BAC Holding International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAC Holding International Bundle

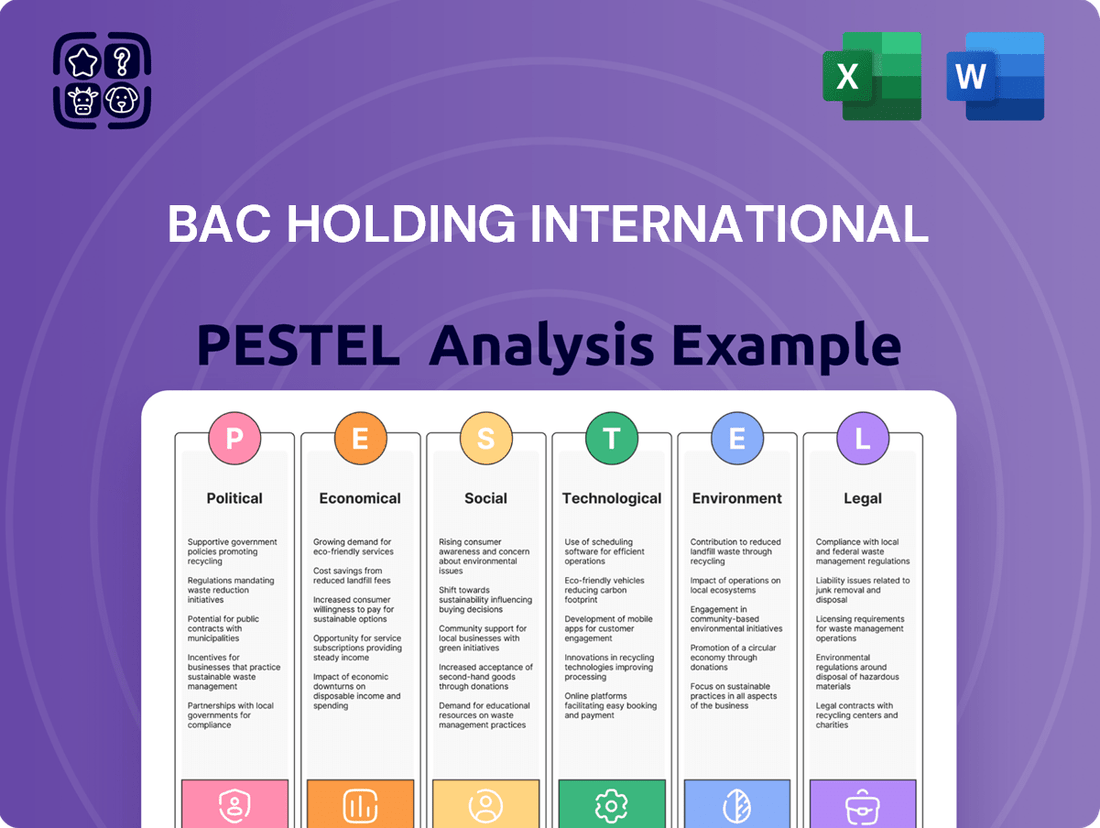

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping BAC Holding International. Our expert-crafted PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a decisive advantage.

Political factors

BAC Holding International operates within Central American nations, where government stability directly influences the financial sector. Stable governments foster predictable policy frameworks, which are crucial for investor confidence and sustained banking operations. For instance, countries with consistent regulatory environments tend to attract more foreign direct investment into their financial markets.

Central bank policies and financial regulatory bodies significantly shape the banking landscape for BAC Holding International. For instance, the European Central Bank's (ECB) ongoing vigilance and potential adjustments to capital requirements, such as the Common Equity Tier 1 (CET1) ratio, directly impact how much capital BAC must hold, influencing its lending capacity and profitability. As of early 2025, the ECB continues to emphasize robust risk management frameworks, pushing banks to maintain strong liquidity buffers in response to evolving economic conditions.

Central America's economic landscape is significantly shaped by trade agreements like the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR), which facilitates smoother cross-border financial transactions and market access for institutions like BAC Holding International. These agreements can boost regional trade volumes, potentially increasing demand for financial services. For instance, CAFTA-DR aims to reduce trade barriers, which could translate into more opportunities for BAC to offer cross-border financing and payment solutions to businesses operating within member countries.

Efforts towards regional integration, such as the Central American Integration System (SICA), also play a crucial role by promoting financial stability and harmonizing regulations. While these initiatives can streamline operations and reduce risk for financial players, they also introduce new competitive pressures. BAC must navigate these evolving dynamics, potentially facing increased competition from international banks seeking to leverage these integrated markets, while also capitalizing on the expanded opportunities for regional business growth and financial service provision.

Political Risk and Corruption

Political instability, including the potential for civil unrest or widespread protests, poses a significant risk to BAC Holding International's operations. Such events can disrupt supply chains, hinder employee access to facilities, and create an unpredictable business environment. For instance, the 2024 Transparency International Corruption Perception Index ranked several countries where BAC might operate, highlighting varying levels of perceived public sector corruption that could increase operational costs through bribery demands or inefficient bureaucratic processes.

