Beam Therapeutics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beam Therapeutics Bundle

Beam Therapeutics navigates a complex landscape, facing intense competition from established gene editing players and the looming threat of novel technologies. Understanding the power of its suppliers, from specialized reagents to intellectual property, is crucial for its operational success.

The complete report reveals the real forces shaping Beam Therapeutics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Beam Therapeutics depends heavily on specialized reagents, enzymes, and materials crucial for its base editing and gene therapy innovations. The highly specific nature of these inputs, particularly proprietary enzymes or delivery mechanisms, grants suppliers substantial leverage when alternative sources are scarce. For instance, the gene therapy market, a key area for Beam, saw significant investment in 2024, with companies like Moderna and Vertex Pharmaceuticals advancing their programs, underscoring the demand for specialized components.

The development and production of precision genetic medicines, like those Beam Therapeutics focuses on, rely heavily on advanced and often custom-built manufacturing equipment. Suppliers of these specialized machines, especially those with unique or patented technologies, wield significant bargaining power.

Beam Therapeutics’ strategic move to invest in internal manufacturing capabilities is a direct response to mitigate this supplier dependence. However, the initial setup and ongoing maintenance of such sophisticated equipment still necessitate reliance on external vendors, keeping this supplier power a relevant consideration.

Beam Therapeutics, while a leader in base editing, may license foundational gene editing intellectual property from external sources. These licensors, acting as suppliers of critical IP, can exert significant bargaining power through their licensing terms and royalty demands, directly impacting Beam's operational costs and market competitiveness.

Contract Research and Manufacturing Organizations (CROs/CMOs)

Contract Research and Manufacturing Organizations (CROs/CMOs) hold significant bargaining power, particularly those specializing in niche areas like gene therapy. Biotech firms like Beam Therapeutics frequently rely on these external partners for critical research, clinical trial management, and manufacturing. This reliance, coupled with the CROs/CMOs' specialized expertise, advanced infrastructure, and adherence to strict regulatory requirements, grants them considerable leverage in negotiations.

The specialized nature of gene editing technologies means fewer CROs/CMOs possess the necessary capabilities. For instance, as of late 2024, the number of CROs with proven GMP manufacturing capacity for advanced gene therapies remained limited, driving up demand and consequently, their pricing power. Companies that can demonstrate a strong track record and possess proprietary technologies or processes further solidify their position.

- Specialized Expertise: CROs/CMOs with deep knowledge in gene therapy development and manufacturing command higher prices.

- Regulatory Compliance: Adherence to stringent FDA and EMA regulations is a key differentiator, increasing their value and bargaining power.

- Limited Competition in Niche Areas: The scarcity of providers capable of handling complex gene editing projects strengthens their negotiating position.

- Infrastructure Investment: Significant capital investment in specialized facilities and equipment translates to higher service costs and less price sensitivity from clients.

Talent and Expertise

The biotechnology sector, especially in advanced areas like gene editing, relies heavily on a niche workforce. Highly skilled scientists and researchers in fields such as base editing and genomics are in limited supply, giving them significant leverage.

This scarcity translates into considerable bargaining power for these professionals, influencing salary expectations, benefits packages, and overall working conditions. For companies like Beam Therapeutics, this dynamic directly impacts operational expenses and the ability to attract and retain top talent.

- High Demand for Specialized Skills: The gene editing field requires very specific expertise, making qualified personnel a valuable commodity.

- Limited Talent Pool: The number of individuals possessing the necessary advanced skills in areas like base editing and clinical development is relatively small.

- Impact on Labor Costs: The bargaining power of these skilled employees can lead to higher compensation and benefit demands, increasing Beam's operating costs.

Suppliers of highly specialized reagents, proprietary enzymes, and advanced manufacturing equipment for gene editing technologies possess significant bargaining power over Beam Therapeutics. This leverage is amplified by the limited number of qualified CROs/CMOs capable of handling complex gene therapy projects, as evidenced by the constrained GMP manufacturing capacity for advanced gene therapies observed in late 2024.

