Alk Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alk Bundle

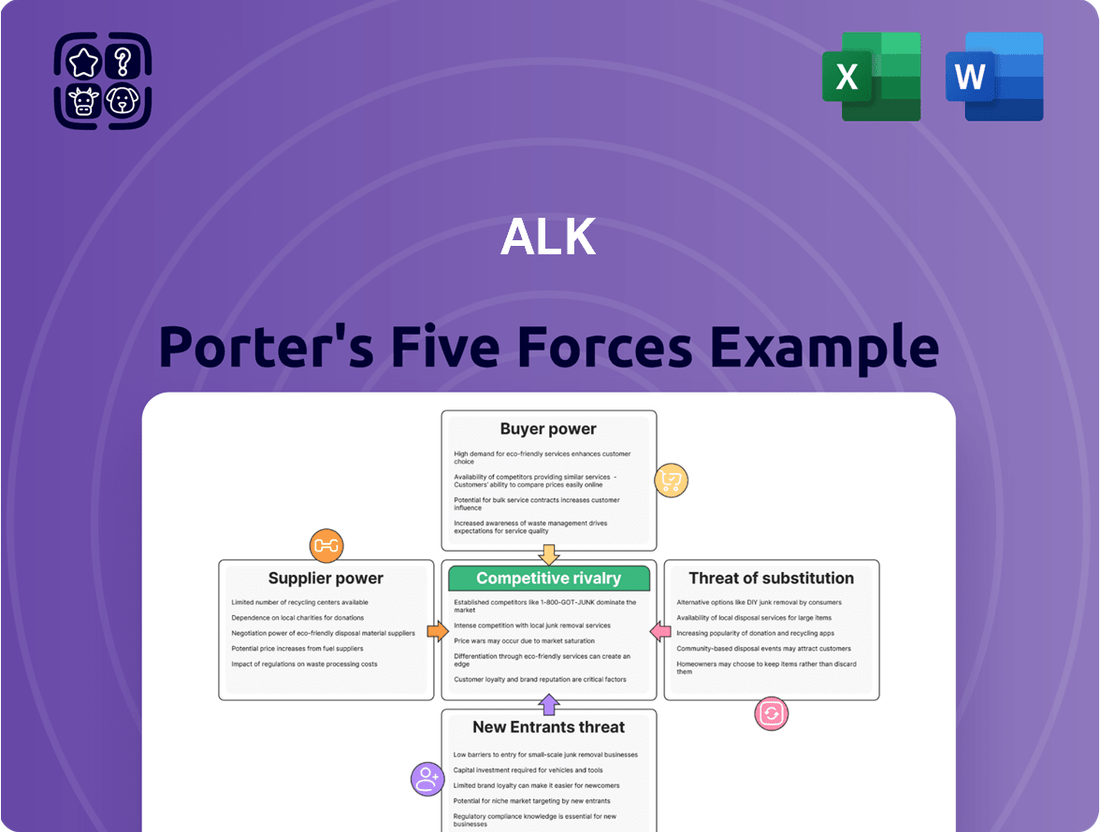

Porter's Five Forces Analysis reveals the competitive landscape Alk operates within, highlighting the power of buyers, suppliers, and the threat of new entrants and substitutes. Understanding these forces is crucial for Alk to navigate its market effectively and identify strategic opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alk’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ALK relies on specialized raw materials and Active Pharmaceutical Ingredients (APIs) for its allergy immunotherapy (AIT) products. This specialization inherently limits the pool of qualified suppliers, granting those suppliers a stronger negotiating position. For instance, the complex manufacturing processes and rigorous quality control demanded for pharmaceutical-grade components mean few companies can meet ALK's needs.

The uniqueness and stringent quality requirements for these pharmaceutical-grade components give these suppliers a significant degree of bargaining power. In 2023, the global pharmaceutical excipients market, which includes many specialized raw materials, was valued at approximately $10.8 billion, with growth driven by increasing demand for high-quality, specialized ingredients.

Any disruptions in this specialized supply chain, or an increase in the costs of these critical raw materials, could directly impact ALK's production efficiency and overall profitability. For example, a sudden shortage of a key API could halt production lines, leading to lost sales and increased expenses to secure alternative, potentially more expensive, sources.

