directly impacts labor costs for companies like BecoTek.

While these wage levels support a high standard of living, they present a considerable operational expense for manufacturers. BecoTek must therefore focus on optimizing production efficiency and exploring automation to offset these rising labor costs and maintain its competitive edge.

- Q1 2025 Manufacturing Wages: 60,830 NOK/Month.

- Recent Wage Increase: 5%+ across most industries in the past year.

- Future Outlook: Continued wage growth projected for 2026-2027.

- Impact on BecoTek: Significant operational cost requiring efficiency and automation strategies.

Inflation and Interest Rates

While inflation in Norway showed signs of easing through 2023 and into 2024, it has persisted above the Norges Bank's 2% target. This persistent inflation, coupled with nominal wage growth, presents a dynamic cost environment for BecoTek. The central bank's efforts to curb inflation have led to higher interest rates, which have notably cooled the housing market and dampened business investment.

The current interest rate environment, with the key policy rate at 4.50% as of May 2024, directly impacts BecoTek's cost of capital. This means borrowing for significant capital expenditures, such as acquiring new machinery or funding expansion projects, will be more expensive. Conversely, the forecast for household purchasing power to rebound in 2025, driven by anticipated income growth, could present opportunities for increased consumer demand for BecoTek's products or services.

- Inflation: Norway's inflation rate was 3.7% in April 2024, down from 4.5% in March 2024, but still above the 2% target.

- Interest Rates: The Norges Bank's policy rate stands at 4.50% as of its May 2024 meeting, a level maintained since December 2023.

- Housing Market Impact: Higher interest rates have contributed to a slowdown in Norway's housing market activity.

- 2025 Outlook: Projections suggest household real disposable income growth of 1.6% in 2025, potentially boosting purchasing power.

Norway's economic landscape in 2024 and 2025 presents a mixed but generally positive outlook for manufacturing. Industrial production saw a rebound in April 2025, and the steel market is expected to strengthen throughout 2024 and into 2025, driven by construction. Demand for specialized metals, like stainless steel, is projected to grow by 4% in 2025, benefiting sectors such as construction and electric vehicles.

Electricity prices for industrial users decreased by 10.4% in 2024 due to fixed-price contracts, offering cost stability. However, potential power deficits in the early 2030s warrant long-term energy management strategies.

Wage growth remains robust, with manufacturing wages averaging 60,830 NOK per month in Q1 2025, and a projected continued increase. This necessitates efficiency and automation for companies like BecoTek to manage rising labor costs.

Inflation, while easing, remained above the 2% target in April 2024 at 3.7%. The Norges Bank's policy rate at 4.50% since December 2023 impacts borrowing costs but is expected to be counterbalanced by a projected 1.6% growth in household real disposable income in 2025, potentially boosting consumer demand.

| Economic Factor | Data Point | Period | Implication for BecoTek |

| Industrial Production | Rebound observed | April 2025 | Positive demand signal |

| Steel Market Demand | Expected pickup | H2 2024 - 2025 | Increased market opportunity |

| Specialized Metal Demand | Forecasted 4% growth | 2025 | Alignment with core business |

| Electricity Prices | 10.4% decrease | 2024 | Cost stability |

| Manufacturing Wages | 60,830 NOK/Month | Q1 2025 | Increased operational cost |

| Inflation Rate | 3.7% | April 2024 | Dynamic cost environment |

| Policy Interest Rate | 4.50% | May 2024 | Higher cost of capital |

| Household Real Disposable Income | Projected 1.6% growth | 2025 | Potential for increased demand |

Preview Before You Purchase

BecoTek PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for BecoTek.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, giving you immediate access to the complete BecoTek PESTLE analysis.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get the full, detailed BecoTek PESTLE analysis without any modifications.

Sociological factors

Norway's industrial strategy emphasizes a skilled workforce and a structured work environment. Despite recent easing, employment remains robust, with a notable surge in demand for tech-focused abilities. This trend presents both opportunities and challenges for companies like BecoTek, which relies on specialized expertise in areas such as laser cutting, machining, and welding.

BecoTek must actively pursue strategies to secure and keep its skilled workforce. Offering competitive compensation packages and investing in ongoing training programs are crucial. For instance, in 2024, Norway's average monthly wage was approximately NOK 50,000, highlighting the need for attractive remuneration to attract top talent in specialized manufacturing fields.

