Aurionpro Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurionpro Solutions Bundle

Aurionpro Solutions operates within a dynamic tech landscape where understanding competitive pressures is paramount. Our analysis reveals the intricate interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the impact of substitutes on Aurionpro's market position.

The complete report reveals the real forces shaping Aurionpro Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for Aurionpro Solutions generally presents a moderate level of bargaining power. While the company utilizes specialized technology, the broader IT services and cloud infrastructure markets are quite competitive, which helps to temper supplier influence.

However, for highly specific software or hardware components critical to Aurionpro's unique offerings, the bargaining power of those particular suppliers can indeed increase. This is especially true if there are few alternative providers for these specialized inputs, potentially impacting costs and availability.

Aurionpro Solutions faces considerable switching costs when changing core technology suppliers. For instance, integrating new proprietary software licenses or migrating complex, deeply embedded systems requires substantial investment in time, personnel, and potential operational downtime. This makes it difficult and costly for Aurionpro to move away from established vendors, thereby strengthening the bargaining power of these suppliers.

Aurionpro Solutions' bargaining power of suppliers is influenced by the uniqueness of their inputs. When suppliers provide highly specialized or proprietary software, specific hardware for smart city projects, or niche security tools, they hold more leverage. For instance, if a key component for their advanced analytics platform is only available from a single vendor, that vendor's power increases significantly.

Conversely, for more common IT infrastructure, widely available programming languages, or standard cloud services, supplier power is generally lower. Aurionpro can often switch between multiple providers for these less differentiated inputs. This is evident in the competitive market for general cloud computing services where pricing and terms are often negotiable.

The evolving technological landscape, particularly the surge in AI and the demand for specialized data center components, is shifting power dynamics. Suppliers offering cutting-edge AI accelerators or highly efficient cooling systems for data centers are gaining more influence. As of early 2024, the demand for AI-specific hardware has outstripped supply for many leading manufacturers, giving those suppliers considerable pricing power.

Availability of Substitutes for Aurionpro's Inputs

The availability of substitute inputs for Aurionpro Solutions hinges on the specific nature of their offerings. For core IT infrastructure needs, the market is quite competitive with numerous cloud providers and general software vendors, offering Aurionpro considerable flexibility in sourcing. This broad IT services landscape, valued at over $1.3 trillion globally in 2024, provides a wide array of tools and platforms.

However, when Aurionpro deals with highly specialized areas like fintech solutions or bespoke mobility hardware and software, the pool of readily available substitutes can shrink significantly. This specialization can lead to a higher bargaining power for suppliers in those niche markets.

- Diverse Input Market: The IT services sector, a key input area for Aurionpro, is characterized by a vast number of vendors, increasing sourcing options.

- Specialization Matters: For highly specialized components or software in fintech and mobility, substitute availability is lower, potentially strengthening supplier positions.

- Cloud Provider Competition: The presence of multiple major cloud service providers (e.g., AWS, Azure, Google Cloud) limits the bargaining power of any single provider for general cloud infrastructure.

- Software Vendor Landscape: The broad availability of general-purpose software and development tools allows for easier substitution compared to proprietary or highly integrated solutions.

Talent Pool and Labor Costs

The availability of skilled IT talent, especially in specialized fields like AI, cybersecurity, and complex system integration, significantly impacts supplier power. A global shortage of cybersecurity professionals, with over 3.5 million open positions worldwide as of early 2024, grants considerable leverage to those possessing these in-demand skills.

This scarcity translates directly to higher labor costs for companies like Aurionpro Solutions. Attracting and retaining top-tier talent in these critical areas requires competitive compensation and benefits packages, directly influencing operational expenses and the bargaining power of individual employees and recruitment agencies.

- Talent Scarcity: A global deficit of over 3.5 million cybersecurity professionals highlights the intense competition for skilled IT workers.

- Increased Labor Costs: The demand for specialized IT skills drives up wages and recruitment expenses for companies like Aurionpro.

- Strategic Talent Management: Aurionpro's ability to retain and attract top talent is crucial for mitigating the bargaining power of suppliers in the labor market.

