Autobio Diagnostics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autobio Diagnostics Bundle

Autobio Diagnostics operates within a dynamic market, influenced by the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Autobio Diagnostics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Autobio Diagnostics' focus on research and development for its core raw materials, particularly antigens and antibodies, is a significant factor in its supplier bargaining power. By achieving over 73% self-supply for these crucial components, the company substantially diminishes its reliance on external vendors.

This high degree of vertical integration directly translates to a reduced ability for suppliers to exert pressure on Autobio Diagnostics. It ensures a more stable and secure supply chain, as the company controls a larger portion of its critical inputs, thereby strengthening its negotiating position and mitigating potential disruptions or price hikes from external sources.

Autobio Diagnostics likely depends on specialized suppliers for critical components and advanced manufacturing technology. The proprietary nature of these inputs, coupled with the potential for high switching costs due to integration and validation processes, can give these suppliers considerable leverage in negotiations.

The in-vitro diagnostics (IVD) sector, including companies like Autobio Diagnostics, relies heavily on specialized raw materials and components that demand stringent quality control. This necessity often results in a limited number of suppliers capable of meeting these high standards. For instance, in 2024, the global IVD market, valued at approximately USD 100 billion, saw continued demand for high-purity reagents and precision-engineered parts, further concentrating supply chains.

When a company like Autobio faces a scarcity of suppliers who can consistently deliver materials meeting their rigorous quality and regulatory requirements, those suppliers gain significant leverage. This limited supplier pool can translate into increased input costs for Autobio or the imposition of less favorable payment terms, directly impacting profitability and operational flexibility.

Impact of Supply Chain Disruptions

Global supply chain challenges, as extensively reported throughout 2024, have amplified the bargaining power of suppliers, particularly those in regions susceptible to geopolitical instability or holding exclusive rights to critical components. Autobio Diagnostics, with its international footprint, is inherently exposed to these vulnerabilities, necessitating robust supplier relationship management.

The impact of these disruptions can significantly alter the cost structure and availability of essential raw materials and specialized diagnostic equipment. For instance, the semiconductor shortage, which continued to affect various industries in 2024, directly impacted the production of advanced medical devices, potentially increasing lead times and prices for Autobio.

- Increased component costs: Reports from late 2024 indicated a 15-20% average increase in the cost of specialized electronic components due to supply chain bottlenecks.

- Extended lead times: Some critical raw materials experienced delivery delays of up to six months, impacting production schedules.

- Supplier consolidation: In niche markets, the number of viable suppliers decreased, concentrating power in the hands of fewer entities.

- Geopolitical risk premiums: Suppliers in politically sensitive regions often factored in higher risk premiums, further inflating prices.

Intellectual Property and Licensing

Intellectual property and licensing are significant factors in the bargaining power of suppliers for Autobio Diagnostics. Critical technologies or biological materials essential for in-vitro diagnostic (IVD) products are often safeguarded by patents or necessitate licensing from their original developers. Suppliers who possess such intellectual property can leverage it to demand higher prices or enforce stringent terms. This directly impacts Autobio's product development timelines and overall cost structure, potentially limiting innovation or increasing manufacturing expenses.

- Patent Protection: Suppliers holding patents on core IVD technologies can dictate terms, influencing Autobio's access to essential components.

- Licensing Fees: Significant licensing fees for proprietary materials can inflate Autobio's cost of goods sold, impacting profitability.

- Exclusive Agreements: Suppliers may offer exclusive licensing, granting Autobio an advantage but also potentially increasing dependency and price leverage.

Autobio Diagnostics' ability to self-supply over 73% of its core raw materials like antigens and antibodies significantly reduces supplier bargaining power. This vertical integration strengthens Autobio's negotiating position by decreasing reliance on external vendors, thus mitigating risks of price hikes or supply disruptions.

However, the IVD sector's reliance on specialized, high-quality materials means a limited supplier pool. In 2024, the global IVD market, valued around USD 100 billion, highlighted this, with demand for precision components concentrating power among a few capable suppliers. This scarcity can lead to increased input costs for Autobio.