Corruption can directly impact BAC's bottom line by inflating costs, delaying projects, and creating an uneven playing field. A higher perceived corruption level, as indicated by a lower score on indices like the Corruption Perception Index, often correlates with increased risk premiums for investors. This can deter foreign direct investment, making it harder for BAC to secure capital for expansion or new ventures, thereby affecting its overall market competitiveness and growth potential.

- Increased Operational Costs: Corruption can lead to demands for illicit payments, adding to the cost of doing business.

- Reputational Damage: Association with corrupt practices, even indirectly, can severely harm BAC's brand image.

- Reduced Foreign Direct Investment: Political instability and corruption deter international investors, limiting capital availability.

- Supply Chain Disruptions: Civil unrest or protests can halt the movement of goods and materials critical to BAC's operations.

Fiscal and Monetary Policy

Government fiscal policies, including spending and taxation, directly influence economic activity and the financial sector. For instance, increased government spending can stimulate demand, potentially boosting loan growth for institutions like BAC. Conversely, rising government debt levels might lead to higher interest rates to attract investors, increasing borrowing costs for banks and potentially dampening consumer lending.

Central bank monetary policies, particularly interest rate decisions, are critical determinants of market liquidity and borrowing costs. In 2024, major central banks continued to navigate inflationary pressures, with interest rate adjustments significantly impacting the cost of funds for banks and the demand for credit from businesses and consumers. For example, the Federal Reserve’s benchmark interest rate, which influenced global borrowing costs, remained a key factor in the financial landscape.

- Government Debt: As of late 2024, many developed nations continued to manage elevated public debt levels, creating a complex environment for fiscal stimulus and potentially influencing long-term interest rate expectations.

- Interest Rate Decisions: Central bank policy rates, such as the Federal Funds Rate or the European Central Bank's main refinancing operations rate, directly affect interbank lending rates and the pricing of loans, impacting BAC's net interest margins.

- Tax Policies: Changes in corporate tax rates can alter a financial institution's after-tax profitability and influence investment decisions, affecting capital allocation and strategic planning for BAC.

Political stability within Central America is paramount for BAC Holding International, as it directly impacts investor confidence and the predictability of financial regulations. Unstable political environments can lead to sudden policy shifts, affecting everything from capital requirements to foreign exchange controls. For instance, the 2024 Transparency International Corruption Perception Index highlighted varying levels of perceived corruption in several Central American nations, directly influencing operational costs and investment attractiveness.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting BAC Holding International, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, helping to identify potential threats and opportunities within BAC Holding International's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for BAC Holding International.

Economic factors

Central America's economic growth is a key driver for BAC Holding International. For instance, the International Monetary Fund (IMF) projected a regional GDP growth of around 3.5% for Central America in 2024, a figure that generally translates to increased consumer spending and business investment. This expansion directly fuels demand for financial services, leading to higher loan origination volumes and potentially better asset quality as borrowers are more likely to meet repayment obligations.

Robust economic expansion in countries like Guatemala and El Salvador, where BAC Holding International has a significant presence, means more disposable income and greater corporate profitability. This scenario supports a healthy loan portfolio for the bank, as businesses expand and individuals seek financing for homes and other purchases. Conversely, a significant economic slowdown, such as a projected regional GDP contraction to below 2%, could dampen loan demand and increase the risk of non-performing loans.

Central banks in key markets where BAC Holding International operates, such as the United States and Europe, have maintained a cautious approach to interest rate policy through early 2024. For instance, the Federal Reserve kept its benchmark federal funds rate steady in a range of 5.25% to 5.50% during its March 2024 meeting, a stance largely continued into mid-2024, reflecting ongoing efforts to curb inflation without stifling economic growth.

This environment directly impacts BAC's net interest margin. When rates are high, the cost of BAC's funding, such as deposits and wholesale borrowing, tends to rise. Conversely, the yields on its loan portfolio also increase, but the net effect on profitability depends on the speed and magnitude of these changes, as well as the duration of its assets and liabilities. For example, if deposit costs reprice faster than loan yields, the net interest margin can be compressed.

The attractiveness of loan products is also significantly influenced by interest rate levels. Higher rates make borrowing more expensive for consumers and businesses, potentially dampening demand for mortgages, auto loans, and business credit. In 2024, while rates remained elevated compared to the preceding decade, signs of potential easing later in the year were being monitored by the market, which could eventually stimulate loan origination for institutions like BAC.

Inflation significantly impacts purchasing power, directly affecting consumer spending and demand for BAC's services. For instance, if inflation in the United States, a key market for BAC, averaged around 3.4% in early 2024, it means consumers' money buys less than it did previously. This erosion of savings can lead to reduced discretionary spending, potentially lowering demand for loans and other financial products offered by BAC.

High inflation also increases BAC's operational costs, from employee wages to the cost of capital. Conversely, stable and predictable inflation, often targeted by central banks like the Federal Reserve, fosters greater consumer confidence and encourages business investment. A stable inflation rate, perhaps hovering around the Fed's 2% target, allows for more accurate financial planning and can support sustained economic growth, benefiting BAC's long-term outlook.

