Baltic Classifieds Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baltic Classifieds Group Bundle

Curious about Baltic Classifieds Group's market position? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, but the real power lies in the full picture.

Unlock strategic clarity by purchasing the complete BCG Matrix. You'll gain a detailed breakdown of each product's quadrant, data-backed recommendations, and a clear roadmap for optimizing your investments and product portfolio.

Don't just guess where Baltic Classifieds Group stands – know it. Purchase the full BCG Matrix today for actionable insights and a competitive edge.

Stars

The automotive vertical, encompassing platforms like Autoplius.lt and Auto24.ee, demonstrates exceptional market dominance within the Baltic Classifieds Group. Autoplius.lt is a staggering six times larger than its closest competitor, while Auto24.ee commands an impressive 36x lead over its nearest rival in 2025, a slight dip from its 40x advantage in 2024. This segment experienced a robust 14% revenue growth, reaching €31.4 million in FY2025, underscoring its strong position in an expanding market driven by increased vehicle transactions and strategic service expansions.

The real estate vertical, encompassing Aruodas.lt, KV.ee, and City24.ee, is a star performer for Baltic Classifieds Group. In 2025, Aruodas.lt stood out, being 27 times larger than its closest competitor, while KV.ee and City24.ee collectively held a significant 13-fold advantage. This segment saw impressive growth from 2024, underscoring its market dominance.

This vertical achieved the highest revenue growth across the group, reaching €22.2 million in FY2025, a substantial 23% increase. This surge is fueled by a favorable economic climate, including reduced interest rates and a robust Lithuanian economy that saw a 10% rise in property transactions. Strategic acquisitions, such as Untu.lt, are further bolstering their data capabilities and market position.

The Jobs & Services vertical, encompassing platforms like CVBankas.lt, GetAPro.lv, and GetAPro.ee, demonstrates robust growth within the Baltic Classifieds Group. CVBankas.lt, a key player in this segment, held a significant 5x lead over its closest competitor in 2025, showcasing its market dominance.

This vertical achieved a notable 15% revenue increase, reaching €16.0 million in fiscal year 2025. This expansion was fueled by strong performance in both the B2C job market and the C2C services sector. The company’s strategic investments in product enhancement, including an AI matching system for CVBankas.lt and new visibility features for service providers on GetAPro.lv, have clearly resonated with users.

The continued investment in recruitment solutions, even amidst rising unemployment figures in the market, highlights the essential nature of these services for businesses seeking talent and individuals offering their skills. This strategic positioning ensures sustained demand and growth for the Jobs & Services vertical.

B2C Revenue Streams

B2C revenue streams are a major strength for Baltic Classifieds Group, representing a full half of the company's overall income. This segment saw robust growth of 17% in the fiscal year 2025, a testament to successful strategies implemented across key verticals.

This impressive growth is largely attributed to consistent annual pricing adjustments and strategic improvements in product offerings and packaging within the Auto and Real Estate sectors. The Jobs segment also continues to contribute significantly to this upward trend.

- 50% of Group Revenue: B2C streams form half of Baltic Classifieds Group's total revenue.

- 17% FY2025 Growth: The B2C segment experienced a substantial 17% increase in revenue for FY2025.

- ARPU Increases: Average Revenue Per User (ARPU) saw significant gains: Auto (+17%), Real Estate (+19%), and Jobs (+12%).

- Strategic Drivers: Growth is fueled by B2C pricing, product enhancements in Auto and Real Estate, and ongoing efforts in Jobs.

Overall Market Leadership and Strong Financial Performance

Baltic Classifieds Group (BCG) demonstrates clear Star characteristics, driven by its commanding presence in key Baltic markets. The company's largest platforms, responsible for a substantial 90% of group revenue, solidify its position as a market leader.

Financially, BCG is performing exceptionally well. In FY2025, the group achieved a significant 15% revenue increase, reaching €82.8 million, and saw its EBITDA grow by 17% to €64.4 million. This strong financial health, coupled with its dominant market share, firmly places its core operations within the Star quadrant of the BCG matrix.

