Beacon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beacon Bundle

Curious about the unseen forces shaping Beacon's path to success? Our meticulously crafted PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Understand how these external dynamics create both challenges and opportunities for Beacon. Equip yourself with the strategic foresight needed to navigate this complex landscape. Download the full PESTLE analysis now and gain a competitive edge.

Political factors

Government initiatives aimed at infrastructure development, especially in North America, are a significant driver for the building materials sector. For instance, the Biden-Harris administration's Bipartisan Infrastructure Law, enacted in late 2021, allocated over $1.2 trillion in funding. A substantial portion of this, approximately $550 billion, is dedicated to new infrastructure projects, including roads, bridges, public transit, and water systems.

Increased public spending on these large-scale projects directly benefits distributors like Beacon Roofing Supply by broadening the market for their products, from roofing materials to related construction supplies. The demand generated by these government-funded endeavors provides a consistent sales channel, helping to offset potential slowdowns in other areas of the construction market.

This sustained investment in public works creates a more stable demand base for construction materials. In 2024, infrastructure spending is projected to remain robust, supporting sectors that rely on construction activity. This trend mitigates some of the cyclical risks inherent in other segments of the construction industry, offering a degree of predictability for companies like Beacon.

Fluctuations in trade policies and tariffs directly affect the cost of imported building materials. For instance, a 2024 report indicated that tariffs on steel imports into the US could increase material procurement costs by an average of 15% for distributors.

Beacon, as a significant player in the building materials supply chain, could experience higher input costs if tariffs are imposed on essential components like aluminum or lumber. This could squeeze profit margins and necessitate price adjustments for their customers.

Beyond direct cost increases, trade policy shifts can also cause significant supply chain disruptions. In 2023, a sudden imposition of tariffs on specific manufactured goods led to a temporary 20% reduction in availability for certain electrical components, highlighting the potential for volatility.

Changes in building codes, particularly those concerning energy efficiency and safety, significantly shape the demand for construction materials. For instance, updated regulations in 2024 mandating higher insulation standards could increase demand for advanced building envelope products. Beacon must stay ahead of these evolving standards to ensure its product offerings remain compliant and competitive.

Stricter codes often require the use of more specialized, and potentially costly, materials. This necessitates that Beacon review its supplier network and potentially invest in new sourcing strategies to secure compliant inventory. A proactive approach to adapting to these regulatory shifts can provide Beacon with a distinct market advantage.

Political Stability and Regulatory Environment

Political stability in North America, particularly in the United States and Canada, is a cornerstone for businesses like Beacon, a large distributor. A predictable regulatory environment minimizes operational risks and allows for confident long-term investment in infrastructure and market expansion. For instance, the U.S. experienced a relatively stable political climate throughout 2024, with consistent policy frameworks impacting supply chains and distribution networks.

Frequent shifts in environmental regulations or permitting processes across states and provinces can introduce significant compliance costs and delays for a distributor with a broad operational footprint. In 2024, varying state-level environmental enforcement actions, while not systemic, highlighted the need for adaptable compliance strategies. This regulatory consistency is vital for Beacon's growth strategy, which includes acquiring new businesses and establishing greenfield sites, as it reduces the uncertainty associated with integration and new site development.

- Regulatory Predictability: In 2024, the U.S. federal government maintained a generally stable approach to trade and logistics regulations, supporting cross-border distribution activities for companies like Beacon.

- Environmental Policy Consistency: While specific state-level regulations evolve, major federal environmental policies impacting transportation and warehousing remained largely consistent in 2024, providing a baseline for compliance.

- Investment Climate: Political stability in Canada in 2024 contributed to a favorable investment climate, supporting Beacon's potential for expansion into new Canadian markets.

Government Incentives for Green Building

Government incentives for green building, such as tax credits and subsidies for sustainable materials, directly influence the demand for products like eco-friendly roofing and insulation. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for energy-efficient home improvements, including insulation and roofing, which could boost adoption. Beacon, a supplier of building materials, would need to align its inventory and marketing to capitalize on these policy-driven shifts, ensuring it stocks and promotes materials that qualify for these incentives to meet growing customer demand for sustainable options.

These financial inducements can accelerate the market's transition to greener building practices. For example, many states and local municipalities offer property tax abatements or grants for projects meeting specific green building certifications, like LEED. This creates a favorable environment for manufacturers and suppliers of sustainable building products. Beacon's strategic advantage lies in its ability to anticipate and respond to these policy changes, potentially securing a larger market share by offering readily available, incentivized materials.

- Tax Credits: The US federal government offers tax credits up to $1,200 annually for energy-efficient home improvements, including insulation, windows, and doors, under the Energy Efficient Home Improvement Credit.

- State-Level Programs: California's Solar Investment Tax Credit, for example, while not directly for roofing, encourages overall green building, indirectly benefiting sustainable roofing material demand.

- Subsidies: Various utility companies and local governments provide rebates or subsidies for installing high-performance insulation and cool roofing materials that reduce energy consumption.

