AppLovin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AppLovin Bundle

Wondering how AppLovin's diverse portfolio stacks up in the competitive mobile app landscape? Our preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantage and pinpoint where to invest for maximum growth, you need the complete picture.

Purchase the full AppLovin BCG Matrix report today and gain a comprehensive, data-driven breakdown of each product's market share and growth rate. Equip yourself with actionable insights and a clear roadmap to optimize your investment strategy and product development decisions.

Stars

AppLovin's AI-driven advertising platform, specifically its Axon 2.0 engine, is a clear Star in the BCG Matrix. Its position is bolstered by a commanding presence in the booming mobile advertising market, characterized by high growth and a leading market share.

The platform's success is evident in its financial performance, with advertising revenue soaring by 71% year-over-year to $1.16 billion in the first quarter of 2025. This growth is directly linked to Axon 2.0's ability to deliver significant value to advertisers, achieving 20-30% lifts in return on investment.

The overall impact of Axon 2.0 is reflected in AppLovin's robust financial results, contributing to a remarkable 40% year-over-year increase in total revenue during Q1 2025. This strong performance solidifies its Star status, indicating continued potential for market leadership and revenue generation.

AppLovin's MAX platform, a cornerstone of its mobile ad tech solutions, firmly positions it as a Star in the BCG matrix. Its in-app bidding technology commands a significant share of the rapidly expanding mobile advertising market.

This dominance is supported by industry analysts like Wedbush Securities, who foresee AppLovin exceeding expectations due to strong mobile ad demand. The global mobile advertising market is a powerhouse, expected to surge from $214.59 billion in 2024 to over $1 trillion by 2032, showcasing an impressive compound annual growth rate of 21.1%.

AppLovin's user acquisition and monetization tools are undeniably stars in their portfolio. These offerings are vital for app developers navigating a crowded and expanding market. The company's advertising segment, which houses these powerful tools, saw an impressive 75% surge in revenue for the entirety of 2024, hitting an astounding $3.2 billion.

High Profitability and Efficiency

The advertising segment truly shines as a Star in AppLovin's portfolio, demonstrating remarkable profitability and operational efficiency. This segment is a cash-generating powerhouse, fueling significant growth while maintaining robust financial health.

- Exceptional Profitability: AppLovin's advertising business is a key driver of its financial success.

- High Growth and Cash Flow: The segment consistently generates substantial cash flow, supporting further expansion and innovation.

- Strong Margins: In Q4 2024, AppLovin reported an impressive 78% adjusted EBITDA margin for its advertising segment.

- Investment in Future Growth: This high-margin performance enables continued investment in research and development, ensuring AppLovin maintains its competitive edge in the fast-evolving advertising landscape.

Strategic Focus on Core Advertising

AppLovin's strategic decision to fully pivot and focus on its core advertising business, including the divestiture of its gaming segment, solidifies the advertising platform as its primary Star. This strategic emphasis allows the company to double down on its strengths in AI-driven ad technology and leverage the immense growth opportunities in the broader digital advertising space. Management has consistently expressed optimism about the advertising segment's growth potential.

- AppLovin's Advertising Segment Growth: In the first quarter of 2024, AppLovin reported a significant increase in its advertising revenue, driven by strong performance in its Software Platform.

- Divestiture Impact: The divestiture of its gaming studios in late 2023 allowed AppLovin to sharpen its focus on its high-margin advertising business.

- AI-Driven Solutions: The company continues to invest heavily in its AI capabilities to enhance ad targeting and performance, a key driver for its Star status.

- Market Opportunity: The digital advertising market continues to expand, with AppLovin well-positioned to capture market share with its specialized platform.

AppLovin's advertising segment, powered by its Axon 2.0 engine and MAX platform, stands out as a clear Star in the BCG Matrix. This segment is characterized by high growth and a dominant market share in the booming mobile advertising industry.

The company's advertising revenue surged by an impressive 75% in 2024, reaching $3.2 billion. This growth is underpinned by strong performance in its Software Platform, which saw a significant increase in the first quarter of 2024. AppLovin's focus on AI-driven solutions and strategic divestiture of its gaming segment further solidifies its position as a Star, enabling it to capitalize on the expanding digital advertising market.