Suppliers holding patents on critical IVD technologies or proprietary materials can command higher prices and enforce strict licensing terms. This intellectual property leverage directly impacts Autobio's product development costs and innovation timelines, potentially increasing manufacturing expenses and limiting flexibility.

| Factor | Impact on Autobio Diagnostics | 2024 Data/Context |

|---|---|---|

| Self-Supply Rate | Reduces supplier leverage | Over 73% for key antigens/antibodies |

| Supplier Concentration | Increases supplier leverage | Limited number of high-quality IVD material suppliers |

| Intellectual Property | Increases supplier leverage | Patented technologies and proprietary materials |

| Global Supply Chain Issues | Increases supplier leverage | Component cost increases (15-20%), extended lead times (up to 6 months) |

What is included in the product

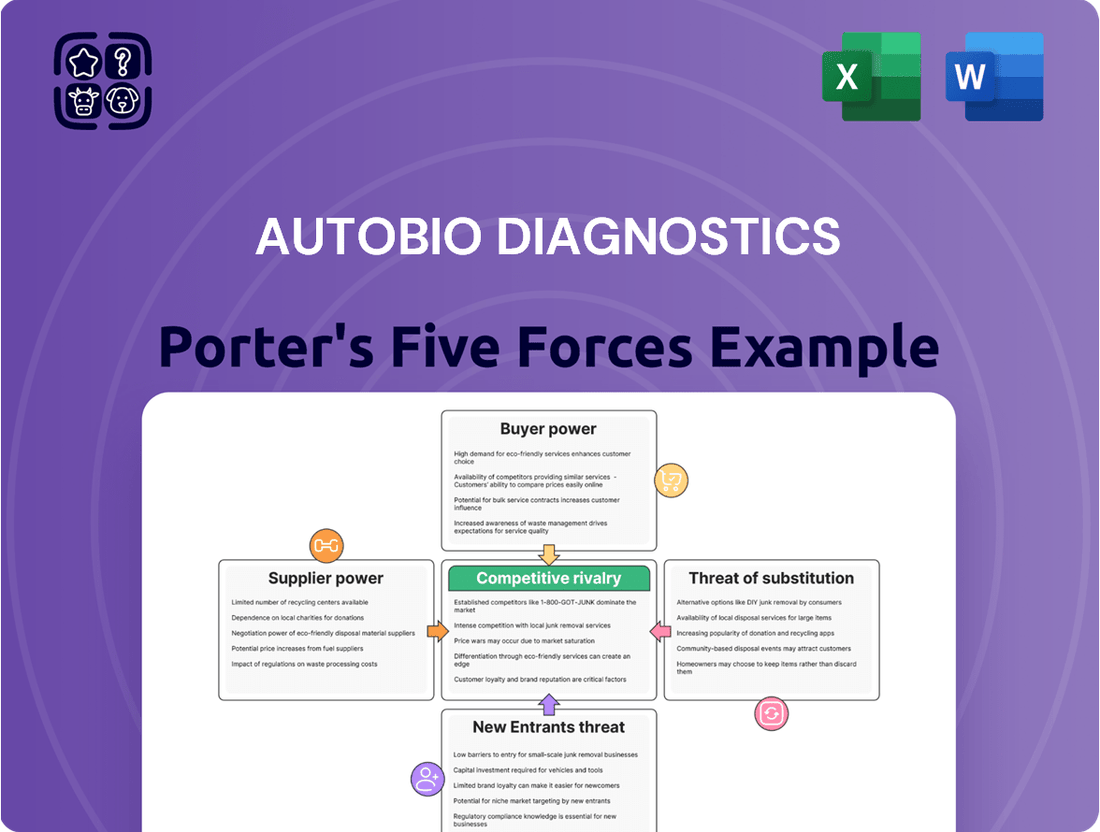

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Autobio Diagnostics, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify competitive threats and opportunities with a visually intuitive breakdown of each force, enabling strategic adjustments before they become critical issues.