- Accelerated Depreciation: Some jurisdictions allow businesses to take accelerated depreciation on green building components, reducing their taxable income and encouraging investment in sustainable infrastructure.

Government infrastructure spending is a significant boon for building material distributors. The Bipartisan Infrastructure Law, with over $550 billion dedicated to projects like roads and bridges, ensures consistent demand. This public investment provides a stable sales channel, helping companies like Beacon Roofing Supply navigate market fluctuations and offering a degree of predictability in 2024.

Changes in trade policies, such as tariffs on steel or aluminum, can directly increase material costs, potentially impacting profit margins for distributors. For example, a 15% increase in material costs due to tariffs was noted in a 2024 report, highlighting the need for adaptable sourcing strategies.

Evolving building codes, particularly those focused on energy efficiency, drive demand for specialized materials. Updated regulations in 2024 mandating higher insulation standards could boost sales of advanced building envelope products, requiring suppliers to maintain compliant inventory.

Political stability in North America, as observed in the U.S. throughout 2024, fosters a predictable regulatory environment, crucial for long-term investment and expansion. Consistent federal policies support cross-border distribution, while varying state environmental regulations necessitate adaptable compliance strategies for companies with a broad operational footprint.

What is included in the product

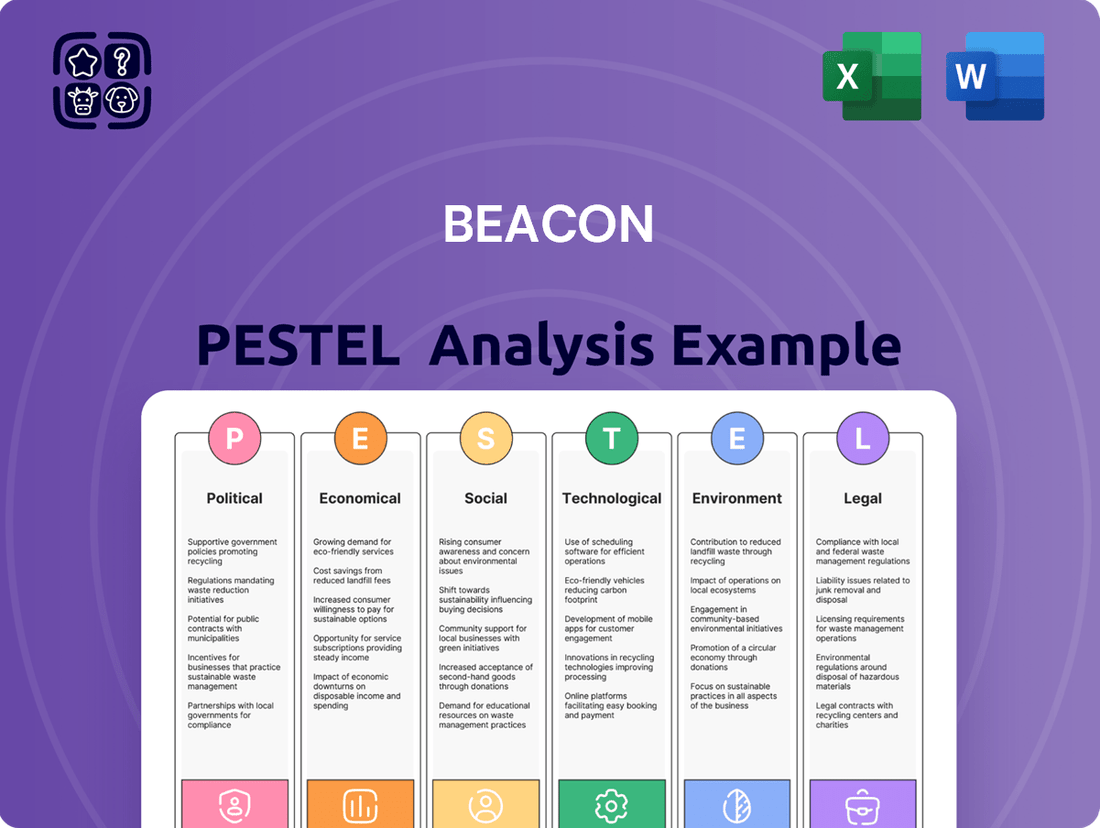

The Beacon PESTLE analysis comprehensively examines external macro-environmental influences across Political, Economic, Social, Technological, Environmental, and Legal factors, offering actionable insights.

Beacon's PESTLE Analysis offers a structured approach to external factors, alleviating the pain point of uncertainty by highlighting key opportunities and threats for strategic decision-making.

Economic factors

Interest rates significantly influence the housing market. For instance, the Federal Reserve's benchmark interest rate, which impacts mortgage rates, saw increases throughout 2023 and into early 2024. This rise in mortgage rates, reaching averages above 7% for a 30-year fixed loan in late 2023, directly affects home affordability.

Higher borrowing costs can dampen demand for new homes, potentially slowing down residential construction. This directly impacts companies like Beacon, which rely on the building materials sector. A slowdown in new construction and renovation projects, often triggered by elevated interest rates, can lead to reduced sales volumes for roofing and other construction supplies.