The scarcity of highly skilled scientists and researchers in niche fields like base editing further strengthens the bargaining power of labor, directly impacting Beam's operational costs. Additionally, licensors of foundational gene editing intellectual property can command substantial royalties, influencing Beam's overall competitiveness.

| Factor | Impact on Beam Therapeutics | 2024 Market Context |

| Specialized Reagents/Enzymes | High dependence, limited alternatives | Growing demand in gene therapy market |

| Advanced Manufacturing Equipment | Reliance on proprietary technology suppliers | Limited specialized equipment providers |

| CROs/CMOs Expertise | Leverage due to niche capabilities and compliance | Scarcity of GMP facilities for gene therapies |

| Skilled Labor | Increased labor costs and retention challenges | High demand for specialized geneticists |

| IP Licensors | Royalty demands impact operational costs | Key factor in early-stage biotech development |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Beam Therapeutics' innovative gene editing technology.

Instantly assess the competitive landscape for Beam Therapeutics, pinpointing key pressures from rivals and potential disruptors in the gene editing space.

Customers Bargaining Power

Beam Therapeutics targets severe diseases with few or no effective treatments, meaning patients have limited alternatives. For instance, sickle cell disease, a primary focus for Beam, affects an estimated 20 million people worldwide, with current treatments often managing symptoms rather than offering a cure. This high unmet medical need significantly weakens the bargaining power of these patients and their healthcare providers when considering Beam's innovative gene editing therapies.

For Beam Therapeutics, the bargaining power of customers, particularly patients undergoing gene therapy, is significantly reduced due to extremely high switching costs. Once a patient receives a gene therapy, transitioning to a different treatment becomes exceptionally complex, often requiring further intricate medical interventions and substantial financial and emotional commitment. This effectively creates a lock-in effect, limiting the patient's ability to switch and thus diminishing their future leverage.

While individual patients typically possess minimal direct bargaining power, the true leverage lies with reimbursement entities like insurance companies and government health programs. These powerful payers negotiate the prices of advanced therapies and establish reimbursement frameworks, directly influencing the market access and financial viability of companies like Beam Therapeutics. Their considerable influence stems from the inherently high costs associated with innovative gene therapies, making their decisions critical.

Physician and Healthcare Provider Influence

Physicians and healthcare providers are critical gatekeepers in the adoption of new therapies like those developed by Beam Therapeutics. Their recommendations are heavily influenced by robust clinical trial data, demonstrated safety, and the practical aspects of administering a treatment. For instance, a physician’s willingness to prescribe a gene therapy can be directly tied to its efficacy compared to existing treatments and the complexity of its delivery. This makes their opinion a significant factor in how quickly a therapy gains traction.

The influence of these medical professionals translates into a powerful, albeit indirect, form of customer bargaining power. If physicians perceive a therapy as superior or more manageable, they are more likely to adopt it, thereby driving demand. Conversely, if they have reservations about efficacy or administration, they can slow down or even prevent its widespread use. This dynamic is particularly relevant in the gene therapy space where novel mechanisms of action require careful evaluation by the medical community.

- Physician Advocacy: Positive endorsements from key opinion leaders in relevant medical fields can significantly accelerate market penetration for gene therapies.

- Clinical Data Requirements: Healthcare providers demand comprehensive data demonstrating a therapy's benefit-risk profile before incorporating it into their practice.

- Reimbursement Influence: Physicians' comfort level with a therapy can also be linked to the likelihood of successful reimbursement, a critical factor for patient access.

- Ease of Administration: Therapies that are simpler to administer, requiring less specialized equipment or training, tend to see faster adoption by healthcare providers.

Patient Advocacy Groups and Public Perception

Patient advocacy groups are increasingly powerful voices in healthcare, capable of significantly influencing market access for novel therapies like those developed by Beam Therapeutics. These organizations actively lobby regulators and payers, pushing for broader availability of treatments and raising public awareness about specific genetic diseases. For instance, in 2024, several prominent patient advocacy groups successfully campaigned for accelerated review and reimbursement of gene therapies for rare conditions, demonstrating their leverage.

The public perception of a company and its products, often amplified by these advocacy groups and media narratives, can directly impact regulatory pathways and commercial success. A positive public image, fostered by effective communication and demonstrated patient benefit, can smooth the path through regulatory hurdles and encourage market adoption. Conversely, negative press or public concern, perhaps related to pricing or perceived safety, can create significant headwinds for new treatments.

- Influence on Regulatory Processes: In 2024, patient advocacy groups played a role in the FDA's decision-making for several new drug approvals, providing crucial patient perspectives that informed labeling and access considerations.

- Impact on Market Acceptance: Public sentiment, shaped by advocacy and media, can influence physician prescribing habits and patient demand, directly affecting a company's revenue projections.

