Badger Meter Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Badger Meter Bundle

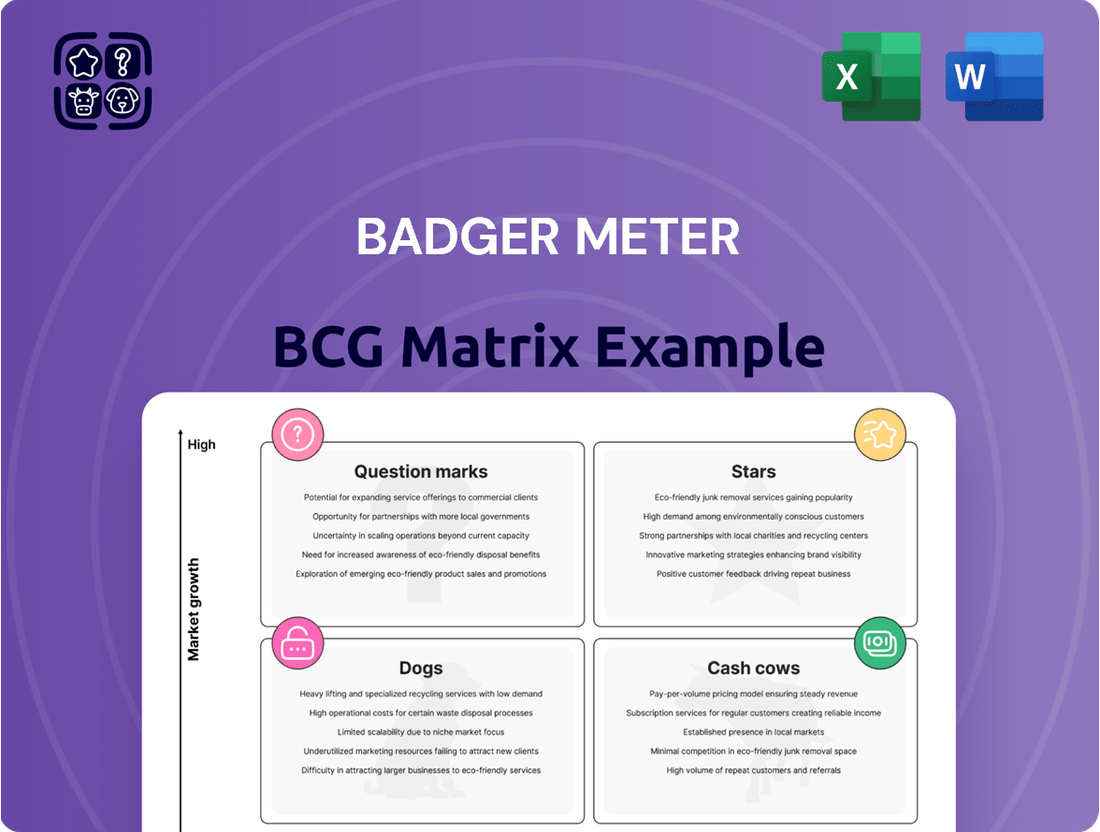

Curious about Badger Meter's strategic product portfolio? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding this positioning is crucial for informed decision-making in a dynamic market.

Don't miss out on the complete strategic picture. Purchase the full BCG Matrix report to unlock detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Badger Meter's product investments and future growth.

Stars

ORION Cellular AMI Endpoints are a cornerstone of Badger Meter's portfolio, directly benefiting from the accelerating adoption of Advanced Metering Infrastructure. These endpoints offer utilities a powerful solution for meter reading without requiring extensive network build-outs, which has been a significant driver of their success. In 2023, Badger Meter reported strong performance in their AMI segment, with cellular endpoints playing a crucial role in this growth.

The recent IoT Network Certified for Smart Connected Infrastructure certification underscores the technological advancement and security of ORION Cellular endpoints. This certification is vital for utilities looking to deploy robust and reliable smart grid solutions. For Badger Meter, this positions them favorably in a market increasingly demanding secure and interoperable connected devices, contributing to their strong market position.

