All for One Midmarket AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

All for One Midmarket AG Bundle

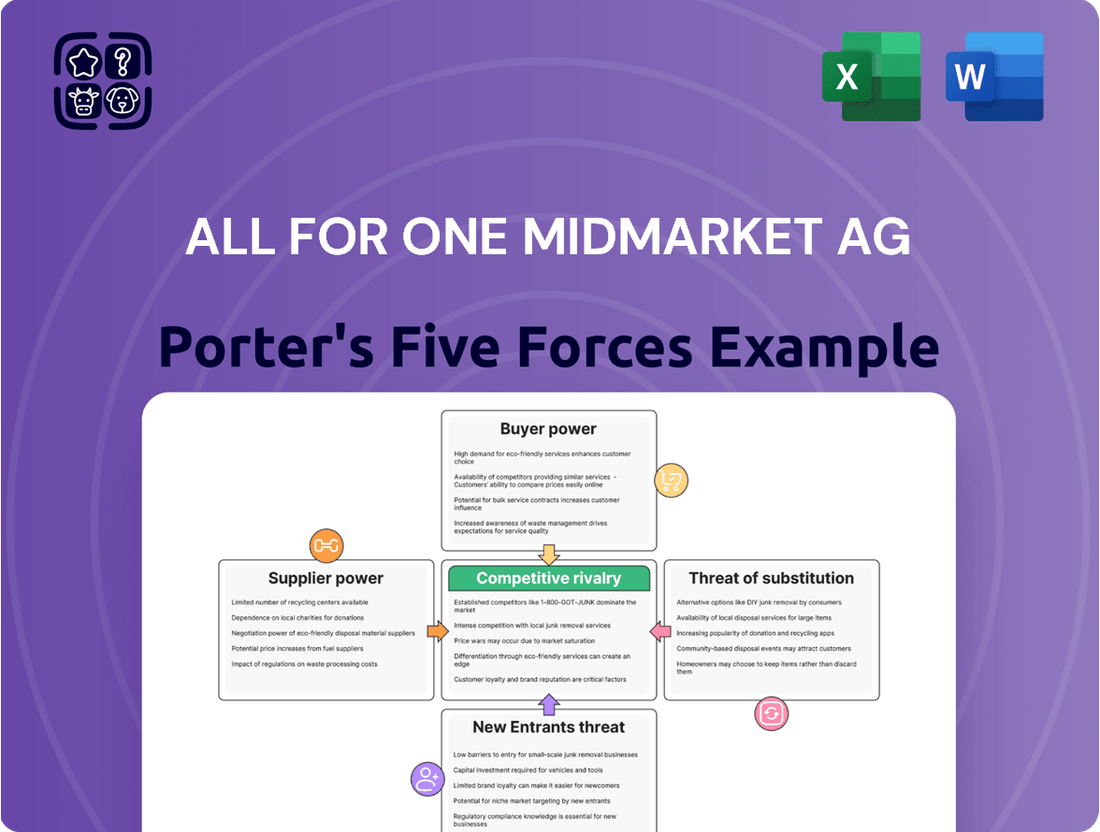

All for One Midmarket AG navigates a competitive landscape shaped by moderate buyer power and significant threat of substitutes, particularly from cloud-based ERP solutions. Understanding these dynamics is crucial for strategic planning.

The full analysis reveals the real forces shaping All for One Midmarket AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

All for One Group SE's reliance on a concentrated group of key technology providers, namely SAP, Microsoft, and IBM, grants these suppliers substantial bargaining power. Their software often represents industry standards, making them indispensable for All for One's core operations and service delivery.

This concentration means that any shifts in licensing agreements, pricing strategies, or future product development from these technology giants can directly influence All for One's operational costs and its ability to offer competitive services. For instance, in 2024, major cloud providers like Microsoft and IBM continued to adjust their pricing models, impacting the cost of infrastructure and software access for many businesses.