Currency Exchange Rates

Currency exchange rates significantly influence BAC Holding International's global financial standing. Fluctuations in the value of local currencies against the US dollar, for instance, can directly affect the worth of BAC's foreign assets and liabilities. A strengthening dollar could devalue foreign earnings when translated back into USD, impacting overall profitability.

For example, if BAC has substantial operations in Europe, a weakening Euro against the dollar would reduce the dollar-equivalent value of those operations' profits. Conversely, a stronger Euro would boost them. This volatility necessitates careful hedging strategies to mitigate potential losses from adverse currency movements in its international transactions.

- Impact on Foreign Assets/Liabilities: A 10% depreciation of the Brazilian Real against the USD in early 2024, for instance, would reduce the USD value of BAC's Brazilian assets by 10%.

- Cross-Border Transaction Costs: Increased volatility in the Mexican Peso could make pricing and invoicing for cross-border sales to Mexico more complex and potentially riskier.

- Profitability of International Operations: If BAC's international subsidiaries generate profits in local currencies, a sustained appreciation of those currencies against the USD would enhance reported consolidated profits.

Employment and Consumer Spending

Strong employment figures and consistent wage growth are crucial economic drivers for BAC Holding International. In 2024, the U.S. unemployment rate remained historically low, hovering around 3.9% through the first half of the year, reflecting a robust labor market. This high employment translates directly into increased consumer confidence and spending power.

When consumers feel secure in their jobs and see their wages rising, they are more likely to engage in significant financial transactions. This includes taking out loans for major purchases, utilizing credit cards for everyday expenses, and applying for mortgages, all of which are core revenue-generating activities for retail banking operations. For instance, mortgage originations saw a notable uptick in early 2024 as interest rates began to stabilize, indicating a direct correlation between employment stability and demand for banking products.

- U.S. Unemployment Rate (H1 2024): Approximately 3.9%

- Impact on BAC: Higher employment boosts demand for loans, credit cards, and mortgages, positively affecting revenue.

- Consumer Spending Trends: Increased disposable income due to wage growth supports higher consumer spending, further benefiting banking sector growth.

- Credit Risk: A stable employment environment generally leads to a lower credit risk profile for banks as individuals are better positioned to manage debt.

Central America's economic outlook for 2024 indicated a regional GDP growth of approximately 3.5%, according to IMF projections. This growth directly fuels demand for financial services, enhancing loan origination and potentially improving asset quality for BAC Holding International. Countries like Guatemala and El Salvador, key markets for BAC, are expected to see increased consumer spending and corporate profitability, supporting a healthy loan portfolio.

Interest rate policies by major central banks, such as the US Federal Reserve maintaining its benchmark rate between 5.25% and 5.50% through mid-2024, impact BAC's net interest margin. While higher rates can increase funding costs, they also offer opportunities for higher loan yields, with the net effect dependent on repricing speeds. Elevated rates in 2024 also influenced loan product attractiveness, potentially dampening demand for credit.

Inflation, averaging around 3.4% in the US in early 2024, erodes consumer purchasing power and can reduce demand for financial products. It also raises BAC's operational costs. Conversely, stable inflation, near the Federal Reserve's 2% target, fosters consumer confidence and supports long-term economic growth beneficial to BAC.

Currency fluctuations are critical for BAC Holding International. A strengthening US dollar, for instance, can devalue foreign earnings, impacting overall profitability. This necessitates robust hedging strategies to mitigate risks associated with currency volatility in international transactions.

A strong labor market, exemplified by the US unemployment rate remaining around 3.9% in H1 2024, boosts consumer confidence and spending. This directly correlates with increased demand for loans, credit cards, and mortgages, core revenue streams for BAC, while also contributing to a lower credit risk profile.

| Economic Factor | 2024/2025 Data/Projection | Impact on BAC Holding International |

|---|---|---|

| Regional GDP Growth (Central America) | Projected ~3.5% (IMF) | Increased demand for financial services, higher loan volumes. |

| US Federal Funds Rate | Maintained 5.25%-5.50% (through mid-2024) | Affects net interest margin; influences loan demand. |

| US Inflation Rate | ~3.4% (early 2024) | Erodes purchasing power, increases operational costs. |

| US Unemployment Rate | ~3.9% (H1 2024) | Boosts consumer confidence and demand for banking products. |

| Currency Volatility (e.g., USD vs. BRL) | Significant fluctuations observed | Impacts value of foreign assets/liabilities; requires hedging. |

Same Document Delivered

BAC Holding International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BAC Holding International will provide you with a detailed understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can confidently purchase knowing you're getting the complete, professionally structured report as displayed.

Sociological factors

Central America is experiencing significant demographic shifts, with a youthful population in many countries like Guatemala and Honduras, while others, such as Costa Rica, are seeing an aging trend. This age distribution directly impacts the demand for financial products, with younger populations seeking digital banking solutions and credit, while older demographics may require retirement planning and wealth management services. BAC Holding International's strategy must adapt to these evolving needs. For instance, in 2024, countries like El Salvador are seeing a notable increase in young adults entering the workforce, creating opportunities for BAC to offer entry-level financial literacy programs and micro-loans.

