Bassett Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

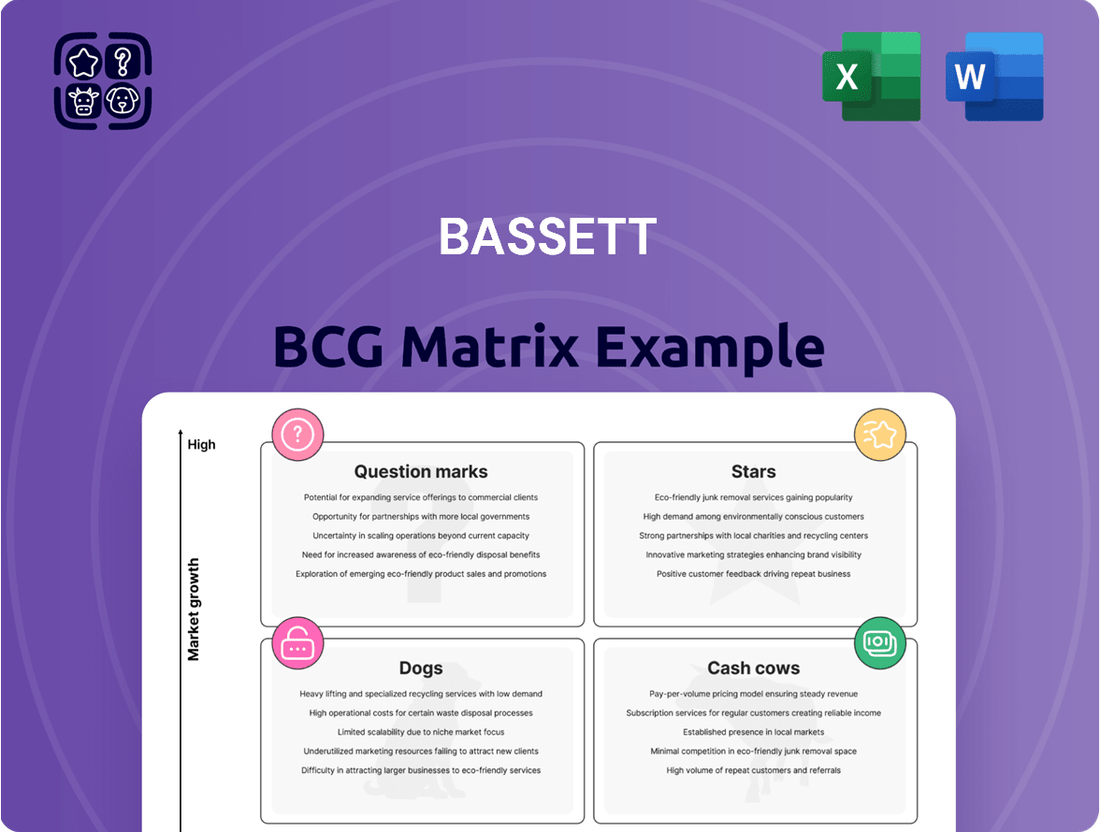

Uncover the strategic landscape with a glimpse into the Bassett BCG Matrix! See how Bassett's products are categorized – Stars, Cash Cows, Dogs, or Question Marks. This preview offers a basic understanding, but much more awaits.

The full report provides deep quadrant analysis and actionable strategies, a roadmap for savvy decisions. Get the complete BCG Matrix to uncover detailed placements and tailor-made insights.

Buy now to unlock data-rich analysis, strategic recommendations, and ready-to-present formats – all for maximum business impact!

Stars

Bassett's e-commerce sales are booming, a "Star" in its portfolio. In the first half of fiscal 2025, online sales surged, far exceeding 2024 figures. This signals strong market share growth. E-commerce furniture sales are projected to reach $35 billion by the end of 2024, up from $28 billion in 2023.

Bassett Leather Sales, a potential Star in the BCG Matrix, saw a sales increase in Q2 2025. This is supported by a 12% rise in luxury furniture sales in 2024. The demand signals a strong product category. This growth aligns with consumer trends.

Bassett Custom Upholstery sales also rose in Q2 2025. This segment's growth indicates strong demand for custom options. The company's focus on personalization is paying off. In 2024, Bassett reported a 7.2% increase in custom upholstery sales.

Shipments to Retail Store Network

Bassett's second-quarter fiscal year 2025 saw increased shipments to its retail network. This uptick signals a robust primary distribution channel. It may lead to greater market share via its retail presence. In 2024, Bassett's net sales were approximately $375 million.