The bargaining power of suppliers for Aurionpro Solutions is generally moderate, but can increase significantly for specialized inputs. While the broader IT market offers many options, niche software or hardware components, particularly those for advanced projects like smart cities or fintech, can be sourced from fewer vendors. This scarcity, coupled with high switching costs for integrated systems, grants these specialized suppliers greater leverage, impacting Aurionpro's costs and operational flexibility.

| Input Type | Supplier Concentration | Switching Costs | Supplier Bargaining Power |

|---|---|---|---|

| General Cloud Infrastructure | Low (Many Providers) | Moderate | Low |

| Specialized AI Hardware | Moderate to High (Limited Vendors) | High | High |

| Fintech Software Solutions | High (Niche Market) | Very High | High |

| Standard IT Services | Low (Fragmented Market) | Low | Low |

What is included in the product

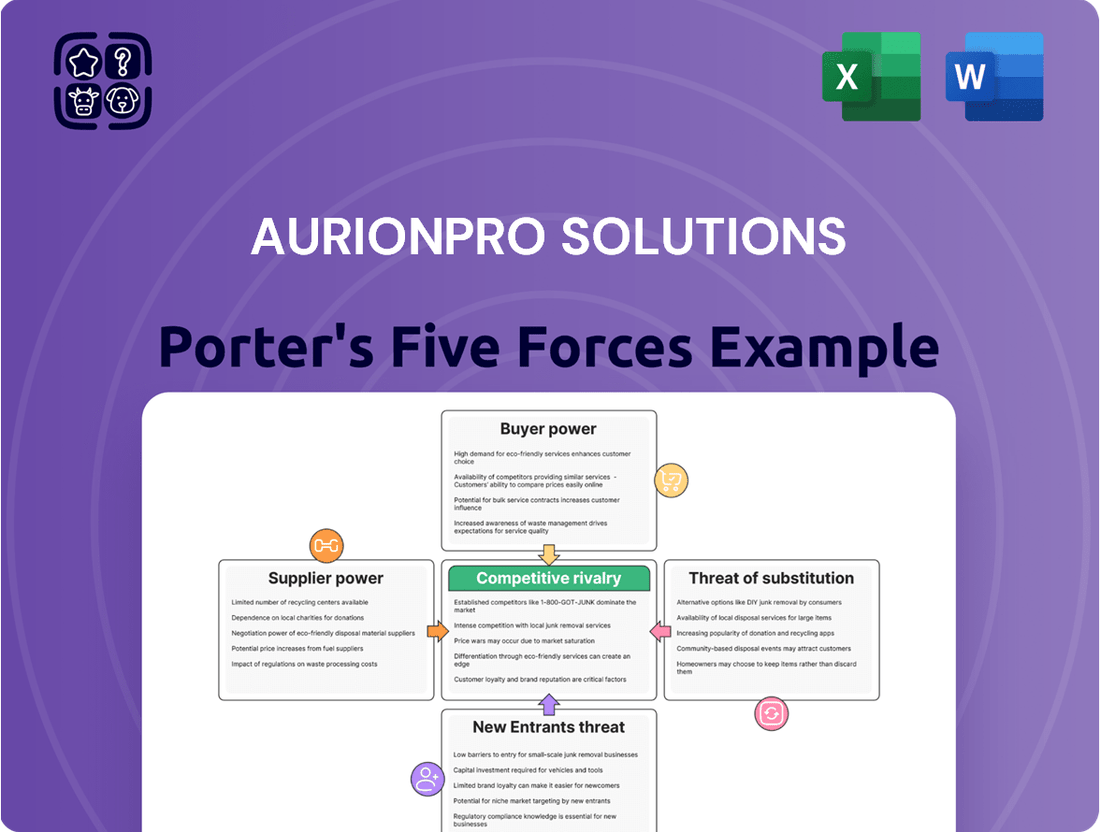

Provides a comprehensive assessment of the competitive forces impacting Aurionpro Solutions, including buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Aurionpro Solutions caters to a broad range of industries like BFSI, fintech, and telecom globally. However, a significant portion of its revenue, 48% in fiscal 2024, came from its top 10 clients, highlighting a notable customer concentration.