Urbanization is another powerful trend reshaping the region, with a growing percentage of the population migrating to cities like Panama City and San Jose. This concentration of people fuels demand for mortgages, consumer loans, and business financing. BAC can leverage this by strategically expanding its branch network and digital presence in these urban hubs, ensuring accessibility for a larger customer base. By 2025, it's projected that over 60% of Central America's population will reside in urban areas, presenting a clear imperative for BAC to align its service offerings with this concentrated market.

Financial inclusion and literacy are crucial for expanding BAC Holding International's market reach. In 2024, a significant portion of the population in many emerging markets still lacks access to basic banking services. For instance, the World Bank's Global Findex Database 2021 indicated that while account ownership is rising, many remain unbanked or underbanked, highlighting a substantial growth opportunity.

Improving financial literacy can directly translate into a larger, more engaged customer base for BAC. When individuals understand financial products and services, they are more likely to utilize them, leading to increased deposits and loan demand. Efforts to boost financial education, as supported by initiatives like those from the OECD, can reduce information asymmetry and foster responsible financial behavior, thereby lowering credit risk for BAC.

Furthermore, a financially literate populace contributes to a more stable banking environment. Informed consumers make better financial decisions, reducing the likelihood of defaults and contributing to the overall health of the financial system. This stability is paramount for BAC's long-term growth and profitability, as it lessens systemic risk and creates a more predictable operating landscape.

Consumer preferences are rapidly shifting towards digital banking. By the end of 2024, it's projected that over 80% of banking interactions will occur through digital channels, a significant jump from previous years. This necessitates BAC Holding International to enhance its mobile app functionality and online platforms, offering seamless, personalized experiences to retain and attract customers.

The demand for tailored financial solutions is also on the rise, with consumers expecting banks to understand their individual needs. BAC must leverage data analytics to offer customized product recommendations and financial advice, moving beyond generic services. This proactive approach to personalization is key to fostering customer loyalty in a competitive market.

Cultural Norms and Trust in Institutions

Cultural attitudes towards banking significantly shape customer behavior. In regions where saving is deeply ingrained, like many parts of Asia, there's a natural inclination towards traditional banking services and a cautious approach to debt. Conversely, cultures that embrace consumerism and readily use credit may see faster adoption of innovative financial products. For BAC Holding International, understanding these nuances is key to tailoring offerings.

Public trust in financial institutions is a critical determinant of engagement. A high level of trust encourages customers to deposit funds, utilize lending services, and remain loyal. For instance, following the 2008 financial crisis, trust in many Western financial institutions saw a decline, impacting customer behavior. In 2024, ongoing efforts to rebuild this trust are evident, with institutions focusing on transparency and customer protection. This directly affects how readily customers will adopt new digital banking platforms or investment products offered by BAC Holding International.

- Cultural Savings Habits: In 2023, the global household savings rate hovered around 10%, but this varies dramatically by region, with some Asian countries exhibiting rates exceeding 20%.

- Consumer Credit Adoption: The average credit card debt per household in the US reached approximately $6,500 in early 2024, indicating a cultural acceptance of borrowing.

- Trust in Financial Institutions: A 2024 Edelman Trust Barometer survey indicated that while trust in financial services globally saw a slight uptick to 62%, it remained below pre-2008 levels in many developed economies.

- Digital Banking Uptake: By the end of 2024, over 75% of banking customers worldwide are expected to use digital channels for at least one banking activity, reflecting a growing comfort with technology.

Income Inequality and Poverty Levels

Significant income inequality can shrink the market for premium financial services, forcing BAC Holding International to consider products catering to a wider range of income brackets. For instance, in 2023, the Gini coefficient in many developed economies remained elevated, indicating substantial wealth concentration, which directly impacts consumer spending power on financial products. This disparity also influences credit risk, as lower-income segments may exhibit higher default probabilities, requiring more sophisticated risk modeling.

Addressing these disparities necessitates tailored financial solutions. BAC Holding International might explore microfinance initiatives or accessible digital banking platforms to serve unbanked or underbanked populations. The World Bank reported in 2024 that financial inclusion remains a critical challenge in several emerging markets, highlighting an opportunity for inclusive product development.

- Market Segmentation: High income inequality can bifurcate the market, with a small affluent segment demanding sophisticated wealth management and a larger segment requiring basic, affordable financial services.

- Credit Risk Management: Poverty levels directly correlate with increased credit risk, necessitating robust underwriting processes and potentially higher interest rates for certain customer segments.

- Product Innovation: There's a growing demand for financial products designed for low-income individuals, such as micro-insurance, affordable remittances, and accessible savings accounts.

- Social Impact Investing: Societal pressure and regulatory trends increasingly favor financial institutions that demonstrate a commitment to financial inclusion and poverty reduction.

Societal attitudes towards financial services, including savings habits and credit adoption, significantly influence BAC Holding International's market penetration. For example, in 2023, global household savings rates varied, with some Asian nations exceeding 20%, contrasting with cultures more inclined towards consumer credit, as seen in the US with average credit card debt around $6,500 by early 2024. Furthermore, public trust in financial institutions, while recovering globally to 62% in 2024 according to Edelman, remains a key factor in customer engagement with digital platforms, impacting BAC's strategic approach to building confidence.