- Market Dominance: BCG holds leading positions across its primary classifieds sites in the Baltic region.

- Revenue Growth: FY2025 saw a 15% revenue increase to €82.8 million.

- EBITDA Growth: The company reported a 17% EBITDA growth, reaching €64.4 million in FY2025.

- Strategic Imperative: Continued investment is crucial to sustain this high-growth, market-leading trajectory.

Baltic Classifieds Group (BCG) exhibits strong Star characteristics due to its dominant market positions and robust financial performance. The company's core verticals, particularly Automotive and Real Estate, are market leaders, driving significant revenue and growth. This positions BCG’s main operations as Stars, demanding continued investment to maintain their high-growth trajectory and market share.

| Vertical | Market Share Lead (2025) | FY2025 Revenue | FY2025 Revenue Growth |

|---|---|---|---|

| Automotive | Autoplius.lt: 6x; Auto24.ee: 36x | €31.4 million | 14% |

| Real Estate | Aruodas.lt: 27x; KV.ee & City24.ee: 13x | €22.2 million | 23% |

| Jobs & Services | CVBankas.lt: 5x | €16.0 million | 15% |

What is included in the product

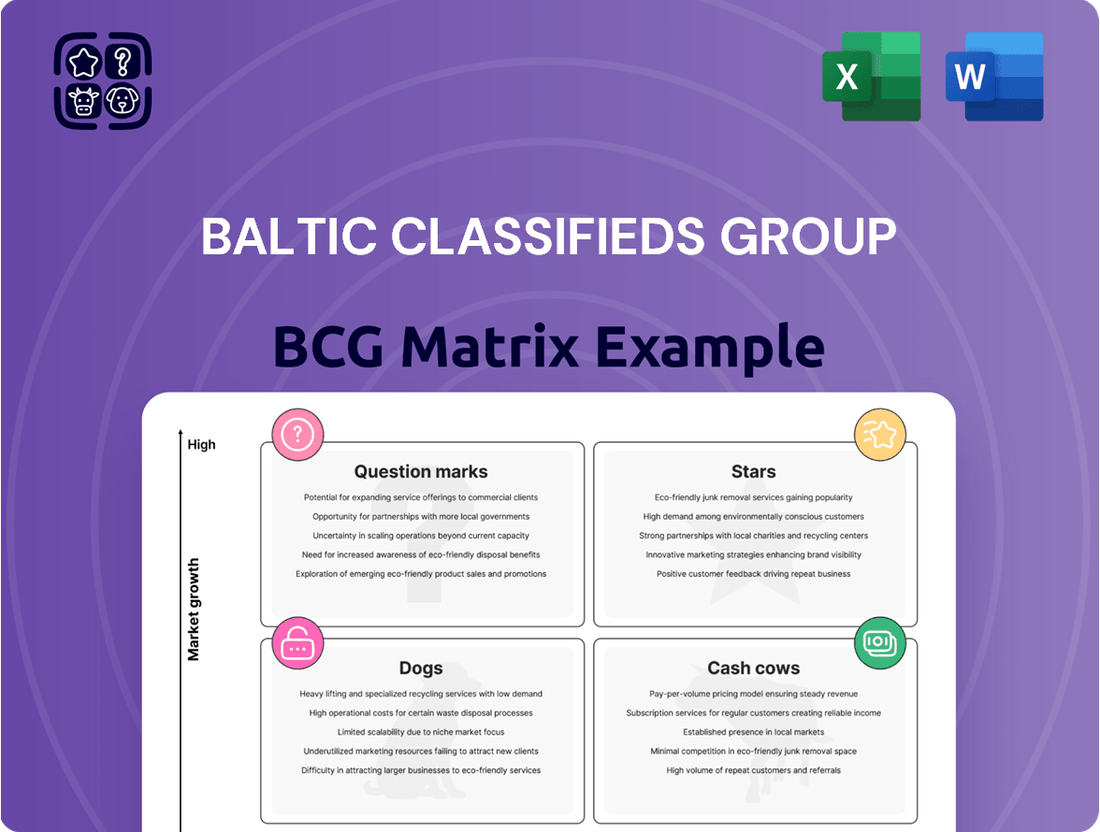

The BCG Matrix categorizes Baltic Classifieds Group's business units by market share and growth, guiding strategic decisions.

