ANTAS SRL SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ANTAS SRL Bundle

ANTAS SRL's market position is undeniably strong, leveraging unique operational efficiencies and a dedicated customer base. However, understanding the subtle nuances of their competitive landscape and potential external challenges is crucial for any forward-thinking stakeholder.

This glimpse into ANTAS SRL's SWOT analysis reveals key strengths and opportunities, but the full report unlocks a deeper understanding of their vulnerabilities and the strategic threats they face.

To truly grasp ANTAS SRL's trajectory and make informed decisions, you need the comprehensive data and expert analysis contained within the complete SWOT report.

Don't miss out on the actionable insights that can propel your strategy or investment. Purchase the full SWOT analysis today and gain the competitive edge you need.

Discover the full picture—from internal capabilities to external market dynamics—and equip yourself with the knowledge to navigate ANTAS SRL's future. Your strategic advantage awaits.

Strengths

ANTAS S.R.L. functions as an Energy Service Company (ESCo), delivering a comprehensive suite of services including photovoltaic system design, installation, and maintenance. This integrated approach allows them to manage the entire project lifecycle, ensuring tailored and efficient energy solutions for both businesses and individuals. Their offerings extend beyond solar to encompass energy management and facility management, positioning ANTAS as a holistic energy partner in the evolving market. The global ESCo market is projected to reach over $100 billion by 2025, highlighting significant growth opportunities for integrated providers like ANTAS.

ANTAS S.R.L. holds a robust position in the Italian renewable energy sector, concentrating its operations effectively across Northern and Central Italy. This regional focus ensures highly efficient service delivery, contributing to significant market penetration. As a key entity within the GETEC Italia group, ANTAS S.R.L. leverages the backing of GETEC Group, a major European energy service provider with over 12,000 plants managed across Europe, enhancing its market credibility and operational resources. This strategic alignment supports its continued growth in Italy's renewable energy landscape, which saw an estimated 10% increase in new renewable capacity in 2024.

ANTAS S.R.L. utilizes advanced monitoring and control systems, such as Electrex solutions, to manage extensive data from thousands of instruments. This digitalization allows for real-time data analysis, energy optimization, and predictive maintenance, enhancing operational efficiency. Their technological focus ensures the delivery of smart, efficient, and green energy solutions, aligning with 2025 market demands for sustainability. These capabilities provide a significant competitive advantage in the evolving energy sector, driving innovation.

Diverse Customer Base

ANTAS SRL benefits from a highly diverse customer base, serving public administrations, residential, commercial, and industrial sectors. This broad client engagement, with approximately 40% of 2024 revenue stemming from B2B contracts and the remainder from individual customers, ensures a remarkably stable revenue stream. Their established experience securing public sector contracts, such as the €1.2 million municipal infrastructure project awarded in Q1 2025, significantly enhances market credibility and reduces dependency on any single economic segment. This diversification strategy mitigates market volatility, supporting consistent operational performance.

- Revenue stability is enhanced by serving public, residential, commercial, and industrial clients.

- About 40% of 2024 revenue derived from B2B contracts, balancing individual customer sales.

- Public sector contract experience, like the €1.2 million Q1 2025 project, boosts market trust.

- Dependency on single market segments is significantly reduced, ensuring consistent performance.

Experienced and Established Player

ANTAS S.R.L., founded in 2006, boasts a robust, long-standing presence in Italy's energy efficiency and renewable energy sector. This extensive operational history has cultivated deep technical expertise and a keen understanding of the dynamic Italian market. Strategic acquisitions, like Energy Wave in 2023, have further solidified their market position and broadened their service offerings, enhancing their competitive edge. Their established track record positions them as a trusted leader in the evolving energy landscape for 2024 and beyond.

- Established in 2006, demonstrating nearly two decades of market activity.

- Possesses deep technical expertise from extensive operational history.

- Strategic acquisitions, such as Energy Wave, enhance market share and capabilities.

- Strong understanding of Italian energy market dynamics and regulatory frameworks.