Customers Bargaining Power

Autobio Diagnostics' primary customers are clinical laboratories, a diverse group encompassing everything from major hospital networks to smaller, independent facilities. This broad customer base, while generally fragmented, can exert significant bargaining power when consolidated.

In certain geographical markets, large purchasing organizations or integrated healthcare systems act as powerful aggregators of demand. These entities can leverage their substantial purchase volumes to negotiate more favorable pricing and contract terms with suppliers like Autobio. For instance, in 2024, major hospital groups in Europe continued to consolidate their procurement processes, increasing their collective buying power.

China's Volume-Based Procurement (VBP) policies, a significant development that extended to in-vitro diagnostics in 2024-2025, are a powerful force. These initiatives are designed to drive down costs, and they are succeeding. For instance, the initial VBP rounds for pharmaceuticals saw average price reductions of over 50% for many drugs.

This focus on scale means that manufacturers capable of high-volume production gain a distinct advantage. Companies that can meet these large-scale demands are better positioned to secure contracts, while those that cannot may struggle to compete. This dynamic directly amplifies the bargaining power of the government and healthcare institutions, who are the primary purchasers under these programs.

Healthcare providers, such as clinical labs, are facing significant pressure to reduce expenses. This heightened price sensitivity means diagnostic companies like Autobio must offer competitive pricing and cost-effective products to remain attractive. In 2024, laboratory test utilization continued to grow, but reimbursement rates for many common tests remained stagnant or declined, further emphasizing the need for cost containment among providers.

Availability of Alternative IVD Solutions

The in vitro diagnostics (IVD) market is highly competitive, featuring many domestic and international companies. This abundance of choice means customers can easily switch if Autobio's products aren't compelling enough. For instance, in 2024, the global IVD market was valued at approximately $106.5 billion, with significant growth projected, indicating a fertile ground for alternatives.

Customers possess considerable bargaining power due to the wide array of available IVD solutions. If Autobio's instruments, reagents, or services lack distinct advantages or competitive pricing, clients can readily opt for competing providers. This ease of switching directly enhances customer leverage.

- Market Competition: The IVD sector is crowded, with numerous players offering diverse products and services.

- Customer Options: Buyers have a broad selection, making it simple to change suppliers based on price, quality, or features.

- Switching Costs: Low switching costs for customers further empower them to seek better value from competitors.

- Differentiation is Key: Autobio must offer unique value propositions to mitigate this customer power.

Switching Costs for Instruments and Systems

The initial outlay for diagnostic instruments and their seamless integration into laboratory operations represent substantial switching costs for Autobio Diagnostics' customers. Laboratories investing heavily in a particular vendor's ecosystem face considerable expense and operational disruption if they decide to transition to a competitor's platform.

These high switching costs significantly diminish the bargaining power of customers, particularly when considering comprehensive, integrated solutions. For instance, a clinical laboratory might have invested hundreds of thousands of dollars in automated immunoassay analyzers and associated software. The cost of new instruments, retraining staff, revalidating assays, and potentially losing workflow efficiency during the transition can easily run into tens or even hundreds of thousands of dollars, making a switch economically unfeasible for many.

- High Capital Investment: Diagnostic instrument systems often require significant upfront capital, creating a barrier to switching.

- Workflow Integration: Deep integration into laboratory information systems (LIS) and established workflows makes changing vendors complex.

- Revalidation Costs: Switching instrument platforms necessitates revalidation of diagnostic tests, adding time and expense.

- Training and Familiarity: Laboratory personnel require training on new systems, impacting immediate productivity.