BEACON Software as a Service (SaaS) is a shining example of a Star in Badger Meter's portfolio. This cloud-based platform is experiencing robust growth, evidenced by a remarkable 28% compound annual growth rate (CAGR) in sales from 2019 through 2024. It plays a crucial role in Badger Meter's software revenue, underscoring its importance to the company's expansion.

The platform's success is fueled by its ability to offer advanced utility management and consumer engagement tools, directly addressing the growing need for data-driven water management solutions. This alignment with market trends, coupled with its predictable recurring revenue model, positions BEACON SaaS as a highly attractive and financially sound investment within the BCG matrix.

BlueEdge™ Integrated Smart Water Solutions, launched in 2024, represents Badger Meter's strategic play in the expanding smart water market. This comprehensive platform, encompassing hardware, communication, software, and services, is designed to tackle intricate water management issues. Its broad scope and tailored approach are key drivers for its anticipated strong market performance.

E-Series Ultrasonic Meters

The E-Series Ultrasonic Meters are a strong performer for Badger Meter, fitting squarely into the Stars category of the BCG matrix. Their widespread adoption is fueling growth within the utility water segment, driven by the essential shift towards advanced metering infrastructure (AMI) systems.

These ultrasonic meters are gaining significant traction due to their superior accuracy and longer lifespan compared to older mechanical models. This makes them a sought-after product as utilities upgrade their systems. Badger Meter's BlueEdge platform further enhances the appeal and market reach of these meters.

- Market Penetration: Badger Meter's E-Series Ultrasonic Meters are a cornerstone of their utility water business.

- Technological Advantage: Offering enhanced accuracy and durability over traditional mechanical meters.

- Growth Driver: Key component in the ongoing transition to advanced metering infrastructure (AMI).

- Strategic Integration: Synergies with the BlueEdge platform boost market potential and customer adoption.

Advanced Water Quality Monitoring Solutions

Badger Meter's advanced water quality monitoring solutions, bolstered by acquisitions like s::can and ATi, are positioned as a strong contender in a high-growth sector. These offerings deliver real-time data and sophisticated analytics crucial for effective water resource management. The market is experiencing significant expansion due to stricter environmental regulations and a growing need for accurate monitoring. Badger Meter's commitment to innovation in this space solidifies its market standing and facilitates share gains.

The company's strategic expansion into water quality monitoring reflects a calculated move into a market segment experiencing robust demand. By integrating technologies from s::can and ATi, Badger Meter is enhancing its ability to provide comprehensive, real-time water quality data. This segment is projected to see continued growth, driven by global initiatives for cleaner water and more stringent environmental compliance. For instance, the global water quality monitoring market was valued at approximately $4.5 billion in 2023 and is anticipated to grow at a CAGR of over 7% through 2030, according to various industry reports.

- Market Growth Drivers: Increasing regulatory mandates and the necessity for precise environmental data fuel demand for advanced monitoring.

- Acquisition Synergy: Integration of s::can and ATi technologies enhances real-time data capabilities and analytical depth.

- Innovation Focus: Continuous investment in R&D ensures Badger Meter remains at the forefront of water quality monitoring technology.

- Competitive Advantage: These solutions offer a distinct advantage in addressing complex water management challenges.

Badger Meter's ORION Cellular AMI Endpoints are a prime example of a Star product. Their integration into the growing Advanced Metering Infrastructure market, coupled with their ability to reduce utility network build-outs, has driven significant success. In 2023, this segment, heavily reliant on cellular endpoints, demonstrated robust growth for Badger Meter.

The E-Series Ultrasonic Meters also shine as Stars, benefiting from the widespread utility shift towards AMI. Their enhanced accuracy and longevity over older mechanical meters make them highly desirable as systems upgrade, further strengthened by integration with Badger Meter's BlueEdge platform.

Badger Meter's advanced water quality monitoring solutions, amplified by acquisitions like s::can and ATi, represent another Star. These offerings provide critical real-time data for water resource management, tapping into a high-growth sector driven by stricter environmental regulations and the demand for precise data.