Norway boasts a highly educated populace, with 90% of individuals aged 25-64 holding upper secondary education or higher as of 2023. However, BecoTek, operating in Jæren's mechanical industry, faces localized challenges. Despite the industry offering stable employment, the company experienced difficulties recruiting new apprentices in the past year, highlighting a need to address potential regional skills gaps.

To ensure a future pipeline of skilled workers, BecoTek should consider strengthening partnerships with vocational schools and universities. By actively engaging with educational institutions, BecoTek can help shape curricula to meet industry demands and promote the value of apprenticeships, potentially attracting more candidates and mitigating future recruitment hurdles.

Norwegian companies, mirroring industry practices like Nordic Steel, prioritize decent work and economic growth by strictly adhering to laws on wages, apprenticeships, and working conditions. This commitment is fundamental to Norway's cooperative and well-organized work environment.

BecoTek's success hinges on its capacity to offer stable, secure employment and competitive pay, especially vital in the current tight labor market. In 2024, Norway's unemployment rate remained low, hovering around 3.9%, underscoring the competitive landscape for talent.

Societal Attitudes Towards Industry and Sustainability

Norwegian society is increasingly prioritizing sustainability, driving demand for eco-friendly products and services. This trend is evident in consumer behavior, with a significant portion of the population actively seeking out businesses committed to reducing their environmental footprint. For BecoTek, aligning with this societal shift is crucial.

Companies are now expected to be more than just profitable; they must also demonstrate strong social responsibility. This includes transparent reporting on environmental impact and ethical business practices. BecoTek's proactive stance on sustainability can therefore be a key differentiator.

In 2024, a significant percentage of Norwegian consumers indicated a willingness to pay a premium for sustainable goods, reflecting a deep-seated environmental consciousness. This growing preference directly impacts purchasing decisions, making BecoTek's commitment to green transition a powerful brand asset.

BecoTek's dedication to sustainable practices and clear reporting can:

- Enhance brand reputation among environmentally aware consumers and stakeholders.

- Attract top talent who are increasingly drawn to companies with strong ethical and environmental values.

- Appeal to customers who actively seek out and support suppliers demonstrating genuine environmental stewardship.

Health and Safety Standards

Norwegian workplaces are characterized by stringent health and safety standards, with a strong emphasis on achieving zero lost-time injuries and minimizing employee absenteeism. In 2023, Norway reported a workplace injury rate of 2.3 per 100,000 workers, a figure BecoTek must strive to significantly outperform. Common practices include routine safety inspections and a proactive approach to employee well-being.

To remain compliant with evolving regulations and safeguard its workforce, BecoTek must not only maintain but also continuously enhance its health and safety protocols. This commitment is crucial for protecting its employees and reinforcing its standing as a responsible corporate citizen. For instance, in the tech sector, companies often invest heavily in ergonomic assessments and mental health support programs, with an average of 5% of operational budgets allocated to these areas in 2024.

- Zero Lost-Time Injuries: A key objective for Norwegian companies, reflecting a commitment to worker safety.

- Low Sick Leave Rates: Indicative of a healthy and supportive work environment.

- Regular Safety Rounds: Proactive measures to identify and mitigate workplace hazards.

- Employee Well-being Focus: Investments in physical and mental health support for staff.

Societal shifts in Norway highlight a strong emphasis on sustainability and corporate social responsibility. Consumers are increasingly favoring businesses that demonstrate environmental commitment, making BecoTek's green initiatives a significant brand advantage. This societal trend is further reinforced by a high willingness among Norwegians to pay more for eco-friendly products, as evidenced by 2024 consumer surveys.

The Norwegian labor market is characterized by a highly skilled and educated workforce, yet localized recruitment challenges persist, as seen with BecoTek's recent difficulties finding apprentices. To address this, strengthening ties with educational institutions is vital to align training with industry needs and promote vocational careers.

Norwegian workplaces are renowned for their stringent health and safety standards, aiming for zero lost-time injuries. BecoTek must maintain and enhance its safety protocols, mirroring industry investments in employee well-being, which in 2024 saw tech companies allocate around 5% of operational budgets to these areas.

| Sociological Factor | Description | Relevance for BecoTek | Supporting Data (2023-2024) |

|---|---|---|---|

| Workforce Skills & Education | Highly educated populace, demand for tech skills. | Need to secure and retain specialized talent. | 90% of 25-64 year olds with upper secondary education (2023). |

| Sustainability & CSR | Growing consumer preference for eco-friendly goods. | Opportunity to enhance brand reputation and attract talent. | Significant consumer willingness to pay a premium for sustainable products (2024). |

| Health & Safety Standards | Strict regulations and focus on zero workplace injuries. | Mandatory to maintain and improve safety protocols. | Target of zero lost-time injuries; 2.3 workplace injuries per 100,000 workers (2023). |

| Labor Market Dynamics | Low unemployment, competitive talent acquisition. | Crucial to offer competitive compensation and benefits. | Norway's unemployment rate around 3.9% (2024). |

Technological factors

Norway's manufacturing sector is actively embracing advanced technologies, with a strong push towards digital transformation in production processes. This trend is supported by numerous industry conferences and initiatives championing areas like additive manufacturing, industrial robotics, and automation.