The advertising business is a significant profit driver for AppLovin, consistently generating substantial cash flow. In Q4 2024, this segment achieved an outstanding 78% adjusted EBITDA margin, demonstrating its exceptional profitability and enabling continued investment in innovation to maintain its competitive edge.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Advertising Revenue | $3.2 billion (+75% YoY) | $1.16 billion (+71% YoY) |

| Adjusted EBITDA Margin (Advertising Segment) | 78% (Q4 2024) | N/A |

| Total Revenue Growth | N/A | 40% YoY (Q1 2025) |

What is included in the product

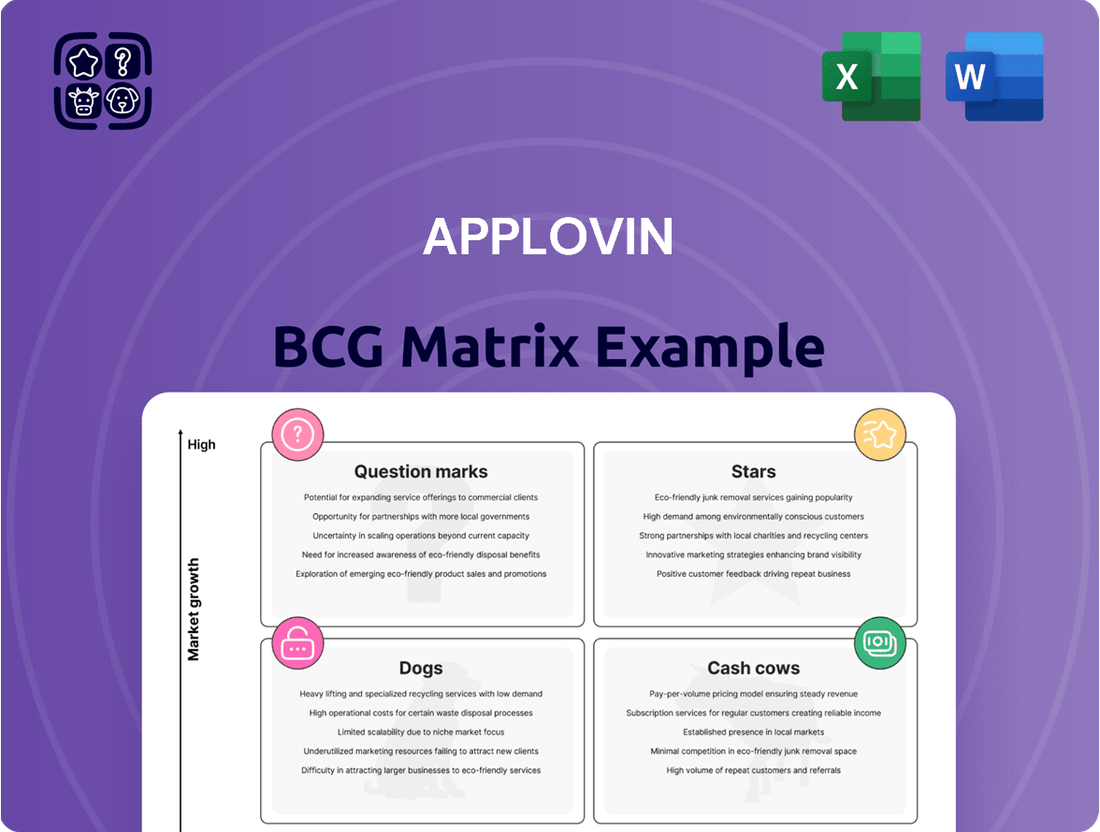

AppLovin's BCG Matrix analyzes its diverse business units, identifying Stars for growth, Cash Cows for profit, Question Marks for potential, and Dogs for divestment.

A clear BCG Matrix visual instantly clarifies AppLovin's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Established mobile app monetization services within AppLovin, particularly those focusing on in-app advertising for seasoned publishers, represent the Cash Cows in its portfolio. These mature offerings have already captured substantial market share within the high-growth advertising sector, demanding minimal new capital for upkeep versus innovation.

These services are designed to generate consistent, high-margin cash flow. For instance, AppLovin's Audience Network, a key component of its monetization suite, consistently drives significant revenue. In the first quarter of 2024, AppLovin reported total revenue of $850 million, with its Software Platform segment, which includes these monetization services, showing robust performance.

AppLovin's core in-app bidding technology, MAX, is a true Cash Cow. It's the backbone for a huge number of publishers, consistently generating revenue by efficiently managing ad inventory in the mature mobile app market.

