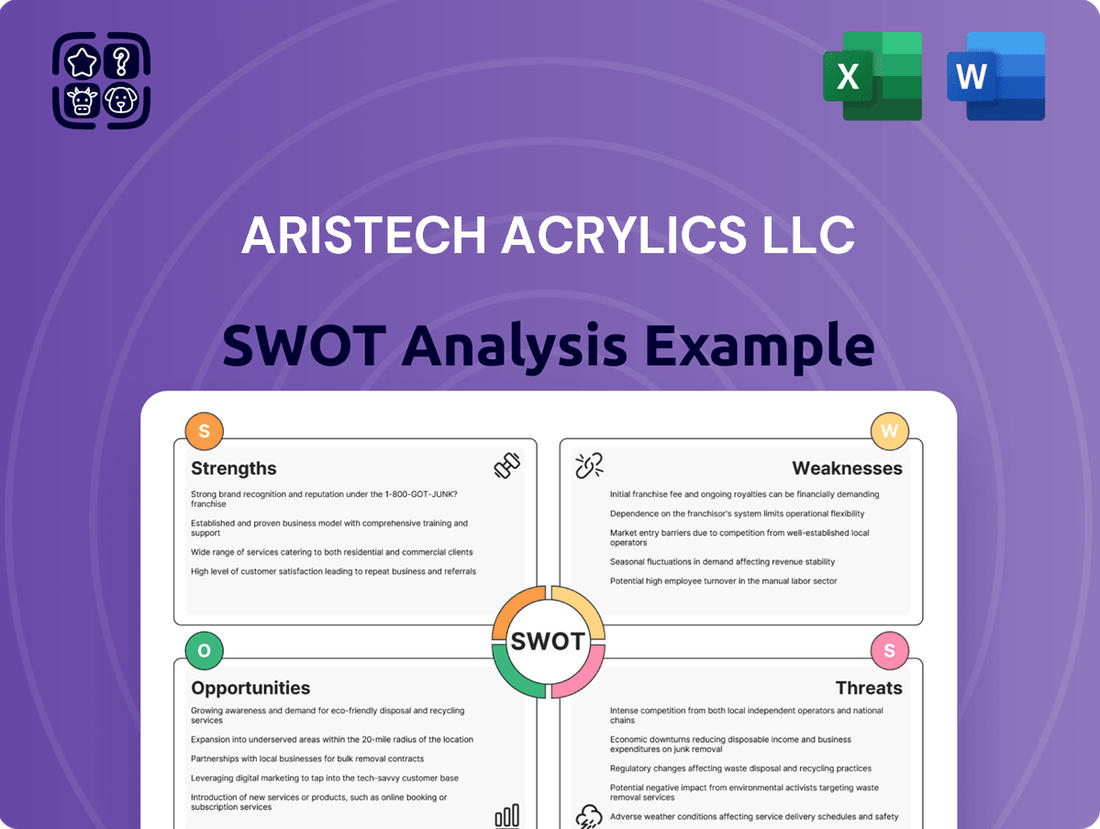

Aristech Acrylics LLC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aristech Acrylics LLC Bundle

Aristech Acrylics LLC boasts strong brand recognition and a wide product range, but faces intense competition and potential supply chain disruptions. Understanding these internal capabilities and external market forces is crucial for strategic decision-making.

While their commitment to quality is a significant strength, navigating evolving customer demands and potential economic downturns presents key challenges. Uncover the full picture of their market position and growth drivers.

Want the full story behind Aristech Acrylics LLC’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Lucite® brand, integral to Aristech Acrylics LLC, is widely recognized for its quality and strong market reputation. This established brand allows Aristech to maintain a robust position, particularly within the sanitary ware and architectural sectors. Their operational history, dating back to 1970, and pioneering role in continuous cast acrylic sheet manufacturing have solidified their status as a key industry player. This enduring legacy continues to underpin their competitive advantage in the 2024-2025 market landscape.