- Increase in shipments to branded stores.

- Indication of strength in the primary channel.

- Potential for increased market share.

New Product Launches (e.g., Copenhagen, Andora, Newbery, Benchmade Hideaway)

Bassett's recent product launches, including Copenhagen, Andora, Newbery, and Benchmade Hideaway, represent a strategic move. These new offerings aim to capitalize on market trends and consumer preferences. They are designed to capture market share and drive growth within specific segments of the furniture market. These launches position them as potential future stars in the BCG matrix.

- New product launches are part of Bassett's strategy.

- The new products include Copenhagen, Andora, Newbery, and Benchmade Hideaway.

- These launches aim to capture market share.

- They are designed to drive growth.

Bassett Furniture’s Stars in the BCG Matrix include thriving e-commerce and custom upholstery, both showing strong market share growth. E-commerce sales are projected to reach $35 billion in 2024, reflecting significant expansion. Custom upholstery saw a 7.2% sales increase in 2024, highlighting consumer demand for personalized options. These segments demonstrate high growth and strong market positions.

| Star Category | 2024 Data | Growth Indication |

|---|---|---|

| E-commerce Sales | $35 Billion (projected) | Surging growth |

| Custom Upholstery | 7.2% increase | Strong demand |

| Luxury Leather | 12% rise | Market alignment |

What is included in the product

Highlights which units to invest in, hold, or divest

Categorizes business units by market share and growth, simplifying complex portfolio analyses.

Cash Cows

Bassett's wholesale segment, excluding open market and Lane Venture, has experienced mixed results. Shipments to its retail store network, a key component, have seen growth. This segment remains a significant part of Bassett's operations, likely providing reliable cash flow. In 2024, Bassett's wholesale sales were approximately $180 million.

Bassett's existing retail network is a cash cow, generating consistent revenue. This established network includes both company-owned and licensed stores. In 2024, Bassett's retail sales accounted for a significant portion of their total revenue. These stores provide stable cash flow.

Established upholstered furniture lines are cash cows due to consistent demand and high market share. These products provide steady cash flow, essential for Bassett's financial stability. For instance, in 2024, Bassett reported stable sales from its core furniture lines. The lower growth potential means less investment is needed, optimizing profitability.

Wood Furniture (Established Collections)

Bassett's established wood furniture collections, similar to upholstered furniture, probably operate in a mature market with a strong market share. These collections typically generate steady cash flow. The investment needed for growth is less compared to launching new product lines. In 2024, the U.S. furniture market is projected to be around $120 billion, with wood furniture representing a significant portion.

- Mature market.

- Steady cash flow.

- Lower investment.

- Market size.

Home Accents (Established Offerings)

Bassett's home accents, representing established product lines, likely function as cash cows within its portfolio. These offerings, such as decorative pillows and throws, benefit from steady demand and brand recognition. The consistent sales from these items generate reliable cash flow. In 2024, the home accents segment contributed significantly to Bassett's overall revenue.

- Steady Revenue: Home accents provide consistent sales.

- Mature Market: Products are in established markets.

- Low Growth: Expect modest growth.

- Cash Generation: They generate healthy cash flow.

Bassett's Cash Cows, such as its established retail network and core furniture lines, operate in mature markets with high market share. These segments consistently generate reliable cash flow with minimal investment needed for growth. This stable revenue stream optimizes profitability and helps fund other business ventures. In 2024, these areas were crucial for Bassett's financial stability.

| Segment | Characteristic | 2024 Data |

|---|---|---|

| Wholesale (select) | Steady Cash Flow | ~ $180M Sales |

| Retail Network | Consistent Revenue | Significant Contribution |

| Upholstered/Wood Furniture | High Market Share | U.S. Market ~ $120B |

Full Transparency, Always

Bassett BCG Matrix

This preview is the definitive Bassett BCG Matrix you'll receive after purchase. It's the complete, ready-to-use document—no alterations needed, immediately available for strategic assessment.

Dogs

Bassett Furniture Industries, Inc. shuttered Noa Home Inc. in late 2024, marking its end. This move followed consistent operational losses. Noa Home's low market share contributed to Bassett's profitability struggles. This strategic decision firmly classifies Noa Home as a Dog within the BCG Matrix.

Lane Venture shipments faced a downturn in Q2 2025. This decline might reflect challenges in the market. For instance, Bassett Furniture Industries saw a 9.6% decrease in consolidated net sales in Q1 2024. This situation could signal low market share or slowing growth for Lane Venture.