All for One Group's reliance on foundational platforms like SAP, Microsoft, and IBM presents significant switching costs for the company. These costs encompass extensive employee re-training, the complex re-development of existing solutions, and the intricate migration of numerous customer systems. This deep integration inherently strengthens the bargaining power of these key technology suppliers.

The specialized nature of enterprise software, especially SAP's ERP systems and cloud solutions like RISE with SAP, means suppliers offer unique and often crucial functionalities. This specialization makes it difficult for All for One Midmarket AG to find readily available substitutes, thereby increasing supplier leverage.

Threat of Forward Integration by Suppliers

Major technology providers such as SAP and Microsoft possess the capability to integrate forward by offering direct consulting and implementation services. This shift could directly impact All for One Midmarket AG by diminishing its market share and intensifying competition for lucrative projects.

While these tech giants typically rely on partner ecosystems, a strategic pivot towards direct midmarket engagement presents a significant threat. For instance, SAP's continued expansion of its cloud solutions and direct customer support channels in 2024 highlights this trend, potentially squeezing the margins and market access for implementation partners like All for One.

- Increased Competition: Direct service offerings from major vendors can lead to more intense competition for implementation contracts.

- Margin Pressure: Vendor competition can force down service fees, impacting profitability.

- Market Share Erosion: Customers might opt for direct vendor services, reducing the addressable market for All for One.

Availability of Skilled Personnel for Suppliers

The global shortage of skilled IT professionals, especially in critical areas like SAP S/4HANA migration and cybersecurity, significantly bolsters the bargaining power of suppliers offering these specialized talents. For instance, in 2024, the demand for cybersecurity experts continued to outstrip supply, with some reports indicating a global shortfall of over 3.4 million professionals.

If All for One Midmarket AG faces difficulties in independently attracting and retaining these essential skills, its reliance on technology partners or third-party talent providers will likely increase. This dependency directly translates to enhanced bargaining power for these external suppliers, potentially leading to higher costs or less favorable contract terms for All for One.

- Global IT Skills Gap: Reports in early 2024 highlighted a persistent and widening gap in specialized IT skills worldwide.

- SAP S/4HANA Demand: The ongoing transition to SAP S/4HANA continues to drive demand for highly skilled consultants, with many companies struggling to find experienced professionals.

- Cybersecurity Workforce Needs: The cybersecurity sector, in particular, faces a critical talent shortage, with organizations actively competing for a limited pool of qualified individuals.

All for One Midmarket AG's dependence on a few core technology providers, like SAP and Microsoft, gives these suppliers considerable leverage. Their essential software and cloud services mean switching is costly and complex, involving re-training and system redesigns. This reliance allows suppliers to dictate terms, as seen with ongoing pricing adjustments by major cloud providers in 2024.

The specialized nature of enterprise software, particularly SAP's ERP, limits readily available substitutes, further strengthening supplier power. Additionally, major vendors are increasingly offering direct services, potentially competing with All for One for implementation projects, as evidenced by SAP's expanded cloud support in 2024.

The global shortage of skilled IT professionals, especially in areas like SAP S/4HANA and cybersecurity, amplifies supplier bargaining power. For instance, the demand for cybersecurity experts in 2024 significantly outstripped supply, creating a talent gap that benefits those who can provide these scarce skills.

| Supplier | Key Offerings | Impact on All for One | 2024 Trend Impact |

|---|---|---|---|

| SAP | ERP Systems (e.g., S/4HANA), Cloud Solutions | High switching costs, specialized functionalities | Continued cloud solution expansion, direct support |

| Microsoft | Cloud Services (Azure), Software | Essential infrastructure, pricing model changes | Ongoing cloud pricing adjustments |

| IBM | Cloud Infrastructure, Consulting Services | Critical for operations, potential for direct competition | Cloud pricing adjustments, evolving service models |

| Specialized IT Talent Providers | SAP Consultants, Cybersecurity Experts | Dependency due to skills gap, increased costs | Persistent global IT skills shortage (e.g., 3.4M+ cybersecurity shortfall) |

What is included in the product

This analysis delves into the competitive forces shaping the midmarket IT solutions landscape for All for One Midmarket AG, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a clear, visual breakdown of all five forces.