The pharmaceutical sector, particularly in niche areas like allergy immunotherapy, relies significantly on specialized R&D and clinical talent. The limited availability of these highly skilled professionals grants them considerable bargaining power.

ALK's capacity for innovation and pipeline development is intrinsically linked to its success in attracting and retaining this crucial human capital. In 2024, the demand for specialized life sciences talent remained robust, with reported salary increases in key research roles reflecting this scarcity.

Suppliers who possess proprietary technologies and specialized equipment essential for ALK Porter’s advanced manufacturing processes wield considerable bargaining power. For instance, in 2024, the semiconductor equipment market, a critical area for AIT products, saw significant consolidation, with a few key players dominating the supply of advanced lithography machines, which can cost upwards of $100 million each.

The high switching costs associated with integrating new, proprietary technologies or equipment present a substantial barrier for ALK. These costs go beyond the initial purchase price, encompassing extensive validation, recalibration, and workforce retraining, which can easily run into millions of dollars and months of downtime, as seen with previous transitions in complex manufacturing environments.

This reliance on a limited number of suppliers for cutting-edge components and machinery directly translates into increased procurement costs and less favorable contractual terms for ALK. In 2023, companies heavily reliant on specialized AI chip manufacturing equipment reported a 15-20% increase in component costs due to supply chain constraints and supplier leverage.

Regulatory and Compliance Services

The pharmaceutical industry's intricate and ever-changing regulatory environment significantly boosts the bargaining power of suppliers offering specialized regulatory and compliance services. Companies in this sector often rely heavily on external consultants and contract research organizations (CROs) for navigating complex approval processes and ensuring market access.

These specialized service providers possess unique expertise that is critical for product success, giving them considerable leverage. For instance, the cost of regulatory affairs consulting services can range from several thousand dollars per month for basic support to hundreds of thousands for comprehensive global submissions, reflecting the high value placed on this specialized knowledge.

- Specialized Expertise: Regulatory consultants possess in-depth knowledge of agencies like the FDA, EMA, and others, which is difficult and time-consuming for pharmaceutical companies to develop internally.

- Criticality of Services: Compliance with regulations is non-negotiable for product approval and market entry, making these services indispensable and increasing supplier leverage.

- High Switching Costs: Once a relationship is established and processes are tailored, switching providers can be costly and disruptive, further cementing supplier power.

- Market Concentration: In certain niche areas of regulatory affairs, the number of highly qualified providers may be limited, concentrating bargaining power among a few key players.

Clinical Trial Site and Patient Recruitment Services

The bargaining power of suppliers in clinical trial site and patient recruitment services for allergy treatments is significant. These specialized providers, often Contract Research Organizations (CROs) or dedicated clinics, are crucial for ALK's development pipeline. Their ability to secure high-quality trial sites and efficiently recruit eligible patients directly influences ALK's time-to-market and overall development expenses.

In 2024, the demand for specialized CROs remained robust, driven by the ongoing innovation in allergy treatment research. Companies like IQVIA and PPD (now part of Thermo Fisher Scientific) continued to be key players, demonstrating strong pricing power due to their established networks and proven track records. The cost of patient recruitment, a critical component, can fluctuate based on the rarity of specific patient profiles needed for trials, directly impacting ALK's operational budget.

- High Demand for Specialized CROs: The need for expert clinical trial management services, particularly in niche therapeutic areas like allergy, grants significant leverage to leading CROs.

- Patient Recruitment Costs: The expense associated with identifying and enrolling patients meeting strict trial criteria can represent a substantial portion of a clinical trial's budget, giving recruitment service providers considerable influence.

- Impact on Timelines: Delays in site activation or patient enrollment, often managed by these suppliers, can push back crucial development milestones for ALK's new allergy therapies.

- Quality and Expertise: The quality of data generated and the efficiency of operations are directly tied to the expertise of the recruitment and site management services, reinforcing their bargaining position.