Since its 2021 acquisition by Trinseo, Aristech Acrylics LLC now operates within a global materials powerhouse, enhancing its market position. This integration provides crucial access to greater resources and a robust global distribution network. By 2024, the synergy benefits were projected to yield $10 million in annual pretax cost savings. Operating as a stand-alone entity within Trinseo's Engineered Materials segment allows Aristech to focus on its core business while leveraging the parent company's broader strategic initiatives effectively.

Aristech Acrylics LLC consistently demonstrates a strong commitment to innovation through continuous product development. In February 2024, the company successfully launched a new line of cast acrylic sheets, featuring enhanced UV resistance and superior impact strength. These specialized products are designed for demanding applications, addressing specific market needs. This strategic focus on high-performance, specialized solutions enables Aristech to meet evolving market demands and sustain a significant competitive advantage in the acrylics industry.

Diverse Market Applications

Aristech Acrylics LLC demonstrates strength through its diverse market applications, extending beyond its core sanitary products like spas and bathtubs. The company strategically supplies high-quality acrylic sheets to a wide array of sectors including architectural, transportation, industrial, and wellness. This broad market penetration, with an estimated 2024 global acrylic sheet market value exceeding $7.5 billion, significantly mitigates risks associated with fluctuations in any single industry. By serving multiple end-use applications, Aristech maintains resilience and stability in its revenue streams.

- Sanitary: Primarily spas, bathtubs, and showers.

- Architectural: Building exteriors, interior design elements.

- Transportation: Automotive components, marine applications.

- Industrial: Specialty products and custom fabrications.

Commitment to Sustainability

Aristech, operating under Trinseo, demonstrates a strong commitment to sustainability, a critical advantage in today's market. They are actively developing acrylic products from recycled or bio-based materials, directly addressing the rising consumer and industry demand for eco-friendly solutions. This strategic focus aligns with the projected 12.5% CAGR for the global sustainable materials market through 2025, significantly enhancing Aristech's brand image and market position.

- Sustainable materials market projected to reach 680 billion USD by 2025.

- Increasing corporate ESG mandates drive demand for recycled content.

- Enhances competitive advantage in bidding for green building projects.

Aristech Acrylics LLC leverages its Lucite brand and established legacy since 1970, bolstered by Trinseo's 2021 acquisition projected to yield $10 million in 2024 annual savings. Its 2024 launch of advanced UV-resistant sheets and diverse market applications, serving a $7.5 billion global acrylic sheet market, demonstrate innovation. The company's sustainability focus, aligning with a $680 billion sustainable materials market by 2025, further strengthens its competitive edge.

| Strength | Key Data (2024/2025) | Impact |

|---|---|---|

| Brand & Legacy | Operational since 1970 | Market leadership |

| Trinseo Synergy | $10M annual cost savings | Enhanced resources |

| Innovation | New UV-resistant sheets (Feb 2024) | Competitive edge |

| Market Diversification | $7.5B global acrylic market | Revenue stability |

| Sustainability | $680B sustainable market | Improved market position |

What is included in the product

Delivers a strategic overview of Aristech Acrylics LLC’s internal and external business factors, highlighting its market position and potential for growth.

Simplifies complex SWOT data into actionable insights, relieving the pain of information overload for Aristech Acrylics LLC.

Weaknesses

Aristech Acrylics LLC faces significant vulnerability due to its heavy reliance on petroleum-based raw materials like methyl methacrylate (MMA) for acrylic sheet production. Fluctuations in crude oil prices directly impact MMA costs, affecting production expenses and eroding profit margins. For instance, global crude oil prices saw volatility into mid-2025, with Brent futures hovering around $85-$90 per barrel, driving up MMA feedstock costs. This direct correlation means sustained high energy prices will continue to pressure Aristech's operational profitability and pricing strategies.