The BCG Matrix provides a clear, visual overview of BCG's portfolio, simplifying complex business unit analysis.

Cash Cows

The combined B2C and C2C classifieds business is the undisputed cash cow for Baltic Classifieds Group, accounting for a dominant 90% of total revenue. In FY2025, this segment demonstrated exceptional financial health, maintaining a near-perfect 99% cash conversion rate. This robust performance underscores its ability to generate substantial cash with minimal reinvestment needs.

Despite experiencing strong growth – 17% for B2C and 13% for C2C in FY2025 – these core classifieds operations are clearly functioning as mature cash cows. Their significant contribution to the group's top line, coupled with a remarkable 78% EBITDA margin in FY2025, highlights their capacity to fund other strategic ventures within the company.

Baltic Classifieds Group's (BCG) platforms like Autoplius.lt, Auto24.ee, Aruodas.lt, KV.ee, City24.ee, CVBankas.lt, and Skelbiu.lt showcase established market leadership. This long-standing dominance in key verticals translates to significant market share, consistently outperforming competitors.

Their strong brand recognition and loyal user base allow for high profit margins with minimal incremental investment. For instance, in 2024, these platforms continued to command a substantial portion of their respective online classifieds markets, demonstrating their mature and stable cash-generating capabilities.

Baltic Classifieds Group's core businesses are true cash cows, boasting an impressive EBITDA margin that climbed to 78% in FY2025. This high profitability translates directly into strong cash generation, with a remarkable 99% cash conversion rate.

The company's operational efficiency is further underscored by its ability to generate €66.8 million in cash from operating activities during FY2025. This robust cash flow has allowed Baltic Classifieds Group to significantly strengthen its balance sheet, reducing net debt to a mere €3.6 million.

Stable and Growing Customer Base

Baltic Classifieds Group's (BCG) automotive, real estate, and jobs verticals demonstrate a stable and growing customer base, a hallmark of a cash cow. The average monthly number of business customers in these key areas shows consistent expansion. For instance, real estate brokers saw a 4% increase, and jobs customers grew by 1% in 2024, reflecting a loyal and expanding professional user base that fuels recurring revenue.

This sustained growth in business customers directly translates to predictable and reliable income streams for BCG. The increasing inventory levels for C2C ads across various sectors further underscore the platform's health and user engagement. In 2024, auto C2C ads increased by 4%, real estate by 12%, and services by 8%, indicating a vibrant and active user community that contributes to steady cash flow.

- Growing Business Customer Base: Real estate brokers (+4%) and Jobs customers (+1%) in 2024 indicate a loyal professional user base.

- Expanding C2C Inventory: Auto (+4%), Real Estate (+12%), and Services (+8%) C2C ad growth in 2024 points to a robust user community.

- Recurring Revenue Potential: The stable and growing customer base across key verticals ensures consistent income.

- Platform Health: Increased ad inventory signifies active user engagement and platform vitality.

Pricing and Packaging Optimizations

Baltic Classifieds Group's strategic pricing and packaging optimizations have significantly boosted revenue in 2024 and are projected to continue this trend through 2025. These adjustments, applied across both B2C and C2C platforms, are designed to enhance yield and average revenue per user (ARPU) within established, high-market-share segments.

The impact of these changes is evident in key sectors. For instance, the Auto segment experienced a notable 21% yield growth, while Real Estate saw a 22% increase. These figures underscore the company's ability to derive greater financial benefit from its dominant market positions without relying on expansive new market penetration.

- Increased Yields: Achieved 21% yield growth in Auto and 22% in Real Estate through refined pricing strategies.

- ARPU Enhancement: Successfully increased average revenue per user across B2C and C2C segments.

- Value Extraction: Maximizing returns from mature, high market share business units.