Customers Bargaining Power

All for One Group's customer base is largely comprised of small and medium-sized enterprises (SMEs) within the German-speaking market. While each individual SME possesses relatively low bargaining power, the sheer volume and collective demand from this broad, somewhat fragmented segment can exert significant influence on pricing strategies and service level agreements, particularly for their more standardized software solutions.

For Small and Medium-sized Enterprises (SMEs), the process of moving their intricate IT systems, especially critical ones like SAP S/4HANA, is a substantial undertaking. This migration demands considerable time, financial investment, and can lead to significant interruptions in daily business operations. These high switching costs effectively limit the immediate ability of individual customers to negotiate better terms once they are deeply embedded within All for One's service ecosystem.

For All for One Midmarket AG, the increasing reliance of Small and Medium-sized Enterprises (SMEs) on IT solutions, particularly for digital transformation, cloud services, and cybersecurity, significantly shapes customer bargaining power. This critical dependence means customers are often more focused on the reliability and quality of these essential services rather than solely on price, thereby mitigating their ability to drive down costs.

In 2024, the global IT services market for SMEs was projected to reach over $500 billion, highlighting the substantial investment SMEs are making in technology to remain competitive. This widespread adoption of IT as a core operational necessity means customers are less likely to switch providers based on minor price differences, as disruption to their digital infrastructure can be far more costly.

Customer Price Sensitivity in a Challenging Economic Climate

Even with the clear advantages of digitalization, the current economic landscape in Europe, marked by geopolitical instability and the looming threat of recession, is likely to make customers more sensitive to pricing. This heightened price consciousness could translate into postponed digitalization initiatives and a diminished appetite for additional software features that aren't deemed absolutely critical.

This increased customer price sensitivity directly bolsters their bargaining power. They might delay project starts or scale back on non-essential software upgrades, giving them more leverage when negotiating terms with suppliers like All for One Midmarket AG. For instance, if economic forecasts predict a slowdown, businesses might re-evaluate discretionary IT spending.

- Increased Price Sensitivity: European customers are expected to be more budget-conscious due to geopolitical uncertainty and potential recessionary pressures.

- Project Delays: Non-essential digitalization projects or software expansions may be postponed, reducing immediate demand.

- Negotiating Leverage: Customers gain more power to negotiate prices and terms as they become more selective with their spending.

- Impact on Software Sales: A focus on core functionalities over advanced or non-essential software modules could affect revenue streams for companies like All for One Midmarket AG.

Availability of Alternative IT Service Providers

The German IT services market, while All for One Midmarket AG holds a strong position, is quite competitive. This means customers have a good number of choices when looking for IT solutions.

With many consulting firms, system integrators, and specialized IT providers available, customers can easily switch or find alternatives. This abundance of options significantly boosts their bargaining power, particularly when the required services are more standard or easily replaceable.

- Competitive Landscape: The German IT market features numerous players, from large consulting groups to niche specialists, offering customers a wide array of choices.

- Customer Options: The availability of alternative providers empowers customers to negotiate better terms, especially for less complex or commoditized IT services.

- Impact on Pricing: This high degree of customer choice can exert downward pressure on pricing for standard IT services, forcing providers like All for One to remain competitive.