Autobio Diagnostics' customers, primarily clinical laboratories, possess moderate bargaining power. This is influenced by market competition and the availability of alternatives, though significant switching costs for integrated systems can mitigate this power. The global IVD market, valued around $106.5 billion in 2024, offers customers numerous choices, allowing them to leverage price and feature comparisons.

| Factor | Impact on Autobio | Customer Leverage |

|---|---|---|

| Market Competition | High | Moderate to High |

| Availability of Alternatives | High | Moderate to High |

| Switching Costs (Instruments/Integration) | High | Low to Moderate |

| Price Sensitivity (Cost Containment Pressure) | High | Moderate to High |

What You See Is What You Get

Autobio Diagnostics Porter's Five Forces Analysis

This preview showcases the complete Autobio Diagnostics Porter's Five Forces Analysis, detailing the competitive landscape of the in-vitro diagnostics industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, offering a comprehensive understanding of industry rivalry, buyer and supplier power, threat of new entrants, and substitutes.

Rivalry Among Competitors

China's In Vitro Diagnostics (IVD) market is characterized by a crowded competitive landscape. While global giants like Roche, Abbott, and Siemens have a significant presence, domestic firms are rapidly gaining ground. Companies such as Snibe, Autobio, and Mindray are increasingly making their mark through innovation and aggressive market strategies.

This intense rivalry stems from the market's dynamic nature, with both established international players and emerging Chinese manufacturers vying for market share. The fierce competition is driving rapid advancements in research and development, as companies strive to differentiate themselves through technological breakthroughs and product offerings.

Autobio Diagnostics stands out with its extensive product range, covering immunoassay, microbiology, biochemistry, and molecular diagnostics, providing a complete suite of solutions. This broad offering allows them to cater to diverse laboratory needs, a key differentiator in a fragmented market.

The pace of innovation is a critical battleground. Companies like Autobio must constantly introduce new tests, enhance automation capabilities, and develop integrated systems to stay ahead. For instance, the demand for rapid molecular diagnostic kits saw significant growth in 2024, driven by ongoing public health concerns and advancements in PCR technology.

This relentless drive for differentiation through technological advancement directly impacts competitive rivalry. Autobio's investment in R&D, aiming to introduce novel diagnostic platforms and improve existing ones, is essential for maintaining market share against competitors who are also aggressively innovating.

The global in-vitro diagnostics (IVD) market is a hotbed of activity, with projections indicating robust expansion. China's IVD market, in particular, is a significant draw for major players, anticipating substantial growth. This burgeoning market attractiveness naturally fuels competitive rivalry.

As companies recognize the lucrative potential, especially within high-demand areas like molecular diagnostics and immunodiagnostics, they are increasingly competing for market share. For instance, the Chinese IVD market was estimated to be worth approximately $12.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2028, according to various market research reports.

Pricing Pressure and Volume-Based Procurement

Competitive rivalry within the in-vitro diagnostics (IVD) sector is intensified by significant pricing pressures, a trend notably driven by Volume-Based Procurement (VBP) initiatives, particularly in China. This strategy, implemented by healthcare systems, aims to reduce overall expenditure on medical supplies and services by consolidating purchasing power and negotiating lower prices for high-volume products.

The impact of VBP is substantial, forcing IVD companies to engage in aggressive price competition. This can lead to a downward spiral in pricing, potentially squeezing profit margins for all market participants, including established players and newer entrants. For instance, in 2024, reports indicated that VBP tenders in China for certain IVD reagents saw price reductions averaging between 20% to 50% compared to previous procurement cycles.

- Aggressive Pricing: VBP mandates that suppliers offer their products at significantly lower prices to secure large volume contracts.

- Margin Squeeze: Companies must balance cost reduction efforts with maintaining product quality and innovation, which can be challenging under intense price pressure.

- Market Consolidation: Smaller or less efficient players may struggle to compete on price, potentially leading to market consolidation as larger companies with economies of scale gain an advantage.

- Focus on Efficiency: The pressure incentivizes companies to streamline operations and improve manufacturing efficiency to sustain profitability.

Strategic Partnerships and Market Expansion

Competitive rivalry within the in-vitro diagnostics (IVD) sector is intensifying as companies forge strategic partnerships to broaden their product offerings and extend their market presence, both at home and abroad. This collaborative approach is becoming a cornerstone for growth.