- Focus on Optimization: Strategic adjustments prioritize extracting more value from existing customer bases.

Baltic Classifieds Group's core classifieds business, encompassing both B2C and C2C segments, functions as its primary cash cow. This segment generated a commanding 90% of the group's total revenue in FY2025, supported by a near-perfect 99% cash conversion rate. Despite robust growth of 17% in B2C and 13% in C2C during FY2025, these operations are firmly established as mature, high-margin generators, achieving an impressive 78% EBITDA margin in the same fiscal year.

The company's leading platforms in automotive, real estate, and jobs verticals, such as Autoplius.lt and Aruodas.lt, demonstrate consistent user engagement and market dominance. This translates into predictable revenue streams, further solidified by strategic pricing optimizations that boosted yields by 21% in Auto and 22% in Real Estate in 2024. The strong cash generation of €66.8 million from operating activities in FY2025 has enabled BCG to significantly reduce its net debt to €3.6 million.

| Metric | FY2025 Value | FY2024 Data Point | Significance |

|---|---|---|---|

| Total Revenue Contribution (Classifieds) | 90% | N/A | Dominant revenue source |

| Cash Conversion Rate | 99% | N/A | High efficiency, low reinvestment |

| EBITDA Margin | 78% | N/A | Strong profitability |

| Operating Cash Flow | €66.8 million | N/A | Substantial cash generation |

| Net Debt | €3.6 million | N/A | Strong balance sheet |

| Real Estate Yield Growth | N/A | 22% | Value extraction from mature segment |

Delivered as Shown

Baltic Classifieds Group BCG Matrix

The Baltic Classifieds Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase, ensuring no surprises and complete readiness for your strategic planning.

Rest assured, the BCG Matrix report displayed here is the exact file you will download upon completing your purchase; it contains no watermarks or demo content, offering a professional and actionable analysis.

What you see is precisely the Baltic Classifieds Group BCG Matrix document that will be delivered to you after your purchase, allowing for immediate application in your business strategy without any need for further editing or revisions.

This preview accurately represents the final BCG Matrix report you will acquire; it's a professionally designed, analysis-ready file that you can download and utilize instantly for your business needs.

Dogs

The Generalist Classifieds Vertical, including platforms like Skelbiu.lt, Osta.ee, KuldneBörs.ee, and Soov.ee, experienced a modest 5% revenue growth in FY2025. This is a significant slowdown compared to the double-digit growth observed in other Baltic Classifieds Group verticals.

While Skelbiu.lt maintains strong market leadership with a 21x advantage, the overall generalist segment's slower expansion, coupled with a 6% decline in listed ads during H1 2025, suggests a maturing or lower-growth market for C2C classifieds.

Within the Baltic Classifieds Group's C2C segment, while overall revenue shows growth, specific sub-segments are showing signs of stagnation or decline. These underperforming areas, such as the 'Generalist' C2C category, may not be attracting sufficient user activity or advertising spend to justify their continued investment.

For example, the 'Generalist' C2C segment, which encompasses a wide array of less specialized items, experienced a lower growth rate compared to more focused categories like Auto and Real Estate in 2024. This slower pace, coupled with a potential decline in listed ads, indicates a lack of market dynamism, positioning these sub-segments as potential 'Dogs' in the BCG matrix.

Some ancillary revenue streams within Baltic Classifieds Group, while contributing to overall revenue, exhibit limited scalability. These services may operate in mature or niche markets with constrained growth potential, hindering significant expansion beyond their current scope.

For instance, while data monetization has shown robust growth, other established ancillary offerings might be situated in low-growth sectors, presenting minimal opportunities for substantial market share gains or increased profitability. These services often necessitate continuous investment for maintenance and operational upkeep without yielding considerable new revenue or market penetration.

Segments Heavily Impacted by External Economic Factors

The Estonian automotive market is a prime example of a segment heavily influenced by external economic factors. New vehicle transaction and ownership taxes, implemented on January 1, 2025, have significantly dampened activity. This has directly contributed to a year-over-year decline of over 40% in used car transactions.