Suppliers of specialized raw materials and Active Pharmaceutical Ingredients (APIs) hold significant bargaining power over ALK due to the limited number of qualified providers and the stringent quality requirements for pharmaceutical-grade components. In 2023, the global pharmaceutical excipients market was valued at approximately $10.8 billion, highlighting the substantial economic activity in this specialized sector.

This power is further amplified by suppliers possessing proprietary technologies and specialized equipment crucial for ALK's advanced manufacturing processes. For example, the semiconductor equipment market, vital for AIT products, saw consolidation in 2024, with a few dominant players supplying advanced lithography machines, which can cost over $100 million each.

Additionally, specialized regulatory and clinical trial service providers exert considerable influence. The cost of regulatory affairs consulting can range from thousands to hundreds of thousands of dollars monthly, reflecting the critical nature of compliance. In 2024, specialized CROs like IQVIA and PPD maintained strong pricing power due to their established networks and expertise in patient recruitment, a key factor impacting ALK's development timelines and budgets.

| Supplier Type | Key Factors Influencing Bargaining Power | Illustrative Data/Costs (2023-2024) |

|---|---|---|

| Specialized Raw Materials/APIs | Limited qualified suppliers, stringent quality demands, complex manufacturing | Global pharmaceutical excipients market: ~$10.8 billion (2023) |

| Proprietary Technology/Equipment | Unique technologies, high switching costs, market concentration | Advanced lithography machines: >$100 million each (2024) |

| Regulatory Services | Niche expertise, criticality of compliance, high switching costs | Regulatory consulting: $Thousands - $Hundreds of thousands/month |

| Clinical Trial Services (CROs/Recruitment) | High demand, specialized expertise, patient recruitment costs | Robust demand for CROs, patient recruitment costs fluctuate based on patient profile rarity |

What is included in the product

Porter's Five Forces Analysis provides a framework for understanding the competitive intensity and attractiveness of an industry by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the impact of each Porter's Five Forces on your business, making strategic adjustments straightforward.

Customers Bargaining Power

Major customers in the healthcare sector, including national healthcare systems, extensive hospital networks, and significant private insurance providers, possess considerable bargaining power. This strength stems from their substantial purchasing volumes and their critical role in shaping reimbursement policies, which directly affects ALK's revenue. For instance, in 2024, the aggregate purchasing power of these entities allows them to negotiate pricing terms that can significantly influence ALK's per-unit revenue.

These large payers can exert pressure on ALK by demanding lower prices or by influencing clinical guidelines and formulary decisions. Their ability to dictate terms impacts ALK's market access and profitability, as seen in the past where influential bodies have recommended specific treatments, thereby setting precedents for market adoption and pricing expectations.

Allergy specialists and prescribing physicians hold significant sway over the adoption of allergy immunotherapy (AIT) products. Their choice of which treatments to recommend directly impacts patient selection and the overall market penetration of companies like ALK.

While these medical professionals don't typically engage in direct price negotiations, their prescribing habits are heavily influenced by factors such as robust clinical trial data, demonstrated efficacy, safety profiles, and the convenience of administration. These elements indirectly shape the demand for ALK's product portfolio.

ALK's strategic focus involves bolstering the evidence base for its foundational AIT products and broadening its reach to more patients. For instance, ALK reported a 10% increase in revenue from its core AIT portfolio in the first half of 2024, underscoring the importance of physician confidence in these treatments.

Patients are increasingly informed about allergies and treatment options, particularly the lasting advantages of immunotherapy. This growing awareness directly impacts their choices, influencing demand for specific therapies.

Preferences are shifting towards easier administration, with sublingual tablets gaining traction over traditional injections. This trend compels companies like ALK to prioritize product innovation in delivery systems, as seen with the development of non-injectable alternatives.

The market has seen new non-injectable treatments emerge, such as adrenaline nasal spray, directly responding to patient desires for convenience and less invasive methods. This highlights a significant shift in how patients engage with allergy management.

Pharmacies and Distribution Channels

Pharmacies, acting as vital distribution conduits for ALK's products, exert a degree of bargaining power, especially when dealing with major pharmacy chains or large-scale wholesalers. These entities can impact the visibility and accessibility of ALK's treatments, leveraging their market presence to negotiate favorable terms concerning stock levels, delivery schedules, and the overall efficiency of the supply chain.