Autobio Diagnostics' partnership with Boditech Med exemplifies this trend. Their joint efforts in developing and expanding sales for crucial products underscore the strategic importance of alliances in navigating a dynamic market. This collaboration, announced in late 2023, aims to leverage each company's strengths, with Autobio focusing on its established reagent development and Boditech Med on its instrument manufacturing capabilities.

The IVD market, valued at approximately $90 billion globally in 2024, sees such partnerships as vital for staying competitive. For instance, companies are increasingly looking to combine molecular diagnostics with immunoassay platforms to offer more comprehensive testing solutions. This strategic alignment helps companies access new customer segments and geographical regions, thereby mitigating risks and accelerating innovation.

- Strategic Alliances: Companies like Autobio Diagnostics are actively forming partnerships to enhance their product portfolios and market reach.

- Market Expansion: Collaborations are crucial for gaining access to new domestic and international markets.

- Product Diversification: Partnerships enable companies to jointly develop and market a wider range of diagnostic solutions.

- Competitive Advantage: Strategic alliances are key differentiators in the increasingly competitive IVD landscape.

The competitive rivalry in the IVD market is fierce, fueled by rapid innovation and aggressive pricing strategies, particularly influenced by China's Volume-Based Procurement (VBP) policies. Autobio Diagnostics faces intense competition from both global powerhouses like Roche and Abbott, and increasingly capable domestic players such as Snibe and Mindray.

This rivalry is characterized by a constant push for technological advancement, with companies investing heavily in R&D to introduce new diagnostic tests and platforms. For example, the demand for rapid molecular diagnostic kits surged in 2024, highlighting the importance of staying ahead in product development.

Strategic partnerships are also a key element of this competitive landscape, allowing companies like Autobio to expand their product offerings and market reach. The global IVD market, projected to reach approximately $90 billion in 2024, sees collaborations as essential for gaining a competitive edge.

The VBP system in China has driven significant price reductions, with some IVD reagents seeing 20% to 50% drops in 2024, intensifying the pressure on profit margins and encouraging operational efficiencies.

| Competitor | Key Product Areas | 2024 Market Presence (Illustrative) |

|---|---|---|

| Roche | Immunoassay, Molecular Diagnostics | Strong global presence, significant share in China |

| Abbott | Immunoassay, Molecular Diagnostics, Point-of-Care | Leading player, expanding in emerging markets |

| Siemens Healthineers | Immunoassay, Clinical Chemistry | Established global footprint |

| Snibe Diagnostics | Immunoassay | Rapidly growing Chinese player, expanding internationally |

| Mindray | Biochemistry, Immunoassay, Hematology | Dominant domestic player in China, growing global presence |

SSubstitutes Threaten

The growing prevalence of direct-to-consumer (DTC) testing presents a significant threat to established players like Autobio Diagnostics. Consumers can now order a wide array of lab tests online and conduct them conveniently at home, bypassing traditional healthcare channels. This shift can siphon off demand from conventional clinical labs and IVD manufacturers.

Advancements in non-IVD diagnostic methods, like ultra-high-end CT and photon-counting CT, offer alternative ways to gather diagnostic information. These imaging technologies can sometimes replace the need for certain in-vitro diagnostic tests, potentially reducing reliance on traditional lab work for specific conditions.

For instance, the global medical imaging market, which includes these advanced technologies, was valued at approximately $37.5 billion in 2023 and is projected to grow significantly. While not a complete replacement for all IVD applications, this trend highlights a growing threat of substitutes that can impact the market share of certain IVD products.

The growing emphasis on preventative healthcare and lifestyle management presents a significant threat of substitutes for Autobio Diagnostics. As individuals increasingly adopt wellness programs and utilize wearable health devices for real-time monitoring, the demand for traditional in-vitro diagnostics (IVD) could decline. This shift moves healthcare from a reactive model to a proactive one, potentially reducing the need for diagnostic tests to identify existing conditions.