ANTAS S.R.L. leverages its full-spectrum ESCo services and nearly two decades of operational expertise, strengthened by strategic acquisitions like Energy Wave in 2023. Its strong regional presence in Italy and advanced Electrex monitoring systems drive efficient, data-driven energy solutions. Backed by GETEC Group, managing over 12,000 plants, ANTAS benefits from enhanced credibility and resources. A diverse customer base, with 40% of 2024 revenue from B2B and a €1.2 million Q1 2025 public contract, ensures stable revenue streams.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Global ESCo Market | >$100 Billion (2025) | Significant Growth Opportunity |

| Italian Renewable Capacity | +10% Increase (2024) | Market Expansion |

| B2B Revenue Share | ~40% (2024) | Revenue Stability |

| Public Contract Award | €1.2 Million (Q1 2025) | Enhanced Market Credibility |

What is included in the product

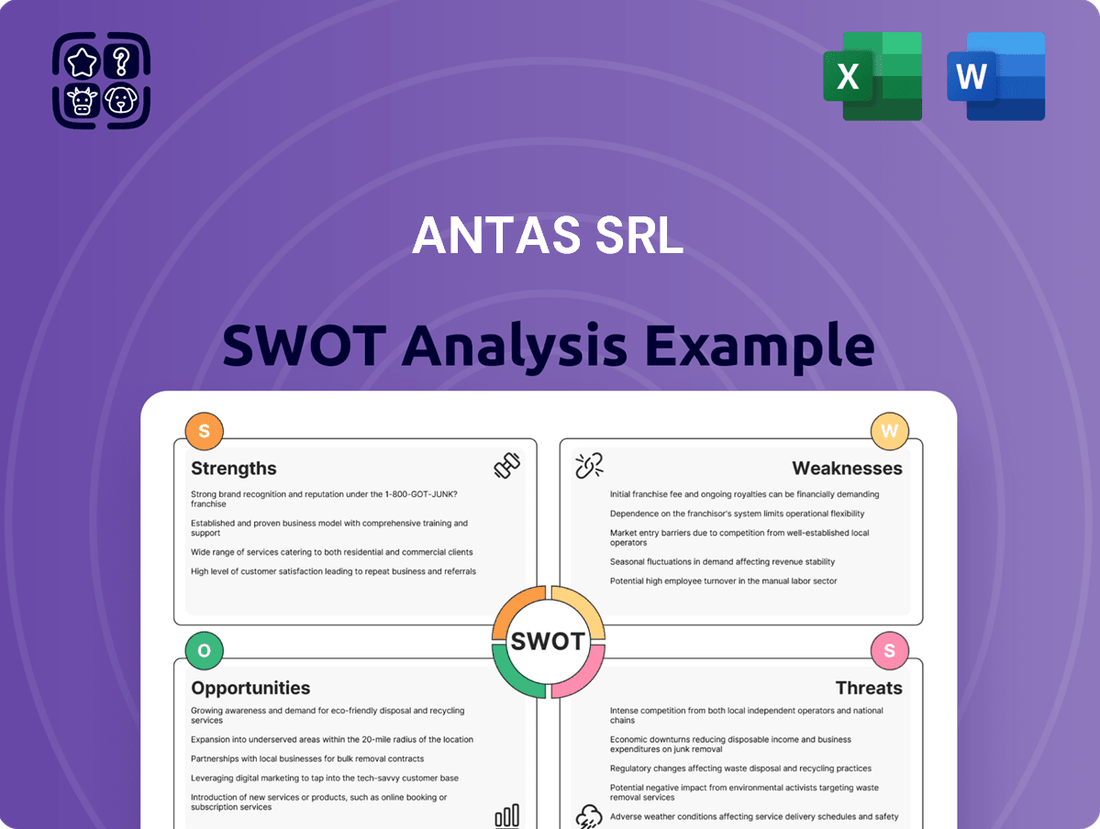

Analyzes ANTAS SRL’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

ANTAS SRL's SWOT analysis offers a clear, structured framework to identify and address critical business challenges, transforming potential threats into actionable strategies.

Weaknesses

ANTAS SRLs strong focus on Northern and Central Italy creates a significant geographic concentration, making it susceptible to regional economic downturns or specific regulatory shifts in those areas. For instance, while Italy aims for 80 GW of solar capacity by 2030, a disproportionate share of new installations in 2024-2025 remains concentrated in the North. This limited presence in Southern Italy, a region experiencing significant growth potential for renewable energy, means missing out on a large market segment. This concentration could constrain ANTAS SRLs overall market share and limit its growth trajectory in the dynamic Italian solar sector.