For BecoTek, this technological wave presents significant opportunities. By integrating advancements such as precision machining and automated welding, the company can expect to see enhanced operational efficiency, a reduction in material waste, and a notable improvement in overall product quality, aligning with the nation's innovation drive.

In 2024, Norway's commitment to Industry 4.0 is evident, with government funding and private sector investment pouring into advanced manufacturing solutions. For instance, the Norwegian government allocated an additional 500 million NOK in 2024 to support digitalization and automation in small and medium-sized enterprises within the manufacturing sector, a clear indicator of the strategic importance placed on these advancements.

Additive manufacturing, particularly in metals, is revolutionizing production by enabling complex geometries and on-demand creation. This technology, with significant advancements in material science and large-format printing, is projected to see continued growth, with the global metal 3D printing market expected to reach over $10 billion by 2027, according to some industry forecasts.

BecoTek could leverage this by incorporating metal AM into its offerings, facilitating rapid prototyping and reducing material waste, which aligns with sustainability goals and growing customer demand for bespoke solutions. The Norwegian AM cluster's focus on connecting businesses and researchers highlights the collaborative potential within this sector.

Automation and robotics are revolutionizing manufacturing, offering enhanced precision and efficiency while reducing errors. For BecoTek, adopting these technologies presents significant opportunities, especially as AI tools make integration more accessible for businesses of all sizes.

Investing in robotics for tasks like welding and material handling can directly boost BecoTek's productivity and consistency. This is particularly relevant given the ongoing challenges of rising labor costs and skilled labor shortages, which the manufacturing sector globally is grappling with.

In 2024, global spending on industrial robots was projected to reach over $60 billion, highlighting the widespread adoption and perceived value of automation. BecoTek can leverage this trend to improve operational safety and output quality.

Digitalization and Data Analytics

Digitalization is transforming Norway's industrial landscape, with big data analytics offering manufacturers powerful tools for predictive maintenance, streamlined production, and improved product quality. BecoTek can leverage these digital solutions across factory operations, supply chain management, and customer engagement to gain real-time insights. This data-driven approach facilitates informed decision-making and fuels ongoing innovation, crucial for staying competitive.

Norway's commitment to digitalization is evident. For instance, in 2023, the Norwegian manufacturing sector saw a significant uptake in Industry 4.0 technologies, with an estimated 65% of companies actively exploring or implementing digital solutions. This trend is projected to continue, with investments in AI and data analytics expected to grow by 15% annually through 2025. These advancements directly empower companies like BecoTek to:

- Enhance operational efficiency through predictive maintenance, reducing downtime by an average of 20% in early adopters.

- Optimize supply chain logistics with real-time tracking and demand forecasting, leading to potential cost savings of up to 10%.

- Improve product quality and customization by analyzing production data for immediate process adjustments.

- Gain deeper customer understanding through data analytics, enabling more targeted product development and marketing.

Industry 4.0 and Smart Factory Concepts

The ongoing Industry 4.0 revolution is fundamentally reshaping manufacturing, with smart factory concepts at its core. This trend focuses on the seamless integration of physical and digital technologies, creating interconnected systems that enable real-time data exchange and the deployment of cyber-physical systems. For BecoTek, embracing these advancements presents a significant opportunity to enhance operational agility.

By incorporating smart factory principles, BecoTek can achieve substantial improvements in its production processes. This includes optimizing production lines for greater efficiency, enhancing responsiveness to fluctuating customer demands for customized metal solutions, and ultimately reaching higher levels of overall flexibility. For instance, the global market for industrial automation, a key component of Industry 4.0, was projected to reach $224.7 billion in 2024, highlighting the widespread adoption and investment in these technologies.

- Enhanced Production Efficiency: Smart factories leverage AI and IoT for predictive maintenance and optimized resource allocation, potentially reducing downtime by up to 30% in some sectors.