This established technology has secured a strong market position, guaranteeing a reliable income stream. This steady cash flow is crucial, allowing AppLovin to fund investments in other promising growth areas of its business.

AppLovin's acquisition of Adjust in 2021 solidified its position in the mobile measurement and analytics space, establishing Adjust as a significant Cash Cow. This platform offers developers crucial tools for analyzing app performance, a fundamental and enduring requirement within the app ecosystem. Adjust's robust recurring revenue model, driven by its essential services, ensures a consistent and high-margin contribution to AppLovin's overall financial health.

High Operational Efficiency in Mature Mobile Ad Channels

AppLovin's mature mobile ad channels exemplify cash cow status due to their exceptional operational efficiency. These established platforms are finely tuned, ensuring consistent and reliable performance, which translates directly into robust free cash flow generation. For instance, AppLovin reported a substantial $826 million in free cash flow during the first quarter of 2025, underscoring the profitability of these mature segments.

- Mature Channels: Highly optimized processes in established mobile ad channels.

- Consistent Performance: Reliable and predictable results from these mature operations.

- Free Cash Flow: Significant generation of cash, evidenced by $826 million in Q1 2025.

- Sustained Profitability: Ability to maintain strong profits even without rapid growth.

Funding for Strategic Investments

AppLovin's core advertising operations function as robust Cash Cows. These segments, characterized by their stability and efficiency, generate significant profits. In 2024, AppLovin reported strong performance in its advertising software segment, contributing substantially to its overall revenue. For instance, the company's advertising technology platform continued to see robust demand, enabling it to maintain healthy profit margins.

The substantial cash generated by these stable and efficient core advertising components effectively acts as a Cash Cow, providing the necessary capital to fund AppLovin's high-growth 'Stars' and riskier 'Question Marks.' This internal funding capability supports research and development in AI, expansion into new verticals, and share repurchases, reducing reliance on external financing.

- Cash Generation: AppLovin's advertising segments consistently produce substantial free cash flow, underpinning its strategic investment capabilities.

- Funding R&D: Profits from these Cash Cows are reinvested into developing advanced AI technologies for ad targeting and optimization.

- Market Expansion: Capital is allocated to explore and enter new industry verticals, diversifying AppLovin's revenue streams.

- Shareholder Returns: Excess cash allows for strategic share repurchases, enhancing shareholder value and reducing dilution.

AppLovin's established in-app advertising and monetization services, particularly those leveraging its MAX platform and Audience Network, function as its primary Cash Cows. These mature offerings benefit from significant market share and operational efficiency, demanding less investment while generating substantial and consistent profits.

These segments are characterized by their predictable revenue streams and high profit margins, providing the financial engine for AppLovin's growth initiatives. For instance, AppLovin's Software Platform segment consistently demonstrates strong performance, contributing significantly to overall profitability.

The robust free cash flow generated by these mature businesses, such as the $826 million reported in Q1 2025, allows AppLovin to fund research and development in areas like AI, explore new market verticals, and execute strategic share repurchases, thereby enhancing shareholder value.

| Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

|---|---|---|---|

| In-App Advertising & Monetization Services (MAX, Audience Network) | Cash Cow | Mature, high market share, efficient operations, stable revenue, high margins | Significant Free Cash Flow Generation ($826M in Q1 2025) |

| Mobile Measurement & Analytics (Adjust) | Cash Cow | Recurring revenue model, essential developer tools, consistent profitability | Steady, high-margin contribution to overall financial health |

What You’re Viewing Is Included

AppLovin BCG Matrix

The AppLovin BCG Matrix preview you're viewing is the definitive document you'll receive upon purchase, offering a clear strategic overview of their business units. This comprehensive analysis, meticulously prepared, will be delivered in its entirety, ready for immediate application in your strategic planning. You can trust that the insights and formatting presented here are precisely what you will download, ensuring no hidden surprises or missing components. This is the actual, unadulterated BCG Matrix report, designed for professional use and immediate strategic deployment.

Dogs

AppLovin's internal mobile gaming segment, which encompasses the company's self-developed and published titles, falls into the 'Dog' category within the BCG Matrix. This classification stems from its performance trends, highlighting a challenging market position.

Evidence of this downturn is seen in its financial results, with a notable 14% decrease in apps revenue reported for Q1 2025. This follows a 1% decline in the preceding quarter, Q4 2024, underscoring a consistent pattern of reduced performance in this area.