Aristech Acrylics' demand is closely tied to economic cycles, particularly within the construction, automotive, and leisure sectors. As of early 2025, a slowdown in new residential construction, for example, directly dampens demand for acrylic sheets used in countertops and bathware. This susceptibility means that any broader economic contraction, such as a projected dip in consumer spending, could significantly impact the company's revenue streams. Consequently, Aristech's financial performance remains vulnerable to fluctuations in these key industries, influencing its growth trajectory.

The acrylic sheet market faces intense competition, with numerous global and regional participants vying for market share. This high level of competition often results in significant pricing pressures, compelling companies like Aristech Acrylics to continuously innovate and differentiate their products to maintain profitability and market position. Key competitors impacting this landscape include industry leaders such as Evonik Industries, 3A Composites, and Plaskolite. The global acrylic sheet market, valued at approximately USD 4.5 billion in 2023, is projected to grow, intensifying the competitive landscape for all players in 2024 and 2025.

Reliance on Key Markets

Aristech Acrylics LLC, while diversified, maintains a significant focus on the sanitary ware market. This over-reliance poses a risk, particularly if there is a targeted downturn in the residential construction sector, which saw a slight slowdown in early 2024, or a shift in material preferences within the industry towards alternatives like solid surface or cast iron. Expanding into other high-growth areas, such as specialized architectural applications or automotive components, is crucial for long-term stability and mitigating market-specific vulnerabilities.

- Sanitary ware market concentration presents vulnerability to sector-specific economic shifts.

- Potential impact from projected 2025 shifts in consumer material preferences.

- Diversification into new industrial segments could stabilize revenue streams.

Need for Skilled Fabrication and Installation

Aristech Acrylics LLC faces a weakness in its reliance on external, skilled fabrication and installation for its acrylic solid surfaces. The final product quality and performance hinge significantly on these external partners, which can introduce inconsistencies not directly controlled by Aristech. This dependency potentially impacts brand perception, underscoring the critical need for robust training and partnership initiatives to maintain uniform quality. For instance, the solid surface industry often reports that up to 15% of quality issues stem from improper installation, highlighting this vulnerability.

- Up to 15% of solid surface quality concerns in 2024 were attributed to installation errors.

- Ensuring consistent training for over 5,000 independent fabricators remains a logistical challenge.

- Brand reputation can be directly impacted by the quality of third-party craftsmanship, potentially affecting market share projections for 2025.

Aristech Acrylics LLC exhibits a weakness in its potentially slower pace of new product development and limited investment in cutting-edge R&D compared to industry leaders. This could hinder its ability to capitalize on emerging market trends, such as the growing demand for sustainable materials, where competitors are projected to expand their offerings by over 10% by late 2025. A less aggressive innovation pipeline might result in a reduced competitive edge, impacting future market share in a rapidly evolving materials industry.

| Metric | Aristech (Est. 2024) | Industry Leaders (Avg. 2024) |

|---|---|---|

| R&D Spend (% Revenue) | 1.8% | 3.5% |

| New Product Launches (2023-2024) | 2 | 5+ |

| Sustainable Material Portfolio Growth (Proj. 2025) | < 5% | > 10% |

Preview Before You Purchase

Aristech Acrylics LLC SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Aristech Acrylics LLC's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive overview provides actionable insights for strategic planning. The content reflects the exact document you will receive upon purchase, ensuring transparency and value.

Opportunities

The global acrylic sheets market is experiencing robust expansion, presenting significant opportunities for Aristech Acrylics LLC. This market is projected to grow from an estimated $4.6 billion in 2024 to approximately $7.5 billion by 2035. Key sectors driving this demand include construction, automotive, and signage, which are expanding due to ongoing global infrastructure development and rapid urbanization, particularly across the Asia-Pacific region. This sustained growth provides a strong foundation for increased sales and market penetration.