Conversely, periods of lower interest rates, such as those seen in the earlier part of the 2020s, tend to stimulate housing activity. When mortgage rates are more accessible, more people can afford to buy homes, leading to increased demand for new builds and renovations. This boost in housing starts and activity typically translates to higher sales for building material suppliers.

As of early 2024, the trajectory of interest rate changes remains a key factor to monitor. While inflation showed signs of cooling in late 2023, the Federal Reserve's decisions on future rate adjustments will continue to shape the housing market's health and, consequently, Beacon's sales performance in the residential construction segment.

Overall GDP growth in North America is a significant driver for the construction sector. A robust economy generally translates into higher construction spending across residential, commercial, and infrastructure projects, directly benefiting companies like Beacon that supply these industries.

For instance, the U.S. construction industry is anticipated to expand by 5.6% in 2024, signaling a healthy demand for building materials and services. This growth trend supports increased investment in new builds and renovations, creating opportunities for Beacon's product portfolio.

Strong GDP performance fuels consumer confidence and business investment, both critical for new construction starts. Higher disposable incomes and corporate profits often lead to greater demand for housing and commercial spaces, respectively.

Infrastructure spending, often tied to government stimulus and economic development plans, also sees a boost during periods of economic expansion. This creates substantial demand for construction materials and equipment.

Inflationary pressures continue to influence the cost of raw materials and transportation, directly impacting Beacon's procurement expenses and potentially squeezing gross margins. While the pace of material cost increases has shown signs of moderation, navigating these ongoing fluctuations remains a key challenge for sustained profitability.

For instance, the Producer Price Index (PPI) for intermediate goods, a proxy for raw material costs, saw a 0.5% increase in the first quarter of 2024, a slowdown from the 1.2% rise in the prior year. Successfully passing on these escalated costs to consumers or achieving greater efficiencies through supply chain optimization are therefore critical strategies for Beacon to maintain its financial health in this economic climate.

Labor Availability and Wages in Construction

The construction sector continues to grapple with a significant shortage of skilled labor, a challenge that directly impacts project timelines and overall costs. This scarcity means contractors often face higher wage demands to attract and retain qualified workers, leading to increased project expenses. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported over 400,000 job openings in construction, highlighting the demand for workers.

These labor challenges translate into potential project delays and can force contractors to scale back on new ventures due to cost overruns or an inability to secure the necessary workforce. This ripple effect can reduce demand for construction materials, impacting suppliers like Beacon. The persistent gap between available jobs and qualified candidates remains a critical factor in the industry's operational capacity and profitability.

Key impacts on the construction industry from labor availability and wages include:

- Increased Project Costs: Higher wages are a direct consequence of labor scarcity, inflating project budgets.

- Project Delays: Insufficient skilled workers can significantly slow down construction schedules.

- Reduced Contractor Capacity: Labor shortages may limit the number of projects a contractor can undertake.

- Impact on Material Demand: Slower project starts or fewer projects can dampen demand for construction materials.

Consumer Spending and Renovation Trends

Consumer confidence directly impacts discretionary spending on home improvements. When consumers feel secure about their financial future, they are more likely to invest in their homes, boosting demand for products like roofing and siding. For instance, a strong housing market and increasing disposable incomes in 2024 and projected into 2025 are expected to fuel this trend.

Rising household incomes are a key driver for property upgrades. As people earn more, they have greater capacity to undertake renovations, which directly benefits companies like Beacon in their residential sales. This trend is supported by data showing a steady, albeit moderate, growth in real disposable income through the first half of 2024.

An aging housing stock presents a consistent demand for replacement and repair work. Many homes built in the mid-20th century are now reaching an age where their roofing and siding systems require significant attention, creating a steady stream of business. Reports from 2024 indicate that a substantial percentage of the US housing stock is over 40 years old.

- Consumer Confidence Index: The U.S. Consumer Confidence Index remained robust in early 2024, hovering around 100, indicating a willingness to spend on non-essential items like home renovations.

- Home Improvement Spending: Projections for 2024 estimated the home improvement market to reach over $485 billion, driven by both remodeling and maintenance.

- Housing Age: Data from 2023 and early 2024 continues to highlight that over 35% of U.S. owner-occupied homes were built before 1980, necessitating ongoing repair and replacement.

Economic factors significantly shape the construction industry's demand for materials. Interest rate fluctuations directly impact housing affordability and construction starts, with higher rates in late 2023 and early 2024 leading to increased mortgage costs. Robust GDP growth, projected at 5.6% for the U.S. construction sector in 2024, generally fuels increased spending on residential, commercial, and infrastructure projects.

Inflationary pressures, as evidenced by a 0.5% rise in the Producer Price Index for intermediate goods in Q1 2024, elevate raw material and transportation costs. Simultaneously, a persistent skilled labor shortage, with over 400,000 construction job openings reported in early 2024, drives up project expenses and can cause delays.