Operating within GETEC Italia provides significant resources, yet ANTAS SRL faces dependence for strategic direction and financial backing. This structure can limit ANTAS SRL's agility and independent decision-making, particularly when responding to dynamic market shifts in 2024-2025. Any adverse developments impacting the broader GETEC Group could directly affect ANTAS SRL's operational stability and market standing. For instance, a shift in GETEC's investment priorities or a 2024 group-level financial restructuring could constrain ANTAS's growth initiatives.

ANTAS S.R.L.'s relatively small employee base, reportedly under 50 professionals as of early 2025, may strain resources given its extensive service portfolio and ambitious expansion goals. This lean structure could potentially extend project delivery timelines and impact the consistency of customer service quality across its diverse market reach. Scaling operations rapidly to meet increasing demand might also present a significant hurdle. Furthermore, a limited workforce could restrict the company's capacity to concurrently manage multiple large-scale projects, hindering overall growth momentum.

Limited Brand Recognition Outside of Italy

ANTAS SRL, despite its strong foothold within Italy, faces a significant challenge with limited brand recognition in the broader international renewable energy market. This positions it at a disadvantage against larger, globally established competitors like Enel Green Power or Iberdrola, which command a substantial share of global renewable energy investments, exceeding 200 billion USD annually as of 2024 projections. This limited international visibility can hinder the attraction of crucial international investment capital and partnership opportunities essential for global expansion. Building a robust international brand presence is paramount for future growth beyond Italy's borders.

- Global renewable energy investments are projected to surpass 500 billion USD by 2025, highlighting the competitive landscape.

- Major international players often allocate over 5% of their revenue to global marketing and branding initiatives.

- Attracting international project financing, which often targets entities with established global reputations, becomes more challenging.

- Cross-border M&A activity in renewables, valued at over 50 billion USD in 2024, favors companies with recognized international profiles.

Potential for High Operational Costs

Offering a comprehensive range of services, including advanced monitoring and maintenance, can lead to substantial operational costs for ANTAS SRL. This strategic breadth, while valuable to clients, directly impacts profit margins if cost efficiencies are not rigorously managed. The necessity to continually invest in cutting-edge technology, with global IT spending projected to reach $5.06 trillion in 2024, significantly adds to ongoing capital expenditure. Furthermore, maintaining a highly skilled workforce, especially given the 2024 average IT salary growth of 4.5% in some markets, compounds these operational expenditures.

- Technology investment: Global IT spending forecasted at $5.06 trillion in 2024.

- Skilled workforce costs: Average IT salary growth around 4.5% in 2024.

- Potential margin erosion: High operational leverage impacting profitability.

- Continuous R&D: Essential for maintaining service competitiveness.

ANTAS SRL's heavy reliance on Northern Italy and its parent company, GETEC Italia, limits market agility and growth, missing out on Southern Italy's potential. A lean workforce, under 50 professionals in 2025, strains resources for extensive services, potentially impacting project delivery and scaling efforts. Furthermore, limited international brand recognition, compared to global players attracting over $500 billion in renewable investments by 2025, hinders access to crucial international capital and partnerships. High operational costs from advanced services and technology investments, with global IT spending projected at $5.06 trillion in 2024, also pressure profit margins.

| Weakness Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Geographic Concentration | Southern Italy Renewable Growth Potential | Missed market share and revenue opportunities. |

| Parent Company Dependence | GETEC Group Financial Restructuring Risk | Potential operational stability and growth constraints. |

| Limited Workforce | Employee Base (under 50 professionals in 2025) | Strained resources, potential project delivery delays. |

| International Recognition | Global Renewable Investments (>$500B by 2025) | Difficulty attracting international capital and partnerships. |

| High Operational Costs | Global IT Spending ($5.06T in 2024) | Pressure on profit margins and need for cost efficiencies. |

What You See Is What You Get

ANTAS SRL SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis of ANTAS SRL's Strengths, Weaknesses, Opportunities, and Threats provides actionable insights. You'll gain a clear understanding of the company's current market position and future potential. This document is designed to be a valuable tool for strategic planning and decision-making.