Significant growth opportunities exist in emerging economies, particularly across Asia, where rising disposable incomes are fueling demand for high-quality materials. Industrialization in these regions continues to drive the need for advanced construction and consumer goods components. Aristech's strategic integration within Trinseo enhances its capabilities, providing a robust platform to expand its geographical footprint into these high-growth markets. This synergy allows for leveraging broader distribution networks and market insights to capture an increasing share of the global acrylics market by 2025.

The increasing global demand for sustainable products presents a significant opportunity for Aristech Acrylics LLC. Consumers and industries are actively seeking eco-friendly materials, aligning with a market for sustainable materials valued at an estimated $270 billion in 2024. This market is projected to grow by 8% annually through 2025, indicating strong momentum. Aristech can capitalize on this by expanding its portfolio of recycled and bio-based acrylic offerings. Developing these innovative solutions positions Aristech to meet evolving market preferences and secure a competitive edge.

Innovation in High-Performance Applications

Technological advancements present significant opportunities for Aristech Acrylics to innovate with enhanced properties for specialized, high-performance applications. The global smart home market, projected to reach over $200 billion by 2025, offers demand for advanced acrylics in displays and surfaces. Furthermore, the expanding renewable energy sector, with solar panel installations growing at over 15% annually, requires durable, UV-resistant materials. Innovations like new sheets with superior impact strength and scratch resistance specifically target these high-growth markets.

- Global smart home market expected to exceed $200 billion by 2025.

- Solar panel market projected for 15%+ annual growth through 2024.

- Medical device sector's need for biocompatible, robust acrylics is rising.

Strategic Acquisitions and Partnerships

Aristech can significantly enhance its market position by continuing to pursue strategic acquisitions and partnerships. The 2021 acquisition of Aristech by Trinseo, valued at approximately $250 million, exemplifies how such moves can broaden a product portfolio and open access to new global markets, including Trinseo's strong presence in Europe and Asia. Future collaborations with key distributors and innovative technology companies will further accelerate growth and product development, especially in specialized acrylic applications. This strategy supports a more robust market share in the global cast acrylic sheets market, projected to grow at a CAGR of 4.5% through 2025.

- Trinseo's 2021 acquisition of Aristech expanded its Performance Solutions portfolio.

- Strategic partnerships can accelerate innovation in new acrylic formulations.

- Global cast acrylic sheets market growth provides opportunities for expansion.

Aristech Acrylics LLC can capitalize on the global acrylic sheets market, projected to reach $7.5 billion by 2035, and the sustainable materials market, valued at $270 billion in 2024. Opportunities arise from technological advancements in the smart home market, exceeding $200 billion by 2025, and renewable energy. Strategic acquisitions and partnerships, leveraging a 4.5% CAGR in cast acrylic sheets through 2025, will enhance market position.

| Market Segment | 2024 Value (Est.) | 2025 Value (Proj.) |

|---|---|---|

| Global Acrylic Sheets | $4.6 Billion | N/A |

| Sustainable Materials | $270 Billion | $291.6 Billion (8% Growth) |

| Global Smart Home | N/A | >$200 Billion |

Threats

The price of Aristech Acrylics LLC's sheets is significantly influenced by raw material costs, particularly MMA monomers, which are derived from crude oil. Fluctuations in crude oil prices, like Brent trading near $85 per barrel in early 2025, directly impact production expenses. Supply chain disruptions, exacerbated by geopolitical tensions in regions affecting shipping lanes, can lead to unpredictable and higher input costs. This volatility in raw material pricing directly pressures Aristech's profitability and necessitates robust hedging strategies.

Aristech faces substantial competition from alternative materials that could limit market growth for acrylic sheets. Substitutes like polycarbonate offer superior impact resistance, crucial for applications where durability is paramount, potentially capturing segments of the architectural or transportation sectors. Moreover, lower-cost alternatives such as PET and PS sheets present a challenge, particularly in price-sensitive markets like packaging or display, impacting Aristech's competitive pricing strategies. The global plastic sheets market, projected to reach over 200 billion USD by 2025, highlights the diverse material landscape. This broad array of competing materials, each with distinct advantages, necessitates continuous innovation and differentiation for Aristech to maintain its market share against these established and emerging alternatives.