- Disease Awareness Campaigns: Groups often fund and lead campaigns that educate the public and healthcare providers about specific diseases, indirectly benefiting companies developing treatments for those conditions.

The bargaining power of customers for Beam Therapeutics is notably low, primarily due to the critical nature of their gene therapies and the lack of viable alternatives for patients with severe genetic diseases. This scarcity of treatment options means patients and their providers have limited leverage in price negotiations. For example, in diseases like sickle cell disease, where Beam is active, the unmet medical need is substantial, giving Beam significant pricing power.

Switching costs for patients are exceptionally high, creating a strong lock-in effect that further reduces customer bargaining power. Once a patient undergoes a gene therapy, the complexity and commitment involved make changing treatments exceedingly difficult. This inherent stickiness in the customer relationship limits their ability to exert pressure on pricing or terms.

While individual patients have minimal power, reimbursement entities like insurance companies and government payers represent a significant, albeit indirect, customer force. These entities negotiate prices for advanced therapies, and their decisions heavily influence market access and Beam's revenue. In 2024, the high cost of gene therapies continued to be a major point of negotiation for these payers.

Physicians, as key influencers and gatekeepers, also wield indirect bargaining power. Their adoption of Beam's therapies depends on robust clinical data, safety profiles, and ease of administration. For instance, in 2024, physician acceptance of new gene therapies was often tied to their perceived superiority over existing treatments and the clarity of reimbursement pathways.

| Customer Segment | Bargaining Power Factor | Impact on Beam Therapeutics |

|---|---|---|

| Patients | High unmet medical need, few alternatives | Low bargaining power, enabling premium pricing |

| Healthcare Providers (Physicians) | Dependence on clinical data, ease of administration | Indirect power through adoption rates; advocacy can increase demand |

| Reimbursement Entities (Payers) | Control over pricing and market access | Significant power; direct negotiation on therapy costs |

| Patient Advocacy Groups | Influence on public perception and regulatory processes | Indirect power; can accelerate market acceptance and access |