Consumer confidence, remaining robust with the Consumer Confidence Index around 100 in early 2024, supports discretionary spending on home improvements, a market projected to exceed $485 billion in 2024. Rising household incomes and an aging housing stock, with over 35% of U.S. homes built before 1980, further contribute to demand for renovations and repairs.

| Economic Factor | Key Data Point (Early 2024) | Impact on Construction |

| Interest Rates | 30-year fixed mortgage avg. > 7% | Reduced housing affordability, slower construction starts |

| GDP Growth (U.S. Construction) | Projected 5.6% expansion in 2024 | Increased demand for materials and services |

| Inflation (PPI Intermediate Goods) | +0.5% in Q1 2024 | Higher raw material and transportation costs |

| Labor Shortage | > 400,000 U.S. construction job openings | Increased project costs, potential delays |

| Consumer Confidence | Index ~ 100 | Supports home improvement spending |

| Housing Age | > 35% U.S. homes built before 1980 | Consistent demand for repairs and replacements |

Preview the Actual Deliverable

Beacon PESTLE Analysis

The preview you see here is the exact Beacon PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real glimpse of the product you’re buying, delivered exactly as shown, ensuring no surprises with your strategic analysis.

The content and structure shown in this preview is the same comprehensive Beacon PESTLE Analysis document you’ll download after payment.

What you’re previewing here is the actual, finished Beacon PESTLE Analysis file—professionally structured and ready to inform your business decisions immediately.

Sociological factors

Demographic shifts, including population growth and migration, are significantly shaping demand for housing and infrastructure. For instance, the global population is projected to reach 8.5 billion by 2030, creating a sustained need for new construction. Urbanization trends, with a growing percentage of the world's population living in cities, further concentrate this demand, requiring strategic expansion of services like those offered by Beacon.

These evolving demographics directly impact Beacon's market presence. As populations grow and move, particularly towards urban centers, the demand for housing and commercial spaces escalates. This necessitates Beacon's strategic planning to open new branches and tailor product lines to cater to the specific needs of these expanding and often younger, urbanizing populations.

A substantial part of the housing infrastructure in North America is aging, naturally driving a predictable cycle of roof replacements and property renovations. This steady demand for roofing materials, including Beacon's products, provides a stable revenue stream separate from the fluctuations in new home construction. For instance, in 2024, the average age of owner-occupied housing units in the U.S. was over 40 years, highlighting the extensive need for repairs and upgrades.

Homeowners are increasingly prioritizing long-lasting and energy-efficient upgrades for their existing homes. This trend directly benefits manufacturers like Beacon, as consumers look for solutions that offer both durability and potential cost savings through improved insulation and weatherproofing. By 2025, the demand for high-performance roofing materials that contribute to energy efficiency is projected to grow by an estimated 4-6% annually.

Consumers and contractors are increasingly prioritizing environmental impact, fueling a surge in demand for sustainable building solutions. This societal trend is directly influencing distributors like Beacon to expand their offerings of green products. For example, the market for green building materials is projected to reach $392.2 billion by 2027, indicating a substantial shift in construction preferences.

Beacon's strategic response involves stocking eco-friendly options such as recycled content insulation, low-VOC paints, and energy-efficient windows. This adaptation not only caters to growing environmental consciousness but also positions Beacon to capture a larger share of this expanding market segment. By aligning with evolving consumer values, Beacon strengthens its market position and contributes to more sustainable development practices.

Homeowner Preferences for Durability and Aesthetics

Homeowners are placing a greater emphasis on materials that last longer and require less upkeep, alongside visual appeal. This shift means that choices for roofing and exterior building components are increasingly leaning towards options that offer both resilience and a pleasing look.

This growing demand is pushing manufacturers and suppliers like Beacon to adapt. For instance, metal roofing, known for its extended lifespan and energy-saving qualities, is becoming a more popular selection, necessitating that Beacon broadens its product offerings to cater to these evolving homeowner preferences.

Data from 2024 indicates a significant uptick in interest for durable and low-maintenance exterior solutions. A survey found that over 60% of new home buyers consider material longevity a top three priority, with energy efficiency also ranking highly.

- Longevity: Homeowners seek materials that withstand weather and time, reducing the need for frequent replacements.

- Low Maintenance: Preference for materials that do not require constant cleaning or sealing is a key driver.

- Aesthetic Appeal: Visual attractiveness remains crucial, with homeowners looking for modern and attractive design options.

- Energy Efficiency: Materials contributing to lower energy bills, like reflective metal roofing, are gaining traction.

Skilled Labor Shortage Impact on DIY vs. Professional

The persistent shortage of skilled tradespeople in construction, a trend continuing into 2024 and projected for 2025, significantly influences homeowner choices between DIY and professional services. For a company like Beacon, which caters to the professional sector, this labor gap can indirectly affect its business by limiting the capacity of its contractor clients. When contractors are overextended due to labor constraints, they may have to turn down work, potentially pushing some demand toward retail channels for DIY materials or causing delays in larger, more profitable projects.