This concentration means large clients, particularly major financial institutions and government bodies, wield considerable bargaining power. Their substantial contract sizes and the potential to shift business elsewhere give them leverage in negotiations.

Customers face moderate to high switching costs when moving away from Aurionpro Solutions' integrated offerings, especially in areas like digital transformation and specialized banking platforms. These systems often become integral to a client's daily operations.

The complexity of integrating Aurionpro's solutions means that switching providers involves significant disruption, potential data migration hurdles, and the need for extensive employee retraining. For instance, a bank adopting Aurionpro's core banking system would incur substantial costs and operational delays if they decided to switch to a competitor.

These embedded costs and operational complexities effectively reduce the bargaining power of customers, as the financial and operational impact of switching is considerable. This is particularly true for clients undertaking large-scale digital transformation projects with Aurionpro, where the vendor lock-in can be quite pronounced.

In the IT solutions sector, customer price sensitivity is a significant factor, particularly for standard services. Businesses actively seeking cost optimization, a trend evident in the ongoing global economic adjustments, will naturally push for lower prices.

However, this sensitivity can shift dramatically when customers require highly specialized solutions. For instance, critical digital transformation projects or advanced cybersecurity implementations often see clients valuing expertise and proven reliability far more than a slightly lower price tag. This was reflected in a 2024 industry survey where 65% of IT decision-makers cited ‘risk mitigation’ as a key factor in vendor selection, often outweighing cost considerations for mission-critical services.

Customer Information and Transparency

Customers in the digital transformation and IT services sector now have an unprecedented amount of information at their fingertips. This includes detailed insights into service provider capabilities, various pricing structures, and what competitors are offering. For instance, a significant portion of B2B buyers now conduct extensive online research before engaging with a vendor, with some reports indicating over 70% of the buying journey happens before any direct sales contact.

The proliferation of online review platforms, in-depth industry analyses, and more transparent bidding processes allows clients to meticulously compare different solutions. This heightened transparency directly translates into stronger customer bargaining power. Companies can leverage this data to negotiate better terms, ensuring they receive optimal value for their IT investments.

- Informed Decisions: Customers can easily compare pricing and service offerings from multiple IT service providers, leading to more strategic vendor selection.

- Access to Data: Online reviews and industry reports provide valuable insights into provider performance and customer satisfaction, empowering buyers.

- Negotiation Leverage: Increased transparency in the market allows customers to negotiate more favorable contracts and pricing structures.

- Market Awareness: Buyers are more aware of alternative solutions and emerging technologies, which can reduce switching costs and increase their power.

Importance of Aurionpro's Services to Customers

Aurionpro's solutions are fundamental to their clients' success in areas like digital transformation, operational efficiency, and cybersecurity. For instance, their banking and payments platforms are crucial for financial institutions to manage transactions and comply with regulations. This deep integration means clients are highly reliant on Aurionpro's services, creating a strong dependence.

The critical nature of Aurionpro's offerings, such as system integration for complex IT infrastructures and strategic consulting for business modernization, means clients cannot easily switch providers without significant disruption. This reliance translates into a powerful bargaining position for customers who require consistent performance and advanced capabilities to maintain their competitive edge.

- Criticality of Digital Transformation: Many businesses, especially in the financial sector, are undergoing significant digital overhauls, making solutions like Aurionpro's essential for survival and growth.

- Operational Dependence: Clients depend on Aurionpro's platforms for day-to-day operations, including payment processing and data security, which are non-negotiable functions.

- Demand for High Performance: The critical nature of these services means customers demand unwavering reliability and cutting-edge features, giving them leverage to negotiate terms.

Aurionpro Solutions' customer concentration, with 48% of fiscal 2024 revenue from its top 10 clients, grants these major clients significant bargaining power. Their ability to shift substantial business volume creates leverage in negotiations, especially given the integrated nature of Aurionpro's specialized IT solutions.