BEACON Software as a Service (SaaS) is a definitive Star, experiencing a remarkable 28% CAGR in sales from 2019 through 2024. This cloud-based platform is vital for Badger Meter's software revenue, supporting advanced utility management and consumer engagement tools.

| Product Category | Star Product Example | Key Growth Driver | 2024 Relevance/Data Point |

|---|---|---|---|

| AMI Endpoints | ORION Cellular AMI Endpoints | Accelerating AMI adoption, reduced network costs | Crucial for utility infrastructure upgrades. |

| Water Meters | E-Series Ultrasonic Meters | Shift to AMI, superior accuracy & longevity | Integral to smart water initiatives. |

| Software | BEACON SaaS | Recurring revenue, advanced analytics | 28% CAGR (2019-2024) in sales. |

| Water Quality Monitoring | s::can and ATi integrations | Stricter regulations, demand for real-time data | Market valued at ~$4.5 billion in 2023, growing over 7% CAGR. |

What is included in the product

The Badger Meter BCG Matrix offers strategic guidance on product portfolio management by categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

A clear visual roadmap for prioritizing investments, easing strategic decision-making pain.

Cash Cows

Traditional mechanical water meters represent Badger Meter's established Cash Cows. These meters hold a dominant market share in the mature North American utility sector, primarily fueled by ongoing replacement needs.

Despite slower growth compared to newer smart meter technologies, these reliable devices continue to generate significant and stable cash flow. Badger Meter's 2024 reports indicate that the utility water meter segment, largely comprised of these traditional meters, remains a substantial contributor to overall revenue, even as the company invests in advanced metering infrastructure.

Their established installed base and proven durability mean they require minimal marketing expenditure, allowing them to contribute heavily to Badger Meter's profitability. This consistent performance underscores their role as a dependable source of income for the company.

Badger Meter's established flow instrumentation for commercial and industrial water applications represents a classic cash cow within the BCG matrix. These are reliable, proven products serving mature markets where the company enjoys a strong, entrenched position.

While the overall flow instrumentation market might see flat sales, this specific segment benefits from the essential nature of water management solutions. Think of the consistent need for accurate measurement in everything from manufacturing plants to municipal water systems. This stability translates directly into predictable revenue streams.

For 2024, Badger Meter reported that its Water Utility segment, which heavily features these types of instruments, continued to demonstrate solid performance. While specific cash cow segment numbers are not broken out separately, the segment's overall contribution to revenue and profitability highlights the enduring value of these established product lines.

The low investment needs for these mature products mean that the significant cash they generate can be reinvested into other areas of the business, such as research and development for innovative smart water technologies or expanding into new geographical markets.

Legacy Fixed Network AMI Systems are Badger Meter's Cash Cows. While the industry is moving towards cellular AMI, these older systems still generate substantial and consistent cash flow for the company. Badger Meter benefits from a large existing customer base and the recurring revenue associated with these established networks.

These systems are in a mature phase, meaning they require minimal new investment, unlike the more dynamic Star products like cellular AMI. This stability allows Badger Meter to harvest profits without significant capital expenditure. For example, in 2023, Badger Meter reported strong performance, with its established product lines continuing to be a significant contributor to overall revenue.

Customer stickiness is high for these legacy systems. Once installed, utilities are often reluctant to switch due to the significant infrastructure and integration already in place. This provides a stable, predictable revenue stream, even as newer technologies gain traction.

Standard Flow Control Valves

Standard flow control valves are a cornerstone of Badger Meter's offerings, holding a significant position in the water management sector. These are mature products, meaning they are well-established in the market and have a strong customer base. This maturity translates into consistent demand and predictable revenue streams for the company.

The reliability of these valves is key to their sustained success. Badger Meter benefits from stable cash flow generated by these essential components, which are integral to many water infrastructure projects and industrial processes. Their widespread adoption across diverse applications solidifies their role as a dependable revenue source.

- High Market Share: Standard flow control valves are a significant contributor to Badger Meter's market leadership in water management solutions.

- Stable Demand: The essential nature of these valves ensures a consistent and predictable demand, underpinning reliable revenue generation.

- Mature Product Line: Representing a mature product, they benefit from established manufacturing processes and extensive market penetration.

- Predictable Revenue: Their widespread use across various industries guarantees continued, predictable cash flow for Badger Meter.