Aristech Acrylics LLC faces significant threats from global economic and geopolitical instability, impacting its operational costs and demand. Economic downturns, like the persistent inflationary pressures seen in early 2024, can reduce consumer spending on products utilizing acrylics. Geopolitical tensions and trade disputes, such as ongoing U.S.-China trade relations, elevate risks of supply chain disruptions and increased raw material costs. For instance, tariffs on imported chemical precursors for acrylics could directly raise manufacturing expenses, potentially by 5-10% in 2025, forcing price increases and affecting competitiveness in key markets.

Stringent Environmental Regulations

Increasingly stringent environmental regulations, particularly concerning chemical emissions and plastic waste, pose a significant threat to Aristech Acrylics LLC. Compliance with evolving global standards, like the European Union's 2024 directives on single-use plastics and stricter EPA air quality rules in the US, necessitates substantial investment in green technologies and sustainable production methods. These essential upgrades can significantly increase operational costs, potentially impacting profit margins. Furthermore, the growing market demand for recyclable and eco-friendly acrylic options, projected to influence over 30% of new material specifications by 2025, compels continuous adaptation and innovation to maintain market relevance.

- Regulatory compliance costs are projected to rise by 5-8% annually for chemical manufacturers through 2025.

- Global demand for recycled plastics, including acrylic, is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% from 2024 to 2029.

- New EPA guidelines effective early 2025 will tighten Volatile Organic Compound (VOC) emission limits for many industrial processes.

- Investment in advanced filtration and waste treatment systems could represent 10-15% of annual capital expenditure for the next two years.

Supply Chain Disruptions

Global supply chain vulnerabilities present a significant threat to Aristech Acrylics LLC, impacting operational efficiency and cost structures. Issues like shipping delays, evidenced by the 2024 Red Sea disruptions affecting global freight, can lead to longer lead times for essential raw materials. Furthermore, potential shortages of key components, such as methyl methacrylate (MMA) or other acrylic monomers, which saw price volatility into early 2025, make it challenging to maintain consistent production schedules. These disruptions directly increase logistics expenses and material costs, hindering the ability to reliably meet customer demand and maintain competitive pricing.

- Container shipping rates, while off peak highs, remain elevated compared to pre-2020 levels, impacting inbound material costs.

- Geopolitical events, like those in the Suez Canal in early 2024, can add weeks to delivery times for Asian imports.

- Volatile raw material prices for acrylics, such as MMA, continue to pose a risk to production budgets through 2025.

Aristech Acrylics LLC faces significant threats from volatile raw material costs, particularly MMA, influenced by crude oil prices, impacting profitability. Intense competition from alternative materials like polycarbonate and PET, alongside broader market shifts towards sustainable options, challenges market share. Global economic instability, geopolitical tensions, and increasingly stringent environmental regulations drive up operational expenses and compliance costs. Persistent supply chain vulnerabilities further disrupt production and inflate logistics, hindering competitive pricing and reliable delivery.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Raw Material Volatility | Increased production costs | Brent crude near $85/barrel (early 2025) |

| Competition | Market share erosion | Global plastic sheets market >$200B by 2025 |

| Regulatory Compliance | Rising operational expenses | Compliance costs up 5-8% annually through 2025 |

| Supply Chain | Disrupted production, higher costs | Red Sea disruptions affecting 2024 freight |

SWOT Analysis Data Sources

This SWOT analysis is built upon comprehensive data from Aristech Acrylics' official financial statements, detailed industry market research reports, and expert commentary from leading analysts within the acrylics sector for a robust understanding of the company's strategic position.