While switching costs are moderate to high due to integration complexities and operational reliance, customers are increasingly informed. Extensive online research and market transparency empower buyers to compare offerings and negotiate favorable terms, balancing the embedded costs of staying with Aurionpro.

The criticality of Aurionpro's services, such as digital transformation and core banking platforms, fosters client dependence. This reliance on high performance and advanced capabilities for operational continuity gives customers leverage to demand optimal value and terms.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | High | 48% of FY24 revenue from top 10 clients. |

| Switching Costs | Moderate to High | Integration complexity, operational reliance. |

| Information Availability | High | Over 70% of B2B buying journey occurs before sales contact. |

| Price Sensitivity | Varies (High for standard, Low for specialized) | 65% of IT decision-makers cite risk mitigation over cost for critical services (2024 survey). |

What You See Is What You Get

Aurionpro Solutions Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Aurionpro Solutions, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Aurionpro's industry. This analysis is meticulously prepared to offer actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The IT solutions and services sector where Aurionpro Solutions operates is incredibly competitive, populated by a vast array of companies. These range from massive global corporations to smaller, highly specialized firms, creating a crowded marketplace.

Aurionpro faces a significant competitive challenge, with 722 active competitors identified. This list includes industry heavyweights such as Cognizant, Wipro, Tata Consultancy Services, Capgemini, Infosys, Accenture, and IBM, underscoring the intense rivalry across the board.

The IT services sector is booming, with Gartner forecasting a robust 9.4% revenue increase for IT services in 2025. This strong industry growth can somewhat ease the intensity of competition, as a larger market pie allows more players to thrive. However, this very expansion also acts as a magnet for new companies entering the fray, and spurs existing firms to aggressively broaden their operations and market share.

The system integration market, a key segment for companies like Aurionpro Solutions, is expected to reach a substantial USD 847.5 billion by 2033, expanding at a compound annual growth rate of 6.88% between 2025 and 2033. Simultaneously, the cybersecurity market is experiencing its own rapid ascent. These expanding sub-sectors contribute to the overall positive growth trajectory, yet they also intensify the competitive landscape by attracting more participants and encouraging aggressive strategies from incumbents.

Aurionpro Solutions carves out its niche by offering specialized solutions in banking, mobility, payments, and security, complemented by strategic consulting and system integration services. This targeted approach aims to set it apart in a crowded market.

Despite these specialized offerings, many competitors provide comparable end-to-end digital transformation services, underscoring the critical need for Aurionpro to maintain robust differentiation. For instance, in the digital banking sector, where Aurionpro is active, the global digital banking market was valued at approximately USD 25.3 billion in 2023 and is projected to grow significantly.

The swift pace of technological advancement, particularly in areas like artificial intelligence and blockchain, necessitates constant innovation. This ongoing evolution is key for Aurionpro to sustain its competitive advantage and relevance in the dynamic IT services landscape.

Switching Costs for Customers

Customers experience moderate to high switching costs when moving away from Aurionpro Solutions. This is a double-edged sword, as these same costs also deter clients from switching to competitors, creating a sticky customer base once integration is complete. This dynamic fuels intense competition for new client acquisition and robust efforts to retain existing ones.

The high integration costs mean that once a client is embedded within Aurionpro's ecosystem, the likelihood of them seeking an alternative provider diminishes significantly. Consequently, companies in this sector, including Aurionpro, often engage in aggressive bidding and focus on demonstrating long-term value to secure initial contracts.

- High Integration Costs: Implementing new software or IT solutions typically involves significant upfront investment in data migration, system configuration, and employee training, making a switch costly.

- Vendor Lock-in Potential: Proprietary technologies or specialized service offerings can create a degree of vendor lock-in, further increasing the perceived risk and expense of changing providers.

- Competitive Bidding: The need to capture clients in the face of these switching costs often leads to competitive pricing and value-added services being offered in initial contract negotiations.

Exit Barriers

Exit barriers in the IT services sector, including for companies like Aurionpro Solutions, are often significant. These can stem from substantial investments in specialized technology and infrastructure, making it costly to simply walk away. In 2024, many IT firms continued to invest heavily in cloud migration tools and cybersecurity platforms, assets that are not easily repurposed.