All for One Midmarket AG's customers, primarily SMEs, face significant switching costs due to the complexity of migrating critical IT systems like SAP S/4HANA. However, in 2024, heightened price sensitivity driven by economic uncertainty in Europe is increasing their bargaining power, potentially leading to postponed projects and a focus on core functionalities. The competitive German IT services market further empowers customers by providing numerous alternatives, enabling them to negotiate terms more effectively for standard IT solutions.

| Factor | Impact on Bargaining Power | 2024 Data/Context |

|---|---|---|

| Switching Costs | Lowers bargaining power | High for complex SAP migrations, limiting immediate negotiation leverage. |

| Price Sensitivity | Increases bargaining power | Heightened due to European economic uncertainty, leading to potential project delays and price negotiations. |

| Competition | Increases bargaining power | Numerous IT service providers in Germany offer customers ample choices for standard solutions. |

What You See Is What You Get

All for One Midmarket AG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces Analysis for All for One Midmarket AG, detailing the competitive landscape and strategic implications. You'll gain immediate access to this professionally formatted analysis, providing valuable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitute products. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you'll get.

Rivalry Among Competitors

The German IT services market is incredibly crowded, featuring a vast array of companies. This includes many other businesses that resell SAP systems, alongside numerous Microsoft partners, global IT outsourcing firms, and niche software providers.

This intense fragmentation means All for One Midmarket AG faces significant pressure. For instance, in 2023, the German IT services market was valued at approximately €110 billion, with a substantial portion of this revenue being contested by a multitude of competitors, highlighting the competitive intensity.

The German IT market is booming, with digital transformation, cloud, and AI fueling substantial growth. This expansion, projected to see the German IT market reach €119.8 billion in 2024 according to Statista, naturally draws in new players and prompts existing companies to broaden their services. Consequently, competition intensifies as businesses vie for a larger slice of this expanding pie.

All for One Group carves out its competitive advantage by providing comprehensive, end-to-end IT solutions specifically tailored for small and medium-sized enterprises (SMEs). Their core strength lies in a deep specialization across key technology platforms like SAP, Microsoft, and IBM, offering a unified approach to IT management.

This integrated strategy presents a challenge to rivals, who might respond by attempting to mirror this holistic offering or by honing in on highly specialized niche markets to differentiate themselves. For instance, while All for One Group reported revenues of €677.8 million for the fiscal year 2023/2024, indicating significant market traction for their broad approach, smaller, specialized IT firms might focus on specific SAP modules or cloud migration services to capture a distinct segment.

Importance of Recurring Revenue and Customer Retention

All for One Midmarket AG's competitive rivalry is intensified by the critical importance of recurring revenue, with a substantial portion of its income stemming from cloud subscriptions and application management services. This recurring revenue model is a primary focus for competitors as well, creating a fierce competition for customer loyalty and long-term service agreements.

The battle for customer retention is a central theme in this market. Competitors are actively vying to secure and maintain these valuable, predictable revenue streams.

- Recurring Revenue Focus: All for One and its rivals prioritize cloud subscription and application management for stable, ongoing income.

- Customer Retention as a Battleground: Securing and keeping customers through long-term contracts is a key competitive differentiator.

- Market Dynamics: The drive for recurring revenue fuels intense competition, pushing companies to offer superior value and service to retain clients.

Talent Shortage and its Impact on Competition

The ongoing scarcity of skilled IT professionals in Germany significantly heats up the competition among IT service providers. Companies adept at attracting and keeping the best talent will find themselves in a much stronger position to deliver superior services and secure new business.

This talent crunch means that firms like All for One Midmarket AG must invest heavily in recruitment and retention strategies. For instance, a 2024 report indicated that over 60% of German companies struggled to fill IT positions, directly impacting project timelines and service delivery capabilities.

- Talent Scarcity: A widespread shortage of qualified IT workers in Germany is a defining characteristic of the current market.

- Competitive Advantage: Firms excelling in talent acquisition and retention gain a crucial edge in service quality and project acquisition.

- Impact on All for One Midmarket AG: The company must prioritize robust HR strategies to navigate this competitive talent landscape effectively.

- Market Data: In 2024, a significant majority of German businesses reported difficulties in filling IT roles, underscoring the intensity of the talent war.

The German IT services landscape is highly fragmented, with numerous players competing for market share, including large global firms and specialized niche providers. This intense rivalry is further fueled by the German IT market's projected growth to €119.8 billion in 2024, attracting new entrants and intensifying competition for existing businesses.