Income inequality also shapes the demand for financial products, potentially limiting the market for premium services while highlighting opportunities in microfinance and accessible digital banking. In 2023, elevated Gini coefficients in many developed economies underscored wealth concentration, directly affecting consumer spending power and credit risk profiles, necessitating BAC to develop inclusive financial solutions.

The increasing adoption of digital banking, with over 75% of global customers expected to use digital channels for at least one banking activity by the end of 2024, underscores a growing comfort with technology that BAC must leverage. This shift necessitates enhanced mobile and online platforms for seamless, personalized customer experiences.

| Sociological Factor | 2023/2024 Data Point | Implication for BAC Holding International |

|---|---|---|

| Cultural Savings Habits | Global household savings rate ~10% (2023), with some Asian countries >20% | Tailor product offerings to regional savings propensities; promote long-term savings products. |

| Consumer Credit Adoption | US average credit card debt ~ $6,500 (early 2024) | Develop responsible credit products and financial literacy programs for credit management. |

| Trust in Financial Institutions | Global trust in financial services: 62% (2024 Edelman) | Prioritize transparency, security, and customer protection to build and maintain trust, especially in digital channels. |

| Digital Banking Uptake | >75% of customers expected to use digital channels for at least one activity (end of 2024) | Invest heavily in user-friendly, secure, and feature-rich digital banking platforms. |

| Income Inequality | Elevated Gini coefficients in developed economies (2023) | Develop tiered product offerings catering to diverse income levels, including microfinance and affordable banking. |

Technological factors

Digital banking adoption in Central America is accelerating, with a significant portion of the population now comfortable using online platforms for financial transactions. For instance, a 2024 report indicated that over 60% of banking customers in key Central American economies utilized digital channels for at least one service in the past year. This trend directly impacts BAC Holding International by creating a demand for robust online services and mobile banking solutions.

However, the effectiveness of these digital offerings is intrinsically linked to the underlying technological infrastructure. While major urban centers boast reliable internet and mobile connectivity, rural areas often face challenges with speed and accessibility. This disparity can limit BAC's ability to uniformly deliver its digital banking services across all customer segments and geographic regions, potentially hindering expansion and operational efficiency in less connected areas.

Fintech innovation is rapidly reshaping the financial landscape, with new players offering specialized services that challenge traditional banking models. For BAC Holding International, this means increased competition from agile startups focused on areas like digital payments, peer-to-peer lending, and wealth management. These firms often leverage advanced technology to offer lower fees and more personalized experiences.

BAC must strategically respond to this evolving competitive environment. This could involve developing its own digital offerings, acquiring promising fintechs, or forming strategic partnerships to integrate innovative solutions into its existing services. For instance, by collaborating with a fintech that specializes in AI-driven credit scoring, BAC could enhance its lending processes and reach a wider customer base.

The global fintech market is projected to reach over $33 trillion by 2030, indicating significant growth and disruption. In 2024, fintech investment continued to be strong, with significant funding rounds in areas like embedded finance and blockchain technology. BAC can leverage these trends by exploring partnerships with companies in these high-growth sectors to expand its service portfolio and maintain a competitive edge.

Cybersecurity and data protection are paramount for BAC Holding International, especially given the escalating threat landscape in the financial sector. The increasing sophistication of cyberattacks necessitates substantial investment in advanced security infrastructure to safeguard sensitive customer data and maintain operational integrity.

Financial institutions globally are facing mounting pressure to comply with stringent data protection regulations. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the significant financial and reputational risks associated with inadequate security measures for BAC.

Artificial Intelligence and Analytics

Artificial Intelligence (AI) and advanced data analytics are rapidly transforming banking. BAC Holding International can leverage these technologies to significantly improve its operations. For instance, AI-powered fraud detection systems are becoming increasingly sophisticated, capable of identifying anomalies in real-time, which is crucial in an evolving threat landscape.

The application of AI extends to enhancing customer experiences through personalized offerings and tailored financial advice. By analyzing vast datasets, BAC can better understand customer behavior and preferences, leading to more targeted product development and marketing campaigns. This data-driven approach also underpins more accurate risk assessment, allowing for better credit scoring and investment decisions.

Operational efficiency is another key area where AI and analytics can make a substantial impact. Automating routine tasks, optimizing resource allocation, and streamlining back-office processes can lead to cost savings and improved service delivery. For example, studies in 2024 indicate that banks implementing AI for customer service saw an average reduction in query resolution times by up to 30%.

- Enhanced Fraud Detection: AI algorithms can analyze transaction patterns to flag suspicious activities with greater accuracy, potentially reducing financial losses.

- Personalized Customer Experiences: Utilizing data analytics allows BAC to offer customized financial products and services, increasing customer satisfaction and loyalty.

- Improved Risk Assessment: AI models can process complex data to provide more precise risk evaluations for lending and investment, minimizing potential defaults.

- Operational Optimization: Automation of tasks and data-driven insights can streamline workflows, leading to greater efficiency and cost reductions across the organization.

Payment Systems and Blockchain

Advancements in payment systems, like real-time payment networks, are transforming transaction speed and efficiency. For BAC Holding International, this means faster settlement times and potentially lower operational costs. By mid-2024, over 70 countries had launched or were developing real-time payment systems, facilitating instant money transfers.