Basic Meter Reading and Billing Software

Badger Meter’s basic meter reading and billing software represents a classic cash cow within their product portfolio. These older systems, while not as cutting-edge as their BEACON SaaS offerings, still power the daily operations for a significant number of utility clients. This installed base ensures a predictable and consistent revenue stream for Badger Meter.

The financial appeal of these legacy systems lies in their maturity. They require minimal new investment for development, allowing Badger Meter to maintain high profit margins. Revenue is primarily generated through established licensing agreements and ongoing support contracts, demonstrating their value as a reliable income source.

These foundational software solutions are indispensable for many utilities, handling critical functions like meter data collection and customer billing. Their continued use underscores their essential role in operational continuity, translating directly into stable, high-margin cash flow for Badger Meter.

- Established Revenue Streams: Licensing and support agreements provide consistent income.

- Low Investment Needs: Reduced ongoing development costs contribute to high margins.

- Essential Utility Functionality: Critical for day-to-day operations of many water utilities.

- Steady Cash Flow: Generates predictable and reliable financial returns for Badger Meter.

Badger Meter's traditional mechanical water meters are prime examples of cash cows. These established products dominate the mature North American utility market, with demand driven by ongoing replacements. Despite the rise of smart meters, these reliable devices continue to be a substantial revenue contributor.

Their robust installed base and proven durability mean they require minimal new investment, allowing them to generate significant and stable cash flow. Badger Meter's 2024 financial reports consistently highlight the utility water meter segment, largely composed of these traditional meters, as a bedrock of profitability, enabling reinvestment in growth areas.

The flow instrumentation for commercial and industrial water applications also functions as a cash cow. These reliable, proven products serve essential water management needs in mature markets where Badger Meter holds a strong position, translating into predictable revenue streams.

| Product Category | Market Maturity | Cash Flow Generation | Investment Needs | 2024 Significance |

|---|---|---|---|---|

| Traditional Mechanical Water Meters | Mature | High & Stable | Low | Substantial Revenue Contributor |

| Flow Instrumentation (Commercial/Industrial) | Mature | Consistent & Predictable | Low | Solid Segment Performance |

Delivered as Shown

Badger Meter BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted for strategic insight, is ready for immediate download and integration into your business planning processes. You'll gain access to the full, professionally formatted analysis without any additional steps or hidden surprises.

Dogs

Badger Meter's flow instrumentation products catering to de-emphasized industrial markets represent a category with limited growth potential and perhaps a lower market share for the company. These segments are characterized by stagnant or declining demand, making significant investment unlikely to generate substantial returns. For instance, in 2023, while the overall municipal market showed strength, certain specialized industrial applications within the flow instrumentation segment experienced headwinds, impacting revenue growth in those specific niches.

Older, non-networked Automatic Meter Reading (AMR) solutions are firmly positioned in the Dogs quadrant of the BCG Matrix. As the utility sector aggressively adopts Advanced Metering Infrastructure (AMI) and cellular-based technologies, these legacy systems face dwindling demand and a shrinking market presence. Their reliance on manual or less efficient data collection methods makes them increasingly undesirable for utilities prioritizing real-time operational intelligence and streamlined data management.

Obsolete mechanical meter models, while foundational to Badger Meter's history, now occupy the Dogs quadrant of the BCG matrix. These units, often phased out due to the advent of advanced smart metering technology, possess minimal market growth potential and a declining market share. For instance, Badger Meter's shift towards IoT-enabled solutions means dedicated resources for older mechanical models are being reallocated.

While a small segment of these legacy meters might still be in operation and require occasional maintenance or parts, active marketing and new development for these products have ceased. The company's focus in 2024 and beyond is squarely on its high-growth smart water meters, which offer advanced data analytics and leak detection capabilities.

Consider Badger Meter's reported revenue growth in its Smart Metering segment, which significantly outpaces any residual revenue from older mechanical lines. This strategic pivot means that the older mechanical models are managed for efficient retirement rather than active market expansion, ensuring resources are concentrated on more profitable and future-oriented product categories.