While ALK's direct engagement is primarily with allergy specialists, the seamless functioning of pharmacy distribution is paramount for ensuring patient access to therapies. For instance, in 2024, the consolidated market share of the top three pharmacy benefit managers (PBMs) in the US remained significant, underscoring the concentrated power within the distribution network.

- Pharmacy Chains' Influence: Large pharmacy chains can negotiate for better margins or preferential placement of ALK's products.

- Wholesaler Negotiations: Major pharmaceutical wholesalers, handling a vast volume of products, have leverage in setting distribution fees and service level agreements.

- Inventory Management Demands: Pharmacies may push for just-in-time inventory models, impacting ALK's warehousing and logistics costs.

- Patient Access Impact: Disruptions or unfavorable terms with key pharmacy partners could directly hinder patient access to allergy immunotherapy treatments.

Competitive Treatment Options

The bargaining power of customers in the allergy treatment market is significant due to the wide array of available options. With numerous symptomatic relief medications and various immunotherapy approaches, patients can readily compare and select alternatives, increasing their leverage.

As the allergy immunotherapy market expands, projected to reach $12.5 billion by 2028 according to some analyses, customers gain even more choices. This competitive landscape compels companies to highlight their unique value propositions and proven clinical results to retain and attract patients.

- Increased Treatment Options: Availability of diverse symptomatic relief and immunotherapy treatments.

- Market Growth: Expanding allergy immunotherapy market provides more patient choices.

- Price Sensitivity: Customers can compare costs and efficacy across different treatment providers.

- Information Accessibility: Online resources and patient reviews empower informed decision-making.

The bargaining power of customers in the allergy treatment market is substantial, driven by a growing number of therapeutic options and increased patient awareness. Major healthcare payers, such as national health systems and large insurance providers, wield significant influence due to their purchasing volume and ability to shape reimbursement policies. Physicians, while not direct negotiators, impact product adoption through their prescribing habits, favoring treatments with strong clinical evidence and convenient administration. Patients themselves are becoming more informed, seeking easier-to-use and effective treatments, which pushes companies to innovate in delivery systems.

| Customer Segment | Source of Bargaining Power | Impact on ALK |

|---|---|---|

| Major Healthcare Payers | High purchasing volume, influence on reimbursement | Price negotiation, market access |

| Allergy Specialists/Physicians | Prescribing decisions, influence on treatment choice | Product adoption, market penetration |

| Informed Patients | Demand for convenience and efficacy, comparison of options | Product innovation, marketing focus |

| Pharmacies/Wholesalers | Distribution control, negotiation of terms | Supply chain efficiency, product accessibility |

What You See Is What You Get

Alk Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, professionally formatted document, ensuring no surprises or placeholder content. Once your payment is processed, you'll gain instant access to this comprehensive analysis, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The allergy immunotherapy market features formidable rivals like Stallergenes, Allergy Therapeutics, and HAL Allergy, all directly vying with ALK for market positioning. These established entities are actively contending for a larger slice of this expanding yet niche sector.

ALK's robust sales growth of 15% in 2024 underscores the highly competitive nature of this market and ALK's success in gaining ground against its peers.

Competitive rivalry in the allergy immunotherapy market is significantly fueled by product differentiation and ongoing innovation. Companies are actively developing new formulations, such as tablets, drops, and patches, to cater to diverse patient preferences and improve treatment adherence. For instance, ALK-Abelló, a key player, is not only focused on its core respiratory allergy portfolio but is also expanding into the critical areas of food allergy and anaphylaxis management.

Competitors are equally engaged in bringing novel advancements to the market, creating a dynamic landscape. This includes the introduction of new treatment indications for existing products and the development of entirely new therapeutic approaches. The innovation extends to delivery methods as well, with advancements like adrenaline nasal sprays offering alternative and potentially more convenient administration routes, thereby intensifying the competitive pressure.

The global allergy immunotherapy market is a hotbed of activity, projected to surge from USD 1.9 billion in 2024 to an impressive USD 4.3-4.5 billion by 2034. This robust growth, with compound annual growth rates ranging from 6.56% to 11.4%, naturally draws significant investment from established companies.