AppLovin's mobile gaming studios, particularly those identified as underperforming, would be categorized as Dogs in a BCG Matrix. The definitive agreement signed on May 7, 2025, to sell its mobile gaming business to Tripledot Studios for $400 million in cash and an equity stake is a clear indicator of this.

This strategic divestiture highlights AppLovin's move to exit a segment that, while potentially having some historical presence, is not generating substantial returns or demonstrating strong future growth prospects. Such segments often require significant resources for maintenance and development without a commensurate payoff, making them prime candidates for divestment.

AppLovin's strategic pivot to concentrate exclusively on its core advertising platform, effectively exiting its mobile game publishing endeavors, clearly positions the gaming segment as a Dog in the BCG Matrix. This deliberate move signals that the mobile gaming business no longer fits the company's ambitious objectives for high growth and robust profit margins.

Limited Contribution to Overall Growth

Despite the mobile gaming market's robust expansion, with projections indicating a global revenue of $126.1 billion by 2025, AppLovin's individual gaming assets have shown a limited contribution to the company's overall high growth trajectory. This suggests that while the broader market is thriving, AppLovin's specific gaming ventures are not currently driving the company's most significant advancements.

The strategic decision to divest certain gaming properties underscores their minor role in shaping AppLovin's future strategic path and financial outcomes. This move reflects a focus on areas with greater potential for impactful growth and alignment with the company's evolving business objectives.

- Market Context: The global mobile gaming market is a significant economic force, expected to reach $126.1 billion in revenue by 2025.

- AppLovin's Gaming Performance: Specific gaming segments within AppLovin's portfolio have not been major drivers of the company's overall revenue growth.

- Strategic Rationale: The sale of these gaming assets indicates their limited influence on AppLovin's future strategic direction and financial performance.

Potential Cash Trap Avoidance

Divesting its mobile gaming segment helps AppLovin sidestep potential cash traps. These are situations where capital gets stuck in underperforming assets, offering little in terms of returns. For instance, if a gaming title shows declining revenue and high operational costs, it becomes a drain rather than a contributor.

This strategic divestiture allows AppLovin to unlock capital and sharpen management's attention. The freed-up resources can then be strategically channeled into its advertising technology (AdTech) business, which shows greater growth potential and market traction.

By shedding the gaming division, AppLovin can better allocate its financial and human capital. This focus on AdTech, a segment AppLovin has emphasized for growth, allows for more concentrated investment in areas with higher expected returns and market share expansion.

- Avoiding Cash Traps: AppLovin's decision to divest its mobile gaming operations is a proactive measure to prevent capital from being tied up in low-return, low-growth products.

- Capital Reallocation: This move frees up significant financial resources and management bandwidth, enabling a strategic shift towards the more promising advertising technology segment.

- Focus on Growth Areas: By concentrating on its AdTech business, AppLovin can invest more effectively in areas with higher growth potential and market opportunities, aiming for better overall financial performance.

- Strategic Portfolio Management: This aligns with a disciplined approach to portfolio management, ensuring that investments are directed towards segments that offer the greatest potential for future value creation.

AppLovin's mobile gaming segment, characterized by its underperformance and limited contribution to overall growth, is firmly placed in the Dogs category of the BCG Matrix. This classification is supported by recent financial trends, including a 14% decrease in apps revenue in Q1 2025, following a 1% decline in Q4 2024.

The definitive agreement to sell its mobile gaming business to Tripledot Studios for $400 million in cash and an equity stake, announced on May 7, 2025, solidifies this position. This strategic divestiture highlights the segment's inability to generate substantial returns or demonstrate strong future growth prospects, making it a prime candidate for exit.

By divesting these gaming assets, AppLovin aims to avoid cash traps and reallocate capital to its more promising advertising technology (AdTech) business. This strategic pivot allows for a sharper focus on areas with higher expected returns and market share expansion.

| Segment | BCG Category | Key Performance Indicator | Strategic Action |

|---|---|---|---|

| Mobile Gaming | Dog | 14% revenue decrease (Q1 2025) | Divestiture to Tripledot Studios ($400M) |

| AdTech | Star/Question Mark (Implied) | High growth potential (Company focus) | Increased investment and resource allocation |

Question Marks

AppLovin's foray into e-commerce advertising positions it as a Question Mark within its business portfolio. The company noted its first significant penetration into this vertical during Q4 2024, demonstrating promising early results with strong return on investment observed during the holiday shopping season.