Niche Flow Sensors with Limited Market Adoption

Within Badger Meter's extensive flow instrumentation offerings, niche flow sensors with limited market adoption would fall into the 'Dogs' category of the BCG Matrix. These are highly specialized products, perhaps designed for very specific, small industries or applications where demand has not materialized as anticipated.

These segments are characterized by low market share and minimal growth potential, suggesting they are not strategic growth drivers for the company. For instance, a specialized sensor for a declining industrial process might fit this description.

Consider a hypothetical scenario where a new, highly technical sensor introduced in 2023 for a niche application captured less than 1% of its projected market by mid-2024, with market growth forecasts remaining stagnant at around 0.5% annually.

- Low Market Share: These niche sensors likely hold a very small percentage of their respective, specialized markets.

- Limited Growth Prospects: The overall demand for these specific sensor types is not expected to increase significantly.

- Resource Allocation Review: Management would likely evaluate whether to continue investing in these products or consider divestiture.

- Potential for Divestiture: Products in this category are often candidates for sale to a company better positioned to serve their limited market.

Proprietary Communication Protocols (non-standardized)

Proprietary communication protocols, particularly those not aligned with current industry standards such as cellular, LoRaWAN, or NB-IoT, would likely be classified as Dogs within the BCG Matrix for Badger Meter. These older technologies are experiencing diminishing customer adoption because the market increasingly favors interoperable and widely supported solutions. This trend directly constrains their market share and future growth prospects.

Customer preference is shifting towards open standards that ensure easier integration and broader compatibility. For instance, in 2024, the global IoT communication market saw significant growth in LPWAN technologies like LoRaWAN and NB-IoT, indicating a clear move away from proprietary systems. Companies relying heavily on these legacy protocols may face challenges in maintaining relevance and competitiveness.

The declining demand for non-standardized communication methods means that products utilizing them are likely to generate low revenue with little to no growth. Badger Meter, like other players in the smart water metering space, must adapt by phasing out or investing heavily in modernizing these older communication technologies. Failure to do so could lead to increased inventory write-downs and reduced profitability for these specific product lines.

- Declining Market Demand: Customers are actively seeking solutions that integrate seamlessly with existing infrastructure, moving away from isolated, proprietary systems.

- Limited Growth Potential: The lack of broad industry support and increasing obsolescence of older hardware make future expansion difficult.

- Higher Support Costs: Maintaining legacy systems can become increasingly expensive due to specialized knowledge requirements and component availability.

- Competitive Disadvantage: Competitors offering solutions based on standardized, modern protocols gain a significant edge in market penetration and customer acquisition.

Badger Meter's older mechanical meters and proprietary communication protocols are prime examples of "Dogs" in the BCG Matrix. These products face low growth and market share due to technological advancements and shifting industry standards.

The company's strategic focus on IoT-enabled smart water meters means resources are being reallocated away from these legacy offerings. For instance, in 2023, while smart metering revenue surged, older product lines saw a corresponding decline.

These "Dog" products, like non-networked AMR systems, are characterized by diminishing customer adoption and higher support costs. Competitors offering modern, standardized solutions present a significant competitive disadvantage.

Management is likely evaluating divestiture or further scaling back investment in these low-performing segments to concentrate on growth areas, such as their robust smart metering solutions, which are driving significant revenue increases in 2024.

Question Marks

SmartCover Systems, acquired by Badger Meter in January 2025, is positioned as a Question Mark within the BCG Matrix. This strategic move marks Badger Meter's foray into the rapidly expanding wastewater collection system monitoring sector, a market demonstrating significant growth potential.

Despite the market's high growth, SmartCover Systems is in its nascent stages of market penetration for Badger Meter. The company faces the challenge of building substantial market share in this competitive landscape.

Significant investment is crucial for SmartCover Systems to transition from a Question Mark to a Star. Badger Meter needs to leverage its existing sales infrastructure and integrate SmartCover's capabilities into its broader BlueEdge platform.

By effectively integrating SmartCover, Badger Meter aims to capitalize on the growing demand for smart infrastructure solutions, turning this early-stage acquisition into a future market leader.