This high growth environment fuels intense competition as existing players like ALK, which aims for at least 10% average revenue growth until 2028, pour resources into research and development and commercial expansion to capture market share.

High Fixed Costs and R&D Investments

The pharmaceutical sector is characterized by substantial fixed costs. These include the expenses for manufacturing plants, extensive research and development (R&D) efforts, and the rigorous process of regulatory approval. These substantial upfront investments compel companies to pursue high sales volumes, intensifying competition as firms strive to recoup their expenditures and gain market share.

ALK intends to make considerable investments in R&D, projecting these expenditures to range between 10% and 15% of its annual revenue from 2025 through 2028. This commitment to innovation is crucial for developing new treatments and maintaining a competitive edge in a market driven by scientific advancement and patent expirations.

- High Capital Outlay: Significant investments in manufacturing infrastructure and advanced R&D facilities are a hallmark of the pharmaceutical industry.

- R&D Intensity: Companies typically allocate a substantial portion of their revenue to R&D, often between 10-20%, to fuel pipeline development.

- Economies of Scale: Achieving high sales volumes is essential to amortize these large fixed costs, leading to aggressive pricing and market share battles.

- Regulatory Hurdles: The cost and time associated with navigating complex regulatory pathways further elevate the barriers to entry and operational expenses.

Geographic Market Dominance

While Europe currently represents the largest segment of the allergy immunotherapy market, North America is a substantial and rapidly expanding region. For instance, in 2023, Europe accounted for approximately 45% of the global allergy immunotherapy market share, with North America following closely at around 35%.

ALK, like other key players, is actively broadening its global presence, meaning competitive intensity can differ significantly from one geographic market to another. Successfully navigating these varied landscapes necessitates region-specific strategies that account for unique regulatory frameworks and healthcare system structures.

- European Market Share: Europe held an estimated 45% of the global allergy immunotherapy market in 2023.

- North American Market Share: North America represented approximately 35% of the global market in 2023, showing strong growth potential.

- Regional Strategy Requirement: Companies must develop tailored approaches to address diverse regulatory and healthcare environments in different geographic markets.

Competitive rivalry in the allergy immunotherapy market is characterized by the presence of established players like ALK, Stallergenes, and Allergy Therapeutics, all actively pursuing market share. This intense competition is driven by the market's significant growth potential, with projections indicating a rise from USD 1.9 billion in 2024 to USD 4.3-4.5 billion by 2034, featuring compound annual growth rates between 6.56% and 11.4%.

High capital outlays for R&D and manufacturing, coupled with stringent regulatory requirements, create substantial barriers to entry. Companies like ALK are investing heavily in innovation, with R&D expenses projected between 10% and 15% of annual revenue from 2025-2028, aiming to differentiate products and secure market position.

Geographic market dynamics also influence rivalry, with Europe holding a significant market share (45% in 2023) and North America showing strong growth (35% in 2023). Companies must adapt region-specific strategies to navigate diverse regulatory landscapes and healthcare systems.

| Key Competitors | 2024 Market Projection (USD Billion) | Projected CAGR (2024-2034) | ALK R&D Spend (2025-2028) |

|---|---|---|---|

| ALK | N/A | 6.56% - 11.4% | 10% - 15% of Revenue |

| Stallergenes | N/A | 6.56% - 11.4% | N/A |

| Allergy Therapeutics | N/A | 6.56% - 11.4% | N/A |

SSubstitutes Threaten

Traditional symptomatic allergy medications, like antihistamines and nasal sprays, are readily available and often cheaper than allergy immunotherapy. These offer quick relief from symptoms, making them a strong substitute for many individuals. For example, the global allergy treatment market, which includes these symptomatic drugs, was valued at over $25 billion in 2023, highlighting their significant market presence.

The emergence of newer biologic drugs presents a growing threat of substitutes for traditional allergy treatments like Allergen Immunotherapy (AIT). For instance, omalizumab (Xolair), approved by the FDA in February 2024 for food allergies, offers a compelling alternative, particularly for patients unresponsive to conventional therapies. This development signifies a shift in treatment paradigms, potentially impacting the market share of AIT.