Same Document Delivered

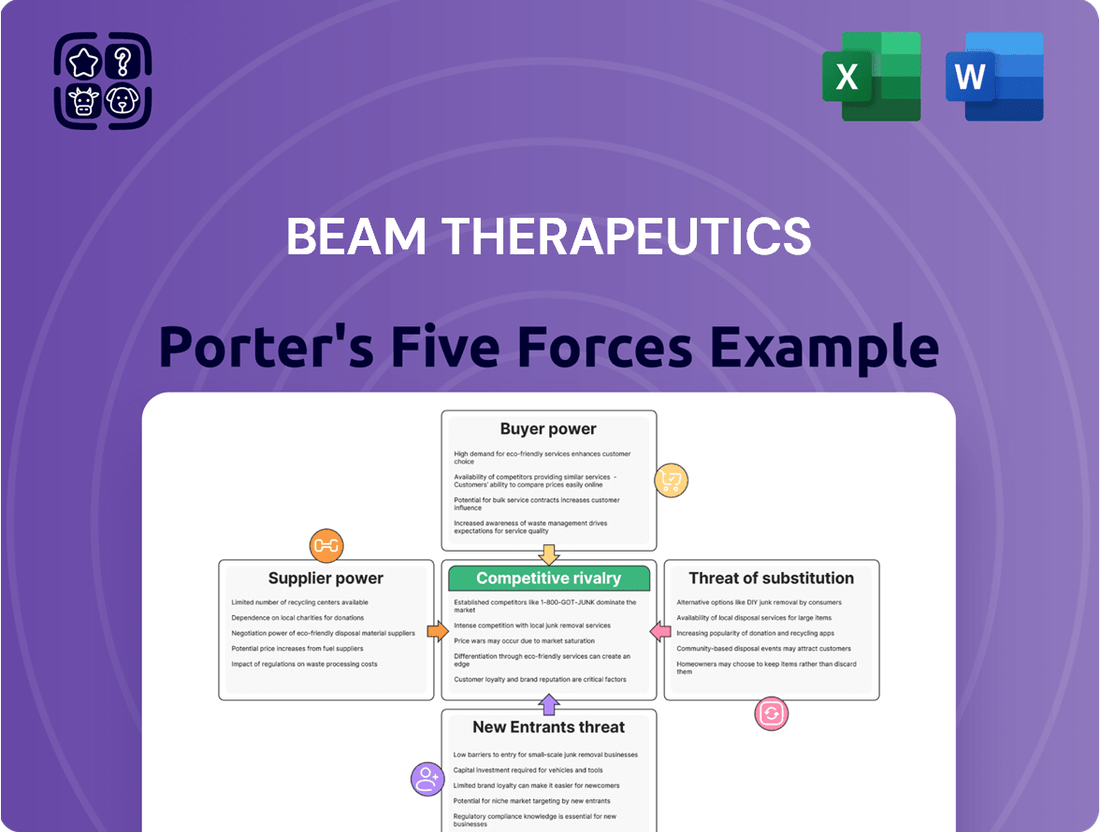

Beam Therapeutics Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Beam Therapeutics, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

The gene editing field is intensely competitive, featuring major players like CRISPR Therapeutics and Editas Medicine. These companies already boast advanced clinical trials or even approved treatments, creating a crowded market for Beam Therapeutics.

CRISPR Therapeutics, for example, achieved a significant milestone with the FDA approval of CASGEVY for sickle cell disease. This directly positions them as a competitor to Beam's own BEAM-101 program, highlighting the existing rivalry for similar patient populations.

The gene editing landscape is a hotbed of innovation, with new technologies and improvements appearing at a breakneck pace. This constant evolution means that even established platforms can be quickly challenged.

While Beam Therapeutics' base editing technology is highly precise, other companies are forging ahead with different gene editing methods. For instance, Prime Medicine is developing prime editing, which may offer distinct benefits and escalate the competitive pressure on Beam.

This rapid technological advancement means that companies must continually invest in research and development to stay ahead. The ability to adapt and integrate new techniques will be crucial for maintaining a competitive edge in this dynamic field.

Beam Therapeutics faces intense competition as numerous companies are developing therapies for a wide range of genetic diseases. For instance, both Beam and other biotech firms are targeting indications like sickle cell disease and alpha-1 antitrypsin deficiency, creating direct competition for patient populations and market share.

This broad pursuit of diverse genetic targets means that multiple players are often vying for the same therapeutic areas. This overlap significantly heightens the competitive rivalry within the gene editing and therapy space, as companies race to bring effective treatments to market.

Strategic Partnerships and Collaborations

Companies in the gene editing sector, including those like Beam Therapeutics, often forge strategic partnerships with larger pharmaceutical firms and leading academic centers. These alliances are crucial for advancing research, sharing the significant financial burdens of development, and accessing specialized expertise and infrastructure. For instance, in early 2024, Vertex Pharmaceuticals and CRISPR Therapeutics, a major competitor in gene editing, announced an expanded collaboration to develop new CRISPR-based therapies, highlighting the trend of deep partnerships within the field.

These collaborations can significantly bolster a competitor's capabilities and market presence, thereby intensifying the overall competitive rivalry. By pooling resources and knowledge, partners can accelerate the pace of innovation and bring therapies to market more efficiently. This dynamic means that companies not actively engaged in such strategic alliances may find themselves at a disadvantage.

- Accelerated Development: Partnerships allow gene editing companies to leverage the extensive clinical trial infrastructure and regulatory expertise of larger pharmaceutical players, speeding up the journey from lab to patient.

- Risk Mitigation: Sharing the substantial costs and inherent risks associated with novel therapeutic development through collaborations is a common strategy to ensure financial sustainability.

- Access to Resources: Collaborations provide access to critical resources such as specialized scientific talent, advanced manufacturing capabilities, and established distribution networks, which are vital for competitive success.

- Competitive Intensification: The formation of strong partnerships by key players in the gene editing space raises the bar for all participants, increasing the intensity of competition as companies strive to secure similar advantageous alliances.

Intellectual Property Litigation and Licensing Battles

The gene editing sector, including companies like Beam Therapeutics, faces intense competitive rivalry stemming from intellectual property litigation and licensing disputes. The foundational CRISPR technologies are particularly contested, with numerous patent applications and ongoing legal challenges. These battles can significantly impact market entry and operational freedom.

Such disputes introduce considerable uncertainty for companies, often leading to substantial legal expenses. For instance, patent disputes in the biotech sector can easily run into millions of dollars in legal fees. Furthermore, unfavorable rulings might necessitate costly licensing agreements or even limit a company's ability to commercialize certain gene editing approaches, directly affecting competitive positioning.