All for One Midmarket AG differentiates itself by offering integrated, end-to-end IT solutions for SMEs, particularly leveraging SAP and Microsoft expertise, a strategy that challenges competitors to either broaden their offerings or focus on specific niches.

The emphasis on recurring revenue from cloud and application management services creates a fierce battle for customer loyalty and long-term contracts, as companies strive to secure stable income streams.

The significant shortage of skilled IT professionals in Germany exacerbates competitive rivalry, as companies like All for One Midmarket AG must invest heavily in talent acquisition and retention to maintain service quality and win new business.

| Competitor Type | Key Differentiators | Impact on All for One Midmarket AG |

|---|---|---|

| Global IT Outsourcing Firms | Broad service portfolios, economies of scale | Pressure on pricing, need for specialized offerings |

| Niche Software Providers | Deep expertise in specific solutions (e.g., SAP modules) | Competition for specialized project wins, potential for partnerships |

| Microsoft Partners | Strong focus on Microsoft ecosystem, cloud solutions | Direct competition for cloud migration and managed services |

| SAP Resellers | Focus on SAP implementations and support | Competition for SAP-centric business, need for integrated solutions |

SSubstitutes Threaten

Larger midmarket companies, particularly those with established IT infrastructure and skilled personnel, may opt to build and maintain their IT systems internally. This in-house capability serves as a direct substitute for engaging external IT service providers like All for One Midmarket AG. In 2024, the trend of digital transformation continued, with many businesses investing heavily in their internal IT departments to gain greater control and customization over their technology stacks.

The threat of substitutes for All for One Midmarket AG's offerings, particularly its SAP, Microsoft, and IBM solutions, is significant. Businesses, especially smaller and medium-sized enterprises (SMEs), can turn to more generic, off-the-shelf business software or readily available cloud platforms. These alternatives often demand less specialized consulting, making them a more accessible and potentially cost-effective choice for managing less complex operational processes.

For instance, the global cloud computing market, which encompasses many of these alternative platforms, was valued at approximately $610 billion in 2023 and is projected to grow substantially. This indicates a large and expanding market for substitute solutions that might bypass the need for the deep integration and specialized support that All for One provides.

The rise of open-source solutions and freeware presents a significant threat of substitution for All for One Midmarket AG. For many small and medium-sized enterprises (SMEs), particularly those with tighter budgets, these alternatives can fulfill basic IT needs, bypassing the need for licensed commercial software. For instance, while All for One Midmarket AG offers robust ERP systems, businesses might opt for open-source customer relationship management (CRM) tools or project management software if their requirements are less complex.

While these free or low-cost options may not match the extensive functionality, integration capabilities, or dedicated support of established providers like All for One Midmarket AG, they are becoming increasingly viable. The 2024 IT landscape shows a continued growth in the adoption of open-source technologies across various business functions, driven by cost savings and a growing community of developers. This trend means that for a segment of the market, the perceived value proposition of proprietary software is directly challenged by readily available, albeit sometimes less sophisticated, substitutes.

Consulting Services from Non-IT Firms

Traditional management consulting firms, even those without extensive IT implementation expertise, can pose a threat by offering strategic digital transformation advice. These firms might compete for the initial planning and strategy phases of a project, potentially diverting clients who would otherwise engage All for One Midmarket AG for comprehensive IT solutions.

For instance, in 2024, the global management consulting market was valued at over $300 billion, with a significant portion dedicated to digital strategy. This indicates a substantial pool of competitors capable of offering high-level advisory services that could substitute for All for One's strategic consulting offerings.

- Strategic Advisory Competition: Non-IT focused consultancies can offer strategic digital transformation roadmaps, acting as substitutes for the initial planning stages of IT projects.

- Market Size Indicator: The global management consulting market's substantial size in 2024 highlights the competitive landscape and the potential for non-IT firms to capture advisory market share.