This downturn has had a tangible effect on Auto24's revenue. Specifically, both C2C and B2C revenue streams have been impacted, leading to a reduction in the Baltic Classifieds Group's overall revenue by 3-4% during the period of January to April 2025. These figures highlight the sensitivity of such segments to legislative changes and broader economic shifts.

Given these substantial external headwinds and the observed contraction in market activity, these segments could be classified as 'Dogs' within the BCG matrix, particularly if the current market decline proves to be a sustained trend rather than a temporary blip.

- Estonian Automotive Market Impact: New vehicle taxes from January 1, 2025, caused used car transactions to fall over 40% year-over-year.

- Auto24 Revenue Effect: This external factor reduced Group revenue by 3-4% from January to April 2025, affecting C2C and B2C streams.

- BCG Matrix Classification: Segments experiencing sustained market contraction due to external economic factors are candidates for the 'Dog' category.

Legacy Products or Features with Low User Engagement

Within Baltic Classifieds Group's portfolio, certain legacy products or features may exhibit low user engagement. These offerings, while still functional, might consume valuable maintenance resources without generating substantial revenue or attracting a significant user base. The company's strategic emphasis on developing and enhancing newer products implicitly acknowledges the existence of these less active components.

These underperforming assets can be categorized as potential 'Dogs' in a BCG-like analysis. For instance, a specific niche classifieds section that saw initial interest but has since been overshadowed by broader, more popular categories might fall into this group. In 2024, companies like BCG often review their product suites to identify such areas, reallocating resources towards growth opportunities.

- Low User Engagement: Products or features with declining or consistently low active user numbers.

- Resource Drain: These may require ongoing maintenance and support, diverting resources from more profitable ventures.

- Limited Market Share: They typically hold a small or shrinking portion of their respective markets.

- Strategic Re-evaluation: Companies often assess these offerings for potential divestment, sunsetting, or significant overhaul to improve performance.

Segments within Baltic Classifieds Group that exhibit low growth and market share are considered 'Dogs' in the BCG matrix. These often include niche or maturing product lines that consume resources without generating significant returns. For example, the Generalist Classifieds Vertical saw only a 5% revenue increase in FY2025, a notable slowdown, and a 6% drop in listed ads in H1 2025, indicating a potential 'Dog' status for this segment.

The Estonian automotive market, impacted by new taxes in early 2025, led to a 40% decline in used car transactions and a 3-4% revenue reduction for Auto24 in early 2025. This sustained contraction due to external factors firmly places such segments as 'Dogs'.

Legacy products with low user engagement and limited scalability, such as certain ancillary revenue streams or niche classifieds sections that have been overshadowed, also fit the 'Dog' profile. These require ongoing investment for maintenance but offer minimal growth potential, often prompting strategic re-evaluation for divestment or sunsetting.

| BCG Category | Segment Example | Key Indicators | 2024/2025 Data Points |

|---|---|---|---|

| Dog | Generalist Classifieds Vertical | Low Market Share, Low Growth | 5% revenue growth FY2025; 6% decline in listed ads H1 2025 |

| Dog | Estonian Automotive (Auto24) | Low Market Share, Negative Growth (due to external factors) | >40% decline in used car transactions; 3-4% Group revenue reduction Jan-Apr 2025 |

| Dog | Legacy Niche Classifieds/Ancillary Services | Low User Engagement, Limited Scalability | Resource drain for maintenance; minimal new revenue generation |

Question Marks

Baltic Classifieds Group's acquisition of Untu.lt in late FY2025 marks a strategic entry into the proptech and automated property valuation sector. This move is designed to bolster BCG's data-driven service offerings and inject greater transparency into the real estate market.

Untu.lt, as a newly acquired venture, currently holds a minimal market share within its specific niche. Despite its potential in a high-growth area, it requires significant investment for integration and development, positioning it as a Question Mark on the BCG matrix.