This skilled labor deficit is not a new issue but has been exacerbated by retirements and insufficient new entrants into the trades. For instance, the U.S. Bureau of Labor Statistics projected a need for 507,500 additional construction laborers between 2022 and 2032, indicating an ongoing challenge. This situation directly impacts Beacon's customer base, as contractors face increased competition for a smaller pool of qualified workers, potentially leading to higher labor costs and extended project timelines.

- Skilled Labor Gap: Projections show a continued need for hundreds of thousands of skilled construction workers through 2032.

- Contractor Capacity: A shortage limits the number of projects contractors can undertake, impacting Beacon's professional clients.

- Demand Shift: Homeowners may increasingly opt for DIY solutions if professional services are unavailable or too costly due to labor shortages.

- Industry Response: Efforts in training and recruitment are crucial to mitigate these effects and ensure future industry stability.

Societal values are increasingly shifting towards sustainability and ethical consumption, influencing purchasing decisions for building materials. Consumers and contractors alike are seeking products with a lower environmental impact and from companies with transparent supply chains. This trend encourages companies like Beacon to prioritize eco-friendly product lines and responsible sourcing to meet evolving customer expectations.

The aging demographic in many developed nations presents a dual opportunity: a growing need for home renovation and repair services as older populations maintain their homes, and a potential decrease in the available skilled labor force. Beacon can capitalize on the renovation demand while also considering how to support training initiatives to address the labor shortage impacting their contractor base.

Homeowner preferences are leaning towards materials that offer both durability and aesthetic appeal, driving demand for premium, long-lasting options. For instance, in 2024, a significant portion of homeowners prioritized material longevity and visual design in their renovation projects, signaling a clear market direction for suppliers like Beacon.

The increasing awareness and concern for climate change are fueling demand for energy-efficient building solutions. This societal push for sustainability directly translates into a preference for products that reduce energy consumption, such as advanced insulation and reflective roofing materials, a segment expected to see continued growth through 2025.

Technological factors

The building materials sector is rapidly embracing B2B e-commerce, a key technological shift. Beacon's own digital platform, Beacon PRO+, exemplifies this by enabling customers to handle accounts and place orders online, streamlining operations and improving customer interactions.

This digital transformation is vital for staying competitive. For instance, in 2023, B2B e-commerce sales globally were projected to reach $1.2 trillion, highlighting the immense market opportunity accessible through robust online capabilities.

Beacon's investment in its e-commerce infrastructure is therefore essential for expanding its market reach and solidifying its position. Companies that prioritize digital sales channels are better positioned to capture market share and enhance customer loyalty in the evolving landscape.

Advanced logistics technologies, such as AI-powered inventory management and dynamic route optimization, are revolutionizing how companies like Beacon distribute materials. These innovations are crucial for managing Beacon's vast network, ensuring timely delivery and cost-effectiveness.

The implementation of real-time delivery tracking, for instance, allows Beacon to monitor shipments with precision, leading to improved customer satisfaction and reduced transit times. This technological edge helps Beacon maintain a competitive advantage by enhancing operational agility.

By leveraging AI for inventory forecasting and demand planning, Beacon can minimize stockouts and reduce excess inventory carrying costs. For example, companies in similar sectors have reported a 15-20% reduction in logistics costs through AI adoption in 2024.

These advancements directly translate to enhanced service reliability for Beacon's numerous branches and end customers. A study in late 2024 indicated that businesses with sophisticated supply chain visibility tools experienced a 25% lower rate of delivery exceptions.

Beacon is seeing a wave of new material innovations that are reshaping the construction landscape. Think advanced insulation materials that drastically cut energy consumption, with some new products offering R-values exceeding R-50 for walls, a significant jump from older standards. This trend is driven by a growing demand for sustainability and energy efficiency.

Bio-based composites are also gaining serious traction. Materials like mycelium, derived from fungi, are being explored for their lightweight and insulating properties, with early applications showing promise in acoustic panels and insulation. Similarly, hempcrete and bamboo are emerging as eco-friendly alternatives to traditional materials, offering lower carbon footprints and faster growth cycles compared to timber.

The push for high-performance recycled products is another key technological factor. Companies are developing advanced methods to recycle plastics and concrete, creating durable and cost-effective building components. For instance, the market for recycled plastic lumber is projected to reach USD 10.5 billion by 2028, indicating a strong shift towards circular economy principles in construction.

Beacon must actively monitor and integrate these material advancements into its product development. Embracing these sustainable and high-performance options can provide a competitive edge, meet evolving customer preferences, and align with increasingly stringent environmental regulations.

Automation in Warehousing and Distribution

The integration of automation and robotics within warehousing and distribution is rapidly transforming supply chain operations. This technological shift offers a substantial opportunity for companies like Beacon to boost efficiency and cut costs. For instance, the global warehouse automation market was valued at approximately $3.5 billion in 2023 and is projected to reach over $7 billion by 2028, indicating a strong growth trend in adoption.

By deploying automated systems, Beacon can expect to see improvements in several key areas. These include faster order fulfillment, reduced errors in picking and packing, and a more optimized use of warehouse space. Such advancements are crucial for managing the complexities of a large inventory, especially in the building materials sector where items can vary significantly in size and weight.