Blockchain technology presents a significant opportunity to further streamline transactions, reduce intermediaries, and enhance security. BAC could leverage blockchain for improved transparency in financial operations and explore new service offerings built on distributed ledger technology. The global blockchain in finance market was projected to reach over $20 billion by 2025, indicating substantial growth and adoption potential.

- Real-Time Payments: Facilitate instant fund transfers, improving cash flow for BAC and its clients.

- Blockchain Adoption: Offers potential for reduced transaction fees and enhanced security in cross-border payments.

- New Service Opportunities: Enables the development of innovative financial products and services leveraging digital ledger technology.

- Adaptation Needs: Requires investment in new technological infrastructure and employee training to meet evolving standards.

Technological advancements are rapidly reshaping the financial sector, influencing how BAC Holding International operates and competes. The increasing adoption of digital banking in Central America, with over 60% of customers using digital channels in 2024, necessitates robust online and mobile solutions. However, disparities in internet infrastructure across the region present challenges for uniform service delivery.

Fintech innovation is a significant disruptor, with the global market projected to exceed $33 trillion by 2030. BAC must strategically respond to competition from agile fintechs by developing its own digital offerings or forming partnerships, such as with AI-focused credit scoring firms. Cybersecurity is also critical, as the average cost of a data breach reached $4.45 million in 2024, demanding substantial investment in security infrastructure.

AI and advanced data analytics offer substantial operational improvements for BAC. AI-powered fraud detection systems and personalized customer experiences are key benefits, with banks using AI for customer service seeing up to a 30% reduction in query resolution times in 2024. Real-time payment systems, adopted in over 70 countries by mid-2024, and blockchain technology also present opportunities for enhanced efficiency and new service development.

| Technology Area | Impact on BAC Holding International | Key Data/Trends (2024-2025) |

|---|---|---|

| Digital Banking Adoption | Increased demand for online and mobile services | Over 60% of customers in key Central American economies used digital channels in 2024. |

| Fintech Innovation | Heightened competition, need for strategic partnerships/acquisitions | Global fintech market projected over $33 trillion by 2030; strong investment in embedded finance and blockchain in 2024. |

| Cybersecurity & Data Protection | Necessity for significant investment in advanced security | Global average cost of data breach reached $4.45 million in 2024. |

| AI & Data Analytics | Improved fraud detection, personalized experiences, operational efficiency | AI in customer service reduced query resolution times by up to 30% in 2024. |

| Payment Systems (Real-Time & Blockchain) | Faster transactions, reduced costs, new service opportunities | Over 70 countries launched or developing real-time payment systems by mid-2024; blockchain in finance market projected over $20 billion by 2025. |

Legal factors

BAC Holding International operates within a complex web of banking and financial sector regulations across Central America. Compliance with these rules, such as capital adequacy ratios, liquidity requirements, and lending limits, directly shapes BAC's operational strategies and risk management. For instance, in 2024, many Central American nations are reinforcing anti-money laundering (AML) and Know Your Customer (KYC) regulations, requiring significant investment in compliance technology and personnel for institutions like BAC.

Licensing requirements are fundamental, with each country having its own set of approvals needed to conduct banking operations, impacting market entry and expansion. For example, obtaining a banking license in El Salvador or Honduras involves rigorous due diligence and adherence to specific minimum capital thresholds, which can be substantial. These regulatory frameworks, including deposit insurance schemes and consumer protection laws, dictate how BAC manages its balance sheet and interacts with its customer base, influencing its ability to offer diverse financial products.

BAC Holding International, like all financial entities, operates under increasingly stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws are designed to prevent financial crimes by ensuring institutions thoroughly vet their clients and monitor transactions for suspicious activity. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting global compliance standards throughout 2024 and into 2025.

BAC's robust compliance framework, encompassing detailed customer due diligence processes and the diligent reporting of any suspected illicit financial flows, is paramount. Failure to adhere to these regulations can result in substantial financial penalties, reputational damage, and even operational restrictions. In 2023 alone, global AML fines reached billions of dollars, underscoring the critical importance of proactive and effective compliance measures for firms like BAC.

BAC Holding International must navigate a complex web of data privacy and consumer protection laws, which are increasingly stringent globally. Regulations like the EU's General Data Protection Regulation (GDPR) and similar frameworks emerging in 2024 and 2025 dictate how customer data can be collected, stored, and utilized. For instance, a 2024 report indicated a 15% increase in data privacy-related lawsuits against companies, highlighting the significant financial and reputational risks of non-compliance.

These legal frameworks directly impact BAC's operational strategies, particularly in customer engagement and marketing. Ensuring fair treatment of consumers, as mandated by laws like the Consumer Rights Act, influences everything from product pricing to complaint resolution processes. Failure to comply can lead to substantial fines; the GDPR, for example, allows for penalties of up to 4% of annual global turnover or €20 million, whichever is higher, a significant consideration for BAC's financial planning.