The threat of substitutes for adrenaline auto-injectors, like those offered by ALK, is growing with the introduction of needle-free nasal sprays. These sprays, such as neffy®, offer a less invasive alternative for managing severe allergic reactions like anaphylaxis. ALK's strategic move to in-license neffy® demonstrates their recognition of this emerging competitive pressure.

Lifestyle Changes and Allergen Avoidance

Simple lifestyle changes and strict allergen avoidance can significantly reduce allergic symptoms for some individuals, acting as a non-pharmacological substitute for allergy medications. While not a complete replacement for medical treatment, these strategies can lessen the demand for pharmaceutical interventions. For instance, in 2024, a significant portion of individuals managing mild allergies reported successfully reducing their reliance on over-the-counter antihistamines by implementing dietary changes or environmental controls.

Increased public awareness regarding allergen avoidance further strengthens this threat. Many consumers are actively seeking natural or behavioral solutions. This trend is reflected in the growing market for hypoallergenic products and air purification systems, which offer alternatives to traditional allergy treatments.

- Lifestyle Modifications: Simple changes like dietary adjustments or environmental controls can reduce allergy symptoms.

- Allergen Avoidance: Strict avoidance of known allergens serves as a direct substitute for medication.

- Public Awareness: Growing consumer knowledge about allergen avoidance fuels demand for non-pharmacological solutions.

- Market Trends: The rise of hypoallergenic products and air purifiers indicates a shift towards alternative allergy management strategies.

Oral Immunotherapy (OIT) for Food Allergies

The rise of Oral Immunotherapy (OIT) for food allergies, especially peanut allergy, is a significant emerging substitute. This approach focuses on desensitizing individuals through controlled allergen exposure, offering a potential alternative to lifelong avoidance strategies.

Research and adoption of OIT are accelerating. For instance, by early 2024, several OIT products had received regulatory approval in major markets, indicating a shift towards proactive treatment. This trend directly challenges the traditional reliance on strict allergen avoidance, which has been the primary management method for decades.

- Growing OIT Adoption: Increasing clinical trials and approved therapies for peanut OIT, such as those by Aimmune Therapeutics (now Nestle Health Science) and others, demonstrate a clear market shift.

- Desensitization as an Alternative: OIT offers a path to tolerance, reducing the severity of reactions and improving quality of life, thereby substituting the need for constant vigilance and emergency medication.

- Shift from Avoidance: The focus is moving from passive avoidance to active management and potential remission of food allergies.

The threat of substitutes for traditional allergy treatments remains robust, encompassing readily available symptomatic medications and emerging advanced therapies. Lifestyle modifications and increased consumer awareness of allergen avoidance also present viable alternatives for many individuals managing allergies.

| Substitute Category | Examples | Impact on Traditional Treatments | 2024 Market Relevance |

|---|---|---|---|

| Symptomatic Medications | Antihistamines, Nasal Sprays | Offer quick relief, often at lower cost. | A significant portion of the $25 billion+ allergy treatment market in 2023. |

| Advanced Therapies | Biologics (e.g., Omalizumab), Oral Immunotherapy (OIT) | Provide novel treatment pathways, especially for severe or unresponsive cases. | Growing approvals and adoption, particularly for OIT in peanut allergies. |

| Non-Pharmacological | Lifestyle changes, Allergen avoidance, Air purifiers | Reduce symptom severity and reliance on medication for some. | Increasing consumer interest and market for hypoallergenic products. |

Entrants Threaten

Developing new pharmaceutical products, particularly intricate allergy immunotherapies, demands substantial and ongoing investment in research and development. These significant upfront expenditures create a formidable barrier for prospective new players entering the market.

ALK, for instance, dedicates a considerable percentage of its revenue to R&D. Projections indicate this commitment will remain between 10% and 15% of annual revenue from 2025 through 2028, underscoring the high cost of innovation in this sector.

The pharmaceutical industry, and by extension the field of AI-driven therapeutics (AIT), faces formidable barriers to entry due to stringent regulatory approval processes. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate rigorous clinical trials, extensive data submission, and adherence to Good Manufacturing Practices (GMP). For instance, bringing a new drug to market typically takes over a decade and can cost upwards of $2.6 billion, a significant deterrent for potential new entrants into the AIT space.