Long-term client contracts are another major factor. These agreements, often spanning several years, lock companies into ongoing service delivery, making a swift exit impractical without incurring penalties or damaging reputation. For instance, a typical enterprise resource planning (ERP) implementation project might involve a multi-year support and maintenance phase.

Furthermore, the intellectual property developed and the established relationships with clients are difficult to divest. Companies build deep expertise and trust over time, which are not readily transferable. The necessity of retaining a highly skilled workforce, crucial for delivering complex IT solutions, also acts as a deterrent to exiting the market, as redeploying or laying off such specialized talent presents its own set of challenges and costs.

- Specialized Assets: High capital expenditure on proprietary software, hardware, and data centers.

- Long-Term Contracts: Multi-year service level agreements (SLAs) and project commitments.

- Client Relationships: Deeply embedded partnerships and trust built over years of service delivery.

- Intellectual Property: Custom-developed solutions, frameworks, and domain expertise.

- Skilled Workforce: Difficulty in managing and redeploying specialized IT talent.

Aurionpro Solutions operates in a fiercely competitive IT services landscape, facing numerous rivals from global giants to niche players. The sheer volume of 722 identified competitors, including major firms like Cognizant and Infosys, highlights the intense rivalry for market share.

While the IT services market is expanding, with a projected 9.4% revenue increase for 2025, this growth also attracts new entrants and fuels aggressive expansion by existing companies. This dynamic means Aurionpro must constantly innovate and differentiate its specialized offerings in areas like digital banking, where the market was valued at approximately USD 25.3 billion in 2023.

The competitive pressure is further amplified by the rapid pace of technological change, particularly in AI and blockchain, demanding continuous investment in innovation to maintain an edge. Although customer switching costs are moderate to high due to integration complexities, this also intensifies the competition for initial client acquisition.

SSubstitutes Threaten

Large enterprises, a key customer segment for Aurionpro Solutions, increasingly consider in-house development for digital solutions. This trend is amplified for core proprietary systems where maintaining complete control over technology and data is paramount. For instance, in 2024, many Fortune 500 companies reported increased investment in their internal IT departments to build custom solutions, reducing reliance on external vendors for critical applications.

The growing accessibility and sophistication of low-code and no-code development platforms further empower in-house teams. These tools enable businesses to rapidly develop and deploy applications without extensive traditional coding expertise. This reduces the perceived need to outsource, as internal capabilities expand, potentially impacting demand for Aurionpro's services in certain project categories.

For standard business functions, clients may opt for readily available software or Software-as-a-Service (SaaS) alternatives instead of Aurionpro's bespoke solutions. These can offer a more budget-friendly and faster implementation path for simpler requirements, potentially impacting Aurionpro's project-based earnings.

The market for generic software is substantial, with the global SaaS market projected to reach over $270 billion in 2024. This wide availability of cost-effective, pre-built solutions presents a direct substitute for custom development, especially for businesses with less complex or unique operational needs.

Clients might opt for independent strategic advisors or niche consultancies that concentrate solely on strategy, bypassing comprehensive solutions providers. This bypasses the need for an integrated approach, offering a more focused alternative.

The emergence of AI-powered consultancies presents a significant threat. These firms can deliver services at a potentially lower cost and with greater speed, directly competing with Aurionpro's consulting offerings.

Direct Competitor Offerings as Substitutes

Aurionpro Solutions faces a significant threat from substitutes due to the broad spectrum of services offered by its numerous competitors. A client could assemble comparable solutions by engaging multiple specialized vendors, rather than opting for Aurionpro's integrated offerings.

For instance, a financial institution might choose to source its core banking system from one provider, its payment gateway from another, and its cybersecurity solutions from a third. This fragmented approach, while potentially more complex to manage, can offer cost savings or access to best-of-breed technologies in specific areas, thereby acting as a viable substitute for a comprehensive platform.

- Fragmented Solutions: Banks can combine specialized services from different vendors to replicate Aurionpro's integrated offerings.