Badger Meter is actively investing in and developing advanced AI-driven leak detection and predictive analytics, a strategic move that positions them firmly in the high-growth smart water management sector. This focus is exemplified by their acquisition of Syrinix, a company specializing in transient detection and leak monitoring, which enhances Badger Meter's capabilities in this cutting-edge area.

These advanced AI solutions, while in early market adoption phases, represent a significant opportunity for Badger Meter to capture market share. The company is building its presence in this innovative space, offering utilities enhanced tools for water loss reduction and infrastructure health monitoring.

For instance, predictive analytics can forecast potential pipe bursts or leaks before they occur, allowing for proactive maintenance and minimizing water wastage. This technology is crucial for utilities aiming to improve operational efficiency and sustainability, especially as water infrastructure ages and faces increasing stress.

Badger Meter is strategically targeting international markets like the Middle East and the UK for expansion, recognizing their substantial growth opportunities in smart water technology. These initiatives are crucial given the company's current lower market share outside North America.

Significant investment is being directed towards these regions to build a stronger market presence. For instance, Badger Meter's international revenue, while growing, represented approximately 16.5% of its total revenue in 2023, highlighting the focus on increasing this segment's contribution.

The company's approach involves establishing distribution channels and adapting its smart metering solutions to meet local needs. This requires careful planning and resource allocation to overcome the challenges of entering new, competitive landscapes and building brand recognition.

Emerging Digital Twin and Network Optimization Software

Emerging digital twin and network optimization software, like Badger Meter's BlueEdge suite, addresses the growing demand from water utilities for advanced, integrated management solutions. This segment represents a high-growth, nascent market, indicating significant future potential.

Badger Meter's strategic positioning in this area suggests an investment in innovation, aiming to capture a share of this developing market. While specific digital twin offerings might be new with low initial market penetration, the underlying technology promises substantial returns as adoption increases.

- Market Potential: The global digital twin market is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars by the end of the decade, driven by sectors like utilities.

- Badger Meter's Role: The BlueEdge platform signifies Badger Meter's commitment to evolving digital solutions, potentially moving into more sophisticated network modeling and simulation capabilities.

- Investment and Adoption: Entry into this advanced software space requires considerable R&D investment and faces the challenge of driving adoption among utilities accustomed to more traditional systems.

- Competitive Landscape: As this market matures, Badger Meter will likely face competition from established software providers and new entrants specializing in IoT and AI-driven optimization.

Newer IoT-enabled Water Quality and Pressure Sensors

Badger Meter's newer IoT-enabled water quality and pressure sensors, integrated with their BlueEdge platform, represent a strategic move into a high-growth, albeit currently low-penetration, market segment. These advanced sensors offer real-time data crucial for utilities and industries, addressing the increasing demand for granular insights into water systems. By focusing on these specialized IoT solutions, Badger Meter is positioning itself to capture future market share in the smart water technology space.

The market for advanced water monitoring technology is expanding rapidly, driven by regulatory pressures and the need for operational efficiency. For instance, the global smart water market was valued at approximately $22.5 billion in 2023 and is projected to grow significantly in the coming years, indicating a strong demand for innovative solutions like Badger Meter's newer sensors.

- High Growth Potential: The IoT-enabled sensors tap into the expanding smart water market, which is expected to see robust growth.

- Real-time Data Focus: These sensors cater to the critical need for immediate, actionable data on water quality and pressure.

- Platform Integration: Integration with Badger Meter's BlueEdge platform enhances their value proposition by providing a unified data management solution.

- Early Market Stage: While promising, the specific market penetration for these newer, specialized sensors is still developing as they gain wider adoption.

SmartCover Systems, acquired by Badger Meter in January 2025, is positioned as a Question Mark. This acquisition signifies Badger Meter's entry into the growing wastewater collection system monitoring market. Despite the market's strong growth, SmartCover Systems currently has low market share, requiring significant investment to evolve into a Star. Badger Meter's integration of SmartCover into its BlueEdge platform is key to unlocking its potential in smart infrastructure.

BCG Matrix Data Sources

Our BCG Matrix draws on a robust blend of financial performance data, comprehensive market research, and expert industry analysis to deliver actionable strategic insights.