Existing patents held by established companies like ALK for their allergy immunotherapy products create a significant barrier to entry. These intellectual property rights protect their innovations, preventing competitors from easily replicating their formulations or technologies for a defined period. For instance, ALK's robust patent portfolio, which includes patents for their SQ allergy immunotherapy tablets, shields their core products from direct imitation.

Need for Specialized Manufacturing and Distribution

The allergy immunotherapy market presents a significant threat of new entrants due to the substantial need for specialized manufacturing and distribution capabilities. Producing these advanced medical products involves complex biological processes that demand highly specialized facilities, adhering to rigorous quality and safety regulations. For instance, companies like ALK-Abelló, a leader in this space, invest heavily in state-of-the-art manufacturing plants to ensure product efficacy and patient safety.

Establishing the necessary infrastructure for allergy immunotherapy production is a capital-intensive undertaking. New players must secure substantial funding to build or acquire facilities capable of handling biological materials and meeting Good Manufacturing Practices (GMP) standards. Furthermore, developing effective global distribution networks, essential for reaching patients worldwide, adds another layer of complexity and cost. This high barrier to entry, driven by the need for specialized manufacturing and distribution, effectively deters many potential new competitors from entering the market.

- High Capital Investment: Building GMP-compliant facilities for biological product manufacturing can cost tens to hundreds of millions of dollars.

- Regulatory Hurdles: Obtaining approvals from health authorities like the FDA and EMA for specialized manufacturing processes is lengthy and costly.

- Technical Expertise: A deep understanding of biological manufacturing and quality control is essential, requiring highly skilled personnel.

- Distribution Network Complexity: Establishing reliable cold-chain logistics and distribution channels globally is a significant operational challenge.

Established Brand Loyalty and Physician Trust

Established brand loyalty and deep physician trust pose a significant barrier to new entrants in the allergy immunotherapy market. Companies like ALK have cultivated decades-long relationships with healthcare professionals, built on consistent product performance and extensive clinical data. For instance, ALK's portfolio, including its sublingual immunotherapy (SLIT) tablets, has been available for years, allowing them to gather substantial real-world evidence and establish a strong reputation.

New companies entering this space face the daunting task of overcoming this ingrained trust. They would need to commit substantial resources to marketing and educational initiatives to even begin to sway physician prescribing habits. Furthermore, replicating the depth of clinical data and long-term safety profiles that established players possess requires considerable investment in rigorous clinical trials and post-market surveillance. This investment hurdle, coupled with the need to demonstrate clear advantages over existing, trusted treatments, makes the threat of new entrants moderate.

- Established Relationships: ALK and similar companies have nurtured long-standing partnerships with allergists and pulmonologists, fostering loyalty through consistent support and reliable product offerings.

- Clinical Data Advantage: Years of real-world data and extensive clinical trial results for established treatments provide a strong evidence base that new entrants must challenge.

- High Marketing & Education Costs: New entrants must invest heavily in physician education and marketing campaigns to build awareness and trust, a significant financial undertaking.

- Physician Inertia: Healthcare providers are often hesitant to switch from treatments they know and trust, especially when patient outcomes are at stake.

The threat of new entrants in the allergy immunotherapy market is generally considered moderate. High capital investment for specialized manufacturing, stringent regulatory approvals, and the need for deep technical expertise create significant upfront barriers. For instance, establishing GMP-compliant facilities can cost tens to hundreds of millions of dollars, and bringing a new drug to market can exceed $2.6 billion.

Furthermore, established players like ALK benefit from strong brand loyalty and deep physician trust, cultivated over years of consistent performance and extensive clinical data. New entrants must overcome this inertia with substantial investment in marketing and education to demonstrate clear advantages over existing, trusted treatments.

The significant R&D investment, projected to remain between 10% and 15% of ALK's annual revenue from 2025-2028, and robust patent portfolios also deter new competition by protecting existing innovations.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including publicly available financial reports, industry-specific market research, and expert commentary from trade publications.