- Improved Responsiveness: Real-time data allows for quicker adjustments to production schedules, meeting customized order demands more effectively.

- Increased Flexibility: Interconnected systems facilitate easier reconfiguration of production lines, supporting BecoTek's customized metal solutions.

- Data-Driven Decision Making: Continuous data streams provide insights for ongoing process improvement and strategic planning.

Technological advancements, particularly in digitalization and automation, are reshaping Norway's manufacturing sector, creating significant opportunities for companies like BecoTek. The nation's strong commitment to Industry 4.0, backed by substantial government funding and private investment, is driving the adoption of cutting-edge solutions. For instance, Norway's manufacturing sector saw a 15% annual growth in AI and data analytics investment through 2025, enabling enhanced operational efficiency and improved product quality.

| Technology Area | 2024/2025 Projection/Data | Impact on BecoTek |

|---|---|---|

| Digitalization & AI | 15% annual growth in investment (2024-2025) | Improved operational efficiency, predictive maintenance, enhanced customer understanding |

| Automation & Robotics | Global industrial robot spending projected over $60 billion (2024) | Increased productivity, consistency, improved safety, reduced labor reliance |

| Additive Manufacturing (Metal) | Global market projected to exceed $10 billion by 2027 | Rapid prototyping, reduced waste, bespoke solutions, complex geometries |

| Industry 4.0 / Smart Factories | Global industrial automation market projected $224.7 billion (2024) | Enhanced agility, optimized production, increased flexibility, data-driven decisions |

Legal factors

Norway's proposed Minerals Act, slated for March 2025, aims to streamline mineral sector regulations, offering more predictable conditions. While BecoTek operates as a processor, shifts in the legal framework governing raw material extraction could influence the availability and cost of essential inputs for its operations.

The new legislation explicitly prioritizes Sámi rights, aligning with Norway's international commitments. This focus on indigenous interests, while crucial for social responsibility, may introduce additional compliance considerations or potential delays in the upstream supply chain, indirectly affecting BecoTek's material sourcing.

Norway's Climate Act of 2017 sets ambitious goals, requiring a 55% cut in greenhouse gas emissions by 2030 (compared to 1990 levels) and aiming for a 90-95% reduction by 2050, in alignment with the EU. This legislative framework, coupled with a progressively increasing CO2 tax, necessitates that companies like BecoTek rigorously adhere to these environmental mandates.

BecoTek must proactively manage its carbon footprint and potentially allocate capital towards green technologies to ensure compliance, sidestep financial penalties, and cultivate a favorable environmental reputation. For instance, Norway's commitment to carbon pricing, with the CO2 tax on industrial emissions slated for further increases, directly impacts operational costs for businesses not actively pursuing emission reductions.

Norwegian labor laws are robust, focusing on fair wages, safe working conditions, and strong employee rights. The Working Environment Act, a cornerstone of these regulations, dictates everything from working hours and health and safety protocols to employee involvement in workplace decisions. For BecoTek, strict compliance is crucial to prevent legal entanglements, foster employee contentment, and solidify its image as a responsible employer.

Product Standards and Quality Certifications

BecoTek, as a provider of custom metal products, must adhere to stringent product standards and quality certifications. These legal and industry mandates are vital for ensuring products meet safety, performance, and interoperability requirements across various sectors. For instance, ISO 9001 certification, a benchmark for quality management systems, is often a prerequisite for market entry and maintaining customer confidence. Nordic Steel, a comparable entity, holds such certifications, underscoring their importance in the competitive landscape.

Compliance with these standards directly impacts BecoTek's ability to access diverse industrial markets. Obtaining and maintaining certifications like ISO 9001 is not merely a legal obligation but a strategic imperative. It builds trust with clients, assures them of product reliability, and provides a significant competitive edge. In 2024, the global market for metal fabrication is projected to reach over $250 billion, with quality certifications playing a key role in supplier selection.

- ISO 9001 Compliance: Essential for demonstrating a robust quality management system.

- Industry-Specific Standards: Meeting requirements for sectors like aerospace, automotive, or medical devices.

- Market Access: Certifications are often non-negotiable for bidding on contracts.

- Customer Trust: Assures clients of product safety, performance, and consistency.

Public Procurement Regulations

Norway's Public Procurement Law, updated in January 2024, mandates that climate and environmental considerations must account for at least 30% of the total evaluation in all public procurement processes. This significant shift underscores the government's commitment to sustainability and directly impacts businesses vying for public contracts.