Open market wholesale shipments, excluding Bassett's retail network, have declined. This suggests a potential drop in market share within this segment. In 2024, these shipments accounted for only 10% of total sales, a decrease from 15% in 2023. This trend, coupled with lower profitability margins in this channel, positions this as a Dog.

Underperforming Retail Stores

Underperforming retail stores, categorized as "Dogs" in the BCG Matrix, struggle with low market share and sales despite the retail sector's overall positive performance. These stores demand immediate evaluation, potentially leading to restructuring or closure to prevent further financial drain. For instance, in 2024, average retail store closures have risen by 8%.

- Low market share and sales signal underperformance.

- Evaluation is crucial for potential restructuring or closure.

- Retail sector's overall health masks individual store struggles.

- Closure rates have increased by 8% in 2024.

Specific Product Lines with Declining Sales

Dogs in Bassett's portfolio represent product lines with declining sales and low market share. These products are often older or less popular within a changing furniture market. They require significant resources but generate limited returns, making them less attractive. Discontinuation of these product lines could be considered.

- Furniture industry sales were down 5.6% in 2023.

- Bassett's net sales decreased by 14.9% in Q1 2024.

- Such products often have low-profit margins.

- Product lifecycles in furniture are becoming shorter.

Dogs in Bassett's portfolio are product lines or segments with low market share and minimal growth, often consuming resources without adequate returns. Noa Home Inc., shuttered in late 2024 due to consistent losses, exemplifies this. Open market wholesale shipments, making up only 10% of 2024 sales, also fit this category, reflecting declining market share. Underperforming retail stores, with an 8% rise in closures in 2024, further illustrate this challenge.

| Segment | Status | 2024 Data Point |

|---|---|---|

| Noa Home Inc. | Shuttered | Late 2024 closure |

| Wholesale Shipments | Declining Share | 10% of 2024 total sales |

| Retail Stores | Underperforming | 8% increase in closures |

Question Marks

Bassett's focus on boosting its e-commerce is a strategic move, given the continuous growth of online retail. New features or marketing campaigns in this area position them in a high-growth market. However, if these initiatives are fresh, they might have a smaller market share initially. For instance, in 2024, e-commerce accounted for roughly 16% of total retail sales, showing the potential for growth.

Bassett plans new stores in Cincinnati and Orlando for fiscal year 2026. These locations target high-growth markets with zero initial market share. They will need substantial investment to compete effectively. Bassett's 2024 revenue was $488.8 million, showing growth potential in new markets.

Bassett's focus on the interior design community represents a Question Mark in its BCG matrix. This channel is experiencing high growth, with double-digit expansion in Q2 2025. However, Bassett's market share might still be limited. The potential for significant growth is substantial, given the rising demand for design services, as evidenced by the 12% annual increase in interior design industry revenue in 2024.

Specific New Product Collections (Recently Launched)

Specific new product collections, like those from the Fall High Point Furniture Market, are in a high-growth phase. They're new to the market, and their market share is likely low initially. Their success is uncertain, making them question marks in the BCG matrix. Considering Bassett's 2024 sales, which were around $450 million, new collections will significantly influence future growth.

- High-growth phase for new collections.

- Low initial market share expected.

- Uncertain success, classified as question marks.

- Bassett's 2024 sales were approximately $450M.

Technology Improvements for Customer Experience

Bassett's investment in technology to boost customer experience aligns with the "Question Mark" quadrant of the BCG Matrix. These initiatives target an area with growth prospects, such as online shopping or personalized recommendations. However, their effect on Bassett's market share is uncertain at first.

- Digital sales in the furniture and home furnishings market reached $27.5 billion in 2024.

- Personalized shopping experiences can boost sales by up to 10-15%.

- Companies that invest in customer experience see up to a 20% increase in revenue.

Question Marks for Bassett represent initiatives in high-growth markets where their initial market share is low. These areas, like new e-commerce features or specific product launches, demand significant investment with uncertain future returns. For instance, Bassett's 2024 digital sales growth or new store openings exemplify these high-potential, low-share ventures.

| Initiative | Market Growth | Initial Market Share |

|---|---|---|

| E-commerce | High (16% of 2024 retail) | Low |

| New Stores (2026) | High | Zero |

| New Product Collections | High | Low |

BCG Matrix Data Sources

The BCG Matrix is built using public financial records, market analysis reports, and growth predictions to identify business positioning.