While the e-commerce advertising sector presents substantial growth opportunities, AppLovin is still in the nascent stages of establishing a commanding presence. This new venture requires further investment and strategic development to solidify its market share against established players in the broader advertising landscape.

AppLovin's strategic acquisition of Wurl positions it squarely within the burgeoning Connected TV (CTV) advertising market, a sector poised for significant expansion. This move places CTV advertising as a Question Mark within the AppLovin BCG Matrix, reflecting its high-growth potential and the ongoing effort to solidify market position.

The CTV advertising landscape is experiencing rapid growth, with projections indicating it will surpass $30 billion in ad spend by 2025. AppLovin intends to harness its advanced AI capabilities to capitalize on this trend, aiming to drive efficiency and effectiveness for advertisers on connected television platforms.

Despite AppLovin's ambitious push, its current market share in CTV advertising stands at 5.71%. This figure highlights the segment as a high-growth opportunity where substantial market leadership is still in the process of being established, making it a critical area for future investment and development.

AppLovin's development of a self-service advertising dashboard positions it as a Question Mark within the BCG matrix. This initiative aims to democratize access to its advanced ad technology, potentially attracting a broader range of clients and expanding market reach. The success of this dashboard is crucial for AppLovin to capture new customer segments and grow its market share.

New Verticals Beyond Gaming and E-commerce

AppLovin is actively exploring new verticals beyond its core gaming and e-commerce strengths, aiming to leverage its AI-driven advertising platform. This expansion into areas like fintech and automotive advertising represents a strategic move to capture additional high-growth opportunities.

While AppLovin is piloting its models in these nascent markets, its current market share remains low. Significant investment will be necessary to nurture these emerging segments and elevate them to Star status within the AppLovin BCG Matrix.

- Fintech and Automotive Expansion: AppLovin's strategic pivot to new verticals like fintech and automotive signals a clear intent to diversify its revenue streams and tap into high-potential markets.

- Nascent Market Share: Despite piloting efforts, AppLovin's current market share in these new verticals is minimal, indicating substantial room for growth but also highlighting the early stage of development.

- Investment Required: Converting these new ventures into Stars will necessitate considerable investment in technology, marketing, and talent to build a strong competitive position.

Integration of AI for Broader Advertising Applications

AppLovin's AI, particularly its Axon platform, is a clear Star in its core mobile gaming ad tech. However, extending these AI capabilities to broader advertising applications, such as web and e-commerce, positions this as a Question Mark for the company. Demonstrating AI efficacy across these new, diverse digital landscapes at scale is paramount for AppLovin to solidify its market position beyond mobile gaming.

The challenge lies in proving the adaptability and performance of their AI models in environments with different user behaviors and data structures compared to mobile games. Success in these new arenas, especially in 2024, will hinge on their ability to secure significant market share and revenue streams from these expanded advertising verticals.

- AI Expansion into Web and E-commerce: AppLovin's AI, like Axon, is a proven performer in mobile gaming, but its application to web and e-commerce advertising represents a strategic expansion.

- Key to Future Growth: The company's ability to prove the effectiveness and scalability of its AI in these new, diverse advertising environments is critical for unlocking future growth opportunities and market dominance.

- 2024 Focus: AppLovin's success in 2024 will be significantly influenced by its progress in demonstrating AI-driven performance improvements for advertisers in web and e-commerce sectors.

AppLovin's expansion into e-commerce and CTV advertising, alongside its development of a self-service dashboard and exploration of new verticals like fintech and automotive, all represent significant Question Marks. These areas offer high growth potential but require substantial investment to build market share and prove the efficacy of their AI across diverse platforms beyond mobile gaming.

The company's ability to demonstrate AI-driven performance improvements in these nascent markets, particularly in 2024, will be crucial for transitioning these ventures from Question Marks to Stars.

AppLovin's strategic focus on these emerging sectors highlights a deliberate effort to diversify and capture new revenue streams, leveraging its core AI strengths.

The success of these initiatives will ultimately depend on securing significant market traction and establishing a competitive edge against established players.

BCG Matrix Data Sources

Our AppLovin BCG Matrix is informed by comprehensive data, including AppLovin's financial reports, industry-specific market research, and competitor performance metrics.