- Patent Landscape: The gene editing field is characterized by a dense web of patents covering various CRISPR-Cas systems and delivery methods.

- Litigation Costs: Legal battles over gene editing patents can incur tens of millions of dollars in expenses for involved parties.

- Licensing Requirements: Companies may need to secure licenses for key technologies, adding to operational costs and potentially limiting exclusivity.

- Market Access: Intellectual property disputes can create barriers to market entry or restrict the scope of commercial applications for gene editing platforms.

Beam Therapeutics operates in a fiercely competitive gene editing arena, with established players like CRISPR Therapeutics and Editas Medicine already holding advanced clinical programs and even approved therapies. CRISPR Therapeutics' FDA approval of CASGEVY for sickle cell disease in late 2023 directly challenges Beam's own efforts in similar patient populations, intensifying the rivalry for market share and patient access.

The rapid pace of innovation means companies must constantly invest in R&D to maintain an edge. For example, while Beam focuses on base editing, competitors like Prime Medicine are advancing prime editing, potentially offering different therapeutic advantages and increasing competitive pressure.

Strategic partnerships are common, as seen with Vertex Pharmaceuticals and CRISPR Therapeutics expanding their collaboration in early 2024. These alliances accelerate development and mitigate risk, but also raise the competitive bar for companies not similarly partnered.

Intellectual property disputes are a significant factor, with ongoing patent battles over foundational CRISPR technologies potentially leading to millions in legal fees and impacting market access for companies like Beam Therapeutics.

| Company | Key Technology | Notable Progress/Approvals (as of mid-2024) | Target Indications |

|---|---|---|---|

| CRISPR Therapeutics | CRISPR-Cas9 | FDA approval for CASGEVY (sickle cell disease, beta-thalassemia) | Sickle cell disease, beta-thalassemia, oncology |

| Editas Medicine | CRISPR-Cas9 | Multiple clinical trials ongoing | Leber congenital amaurosis, sickle cell disease |

| Beam Therapeutics | Base Editing | Multiple clinical trials ongoing (e.g., for sickle cell disease) | Sickle cell disease, beta-thalassemia, other genetic diseases |

| Prime Medicine | Prime Editing | Multiple clinical trials ongoing | Various genetic diseases |

SSubstitutes Threaten

For many genetic diseases, traditional medical treatments, even if symptomatic, act as substitutes for gene editing therapies. For instance, in sickle cell disease, established treatments like hydroxyurea and blood transfusions offer alternatives, though they don't correct the underlying genetic defect. In 2024, the global sickle cell disease market was valued at approximately $3.5 billion, highlighting the significant presence of these existing therapies.

Beyond base editing, other gene therapy techniques like CRISPR-Cas9, which induces double-strand DNA breaks, and established viral vector-based therapies pose as significant substitutes. While Beam emphasizes the precision of its base editing, the clinical success and safety records of these alternatives could impact market adoption.

Small molecule drugs and biologics can pose a threat by offering alternative treatment pathways that don't directly involve gene editing. For instance, if a biologic therapy effectively manages the symptoms of a genetic disorder with fewer side effects or at a lower cost, it might deter patients from pursuing gene-editing therapies like those developed by Beam Therapeutics. The market for biologics is substantial, with global sales expected to reach over $600 billion by 2024, indicating a well-established and competitive landscape.

Lifestyle and Dietary Interventions

For certain genetic disorders, particularly metabolic ones like Glycogen Storage Disease Type Ia (GSDIa), lifestyle and dietary interventions can act as substitutes for advanced genetic therapies. These non-pharmacological strategies, though demanding, aim to manage the condition by controlling nutrient intake and physical activity.

The effectiveness of these interventions directly impacts the perceived need for gene editing solutions. For instance, meticulous dietary management, including frequent carbohydrate intake and avoidance of certain foods, is the cornerstone of GSDIa treatment, delaying or preventing severe complications. This established approach presents a significant barrier for new therapies if it can adequately control disease progression.

- Dietary Management: Strict adherence to specific carbohydrate intake schedules is vital for GSDIa patients, often requiring multiple small meals throughout the day.

- Lifestyle Modifications: Avoiding prolonged fasting and managing exercise intensity are key components to prevent hypoglycemia in GSDIa.

- Burden of Intervention: The continuous and rigorous nature of these lifestyle and dietary changes can be a significant burden on patients and caregivers, potentially increasing receptiveness to alternative treatments like gene therapy.