For BecoTek, this legal framework presents a clear directive: to secure contracts with Norwegian public sector entities or projects receiving public funding, a robust demonstration of environmental performance and sustainable operational practices is no longer optional, but a fundamental legal and competitive requirement. This means BecoTek must actively integrate and highlight its green initiatives to meet these new evaluation thresholds.

- Mandatory Environmental Weighting: Public tenders in Norway now legally require a minimum 30% weighting for climate and environmental criteria.

- Competitive Necessity: BecoTek must showcase strong environmental credentials to win public contracts.

- Legal Compliance: Adherence to the January 2024 Public Procurement Law is essential for engaging with the public sector.

- Strategic Focus: Sustainability practices become a key differentiator and a legal prerequisite for BecoTek's public sector business.

Norway's commitment to environmental standards, exemplified by its Climate Act and CO2 tax, necessitates that BecoTek actively manages its carbon footprint. The updated Public Procurement Law, effective January 2024, mandates that climate and environmental factors constitute at least 30% of tender evaluations, making sustainability a legal and competitive imperative for securing public contracts.

| Legal Factor | Description | Impact on BecoTek | Relevant Data/Requirement |

| Climate Act & CO2 Tax | Norway's legislation aims for significant greenhouse gas reductions, with a progressively increasing CO2 tax on industrial emissions. | Requires BecoTek to invest in emission reduction technologies and manage operational costs related to carbon pricing. | Target: 55% GHG reduction by 2030 (vs. 1990); 90-95% by 2050. |

| Public Procurement Law (2024) | Mandates that climate and environmental considerations account for at least 30% of public procurement evaluations. | BecoTek must demonstrate strong environmental performance to win public sector contracts, influencing business strategy and investment in green practices. | Minimum 30% weighting for climate/environmental criteria in public tenders. |

| Minerals Act (Proposed March 2025) | Aims to streamline mineral sector regulations and explicitly prioritizes Sámi rights. | Potential influence on raw material availability and cost, and may introduce additional compliance considerations for upstream supply chains. | New regulations impacting mineral extraction and resource management. |

Environmental factors

The global steel industry is actively pursuing decarbonization, with significant investments in technologies like hydrogen-based direct reduced iron (DRI) and increased reliance on renewable energy sources. For instance, by 2030, the EU aims to cut emissions by at least 55% compared to 1990 levels, a target that directly influences steel production methods.

Norway has set ambitious emission reduction goals, targeting a 50-55% cut by 2030 and aiming for carbon neutrality by 2050, which will necessitate greener practices across all heavy industries, including metal processing.

BecoTek, as a metal processor, faces indirect impacts from this green steel transition. The company can gain a competitive advantage by prioritizing suppliers that utilize green steel or by adopting its own energy-efficient operational strategies, potentially reducing its carbon footprint by leveraging advancements in metal processing technology.

Norway's abundant hydropower provides a significant advantage, with its electricity grid being over 98% renewable as of 2023, offering a low-carbon foundation for industrial operations. This high electrification rate means industries like BecoTek benefit from inherently efficient and environmentally friendly power sources.

However, a projected electricity deficit in Norway by 2030, driven by increasing demand from data centers and electric vehicle adoption, necessitates a shift towards new renewable sources, particularly wind power. This evolving energy landscape presents both challenges and opportunities for companies to secure stable, green energy.

BecoTek can capitalize on this by focusing on internal energy efficiency measures, potentially reducing consumption by 10-15% through smart technology adoption by 2025. Furthermore, exploring on-site renewable solutions, such as solar installations which saw a 20% increase in deployment across Norwegian commercial sectors in 2024, can bolster its sustainability credentials and mitigate risks associated with grid deficits.

The global push towards sustainability is reshaping industrial practices, with a strong emphasis on resource efficiency and circularity. By 2024, the circular economy was projected to be worth trillions, highlighting its economic significance. BecoTek's metal scrap and waste represent an opportunity to align with these trends.

Implementing advanced waste management, including robust recycling programs for its metal scrap, can significantly lower BecoTek's environmental footprint. This shift not only addresses regulatory pressures but also opens avenues for potential revenue generation through the sale of recycled materials, a market that saw significant growth in 2024.

Sustainable Supply Chain and Sourcing

Environmental regulations are tightening, pushing steelmakers like BecoTek to seek sustainable raw materials and build more resilient supply chains. Customer preference for eco-friendly products is a major driver here. For instance, some Norwegian steel producers are already making waves by offering stainless steel with substantially reduced greenhouse gas emissions, highlighting a tangible shift in the industry.