Technological Advancements in Point-of-Care (POCT) and Home Testing

The growing prevalence of Point-of-Care Testing (POCT) and home diagnostic kits presents a significant threat of substitutes for traditional in-vitro diagnostic (IVD) products. These advancements offer faster, more convenient testing options directly to patients or at the point of care, potentially bypassing centralized laboratory services. For Autobio Diagnostics, while they are active in molecular diagnostics, the increasing consumer adoption of self-administered tests could divert demand from their established clinical laboratory offerings.

Consider these key aspects of this threat:

- Market Shift: The global POCT market was valued at approximately $30.5 billion in 2023 and is projected to grow significantly, indicating a strong consumer and healthcare provider preference for decentralized testing.

- Convenience Factor: Home testing kits, particularly for conditions like infectious diseases or chronic disease monitoring, offer unparalleled convenience, reducing patient travel and wait times associated with traditional lab visits.

- Technological Integration: Advancements in biosensor technology and connectivity allow for more accurate and user-friendly home testing devices, further enhancing their appeal as substitutes.

- Impact on Autobio: As home testing becomes more sophisticated and accepted, it could erode the market share of traditional lab-based diagnostic services, impacting Autobio's revenue streams if they do not adapt their product portfolio or service model.

Integrated Digital Health and AI-driven Predictive Analytics

The burgeoning field of integrated digital health, particularly AI-driven predictive analytics, poses a significant threat of substitution for traditional in-vitro diagnostic (IVD) companies like Autobio Diagnostics. These advanced technologies can analyze vast datasets, including patient history, genetic information, and real-time physiological data, to predict disease onset or progression. For instance, AI algorithms are showing promise in early cancer detection from imaging or blood markers, potentially bypassing the need for extensive IVD panels in certain screening scenarios. In 2024, the digital health market continued its rapid expansion, with investments in AI healthcare solutions reaching tens of billions globally, indicating a strong market push towards these substitute solutions.

AI-powered diagnostics offer enhanced precision and significantly reduced turnaround times compared to conventional IVD methods. This efficiency can directly impact patient care pathways and healthcare costs. For example, AI models are being developed to interpret complex genomic data for personalized medicine, offering insights that might previously have required multiple sequential IVD tests. The increasing adoption of these AI-driven tools in clinical decision support systems means that healthcare providers may rely less on traditional, lab-based IVD workflows for initial assessments and monitoring, thereby diminishing the demand for Autobio's core product offerings.

- AI-driven predictive analytics can forecast disease risk, potentially reducing the need for broad IVD screening panels.

- The global digital health market saw substantial growth in 2024, with significant capital flowing into AI healthcare applications.

- AI diagnostics promise greater precision and faster results, challenging traditional IVD turnaround times.

- Advancements in AI for genomic interpretation and personalized medicine offer alternatives to multi-test IVD strategies.

The increasing sophistication of non-IVD diagnostic modalities, such as advanced imaging techniques, represents a growing threat of substitution for Autobio Diagnostics. These technologies can provide diagnostic insights that previously relied heavily on in-vitro testing. For instance, the global medical imaging market was valued at approximately $37.5 billion in 2023, highlighting the significant investment and adoption of these alternative diagnostic approaches.

The rise of direct-to-consumer (DTC) health testing and home-use diagnostic kits offers consumers convenient alternatives to traditional laboratory services. This trend, fueled by advancements in biosensor technology and user-friendly interfaces, allows for self-administered testing, potentially diverting demand from established IVD providers. The global Point-of-Care Testing (POCT) market, a close relative to home testing, was valued at around $30.5 billion in 2023, underscoring the shift towards decentralized diagnostics.

AI-driven predictive analytics in digital health presents a substantial substitution threat by forecasting disease risk and potentially reducing the need for extensive IVD screening. The rapid expansion of the digital health market in 2024, with billions invested in AI healthcare, signals a strong market preference for these forward-looking diagnostic solutions that offer enhanced precision and faster results, challenging traditional IVD workflows.

Entrants Threaten

Launching an in-vitro diagnostics (IVD) company, especially one covering multiple areas like immunoassay, microbiology, biochemistry, and molecular diagnostics, demands significant upfront investment. For instance, in 2024, the global IVD market saw continued growth, with companies investing heavily in advanced technologies. This high capital requirement for research, development, manufacturing infrastructure, and specialized equipment acts as a considerable deterrent for new entrants.