Emerging Therapeutic Approaches

The threat of substitutes for Beam Therapeutics' gene editing technology is growing as the biotechnology sector rapidly innovates. Alternative therapeutic modalities are emerging that could achieve similar patient outcomes without direct genetic modification.

These include advanced RNA-based therapies, which can modulate gene expression, and protein replacement therapies that address genetic disorders by supplying functional proteins. Furthermore, sophisticated cell therapies, not reliant on altering a patient's DNA, are also gaining traction.

For instance, the market for RNA therapeutics, including mRNA vaccines and therapies for rare diseases, saw significant growth, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030. This expansion highlights the increasing viability and adoption of non-gene editing approaches.

- RNA-based therapies: Offer transient modulation of gene expression, potentially bypassing the permanence and off-target concerns associated with gene editing.

- Protein replacement therapies: Directly address the functional deficit in genetic diseases by providing the missing or faulty protein, a well-established therapeutic strategy.

- Advanced cell therapies: Utilize modified or engineered cells to treat diseases, offering alternative mechanisms of action that may not require direct DNA editing.

- Market growth: The global gene therapy market was valued at approximately $12.5 billion in 2023 and is expected to reach over $30 billion by 2030, but the rise of these substitutes could temper its growth trajectory.

The threat of substitutes for Beam Therapeutics' gene editing technology is significant, encompassing traditional treatments, other gene therapy modalities, and emerging biotechnologies. Established therapies like hydroxyurea for sickle cell disease, valued in a $3.5 billion market in 2024, offer symptomatic relief and present a baseline for comparison. Other gene editing techniques such as CRISPR-Cas9 and existing viral vector therapies also represent direct substitutes, leveraging established clinical data and safety profiles.

Furthermore, the substantial global biologics market, projected to exceed $600 billion by 2024, provides a broad category of alternative treatments that manage genetic disorders without direct DNA modification. Even lifestyle and dietary interventions for conditions like GSDIa serve as substitutes by managing disease progression, albeit with significant patient burden. The rapid innovation in RNA-based therapies, protein replacement, and cell therapies further intensifies this threat, as these modalities offer alternative mechanisms to address genetic defects.

| Substitute Category | Example Therapies/Interventions | Market Context/Data Point |

| Traditional Treatments | Hydroxyurea, Blood Transfusions (Sickle Cell Disease) | Sickle Cell Disease Market: ~$3.5 billion (2024) |

| Alternative Gene Therapies | CRISPR-Cas9, Viral Vector Therapies | Global Gene Therapy Market: ~$12.5 billion (2023), projected to exceed $30 billion by 2030 |

| Biologics and Small Molecules | Various protein or antibody-based drugs | Global Biologics Market: >$600 billion (2024) |

| Lifestyle/Dietary Interventions | Strict dietary management (GSDIa) | Cornerstone of treatment for specific metabolic disorders |

| Emerging Biotechnologies | RNA-based therapies, Protein Replacement, Cell Therapies | RNA Therapeutics CAGR: >15% through 2030 |

Entrants Threaten

Developing cutting-edge genetic medicines, like those Beam Therapeutics is pioneering with base editing, demands immense capital. This includes significant outlays for research, extensive clinical trials, and building specialized manufacturing capabilities. For instance, in 2024, early-stage biotech companies often seek hundreds of millions of dollars in funding to advance their platforms through preclinical and early clinical stages, a figure that escalates dramatically for more advanced programs.

These substantial upfront financial commitments create a formidable barrier to entry for potential competitors. New companies would need to secure comparable funding to even begin competing, making it difficult for smaller, less capitalized players to enter the precision genetic medicine space. This high capital requirement effectively shields existing companies like Beam Therapeutics from immediate, widespread competition.

Extensive regulatory hurdles significantly deter new entrants in the gene therapy space, a sector where Beam Therapeutics operates. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous approval processes, demanding extensive preclinical and clinical testing to ensure safety and efficacy. For instance, the average cost to bring a new drug to market, including gene therapies, can exceed $2 billion, with clinical trials alone often spanning years and requiring substantial investment. This demanding pathway, characterized by multiple phases of human testing and meticulous data submission, acts as a powerful barrier, limiting the number of companies capable of successfully navigating the landscape and bringing novel therapies to patients.