The data revenue stream for Baltic Classifieds Group is a burgeoning area, experiencing a remarkable 110% growth in FY2025. This expansion is primarily fueled by the increasing popularity of car history report services and the strategic acquisition of a real estate data platform.

Despite its rapid growth trajectory, the data segment currently accounts for approximately 10% of the group's remaining revenue (after core classifieds), indicating a relatively small market share within the broader business. This combination of high growth potential and a low current market presence positions it squarely in the Question Mark category of the BCG matrix.

Significant ongoing investment will be crucial to nurture this segment, aiming to convert its high growth into a dominant market share for Baltic Classifieds Group.

Baltic Classifieds Group's stated objective to 'selectively acquire complementary businesses within our current markets and potentially in new territories' signals a clear intent to explore new growth avenues. Any such new market entries or strategic expansions, prior to establishing significant market share, would fall into the question marks category of the BCG matrix.

These ventures are characterized by operating in potentially high-growth markets but with unproven market share. This requires substantial investment to achieve success and establish a foothold, making their future market position uncertain.

Co-living Project Packages in Real Estate

Aruodas.lt's introduction of specialized B2C packages for co-living projects positions them within a nascent but potentially high-growth real estate segment. Given the novelty of this market, Baltic Classifieds Group's (BCG) current market share in co-living is likely minimal. This strategic move can be viewed as an investment in a developing area, where future market penetration and success remain uncertain, thus classifying co-living project packages as a 'Question Mark' within the BCG matrix.

- Emerging Market: Co-living is a relatively new property type, with significant growth anticipated in the coming years.

- Low Current Share: BCG's existing market share in the specialized co-living package segment is presumed to be low due to its recent introduction.

- High Growth Potential: The initiative represents a strategic bet on a sector expected to expand considerably.

- Uncertain Future: The ultimate success and market position of these packages are yet to be determined, aligning with the 'Question Mark' classification.

New Features and Product Enhancements with Unproven Monetization

Baltic Classifieds Group is continuously investing in product improvements across its platforms. For instance, Autoplius.lt has seen the introduction of an assessment tool for car dealers, while KV.ee has enhanced its map search functionality. GetAPro.lv now offers new visibility options for service providers, all aimed at boosting user experience and future revenue generation.

These ongoing enhancements, while promising for long-term growth, currently represent investments with unproven monetization strategies. Their immediate impact on market share expansion or significant new revenue generation is still under evaluation, placing them in the question mark category of the BCG matrix.

- Product Enhancements: Investments in tools like car dealer assessments on Autoplius.lt and improved map search on KV.ee.

- User Engagement Focus: New visibility options for service providers on GetAPro.lv aim to increase user interaction.

- Unproven Monetization: The direct financial impact and market share gains from these innovations are still being assessed.

- High-Growth Potential: These features are positioned as potential future growth drivers, but their current market penetration and revenue contribution are low.

Baltic Classifieds Group's (BCG) strategic initiatives, such as the acquisition of Untu.lt and the development of specialized B2C packages for co-living projects on Aruodas.lt, represent investments in emerging markets with uncertain future market share. Similarly, ongoing product enhancements across platforms like Autoplius.lt, KV.ee, and GetAPro.lv are currently in a phase of unproven monetization, despite their potential for future revenue growth. These ventures, characterized by high growth potential but low current market penetration, are classified as Question Marks on the BCG matrix, requiring significant investment to determine their future success and market positioning.

| Initiative | Market Segment | Current Market Share | Growth Potential | BCG Classification |

|---|---|---|---|---|

| Untu.lt Acquisition | Proptech / Automated Property Valuation | Minimal | High | Question Mark |

| Co-living Packages (Aruodas.lt) | Real Estate (Specialized) | Low | High | Question Mark |

| Product Enhancements (Autoplius.lt, KV.ee, GetAPro.lv) | Platform Features / User Experience | Low (Monetization Impact) | Medium to High | Question Mark |

| Data Revenue Segment | Data Services | ~10% of non-core revenue | High (110% growth FY2025) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Baltic Classifieds Group's reporting, industry research, and competitor analysis to ensure reliable insights.