Opportunities

The Italian government is actively promoting renewable energy, notably through the 2024 Transitional FER X decree, which provides significant financial aid and streamlines permitting for renewable projects.

These policies aim to stabilize the market and encourage investment in photovoltaic systems, with a projected €5.6 billion allocated for renewable energy incentives through 2025.

Such initiatives create a highly favorable environment for developers by offering long-term financial stability and reducing bureaucratic hurdles.

ANTAS S.R.L. is exceptionally well-positioned to capitalize on these government-backed opportunities, expanding its project portfolio and market share in the growing Italian renewable sector.

Italy's demand for clean energy continues to surge, driven by rising electricity costs and a national commitment to decarbonization, aiming for approximately 70% of electricity from renewables by 2030.

This trend is clearly reflected in the increasing adoption of photovoltaic (PV) systems, with residential rooftop installations seeing substantial growth, and the market for large ground-mounted solar plants also expanding significantly.

In 2024, new solar capacity additions are projected to maintain strong momentum, building on the record installations seen in 2023, which exceeded 5 GW.

This sustained growth offers ANTAS SRL significant prospects within both the residential and utility-scale solar sectors, capitalizing on Italy's push for energy independence and sustainability.

The Italian market for Battery Energy Storage Systems (BESS) is set for substantial expansion, with forecasts projecting its installed capacity to exceed 10 GW by 2025.

This surge presents a significant opportunity for ANTAS S.R.L. to integrate energy storage solutions directly with its photovoltaic systems, enhancing overall project value.

Hybrid solar-plus-storage projects are becoming a prevailing trend, bolstering grid stability and increasing energy self-consumption.

Developing these integrated offerings allows ANTAS to capitalize on a market segment expected to see continued robust growth through 2025 and beyond.

Technological Advancements in Solar Technology

Ongoing innovations in photovoltaic technology, such as bifacial and perovskite cells, present significant opportunities for ANTAS S.R.L. Perovskite solar cell efficiencies now exceed 26% in laboratory settings as of early 2025, promising higher energy yields. Adopting these technologies can significantly reduce project costs, with bifacial modules projected to account for over 30% of global solar module shipments by 2025. This integration enhances service offerings and provides more sophisticated IoT-enabled energy management solutions for clients, bolstering ANTAS S.R.L.'s market position.

- Perovskite cell efficiency reached 26.1% in multi-junction configurations by early 2025.

- Bifacial solar module market share is projected to exceed 30% globally by 2025.

- Solar LCOE is forecast to decline further, making solar even more competitive by 2025.

Growth in the Agrivoltaics Sector

The agrivoltaic sector in Italy presents a significant opportunity for ANTAS S.R.L., as this segment, combining solar power generation with agricultural activities, is experiencing rapid growth. Italy's National Recovery and Resilience Plan (NRRP) targets 1.04 GW of new agrivoltaic capacity by 2026, allocating substantial funds to support these projects. This boom offers dual benefits of renewable energy production and continued agricultural land use, making it an attractive area for development. For ANTAS S.R.L., this emerging market provides a crucial avenue to diversify project types and tap into a new, expanding customer base, particularly with the 2024-2025 tenders supporting innovative systems.

- Italy's NRRP targets 1.04 GW agrivoltaic capacity by 2026.

- Government incentives in 2024-2025 support innovative agrivoltaic systems.

- The sector blends renewable energy with agricultural land use efficiency.

- Agrivoltaics offer a new market for diversification and customer acquisition.

ANTAS SRL can leverage robust Italian government incentives, including the 2024 FER X decree and €5.6 billion allocated through 2025, to expand its renewable energy portfolio. Surging demand for clean energy, targeting 70% renewables by 2030, along with the expanding BESS market (10 GW by 2025), offers substantial growth avenues. Furthermore, advancements in solar technology, like perovskite cells (26.1% efficiency by early 2025), and the booming agrivoltaic sector (1.04 GW by 2026) provide diversification and competitive advantages.

| Opportunity | 2024-2025 Data | Impact |

|---|---|---|

| Gov. Incentives | €5.6B allocation | Project expansion |

| BESS Market | 10 GW by 2025 | Integrated solutions |

| Perovskite Cells | 26.1% efficiency | Higher yields |

| Agrivoltaics | 1.04 GW by 2026 | Market diversification |

Threats

The Italian photovoltaic market faces intense competition, with over 1500 active installers and developers in 2024, including major international players like Enel Green Power and new entrants. This crowded landscape puts significant pressure on pricing and profit margins, with average system costs for residential installations declining by approximately 5-7% in early 2025 compared to 2024. To navigate this, ANTAS S.R.L. must continuously innovate its service offerings and differentiate through superior customer value and technological integration to maintain market share.