- Client Diversion Risk: Clients may opt for these broader strategic consultancies, bypassing specialized IT firms like All for One for the crucial early-stage decision-making.

Delaying Digital Transformation Initiatives

In periods of economic instability, clients may opt to postpone or reduce their spending on digital transformation projects. This hesitation means they might continue using existing, less efficient manual processes or older, outdated systems instead of adopting new IT solutions. For instance, a report from McKinsey in late 2023 indicated that while digital investment remains a priority for many businesses, a significant portion of companies were re-evaluating project timelines due to budget constraints.

This delay in adopting new technologies effectively serves as a substitute for engaging with IT service providers for new project work. Companies might explore optimizing existing infrastructure or extending the lifespan of legacy systems rather than committing to the upfront costs and potential disruption of a full digital transformation. This trend was observed in 2024, with some IT consulting firms reporting a slowdown in new, large-scale transformation deals as businesses adopted a more cautious approach to capital expenditure.

The threat of substitutes in this context can be quantified by the potential revenue lost from delayed or cancelled digital transformation projects. For example, if a company typically invests $1 million in a digital transformation project and decides to delay it for a year, that represents a $1 million substitute for the IT service provider. This phenomenon impacts companies like All for One Midmarket AG, which offers such transformation services.

- Customer Hesitation: Economic uncertainty leads clients to defer digital transformation investments.

- Reliance on Legacy Systems: Businesses may continue using older, less efficient manual or IT systems.

- Substitute for New Projects: Postponement of digital initiatives acts as a direct substitute for new IT project engagements.

- Revenue Impact: Delayed projects represent lost revenue opportunities for IT service providers, with potential project values in the millions of dollars being deferred.

The threat of substitutes for All for One Midmarket AG is multifaceted, encompassing internal IT development, generic software, and even strategic consulting from non-IT firms. Businesses increasingly invest in in-house IT capabilities, a trend amplified in 2024 as digital transformation efforts deepened. Generic off-the-shelf software and cloud platforms offer accessible alternatives for less complex needs, bypassing the specialized consulting All for One provides. The global cloud computing market's substantial valuation, around $610 billion in 2023, underscores the breadth of these substitute options.

| Substitute Type | Description | Market Context (2023/2024) | Impact on All for One |

|---|---|---|---|

| Internal IT Development | Companies building their own IT systems. | Continued digital transformation investment in 2024. | Reduces demand for external IT services. |

| Generic Software/Cloud Platforms | Off-the-shelf solutions for simpler processes. | Global cloud market ~$610 billion (2023). | Offers cost-effective alternatives for SMEs. |

| Open-Source/Freeware | Free or low-cost software solutions. | Growing adoption in 2024 for cost savings. | Challenges proprietary software value proposition. |

| Management Consulting | Strategic advice from non-IT firms. | Global market >$300 billion (2024). | Competes for initial planning and strategy phases. |

| Economic Hesitation | Postponing IT investments due to uncertainty. | Businesses re-evaluating project timelines (late 2023). | Acts as a substitute for new project revenue. |

Entrants Threaten

Entering the IT consulting and service market for small and medium-sized enterprises (SMEs), particularly those needing expertise in complex systems like SAP, demands significant upfront capital. This includes substantial investments in robust technology infrastructure, obtaining crucial industry certifications, and recruiting highly skilled professionals. For instance, a new entrant might need to invest upwards of $1 million in certified SAP consultants and cloud infrastructure to even begin competing effectively.

All for One Group has cultivated a robust brand reputation and deep customer trust within the SME sector, a significant barrier to new entrants. Their long-standing presence means potential competitors face a considerable uphill battle in replicating this established credibility and the intricate client relationships already in place.

Becoming a certified partner for giants like SAP, Microsoft, and IBM is no small feat. It requires substantial investment in training, often running into tens of thousands of dollars per employee, and a commitment to meeting stringent quality and performance benchmarks. For instance, achieving Gold Partner status with Microsoft, a common goal for IT service providers, involves demonstrating a high level of technical expertise and customer success, which takes time and resources to build.