The in-vitro diagnostics (IVD) market presents a formidable barrier to new entrants due to its intricate regulatory environment. Companies must navigate demanding product registration processes, establish robust quality management systems, and conduct extensive clinical trials. For instance, China's IVD regulatory framework has undergone significant revisions, with updates to its classification catalog and new regulations implemented in 2024 and continuing into 2025, demanding substantial investment and expertise to comply.

Autobio Diagnostics faces a significant threat from new entrants due to the intense need for specialized expertise. Developing and bringing In Vitro Diagnostic (IVD) products to market requires deep scientific knowledge, advanced technical skills, and a strong understanding of clinical applications. This includes having robust research and development teams and skilled service engineers.

New companies entering the IVD space must be able to attract and retain top talent in these critical areas. The competition for highly qualified scientists, engineers, and clinical specialists is fierce, making it a substantial hurdle for any newcomer. For instance, in 2023, the global IVD market saw significant investment, with companies like Roche and Abbott continuing to lead, indicating a high demand for skilled personnel.

Established Distribution Networks and Customer Relationships

Autobio Diagnostics benefits from a robust, nationwide marketing network across China and a significant international presence, exporting to over 100 countries and serving more than ten thousand medical institutions.

New competitors face a substantial hurdle in replicating Autobio's established distribution channels and the deep-seated trust and relationships it has cultivated with clinical laboratories.

- Extensive Reach: Autobio's network spans China and extends to over 100 export markets.

- Customer Loyalty: Over 10,000 medical institutions rely on Autobio's products, indicating strong existing relationships.

- Barriers to Entry: New entrants would find it challenging and costly to build similar distribution infrastructure and gain customer confidence.

Intellectual Property and Patent Protection

The in-vitro diagnostics (IVD) sector heavily relies on intellectual property. Autobio, like other established companies, possesses a substantial patent portfolio, acting as a significant hurdle for newcomers. These patents protect proprietary technologies and diagnostic methods, requiring new entrants to either innovate independently or incur substantial licensing fees.

Developing entirely new, patentable technologies is a costly and time-consuming endeavor. For instance, in 2024, the average cost to secure a patent in the life sciences sector could range from $5,000 to $20,000 or more, depending on the complexity and geographic coverage. This financial commitment, coupled with the need for extensive research and development, deters many potential competitors.

- High R&D Investment: New entrants face significant upfront costs for research and development to create unique, patentable diagnostic solutions.

- Licensing Costs: Acquiring licenses for existing patented technologies can be prohibitively expensive, impacting profitability for new players.

- Patent Enforcement: Established companies actively defend their intellectual property, creating legal risks for those who infringe on existing patents.

The threat of new entrants for Autobio Diagnostics is moderate. While the IVD market demands significant capital investment, stringent regulatory compliance, and specialized expertise, Autobio's established brand, extensive distribution network, and strong patent portfolio create substantial barriers. Newcomers would need considerable resources to overcome these hurdles and compete effectively.

| Factor | Impact on Autobio | Example Data (2024/2025) |

| Capital Requirements | High barrier | IVD market R&D investment in advanced tech continues to grow. |

| Regulatory Hurdles | High barrier | China's IVD regulations updated in 2024/2025, requiring compliance investment. |

| Specialized Expertise | High barrier | Fierce competition for skilled scientists and engineers in the IVD sector. |

| Distribution Network | Low threat | Autobio's network covers China and 100+ export markets. |

| Intellectual Property | Low threat | Autobio's patent portfolio protects proprietary technologies. |

Porter's Five Forces Analysis Data Sources

Our Autobio Diagnostics Porter's Five Forces analysis is built upon a robust foundation of data, including Autobio's annual reports, industry-specific market research from firms like Frost & Sullivan, and relevant regulatory filings. This blend ensures a comprehensive understanding of the competitive landscape.