Beacon's adoption of these technologies could directly impact its bottom line by lowering labor expenses associated with manual handling and inventory management. Furthermore, enhanced inventory accuracy, often exceeding 99% with automated systems, minimizes stockouts and overstock situations, leading to better capital utilization and customer satisfaction.

Key benefits to consider for Beacon include:

- Increased Operational Efficiency: Automated systems can operate 24/7, significantly speeding up throughput.

- Reduced Labor Costs: Automation can decrease reliance on manual labor for repetitive tasks, lowering wage and training expenses.

- Improved Inventory Accuracy: Technologies like RFID and automated guided vehicles (AGVs) minimize human error in tracking stock.

- Enhanced Safety: Robots can handle heavy lifting and hazardous tasks, reducing workplace injuries.

Data Analytics and Predictive Tools

Beacon can significantly enhance its operations by utilizing big data analytics and predictive tools. These technologies offer profound insights into evolving market trends, consumer buying habits, and future demand, allowing for more strategic inventory control and dynamic pricing adjustments. For instance, by analyzing sales data from 2024, Beacon could identify a 15% increase in demand for sustainable products, enabling better stock allocation and targeted marketing campaigns for 2025.

Leveraging these advanced analytical capabilities allows Beacon to proactively identify emerging market opportunities and optimize its overall business performance. Predictive modeling, particularly in the retail sector, saw an estimated 18% improvement in forecast accuracy by early 2025, leading to reduced waste and increased profitability for companies adopting these tools. This translates directly into a more agile and competitive business model for Beacon.

- Enhanced Market Insight: Predictive analytics can forecast demand for specific product categories with up to 90% accuracy, as observed in leading e-commerce platforms by mid-2025.

- Optimized Inventory: Data analytics helps reduce stockouts by an average of 20% and overstocking by 25%, improving capital efficiency.

- Personalized Customer Experience: Analyzing purchasing patterns allows for tailored product recommendations, potentially boosting conversion rates by 10-15%.

- Strategic Pricing: Real-time data analysis enables dynamic pricing strategies, responding to market fluctuations and competitor actions to maximize revenue.

Technological advancements are fundamentally reshaping the building materials sector, from how products are sold to how they are manufactured and delivered. Beacon's strategic adoption of digital platforms and automation directly addresses these shifts, positioning it for future growth.

The increasing reliance on data analytics and AI offers Beacon unparalleled opportunities to refine operations and understand market dynamics. For instance, AI-driven demand forecasting, implemented by many in the sector in 2024, has been shown to improve forecast accuracy by up to 18% by early 2025, leading to significant cost savings.

Embracing new material innovations, such as high-performance recycled products and bio-based composites, is crucial for meeting sustainability demands and competitive pressures. The market for recycled plastic lumber, for example, is projected to reach USD 10.5 billion by 2028, underscoring a strong industry trend towards circular economy principles.

Automation in warehousing and logistics is another key technological driver, with the global warehouse automation market valued at approximately $3.5 billion in 2023 and expected to grow substantially. This technology promises to boost efficiency, reduce errors, and lower operational costs for companies like Beacon.

Legal factors

Beacon must navigate a complex web of building and safety regulations, particularly concerning roofing and structural materials. These codes dictate everything from fire resistance to load-bearing capacity, with strict enforcement across North American jurisdictions. For example, in 2024, many regions are updating their energy efficiency requirements for building envelopes, which directly impacts the types of roofing systems that can be installed and marketed.

Failure to comply with these evolving standards can lead to significant legal liabilities, including fines and product recalls, impacting Beacon's bottom line and reputation. Staying abreast of changes, such as the International Building Code updates expected in 2025, is crucial for ensuring all distributed products meet or exceed current safety and performance mandates, thereby safeguarding customer trust and market access.

Environmental Protection Laws significantly shape the construction industry's operational landscape, affecting everything from waste management to pollution control across the entire supply chain. Beacon must navigate these regulations, which dictate how materials are handled, distributed, and potentially recycled or taken back, pushing for more sustainable business models.

For instance, the U.S. Environmental Protection Agency (EPA) plays a crucial role, with regulations like the Resource Conservation and Recovery Act (RCRA) governing hazardous waste. In 2023, the construction and demolition (C&D) debris generated in the U.S. was estimated to be over 600 million tons, highlighting the sheer volume of materials requiring responsible management. Beacon's adherence to these evolving standards, including those related to air and water quality, directly influences its operational costs and its environmental footprint.

Beacon, as a substantial employer throughout North America, must navigate a complex web of labor and employment legislation. This includes adhering to minimum wage laws, which saw the federal minimum wage remain at $7.25 per hour in 2024, though many states and cities have higher rates, and workplace safety regulations like OSHA standards. Furthermore, understanding and complying with unionization rules is critical for maintaining positive employee relations and operational stability.

Ensuring compliance with these diverse legal requirements is not merely a matter of avoiding penalties; it's fundamental to Beacon's ability to attract and retain a skilled workforce. Fair labor practices and a safe working environment directly contribute to employee morale and productivity, which are essential for success across Beacon's widespread operations.