This complexity acts as a significant barrier for potential new entrants. They must navigate a steep learning curve to understand the intricate product suites and service requirements of these established vendors. In 2024, the ongoing evolution of cloud-based solutions and AI integration within these ecosystems further elevates the technical proficiency and ongoing training demands, making it even harder for newcomers to gain a foothold and compete effectively with established, certified partners.

Access to Skilled IT Talent

The persistent scarcity of skilled IT talent in Germany, especially in high-demand fields like cloud computing and cybersecurity, creates a substantial hurdle for new companies entering the market. For instance, in 2024, reports indicated a deficit of over 100,000 IT specialists across the nation.

New entrants face considerable difficulty in attracting and retaining qualified IT professionals, as established companies often offer more competitive compensation and benefits packages. This talent war significantly elevates the cost and complexity of building a capable IT workforce, acting as a potent barrier.

- IT Specialist Shortage: Germany faced an estimated shortage of over 100,000 IT professionals in 2024.

- Specialized Skills in Demand: Cloud migration and cybersecurity expertise are particularly scarce.

- Talent Acquisition Costs: New entrants must compete with established firms for limited talent, increasing recruitment expenses.

- Retention Challenges: High demand for IT skills makes retaining employees difficult and costly for newer companies.

Regulatory and Compliance Requirements

The German market, with its robust data protection laws like GDPR and upcoming cybersecurity mandates such as NIS2 set to take effect in 2025, presents a significant hurdle for new entrants. These regulations demand substantial investment in compliance infrastructure and ongoing operational adjustments.

Navigating this intricate web of legal and technical requirements significantly increases the initial capital outlay and operational complexity for any company seeking to enter All for One Midmarket AG's competitive space.

- High Compliance Costs: New entrants face substantial expenses related to legal counsel, data security systems, and personnel training to meet GDPR and NIS2 standards.

- Operational Burden: Adhering to strict data handling and cybersecurity protocols adds layers of operational complexity, potentially slowing down market entry and scaling.

- Barrier to Entry: The sheer weight of these regulatory obligations acts as a significant deterrent, favoring established players with existing compliance frameworks and resources.

The threat of new entrants for All for One Midmarket AG is moderate due to high capital requirements, stringent vendor certifications, and a scarcity of skilled IT talent in Germany, where over 100,000 IT specialists were reportedly lacking in 2024. Established brand loyalty and complex regulatory environments like GDPR also present significant barriers, making it costly and time-consuming for newcomers to gain traction and compete effectively.

| Barrier | Description | Impact on New Entrants | Example Data (2024/2025) |

|---|---|---|---|

| Capital Investment | Technology infrastructure, certifications, recruitment | High barrier; requires significant upfront funds | Estimated $1M+ for certified SAP consultants and cloud infrastructure |

| Brand Reputation & Customer Trust | Long-standing presence and relationships | High barrier; difficult to replicate established credibility | N/A (qualitative) |

| Vendor Certifications | SAP, Microsoft, IBM partnerships | High barrier; requires extensive training and performance | Microsoft Gold Partner status involves significant training investment |

| Technical Complexity | Navigating vendor product suites and evolving tech (AI, cloud) | High barrier; steep learning curve and ongoing training needs | Increasing demand for AI integration expertise |

| Talent Scarcity | Shortage of skilled IT professionals in Germany | High barrier; increased recruitment costs and retention challenges | Over 100,000 IT specialists shortage in Germany (2024) |

| Regulatory Compliance | GDPR, NIS2 (effective 2025) | High barrier; substantial investment in compliance infrastructure | High compliance costs for data security and legal counsel |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for All for One Midmarket AG is built upon a foundation of comprehensive data, drawing from the company's official annual reports, investor relations materials, and reputable industry analysis platforms like Statista and IBISWorld. This ensures a robust understanding of market dynamics and competitive pressures.