- Cost Efficiency: Sourcing individual components might be perceived as more cost-effective than a bundled solution.

- Technological Specialization: Clients may opt for niche providers offering superior technology in specific domains like payments or cybersecurity.

Emerging Technologies Enabling Self-Service

Advancements in artificial intelligence, automation, and increasingly intuitive platforms are empowering businesses to handle more digital tasks internally. This trend reduces the dependency on external IT service providers like Aurionpro Solutions for certain functions. For example, the rise of embedded finance, including payments, allows companies to integrate financial services directly into their existing software, potentially bypassing specialized providers.

The increasing sophistication of self-service technologies presents a significant threat of substitutes for traditional IT service offerings. By 2024, the global market for Robotic Process Automation (RPA), a key enabler of self-service, was projected to reach $13.7 billion, indicating a strong shift towards automation. This allows companies to manage tasks such as data entry, customer onboarding, and basic IT support without specialized external help.

- AI-driven automation is reducing the need for manual intervention in IT operations.

- Low-code/no-code platforms enable business users to build applications, lessening reliance on custom development services.

- Embedded finance solutions integrate payment and other financial functionalities directly into software, potentially displacing standalone payment gateway providers.

The threat of substitutes for Aurionpro Solutions is significant, as clients can achieve similar outcomes by piecing together solutions from various specialized vendors. This fragmentation can offer cost advantages or access to leading-edge technology in specific areas, presenting a viable alternative to Aurionpro's integrated approach. For instance, a bank might source its core banking platform from one vendor, its payment processing from another, and its cybersecurity from a third, bypassing a single comprehensive provider.

Furthermore, the rise of readily available Software-as-a-Service (SaaS) and low-code/no-code platforms allows businesses to develop standard applications internally, reducing the need for custom development services. The global SaaS market was projected to exceed $270 billion in 2024, highlighting the widespread availability of cost-effective, pre-built alternatives for less complex needs.

The increasing sophistication of AI and automation also empowers businesses to handle more digital tasks in-house, lessening reliance on external IT providers. For example, the growth in Robotic Process Automation (RPA), with a global market projected at $13.7 billion in 2024, enables companies to manage routine IT functions without specialized external support.

| Substitute Category | Description | Example for Aurionpro's Clients | Impact on Aurionpro |

|---|---|---|---|

| In-house Development | Clients building solutions internally using their own IT teams. | Fortune 500 companies increasing internal IT investment in 2024 for custom digital solutions. | Reduced demand for outsourced custom development. |

| Off-the-Shelf Software/SaaS | Using pre-built software or cloud-based services for standard functions. | Financial institutions opting for readily available banking software instead of custom platforms. | Potential loss of revenue for standard project types. |

| Specialized Niche Vendors | Engaging multiple vendors for best-of-breed solutions in specific areas. | A bank sourcing payment gateways from a specialized provider and cybersecurity from another. | Fragmented client projects, potentially lower overall project value. |

| AI-Powered Automation & Self-Service | Leveraging AI and automation tools to manage IT tasks internally. | Companies using RPA for data entry and customer onboarding, reducing need for external support. | Decreased demand for IT support and maintenance services. |

Entrants Threaten

Entering the digital transformation and specialized IT solutions market, where Aurionpro Solutions operates, demands substantial capital. This includes significant investments in cutting-edge technology infrastructure, ongoing research and development to stay ahead of the curve, and attracting highly skilled talent, all of which represent considerable upfront costs for any new player.

Aurionpro's strategic focus on intricate solutions within sectors like banking, mobility, payments, and cybersecurity further elevates these capital requirements. For instance, developing robust and secure payment gateway solutions or advanced banking platforms requires extensive R&D and compliance certifications, creating a high barrier to entry. In 2023, the global digital transformation market was valued at approximately $500 billion, with significant portions dedicated to infrastructure and software development, underscoring the scale of investment needed.