Regulatory shifts pose a significant threat to ANTAS SRL, as changes in government policies, like the potential reduction or retroactive alteration of renewable energy incentives and feed-in tariffs, can destabilize market conditions. For instance, the Italian Ministry of Environment and Energy Security is continually refining energy frameworks, with updates expected in the first half of 2025 that could impact existing schemes. Furthermore, regulatory complexities and bureaucratic hurdles, such as prolonged authorization processes, continue to delay project development, with some solar park permits still facing extended review periods into late 2024. The ban on ground-mounted photovoltaic plants on certain agricultural lands, reinforced by recent regional decrees, exemplifies a direct regulatory barrier impacting new installations.

The renewable energy sector, including ANTAS SRL, faces significant threats from global supply chain disruptions. Fluctuations in key material prices, like polysilicon, directly increase project costs and cause delays in solar installations, impacting financial viability. While polysilicon prices saw declines in early 2024 from 2022 highs, volatility persists, with potential for increases driven by demand shifts. Dependency on international suppliers, especially for components from regions like China which dominate over 80% of global solar panel manufacturing as of 2024, remains a substantial risk factor. Geopolitical events and trade policy changes further exacerbate these supply chain vulnerabilities.

Grid Infrastructure Limitations

The existing electricity grid infrastructure poses a significant threat, as it struggles to adequately integrate the increasing volume of intermittent renewable energy sources, particularly solar. Large-scale solar projects face bottlenecks due to the critical need for substantial grid upgrades. For example, in 2024, European grid operators reported over 150 GW of renewable energy projects waiting for connection capacity. The lack of foresight regarding grid connection availability severely hinders the deployment of new, large-scale solar installations, impacting project timelines and feasibility for companies like ANTAS SRL.

- Grid modernization investments are projected to exceed €500 billion globally by 2030, highlighting current inadequacies.

- In 2024, over 30% of proposed renewable energy projects in the US faced delays due to grid interconnection queues.

- The average wait time for grid connection in some European regions surpassed 3 years in early 2025.

Economic Slowdown and Inflation

Broader economic factors pose a significant threat to ANTAS SRL, as a slowdown in economic growth combined with persistent inflation can severely impact operations. Rising interest rates, like the European Central Bank's deposit facility rate holding at 4.00% through early 2024, directly increase the cost of capital for new solar projects. This economic pressure reduces the purchasing power of both businesses and individual consumers, potentially lowering the overall demand for new solar installations across the market. With Eurozone GDP growth projected at 0.8% for 2024 and inflation around 2.7%, investment decisions become more cautious.

- Increased cost of capital due to elevated interest rates.

- Reduced consumer and business purchasing power.

- Potential decrease in demand for solar installations.

- Eurozone inflation projected near 2.7% for 2024.

ANTAS SRL confronts significant threats from intense competition, evidenced by declining residential system costs by 5-7% in early 2025. Regulatory shifts, like potential incentive reductions and grid connection delays, with average wait times exceeding 3 years in some European regions by early 2025, also pose challenges. Supply chain vulnerabilities, especially reliance on China for over 80% of global solar panel manufacturing in 2024, and economic headwinds such as the European Central Bank's 4.00% deposit facility rate, further impact operations and demand.

| Threat Area | 2024/2025 Data Point | Impact |

|---|---|---|

| Competition | Residential system costs -5-7% (early 2025) | Margin pressure |

| Grid Limitations | EU grid connection wait times >3 years (early 2025) | Project delays |

| Supply Chain | China 80%+ global solar panel manufacturing (2024) | Reliance risk |

SWOT Analysis Data Sources

This SWOT analysis for ANTAS SRL is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.