Beam Therapeutics' robust intellectual property portfolio, particularly concerning its groundbreaking base editing technology, presents a significant barrier to entry. The sheer difficulty and expense associated with developing and patenting novel gene editing tools mean new entrants face immense hurdles in creating comparable, non-infringing technologies. This creates a substantial competitive moat, limiting the threat of new companies effectively challenging Beam's market position.

Need for Specialized Expertise and Talent

The highly specialized nature of gene editing, particularly base editing, requires a deep pool of scientific and technical talent. New entrants face a significant hurdle in attracting and retaining this expertise, as established companies like Beam Therapeutics have already built experienced teams. This talent gap can slow down research and development timelines, making it difficult for newcomers to compete effectively.

For instance, as of early 2024, the demand for gene therapy specialists, including those with expertise in CRISPR and base editing, far outstrips the available supply. Many leading biotech firms are actively recruiting from a limited pool of highly qualified scientists, driving up compensation and making it challenging for startups to assemble competitive teams.

- Talent Scarcity: The niche skillset required for advanced gene editing is scarce, creating a barrier for new companies.

- Established Teams: Companies like Beam Therapeutics benefit from existing, experienced scientific personnel.

- Recruitment Challenges: Startups struggle to attract top-tier talent due to competition and higher compensation demands.

- R&D Delays: A lack of specialized expertise can significantly impede a new entrant's ability to advance its technology and pipeline.

Time and Cost of Clinical Development

The sheer time and cost involved in bringing a genetic medicine like those developed by Beam Therapeutics to market act as a significant barrier to entry. This process, from initial discovery through extensive clinical trials and regulatory approval, can easily span more than a decade. Consider that the average cost to develop a new drug, including the failures, is estimated by some studies to be well over $2 billion, with some analyses placing it closer to $6 billion when accounting for the cost of capital and the high failure rate.

This lengthy and capital-intensive journey is fraught with risk. High attrition rates in clinical trials mean that many promising candidates fail to demonstrate sufficient safety or efficacy, leading to substantial financial losses for the developing company. For instance, in 2023, the FDA approved a record number of novel drugs, yet the vast majority of candidates entering Phase 1 trials never reach the market.

These factors create a formidable deterrent for potential new entrants. The need for immense upfront capital, coupled with the extended timelines and inherent uncertainty of clinical success, makes the genetic medicine landscape a challenging arena for companies without established infrastructure and significant financial backing.

- Extended Development Timelines: Genetic medicine development often exceeds 10 years from discovery to market.

- High Development Costs: Estimates suggest drug development costs can range from $2 billion to over $6 billion.

- Clinical Trial Attrition: A significant percentage of drug candidates fail during clinical testing, increasing overall costs and risk.

The threat of new entrants into the gene editing space, where Beam Therapeutics operates, is significantly mitigated by the immense capital requirements. Developing these sophisticated therapies demands substantial investment in research, clinical trials, and specialized manufacturing. For example, in 2024, early-stage biotech firms often need hundreds of millions of dollars to advance their platforms, a figure that grows exponentially for more mature programs.

This high barrier to entry means that new companies must secure comparable funding to even begin competing, making it difficult for less capitalized players to enter the precision genetic medicine market. Consequently, established companies like Beam Therapeutics are largely protected from immediate, widespread competition.

The lengthy development cycles and high failure rates inherent in genetic medicine further deter new entrants. The journey from discovery to market approval can easily exceed a decade, with estimated development costs ranging from $2 billion to over $6 billion when accounting for failures and the cost of capital. This extended timeline and inherent risk, coupled with significant upfront capital needs, create a formidable challenge for new companies without established infrastructure and substantial financial backing.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024 Estimates) |

|---|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, and manufacturing. | Requires significant funding, limiting smaller players. | Early-stage biotech funding often in the hundreds of millions. |

| Development Time & Cost | Long timelines (10+ years) and substantial investment. | Deters companies unwilling to commit extensive resources and time. | Overall drug development costs can exceed $2 billion to $6 billion. |

| Clinical Trial Risk | High attrition rates in clinical testing. | Increases overall costs and uncertainty for new ventures. | Most candidates entering Phase 1 do not reach market approval. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Beam Therapeutics is built upon a foundation of data from SEC filings, investor presentations, and reputable biotechnology industry research reports. This ensures a comprehensive understanding of the competitive landscape, including the bargaining power of suppliers and buyers, the threat of new entrants, and the intensity of rivalry.