Labor Laws and Employment Regulations

BAC Holding International must navigate a complex web of labor laws and employment regulations across its operating regions. These regulations directly influence human resource strategies, dictating minimum wage requirements, overtime pay, and mandated employee benefits such as health insurance and retirement plans. For instance, in 2024, the average minimum wage across OECD countries continued its upward trend, impacting labor costs for companies like BAC. Understanding and complying with these varying legal frameworks is crucial for managing operational expenses and maintaining a stable workforce.

Working conditions, including health and safety standards, are heavily regulated, requiring BAC to invest in safe environments and potentially impacting productivity if standards are not met. Furthermore, laws governing employee rights, collective bargaining, and unionization can significantly shape BAC's organizational structure and employee relations. For example, recent reports indicate a rise in union activity in certain sectors in 2024, which could necessitate adjustments in BAC's approach to employee representation and negotiation.

- Wage Compliance: Adherence to minimum wage laws and overtime regulations is paramount, with potential penalties for non-compliance.

- Working Conditions: Ensuring a safe and healthy work environment is mandated, requiring investment in safety protocols and equipment.

- Employee Benefits: Statutory requirements for benefits like paid leave, health insurance, and pension contributions add to overall labor costs.

- Unionization: Laws permitting and governing collective bargaining can influence employee relations and operational flexibility.

Contract Law and Dispute Resolution

Contract law and dispute resolution are critical for BAC Holding International's operations in Central America. The enforceability of agreements directly impacts the company's ability to manage partnerships, secure financing, and conduct daily business. Predictable legal frameworks are paramount for efficient operations.

Efficient judicial processes are essential for resolving contractual disputes promptly and fairly. Delays or inconsistencies in dispute resolution can lead to significant financial losses and operational disruptions for BAC. For instance, a World Bank report in 2023 highlighted that resolving commercial disputes in some Central American nations can take over 500 days, impacting business confidence.

- Contractual Enforceability: BAC Holding International relies on robust contract law to ensure its agreements are legally binding and protect its interests across various business ventures.

- Dispute Resolution Mechanisms: Access to efficient and transparent legal channels for resolving commercial disputes is vital for minimizing risk and maintaining operational stability.

- Legal Framework Predictability: A clear and stable legal environment fosters investor confidence and facilitates long-term strategic planning for BAC.

BAC Holding International must navigate a landscape of evolving financial regulations, including capital adequacy and liquidity requirements, which directly influence its business models and risk appetite. For instance, in 2024, many Central American countries are strengthening anti-money laundering (AML) and Know Your Customer (KYC) protocols, necessitating significant investments in compliance infrastructure and personnel for institutions like BAC.

Licensing and operational approvals are country-specific, impacting market entry and expansion strategies for BAC. For example, obtaining banking licenses in El Salvador or Honduras involves rigorous due diligence and substantial minimum capital requirements. These legal frameworks, encompassing deposit insurance and consumer protection laws, dictate BAC's balance sheet management and customer interactions, influencing its product offerings.

BAC Holding International faces stringent data privacy and consumer protection laws, with GDPR-like regulations increasingly shaping data handling practices. A 2024 report highlighted a 15% rise in data privacy lawsuits, underscoring the financial and reputational risks of non-compliance for firms like BAC.

Environmental factors

Climate change presents significant physical risks to BAC Holding International, particularly in Central America. An increased frequency and intensity of events like hurricanes, floods, and droughts can directly impact BAC's loan portfolios. For instance, damage to collateral, such as agricultural land or property, can devalue assets backing loans, while business disruptions from these disasters can lead to increased credit defaults.

These environmental factors necessitate robust risk assessment and mitigation strategies for BAC. For example, the World Bank projects that climate change could push millions into poverty in Latin America by 2030 due to impacts on agriculture and infrastructure, directly affecting borrowers' ability to repay loans. BAC must therefore integrate climate risk into its lending decisions and potentially develop specialized financial products to support adaptation and resilience among its clients.

Environmental regulations pose a significant consideration for BAC Holding International, particularly as it finances projects with potential environmental impacts. Compliance with evolving environmental protection laws, such as those governing emissions or waste management, can influence the feasibility and cost of projects BAC chooses to fund. For instance, stricter regulations might necessitate more thorough environmental impact assessments, potentially delaying or increasing the expense of loan approvals.

The company's commitment to sustainable lending practices and adherence to environmental standards directly affects its reputational risk and access to capital. In 2024, many financial institutions are increasingly scrutinized for their environmental, social, and governance (ESG) performance, with investors and regulators prioritizing those demonstrating robust environmental stewardship. Failure to comply with regulations or a perception of financing environmentally damaging projects could lead to negative publicity and impact BAC's ability to secure future financing or attract environmentally conscious investors.

BAC Holding International faces increasing pressure from investors, regulators, and the public to demonstrate strong Environmental, Social, and Governance (ESG) performance. By 2024, over $37 trillion in assets under management globally were aligned with ESG principles, highlighting a significant shift in investment priorities.

BAC's proactive commitment to environmental sustainability, such as reducing its carbon footprint, and fostering social responsibility, including fair labor practices, directly impacts its ability to attract capital. Companies with robust ESG profiles often see lower costs of capital and improved brand reputation, making them more appealing to a growing segment of socially conscious clients and top talent.