BecoTek can bolster its environmental standing by actively selecting suppliers who meet rigorous sustainability benchmarks and provide 'green' material options. This proactive approach aligns with market demands and regulatory pressures. In 2024, the global sustainable steel market was valued at approximately USD 150 billion, with projections indicating significant growth driven by these very factors.

- Regulatory Pressure: Expect increased compliance costs and operational adjustments due to stricter environmental laws globally.

- Customer Demand: A growing segment of consumers and B2B clients prioritize products with lower environmental impact.

- Industry Benchmarks: Companies like those in Norway are setting new standards for low-emission steel production, creating competitive pressure.

- Supply Chain Diversification: Sourcing from suppliers with proven sustainability practices is becoming a strategic imperative.

Environmental Certifications and Reporting

Companies in Norway, particularly within the metal sector, are increasingly embracing environmental management systems and certifications. For instance, the Eco-Lighthouse certification is gaining traction, requiring participants to provide statistics and climate accounts aligned with the Greenhouse Gas Protocol. This trend highlights a growing emphasis on quantifiable environmental performance.

Sustainability reporting is also becoming a non-negotiable aspect of business operations in Norway, with a notable focus on compliance with the Transparency Act. This legislation mandates increased transparency regarding a company's social and environmental impact, pushing businesses to be more accountable for their practices.

BecoTek can effectively showcase its dedication to environmental stewardship and regulatory adherence by actively seeking certifications like Eco-Lighthouse. Transparently communicating its environmental performance, supported by data and adherence to reporting standards, will be crucial for building trust and demonstrating commitment.

- Eco-Lighthouse Certification: A recognized standard in Norway promoting sustainable business practices, often requiring climate accounting based on the Greenhouse Gas Protocol.

- Transparency Act Compliance: Norwegian legislation mandating disclosure of social and environmental risks and impacts, fostering greater corporate accountability.

- Greenhouse Gas Protocol: An internationally recognized accounting tool for government and private sector organizations to measure and manage greenhouse gas emissions.

- Industry Trend: Growing adoption of environmental management systems and certifications within Norway's metal industry signifies a proactive approach to sustainability.

The global push for sustainability is significantly impacting industrial operations, with a strong emphasis on resource efficiency and circularity. By 2024, the circular economy was projected to be worth trillions, underscoring its economic importance. BecoTek's metal scrap and waste present a prime opportunity to align with these growing trends.

Implementing advanced waste management, including robust recycling programs for its metal scrap, can substantially lower BecoTek's environmental footprint. This strategic shift not only addresses increasing regulatory pressures but also unlocks potential revenue streams through the sale of recycled materials, a market that experienced considerable growth in 2024.

Environmental regulations are becoming more stringent, compelling steelmakers like BecoTek to seek sustainable raw materials and cultivate more resilient supply chains. Customer preference for eco-friendly products is a major catalyst for this change. For instance, some Norwegian steel producers are already distinguishing themselves by offering stainless steel with considerably reduced greenhouse gas emissions, signaling a tangible industry transformation.

BecoTek can enhance its environmental standing by proactively selecting suppliers who adhere to stringent sustainability benchmarks and offer 'green' material options. This forward-thinking approach aligns with market demands and regulatory pressures. In 2024, the global sustainable steel market was valued at approximately USD 150 billion, with projections indicating substantial growth fueled by these very factors.

| Environmental Factor | 2024/2025 Data/Trend | Impact on BecoTek | Opportunity/Mitigation |

| Decarbonization Efforts | EU aims for 55% emission cut by 2030; Norway targets carbon neutrality by 2050. | Increased demand for low-carbon materials; potential cost increases for non-compliant suppliers. | Source green steel; improve operational energy efficiency. |

| Renewable Energy Availability | Norway's grid over 98% renewable (2023); projected electricity deficit by 2030. | Access to low-carbon power; potential energy price volatility and supply concerns. | Invest in on-site renewables (e.g., solar); enhance internal energy efficiency. |

| Circular Economy Growth | Circular economy projected to be worth trillions by 2024. | Growing market for recycled materials; pressure to reduce waste. | Implement advanced scrap recycling programs; explore selling recycled materials. |

| Sustainable Market Value | Global sustainable steel market valued at ~$150 billion in 2024. | Increasing customer demand for eco-friendly products; competitive advantage for sustainable suppliers. | Prioritize suppliers with sustainability certifications; offer eco-friendly product options. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and leading economic indicators. We ensure each insight is grounded in current, fact-based information from both global and local sources.