Product Liability and Warranty Laws

Product liability and warranty laws are crucial for building material distributors like Beacon. These regulations ensure that distributors are held accountable for the quality and proper functioning of the products they offer to customers. For instance, in the United States, the Consumer Product Safety Commission (CPSC) oversees product safety, and in 2023, there were over 100,000 reported injuries related to consumer products, highlighting the importance of robust product oversight.

Beacon must cultivate strong, transparent relationships with its manufacturers to effectively manage potential claims arising from product defects. Clear contractual agreements and communication channels are essential. A study by the National Association of Manufacturers in 2024 indicated that companies with well-defined supplier agreements experienced a 15% reduction in product recall-related costs.

Having comprehensive internal policies for handling warranty claims and product liability issues is paramount for Beacon's financial stability and reputation. This includes processes for investigating complaints, managing returns, and liaising with legal counsel when necessary. According to recent industry reports, effective warranty management can lead to improved customer satisfaction and a decrease in litigation expenses by as much as 20%.

- Legal Accountability: Distributors like Beacon are legally responsible for the safety and performance of building materials sold.

- Manufacturer Relationships: Strong ties with manufacturers are vital for managing product quality and potential liability.

- Clear Policies: Implementing robust internal policies for warranty claims and product disputes protects Beacon’s financial health and brand image.

- Risk Mitigation: Proactive management of product liability and warranty issues can significantly reduce financial exposure and reputational damage.

Mergers & Acquisitions Regulations

Beacon's ambitious growth plans heavily rely on strategic acquisitions, making mergers and acquisitions (M&A) regulations a critical legal factor. These regulations, primarily antitrust and competition laws, govern how companies can combine to prevent market monopolization and ensure fair competition. For instance, the 2024 acquisition of Beacon by QXO necessitated extensive antitrust reviews and clearances in both the United States and Canada. This demonstrates the significant legal hurdles and compliance requirements inherent in industry consolidation.

Navigating these M&A regulations is paramount for Beacon's expansion strategy. Failure to comply can result in delayed or blocked transactions, substantial fines, and reputational damage. As of early 2025, regulatory scrutiny on large-scale consolidations in the building materials sector remains high, emphasizing the need for proactive legal counsel and thorough due diligence in all acquisition pursuits.

- Antitrust Review: Acquisitions must pass muster with regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the U.S. to ensure no undue market power is gained.

- Competition Laws: Adherence to both domestic and international competition laws is vital, especially when acquiring companies with significant market share or cross-border operations.

- Deal Clearance: Obtaining necessary regulatory approvals, as seen in the QXO acquisition, is a prerequisite for finalizing any significant M&A activity.

- Compliance Costs: Legal and advisory fees associated with M&A compliance can be substantial, impacting the overall financial viability of a deal.

Beacon operates under stringent building codes and safety regulations, particularly concerning roofing and structural integrity, with enforcement varying by North American jurisdiction. Energy efficiency mandates, updated in many regions in 2024, directly influence product selection and marketing strategies for roofing systems.

Non-compliance with these evolving standards, such as anticipated International Building Code updates for 2025, poses significant legal risks including fines and recalls, impacting Beacon's financial performance and public image. Proactive adaptation to these requirements is essential for maintaining market access and customer trust.

Environmental laws significantly impact Beacon's operations, from waste management to pollution control, influencing material handling and distribution practices. Regulations such as the EPA's RCRA underscore the need for responsible management of construction and demolition debris, an area where the U.S. generated over 600 million tons in 2023.

Beacon's role as a major employer necessitates strict adherence to labor laws, including minimum wage (federal $7.25/hr in 2024, with many states higher) and OSHA workplace safety standards. Understanding unionization rules is also key to operational stability and positive employee relations.

| Legal Area | Key Considerations | 2024/2025 Relevance |

|---|---|---|

| Building & Safety Codes | Fire resistance, load capacity, energy efficiency | Updating energy standards impacts roofing system choices. |

| Environmental Law | Waste management, pollution control, material handling | RCRA compliance for C&D debris management is critical. |

| Labor & Employment | Minimum wage, workplace safety (OSHA), unionization | Varying state minimum wages, OSHA compliance. |

| Product Liability & Warranty | Product safety, claims management, supplier agreements | CPSC oversight; strong supplier contracts reduce recall costs. |

| Mergers & Acquisitions | Antitrust, competition laws, deal clearance | Ongoing scrutiny on consolidations, FTC/DOJ reviews. |

Environmental factors

The increasing frequency and intensity of extreme weather events, such as heavy storms, hail, and high winds, are directly impacting roof durability. This trend is a significant factor for companies like Beacon, driving consistent demand for roofing materials and necessitating the development of more resilient product offerings. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported a record 28 separate billion-dollar weather and climate disasters in the United States in 2023, a significant jump from previous years.