Resource Scarcity and Energy Costs

Resource scarcity, particularly concerning water and energy, presents a significant environmental challenge for BAC Holding International and the sectors it supports. Fluctuating energy costs directly impact operational expenses for businesses, potentially reducing profitability and investment capacity. For instance, in 2024, global energy prices saw volatility driven by geopolitical events and supply chain disruptions, impacting industries from manufacturing to agriculture, which are key lending areas for BAC.

These environmental factors can erode the economic viability of businesses BAC lends to. Sectors heavily reliant on energy-intensive processes or water resources are particularly vulnerable. Higher operational costs can lead to reduced margins, making it harder for these businesses to service debt. Furthermore, BAC's own infrastructure, including data centers and office buildings, faces increased utility bills, potentially affecting its bottom line.

The impact on consumers is also notable, as higher energy and resource costs can translate into reduced disposable income, affecting demand for goods and services. This ripple effect can further strain the financial health of BAC's borrowers.

- Global energy prices averaged $80-$90 per barrel for Brent crude in early 2024, a significant increase from previous years, impacting transportation and production costs across industries.

- Water stress affects over 2 billion people globally, with projections indicating increased scarcity in many regions by 2030, directly impacting agricultural and industrial output.

- The International Energy Agency reported that electricity prices for industrial consumers in the EU increased by an average of 15% in 2023 compared to 2022, highlighting rising operational burdens.

- Companies in water-scarce regions may face increased capital expenditure for water management solutions, diverting funds from other growth initiatives.

Sustainable Finance and Green Lending

The financial sector is increasingly prioritizing environmental, social, and governance (ESG) factors, with sustainable finance and green lending emerging as significant growth areas. This trend presents BAC Holding International with opportunities to develop innovative financial products that support environmentally conscious initiatives.

BAC can capitalize on this by offering specialized lending for renewable energy projects, sustainable agriculture, and other green ventures. For instance, the global green bond market reached an estimated $1 trillion in issuance during 2023, demonstrating substantial investor appetite for such instruments. By aligning its offerings with these global shifts, BAC can tap into new market segments and enhance its reputation as a forward-thinking financial institution.

- Sustainable Finance Growth: The global sustainable finance market is projected to reach $50 trillion by 2025, indicating a robust demand for ESG-aligned investments and lending.

- Green Lending Opportunities: BAC can introduce green loan products with favorable terms for businesses investing in renewable energy, energy efficiency, and pollution control, mirroring a growing trend in the banking sector.

- Market Differentiation: Developing a portfolio of green financial products can differentiate BAC from competitors and attract a customer base increasingly concerned with environmental impact.

- Regulatory Tailwinds: Many governments are implementing policies and incentives to promote green finance, creating a favorable regulatory environment for institutions like BAC to expand their sustainable offerings.

Environmental factors like climate change and resource scarcity pose direct risks to BAC Holding International's loan portfolios, particularly in Central America. Increased extreme weather events can damage collateral and lead to higher credit defaults, impacting borrowers' ability to repay. For example, the World Bank projects climate change could push millions into poverty in Latin America by 2030, directly affecting loan repayment capacity.

Evolving environmental regulations also influence project feasibility and costs for BAC, requiring compliance with laws on emissions and waste management. Failure to adhere to these standards, or a perception of financing environmentally damaging projects, can harm BAC's reputation and access to capital, especially as investors increasingly prioritize ESG performance, with over $37 trillion in global assets under management aligned with ESG principles by 2024.

Resource scarcity, particularly water and energy, heightens operational costs for businesses BAC lends to, potentially reducing their profitability and debt servicing capacity. Global energy prices saw volatility in early 2024, with Brent crude averaging $80-$90 per barrel, impacting key lending sectors like manufacturing and agriculture. Water stress, affecting over 2 billion people globally, further impacts agricultural and industrial output.

The growing demand for sustainable finance and green lending presents BAC with opportunities to develop innovative financial products. The global green bond market reached an estimated $1 trillion in issuance during 2023, signaling strong investor interest. By offering specialized lending for renewable energy and sustainable agriculture, BAC can tap into new markets and enhance its reputation.

| Environmental Factor | Impact on BAC Holding International | Relevant Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased credit risk from damaged collateral and business disruptions. | World Bank projection: Millions pushed into poverty in Latin America by 2030 due to climate impacts. |

| Environmental Regulations | Increased project costs and potential reputational damage from non-compliance. | Growing investor focus on ESG performance; over $37 trillion in global AUM aligned with ESG by 2024. |

| Resource Scarcity (Energy & Water) | Higher operational costs for borrowers, potentially impacting loan repayment; increased utility costs for BAC. | Brent crude averaged $80-$90/barrel in early 2024; water stress affects over 2 billion globally. |

| Shift to Sustainable Finance | Opportunity to develop green lending products and attract ESG-conscious investors. | Global green bond market estimated at $1 trillion in 2023; sustainable finance market projected to reach $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for BAC Holding International is built upon a robust foundation of data sourced from leading international financial institutions, government economic reports, and reputable industry analysis firms. This ensures comprehensive coverage of political stability, economic trends, and technological advancements impacting the global business landscape.