The banking, payments, and security sectors are subject to rigorous regulations, creating significant compliance burdens for technology solution providers like Aurionpro Solutions. New entrants face substantial challenges in navigating these complex frameworks, obtaining essential certifications, and establishing robust security and data privacy protocols. For instance, in 2024, the global regulatory technology market was valued at approximately $11.1 billion, indicating the scale of investment required for compliance.

Established players like Aurionpro Solutions often leverage significant economies of scale. This allows them to spread development costs for complex solutions across a larger customer base, leading to lower per-unit costs. For instance, in 2023, Aurionpro's revenue growth of approximately 25% suggests a substantial operational scale that new entrants would struggle to replicate quickly.

Furthermore, Aurionpro's years of experience and established reputation build trust, particularly with large enterprise clients who prioritize reliability and proven delivery. New entrants, lacking this history, face a considerable hurdle in convincing these discerning clients to switch from established, trusted providers, especially when dealing with critical business solutions.

Brand Loyalty and Established Relationships

Aurionpro Solutions benefits significantly from its deeply entrenched customer relationships, with top clients typically engaging for over eight years. This long-standing loyalty, coupled with a robust and diversified customer base across multiple sectors, creates a substantial barrier for new entrants.

The enterprise IT solutions market demands considerable investment in building brand recognition and fostering trust, a process that new competitors find arduous and time-consuming. Consequently, newcomers face immense difficulty in displacing these established connections and achieving market penetration.

- Customer Retention: Aurionpro's average client tenure exceeds 8 years, indicating strong loyalty and satisfaction.

- Market Trust: Building the necessary brand recognition and trust in the IT solutions sector is a lengthy and costly endeavor for new players.

- Relationship Barriers: Entrenched relationships make it challenging for new entrants to gain traction and market acceptance.

Access to Distribution Channels and Specialized Talent

New entrants face substantial hurdles in securing essential distribution channels and specialized talent, which acts as a significant barrier to market entry for Aurionpro Solutions. Aurionpro's established global sales network and existing partnerships are not easily replicated by newcomers. The ongoing global scarcity of skilled cybersecurity and AI professionals, a critical need in the tech sector, further complicates talent acquisition for any emerging competitor.

The difficulty in accessing established distribution networks means new companies must invest heavily in building their own sales infrastructure or securing partnerships, a process that can take years and significant capital. For instance, in 2024, the global IT services market, where Aurionpro operates, saw continued consolidation, making it harder for smaller, new entrants to secure shelf space or preferred vendor status with major clients.

- Distribution Channel Access: New entrants struggle to gain traction with established distribution partners, requiring substantial investment to build alternative channels.

- Specialized Talent Acquisition: A global shortage of cybersecurity and AI experts in 2024 makes it challenging and costly for new companies to attract and retain the necessary skilled workforce.

- Replication Difficulty: Aurionpro's extensive global presence and deeply entrenched sales channels represent a significant competitive advantage that is hard for new players to match.

The threat of new entrants for Aurionpro Solutions is moderate due to high capital requirements for technology, R&D, and skilled talent, coupled with stringent regulatory compliance in sectors like banking and payments. Aurionpro's established economies of scale, long-term customer relationships averaging over eight years, and strong brand reputation create significant barriers. Furthermore, securing distribution channels and specialized talent, particularly in cybersecurity and AI, presents considerable challenges for newcomers. The global IT services market in 2024 continues to consolidate, making it harder for new entrants to establish themselves.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment in technology, R&D, and talent. | High barrier, requiring substantial upfront funding. |

| Regulatory Compliance | Navigating complex frameworks in banking, payments, and security. | Demands extensive resources and time for certifications. |

| Economies of Scale | Aurionpro's operational scale and cost efficiencies. | New entrants struggle to match cost structures quickly. |

| Customer Relationships & Brand Trust | Years of experience and established client loyalty. | Difficult for new players to gain trust and displace incumbents. |

| Distribution Channels & Talent | Access to sales networks and specialized skills (e.g., AI, cybersecurity). | Challenging and costly for new entrants to replicate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aurionpro Solutions is built on a foundation of comprehensive data, including their annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and competitor analysis to provide a robust understanding of the competitive landscape.