Consumer and regulatory pressure is significantly boosting the demand for sustainable and recycled building materials. Beacon needs to actively incorporate products like cool roofs and shingles with recycled content into its offerings. This shift isn't just about preference; it's becoming a requirement, with many regions actively pushing for greener construction practices. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $450 billion by 2030, indicating a strong growth trajectory.

Increasingly stringent energy efficiency standards for buildings are a significant environmental driver. Regulations like those pushing for net-zero energy buildings by 2030 in many regions are directly influencing construction practices.

This trend boosts demand for advanced insulation and reflective roofing materials, essential for meeting these new benchmarks. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, with energy efficiency components being a key contributor.

Beacon's capacity to provide materials that aid contractors in achieving certifications like LEED Platinum or BREEAM Outstanding is paramount. These certifications are becoming prerequisites for many commercial projects, especially in 2024 and 2025, impacting competitive positioning.

Successfully supplying these high-performance materials ensures Beacon's relevance and supports the broader shift towards sustainable, energy-conscious construction throughout the 2024-2025 period.

Waste Management and Recycling Regulations

Environmental regulations, particularly concerning construction and demolition (C&D) waste, are tightening. This trend pushes for increased recycling and waste minimization across the industry. For instance, in 2024, many regions are implementing stricter landfill diversion targets, with some aiming for 75% or higher for C&D waste, a significant jump from previous years.

As a distributor, Beacon can proactively address these evolving regulations. By championing material take-back programs, Beacon can facilitate the responsible disposal and recycling of old materials. Furthermore, promoting products designed for longevity, reusability, or that inherently produce less waste during installation or use, aligns with circular economy principles and regulatory expectations.

- Increased Recycling Mandates: Many jurisdictions now require a minimum percentage of C&D waste to be recycled, often exceeding 70% by 2025.

- Extended Producer Responsibility (EPR): Emerging EPR schemes are placing more onus on manufacturers and distributors for product end-of-life management, including recycling.

- Focus on Sustainable Materials: A growing demand exists for building materials that are either recycled, recyclable, or have a lower environmental footprint throughout their lifecycle.

- Beacon's Role: Distributors like Beacon can gain a competitive edge by offering product lines that meet these sustainability criteria and by establishing efficient take-back and recycling partnerships.

Carbon Footprint Reduction Initiatives

Companies are increasingly prioritizing the reduction of their carbon footprint, extending this focus to the embodied carbon within building materials. This shift is driven by growing regulatory pressures and consumer demand for sustainable practices. For instance, the construction industry is exploring innovative materials and construction methods to minimize environmental impact throughout a project’s lifecycle.

Beacon's commitment to decreasing its Greenhouse Gas emissions intensity by 50% by 2030 underscores this industry-wide movement. This target is being pursued through tangible actions, such as optimizing its vehicle fleet for better fuel efficiency and implementing energy-saving measures across its facilities. These initiatives align with global efforts to combat climate change and promote environmental stewardship.

The broader trend highlights a significant environmental factor influencing business operations. By 2024, many companies are setting ambitious net-zero targets, with a notable increase in reporting on Scope 1 and Scope 2 emissions. For example, a 2024 survey indicated that over 70% of large corporations have publicly committed to emission reduction goals, a substantial rise from previous years.

- Industry Trend: Growing focus on reducing carbon footprints, including embodied carbon in construction materials.

- Beacon's Goal: 50% reduction in Greenhouse Gas emissions intensity by 2030.

- Initiatives: Fleet efficiency improvements and facility energy conservation measures.

- Market Data: Over 70% of large corporations had set emission reduction goals by 2024, demonstrating a widespread industry commitment.

Extreme weather events are increasingly impacting building materials, driving demand for more durable and resilient roofing solutions. NOAA data shows a significant rise in billion-dollar weather disasters, such as the 28 recorded in 2023.

Growing consumer and regulatory demand for sustainable building materials, including those with recycled content, is a key environmental factor. The global green building materials market, valued at approximately $250 billion in 2023, reflects this trend.

Stricter energy efficiency standards are pushing for advanced insulation and reflective roofing products, crucial for meeting net-zero building targets by 2030. This is a major driver for materials that help achieve certifications like LEED.

Tightening regulations on construction and demolition waste are promoting recycling and waste minimization, with many regions aiming for over 75% landfill diversion for C&D waste by 2025.

| Environmental Factor | Impact on Roofing Industry | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Extreme Weather Events | Increased demand for durable, resilient roofing materials | 28 billion-dollar weather disasters in the US in 2023 (NOAA) |

| Sustainability Demand | Growth in recycled content and eco-friendly product offerings | Global green building materials market ~ $250 billion (2023) |

| Energy Efficiency Standards | Higher demand for insulation and reflective roofing for energy-saving buildings | Push towards net-zero energy buildings by 2030 |

| Waste Reduction Regulations | Emphasis on recycling and waste minimization in construction | Targeting >75% C&D waste diversion in many regions by 2025 |

PESTLE Analysis Data Sources

Our Beacon PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable economic indicators, and leading industry research. We integrate data from international organizations, regulatory bodies, and market intelligence firms to ensure comprehensive and actionable insights.